1 SPY 03/18/2024 490/495 Bull Put Spread – sold on 03/11 at $0.29

Monthly Archives: March 2024

SPX

#SyntheticShortStock – Good IV for rolling this week so taking a little more risk.

Rolled SPX Mar 19 2024 5145.0 Puts to Mar 19 2024 5150.0 Puts @ 2.00 credit (26.05 and 26.75 total now)

XBI

#ShortPuts – One add to the ladder.

Sold XBI Apr 19 2024 87.0 Put @ 1.15

VFC PARA MU NKE Puts

Sold 1 VFC Mar 22 2024 13.5 Put at $0.07

Sold 1 PARA Mar 22 2024 10.5 Put at $0.08

Sold 1 MU Mar 22 2024 72 Put at $0.09

Sold 1 NKE Mar 22 2024 83 Put at $0.12

#EveryLittleBitHelps

TQQQ,

STO May 17, 45 [uts at 1.02

SPX 0-dte 3/18/24

#SPX0dte Sold to Open $SPX Mar 18th 5125/5155-5160/5190 condors for 15.60, IV 17.7%

20-winged test trade going for 12.75

Earnings 3/18 – 3/22

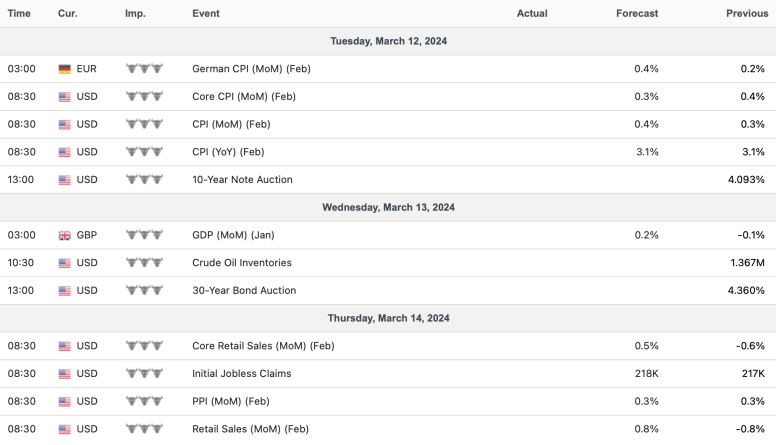

Economic Calendar 3/18 – 3/22

#FOMC interest rate decision is Wednesday afternoon

SPY Expiration

1 SPY 03/15/2024 495/500 Bull Put Spread – Sold on 03/05 at $0.41 Credit

TQQQ,

BTC March 22, 48 puts at .11 cents, sold at .75 cents. I an raising some cash because I think there is a buying opportunity coming in the next week or two.

TSLA

#SyntheticStock – Another round.

Bought to Close TSLA Mar 15 2024 165.0 Calls @ .15 (sold for 12.85)

Sold TSLA Mar 22 2024 160.0 Calls @ 5.40

SPX

#SyntheticShortStock – Finally getting a little weakness. Roll these down a little and hopefully reset the selling level a lot lower. Going out to Tue and down 10 points.

Rolled SPX Mar 15 2024 5155.0 Puts to Mar 19 2024 5145.0 Puts @ 1.75 credit (24.80 total now)

META

#onlyspreads

#everylittlebithelps

Sto META 22 MAR 2024 445/440 PUT @.19

SPY Puts

Sold 1 SPY 03/19/2024 495/500 Bull Put Spread at $0.27

Sold 1 SPY 03/20/2024 495/500 Bull Put Spread at $0.38

Sold 1 SPY 03/21/2024 490/495 Bull Put Spread at $0.22

Sold 1 SPY 03/22/2024 490/495 Bull Put Spread at $0.27

TQQQ,

It looks like my 45 puts that I sold at 1.01 will expire at zero today.

SPX 0-dte 3/15/24

#SPX0dte Sold to Open $SPX 5130/5150-5155/5185 condors for 18.00, IV 22%

20-winged test going for 14.00.

HE MARA ULTY

STO HE 15 MAR /28 MAR 2024 12 PUT @.05

STO MARA 15 MAR 2024/22 MAR 2024 17 PUT @.72

STO MARA 15 MAR 2024/22 MAR 2024 18 PUT @.81

—————-

#smallbuy

#onDIScount

BOT ULTY @18.57

UVXY Calls

Sold UVXY 03/22/2024 13/9.5 Bear Call Spreads at $0.08 Credit

Sold UVXY 03/28/2024 13/9.5 Bear Call Spreads at $0.12 Credit

Sold UVXY 04/05/2024 13/9.5 Bear Call Spreads at $0.14 Credit

SPY Expiration

1 SPY 03/14/2024 490/495 Bull Put Spread – Sold on 03/05 at $0.33 Credit

1 SPY 03/14/2024 525/520 Bear Call Spread – Sold on 03/01 at $0.67 Credit

TSLA late trades

Bought 1 TSLA 03/22/2024 145.0 Put / Sold 1 TSLA 03/15/2024 157.5 Put at $0.09 Credit

Hoping the short expires tomorrow leaving me with a long put to write against AGAIN.

Sold 1 TSLA 03/15/2024 180/170 Bear Call Spread at $0.15 for additional downside protection

TSLA

#SyntheticStock – Roll down again. Almost keeping up with the drop.

Rolled TSLA Mar 15 2024 170.0 Calls to Mar 15 2024 165.0 Calls @ 2.00 credit (12.85 total now)

SPX

#SyntheticShortStock – A straight roll…my favorite kind. Feels like a free day when no adjustments needed. Triple witching tomorrow so IV hanging in there nicely. Could’ve gotten over 10.00 if I would’ve held out a little longer. You never know.

Rolled SPX Mar 14 2024 5155.0 Puts to Mar 15 2024 5155.0 Puts @ 8.75 credit (23.20 total now)

TSLA 1-DTE

Sold 1 TSLA 03/15/2024 150/160 Bull Put Spread at $0.35

Sold 1 TSLA 03/15/2024 187.5/177.5 Bear Call Spread at $0.15

SPX 0-dte 3/14/24

#SPX0dte Sold to Open $SPX Mar 14th 5145/5175-5180/5210 condors for 15.25, IV 18.29%

20-winged test going for 12.40

SPY Expiration

1 SPY 03/13/2024 490/495 Bull Put Spread – sold on 03/05 at $0.27 Credit

1 SPY 03/13/2024 523/519 Bear Call Spread – sold on 03/11 at $0.25 Credit

SPY

STO SPY 20 MAR 2024 506/502 PUT @.43

SPX 0DTE Iron Fly

$SPX STO 3/13 5155/5175/5195 Iron Fly at 13.30 around 9:45

$SPX BTC 3/13 5155/5175/5195 Iron Fly at 11.25 around 12:00

15% of max

SPX

#SyntheticShortStock – Rolling a little earlier today.

Rolled SPX Mar 13 2024 5150.0 Puts to Mar 14 2024 5155.0 Puts @ 7.40 credit (14.45 total now)

COIN AMZN Call

#coveredcalls #syntheticcoveredcalls

$COIN STO 3/15 270 call at $8.06

$AMZN STO 3/15 182.5 call at .15

QQQ ULTY SMH NVDA SPY

#onlyspreads

#everylittlebithelps

STO QQQ 20 MAR 2024 419/416 PUT @.09

Sto SMH 22 MAR 2024 198/196 PUT @.07

Sto NVDA 22 MAR 2024 730/725 PUT @.24

STO SPY 20 MAR 2024 498/494 PUT @.10

BOT ULTY @19.58

SPX 0-dte 3/13/24

#SPX0dte Sold to Open $SPX Mar 13th 5140/5170-5175/5205 condors for 14.65, IV 16.55%

20-winged test going for 11.95.

GRPN Puts

Sold 1 GRPN 03/15/2024 9/13.5 Bull Put Spread at $0.37 Credit

#Earnings

FITB GPS FBTC Stocks

Sold tiny bits of these

Sold FITB at $37.01

Sold GPS at $22.08 and $23.09.

Sold FBTC at $64.01. Bought at $34.00.

Sold ADM at $57.77. Bought at $56.40

SPY Expiration

1 SPY 495/500 Bull Put Spread

1 SPY 524/518 Bear Call Spread

1 SPY 519 Diagonal Call

BA

#onlyspreads

#everylittlebithelps

tIP STO BA 22 MAR 2024 202.5/205 CALL @.10

SPX

#SyntheticShortStock – Another round.

Bought to Close SPX Mar 12 2024 5135.0 Puts @ .17 (sold for 13.75, 20.15, and 20.40)

Sold SPX Mar 13 2024 5150.0 Puts @ 7.05

BA put

Sold 1 BA 03/15/2024 165.0 Put at $0.13

Sold a LUV 03/15/2024 27. 0 put at $0.06.

Same theme

BA

#CoveredCalls – Fairly aggressive roll (again)

Rolled BA Mar 22 2024 192.5 Calls to Mar 22 2024 185.0 Calls @ 3.05 credit (11.95 total now)

TSLA Puts

Sold 1 TSLA 03/15/2024 152.5/162.5 Bull Put Spread at $0.28 Credit

SPX 0-dte 3/12/24

#SPX0dte At 6:33a, Sold to Open $SPX Mar 12th 5110/5140-5145/5175 condors for 17.40, IV 23.67%

20-winged test trade went for 13.85

CPI for February

Consumer prices rose 0.4% in February, as expected, and 3.2% from a year ago, vs expected 3.1%

IWM TQQQ SPY META

#onlyspreads

#everylittlebithelps

STO IWM 22 MAR 2024 194/193 PUT @.11

STO TQQQ 15 MAR 2024 51/48 PUT @.08

STO SPY 18 MAR 2024 488/484 PUT @.12

STO SPY 18 MAR 2024 489/485 PUT @.11

tIP STO META 15 MAR 2024 445/440 PUT @.16

Another Recap of 0DTE Trades

The link with charts and data is here:

https://optionalpha.com/blog/0dte-options-strategy-performance#:~:text=Top%20Performing%20Trades-,0DTE%20Options%3A,-Strategy%20Insights%20fromCharacteristics of Profitable 0DTE Traders

This research represents the activity and habits of the roughly 20% of Option Alpha 0DTE traders who have over 100 trades and are net profitable. 100 trades were chosen arbitrarily but should provide a “good enough” filter to represent a serious 0DTE trader.

The results provide an overview of the trading behaviors and performance of profitable traders for different strategy types, holding periods, and entry and exit conditions.

The research showed that three key variables led to better performance:

• Strategy type

• Entry & exit times

• Profit targets & stop losses

Neutral strategies

Neutral strategies were not only the most popular setups, they also had the best performance overall. Iron butterflies and iron condors comprised 78% of 0DTE positions and had win rates of 66.76% and 70.19%, respectively.

Entry & exit time of profitable trades

Most profitable trades were entered after the morning volatility and remained open for an average of approximately two hours. Broadly, consistently profitable traders opened positions at approximately 10:15 AM ET and closed shortly after 12:00 PM ET.

Line graph showing the entry time for all profitable 0DTE trades at Option Alpha.

Line graph showing the exit time for all profitable 0DTE trades at Option Alpha.

Optimizing profit targets and stop losses

Next, we wanted to determine what the most common exits were for both profitable and losing trades since the majority of these trades were not held until expiration.

The average percentage gain and loss for each strategy type highlights where successful traders are putting their profit-taking and stop losses.

The average gain and loss % for profitable 0DTE positions.

The data shows that targeting iron butterflies with small profit targets and stop losses led to successful trading based on the research. Profitable Option Alpha traders opened trades at 10:15 am EST on Mondays and Wednesdays and closed the position when it hit a profit of 15%, cut losses at -25%, or exited the trade at 12:00pm EST if neither exit criteria were met.

AAP Stock

Sold a tiny bit of AAP at 75.15. Bought last May at 73.50

SPY Expiration

1 SPY 495/500 Bull Put Spread

PFE

#BullPutSpreads – Taking the quickie on the bounce up to the 50 day.

Bought to Close PFE Aug 16 2024 30.0/25.0 Bull Put Spreads @ 2.45 (sold for 3.20)

TSLA

#SyntheticStock – Roll down into strength.

Rolled TSLA Mar 15 2024 195.0 Calls to Mar 15 2024 180.0 Calls @ 3.15 credit (6.40 total now)

BA

#CoveredCalls – Fairly aggressive roll.

Rolled BA Mar 15 2024 197.5 Calls @ to Mar 22 2024 192.5 Calls @ 3.40 credit (8.90 total now)

XBI

#ShortPuts – One add.

Sold XBI Apr 19 2024 89.0 Put @ 1.10

SPX

#SyntheticShortStock – A nice VIX pop and good IV tomorrow for CPI allows for a nice roll and credit.

Rolled SPX Mar 11 2024 5145.0 Puts to Mar 12 2024 5135.0 Puts @ 3.75 credit (13.75 and 20.40 total now)

SPY Puts

Sold 1 SPY 03/18/2024 490/495 Bull Put Spread at $0.29

ORCL KSS GRPN ARM AZO Puts

Sold 1 ORCL 03/15/2024 94/99 Bull Put Spread at $0.45

Sold 1 KSS 03/15/2024 19/23 Bull Put Spread at $0.31 Credit

Sold 1 GRPN 03/15/2024 9/14 Bull Put Spread at $0.42 Credit

#Earnings this week

Sold 1 ARM 03/15/2024 90/96 Bull Put Spread at $0.28 Credit

Sold 1 AZO 03/15/2024 2800/2850 Bull Put Spread at $0.53 (paired with the 3250/3200 Bear Call Spread sold last week)

NVDA Calls

Sold 1 NVDA 03/15/2024 1100/1070 Bear Call Spread at $0.60 Credit

VXX UVXY

Sold VXX 03/15/2024 19.00 Covered Calls at $0.06

Sold UVXY 03/15/2024 10.00 Covered Calls at $0.06

NVDY

#dividends

BOT NVDY @26.96

Earnings this week

SPX 0-dte 3/11/24

#SPX0dte Sold to Open $SPX Mar 11th 5070/5100-5105/5135 condors for 18.80, IV 23.39%

20-winged test at 14.50

This is high IV and high premium for a day with nothing major scheduled. $VIX is up as well. CPI report tomorrow morning.

Economic Calendar 3/11 – 3/15

SPY Expiration

1 SPY 03/08/2024 516.0 Call

1 SPY 495/500 Bull Put Spread

ARM Put Roll

#shortputs

$ARM BTC 3/8 130 put and STO 3/15 125 put at added credit of $4.36

VXX Calls

Extending my BEAR Call Ladder in VXX

Sold VXX 04/05/2024 25/20 Bear Calls Spreads at $0.18

Lots of the VXX spreads are expiring today

CEG Puts

Sold 1 CEG 03/15/2024 160/165 Bull Put Spread at $0.53 Credit

SPY Diagonal Calls

0-DTE for the short side

Bought 1 SPY 03/11/2024 522 Call at $0.26 / Sold 1 SPY 03/08/2024 518 Call at $0.56 for a $0.30 Credit

After a bit more rally in SPY:

Bought 1 SPY 03/11/2024 523 Call at $0.28 / Sold to close 1 SPY 03/08/2024 519 Call at $0.58 for a $0.30 Credit

TQQQ,

These will expire at zero today.

51 puts at 1.59

45 putss at .77

SPX

#SyntheticShortStock – Added a 2029 position at 5200/5200/5600 yesterday. Didn’t get a chance to sell against it.

Sold SPX Mar 11 2024 5145.0 Put @ 10.00

Maybe a little early on these though.

Rolled SPX Mar 08 2024 5125.0 Puts to Mar 11 2024 5145.0 Puts @ 8.00 credit (16.65 total now)

AVGO Call Spread

Bought to Close 1 AVGO 03/08/2024 1730/1700 Bear Call Spread at $0.01.

Sold on Monday at $0.87

#Earnings

HE

#rolling

HE / MAR 8,2024 TO MAR 15, 2024 ,12 PUT @.17

FITB Stock

Sold a tiny bit of FITB at $36.75 ( a new high )

Bought almost a year ago at $22.15

#FormerFallingKnife

SPX 0dte 3/8/24

#SPX0dte Sold to Open $SPX Mar 8th 5140/5170-5175/5205 condors for 17.35, IV 22.1%

20-point-winged test trade was at 13.65

February Jobs Report

#Jobs — Gains exceed expectations again, but UE rises.

Gain of +275,000 non-farm payroll jobs, vs. expected gain of 198K

Unemployment up 0.2 to 3.9%, vs expected 3.7%

U6 unemployment 7.3%, up by 0.1

Labor force participation unchanged at 62.5%

Average hourly earnings up by 0.1%; 4.3% increase over the year

December jobs revised down by -43K to +290K

January jobs revised down by -124K to 229K

TQQQ,

STO September 53 puts at 5.51

TQQQ,

STO April 26, 55 puts at 1.80

Tesla Puts 1-dte

Sold 1 TSLA 03/08/2024 155/165 Bull Put Spread at $0.28 Credit

If TSLA keeps falling I will do another one next week

SPY Diagonal Calls

Bought 1 SPY 03/08/2024 519 Call / Sold 1 SPY 03/07/2024 514.0 Call at $0.48 Credit on the open.

With 30 minutes to go I may have to roll the short up for tomorrow

XEL Put Spread Covered

Bought to close XEL 03/15/2024 50/35 Bull Put Spread at $0.96

Originally Sold at $1.20 Credit

The stock is spending too much time below 50 for me to hold this another week.

Still short 45(as a spread), 40 and even 30 Puts for next Friday