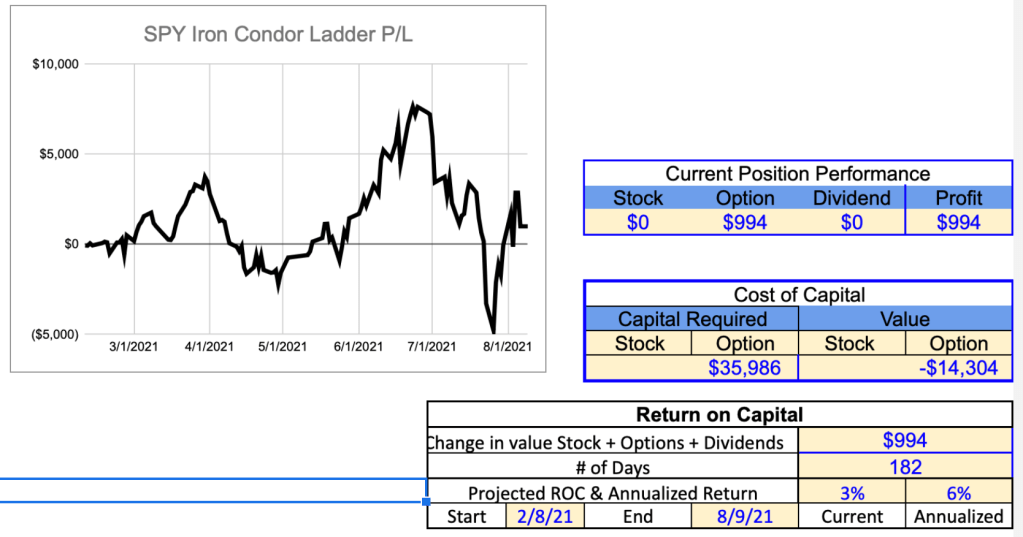

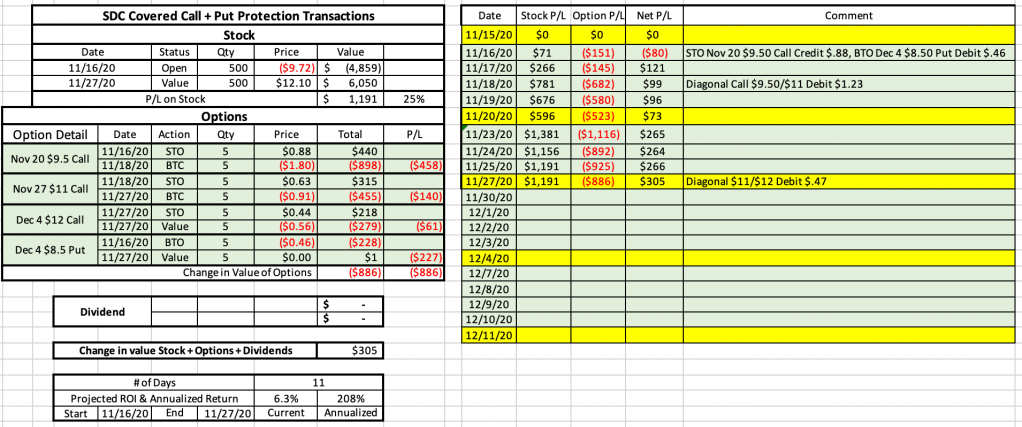

Over the past few years I have been working to evolve a system for tracking my positions that doesn’t take a lot of time. It has been informative and helped evolve my trading practices. I am able to download my current portfolio and daily trades (custom date in historical trades using current day as the starting date) from my Schwab accounts. Once they are downloaded the google sheets program does the magic and gives me my performance for each of the positions generating a graph like the ones below.

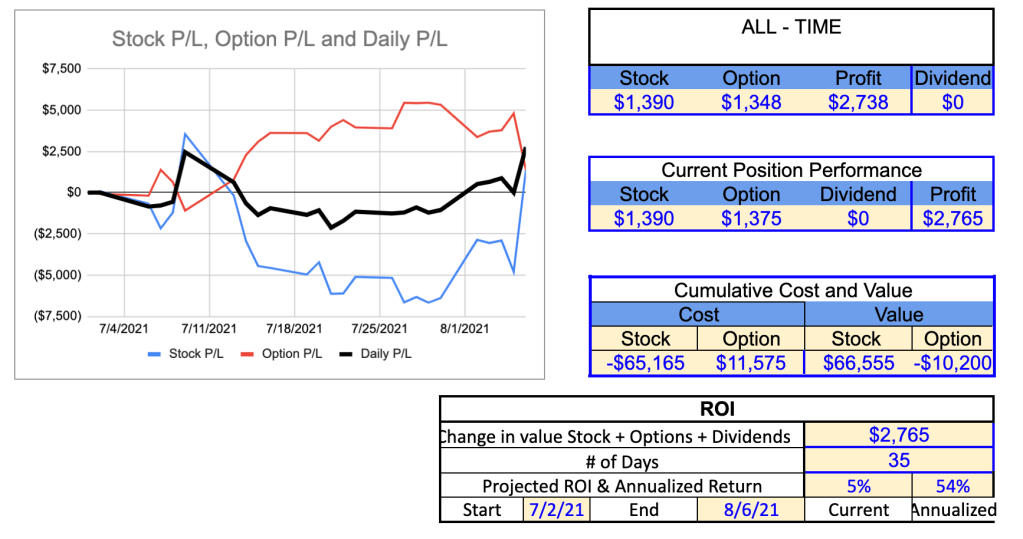

The graphs give me the cumulative daily profit for the stock, option(s), dividends and net of the three.

Ideally the black line (net profit) should be above the blue line (profit/loss from the stock). As you can see in the charts below it is a challenge to get the black line above the blue line. When the stock price drops and I make money on the short calls it out performs the stock but when the stock goes on a run the loss on the options tend to offset the gains.

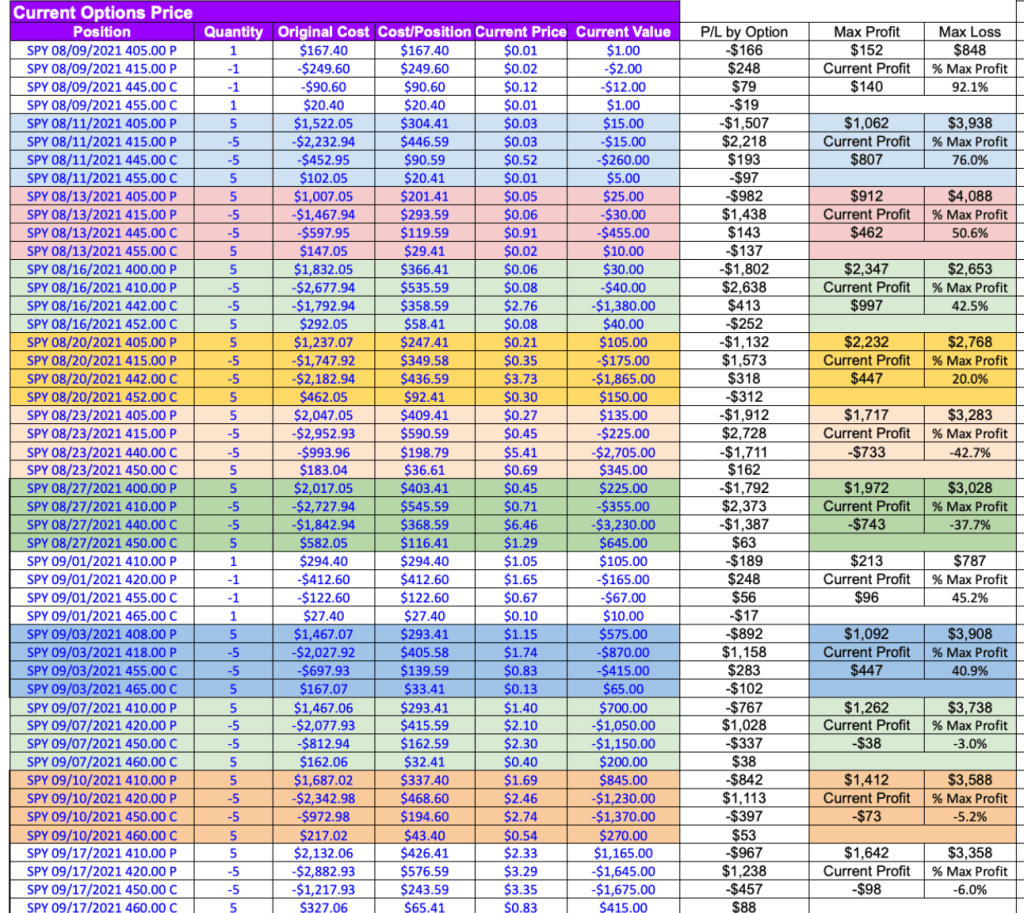

I try and hold my stock positions for 12 months so I only pay long term capital gains when I sell them (which can be a challenge based on the tax rules). Lots of rolls on the options. Some weekly, some monthly.

I use Schwab for the trading and downloads.

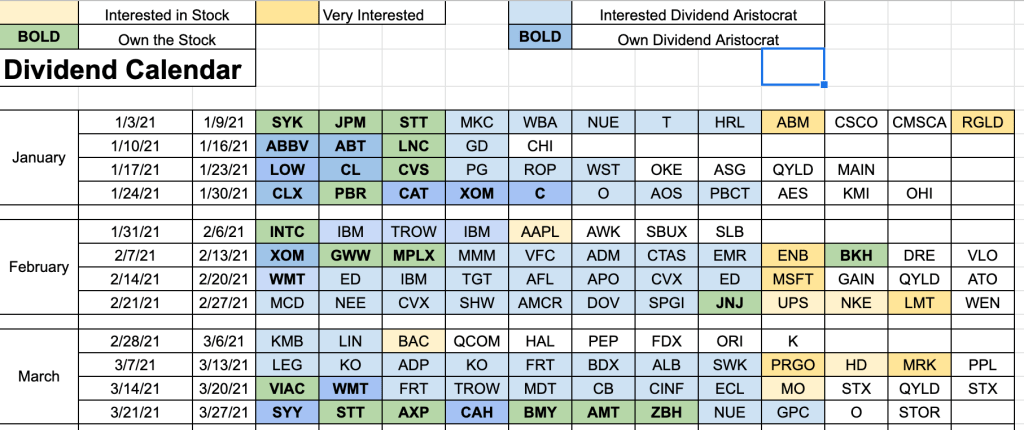

Hope you find this interesting and it might give you some ideas. I track about forty positions between two accounts.