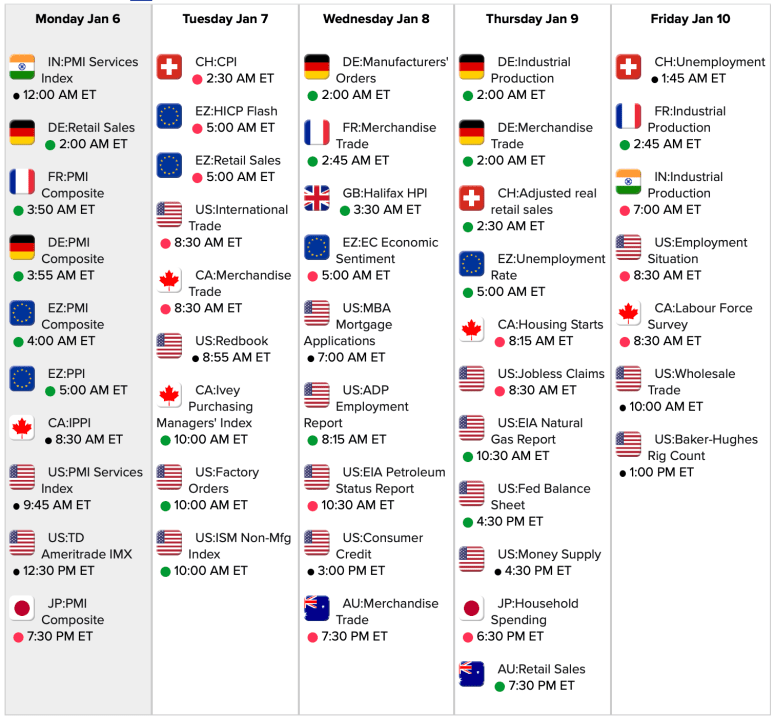

#Jobs — Gains slowed in April, rising less than expected, which is good news for the hope of lower interest rates.

Gain of +175,000 non-farm payroll jobs, vs. expected gain of 240K

Unemployment up 0.1% to 3.9%, vs expectation of unchanged

U6 unemployment 7.4%, up by 0.1%

Labor force participation unchanged at 62.7%

Average hourly earnings up by 0.2%, less than expected; +3.9% Y/Y

February jobs revised down by -34K to +236K

March jobs revised up by +12K to +315K