Adding.

Sold XBI Nov 15 2024 90.0 Puts @ 1.33

Adding.

Sold XBI Nov 15 2024 90.0 Puts @ 1.33

1 SPY 10/09/2024 545/566 Bull Put Spread

1 SPY 10/09/2024 533/553 Bull Put Spread

Running low on SPY Puts

1 GLD 10/09/2024 235/240 Bull Put Spread

#ShortPuts Rolled QQQ 480 PUTS (Wed to Fri) @ 1.01 Credit

Right at the open.

Rolled SPX Oct 18 2024 5650.0 Puts to Oct 18 2024 5675.0 Puts @ 4.50 credit (28.95 total now)

Bought 1 TQQQ 10/18/2024 85 Call / Sold 1 TQQQ 10/11/2024 77 Call at $0.28 Diagonal Credit

#VIXIndicator. New $SPX high means the DW is canceled. That may be the fakest headfake I’ve ever seen this indicator produce. I don’t know why $VIX is so high, but can only guess it has to do with the trader uncertainty about how fast rates will come down, which seems to be a silly fear given the strength of just about everything right now.

Sold 1 AVGO 10/11/2024 195/190 Bear Call Spread at $0.25 Credit

Sold 1 AVGO 10/11/2024 155/165 Bull Put Spread at $0.13 Credit

Bought VXX 01/17/2025 25.00 Puts at $0.07

#VXXContango

Sold 1 BA 10/11/2024 143 Put at $0.34

Bought 1 VXX 01/17/2025 26.0 Put at $0.19

Bought 1 VXX 01/17/2025 27.0 Put at $0.19

Bought 1 VXX 01/17/2025 28.0 Put at $0.19

#VXXContango

#SPX0dte Sold to Open 5665/5686-5795/5815 condors for 1.00, IV 19.03%, deltas -.06 +.05

1 SPY 544/558 Bull Put Spread

1 SPY 543/558 Bull Put Spread

Sold 1 VXX Oct 11 2024 80/62 Bear Call Spread at $0.46 Credit

Trying out a new stock

Sold 1 RBLX Oct 11 2024 45/42 Bear Call Spread at $0.26

https://www.zerohedge.com/markets/pedophile-hellscape-roblox-shares-tank-after-hindenburg-alleges-inflated-metrics-rampant

Bought VXX Mar 21 2025 23.0 Puts at $.20, $0.19 and $0.18

Bought 1 VXX Mar 21 2025 24.0 Put at $.25

Bought 1 VXX Mar 21 2025 25.0 Put at $.30

Bought 1 VXX Mar 21 2025 26.0 Put at $.35

Bought 1 VXX Mar 21 2025 27.0 Put at $.40

164 DTE

Bought 1 VXX Jan 17 2025 25.0 Put at $0.19

101 DTE

#VXXContango

Sold 1 GLD Oct 09 2024 235/240 Bull Put Spread at $0.26 Credit

Sold 1 GLD Oct 11 2024 232.5/240 Bull Put Spread at $0.38 Credit

Sold 1 GLD Oct 14 2024 228/236 Bull Put Spread at $0.14 Credit

Bought 1 NUGT Oct 18 2024 38 Put / Sold 1 NUGT Oct 11 2024 45 Put at $0.38 Diagonal Credit

Dumping all my covered TLT stock in case the 200 day doesn’t hold. SPAXX interest still above the TLT divvy so getting the cash back in there. Partially re-loading with put sales below the 200 day.

Sold TLT Shares @ 94.20 net (after closing short calls) basis of 89.30

Sold TLT Nov 01 2024 90.0 Puts @ .23

Sold TLT Nov 01 2024 91.0 Puts @ .34

Bought to Close NVDA Nov 01 2024 110.0 Put @ .95 (sold for 3.42)

#SPX0dte Sold to Open $SPX Oct 8th 5615/5635-5760/5780 condors for 1.25, IV 22.15%, deltas -.06 +.06

#VIXindicator The high $VIX close on Monday was over 50% higher than the recent low of 14.90. This fires the Downside Warning. The last one fired on Sept 3rd and was only good for an additional 2% down over 4 days.

$VKTX STO 10/11 61 put at .90

$PLTR STO 10/11 38 put at .33

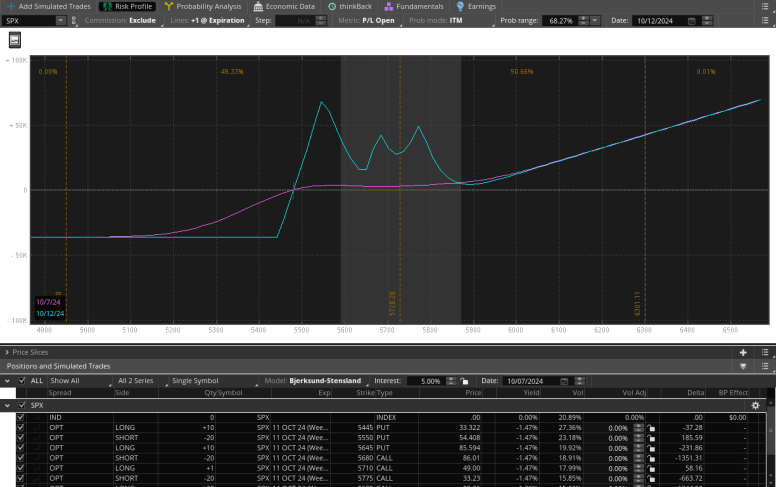

So here is an example of what I have been working on the last few years. Has taken a while to get the structure and ratios correct. Profits develop slowly but there is a huge range that you can have profits and if you notice no risk to the upside. Also to the downside SPX has to fall another 250 points before I lose any money.

You start with a butterfly, regular or slightly broken wing butterfly. Then I go long a call to the upside so that the positions starts out delta neutral. 30 DTE. Then you let the market move. This one took and adjustment about 2 weeks ago and another last week. Theta accelerates as we get closer to expiration. Has been 4-6 k daily since Friday and as you can see I am developing profit of about 4k today. There is potential for another 11-44k if I held all the way to expiration but be aware now that Schwab is messing up TOS I usually get phone calls and multiple warnings to close the position by noon to 1 EST. Even if I have a winning position and want the “cash settled close” they will not let me hold it to market close. They will close it as a market order and you lose thousands.

Adjustments are either verticals, adjusting the short or long strikes, or in this case I added 2 calendar spreads. To the downside we can pull in the long lower put wing on the butterfly.

Here is what it looks like from the close today until expiration Friday. The trick is don’t be super greedy with these. You have a 10-70%profit take it. Don’t hold out for another 10k if you already have 23k in profits. Take the money and run. I will probably close this at 10K profits (total risk around 26k between the 10k margin and the cost of the butterfly, long call, and calendars). But if it is still dead center all week I may try carrying this one into Friday.

As soon as it closes I open the next 30 DTE cycle. Rinse and repeat, don’t have to watch the market all day, adjustments are as needed not all over the place. Have a life and make a bunch trading. The ideal trade, only time will tell 🙂

1 SPY 525/547 Bull Put Spread

1 SPY 553/563 Bull Put Spread

1 SPY 583/576 Bear Call Spread

Sold 1 TQQQ 10/11/2024 82/76 Bear Call Spread at $0.15 Credit

#VIXindicator. Afternoon surprise… despite the volatility last week the Upside Warning survived. Not today. A Downside warning will take effect if $VIX closes above 22.34.

Sold 1 SPY 10/08/2024 544/558 Bull Put Spread at $0.32 Credit

#ShortPuts QQQ 10/09/24 480 @ 1.18 Credit

Bought 1 AMZN Oct 18 2024 155 Put / Sold 1 AMZN Oct 11 2024 175 Put at $0.33 Diagonal Credit

Sold 1 AVGO Oct 11 2024 147/160 Bull Put Spread at $0.16 Credit

Sold 1 SOXL Oct 11 2024 25/30 Bull Put Spread at $0.15 Credit

Sold 1 TQQQ Oct 11 2024 51/61 Bull Put Spread at $0.14 Credit

Sold 1 VXX Oct 11 2024 80/65 Bear Call Spread at $0.34 Credit

Sold 1 VXX Oct 11 2024 80/58 Bear Call Spread at $1.14 Credit

#SPX0dte Sold to Open $SPX Oct 7th 5640/5660-5790/5810 condors for 1.10, IV 22.90%, deltas -.06 +.05

#assignment

$VKTX 66 put

#optionsexpiration

$TQQQ 70 put

$ENPH 115 call

SOXL 30 and 33 put

SOXL 45.5 call

After a bunch of Call rolls I’m left with:

EXPIRED:

AMZN 172.5/180 Bull Put Spread

AMZN 172.5/182.5 Bull Put Spread

AMZN 197.5/187.5 Bear Call Spread

AVGO 145/155 Bull Put Spread

AVGO 150/160 Bull Put Spread

AVGO 182.5/177.5 Bear Call Spread

BBY 107/100 Bear Call Spread – finally out of BBY

BBY 106/100 Bear Call Spread

GLD 227.5/236 Bull Put Spread

NUGT 41/46 Bull Put Spread

NUGT 62/57 Bear Call Spread

SPY 543/556 Bull Put Spread

TQQQ 55/62 Bull Put Spread

TQQQ 57/64 Bull Put Spread

TQQQ 57/65 Bull Put Spread

TQQQ 80/77 Bear Call Spread

TQQQ 80/76 Bear Call Spread

TQQQ 79/75 Bear Call Spread

TQQQ 78/72.5 Bear Call Spread

VXX 46 Diagonal Puts

VXX 49 Diagonal Put

VXX 68/61 Bear Call Spread

VXX 63/58 Bear Call Spread

VXX 66/56 Bear Call Spread

AVGO 150 Put

DVN 36.5 Put

NIKE 72 Put

NUGT 42.5 Put

OXY 46.5 Put

SOXL 25 Put

TQQQ 58.5 Put

SOXL 47 Covered Call

ASSIGNMENTS:

1 DVN 40.5 Covered Call – vs.stock put to me at 39.50 last Friday

Had to roll it once again – only $0.02 out of the money at 4:00

Rolled SPY 10/04/2024 580/573 Bear Call Spread to 1 SPY 10/07/2024 583/576 Bear Call Spread $0.28 Credit

Starting a new Put Ladder after most of my SPY put spreads expired yesterday.

Sold 1 SPY 10/07/2024 553/563 Bull Put Spread at $0.28 Credit

Sold 1 SPY 10/09/2024 541/556 Bull Put Spread at $0.30 Credit

Got the rest finally.

Bought to Close VXX Oct 04 2024 53.0 Puts @ .05 (sold for 1.30)

Sold VXX Oct 11 2024 53.0 Puts @ 1.60

A few.

BA: Selling against synthetic stock.

Bought to Close BA Oct 04 2024 160.0 Calls @ .03 (sold for 2.70)

Sold BA Oct 11 2024 155.0 Calls @ 2.45

SPX: Roll up for a little more premium. Staying slightly long deltas but keeping some downside room.

Rolled SPX Oct 18 2024 5630.0 Puts to Oct 18 2024 5650.0 Puts @ 3.75 credit (24.45 total now)

TLT: Got the regular divvy and keeping the stock. And 6 months of divvys on the call sales. LOL

Bought to Close TLT Oct 04 2024 97.0 Calls @ .01 (sold for 2.10)

Sold TLT Oct 18 2024 97.0 Calls @ .55

VXX: Sold against synthetic short stock.

Bought to Close VXX Oct 04 2024 50.0 Puts @ .05 (sold for 1.15)…waiting on 53s to fill also.

Sold VXX Oct 11 2024 52.5 Puts @ 1.45

STO October 11, $77 covered calls at .47

#SPX0dte Sold to Open $SPX Oct 4th 5635/5655-5800/5820 condors for 1.35, IV 26.95%, deltas -.08 +.05

I waited for the first red candle after the Jobs report on the 5-min futures chart. Took 35 minutes.

#Jobs — Wildly beating expectations, including upward revisions to July and August

Gain of +254,000 non-farm payroll jobs, vs. expected gain of 151K

Unemployment down 0.1% to 4.1%, vs expected unchanged

U6 unemployment 7.7%, down by 0.2

Labor force participation unchanged at 62.7%

Average hourly earnings up by 0.4%; +4.0% Y/Y

August jobs revised up by +17K to +159K

July jobs revised up by +55K to +144K

1 SPY 542/552 Bull Put Spread

1 SPT 544/559 Bull Put Spread

1 SPY 550/560 Bull Put Spread

1 SPY 545/561 Bull Put Spread

1 SPY 554/562 Bull Put Spread

1 SPY 580/573 Bear Call Spread (rolled up yesterday)

Was hoping this one would expire but it got over 568 just after 4:00 so ….

Rolled 1 SPY Oct 03 2024 580/568 Bear Call Spread to tomorrow’s SPY 10/04/2024 580/573 Bear Call Spread for $0.40 Credit

Today’s morning low in SPY was $566.82

Sold 1 SPY 10/03/2024 561.00 Put at $0.21 – Expires today

Sold 1 SPY 10/04/2024 556.00 Put at $0.40.

Both sold against leftover long puts from previous diagonal put spreads.

Sold a tiny bit of HES stock at $141.85. Bought in early Sept at $129.00

#FormerFallingKnife

Added a tiny bit of AAP at $36.75. New low.

#FallingKnife

#SPX0dte Sold to Open $SPX Oct 3rd 5610/5630-5765/5785 condors for 1.25, IV 24.96%, deltas -.06 +.05

#smallbuy

#dividends

#exdivtomorrow

#ACROSS3ACCOUNTS

BOT EBF @24.31 …../special 2.50 /divvy coming up/ #dividendcapture

BOT CRSH @13.09

BOT YMAG @19.14

BOT TSLY @13.64

BOT GDXY @18.45

BOT YMAX @17.58

1 SPY 550/560 Bull Put Spread

1 SPY 551/561 Bull Put Spread

1 SPY 554/562 Bull Put Spread

1 GLD 526/536 Bull Put Spread

Was hoping this one would expire but ….

Rolled 1 SPY Oct 02 2024 583/569 Bear Call Spread to tomorrow’s SPY 10/03/2024 580/573 Bear Call Spread for $0.22 Credit

#SPX0dte Sold to Open $SPX Oct 2nd 5605/5625-5765/5785 condors for 1.15, IV 24.61%, deltas -.05 +.05

Shifting longs to March 2025 while financing the buy with 1 week Put Sales

Bought 1 VXX March 21 2024 23.0 Put at $0.42

Sold 1 VXX Oct 04 2024 49.0 Put at $0.58 for a $0.16 Diagonal Credit

#VXXContango

1 SPY 550/560 Bull Put Spread

1 SPY 557/564 Bull Put Spread

1 SPY 565 Diagonal Put

1 SPY 566 Diagonal Put

1 SPY 584/573 Bear Call Spread

1 SPY 580/572 Bear Call Spread

$NVDA STO 11/15 114 put at 6.50

Sold 1 VXX 10/04/2024 71/61 Bear Call Spread at $0.48 Credit

Sold 1 VXX 10/04/2024 72/62 Bear Call Spread at $0.44 Credit

Bought to close 1 SPY 10/01/2024 577.00 Call at $0.01. Sold yesterday at $0.31

Sold 1 SPY 10/01/2024 572.00 Call at $0.15

#DoubleDip

Sold 1 NUGT 10/04/2024 64/57 Bear Call Spread at $0.18 Credit

Sold 1 TQQQ 10/04/2024 57/64 Bull Put Spread at $0.42 Credit

Sold 1 TQQQ 10/04/2024 55/62 Bull Put Spread at $0.28 Credit

Sold 1 AVGO 10/04/2024 145/155 Bull Put Spread at $0.24 Credit

Sell 1 VXX 10/04/2024 68/58 Bear Call Spread at $0.43 Credit

Bought 1 SPY 10/02/2024 554.00 Put / Sold 1 SPY 10/01/2024 564.00 Put at $0.25 Diagonal Credit

Sold 1 SPY 10/03/2024 542/552 Bull Put Spread at $0.26 Credit

You wonder why they want the restriction on automation in the new contract? No putting the AI genie back in the bottle now.

https://x.com/ShangguanJiewen/status/1840736962564559310

Starter just before the election.

Sold NVDA Nov 01 2024 110.0 Put @ 3.42

#SPX0dte Sold to Open $SPX 5670/5690-5810/5830 condors for 1.25, IV 21.54%, deltas -.06 +.06