#FuzzyLEAPs

Existing LEAP:

Dec 20th 2030 7700 Put

Daily:

Rolled: Jan 16th 2026 6915 Put

To: Jan 20th 2026 6890 Put

@ 4.70 Credit

LEAPs Covered: 50.00%

SPX @ Time of Roll: 6943

Total Credit Per LEAP: 13.1

Credit as % of LEAP Cost: 1.41%

Recent Updates

SPX

One add.

Sold SPX Jan 20 2026 6925.0 Put @ 12.00

SPX

At the open:

Bought to Close SPX Jan 16 2026 6850.0 Put @ .35 (sold for 12.00)

Bought to Close SPX Jan 16 2026 6875.0 Put @ .70 (sold for 12.00)

Sold SPX Jan 20 2026 6920.0 Puts @ 12.10

Waiting for AM settlement now due to my fat finger yesterday. First time I’ve ever had an AM expiration so once SET gets published I’m hoping I can sell those again. SPX closed at 6944 yesterday but was up about 15 at the open so hoping all my 6950s go worthless shortly.

Takes 30-60 minutes after the open:

AM-settled SPX options (standard monthly expirations) are cash-settled on the third Friday morning, based on the “Special Opening Quotation” (SOQ) of the S&P 500, calculated from the opening prices of all constituent stocks, with the final value published under the ticker SET after all stocks have opened, resulting in cash profits or losses credited/debited to accounts the next day, not share delivery.

XSP rolls for 1/16/26

#FuzzyLEAPs

Filled at the bell: Rolled $XSP Jan 16th 692 put to Jan 20th 692 put for .83

I had this order going in pre-market with no fill. Filled immediately after bell, after which premium quickly dropped to around .70. This seems to be a good fill for being 4 pts OTM…. grabbing high premium at the volatile moment of the open may be an approach to consider often.

I was NOT filled on 696 roll, limit order of 1.10. But I will wait since we are ATM like yesterday.

SOXL Put

Sold 1 SOXL 01/16/2026 55.0 Put at $0.31

#1DTE

SPX

Finally got a little dip.

Fat fingered to AM expiration:

Rolled SPX Jan 15 2026 6940.0 Puts to Jan 16 2026 6950.0 Puts @ 6.00 credit. (33.00 total now)

Regular expiration:

Rolled SPX Jan 15 2026 6940.0 Puts to Jan 16 2026 6950.0 Puts @ 9.00 credit. (36.00 total now)

New carpet in the rental houses:

Rolled Dec 2029 6900 long puts up to Dec 2029 7000 long puts

Rolled Dec 2029 6900/7300 BeCS to Dec 2029 7000/7400 BeCS

Net debit for the whole thing: 32.60 per house

SPX

#FuzzyLEAPs

Existing LEAP:

Dec 20th 2030 7700 Put

Daily:

Rolled: Jan 15th 2026 6925 Put

To: Jan 16th 2026 6915 Put

@ 4.50 Credit

LEAPs Covered: 50.00%

SPX @ Time of Roll: 6955

Total Credit Per LEAP: 10.75

Credit as % of LEAP Cost: 1.16%

GLD

STO Feb. 27, $400 puts at 3.10 for a small trade.

SOXL SWKS Puts

Sold 1 SOXL 01/16/2025 50.0 Put at $0.07

Sold 1 SWKS 01/16/2025 57.5 Put at $0.22

#TinyPuts

XSP rolls 1/15/26

#fuzzyleaps

Rolled $XSP Jan 15th 692 put to Jan 16th 692 put for .53

Order in for .88 to roll the 696 puts. Since this is close to the money roll premium should increase as day progresses.

SLV Expiration

1 SLV 55/60 Bull Put Spread

1 SLV 71/74.5 Bull Put Spread

1 SLV 73/75.5 Bull Put Spread

SPX

Added one more out to Friday. Filled just before the big bounce.

Sold SPX Jan 16 2026 6850.0 Put @ 12.00

CVX Stock

Sold out of my last tiny bit of CVX at the former 52-week high of $168.96.

Bought in September 2024 at $139.00

Thanks Venezuela

VIX 20/35 Bull Call spread

Rolled VIX Jan 20 20/35 Bull Call spread to Feb 17 20/35 for $0.67

TQQQ,

STO February 27, $45 puts at 1.60

SPX

SOXL Puts

Sold 1 SOXL 01/16/2026 43/47 Bull Put Spread at $0.20 Credit

#EveryLittleBitHelps

QQQI

#shortputs

Sto QQQI 16 JAN 2026 54 PUT @.22

SPX

#FuzzyLEAPs

Existing LEAP:

Dec 20th 2030 7700 Put

Daily:

Rolled: Jan 14th 2026 6925 Put

To: Jan 15th 2026 6925 Put

@ 9.50 Credit

LEAPs Covered: 50.00%

SPX @ Time of Roll: 6898

Naturally we are rallying after my fill, so I could have done even better by waiting. Oh well. 9.50 is still a decent amount of Benjamins!

XSP and SPY for 1/14/26

#FuzzyLEAPs

Rolled $XSP Jan 14th 692 put to Jan 15th 692 put, .83 credit

Missed the fill on rolling ITM 696 puts. Waiting to see if we can rally into afternoon.

Closed my third $SPY spread:

STC $SPY Jan 2028 685/685/725 LEAP spread for 31.20 right after the open (could have almost been breakeven had I waited)

Originally bought for 33.50 on Dec 11th.

Loss of -2.25 on LEAPs

Gain of 13.67 on daily put sales.

TOTAL profit +11.42

I now have one 690/690/730 $SPY LEAP spread I plan to keep open as a hedge.

I have ITM Jan 14th 692 put that I will keep rolling until it expires worthless, after which I will leave the LEAP spread “uncovered” with no daily puts.

I will also add a fourth and final $XSP LEAP spread when we return toward new highs.

BOIL Put

Sold 1 BOIL 01/16/2025 14.0 Put at $0.06

#TinyPuts

CLX DOW GIS SLB

Taking some smallish gains on part of these positions near recent recovery highs

Sold CLX at $110.90 (recent low at $96.66)

Sold DOW at $28.17 (recent low at $20.40)

Sold GIS at $45.01 (recent low at $42.79)

Sold SLB at $46.63 – bought in September 2024 at $41

#FormerFallingKnife

TQQQBTC Feb. 13, $46 puts…

TQQQBTC Feb. 13, $46 puts at .95, sold at 1.70

TQQQ,

BTC Feb. 6, $46 puts at .72, sold at 1.21

I am back to 100% cash.

TQQQ,

BTC Feb. 20. $45 puts at 1.00, sold at 1.51 just to reduce risk.

SLV Puts

Sold 1 SLV 01/14/2026 71/74.5 Bull Put Spread at $0.14 Credit

Sold 1 SLV 01/16/2026 68/71 Bull Put Spread at $0.16 Credit

BAX MSTX SOXL

Sold BAX 01/16/2026 22.5 Covered Calls at $0.02

Sold 1 MSTX 01/16/2026 6.0 Covered Call at $0.02

Sold 1 MSTX 01/16/2026 3.5 Put at $0.07

Sold 1 MSTX 01/16/2026 3.0 Put at $0.03

Sold 1 SOXL 01/16/2026 41.0 Put at $0.06

#EveryLittleBitHelps

SPX

Added one out to Friday.

Sold SPX Jan 16 2026 6875.0 Put @ 12.00

SPX

Straight roll on the opening dip. Same credit as yesterday.

Rolled SPX Jan 13 2026 6940.0 Puts to Jan 14 2026 6940.0 Puts @ 8.00 credit. (20.50 total now)

SPX

#FuzzyLEAPs

Existing LEAP:

Dec 20th 2030 7700 Put

Daily:

Rolled: Jan 13th 2026 6925 Put

To: Jan 14th 2026 6925 Put

@ 4.50 Credit

LEAPs Covered: 50.00%

XSP and SPY rolls 1/13/26

#FuzzyLEAPs

Rolled $XSP Jan 13th 696 puts to Jan 14th 696 puts, .85 credit

Rolled $SPY Jan 13th 692 put to Jan 14th 692 put, .70 credit

Will probably sell another XSP daily today.

I’m going to dump one of my two $SPY spreads on a decent pullback, and may keep the other as a longer-term hedge against XSP strategy going forward.

SOXL

Added one more:

Bought 1 SOXL 01/23/2026 64.0 Call / Sold 1 SOXL 01/16/2026 59.0 Call at $0.24 Diagonal Credit

SPX

After doing some paper trading, I am ready to dive into the FuzzyLEAPs trade:

Bought to Open SPX Dec 20 2030 7700 Puts @ 927

Sold SPX Jan 13 2026 6925 Puts @ 3.00

I plan to scale in and out of the daily short puts, depending on how far SPX is above its 12-Month MA. For this opening trade, I sold half of the available position, leaving half of the LEAP puts uncovered. In future posts, I will represent this as a percentage, like this:

LEAPs 50% covered.

Also, I am simply buying the Put, without selling the Call Spread, just to keep it simple. I plan to always keep the LEAP Puts above the short Puts, to eliminate any margin requirements. I picked the 7700 LEAP Put to start with simply because it is 10% ITM.

My target delta for selling daily Puts is between 10 and 20, but that will vary of course depending on market movements.

SLV Expiration

1 SLV Jan 12/2026 57/61 Bull Put Spread

BOIL Call Ladder

On the open

Sold 1 BOIL 01/16/2026 22.0 Covered Call at $0.10

Sold 1 BOIL 01/23/2026 22.0 Covered Call at $0.25

Sold 1 BOIL 01/30/2026 22.0 Covered Call at $0.41

SLV SOXL Spreads

Sold 1 SLV 01/14/2026 80/77.5 Bear Call Spread at $0.71 Credit (on the opening this morning)

Sold 1 SLV 01/16/2026 85.5/83 Bear Call Spread at $0.31 Credit (on the opening this morning)

Sold 1 SLV 01/16/2026 90/87 Bear Call Spread at $0.16 Credit (just now)

Sold 1 SOXL 01/16/2026 43.5/46 Bull Put Spread at $0.19 Credit (on the opening this morning)

Bought 1 SOXL 01/23/2026 64.0 Call / Sold 1 SOXL 01/16/2026 59.0 Call at $0.12 Diagonal Credit

SPY/XSP trades 1/12/26

#FuzzyLEAPs

Rolled $SPX Jan 12th 692 put to Jan 13th 692 put for .90

Opened my second $XSP LEAP spread (replacing SPY spread closed on Friday).

Dec 2028 690/690/730 spread for 37.60

Sold against it TODAY’s 694 put for .77

I could have sold tomorrow’s 694 for almost twice the price, so it may be futile to sell same day then roll later, but kind of testing that out.

Now I have 2 positions on each of SPY and XSP. I have one short put on each that are not rolled yet.

I will wait to close another SPY on a down day. I’m fine for now with two of each as assignment risk is lower than before.

SPX

Out the rest of the day so an early roll. Good premium with some big banks reporting before the open. Might add one more put sale if there’s a decent afternoon drop.

Rolled SPX Jan 12 2026 6940.0 Puts to Jan 13 2026 6940.0 Puts @ 8.00 credit. (12.50 total now)

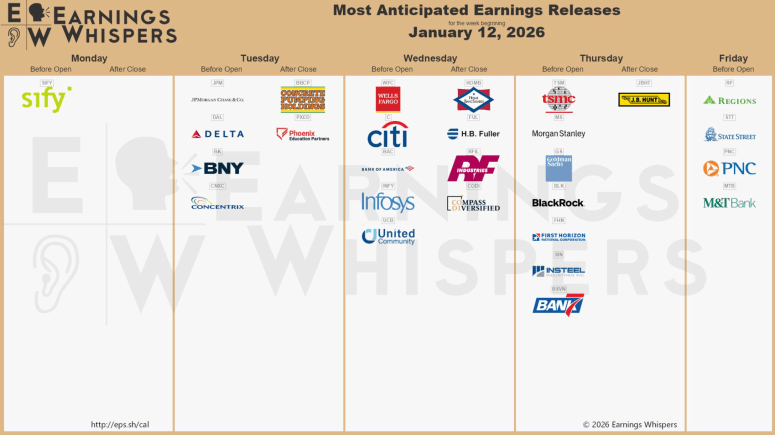

Earnings 1/12 – 1/16

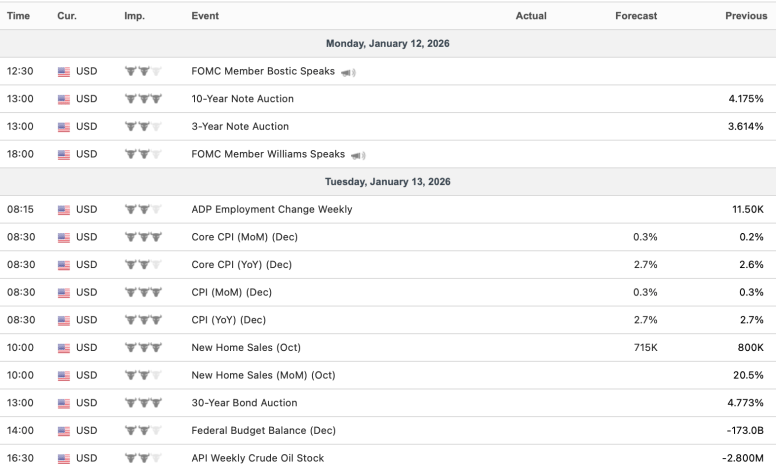

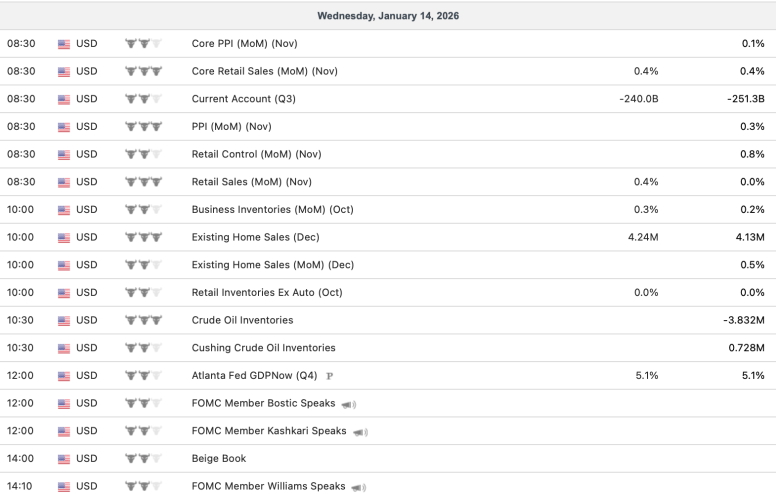

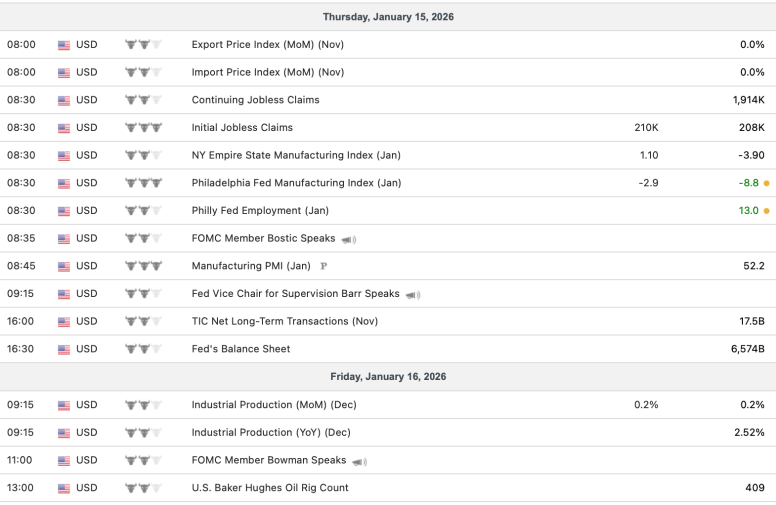

Econ Calendar 1/12 – 1/16

Question for @fuzzballl about SPX LEAPS

1. What is the advantage of doing LEAPS out to 2030 instead of staying with 2028 or 2029?

Theta decay would become an issue with 1 year or less before expiry.

The initial investment is larger if going out to 2030 vs. staying with 2028-2029.

The only benefit that I can think of going to 2030 is if SPX will start declining.

You would still have to roll up in case the SPX will keep moving up, so why not get the maximum return on your investment by staying in 2028-2029?

2. I understand the reason for keeping uncovered LEAPS. You can get much higher premium if you catch SPX in a down move. However, does the math works? If you are waiting for 3-5 trading days, then the premium lost would be $30-50 per LEAP. Do you think you can get that much in a down move in SPX to counter the lost revenue?

Of course, if you are holding uncovered LEAPS just as a hedge, then my question is irrelevant.

Would love to know what you think about this.

AMZN

AMAZON PHARMACY TO START SELLING NOVO NORDISK’S WEGOVY PILL

- $25/mo on insurance plans

- $149/mo cash-pay option

- free shipping to all 50 states, same-day delivery available to ~half of customers

$HIMS $NVO $LLY $AMZN

OptionsExpiration

GLD 430/425 Bear Call Spread

HLT 282.5/285 Bull Put Spread

HLT 282.5/287.5 Bull Put Spread

NVDA 172.5/175 Bull Put Spread

NVDA 212.5/207.5 Bear Call Spread

NVDA 202.5/197.5 Bear Call Spread

SLV 57/62 Bull Put Spread

SLV 60/65 Bull Put Spread

SLV 80/75 Bear Call Spread

SOXL 40/45 Bull Put Spread

SOXL 41/45.5 Bull Put Spread

APA 22.5 Put

CAG 16.0 Put

CPB 25.5 Put

LW 40.0 Put

BAX 23.0 Covered Calls

BOIL 25.0 Covered Call

MSTX 6.5 Covered Call

TZA 10.0 Covered Calls

Assignments:

1 BAX 20.5 Covered Call

1 IP 43.0 Covered Call

BOIL 18.5 Puts

BOIL 18.0 Put

BOIL 16.0 Puts

SPX

Bought to Close SPX Jan 9 2026 6925.0 Puts @ .15 (sold for 22.50)

Sold SPX Jan 12 2026 6940.0 Puts @ 4.50 (leaving one more uncovered)

TQQQ,

BTC January 30, $46 puts ay .45, Sold at 1.12 nd 21 days to expiration.

SOXL Spread

Sold 1 SOXL 01/16/2026 60/57.5 Bear Call Spread at $0.46 Credit

SPY/XSP for 1/9/26

#FuzzyLEAPs

Rolled $SPY Jan 9th 689 put to Jan 12th 689 put, .70 credit

Holding off on rolling 691 since it’s close to ATM. Seeing if premium increases toward day’s end.

Closed another SPY LEAP spread: Jan 2028 685/685/725 for 31.50. Originally purchased on Dec 4th for 36.11.

Allowing associated Jan 9th 687 put to expire.

Lost 4.61 on LEAPs, gained 17.59 from daily put sales.

Profit on trade is 12.98

Opened my first $XSP spread:

Bought the Dec 2028 695/695/735 spread for 39.39.

Sold Jan 12th 691 put for .70

XSP SPX

#creditspread

Closed to free capital

BTC VERTICAL XSP 12 JAN 2026 680/675 PUT @.05

BTC VERTICAL XSP 9 JAN 2026 686/682 PUT @.05

BTC VERTICAL SPX 9 JAN 2026 6825/6820 PUT @.05

BTC VERTICAL XSP 9 JAN 2026 683/678 PUT @.05

December Jobs Report

#Jobs — Lower than expected but UE drops.

Gain of +50,000 non-farm payroll jobs, vs. expected gain of 73K

Unemployment down by 0.2 at 4.4%

U6 unemployment 8.4%, down by 0.3

Labor force participation down 0.1 to 62.4%

Average hourly earnings up by 0.3%; +3.8% Y/Y

November jobs revised down by -8K to +56K

October jobs revised down by -68K to -173K

EMN DOW Stock

Sold out of my tiny position in EMN at $70.25

Bought on August 1 2025 at $57.00 and really never got the chance to average down.

Also got the latest quarterly dividend payment today in my account.

Also sold part of my position in DOW at $26.35 for a small overall gain

SPX

Great premium tomorrow with the early morning data dump and possible tariff decision.

Rolled SPX Jan 8 2026 6925.0 Puts to Jan 9 2026 6925.0 Puts @ 12.00 credit (22.50 total now)

SPY rolls 1/8/26

#FuzzyLEAPs $SPY

Rolled Jan 8th 687 put to Jan 9th 687 put for 1.11

Rolled Jan 8th 689 put to Jan 9th 689 put for 1.10

Rolled Jan 8th 691 put to Jan 9th 691 put for 1.00

Bought to close 690 put for 1.66 (sold for 1.03 yesterday)

Sold to close Jan 2028 LEAPs spread 690/690/730 for 34.45. Bought this for 33.20 on Tuesday.

I closed this spread and its daily short with intention to migrate to $XSP. I made 1.25 on the LEAPs and .18 on 2 put sales.

HLT Calls

Rolled HLT 01/09/2026 300/297.5 Bear Call Spreads to HLT 01/16/2026 305/300 Bear Call Spreads at $0.20 Credit

GIS Stock

Added a bit more at $42.91.

Ex-div tomorrow

SLV and GLD Expiration

SLV 56.5/61.5 Bull Put Spread

SLV 59/62 Bull Put Spread

SLV 60/65 Bull Put Spread

SLV 77/74.5 Bear Call Spread

SLV 74.5 Diagonal Call

SLV 75.0 Diagonal Calls

GLD 425/420 Bear Call Spread

XSP/SPX

#creditspread

#everylittlebithelps

SOLD VERTICAL XSP 12 JAN 2026 680/675 PUT @.17

SOLD VERTICAL XSP 9 JAN 2026 686/682 PUT @.26

SOLD VERTICAL XSP 9 JAN 2026 683/678 PUT @.15

==—

SOLD VERTICAL SPX 9 JAN 2026 6825/6820 PUT @.30

SLV Spreads

Sold 1 SLV 01/09/2026 60/65 Bull Put Spread at $0.18 Credit

Sold 1 SLV 01/09/2026 80/75 Bear Call Spread at $0.39 Credit

#EveryLittleBitHelps

TQQQ,

BTO March 20, $50 calls at 9.10

SPX

Rolled SPX Jan 7 2026 6925.0 Puts to Jan 8 2026 6925.0 Puts @ 4.60 credit (10.50 total now)

CPB CAG Puts

Sold 1 CPB 01/09/2026 25.5 Put at $0.10

Sold 1 CAG 01/09/2026 16.0 Put at $0.05

#TinyPuts #EveryLittleBitHelps

HLT Spreads

Adding one more at a better credit:

Sold 1 HLT 01/09/2026 300/297.5 Bear Call Spread at $0.65 Credit

Also:

Sold 1 HLT 01/09/2026 282.5/287.5 Bull Put Spread at $0.22 Credit

Sold 1 HLT 01/09/2026 282.5/285 Bull Put Spread at $0.12 Credit

BOIL Put

Rolled the long side of a spread down and out

Sold to close 1 BOIL 01/09/2026 19.0 Put at $0.53 (Bought at $0.29)

Bought to open 1 BOIL 01/16/2026 17.0 Put at $0.34 for a $0.19 Credit

FallingKnife stocks

Added to all these at or below prior 52-week lows:

CAG at $16.28 and $16.25

CPB at $26.50 (Ex-div tomorrow)

GIS at $43.50 and $43.27 (Ex-Div 01/09)

HPQ at $21.21

KHC at $23.00

KMB at $97.00

LW at $40.40

All have decent dividends

SPY rolls 1/7/26

#FuzzyLEAPs $SPY rolls:

Rolled Jan 7th 689 put to Jan 8th 689 put for .53

Rolled Jan 7th 690 put to Jan 8th 690 put for .60

Rolled Jan 7th 686 put FIVE strikes higher to Jan 8th 691 put for 1.23

Still leaving one LEAP spread without a daily short, which I’ll probably add on a decent pull back. Also considering migrating this whole mess to $XSP to avoid assignment risk.

KHC Stock

Added a tiny bit of KHC at $23.48

#SP500 #FallngKnife

HLT Spread

Sold 1 HLT 01/09/2026 300/297.5 Bear Call Spread at $0.35 Credit

GE,

STO February 20, 310/320 put spread at 3.40

SPY rolls 1/6/26

#FuzzyLEAPs Rolling on the intraday swings

At the low of day, rolled $SPY Jan 6th 686 put to Jan 7th 686 put for .61 (10.25 so far)

As we spiked higher, rolled Jan 6th 689 put to Jan 7th 689 put for .69 (7.42 so far)

My 687 roll didn’t fill yet, so looking for another dip to get good premium. (15.87 so far)

BOIL SOXL GLD Spreads

Bought 1 BOIL 01/16/2026 15.0 Put / Sold 1 BOIL 01/09/2026 17.5 Put at $0.13 Diagonal Credit

Bought 1 SOXL 01/16/2026 58.0 Call / Sold 1 SOXL 01/09/2026 52.5 Call at $0.12 Diagonal Credit

Sold 1 GLD 01/07/2026 425/420 Bear Call Spread at $0.15 Credit

Sold 1 GLD 01/09/2026 430/425 Bear Call Spread at $0.22 Credit

BW

#rolling

Sto-BW /from-16 JAN 2026 7.5 PUT to-15 MAY 2026/@1.17

SLV Expiration

1 SLV 74/71.5 Bear Call Spread

1 SLV 58.50/61 Bull Put Spread

1 SLV 60/63 Bull Put Spread

META GOOGL SOXL AMZN Covered CAlls

#coveredcalls #syntheticcoveredcalls

$META STO 1/9 685 calls at 1.10

$GOOGL STO 1/9 327.5 calls at .80

$SOXL STO 1/9 56 calls at .45

$AMZN STO 1/9 240 calls at .45

KMB Puts

Sold 1 KMB 01/09/2026 95/96 Bull Put Spread at $0.15 Credit

SLB HAL Stock

Sold a tiny bit of SLB at $45.01.

Bought at $40 in September of 2024

Sold a tiny bit of HAL at $33.03.

Bought at $30 in September of 2024

SPY rolls 1/5/26

#FuzzyLEAPs Tried to wait for a dip to roll but never got it. As a result, I’m getting less than I could have had I rolled early. However, now I feel we are enough above 686 that I’m going to let today’s expire.

Sold $SPY Jan 6th 686 put for .66. Today’s 686 will expire, barring some last minute crash, in which case I will close it.

My other two expire tomorrow so I will let them ride since they are close enough to the money, 687 and 689.

SPY

I’ll look to reload on any decent dips.

Bought to Close SPY Feb 20 2026 700.0 Puts @ 16.60 (sold for 18.70)