STC all of the shares in the index at 81.00, my cost was 71.04, the market seems to be worried about something.

Monthly Archives: November 2024

SPX 0-dte trades for 11/14/24

#SPX0dte Sold to Open $SPX Nov 14th 5915/5935-6030/6050 condors for 1.10, IV 17.62%, deltas -.06 +.07

Sold right at the open, but NOT a good fill. I set limit too low, should have been 1.20 and waited a few seconds.

SOXL

#everylittlebithelps

SOLD SOXL 15 NOV 2024 26.5 PUT @.11

SPX

Rolled SPX Nov 13 2024 6000.0 Puts to Nov 14 2024 6000.0 Puts @ 8.00 credit (30.40 total now)

QQQ

BTC 11/12/24 QQQ 510 Calls @ $4.44 (yesterday)

Ouch

TQQQ, BTC Nov. 22, $89…

TQQQ, BTC Nov. 22, $89 covered calls at .37 and still long the TQQQ.

SPX 0-dte trades for 11/13/24

#SPX0dte Sold to Open $SPX Nov 13th 5950/5980-5985/6015 condors for 15.65, IV 17.09%

SPY Expiration

1 SPY 585/594 Bull Put Spread

1 SPY 553/578 Bull Put Spread

TSLA Puts

Sold 1 TSLA Nov 15 2024 277.5/297.5 Bull Put Spread at $1.19 Credit

Sold 1 TSLA Nov 15 2024 270/290 Bull Put Spread at $0.66 Credit

TQQQ

Sold 1 TQQQ Nov 15 2024 72.5/77/86/89 Iron Condor at $0.55 Credit

SPX

This might slow down the craziness. LOL

Rolled SPX Nov 12 2024 5975.0 Puts to Nov 13 2024 6000.0 Puts @ 17.00 credit (22.40 total now)

SPX 0-dte trades for 11/12/24

#SPX0dte Sold to Open $SPX Nov 12th 5925/5945-6040/6060 condors for 1.15, IV 17.46%, deltas -.05 +.08

Trying different tweaks on this trade. For a few years selling this about an hour before the open gave good advantage, but in the last several months that seemed to disappear, with little or no decay occurring in that hour. Placing a limit order after the open is like a moving target as things move pretty quickly. So today I saw that in premarket the mid price was between 1.05 and 1.12, so I set the order for 1.15 to be submitted AT THE OPEN. It took a few seconds but the spike higher in the first minute filled me. When we reached that height again five minutes later the price was down to .95. So volatility at the open can net more premium, at the risk of a strong spike becoming a big move.

Tiny Puts

Sold 1 OXY Nov 15 2024 45 Put at $0.06

Sold 1 MRNA Nov 15 2024 37.5 Put at $0.12

Sold 1 CE Nov 15 2024 75 Put at $0.35

BA

Synthetic long stock battling to get back to even.

Bought to Close BA Nov 15 2024 165.0 Calls @ .09 (sold for 1.93)

Sold BA Dec 20 2024 165.0 Calls @ 2.21

LEAPS position was 175/175/135 synthetic long with disaster puts. Rolling down the disaster puts for more credit.

Rolled BA Dec 18 2026 135.0 Puts to Dec 18 2026 100.0 Puts @ 9.70 credit

SPX

Rally finally losing a little steam. I wouldn’t mind sideways for awhile.

Bought to Close SPX Nov 11 2024 5945.0 Puts @ .35 (sold for 12.75)

Sold SPX Nov 12 2024 5975.0 Puts @ 5.40

TQQQ,

I rolled my Nov. 15, 85 calls to Nov. 22, $89 calls for a credit of .01

SPX 0-dte trades for 11/11/24

#SPX0dte Sold to Open $SPX Nov 11th 5950/5970-6060/6080 condors for .90, IV 15.84%, deltas -.09 +.03, at 9:35 ET

I entered this trade when the deltas were -.07 +.05 but it didn’t fill until the slight move down when deltas were pretty skewed.

Upside Warning in effect

#VIXindicator Since early October the $VIX remained stubbornly high despite the indexes hovering near all-time highs. The election released the tension and caused a massive collapse in the VIX, and now we get the Upside Warning at new all-time highs. This means we likely have higher to go in the coming days or weeks.

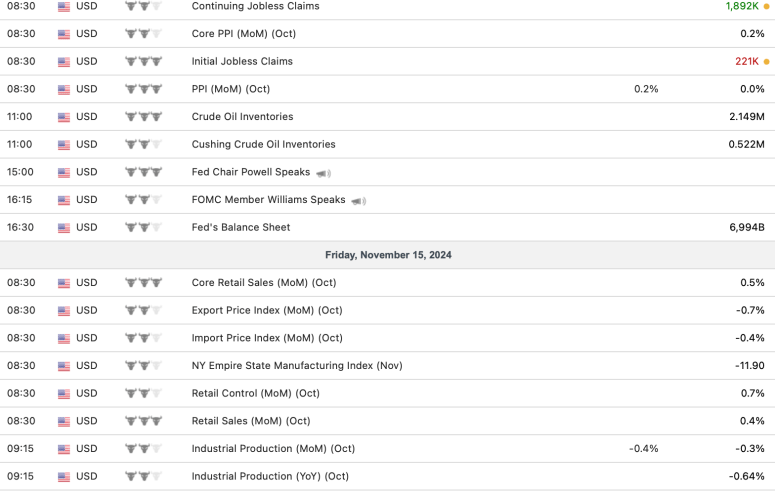

Earnings 11/11 – 11/15

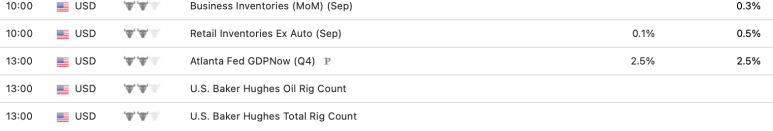

Econ Calendar 11/11 – 11/15

SPCE

#optionsexpiration

SPCE 7 call .77 {2.40 so far}

SPX

Rolled right at the open to start capturing the weekend premium.

Rolled SPX Nov 08 2024 5925.0 Puts to Nov 11 2024 5945.0 Puts @ 5.75 credit (12.75 total now)

#AIC asymmetric iron condor. Whoever…

#AIC asymmetric iron condor.

Whoever did the SPY AIC i posted a few weeks ago, go ahead and close for close to max profits. On 10 contracts I had $779 profits including commissions.

Sorry don’t have time to post more often, life is too busy!! I have become a lone wolf trader. Don’t mind sharing just don’t have time.

But I have kept meticulous trade records since Oct 2022 and am averaging $6041 per month for the last 24 months on about 100k risk. Works out to 145% returns in 24 months or 72.5% annualized. This is using just 6 tactics. Jade lizards, BWB, AIC, Synthetics, Strangles, and opportunistic trades. My favorite has been a synthetic straddle with futures. When the market moves either way that juices your returns.

Now scaling to bigger amounts as this is my early retirement plan 🙂

QQQ

Rolled 11/12/24 QQQ 508 calls to 11/15/24 510 calls @ .03 credit

SPX 0-dte trades for 11/8/24

#SPX0dte Sold to open $SPX Nov 8th 5905/5925-6025/6045 condors for 1.00, IV 17.5%, deltas -.05 +.07

I placed this order about 1 minute after the open but it didn’t fill until the spike higher at 9:34… i let the fill price come to me. Waiting until after Michigan data before trying anything else.

META NVDA Calls Rolled

#rolling

$META BTC 11/8 582.5 and STO 11/15 587.5 at added credit of 1.62 and extra $5 if called away

$NVDA BTC 11/8 145 and STO 11/15 147 at added credit of .4 plus $2 more if called away

$MSFT BTC 11/8 422.50 and STO 11/15 427.50 at even but would gain $5 if called away

VXX

Sold againt synthetic short stock.

Rolled VXX Nov 08 2024 54.0 Puts to Dec 20 2024 51.0 Puts @ .75 debit (1.45 toal now)

BA

Small roll up for additional credit.

Rolled BA Nov 15 2024 150.0 Puts to Nov 15 2024 152.5 Puts @ 1.15 credit (3.85 total now)

SPX

Selling tomorrow near yesterday’s high and the expected move.

Bought to Close SPX Nov 07 2024 5875.0 Puts @ .40 (sold for 11.50)

Sold SPX Nov 08 2024 5925.0 Puts @ 7.00

SPY and SOXL call

Sold 1 SPY 11/07/2024 598.0 Diagonal Call at $0.27

Sold 1 SOXL 11/15/2024 43.0 Covered Call at $0.12

Closing some TQQQ DJT VXX and SPY

Bought to close 1 TQQQ 11/15/2024 49/60 Bull Put Spread $0.05 ( a week early)

Bought to close 1 DJT 11/08/2024 100/80 Bear Call spread at $0.01

Bought to close 1 VXX 11/08/2024 75/70 Bear Call Spread at $0.01

Sold to close 1 SPY 11/07/2024 599.0 Call at $0.16. Bought at $0.13 yesterday as the long side of a diagonal spread

QQQ

Rolled up and out 11/8/24 QQQ 504 Calls to 11/12/24 508 for $.43 Credit

SPX 0-dte trades for 11/7/24

#SPX0dte Volatility pretty quiet compared to recent fed days. Watching premium drain out so I’m taking a shot that we’ll see enough decay in the morning for a trade. Sold this with SPX about 6 points above center.

Sold to Open $SPX 5920/5950-5955/5985 condors for 20.00, IV 25.09%

SPY and GLD Expirations

1 SPY 540/500 Bull Put Spread

SPY 592 Diagonal Calls

1 GLD 230/244 Bull Put Spread

MSTR Call Roll

$MSTR BTC 11/8 252.5 call and STO 11/15 265 call at added credit of 1.38 and added 12.50 if called away

SPX

Not sure what I’ll use these for but it seems like a good day to do it.

Bought to Open SPX Dec 19 2025 1000.0 Puts @ 1.60

SPX

Wouldn’t mind these new ones taking some heat tomorrow. C’mon JP!

Bought to Close SPX Nov 06 2024 5825.0 Puts @ .25 (Sold for 30.60)

Sold SPX Nov 07 2024 5875.0 Puts @ 11.50

Tiny Trades

At new yearly highs

Sold LNC at $36.50

Sold TFC at $45.35

Sold USB at $50.85

#FormerFallingKnife

TSLA Calls – NUE Puts

Sold 1 TSLA 315/305 Bear Call Spread at $0.63 Credit

Sold 1 NUE 150/160 Bull Put Spread at $0.37 Credit

SPY Puts

Sold 1 SPY 11/07/2024 568/575 Bull Put Spread at $0.16 Credit

Tiny Puts

Sold 1 MRNA 11/08/2024 40.0 Put at $0.11

VXX Puts rolled

Rolled a long VXX 11/08/2024 45.0 Put to 1 VXX 11/15/2024 40.0 Put at $0.45 Credit

Rolled a long VXX 11/08/2024 44.5 Put to 1 VXX 11/15/2024 40.0 Put at $0.34 Credit

Rolled a long VXX 11/08/2024 44.0 Put to 1 VXX 11/15/2024 39.0 Put at $0.19 Credit

SPY

Taking these early on the bounce.

Bought to Close SPY Nov 15 2024 555.0 Put @ .50 (sold for 2.90)

Bought to Close SPY Dec 20 2024 510.0 Put @ .98 (sold for 3.00)

Bought to Close SPY Dec 20 2024 510.0 Put @ .97 (sold for 3.27)

Bought to Close SPY Dec 20 2024 520.0 Put @ 1.20 (sold for 3.15)

Bought to Close SPY Dec 20 2024 525.0 Put @ 1.40 (sold for 4.37)

Bought to Close SPY Dec 20 2024 530.0 Put @ 1.60 (sold for 3.47)

DJT

Sold to Close DJT LongStraddle for $3 Loss instead of trying to save a bad trade w/ adjustments

Closed spec trade

#SPX0dte BTC $SPX Nov 8th 5695/5725-5730/5760 condors for 29.20. Sold Monday for 28.00. Now that this is hugely OTM I’m closing now when puts still have some value, rather than wait for a full 2-dollar loss.

TQQQ,

STO November 15, $85 covered calls at .35

SPX 0-dte trades for 11/6/24

#SPX0dte Sold to Open $SPX Nov 6th 5810/5790 put spreads for .90, delta -.08, IV 35.44%

Even though we making new all time highs by the minute, still too hesitant to sell a call spread yet.

SPY Expiration

1 SPY 550/560 Bull Put Spread

1 SPY 578 Diagonal Call (sold today at $0.15)

PLTR NVO NVDA MSTR COIN Calls

#coveredcalls

$PLTR STO 11/8 54 call at .40

$NVO STO 11/8 112 call at 1.12

$NVDA STO 11/8 145 call at .72

$MSTR STO 11/8 252.50 call at 10.00

$COIN STO 11/8 215 call at 4.00

QQQ

STO 11/8/24 QQQ 504 Calls @$1.26 Credit

Sold against LEAPS Position

Tuesday Trades

Sold DJT 11/08/2024 100/95 Bear Call Spreads at $0.14 Credit

Sold 1 DJT 11/08/2024 3/8 Bull Put Spread at $0.18 Credit

Sold VXX 11/08/2024 45/47.5 Bull Put Spreads at $0.21 and $0.24 Credit

Sold 1 VXX 11/08/2024 43/47 Bull Put Spread $0.14 Credit

Sold 1 VXX 11/08/2024 42/46.5 Bull Put Spread $0.20 Credit

Sold 1 VXX 11/08/2024 41/46 Bull Put Spread $0.14 Credit

Sold 1 VXX 11/08/2024 80/65 Bull Put Spread $0.30 Credit

Sold 1 NUE 11/08/2024 172.5/162.5 Bear Call Spread at $0.27 Credit

Sold 1 NUGT 11/08/2024 40/44 Bull Put Spread at $0.24 Credit

Sold 1 TSLA 11/08/2024 310/300 Bear Call Spread at $0.17 Credit

Sold 1 TSLA 11/08/2024 200/210 Bull Put Spread at $0.14 Credit

Sold 1 SPY 11/05/2024 578.0 Diagonal Call at $0.15

Sold 1 SMCI 11/08/2024 12.0 Put at $0.18

Sold 1 JBLU 11/08/2024 6.0 Covered Call at $0.08

SPX 0-dte trades for 11/5/24

#SPX0dte Sold to Open $SPX Nov 5th 5630/5650-5775/5795 condors for 1.20, IV 23.41%, deltas -.06 +.06

Econ Calendar adjusted

My apologies but the calendar I posted on Sunday was incorrectly set with the wrong time zone (Daylight Savings glitch). I have now edited the post to reflect Eastern time, as per usual. The Econ calendar is always available quickly in the menu bar above.

Low risk long shot

#SPX0dte One minute after close on Monday was filled on a speculative trade. It’s the highest premium I’ve ever sold a 30-point condor for, so risk is total of 2.00 for max gain of 28.00. More likely, if we’re still close to this price level on Friday, I would close for 5.00 to 10.00 profit. I had an order in for a few days for an ATM Nov 8th trade at 28.00, but it didn’t fill until yesterday.

Sold to open $SPX Nov 8th 5695/5725-5730/5760 condors for 28.00.

SPY Expiration

1 SPY 11/04/2024 550/560 Bull Put Spread

Monday Spreads

Reporting late because I was in the air all day

Sold 1 DJT Nov 08 2024 3/10 Bull Put Spread at $0.42 Credit

Sold 1 SPY Nov 05 2024 550/560 Bull Put Spread $0.15 Credit

Sold 1 SPY Nov 06 2024 540/550 Bull Put Spread $0.33 Credit

Monday Tiny Puts

Reporting late because I was in the air all day

Sold 1 APA Nov 08 2024 20.0 Put at $0.06

Sold 1 DJT Nov 08 2024 4.0 Put at $0.07

Sold 1 PFE Nov 08 2024 26.5 Put at $0.07

Sold 1 CVS Nov 08 2024 46.0 Put at $0.07

Sold 1 SOXL Nov 08 2024 22.0 Put at $0.08

Sold 1 DJT Nov 08 2024 7.0 Put at $0.20

Sold 1 SMCI Nov 08 2024 13.0 Put at $0.25

Sold 1 DJT Nov 08 2024 8.0 Put at $0.28

Sold 1 SMCI Nov 08 2024 14.0 Put at $0.62

DJT

LongStraddle DJT 11/8/24 34 C/P @$17.38 Debit

Break-evens: $51.38 > or $16.62 <

MARA

#rolling

tIP SOLD CALENDAR MARA 15 NOV 24/8 NOV 24 18 PUT @.31

SPX

Rolling down but taking a little premium too. Might still have good premium post election with the Fed coming.

Rolled SPX Nov 05 2024 5835.0 Puts to Nov 06 2024 5825.0 Puts @ 4.50 credit (30.60 total now)

BA

I think the vote will pass this time.

Rolled BA Nov 15 2024 145.0 Puts to Nov 15 2024 155.0 Puts @ 3.40 credit (5.40 total now)

And:

Sold BA Nov 15 2024 150.0 Puts @ 2.70

SPX 0-dte trades for 11/4/24

#SPX0dte Sold to Open $SPX Nov 4th 5640/5660-5790/5810 condors for 1.10, IV 23.01%, deltas -.06 +.06

Looking at a chart for this condor the price has been lowering all night so I’m going to enter before market, since today has no major economic moves. IV seems high just because what’s coming the rest of the week.

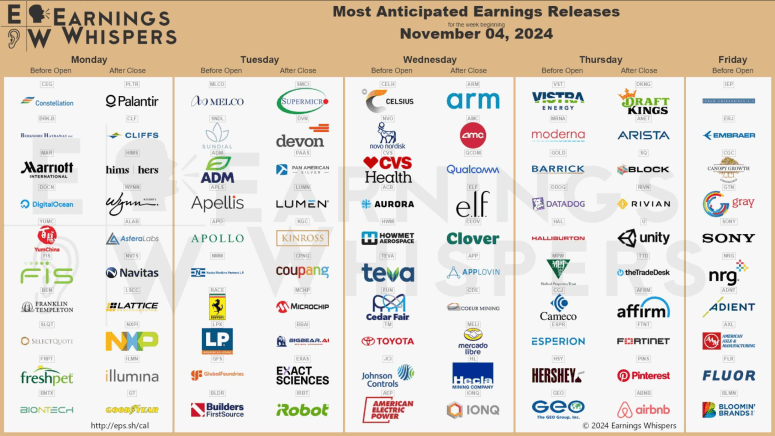

Earnings 11/4 – 11/8

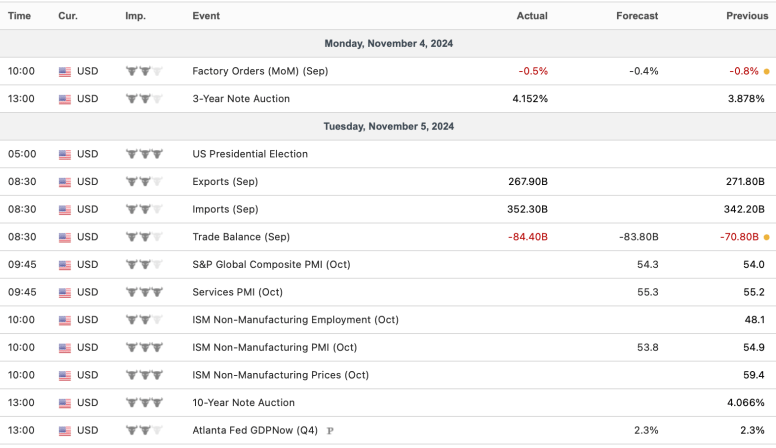

Econ Calendar 11/4 – 11/8

SOXL

#optionsexpiration

soxl 11/1/2024 ,28.5 put

OptionsExpiration

Rolled up some VXX and VFC Calls and rolled down some NUGT and NUE Puts, but much better than last week.

Taking most of next week off so I’ve rolled most positions out past 11/08.

EXPIRED:

AVGO 145/157.5 Bull Put Spread

AVGO 150/160 Bull Put Spread

AVGO 152.5/162.5 Bull Put Spread

AVGO 212.5/187.5 Bear Call Spread

AVGO 197.5/185 Bear Call Spread

CVS 74/59 Bear Call Spread

DJT 23/28 Bull Put Spread

DJT 75/58 Bear Call Spread

DJT 70/56 Bear Call Spread

GLD 246/250 Bull Put Spread

GLD 247.5/251 Bull Put Spread

NUE 160/155 Bear Call Spread

SOXL 23/27 Bull Put Spread

SOXL 23.5/27.5 Bull Put Spread

SOXL 44/40 Bear Call Spread

SOXL 55/50 Bear Call Spread

SPY 555/565 Bull Put Spread

TQQQ 58/66 Bull Put Spread

TQQQ 86/81 Bear Call Spread

TSLA 205/227.5 Bull Put Spread

TSLA 290/270 Bear Call Spread

TSLA 287.5/260 Bear Call Spread

VFC 14/18 Bull Put Spread

VXX 49.5 Diagonal Put

VXX 50.0 Diagonal Puts

VXX 43/49.5 Bull Put Spread

VXX 43.5/49.5 Bull Put Spread

VXX 44/49.5 Bull Put Spread

VXX 70/59 Bear Call Spread

VXX 70/60 Bear Call Spread

VXX 70/62 Bear Call Spread

BOIL 10.0 Covered Calls

BOIL 10.5 Covered Call

SOXL 44.0 Covered Call

WBA 10.0 Covered Calls

AAP 33.5 Put

APA 22.5 Put

DJT 29.5 Put

DJT 29.0 Put

EL 60.0 Puts

INTC 18.0 Put

INTC 18.5 Put

SMCI 25.0 Put

SMCI 20.0 Put

SOXL 27.0 Put

ASSIGNMENTS:

1 JBLU 6.0 Put

2 VFC 18.5 Covered Calls

Against stock put to me at 17.0 and 18.5 last week.

DJT Put Roll

Bought to close 1 DJT 11/01/2024 30.0 Put at $0.01

Replaced it with 1 short DJT 11/08/2024 9.0 Put at $0.26.

#ElectionWeek

SNOW

Selling against synthetic stock. Goal is to get out at even at some point.

Bought to Close SNOW Nov 01 2024 117.0 Calls @ .23 (sold for 2.65)

Sold SNOW Nov 08 2024 117.0 Calls @ 3.08

DJT Iron Condor

Sold 1 DJT 11/08/2024 90/80 Bear Call Spread at $0.33 Credit

Sold 1 DJT 11/08/2024 3/13 Bull Put Spread at $0.65 Credit

#ElectionWeek

TQQQ Puts

Sold 1 TQQQ 11/15/2024 50/60 Bull Put Spread at $0.67 Credit

Sold 1 TQQQ 11/15/2024 49/59 Bull Put Spread at $0.60 Credit

Avoiding #ElectionWeek for this one

SMCI Put Roll

Bought to close 1 SMCI 11/01/2024 22.0 Put at $0.02.

Replaced it with 1 short SMCI 11/08/2024 14.0 Put at $0.37

VXX

Another round.

Bought to Close VXX Nov 01 2024 53.0 Puts @ .05 (sold for 1.60)

Sold VXX Nov 08 2024 54.0 Puts @ 2.20

SPX

Straight roll. See if we get any sort of follow through on Mon or Tue.

Rolled SPX Nov 01 2024 5835.0 Puts to Nov 05 2024 5835.0 Puts @ 1.50 credit (26.10 total now)

DJT Puts

Sold DJT 11/08/2024 5.0 Puts at $0.07 and $0.10

#ElectionWeek

#EveryLittleBitHelps

VXX Puts

Sold 1 VXX 11/08/2024 49.0 Put at $0.36

Sold against the VXX Mar 21 2025 24.0 Put I bought yesterday at $0.13

Sold 1 VXX 11/08/2024 45/49.5 Bull Put Spread at $0.38 Credit