Sold 1 AAL 05/01/2020 9.00 Put @ 0.27.

Stock Day’s Range: $10.24 – $10.67

Daily Archives: Thursday, April 23, 2020

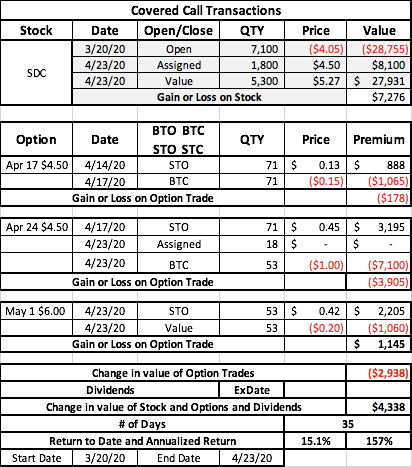

SDC Partial Assignment + Roll Up and Out

Assigned on 18 of 71 calls last night. Rolled Apr $4.50 up and out to May 1 $6.00. Stock was at $6.00 when I did the roll….then reversed and gave up any gains. Probably should have waited until tomorrow but I didn’t want more called away.

OXY

Sold 1 OXY May 01 2020 17.50 Covered Call @ 0.17

SPX 1-dte

SPX1dte Sold to Open, 4 minutes after the market closed:

$SPX Apr 24th 2675/2695-2880/2900 condors for 1.00, IV 27.75%, SPX 2797, deltas: -.04,+.04

#rolling TSLA Rolled May 15,…

#rolling TSLA

Rolled May 15, 320/450 inverted strangle to June 19 325/450 for 8.19. I picked up 5 more points on the call side.

I have taken in $14,526 in premium.

SPY

#CoveredCalls – Another round…

Bought to Close SPY APR 24 2020 292.5 Call @ .05 (sold for 1.51)

Sold SPY MAY 01 2020 290.0 Call @ 1.60

GILD

Day Trade BTO Apr24 79/77 Puts $0.99 STC $1.50 in a 15 min period

VXX

Bought 1 VXX Jan 15 2021 21.00 Put @ 1.99.

Bought 1 VXX Jan 15 2021 16.00 Put @ 0.75

The strike is a point closer to the stock than my first buy for the same money.

I re-invested the proceeds of my ADS covered calls into these.

ADS covered call ladder

Sold 1 ADS 05/01/2020 45.00 Covered Call @ 0.75.

Sold 1 ADS 05/15/2020 50.00 Covered Call @ 0.75.

Sold 1 ADS 05/22/2020 48.00 Covered Call @ 1.05.

The stock is at 40 after it’s earnings report.

“Alliance Data Systems (ADS) said Thursday that it booked Q1 core earnings of $0.75 per share, which is significantly down from $3.79 in the same period last year. Analysts surveyed by Capital IQ were looking for EPS of $3.84.

Revenue increased to $1.38 billion from $1.33 billion in the prior-year quarter. The CapIQ-compiled consensus view was for revenue of $1.31 billion.

The data-driven marketing and customer loyalty solutions provider said that it increased its provision for loan losses by $404 million, attributing over $300 million of the increase to the economic impact of the COVID-19 crisis.

Alliance said that it expects cost reduction measures to result in $150 million in savings, which will be recognized in FY2020. The company also suspended share buybacks and reduced the quarterly dividend to $0.21 per share, down from the prior distribution of $0.63, payable on June 1 to stockholders of record on May 14.”

GUSH

I was able to dump the GUSH that was put to me on the exercise of the March 1.00 short puts at a gain.

Sold GUSH @ 29.20 yesterday.

BX Puts Closed / TWTR Calls Rolled / AMD Puts

#shortputs

$BX BTC 4/24 45 puts at .15 STO 4/8 at 2.02

$AMD STO 4/24 55 puts at .50

#coveredcalls

$TWTR BTC 4/24 28 calls and STO 5/1 31.50 calls at credit of .23 Stock at 28.54

AAL Neutralized my entire stock/option…

AAL Neutralized my entire stock/option positions, just in case earnings are tomorrow.

AAL Earning tomorrow morning. Since…

AAL Earning tomorrow morning. Since we already know that earnings will be down, because of CV, I feel that, it already has been baked into the price, but still conflicted over weather to hold over earnings, something I never do. Anybody????

SKX earnings analysis

#Earnings $SKX reports tonight. Below are details on earnings one-day moves over the last 12 quarters.

Feb. 6, 2020 AC +4.05%

Oct. 22, 2019 AC -3.36%

July 18, 2019 AC +11.96%

April 18, 2019 BO -10.43%

Feb. 7, 2019 AC +15.19%

Oct. 18, 2018 AC +13.78%

July 19, 2018 AC -20.99%

April 19, 2018 AC -27.04% Biggest DOWN

Feb. 8, 2018 AC +7.54%

Oct. 19, 2017 AC +41.44% Biggest UP

July 20, 2017 AC +0.67%

April 20, 2017 AC -2.56%

Avg (+ or -) 13.25%

Bias 2.52%, positive bias on earnings.

With stock at 25.00 the data suggests these ranges:

Based on current IV (expected move into Friday per TOS): 21.80 to 28.20 (+/- 12.8%)

Based on AVERAGE one-day move over last 12 quarters: 21.69 to 28.31

Based on MAXIMUM one-day move over last 12 Q’s (41.4%): 14.64 to 35.36

Based on DOWN max only (-27.0%): 18.24

Open to requests for other symbols.

#coveredcallsDUST Was long 10,700 shares…

#coveredcallsDUST

Was long 10,700 shares DUST.

This morning DUST did a 1 for 25 reverse split.

What happens to my 8 May 20 2.00 call which I sold a few days ago? T.O.S. has is as a 2.oo call not a 50.00 call (2 x 25)

I’ve never held options when an underlying split.

Do I need to be concerned?

Thanks