If the Dow finishes negative today it will be first 9-day losing streak since the 70’s.

Monthly Archives: December 2024

SPX 0-dte trades for 12/17/24

#SPX0dte At the bell, sold to open $SPX 5990/6010-6095/6115 condors for .90, IV 14.86%, deltas -.10, +.02

Opposite of yesterday as far as delta skew. At 9:25 the deltas were -.06 +.05. What a difference the open makes.

SOXL SPCE

#shortputs

SOLD SOXL 20 DEC 24 25 PUT @.06

tIP SOLD SPCE 20 DEC 24 6 PUT @.13

SOLD SPCE 20 DEC 24 5.5 PUT @.04

#coveredcalls

tIP SOLD SPCE 20 DEC 24 7 CALL @.06

#everylittlebithelps

ADBE

Couldn’t resist. Selling at the expected move and near recent lows.

Sold ADBE Jan 17 2025 435.0 Put @ 4.20

AMZN Call

#syntheticcoveredcalls

$AMZN STO 12/20 242.50 call at .45

QQQ

Rolled short calls again; now out to 12/31/24 and up to $546 for $.15 credit

SPX

With VIX down here this is about all you can hope for in a one day roll. Wed gets a little better with JP coming out to say hello.

Rolled SPX Dec 16 2024 6070.0 Puts to Dec 17 2024 6070.0 Puts @ 6.00 credit (19.50 total now)

DVN MPC Stocks

Added a tiny bit of DVN at $32.78

Started a tiny position in MPC at $140.00

#FallingKnife

SNOW XLU

Quick summary.

Out of SNOW synthetic long and XLU synthetic short. Losses on both took about 30 percent of my BA gains but really simplifies everything. End of year house cleaning with ultimate goal of nothing but SPX, SPY, and VXX positions.

BA

Happily out after riding it all the way down and being aggressive on the way up.

Closed BA Dec 18 2026 175/175/100 Synthetic Stock @ 18.00 credit (basis 6.15 debit)

Bought to Close BA Jan 24 2025 165.0 Calls @ 14.20 (sold for 2.35)

Gain on synthetic and loss on call sales is a wash.

Money made here:

Bought to Close BA Dec 20 2024 160.0 Puts @ .17 (sold for 8.65)

Bought to Close BA Dec 20 2024 160.0 Puts @ .17 (sold for 10.80)

QQQ

Rolled 12/23/24 $543 short calls to 12/27 $544 for $.49 credit

CLF DVN NUE

#TinyPuts

Sold 1 CLF 12/20/2024 9.5 Put at $0.07

Sold 1 DVN 12/20/2024 31.5 Put at $0.07

Sold 1 NUE 12/20/2024 117.0 Put at $0.20

#EveryLittleBitHelps

WBA SOXL TOL Calls

Sold WBA 12/20/2024 12.0 Covered Calls at $0.04

Sold 1 SOXL 12/27/2024 40.0 Covered Call at $0.13

#EveryLittleBitHelps

Sold TOL 12/20/2024 155/145 Bear Call Spreads at $0.25

COP CVS LEG PSX Stocks

Started a tiny bit in COP at $100.00

Added a tiny bit of CVS at $48.00

Added a tiny bit of LEG at $10.95

Started a tiny position in PSX at $118.00

#FallingKnife

META GOOGL Call

#coveredcalls

$META STO 12/20 645 call at 1.75

$GOOGL STO 12/20 207.50 call at .50

QQQ

Rolled 12/18/24 $540 short calls to out Monday 12/23 and up to $543 for .28 credit

Aggressively rolling the short side of the LEAPS covered call position as I will be out of town Thur and Friday and unable to attend to the market. The long LEAPS are the core money maker in this position (as long as the market continues to rise). Theta credits are secondary.

SPX 0-dte trades for 12/16/24

#SPX0dte Sold to Open $SPX Dec 16th 6000/6020-6090/6110 condors for 1.05, IV 12.00%, deltas -.05 +.09

Filled at the open… pre market deltas lied to me… this was -.06 +.07 at 6 minutes before the open. Bumped up to 1.20 after my fill but then fell back to .80. These narrow ones are pretty sensitive. Upside stop is close, at 6073

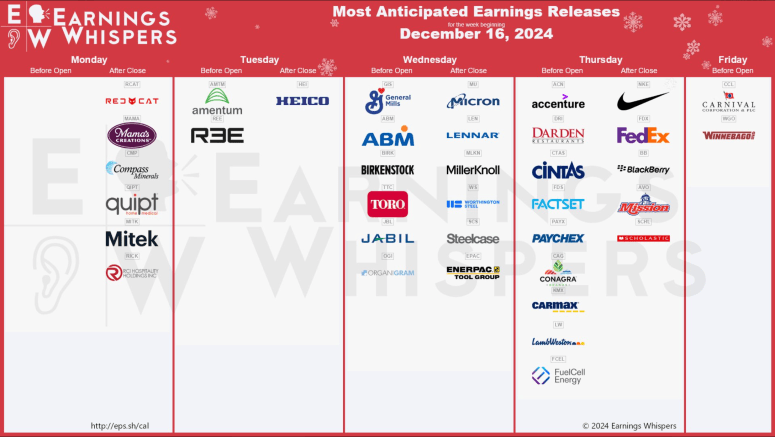

Earnings 12/16 – 12/20

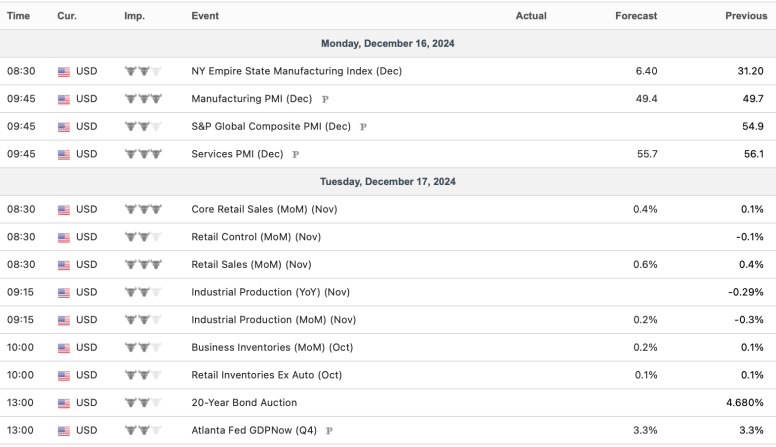

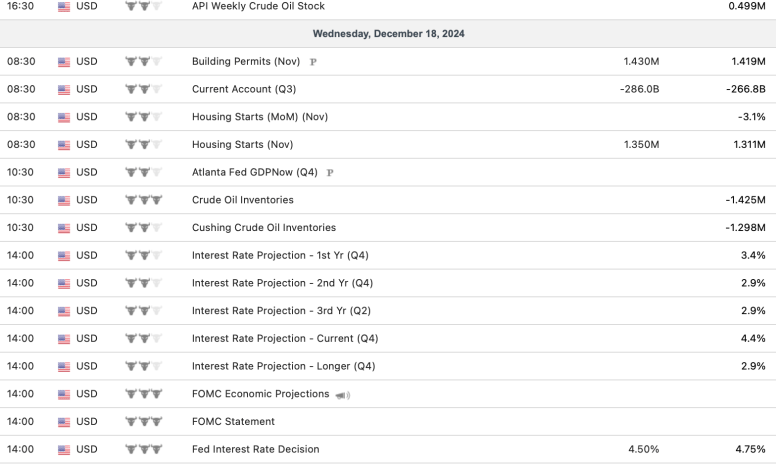

Econ Calendar 12/16 – 12/20

#optionepiration #assignment SPCE 6.5 and…

SOXL SPCE

#optionepiration

SOXL 25 puts

SPCE 7 calls

#assignment

SPCE 6.5 and 7 puts

Options Expiration

Big losses on old AVGO, SPY and TQQQ Call spreads, and an early assignment on a NUE 140 Put destroyed my week, despite the winners below:

Expired:

AVGO 143/150 Bull Put Spread

AVGO 145/152.5 Bull Put Spreads

AVGO 147/155 Bull Put Spread

BOIL 60/50 Bear Call Spread

BOIL 59/50 Bear Call Spread

BOIL 32/35.5 Bull Put Spread

CVS 65/57 Bear Call Spread

NUE 167.5/155 Bear Call Spread

NUGT 53.5/49.5 Bear Call Spread

ORCL 145/157.5 Bull Put Spread

ORCL 150/160 Bull Put Spread

SPY 579/599 Bull Put Spread

TQQQ 74/80 Bull Put Spread

VFC 24/22 Bear Call Spread

VXX 54/47.5 Bear Call Spreads

VXX 57/48 Bear Call Spreads

VXX 56/47.5 Bear Call Spreads

VXX 45/47 Bear Call Spreads

CLF 13.5 Covered Calls

NUGT 47 Covered Call

NUGT 49 Covered Call

SOXL 38.5 Covered Call

WBA 10.5 Covered Calls

AI 27 Put

AVGO 145 Put

SOXL 24 Put

SPCE 6 Puts

TQQQ 77 Put

SPX

Keep going sideways until I have to roll down.

Rolled SPX Dec 13 2024 6070.0 Puts to Dec 16 2024 6070.0 Puts @ 2.90 credit (13.50 total now)

AI TOL NUE

Closed 1 AI 12/13/2024 25.5/35 Bull Put Spread at $0.01 #releasingmargin

Rolled 1 TOL 134/140 Bull Put Spread to next week’s TOL 130/139 Bull Put Spread at $0.08 Credit

Rolled 1 TOL 133/139 Bull Put Spread to next week’s TOL 130/139 Bull Put Spread at $0.75 Credit

Rolled 1 NUE 12/123/2024 129.0 Put to next week’s NUE 125.0 Put at $0.05 Credit

DOW LYB Stocks

Added a tiny bit to DOW at $41.00

Added a tiny bit to LYB at $75.00

#SP500 #FallingKnife

TQQQ,

STO Dec. 27, $91 puts at 3.35And My $85 puts will expire today at zero.

QQQ

Rolled today’s $534 short calls out and up to 12/18/24 $540 for $.16 Credit

SPY Expiration

1 SPY 598 Diagonal Put

SPX

Rolled SPX Dec 12 2024 6070.0 Puts to Dec 13 2024 6070.0 Puts @ 6.00 credit (10.60 toal now)

NUE Diagonal Put

Bought 1 NUE 12/20/2024 120 Put / Sold 1 NUE 12/13/2024 129 Put at $0.27 Credit

#1DTE

VXX Put Rolldown

Rolled 1 VXX 12/13/2024 43.0 Put to next week’s VXX 42.0 Put for $0.03 Credit

CVS DVN Stock

Added tiny bit to my CVS position at $51.00 and $50.00

Added tiny bit to my DVN position at $34.00 (ex-div tomorrow – yield 5.75%)

#SP500 #FallingKnife

QQQ

Rolled 12/12 $534 short calls to 12/13/24 for $.21 Credit

SPX 0-dte trades for 12/12/24

#SPX0dte Sold to Open $SPX Dec 12th 6015/6035-6105/6125 condors for .70, IV 12.03%, deltas -.08 +.04

Pretty low premium for a narrow condor, but it filled on the down move.

SPY Expiration

1 SPY 616/608 Bear Call Spread

1 SPY 593/601 Bull Put Spread

1 SPY 1 600.0 Diagonal Put

SPX

Gotta love it. Six straight days of chopping around the 6070 level. Let’s do it for six more months! LOL

Bought to Close SPX Dec 11 2024 6070.0 Puts @ .35 (sold for 30.60)

Sold SPX Dec 12 2024 6070.0 Puts @ 4.60

BAX CVS

#TinyTrades

Bought BAX at $31.00 and $30.83

Bought CVS at $52.71

#SP500 #FallingKnife

QQQ

#coveredcalls STO 12/12/24 QQQ 534 calls @.25

Selling against the LEAPS position

SPCE Put

Sold 1 SPCE 12/13/2024 6.0 Put at $0.09

#EveryLittleBitHelps

SPY Calls

Bought 1 SPY 12/12/2024 613 Call / Sold 1 SPY 12/11/2024 608 Call at $0.15 Diagonal Credit

SPX 0-dte trades for 12/11/24

#SPX0dte Sold to Open $SPX Dec 11th 5985/6005-6095/6115 condors for 1.00, IV 14.54%, deltas -.05 +.06

SPY Expiration

1 SPY 607 Diagonal Call

XRP Crypto

Been gradually adding to my lottery ticket. Enter at your own risk!

Owned a bunch at 1.70 forever. Added a little more at 2.00. Will buy dips below 2.00 until reaching my limit. Could go to zero or 10.

I remember Bitcoin at 20 and thought it had no chance. I’m still not a believer but want to be involved with defined risk if we get another run on a cheap one.

SPY

Starting a new ladder at the 50 day and lower.

Sold SPY Jan 17 2025 580.0 Put @ 3.05

Sold SPY Jan 17 2025 585.0 Put @ 3.70

SPY Put

Sold 1 SPY 12/11/2024 600 Put at $0.28

RDDT

Adding to 1/15/27 RDDT $80 CALL long LEAPS position for $97.50 debit on today’s weakness (initial lot purchased on 10/30 for $27.46)

Housekeeping: BTC RDDT 1/15/27 $95 short PUTS for $18.

WBA TQQQ SPCE

Sold WBA 01/17/2025 17.5 Covered Calls at $0.06

Walgreens Shares Spike Off 28-Year Lows On Private-Equity Interest

Sold 1 TQQQ 12/13/2024 77.0 Put at $0.08

Sold 1 SPCE 12/13/2024 6.0 Put at $0.08

#TinyTrades

BA

Rolling short calls again out to the week before earnings. Still short a bunch of Dec 20 160 strike puts.

Rolled BA Jan 10 2025 160.0 Calls to Jan 24 2025 165.0 Calls @ 1.10 debit (2.35 total now)

More Spreads

Sold 1 AVGO 12/13/2024 145/150 Bull Put Spread at $0.25 Credit

Sold 1 BOIL 12/13/2024 32/35.5 Bull Put Spread at $0.18 Credit

ORCL AVGO SOXL Puts

Tiny Trades:

Bought to close 1 ORCL 12/13/2024 150.0 Put at $0.01

#ReleasingMargin

Sold 1 AVGO 12/13/2024 145.0 Put at $0.08

Sold 1 SOXL 12/13/2024 24.0 Put at $0.06

#EveryLittleBitHelps

Thanks for the idea @walter6871

SPX

Keep rolling sideways as long as the premium is still there.

Rolled SPX Dec 10 2024 6070.0 Puts to Dec 11 2024 6070.0 Puts @ 6.50 credit (30.75 total now)

SPCE SOXL

#everylittlebithelps

#shortputs

SOLD SPCE 13 DEC 24 7 CALL @.10

SOLD SOXL 13 DEC 24 25 PUT @.07

#dividends

#addingtostable

BOT CRF @8.72

BOT CLM @8.51

TOL Puts

Sold 1 TOL 12/13/2024 134/139 Bull Put Spread at $0.25 Credit (post-earnings)

SPX 0-dte trades for 12/10/24

#SPX0dte Sold 1 minute aftyer open: $SPX Dec 10th 6005/6025-6095/6115 condors for 1.00, IV 13.21%, deltas -.11 +.03

MSTY YMAX SDIV

#dividends

BOT MSTY @33.49

tIP BOT YMAX @18.55

tIP BOT CONY @17.10

————–

#selling

#releasecapital

#weakdividends

SOLD SDIV

GLD SPY Expiration

1 GLD 235/245 Bull Put Spread

1 SPY 594/604 Bull Put Spread

1 SPY 617/611 Bear Call Spread

TQQQ,

STO December 13, $85 puts at 1.45

TOL Puts

Sold 1 TOL 12/13/2024 133/140 Bull Put Spread at $0.28 Credit (earnings today AMC)

0-dte Strangles

#SPX0dte I have been testing a new strategy and just completed my second attempt at doing it live.

Recently we’ve seen fairly significant moves in SPX toward end of day. For a couple weeks I’ve been watching ATM strangles with 5-point centers. Once these drop below 6 or even 5 bucks (after 1pm ET), it is a fair bet to BUY one and then wait for a move. The idea is to cover the full cost of the trade plus some profit on the first move, then try to get as much as you can extra profit from the other side.

Today I bought $SPX Dec 9th 6060/6065 strangles for 4.70 at 2:17pm ET.

I had to wait over 20 minutes for a move, and in that time it dropped to 3.85. Loss of less than a dollar… if it had gone more than a dollar in the red I may have stopped out. But then the spike down happened and my put option sold for 6.00. So I was 1.30 in profit. Now I can choose to wait for a total bounce and perhaps even get a double. On some test days this DID happen. But when I saw no immediate strong bounce, I closed today’s for .90. Sure enough, SPX took a further drop so .90 was nice to catch. Had I been willing to sit with the risk longer, I could have sold put side for as much as 7.00 (at least so far), but I think these trades are best when goal is 1.00 to 2.00 in profit. For this one I got 2.20.

On Friday I bought a strangle for 5.60 and got the down move almost immediately. It didn’t go very far and started to recover, so I sold put for 6.00. With .40 profit I decided to wait for a full recovery and sell call if it got to 4.00. It didn’t; the drop continued so it expired.

SPY Puts

Bought 1 SPY 12/16/2024 589 Put / Sold 1 SPY 12/12/2024 598 Put at $0.21 Diagonal Credit

#EveryLittleBitHelps

SPX

Rolled SPX Dec 09 2024 6070.0 Puts to Dec 10 2024 6070.0 Puts @ 6.00 credit (24.15 total now)

Monday Spreads

Sold 1 AI 12/13/2024 25.50/35 Bull Put Spread at $1.04 Credit (earnings today AMC)

Sold 1 ORCL 12/13/2024 150/160 Bull Put Spread at $0.26 Credit (earnings today AMC)

Sold 1 ORCL 12/13/2024 145/157.5 Bull Put Spread at $0.26 Credit (earnings today AMC)

Sold 1 AVGO 12/09/2024 135/155 Bull Put Spread at $0.63 Credit

Sold 1 AVGO 12/09/2024 143/152.5 Bull Put Spread at $0.22 Credit

Sold 1 NUGT 12/09/2024 53.5/49.5 Bear Call Spread at $0.16 Credit

Sold 1 VFC 12/13/2024 24/22 Bear Call Spread at $0.24 Credit

Sold 1 TSLA 12/20/2024 280/310 Bull Put Spread at $0.43 Credit

Bought 1 CVS 12/27/2024 63 Call / Sold 1 CVS 12/13/2024 57.0 Call at $0.23 Diagonal Credit

Sold VXX 12/09/2024 54/47.5 Bear Call Spreads at $0.16 Credit

SPX 0-dte trades for 12/9/24

#SPX0dte Sold to Open $SPX Dec 9th 6035/6055-6115/6135 condors for 1.05, IV 12.00%, deltas -.09, +.07

Fairly narrow with aggressive deltas but only way to get premium. Overnight moves pretty mellow, so looking for a sideways goong into Wednesday’s CPI.

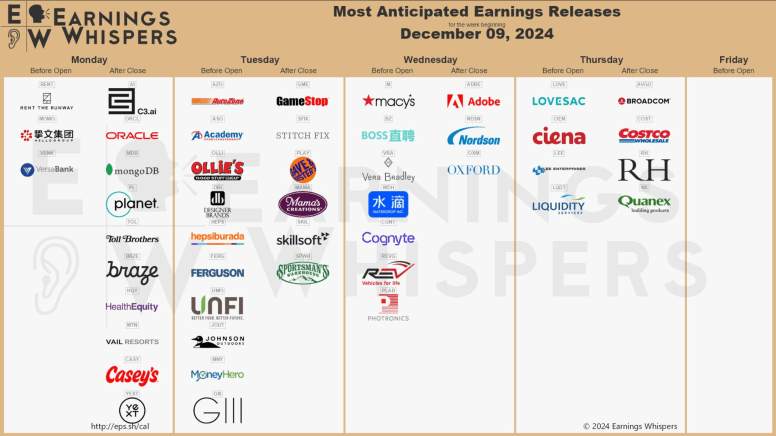

Earnings 12/9 – 12/13

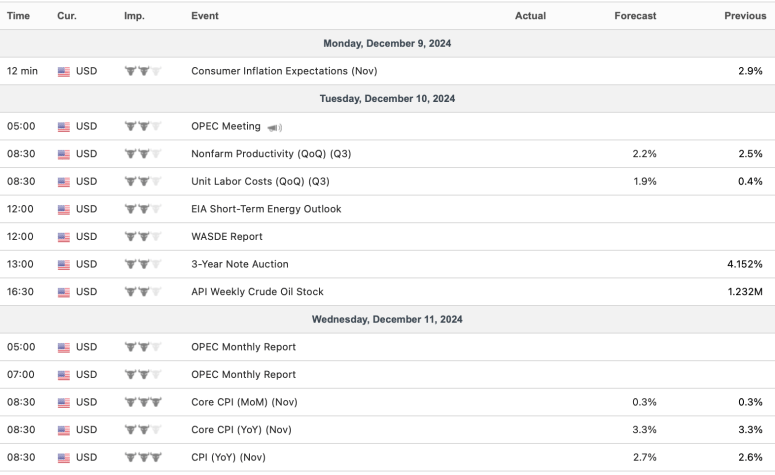

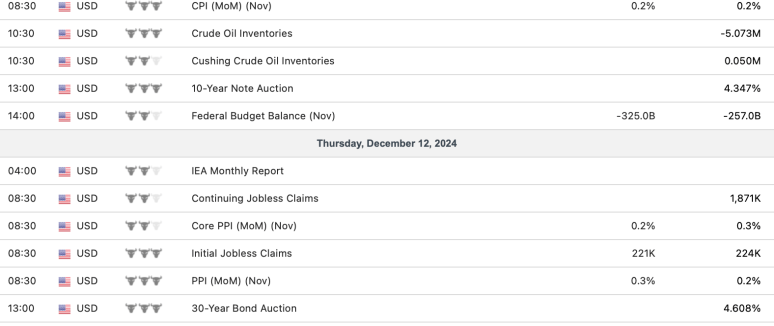

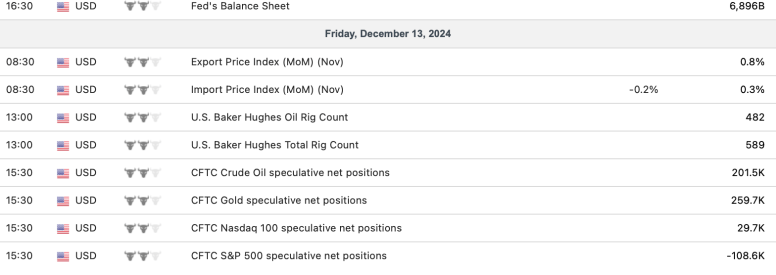

Econ Calendar 12/9 – 12/13

OptionsExpiration

AVGO 135/160 Bull Put Spread

BOIL 28/33 Bull Put Spread

BOIL 60/50 Bear Call Spread

BOIL 65/55 Bear Call Spread

CRM 270/280 Bull Put Spread4

CVS 65/60 Bear Call Spread

NUGT 50/47 Bear Call Spread

SPY 604 Diagonal Put

TQQQ 55/70.5 Bull Put Spread

VXX 50/45 Bear Call Spreads

VXX 51/45 Bear Call Spread

VXX 52/45 Bear Call Spreads

VXX 41 Diagonal Put

DLTR 49 Put

DG 55 Put

SOXS 18.5 Put

INTC 20 Put

FL 17.5 Put

CLF 14.0 Covered Calls

NUGT 47.0 Covered Calls

SOXL 36.0 Covered Call

SOXL 37.0 Covered Call

TQQQ,

I will be calles away on my $85 calls that I sold so will look to reload next week.

SPY Calls and Puts

Sold 1 SPY 12/10/2024 603 Put at $0.44

Sold 1 SPY 12/09/2024 604 Put at $0.27

Sold 1 SPY 12/09/2024 611 Call at $0.25

#OnlySpreads

SPX

Staying a little inside the expected move until something changes.

Rolled SPX Dec 06 2024 6065.0 Puts to Dec 09 2024 6070.0 Puts @ 5.50 credit (18.15 total now)

QQQ

Closed 12/10/24 545 short calls for $.02 debit

SPX-0dte for 12/6/24

#SPX0dte Sold 6065/6095-6100/6130 condors for 10.10, IV 12.09%

Tight leash…. this has been a chase as premium dropping pretty rapidly.

NWL TROW APA CE DVN LYB OXY Stock

Sold my last tiny bit of NWL at $10.24

Sold a bit of TROW at $125.01

#FormerFallingKnife

Added a tiny bit of APA at $21.00

Added a tiny bit of CE at $69.00

Added a tiny bit of DVN at $35.00

Added a tiny bit of LYB at $76.00

Added a tiny bit of OXY at $48.00

#FallingKnife

November Jobs Report

#Jobs — Higher than expected, UE rate rising

Gain of +227,000 non-farm payroll jobs, vs. expected gain of 214K

Unemployment up 0.1 to 4.2%, as expected

U6 unemployment 7.8%, up by 0.1

Labor force participation down 0.1 at 62.5%

Average hourly earnings up by 0.4%; +4.0% Y/Y

October jobs revised up by +24K to +36K

September jobs revised up by +32K to +255K

SPY Expiration

1 SPY 612/608 Bear Call Spread

1 SPY 612/607 Bear Call Spread

SPY Puts

The relentless move up has kept me from setting up new put Spreads

Sort of forcing this …

Bought 1 SPY Dec 09/2024 594 Put / Sold 1 SPY Dec 06 2024 604 Put at $0.38 Credit

SPCE

#shortputs

#everylittlebithelps

SOLD SPCE 13 DEC 24 6.5 PUT @.36