1 SPY 549/560 Bull Put Spread

1 SPY 550/562 Bull Put Spread

1 SPY 567 Diagonal Put

1 SPY 577/574 Bear Call Spread (ended up surprisingly close)

Monthly Archives: September 2024

TQQQ,

BTC October 4, ocvered calls and sold the TQQQ shares at 71.22 and now 100% cash.

I got back in.

BTO the TQQQ and sold the October 4, 71.50 calls at 69.32

Monday Spreads

Sold 1 SPY 10/02/2024 550/560 Bull Put Spread at $0.30 Credit

Sold 1 TQQQ 10/04/2024 57/65 Bull Put Spread at $0.33 Credit

Sold 1 AVGO 10/04/2024 150/160 Bull Put Spread at $0.28 Credit

Sold 1 NUGT 10/04/2024 41/46 Bull Put Spread at $0.33 Credit

Sold 1 GLD 10/04/2024 227.5/236 Bull Put Spread at $0.17 Credit

Sold 1 AMZN 10/04/2024 172.5/180 Bull Put Spread at $0.41 Credit

Bought 1 AMZN 10/11/2024 172.5 Put / Sold 1 AMZN 10/04/2024 182.5 Put at $0.64 Diagonal Credit

Sold 1 CVS 10/04/2024 67/64 Bear Call Spread at $0.44 Credit

Sold 1 VXX 10/04/2024 66/56 Bear Call Spread at $0.64 Credit

Monday Puts

Sold 1 AVGO Oct 04 2024 150 Put at $0.06

Sold 1 TQQQ Oct 04 2024 58.5 Put at $0.06

Sold 1 NKE Oct 04 2024 72 Put at $0.06

Sold 1 OXY Oct 04 2024 46.5 Put at $0.09

Sold 1 DVN Oct 04 2024 36.5 Put at $0.13

Sold 1 NUGT Oct 04 2024 42.5 Put at $0.15

#Tiny99PercentPuts

#EveryLittleBitHelps

VXX

Adding to synthetic short.

VXX Jan 16 2026 55/55/85 @ 17.00 debit.

And:

Sold VXX Oct 04 2024 51.0 Puts @ 1.15

SPX 0-dte trades for 9/30/24

#SPX0dte Sold to Open $SPX Sept 30th 5630/5650-5780/5800 condors for 1.20, IV 23.12%, deltas -.06 +.06

$VIX moving higher and deltas wider than last week

Earnings 9/30 – 10/4

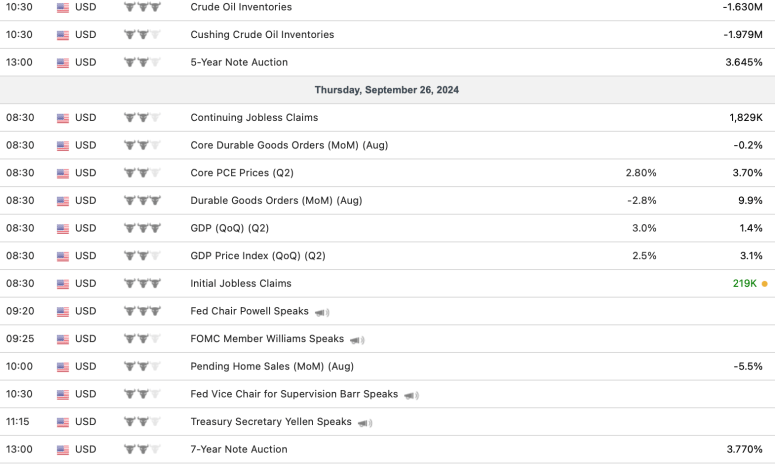

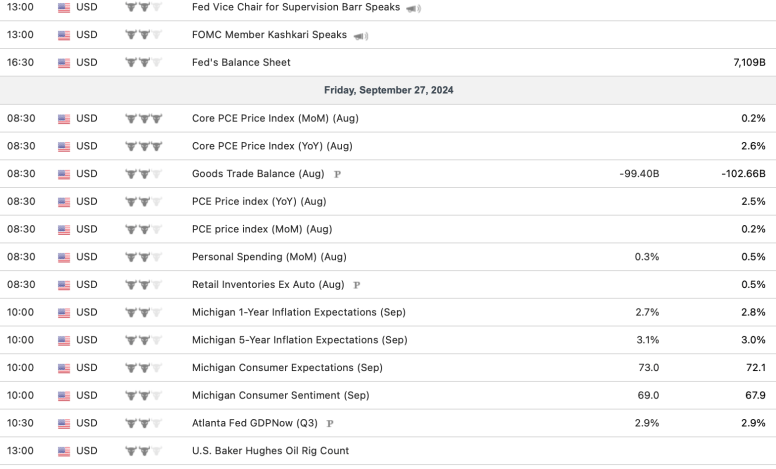

Econ Calendar 9/30 – 10/4

Not your normal Friday VIX….

VIX is Waking Up

OptionsExpiration

After rolling TQQQ Calls and VXX Calls up, here is what’s left:

Expired:

AVGO 138/172.5 Bull Put Spread

DVN 38 Put

JDST 23 Put

MU 74 Put

NUGT 38/48 Bull Put Spread

NUGT 54 Diagonal Call

CLF 13 Covered Calls

SOXS 19 Put

SOXS 18 Put

SPY 543/558 Bull Put Spread

SPY 552/562 Bull Put Spread

SPY 567 Diagonal Put

SPY 574 Diagonal Call

UPS 117/126 Bull Put Spread

TQQQ 73.5 Diagonal Call

VXX 47 Diagonal Put

VXX 40/45 Bull Put Spread

VXX 45 Diagonal Puts

Assignments:

1 TQQQ 71.0 Covered Call – vs. stock put to me at $71 Aug 1st

1 FCX 46.0 Covered Call – vs. stock put to me at $46 Jul 19th

1 DVN 39.5 Put (5% dividend payer)

SPY

SPY 567/557 Bull PUT expiring today – Likely OTM into the Close

QQQ

#CoveredCalls QQQ 499 expiring today

#CoveredCalls QQQ 9/30/24 490 @ 0.96 Credit opening a new position

VXX Calls

Rolled 1 VXX 68/48 Bear Call Spread to next week for $0.40 Credit

BOIL Covered Calls

Bought to close BOIL 09/27/2024 12.00 Covered Calls at $0.04

Sold BOIL 10/04/2024 13.50 Covered Calls at $0.23

TQQQ,

BTO, October 18, $65 calls at 8.50

BA SNOW SPX TLT XLU

A few:

BA: Sold against synthetic stock.

Rolled BA Sep 27 2024 155.0 Calls to Oct 04 2024 160.0 Calls @ .25 credit (2.70 total now)

SNOW: Sold against synthetic stock.

Rolled SNOW Sep 27 2024 110.0 Calls to Oct 18 2024 115.0 Calls @ .05 credit (3.90 total now)

SPX: No changes but looking at a possible roll up of the short puts.

TLT: Covered stock I’m hanging onto for one more week to get the divvy.

Rolled Sep 27 2024 97.0 Calls to Oct 04 2024 97.0 Calls @ .14 credit (2.10 total now)

XLU: Sold against synthetic short stock.

Bought to Close XLU Sep 27 2024 77.5 Puts @ .01 filled yesterday (sold for .28)

Sold XLU Oct 18 2024 77.5 Puts @ .31

TQQQ Calls

Bought 1 TQQQ Oct 11 2024 85 Call / Sold 1 TQQQ Oct 04 2024 76 Call at $0.84 Diagonal Credit

#OnlySpreads

VXX Long term Puts

Financing more long Jan 2025 Puts

Bought 1 VXX 01/17/2025 25.00 Put / Sold 1 VXX 10/04/2024 46.00 Put at $0.18 Credit

Bought 1 VXX 01/17/2025 26.00 Put / Sold 1 VXX 10/04/2024 46.00 Put at $0.18 Credit

Bought back to close 1 VXX 09/27/2024 46.0 Diagonal Put at $0.01 to release some margin

#VXXContango

SPX 0-dte for 9/27/24

#SPX0dte Sold to Open $SPX Sept 27th 5680/5700-5795/5815 condors for 1.10, IV 16.88%, deltas -.07 +.06

SPY Expiration

1 SPY 580/576 Bear Call Spread

EL Stock

The revival of China really pushed this one

Bought on 09/10 at $85.00. Sold today at $101.08

#TinyBuy

SPY Puts

Sold 1 SPY 09/27/2024 558/567 Bull Put Spread at $0.28 Credit

#EveryLittleBitHelps

XBI

Starting a pre-election ladder at the 200 day.

Sold XBI Nov 01 2024 93.0 Puts @ 1.30

TLT

Another round.

Sold TLT Oct 18 2024 100.0 Calls @ .41

TQQQ Put

#shortputs

$TQQQ STO 10/4 70 put at 1.07

QQQ

#CoveredCalls QQQ 9/27/24 499 @ 0.34 Credit (1DTE)

SPX 0-dte trades for 9/26/24

#SPX0dte Sold to Open $SPX Sept 26th 5675/5695-5800/5820 condors for 1.40, IV 17.42%, deltas -.08 +.06. First time with strikes over 5800

TLT

On the road this week so not doing much. These were sold against synthetic long stock.

Bought to Close TLT Sep 30 2024 102.0 Calls @ .01 (sold for .80)

SPY and GLD Expirations

1 SPY 531/541 Bull Put Spread

1 SPY 558/567 Bull Put Spread – sold today

1 SPY 551/567 Bull Put Spread

1 SPY 579/571 Bear Call Spread

1 SPY 579/574 Bear Call Spread

1 GLD 248/246 Bear Call Spread

SPY

#BullPutSpread STO SPY 9/27/24 567/557 @ 0.83 Credit

#CoveredCalls QQQ 492 expiring today

SPY 0DTE

Sold 1 SPY 09/25/2024 558/567 Bull Put Spread at $0.17 Credit

SOXL

#everylittlebithelps

#shortputs

SOLD SOXL 27 SEP 24 31.5 PUT @.13

#coveredcalls

SOLD SOXL 4 OCT 24 45.5 CALL @.14

CVS

Sold 1 CVS Oct 11 2024 64.0 Covered Call at $0.30

Sold 1 CVS Oct 18 2024 64.0 Covered Call at $0.44

SOXL

Rolled my SOXL 09/27/2024 45.0 Covered Calls to SOXL 10/04/2024 45.5 Covered Calls for $0.14 Credit

TQQQ,

I rolled my Sept. 27, 75 calls to October 4, 77calls for a credit of .38

TQQQ Diagonal Calls

Bought 1 TQQQ 10/04/2024 80 Call / Sold 1 TQQQ 09/27/2024 73.50 Call at $0.34 Diagonal Credit

#OnlySpreads

SPY Puts and Calls

Sold 1 SPY 09/25/2024 579/574 Bear Call Spread at $0.21 Credit – #0DTE

Sold 1 SPY 09/26/2024 580/576 Bear Call Spread at $0.19 Credit

Sold 1 SPY 09/27/2024 543/567 Bull Put Spread at $0.86 Credit

VXX long term Puts

Added some more long VXX 01/17/2025 24.00 Puts at $0.06.

#VXXContango

SPX 0-dte trades for 9/25/24

#SPX0dte Sold to Open 5660/5680-5770/5790 condors for 1.00, IV 16.11%, deltas -.07 +.06

SPY Expiration

1 SPY 532/542 Bull Put Spread

1 SPY 547/565 Bull Put Spread

1 SPY 565 Diagonal Put

Closed 1 SPY 578/571 Bear Call Spread at $0.10. Was due to expire until 2 minutes before the close

VXX Long Term Puts

Bought VXX Jan 17 2025 24.0 Puts at $0.11, $0.10, $0.08 and $0.07

#VXXContango

MU SOXS JDST Puts

Sold 1 MU SEP 27 2024 74 Put at $0.08

Sold 1 SOXS Sep 27 2024 19 Put at $0.11

Sold 1 JDST Sep 27 2024 23 Put at $0.25

#Tiny99PercentPuts

QQQ

#CoveredCalls QQQ 25 Sep 24 492 Call 1DTE – Sold at .55, Theta Decay in Play

Econ Calendar update

Guess I gotta check for updates more often. The current sharp drop seems driven by “CB Consumer Confidence” Data released at 10am ET, which was not on calendar when I copied it into the menu above but is there on Bloomberg’s site now.

SPX 0-dte trades for 9/24/24

#SPX0dte Sold to Open $SPX Sept 24th 5690/5720-5725/5755 condors for 14.70, IV 17.70%

Premium was pretty low for the wide condor so I skipped it.

SPX

Rolled SPX Oct 18 2024 5610.0 Puts to Oct 18 2024 5630.0 Puts @ 3.70 credit (20.70 total now)

Upside Warning now in effect

#VIXindicator The last Upside Warning fired on Aug 13 when SPX was 6% above the latest low, and peaked on Aug 26 at 10.4% above the low, so it caught over 4% of upside. Currently the SPX is 6% above the Sept 6th low.

SPY Expirations

SPY 533/543 Bull Put Spread

SPY 566 Diagonal Put

SPY 577/571 Bear Call Spread

SPY Diagonal Put

Bought 1 SPY 09/25/2024 551 Put / Sold 1 SPY 09/24/2024 565 Put at $0.18 Credit

#EveryLittleBitHelps

VKTX Put

Adding

$VKTX STO 9/27 66 put at 1.80

VXX Calls – SPY Puts

Sold 1 VXX 09/27/2024 60/50 Bear Call Spread at $0.52 Credit

Balancing the risk of the VXX Put spread from earlier today

Bought 1 SPY 09/24/2024 547 Put at $0.02 / Sold 1 SPY 09/23/2024 566 Put at $0.16 for a $0.14 Diagonal Credit.

I’ve got other Put and Call Spreads on SPY expiring today.

Sold 1 SPY 09/27/2024 552/562 Bull Put Spread at $0.83 Credit

Sold 1 SPY 09/60/2024 550/560 Bull Put Spread at $0.77 Credit

VXX Puts

Bought 1 VXX Jan 17 2025 30.0 Put / Sold 1 VXX Sep 29 2024 47.0 Put at $0.24 Credit

Financing another long term #VXXContango Put

SPX 0-dte for 9/23/24

#SPX0dte Sold to Open $SPX Sept 23rd 5630/5650-5755/5775 condors for 1.45, IV 19.88%, deltas -.07 +.07

IBIT options

SEC approves options trading for BlackRock’s iShares Bitcoin Trust (IBIT)

Earnings 9/23 – 9/27

Economic Calendar 9/23 – 9/27

OptionsExpiration

SPY 460/515 Bull Put Spread

SPY 540/551 Bull Put Spread

SPY 576/571 Bear Call Spread

TQQQ 47/57 Bull Put Spread

TQQQ 48/58 Bull Put Spread

TQQQ 49/58 Bull Put Spread

TQQQ 76/71 Bear Call Spread

TQQQ 76/72.5 Bear Call Spread

TQQQ 71 Covered Call

VXX 70/57 Bear Call Spread

VXX 70/60 Bear Call Spread

VXX 46.5 Diagonal Put

VXX 46 Diagonal Put

NUGT 60/55 Bear Call Spread

NUGT 41/45 Bull Put Spread

NUGT 43 Put

UPS 115/123/132/141 Iron Condor

DLTR 56/71/74/80 Iron Condor

DLTR 80/75 Bear Call Spread

AMZN 177.5 Diagonal Put

AMZN 167.5/175 Bull Put Spread

VFC 21/19 Bear Call Spread

BBY 108/101 Bear Call Spread

BBY 109/102 Bear Call Spread

AVGO 172.5 Diagonal Call

AVGO 147 Diagonal Put

BOIL 11 Covered Calls

CLF 12.5 Covered Calls

FCX 46 Covered Call

WBA 10.5 Covered Calls

CVS 64 Covered Call

BEN 17.5 Put

EL 84 Put

MOS 24 Put

SQQQ 7.5 Put

Expiration TQQQ / VKTX Puts

#optionsexpiration

$TQQQ 65 put

$VKTX 64 put

#shortputs

$TQQQ STO 9/27 68 put at .96

$VKTX STO 9/27 68 put at .1.90

SOXL META GS

#optionsexpiration

SOXL 52 call

SOXL 26 put

META 485/487.5 put

#shortputs

#everylittlebithelps

SOLD GS 27 SEP 2024 470/467.5 PUT @.08

SPY Calls and Puts

Sold 1 SPY 10/11/2024 505/535 Bull Put Spread at $0.75 Credit

Extending the Put Ladder

Sold 1 SPY 09/23/2024 577/571 Bear Call Spread at $0.52 Credit

Sold 1 SPY 09/24/2024 578/571 Bear Call Spread at $0.77 Credit

Replacing old calls lost to assignment

SPY

Buying these to sell against on the next implosion. Far enough out to cover all the election drama also.

Bought to Open SPY Mar 21 2025 200.0 Puts @ .28

Bought to Open SPY Mar 21 2025 250.0 Puts @ .47

SPX

Let’s give Mr. Market something to think about.

Rolled SPX Oct 18 2024 5600.0 Puts to Oct 18 2024 5610.0 Puts @ 2.00 credit (17.00 total now)

New positions are currently about 32 long deltas and 425 theta overall including the LEAPS.

Fun fact: 5630 is the highest strike I’ve ever sold so almost there.

TQQQ Calls

Sold 1 TQQQ 09/27/2024 76/71.5 Bear Call Spread at $0.75 Credit

GS

#everylittlebithelps

SOLD GS 27 SEP 2024 470/467.5 PUT @.08

BA SNOW XLU

BA and SNOW synthetic long and XLU synthetic short.

Bought to Close BA Sep 20 2024 157.5 Calls @ .07 (sold for 8.75)

Sold BA Sep 27 2024 155.0 Calls @ 2.47

Bought to Close SNOW Sep 20 2024 114.0 Calls @ .21 (sold for 4.65)

Sold SNOW Sep 27 2024 110.0 Calls @ 3.86

Bought to Close XLU Sep 20 2024 75.0 Puts @ .01 (sold for .26)

Sold XLU Sep 27 2024 77.5 Puts @ .28

SPY Calls

Sold these to start making back some of my SPY loss:

Sold 1 SPY 09/20/2024 576/571 Bear Call Spread at $0.51 Credit – expires today

Sold 1 SPY 09/25/2024 579/571 Bear Call Spread at $1.67 Credit

TQQQ,

I rolled my Sept. 20, 71 calls up to Sept. 27, 75 calls for a debit of .02 and could have done them even if I had waited.

SPY early assignments

I thought I had moved my short SPY calls out far enough to avoid assignment on the ex-date today, but the yesterday’s big 10 point move pushed them too far into the money and nuked all the remaining time premium.

Assigned on 1 SPY 09/27/2024 556 Call and on 1 SPY 09/30/2024 551 Call.

With the stock closing at $570.90 I was looking at a big loss.

Luckily I was able to cover the short stock at $567.97 in the pre-market.

Better, but not great.

SPX 0-dte trades for 9/20/24

#SPX0dte Sold to Open $SPX 5610/5630-5775/5795 condors for 1.10, IV 25.11%, deltas -.06, +.05. I went a strike further on call side just to reduce risk on a Friday in a week with strong profit already.

SPX

#SyntheticShortStock – After looking things over for awhile I’m hanging on to the rest of the positions. Instead of rolling the daily put sales back in and up decided to leave them in the Oct monthly and just roll up there. Gives me few a more long deltas overall but plenty of room (half the expected move) for a drop while collecting good premium and theta.

Rolled SPX Oct 18 2024 5570.0 Puts to Oct 18 2024 5600.0 Puts @ 5.00 credit (15.00 total now)

SPX

#SyntheticShortStock – Due to the big rally today the deltas are starting to flip short. As an experiment closing my oldest position just to see what sort of fills I get in the LEAPS with the wide bid/ask. Turned out better than I expected getting filled just slightly worse than the mid.

Final numbers:

Initial trade:

Opened Dec 2027 5000/5000/5400 synthetic short at 225.00 debit

Closed Dec 2027 5000/5000/5400 synthetic short at 8.80 credit (this includes closing Oct 18th 5570 strike daily put sale)

Net loss on LEAPS of 216.20

Total premium received on daily sales of 427.15

Net gain of 210.95

Not bad with a synthetic short in a straight up market.

SPY Puts 0DTE

Sold 1 SPY 09/19/2024 560/565 Bull Put Spread at $0.23 Credit

SPX 0-dte trades for 9/19/24

#SPX0dte Sold to Open $SPX Sept 19th 5580/5600-5750/5770 condors for 1.90, IV 25.40%, deltas -.10, +.06

TQQQ,

I bought to open the Stock of TQQQ and will write covered calls on a weekly basis.

SOXL ULTY YMAX

#.06Delta

SOLD SOXL 20 SEP 2024 26 PUT @.10

#smallbuy

#dividends

BOT ULTY @11.25

BOT YMAX @17.57

#rolling

SOLD – MARA 20 SEP 2024 18 PUT/ 27 SEP 2024/@.18