#SPX0dte At 11:21pm ET, sold to Open $SPX Aug 1st 5435/5455-5610/5630 condors for 1.65, IV 20.35%, deltas -.06 +.06

Monthly Archives: July 2024

SPX 0-dte

#SPX0dte I would have stayed away but I was smarting from yesterday so I took a shot. I liked the pullback from the HoD and sold the $SPX July 31st 5500/5530-5535/5565 condors for 15.20 at 3:21p ET. White knuckled through the dip and it came back to center and exited for 11.00. Over 15.00 with only 39 minutes left in the day is super… but we all know this thing can move FAR in the last hour on FOMC decision days.

SPY

Taking almost half on the bounce.

Bought to Close SPY Sep 20 2024 500.0 Put @ 1.67 (sold for 3.00)

TQQQ,

BTC September 6, 50 puts at .76

BTC August 60 puts at .75

I am reducing my exposure until this correction has run its course.

NVDY SOXL

BOT NVDY @23.92

—

#coveredcalls

#everylittlebithelps

SOLD SOXL 2 AUG 2024 52 CALL @.06

TQQQ,

STO September 6, $50 puts at .91

MARA

Sto MARA 2 AUG 2024 18 PUT @.19 and .20

#everylittlebithelps

SPX 0-dte

#SPX0dte Sold to Open $SPX July 30th 5375/5395-5535/5555 condors for 1.35, deltas -.06 +.06, IV 16.21%

Sorry for not posting today, I just got back from Colorado last night. I sold a wide condor last night and two tight condors today for a total of +3.65. Hopefully tomorrow will be another quiet day so I can avoid Wednesday altogether.

TSLY USOY NVDY GDXY

#dividends

#smallbuy

BOT GDXY @18.43

BOT TSLY @15.75

BOT USOY @18.05

BOT NVDY @25.76

BA SNOW TLT

Was busy Thur and Fri (and Sat)…out on the road. Sturgis baby! Still got my Fri expiration stuff done.

BA: Synthetic stock (earnings next week)

Rolled BA JUL 26 2024 182.5 Calls to AUG 02 2024 185.0 Calls @ 1.00 credit (1.90 total now)

SNOW: Synthetic stock

Bought to Close SNOW JUL 26 2024 133.0 Calls @ .03 (sold for 2.10)

Sold SNOW AUG 02 2024 132.0 Calls @ 2.75

TLT: Could have closed for a couple cents and then sold again but was in a hurry so did the roll.

Rolled TLT JUL 26 2024 93.0 Puts to AUG 02 2024 93.0 Puts @ .83 credit (1.44 total now)

Earnings 7/29 – 8/2

Economic Calendar 7/29 – 8/2

CONY NVDY TQQQ TSLA SPYI QYLD SOXL

#smallbuy

#dividends

BOT CONY @19.83

BOT NVDY @25.81

BOT SPYI @49.59

BOT QYLD @17.28

———

#rolling

SOLD TQQQ 2 AUG 24/26 JUL 24 67.5 PUT @1.49

———–

SOLD to close half of spread TQQQ 26 JUL 2024 65.5 PUT @1.45

BOT TSLA 26 JUL 2024 205/200 PUT @.09

————

#optionsexpiration

52 call soxl

OptionsExpiration

EXPIRED

CMG 42.4/47.2 Bull Put Spread

CRWD 210/220 Bull Put Spread

DXCM 55/60 Bull Put Spread

FCX 40/42.5 Bull Put Spread

LVS 35.5/38.5 Bull Put Spread

LVS 35/38 Bull Put Spread

NOC 395/412.5 Bull Put Spread

NUE 175/165 Bear Call Spread

NUE 150/155 Bull Put Spread

SCHW 72/68 Bear Call Spread

SCHW 60/63 Bull Put Spread

SOXS 18/21 Bull Put Spread

SPY 528/533 Bull Put Spread

SPY 535/540 Bull Put Spread

TQQQ 82/78 Bear Call Spreads

TSLA 300/310 Bear Call Spread

TSLA 305/315 Bear Call Spread

UPS 122.0 Diagonal Put

UPS 123.0 Diagonal Put

UPS 124.0 Diagonal Put

UPS 125.0 Diagonal Put

UVXY 35/31 Bear Call Spread

1 BOIL 15.5 Covered Call

1 SBUX 84 Covered Call

WBA 13.0 Covered Calls

ASSIGNMENTS

1 BMY 43.5 Covered Call

BMY 44.0 Covered Calls

BMY 44.5 Covered Calls

1 BMY 45.0 Covered Call

1 SCHW 66.0 Covered Call

1 SQQQ 9.0 Covered Call

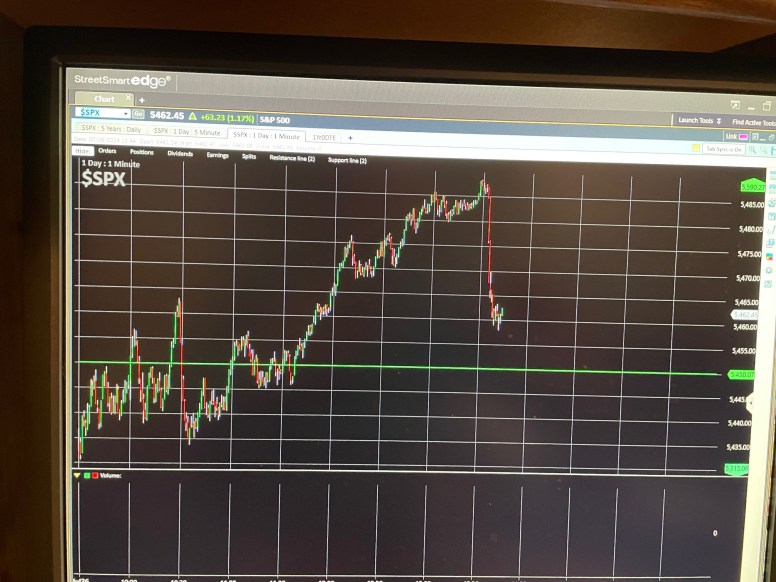

Bungee Jump Time???

SPX 0-dte trades 7/26/24

#SPX0dte Bought to Open $SPX July 26th 5420/5450-5455/5485 condors for -18.50 at 11:26am, sold to close at 12:06 for 20.50.

Going long has been best bet this week, although today certainly quieter than yesterday so not pressing this beyond 2 bucks. May try again in a bit when the ATM condors are cheaper and require less of a move to turn profit.

SPY Expiration

1 SPY 07/25/2024 565/553 Bear Call Spread

1 SPY 07/25/2024 533/538 Bull Put Spread

SPX trades 7/25/24

#SPX0dte Sold to Open $SPX July 25th 5330/5350-5500/5520 condors for 1.35, IV 29.61%, deltas -.06 +.07

A 150-pt spread and now that data caused only minor movement we might have a quieter day than yesterday.

I didn’t post yesterday because I was experimenting with a bearish bias. I lost a bit with an overnight short condor, fortunately getting a little bump higher at the open that allowed me to get out. Then I BOUGHT the ATM tight condor for 18.50, and later closed it for 22.50. Could have let it expire and gotten 30. I also made a couple more bucks by buying a put spread with 25 minutes before close and cashing out at expiration. A good day but a bit haphazard and off-plan. More often lately, buying rather than selling is the safer bet.

SPY

Can’t resist. Selling outside the expected move and down at the 200 day.

Sold SPY Sep 20 2024 500.0 Put @ 3.00

NVDY AMDY

BOT NVDY @26.38

BOT AMDY @14.70

UVXY Calls

Sold 1 UVXY 07/26/2024 35/31 Bear Call Spread at $0.14 Credit

#EveryLittleBitHelps

Upside Warning canceled

#VIXindicator We touched on a new low on Friday of 10.62, but it seemed like some anomaly and I thought it might be corrected. But it remains on the charts, which means the upside warning was actually canceled on that same day, when VIX hit 50% above that low, and closed that way which would have meant a Downside Warning. Now that we see the activity this week, that warning is solid.

But in any case, we just hit over 50% of the previous 11.52 low (May 23rd), so now the Upside Warning is officially canceled.

Measuring from the 10.62 low, if we close above 15.93 it will mean a downside warning.

SPY Put Ladder

Sold 1 SPY 07/24/2024 536/541 Bull Put Spread at $0.13 Credit

Sold 1 SPY 07/25/2024 533/538 Bull Put Spread at $0.24 Credit

Sold 1 SPY 07/26/2024 528/533 Bull Put Spread at $0.24 Credit

#EveryLittleBitHelps

VXX Reverse split

Effective today – 1 for 4

TSLA TQQQ

STO TSLA 26 JUL 2024 205/200 PUT @.21

STO TQQQ 26 JUL 2024 67.5/65.5 PUT @.11

SPY Expiration

SPY 535 /550 Bull Put Spread

SPY 535/551 Bull Put Spread

SPY 561/559 Bear Call Spread

SPY 560/559 Bear Call Spread

TQQQ Calls

Sold 1 TQQQ 07/26/2024 82/78 Bear Call Spread at $0.32 Credit

CRWD – Testing the waters

Sold to open $CRWD 8/30 240/230 bull put spread @ 1.78

CRWD – Testing the waters

Sold to open $CRWD 8/30 240/230 bull put spread @ 1.78

UPS Puts

Partly a disaster recovery trade

Bought 1 UPS 08/02/2024 115 Put / Sold 1 UPS 07/26/2024 124 Put at $0.54 Diagonal Credit

Bought 1 UPS 08/02/2024 115 Put / Sold 1 UPS 07/26/2024 123 Put at $0.33 Diagonal Credit

Bought 1 UPS 08/02/2024 115 Put / Sold 1 UPS 07/26/2024 122 Put at $0.28 Diagonal Credit

SPX butterfly

Taking profits. So the trade I posted a few weeks ago needed an adjustment with the market run up. At the time another butterfly adjustment was used as it was the cheapest. I will also use verticals, calendars, or diagonals. Now it is time to take profits. I typically target profits of 5-10%. Rinse and repeat.

I chose the butterfly at the time because the market makers have been manipulating the volatility between the expirations on the calendars so they don’t have to pay out on winning trades. I first noticed that as the VIX contracted and would watch the individual legs and can also see it on the algo. Anyway, by using butterfly adjustment in lower volatility they cannot mess with the IV on the legs as much. I saw this happen on the service once to the tune of 600k on expiration day. We were up over 1 million on a winning fly and they managed to crush the vol of the longer options so they only had to pay 400k by the end of the day. Lesson learned, they can’t change the IV that much in the same expiration cycle or they would have to do it to the entire option chain.

This is how I morphed it and you can see my current profits are around $1100-1300 on 10k margin. I have this exact trade in 6 different account so $1100 x 6 = $6600 in profits for about 2 weeks of “work” so not a bad payday.

The trick is not over or under adjusting. Adjust only when necessary.

SPY Trades

Sold 1 SPY 07/23/2024 559.0 Call at $0.27

Sold 1 SPY 07/23/2024 550.0 Put at $0.31

SPX 0-dte trades 7/23/24

#SPX0dte Sold to Open $SPX July 23rd 5530/5560-5565/5595 condors for 16.95, IV 20.17%

Last Night: Sold July 23rd 5480/5500-5615/5635 condors for 1.25, deltas -.08 +.06

SPY Expiration

1 SPY 537/547 Bull Put Spread

1 SPY 538/548 Bull Put Spread

1 SPY 570/556 Bear Call Spread

1 SPY 565/555 Bear Call Spread

1 SPY 559/555 Bear Call Spread

More SPY Spreads

Bought 1 SPY 07/25/2024 534 Put/ Sold 1 SPY 07/24/2024 544 Put for a $0.44 Diagonal Credit

FCX SCHW SOXL Covered Calls

Sold 1 FCX 07/26/2024 46.0 Covered Call at $0.86

Sold 1 SCHW 07/26/2024 66.0 Covered Call at $0.35

Sold 1 SOXL 07/26/2024 54.0 Covered Call at $1.20

All written against stock put to me on Friday

Monday Spreads

Sold 1 SCHW 07/26/2024 72/67 Bear Call Spread at $0.19 Credit

Sold 1 CRWD 07/26/2024 210/220 Bull Put Spread at $0.24 Credit

Sold 1 SOXS 07/26/2024 18/21 Bull Put Spread at $0.36 Credit

Sold 1 TSLA 07/26/2024 310/300 Bear Call Spread at $0.24 Credit

TQQQ Stock and Calls

So the TQQQ 71.0 put that I thought had expired last Friday got assigned anyway after the stock drifted a few cents below the strike price after hours.

Lucky Me 🙂

Sold the TQQQ stock position on the open at $73.66 !!

Also sold 1 TQQQ 07/26/2024 82/78 Bear Call Spread at $0.46 Credit.

SPY Calls

Bought 1 SPY 07/23/2024 560 Call/ Sold 1 SPY 07/22/2024 555 Call for a $0.29 Diagonal Credit

Bought 1 SPY 07/23/2024 561 Call/ Sold 1 SPY 07/22/2024 556 Call for a $0.16 Diagonal Credit

SPX 0-dte trades for 7/22/24

#SPX0dte Sold to Open $SPX 5510/5540-5545/5575 condors for 17.25, IV 21.49%, at 9:33 ET

Earnings 7/22 – 7/26

Economic Calendar 7/22 – 7/26

SGOV BIL SOXL MARA TQQQ

———

#Park some cash

BOT SGOV @100.59

BOT BIL @91.68

———-

#coveredcalls

Sto SOXL 26 JUL 2024 52/85 CALL @1.41

————-

Sell to close

half of credit spread

STC SOXL 19 JUL 2024 48 PUT @.17 credit

———-

#closing

BOT MARA 19 JUL 2024 24.5 PUT @.10

BOT TQQQ 100 19 JUL 2024 71/66 PUT @.14

—–

#stocksplits

SOLD IWMY @14.10

—

#assignment

soxl 52 put

OptionsExpiration

BMY 43.5 Covered Call

BOIL 15.5 Covered Call

BOIL 16 Covered Calls

CVS 64 Covered Call

VXX 12 Covered Calls

NKE 66/71 Bull Put Spreads

NKE 66/70 Bull Put Spread

BMY 36/39.5 Bull Put Spread

UAL 34/39 Bull Put Spread

TQQQ 66/71 Bull Put Spread (barely)

SCHW 57.5/62 Bull Put Spread (barely)

SOXL 59/55 Bear Call Spread

NUE 177.5/170 Bear Call Spread

SPY 537/547 Bull Put Spread

SPY 542/547 Bull Put Spread

SPY 543/548 Bull Put Spread

SPY 552 Diagonal Call (big, big winner)

ASSIGNMENTS:

GILD 71.0 Covered Call

FCX 46 Put

SCHW 66 Put

SOXL 53 Put

Schwab Not Working

Thanks to Crowdstrike (?) I cant close out my positions on any Schwab platform other than the new TOS. Unfortunately my accounts not moved over yet.. Not a good place to be on Friday opex!

TLT

Let’s try to triple the divvy in a week. LOL

Sold TLT Jul 26 2024 93.0 Puts @ .61

SPX

A much needed reset lower. Wouldn’t mind doing this next month too. Still have all my premium while reducing losses on the LEAPS. At some point (hopefully lower) the market will come back and take out my short put daily sales. A big rally I’ll roll back in and up (which is what happened last time).

Rolled SPX Jul 19 2024 5620.0 Puts to Aug 16 2024 5585.0 Puts @ .50 credit (9.85 total now)

Friday Spreads

Sold 1 UPS 07/26/2024 126/131 Bull Put Spread at $0.29 Credit

Sold 1 NOC 395/412.5 Bull Put Spread at $0.94 Credit

#Earnings next week

SPX 0-dte trades 7/19/24

#SPX0dte Sold to Open $SPX July 19th 5520/5550-5555/5585 condors for 19.70, IV 25.31%, at 8:15am.

No hedge trade at the moment. Looking for 10%.

SPY Expiration

1 SPY 07/18/2024 547/552 Bull Put Spread

SPY Diagonal Put

Bought 1 SPY 07/23/2024 535 Put / Sold 1 SPY 07/19/2024 549 Put at $0.52 Credit

The short expires tomorrow

LLY BUCS

$LLY BTO 8/9 840/880 Bull call spread at 17.03

Earnings 8/8 before market. Plan is to capture earnings run. If it doesn’t work I will at least lose weight since I’ll have less disposable income to eat at McDonalds.

SPY FCX Spreads

SOXL Calls

Sold 1 SOXL 07/19/2024 59/55 Bear Call Spread at $0.24 Credit.

Trying to offset some of the pain of my SOXL put positions

Market finally woke up from…

Market finally woke up from it’s several month binge. I really hate one way markets. Much easier to trade bi-directional markets when income trading.

LVS Puts

Sold 1 LVS 07/26/2024 35.5/38.5 Bull Put Spread at $0.30 Credit

#Earnings next week

VXX Long Term Puts

Bought VXX Jan 17 2025 6.0 Puts at $0.10

Bought VXX Jan 17 2025 5.0 Puts at $0.03

#VXXContango

CLF Calls Rolled

Bought to close CLF 07/19/2024 17.0 Covered Calls at $0.02.

Sold to open Sold CLF 08/02/2024 17.5 Covered Calls at $0.21

TSLA Calls Closed

Bought to close 2 TSLA 07/19/2024 315/300 Bear Call Spreads at $0.01.

Sold on Monday at $0.28 and $0.56.

SPX

Rolling on the early bounce just in case it doesn’t last.

Rolled SPX Jul 18 2024 5625.0 Puts to Jul 19 2024 5620.0 Puts @ 2.00 credit (9.35 total now)

SPX 0-dte trades 7/18/24

#SPX0dte So after two days out of three with the long trade doing nicely and the short one doing poorly, I decided to only buy the hedge long condor last night and wait for morning for the short.

Last night, bought to open $SPX July 18th 5500/5520-5670/5690 condors for 1.05, deltas -.05 +.05.

This was pretty wide and a nice condor to SELL, or even a strike or two tighter in. Sure enough it is down to about .60 now. But still there for a hedge in case we get a big bounce or collapse. Looking to enter ATM after the open, unless we swing wildly from 8:30 data.

TQQQ,

I covered all my $70 put options and took a hit but am still good on the year. I did not see this comming but that happens.

SPX

I’ll give it another day before rolling further out.

Rolled SPX Jul 17 2024 5630.0 Puts to Jul 18 2024 5625.0 Puts @ .50 credit (7.35 total now)

MARA YMAG YMAX

#shortputs

STO MARA 19 JUL 2024 24.5 PUT @.34

———-

#ONSALE

#dividends

#exdivday

BOT YMAG @20.36

BOT YMAX @19.38

Closing DJT Spread

Bought to close 1 DJT 07/19/2024 70/65 Bear Call Spread at $0.01. Sold on Monday at $0.28

Wednesday Spreads

Sold 1 SOXL 07/19/2024 48/52 Bull Put Spread at $0.28 Credit (too early)

Sold 1 SOXL 07/19/2024 46/50 Bull Put Spread at $0.23 Credit

Sold 1 SCHW 07/19/2024 60/63 Bull Put Spread at $0.23 Credit (way too early)

Sold 1 SCHW 07/19/2024 57.5/62 Bull Put Spread at $0.28 Credit

Sold 1 TQQQ 07/19/2024 68/73 Bull Put Spread at $0.33 Credit (also too early)

Sold 1 TQQQ 07/19/2024 66/71 Bull Put Spread at $0.23 Credit

SOXL Put

Sold 1 SOXL Jul 19 2024 53.0 Put at $0.19 (I was really, really too early)

#EveryLittleBitHelps

NVDA

Adding one.

Sold NVDA Aug 16 2024 110.0 Put @ 2.50

BMY Covered Call

Closed 1 BMY 07/19/2024 43.5 Covered Call at $0.01

Replaced it with 1 BMY 07/26/2024 44.5 Covered Call at $0.16.

#Earnings on July 26th

SPY Expiration

1 SPY 07/16/2024 544/557 Bull Put Spread

1 SPY 07/16/2024 548/558 Bull Put Spread

1 SPY 07/16/2024 549/559 Bull Put Spread

ZION Stock

Sold most of my tiny position in ZION at $49.01, $50.01 and $50.15.

#FormerFallingKnife

SPX 0-dte trades for 7/17/24

#SPX0dte Sold to open $SPX July 17th 5630/5660-5665/5695 condors for 17.05, IV 12.67%, at 11:44p ET

Bought to open 5585/5605-5710/5730 condors for .95, delta -.05 +.04

SPX

Another round. Selling tomorrow at half the expected move. Not much in the way of data tomorrow but unemployment on Thur.

Existing positions after a few credit rolls:

Bought to Close SPX Jul 16 2024 5620.0 Puts @ .60 (sold for 45.25)

New position sold yesterday:

Bought to Close SPX Jul 16 2024 5620.0 Put @ .60 (sold for 7.50)

And:

Sold SPX Jul 17 2024 5630.0 Puts @ 6.85

TLT

Changed my mind already. Big run today I’ll reload the covered calls out in Aug. Wouldn’t mind these taking some heat. Might be an issue with a surprise July cut but I’m betting not.

Sold TLT Aug 16 2024 97.0 Calls @ .43

TLT

Getting the stock uncovered and taking the gains on the short puts. Reload puts on a pullback possibly.

Bought to Close TLT Jul 19 2024 93.5 Puts @ .29 (sold for 2.10)

Bought to Close TLT Jul 19 2024 94.0 Calls @ .40 (sold for .56)