#FuzzyLEAPs Was expecting to trade all three strikes after the close, but my lowest strike filled on this late day rally:

Rolled $XSP Mar 9th 683 put to Mar 10th 683 put, .60 credit

Recent Updates

New highs today

Highest $VIX since April 2025

Highest $USO since October 2018

But, $SPX only lowest since November.

SPX

Roll to Tomorrow:

Rolled SPX Mar 9 2026 6750.0 Put to Mar 10 6725.0 Put @ 1.15 credit (62.45 total now)

Rolled SPX Mar 9 2026 6750.0 Puts to Mar 10 6725.0 Puts @ 1.00 credit (37.95 total now)

Rolled SPX Mar 9 2026 6725.0 Puts to Mar 10 6700.0 Puts @ 8.60 credit (54.70 total now)

Roll to Friday:

Rolled SPX Mar 9 2026 6850.0 Puts to Mar 13 6835.0 Puts @ 1.55 credit (47.15 total now)

Rolled SPX Mar 9 2026 6810.0 Put to Mar 13 6775.0 Put @ 3.80 credit (54.35 total now)

#fuzzyleaps I was wondering if…

#fuzzyleaps

I was wondering if it was time to roll the leaps down, please share your thoughts.

SPX

#fuzzyleaps #onlyspreads

I applied some of my credit received thus far to closing my short puts:

BTC today’s SPX Mar 9th 2026 6900 Put @ 222.50.

BTC tomorrow’s SPX Mar 10th 2026 6650 Put @ 40.20.

Remaining total credit received: 202.99.

Then, I decided to switch to spreads until this craziness calms down, so:

STO tomorrow’s SPX Mar 10th 2026 6570/6500 BUPS @ 10.00.

That leaves 2/3 LEAPs uncovered. I plan to sell another BUPS for tomorrow later today, and keep the other LEAP uncovered.

I picked the spread by selling the delta 20 put, and setting the spread width at 1% of the SPX (so around 70 with the SPX around 7000). I don’t plan to manage the spreads if they go ITM. I’ll just hold them through expiration and let the LEAPs cover the losses. If they go way OTM, I may close them for a small amount. I’ll see how I feel if/when that happens.

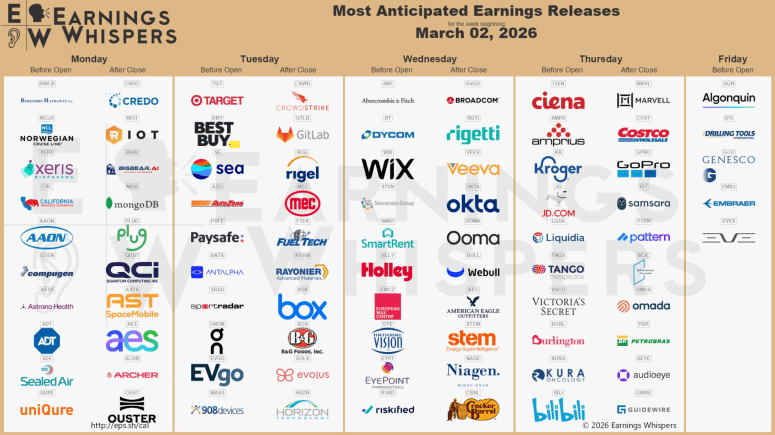

Earnings 3/9 – 3/13

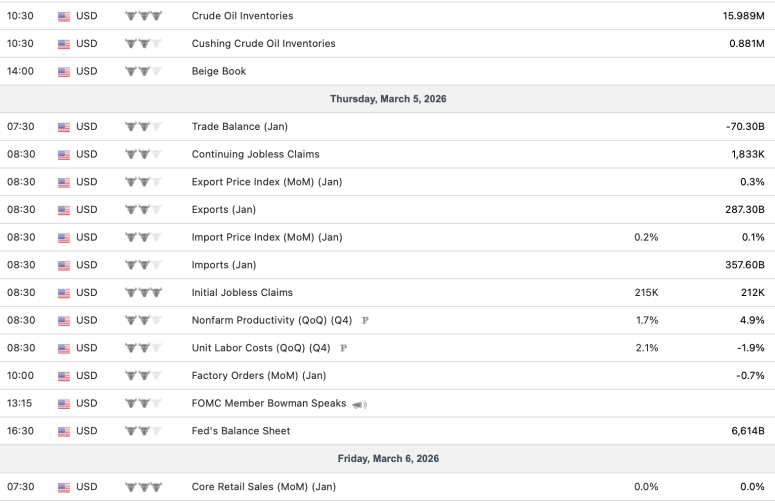

Econ Calendar 3/9 – 3/13

SPX trades

Apr‑17‑26 6800 / Mar‑10‑26 6740 Put Diagonal @ 145.65

I’d like to give a short summary of my main trade this year, for general information and discussion. I’ve been running a systematic SPX short‑strangle approach, usually 1DTE or a few days out. My hedge is a longer‑dated strangle a few months out, with strikes roughly 100 points above/below then SPX price. At least one side of the short strangle typically expires worthless, and I aim to roll for a net credit, targeting about $20/day in total net credit.

When an expiring leg goes deep ITM, I try to roll it as close to ATM as possible as long as I can still collect a small credit. The credit from the opposite side helps offset the cost a little. This rolling method naturally builds in mean‑reversion, and it has worked well in this range‑bound market. Occasionally I’ll pay up to roll the hedge up or down – only on the side that has become significantly cheaper after a large move (today that would be rolling down the call hedge). This adjustment pays if SPX reverses and also helps reduce margin. The trade is up 57% YTD on the average carrying risk.

Today, I initially looked to roll down the April 7000 call to 6900 or lower, but ultimately decided to close that side entirely. I did add a few units to the put side. The new put diagonal costs $145, with a breakeven range of 6610 – 6850 and a max profit around $5,500. The structure is currently -2.2 delta, essentially neutral. When rolling, I may lean slightly based on market conditions at that moment. The carrying cost of this diagonal is fully covered by profits accumulated so far.

In another account, I have been trading the SPX double diag (Friday/Monday expiration), 100-200% on every trade in the last few weeks. I think the success has much more to do with the market condition than the strategy itself or the trader, and we need to adjust based on market condition.

I have a few small option positions on other stocks, but for the two accounts I’m now 50% in cash. My sense is that the market is setting up to break out of this range – likely sooner rather than later.

Trade well and be safe.

XSP rolls 3/6/26 – New Trick!

#FuzzyLEAPs Learned a new trick. Second day in a row I allowed deep ITM puts expire, then sold next day’s right after the closing bell, giving me much higher premium than was available had I rolled during market hours. ***Even at the highs of the day, this kind of credit on rolls was not possible.***

$XSP closed at 674.00

Mar 6th 693 puts, 19.00 debit for expiring. Sold Mar 9th 693 puts for 19.70

Mar 6th 695 put, 21.00 debit for expiring. Sold Mar 9th 695 put for 21.75

This is pretty good news for these deep ITM options. I wonder if it still will work if we get 40 or 50 bucks ITM.

OptionsExpiration

PANW 130/136 Bull Put Spread

SLV 98/92 Bear Call Spread

SLV 65.50/68.5 Bull Put Spread

BBY 49/51 Bull Put Spread

NFLX 83/88 Bull Put Spread

SPY 641/644 Bull Put Spread

SPY 653/656 Bull Put Spread

SPY 661/664 Bull Put Spread

CCL 25.5 Put

CPB 25.5 Put

CPB 25.0 Put

CPB 24.5 Put

FISV 57.5 Put

HPQ 17.5 Puts

MSTX 2.0 Put

SLV 60.0 Put

CAG 20.0 Covered Calls

HPQ 20.5 Covered Calls

SPCE Covered Call

ASSIGNMENTS:

1 DOW 32.0 Covered Call

SPX

Rolled SPX Mar 6 2026 6855.0 Puts to Mar 9 6850.0 Puts @ 3.85 credit (45.60 total now)

Rolled SPX Mar 6 2026 6825.0 Put to Mar 9 6810.0 Put @ 4.00 credit (50.55 total now)

Rolled SPX Mar 6 2026 6775.0 Puts to Mar 9 6750.0 Puts @ 15.00 credit (37.00 total now)

Rolled SPX Mar 6 2026 6775.0 Put to Mar 9 6750.0 Put @ 25.00 credit (61.30 total now)

Rolled SPX Mar 6 2026 6750.0 Puts to Mar 9 6725.0 Puts @ 30.30 credit (46.10 total now)

Closing SPX puts before the weekend

Leaving paired short LEAP positions uncovered again.

Bought to close $SPX Mar 6 6740 put @ 6.20

Bought to close $SPX Mar 6 6760 put @ 15.50

CPB Puts

Bought to close 1 CPB 03/06/25.5 Put at $0.05 (sold for $0.15)

Sold 1 CPB 03/13/2026 23.5 Put at $0.10

SPX

#fuzzyleaps

Rolled today’s SPX Mar 6th 2026 6750 Put out and down to Mar 10th 6650 Put @ 20.00.

VIX Thoughts

NVDA

Small loss to go ahead and get this account to 100 percent cash.

Bought to Close NVDA March 20th 180/180/185 Jade Lizards @ 8.55 debit (sold for 8.10)

SPY

Reloading just below the 200 day.

Bought to Open SPY Apr 17 2026 350.0 Puts @ .23

Sold SPY Apr 17 2026 600.0 Put @ 4.75

Sold SPY Apr 17 2026 625.0 Put @ 6.75

Sold SPY Apr 17 2026 650.0 Put @ 10.90

SPY Spread reload

Sold 1 SPY 03/06/2026 661/664 Bull Put Spread at $0.12 Credit – expires today

Sold 1 SPY 03/09/2026 651/654 Bull Put at $0.19 Credit

Sold 1 SPY 03/10/2026 642/645 Bull Put at $0.17 Credit

Sold 1 SPY 03/11/2026 637/640 Bull Put at $0.18 Credit

LYB PAYX BXP Stock

Sold the last of my LYB at $68.88

Good Dividend payer but I’ve been holding since 2024

#FormerFallingKnife

Sold a tiny bit more of PAYX at $100.07. Bought on Feb 4th at $96.80

Started a tiny new position in BXP at $53.00

#FallingKnife

February Jobs Report

#Jobs — Unexpected loss of jobs. Negative revision also means December lost jobs.

Loss of -92,000 non-farm payroll jobs, vs. expected gain of 50K

Unemployment up by 0.1 at 4.4%

U6 unemployment 7.9%, down by 0.2

Labor force participation down 0.5 to 62.0%

Average hourly earnings up by 0.4%; +3.8% Y/Y

January jobs revised down by -4K to +126K

December jobs revised down by -65K to -17K

CPB Stock

Early assignment on 1 CPB 26.0 Put

#Earnings on March 11th so covered call premiums may be good

SPY Expiration

SPY 657/660 Bull Put Spread

SPY 650/652 Bull Put Spread

SPX

ROTH IRA up and running. Did a partial conversion and all approvals today. Good to go. Don’t wanna miss the massive premiums right now!

Bought SPX Dec 20 2030 6900.0 Puts @ 800.00

Sold SPX Mar 06 2026 6750.0 Puts @ 15.50

Sold SPX Mar 06 2026 6775.0 Puts @ 22.00

SPX roll

Rolled $SPX Mar 5 6800p down and out to Mar 6 6740 put @ 10.15 credit

SPX

Rolled SPX Mar 5 2026 6800.0 Put to Mar 6 6775.0 Put @ 11.30 credit (36.30 total now)

SPX

Final Actual Numbers in One Account Now Back in Cash

Building positions:

1 added in Jul 2025

1 added in Aug 2025

1 added in Dec 2025

Lots of various sized roll ups (5 total) eventually getting everything to 7000 strike in 2029 expiration.

Total Cost to this point:

166078.60

Total credit to close LEAPS:

159899.80

Loss on LEAPS:

-6178.80

Total premium received:

152337.90

===================

Total gain:

146159.10

===================

SPX

#fuzzyleaps

I would like to have held out for a rally later but ran out of time:

Rolled today’s SPX Mar 5th 2026 6900 Put to Mar 9th 2026 6900 Put @ 10.50.

SPX

Closed the rest of my 7000/7400 LEAPs Call Spreads @ 210.95. These were filling over 221 recently so taking advantage of the dip. Still holding some long 7000 strikes puts.

UVXY 1DTE

Sold 1 UVXY 03/06/2026 53/49 Bear Call Spread at $0.32 Credit

Sold 1 UVXY 03/06/2026 55/50 Bear Call Spread at $0.40 Credit

CPB PAYX LYB stocks

Added a tiny bit of CPB at $25.00

#FallingKnife

Sold a tiny bit of PAYX at $97.01 (vs a buy at $94.80 last month)

Sold all of my LYB position in one account at $67.08 for a small gain after holding on since 2024

#FormerFallingKnife

Thursday Trades

Sold 1 SLV 03/06/2026 65/69 Bull Put Spread at $0.18 Credit

Sold 1 SLV 03/06/2026 65.5/68.5 Bull Put Spread at $0.14 Credit

Sold 1 SLV 03/09/2026 60.0 Put at $0.11

Sold 1 SLV 03/11/2026 56/62 Bull Put Spread at $0.21 Credit

Sold 1 SLV 03/13/2026 59/64 Bull Put Spread at $0.35 Credit

Sold 1 SPY 03/09/2026 655/658 Bull Put Spread at $0.16 Credit

Sold 1 SPY 03/09/2026 654/657 Bull Put Spread at $0.20 Credit

Sold 1 SPY 03/10/2026 652/655 Bull Put Spread at $0.19 Credit

Sold 1 SPY 03/10/2026 651/654 Bull Put Spread at $0.22 Credit

Sold 1 SPY 03/11/2026 645/650 Bull Put Spread at $0.33 Credit

Bought 1 PANW 03/13/2026 172.5 Call / Sold 1 PANW 03/06/2026 165.0 Call at $0.17 Diagonal Credit

Bought to close 1 ORCL 03/06/2026 115/122 Bull Put Spread at $0.01

Bought to close 1 ORCL 03/06/2026 116/123 Bull Put Spread at $0.01

Sold TZA 03/20/2026 10.0 Covered Calls at $0.04

XSP rolls 3/5/26

#FuzzyLEAPs Another day opening with the 683 ATM, so rolling a day ahead. I got 1.40; if this was rolling from today would have gotten 1.75. I think that difference is small enough that I will keep this a day out as long as we are opening close to ATM.

Rolled $XSP Mar 6th 683 put to Mar 9th 683 put, 1.40 credit.

Now hoping for a rally to give me better rolls on 693 and 695

SPX

#fuzzyleaps

STO SPX Mar 6th 6750 Put @ 11.00.

SPY SLV Expiration

SPY 03/04/2026 653/656 Bull Put Spread

SPY 03/04/2026 657/660 Bull Put Spread

SPY 03/04/2026 660/663 Bull Put Spread

SLV 03/04/2026 66.0 Put

AMZN

Sold to Close AMZN covered stock @ 202.30 credit (basis 197.55)

SPX

Bought to Close SPX Mar 4 2026 6850.0 Put @ .30 (sold for 28.00)

Closed another LEAP position also @ 590.00 credit

More Wednesday trades

Sold my highest cost lots of VZ at $51.11 for a small gain – had these since 2022

Nice dividend income though 🙂

Sold 1 DOW 03/06/2026 34.5/33 Bear Call Spread at $0.13 Credit

Sold 1 CCL 03/06/2026 25.5 Put at $0.09

Sold 1 CPB 03/06/2026 25.0 Put at $0.10

Sold 1 MSTX 03/13/2026 6.0 Covered Call at $0.02

#EveryLittleBitHelps

SPX

#fuzzyleaps

Using today’s rally to de-risk:

BTC today’s SPX Mar 4th 2026 6775 Put @ 1.00 debit.

1/3 LEAPs covered now. Waiting for a selloff to sell another one.

Wednesday SLV trades

Rolled 1 SLV 03/06/2026 87/77 Bear Call Spread to 1 SLV 03/11/2026 90/82 Bear Call Spread at $0.30 Credit.

Pushed the short call strike up 5 points

Rolled 1 SLV 03/06/2026 87/77 Bear Call Spread to 1 SLV 03/13/2026 88/83 Bear Call Spread at $0.08 Credit.

Pushed the short call strike up 6 points AND tightened the spread to 5 points from 10

#OnlySpreads

XSP rolls 3/4/26

#FuzzyLEAPs Since my lower strike opened ATM, I rolled it for the premium even though it is a day out.

Rolled $XSP Mar 5th 683 put to Mar 6th 683 put, 1.10 credit

GLD,

STO April 17, $400 puts at 2.60 for a small trade.

SPY Expiration

SPY 03/03/2026 657/659 Bull Put Spread

SPY 03/03/2026 660/663 Bull Put Spread

SPX

Rolled today’s SPX Mar 3rd 2026 6900 Put to Mar 5th 6900 Put @ 10.00.

SPX roll

Rolled $SPX Mar 3 6820 put down and out to Mar 4 6770 put @ 3.85 credit

SPX

Rolled to Friday. Not sure about total credit yet. A little behind on my accounting. Celebrated my last night in Vegas last night kinda late. 🙂 🙂 🙂 🙂

Rolled SPX Mar 3 2026 6875.0 Put to Mar 6 6855.0 Put .45 credit

Rolled SPX Mar 3 2026 6850.0 Put to Mar 6 6825.0 Put 6.80 credit

Remaining strikes now at 6855, 6850, 6825, 6800

XSP rolls 3/3/24

#FuzzyLEAPs Rolled DOWN one of my LEAP spreads and used credit to roll down one of my daily put strikes.

Sold to close 695/695/735 LEAP for 50.50. Opened two of them in January, average price 38.90.

Opened 685/685/725 LEAPs for 40.70 on Feb 24th. So the roll gave me a 9.80 credit.

Rolled $XSP Mar 3rd 695 put to Mar 5th (2 days) 683 put, 10.50 debit.

Now I need to figure out what to do with the other 695, and two 693’s with today’s expiry.

SPX

#fuzzyleaps

Locked in some profits on LEAPs:

Rolled SPX Dec 20th 2030 7600 Long Puts to Dec 20th 2030 7000 Long Puts @ 189.00 credit.

Remaining cost basis of 7000 LEAP Puts 678.47.

These are simple puts, without the BECS.

Now to work on today’s short Put…

TQQQ,

STO April 17, $35 puts at 1.51

I covered them at 1.40 for a day trade.

Tuesday Trades

Rolled 1 SLV 03/04/2026 86/76 Bear Call Spread to 1 SLV 03/06/2026 88/78 Bear Call Spread at $0.08 Credit

Sold 1 NFLX 03/06/2026 86/90 Bull Put Spread at $0.15 Credit

Sold 1 NFLX 03/06/2026 85/89 Bull Put Spread at $0.14 Credit

Sold 1 WDAY 03/06/2026 143.0 Call at $0.77 (sold against a leftover long from last week’s diagonal spread)

Bought 1 WDAY 03/13/2026 150.0 Call / Sold 1 WDAY 03/06/2026 142.0 Call for a $0.27 Diagonal Credit

Sold 1 SPY 03/03/2026 657/659 Bull Put Spread at $0.05 Credit – expires today

Sold 1 SPY 03/04/2026 653/656 Bull Put Spread at $0.21 Credit

Sold 1 SPY 03/05/2026 657/660 Bull Put Spread at $0.34 Credit

Sold 1 SPY 03/05/2026 650/652 Bull Put Spread at $0.19 Credit

Sold 1 SPY 03/06/2026 653/656 Bull Put Spread at $0.36 Credit

Sold 1 SPY 03/06/2026 641/644 Bull Put Spread at $0.20 Credit

Sold 1 CPB 03/06/2026 25.5 Put at $0.10

Sold 1 FISV 03/06/2026 57.5 Put at $0.35

Monday 3/2 trades

Re-establishing positions from CC’s that got exercised .

DE @ 632 Mar 20 STO -610 p $8.00 25% annualized

LNG @ 285 Mar 20 STO -230 p $1.65 15% annualized

EWW @ 79 Mar 20 STO -80 p $2.15 54% annualized ITM short put which I rarely do but the number worked

TRPG @ 240 Mar 20 STO -230 $3.56 31% annualized

SPGI @443 Mat 20 STO -420 p $4.90 23% annualized sensing a bottom on this maybe ?

XSP @ 689 Mar 3 STO – 682 p $1.20 64% annualized

Mar 5 STO -678 p $2.20 39% annualized

SPX put roll

$SPX closing at 6881.62 replaced expiring Mar 2 6780 put: Sold to open Mar 3 6820p @ 10.50, tomorrow around 25 points outside the expected move.

SLV SPY Expiration

SLV 03/02/2026 69/72 Bull Put Spread

SLV 03/02/2026 73/75 Bull Put Spreads

SLV 03/02/2026 74/76 Bull Put Spreads

SLV 70.0 Put

SLV 74.0 Put

SPY 03/02/2026 663/666 Bull Put Spread

SPX SPY

Bought to Close SPX Mar 2 2026 6825.0 Put @ .25 (sold for 43.25)

Bought to Close SPX Mar 2 2026 6825.0 Put @ .25 (sold for 47.75)

Bought to Close SPX Mar 2 2026 6825.0 Puts @ .25 (sold for 19.80

Bought to Close SPX Mar 2 2026 6850.0 Puts @ .40 (sold for 21.10)

Bought to Close SPX Mar 2 2026 6850.0 Puts @ .40 (sold for 66.95)

Rolled SPX Mar 2 2026 6880.0 Puts to Mar 3 6875.0 Puts @ 11.15 credit (41.30 total now)

Sold to Close 75 percent of my LEAPS positions prepping for a ROTH IRA conversion.

Bought to Close all SPY positions at breakeven for same reason.

SPX

#fuzzyleaps

Rolled today’s SPX Mar 2nd 2026 6825 Put to Mar 4th 2026 6775 Put @ 12.50.

SPY Put Spread

Sold 1 SPY 03/04/2026 660/663 Bull Put Spread at $0.13 Credit

SPX

Bought to Close SPX Mar 20 2026 7100.0/7105.0 Bear Call Spreads @ .75 (sold for 1.50)

More Monday trades

Bought to close HPQ 03/06/2026 15.5 Puts at $0.01

Bought to close PSKY 03/06/2026 10.0 Put at $0.01

Sold 1 SLV 03/02/2026 70.0 Put at $0.02 – expires today

Sold 1 SLV 03/02/2026 74.0 Put at $0.08 – expires today

Sold 1 SLV 03/04/2026 66.0 Put at $0.08

Sold 1 SLV 03/06/2026 60.0 Put at $0.07

Sold 1 MSTX 03/06/2026 2.0 Put at $0.07

Sold HPQ 03/06/2026 17.5 Puts at $0.09 and $0.10

Sold 1 CPB 03/06/2026 26.0 Put at $0.15

Sold 1 BOIL 03/06/2026 22.0 Covered Call at $0.08

Sold 1 DOW 03/06/2026 32.0 Covered Call at $0.28

#EveryLittleBitHelps

XSP rolls 3/2/26

#FuzzyLEAPs Since we’ve gone up nicely since the opening lows I’m just doing standard rolls and not trying anything fancy.

Rolled $XSP Mar 2nd 693 puts to Mar 3rd 693 puts, .40 credit

Waiting for fill on 695’s…

Monday Spreads

Sold 1 SLV 03/06/2026 64.5/69.5 Bull Put Spread at $0.23 Credit

Sold 1 SLV 03/06/2026 64/70 Bull Put Spread at $0.24 Credit

Sold 1 SLV 03/04/2026 68/75 Bull Put Spread at $0.43 Credit

Sold SLV 03/04/2026 67/74 Bull Put Spreads at $0.35 and $0.37 Credits

Sold 1 SLV 03/04/2026 68/73 Bull Put Spread at $0.35 Credit

Sold 1 SLV 03/04/2026 66/73 Bull Put Spread at $0.23 Credit

Sold SLV 03/02/2026 73/75 Bull Put Spreads at $0.03 and $0.07 Credits – expires today

Sold SLV 03/02/2026 74/76 Bull Put Spreads at $0.05, $0.10 and $0.11 Credits – expires today

Sold 1 SPY 03/04/2026 657/660 Bull Put Spread at $0.13 Credit

Sold 1 SPY 03/03/2026 660/663 Bull Put Spread at $0.21 Credit

Sold 1 SPY 03/02/2026 663/666 Bull Put Spread at $0.08 Credit – expires today

Sold 1 BBY 03/06/2026 49/51 Bull Put Spread at $0.12 Credit

Sold 1 DOW 03/06/2026 34.5/32.5 Bear Call Spread at $0.12 Credit

SPX put

Starting to put covers back on the synthetic short LEAPS.

Sold $SPX Mar 2 6780 put @ 6.30

Took profits on GUSH

On the spike in oil, closed this position at the open: Sold to close Mar 20 35 calls @ 2.12. Bought for .56 on Feb 10.

OXY HAL Stock

Sold half my remaining tiny position in OXY at $56.32 pre-market.

Bought in December 2024 at $45.78

Sold the last tiny bit of HAL at $36.80

Bought in April 2025 at $23.44

Earnings 3/1 – 3/5

Econ Calendar 3/1 – 3/5

Markets

https://www.zerohedge.com/markets/market-topping-process

“Technically, the market looks weak, as shown in the chart below. Momentum continues to fade along with Relative Strength. Furthermore, the market has been making lower highs as of late and is threatening to break important support at the 100-day moving average.”

PSKY

Closed some PSKY 03/06/2026 9.5 Puts at $0.01 ( a week early)

Sold at $0.11 and $0.24

OptionsExpiration

Busy, busy #Earnings week

CRM 140/145 Bull Put Spread

CRM 227.5/222.5 Bear Call Spread

NFLX 75/82 Bull Put Spread

ORCL 128/131 Bull Put Spread

ORCL 167.5/162.5 Bear Call Spread

ORCL 167.5/160 Bear Call Spread

SLV 62/70.5 Bull Put Spread

SLV 65.5/71 Bull Put Spread

SLV 69.5/73 Bull Put Spread

SLV 71.5/74.5 Bull Put Spread

WDAY 115/118 Bull Put Spread

WDAY 140/135 Bear Call Spread

#OnlySpreads

AI 7.5 Put

BOIL 15.0 Put

CTRA 28.0 Put

CTRA 27.5 Put

FIS 43.0 Put

FIS 42.0 Put

HPQ 15.0 Put

HPQ 15.5 Put

HPQ 17.0 Put

PSKY 9.0 Puts

PSKY 10.0 Put

TTD 18.0 Put

TTD 17.5 Put

TZA 5.5 Put

WBD 25.0 Put

#TinyPuts

BAX 22.5 Covered Calls

BOIL 22.0 Covered Call

DOW 32.5 Covered Call

HRL 27.0 Covered Call

MSTX 6.0 Covered Call

TZA 10.0 Covered Calls

#EveryLittleBitHelps

ASSIGNMENTS:

1 PSKY 12.0 Covered Call – stock put to me at $11.50 on 01/30

SPX

Rolled earlier. Just now getting a chance to post.

Rolled SPX Feb 27 2026 6850.0 Puts to Mar 2 6825.0 Puts @ 13.10 credit (19.80 total now)

Rolled SPX Feb 27 2026 6875.0 Puts to Mar 2 6850.0 Puts @ 7.10 credit (66.95 total now)

Rolled SPX Feb 27 2026 6875.0 Puts to Mar 2 6850.0 Puts @ 9.50 credit (20.50 total now)

Rolled SPX Feb 27 2026 6900.0 Puts to Mar 2 6880.0 Puts @ 2.65 credit (30.15 total now)

Accidentally rolled my ladder position to Monday instead of next Friday. I’ll adjust it on Monday.

Rolled SPX Feb 27 2026 6850.0 Put to Mar 2 6825.0 Put @ 13.10 credit (47.80 total now)

Closing short SPX puts

Taking these off and leaving the paired synthetic shorts uncovered for potential weekend downside if there is military action in the middle east:

Bought to close $SPX Feb 27 6860 put @ .35

Bought to close $SPX Feb 27 6890 put @ 17.30

SPX

#fuzzyleaps

Rolled today’s SPX Feb 27th 2026 6900 Put to Mar 3rd 2026 6900 Put @ 20.00.

TQQQ,

STO April 17, $35 puts at 1.05

BTC at 1.03because this market does not feel right to me and who knows what will happen over the weekend.

CMG TMO Spreads closed

Bought to close 1 CMG 02/27/2026 42/38 Bear Call Spread at $0.01

Bought to close 1 TMO 02/27/2026 475/490 Bull Put Spread at $0.05

SLV Puts Closed, Calls Rolled

Bought to close 1 SLV 02/27/2026 70/74 Bull Put Spread at $0.01

Rolled 1 SLV 02/27/2026 89/84.5 Bear Call Spread to 1 SLV 03/06/2026 98/92 Bear Call Spread at $0.09 Credit

XSP roll for 2/27/26

#FuzzyLEAPs

Rolled $XSP Feb 27th 693 puts to Mar 2nd 693 puts, .70 credit

I’m moving to Denver over the weekend, folks. Second time I’m leaving LA for a new adventure!

SLV Calls Rolled

Rolled 1 SLV 02/27/2026 82/80 Bear Call Spread to 1 SLV 03/02/2026 87/81 Bear Call Spread at $0.54 Credit

#DamageControl