Sold 1 INTC Dec 06 2024 20.0 Put at $0.06

#TinyTrade

Monthly Archives: December 2024

DJT

#onlyspreads closed DJT 1/17/25 34 C/P @ $1.95 Credit

Grabbed for the chicken, got only feathers

BA

Rolling the rest of the short puts up. 160 short calls need all the help they can get.

Rolled BA Dec 20 2024 155.0 Puts to Dec 20 2024 160.0 Puts @ 2.40 credit (8.65 total now)

DVN DOW MCHP CE LYB Stock

Added tiny bits of these at new lows

DVN at $36.00

DOW at $42.00

MCHP at $60.00

CE at $70.00

LYB at $77.00

#SP500 #FallingKnife

VXX Calls

Last one for this week

Sold 1 VXX Dec 06/2024 50/45 Bear Call Spread at $0.14 Credit

SPX

Not a lot of premium left today so rolling early.

Rolled SPX Dec 05 2024 6055.0 Puts to Dec 06 2024 6065.0 Puts 7.25 credit (12.65 total now)

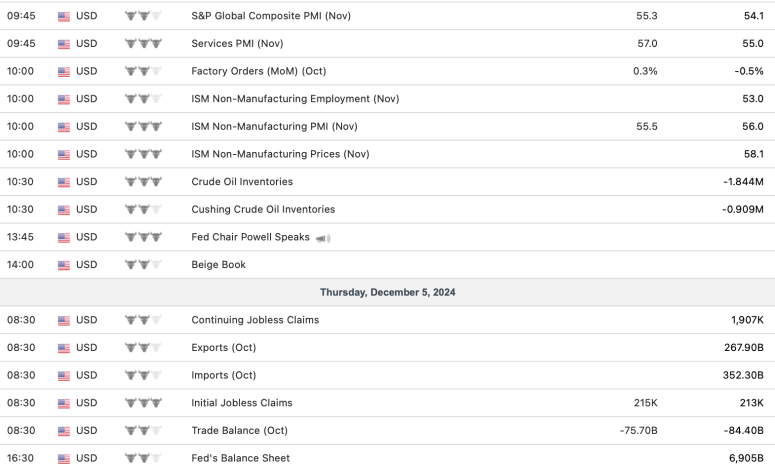

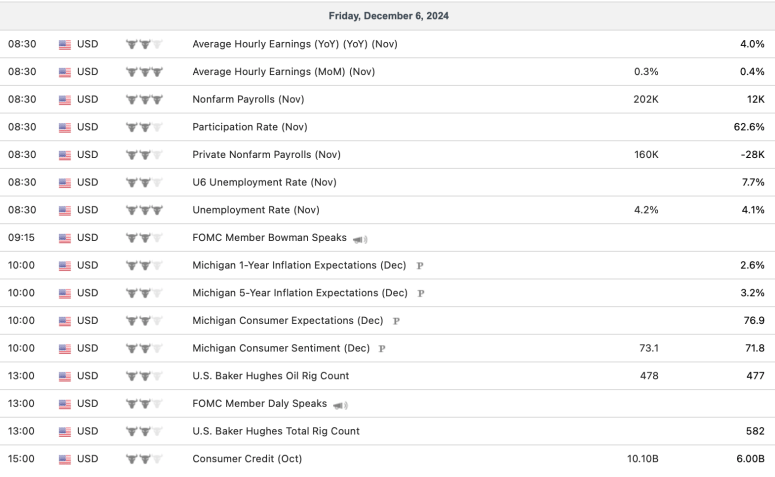

SPX 0-dte trades for 12/5/24

#SPX0dte Sold to Open $SPX Dec 5th 6035/6055-6115/6135 condors for .95, IV 12.37%, deltas -.10 +.05

Bullish leaning. Quiet overnight, so hopefully we stay sideways because this is a tight range. All attention seems to be on BitCoin topping 100k.

SPX LEAPS and 0DTE

Been getting a lot of requests so hopefully this explains things. My first try at something like this.

Critiques or corrections requested. Don’t want to redo anything though. LOL

GLD Expiration

1 GLD 249/246 Bear Call Spread

VXX Calls

Sold VXX Dec 06/2024 52/45 Bear Call Spreads at $0.13 and $0.14

Sold VXX Dec 06/2024 51/45 Bear Call Spreads at $0.14 and $0.15

Offsetting VXX Puts that I’m forced to roll out

SPX

Another round. Selling tomorrow just inside the expected move.

Bought to Close SPX Dec 04 2024 6035.0 Puts @ .40 (sold for 6.65)

Sold SPX Dec 05 2024 6055.0 Puts @ 5.40

VXX Puts

Sold to close VXX Dec 06 2024 40.0 Puts at $0.08. Bought at $0.03 and $0.05

Bought 1 VXX Jan 17 2025 35 Put at $0.26

Paid for it by selling i VXX Dec 06 2024 41.0 Put at $0.33

NWL DVN LYB

#TinyTrades

Sold NWL at $9.82

Bought DVN at $37.00

Bought LYB at $78.66

BOIL SOXS FL Puts

Sold 1 BOIL Dec 06 2024 28/33 Bull Put Spread at $0.18 Credit

Sold 1 SOXS Dec 06 2024 18.5 Put at $0.06

Sold 1 FL Dec 06 2024 17.5 Put at $0.10 (post earnings)

#EveryLittleBitHelps

QQQ

Yesterday Rolled 12/6/24 short calls out to 12/9/24 and up to 530 for $.33 Credit

Today Rolled again 12/9/24 short calls out to 12/10/24 and up to 545 for $.34 Credit

Ridin’ the Bull

SPX 0-dte trades for 12/4/24

#SPX0dte Nine minutes after the open, sold to open $SPX Dec 4th 6005/6025-6095/6115 condors for .95, deltas -.07 +.07, IV 13.97%

Probably need to go back to pre-market sale on this trade, given the low premium and narrow widths. Premium drops very quickly after the open, and it probably will be this way through the holiday.

SPY Expiration

1 SPY 610/606 Bear Call Spread

1 SPY 609/606 Bear Call Spread

SPX

Staying aggressive. IV picks up a little on Thur and Fri in case a roll is needed.

Bought to Close SPX Dec 03 2024 6025.0 Puts @ .35 (sold for 5.00)

Bought to Close SPX Dec 03 2024 6030.0 Put @ .55 (sold for 5.50)

Sold SPX Dec 04 2024 6035.0 Puts @ 6.65

GLD NUGT Calls

Sold 1 GLD Dec 04 2024 249/246 Bear Call Spread at $0.19 Credit

Sold 1 NUGT Dec 06 2024 50/47 Bear Call Spread at $0.18 Credit

South Korea

Well that was quick. 2 hours of martial law and it’s over. Selling some premium into the bounce: Sold to open Jan 17 50 puts @ 1.33.

CRM Puts

Sold 1 CRM Dec 06 2024 270/280 Bull Put Spread at $0.22 Credit

SPX 0-dte trades for 12/3/24

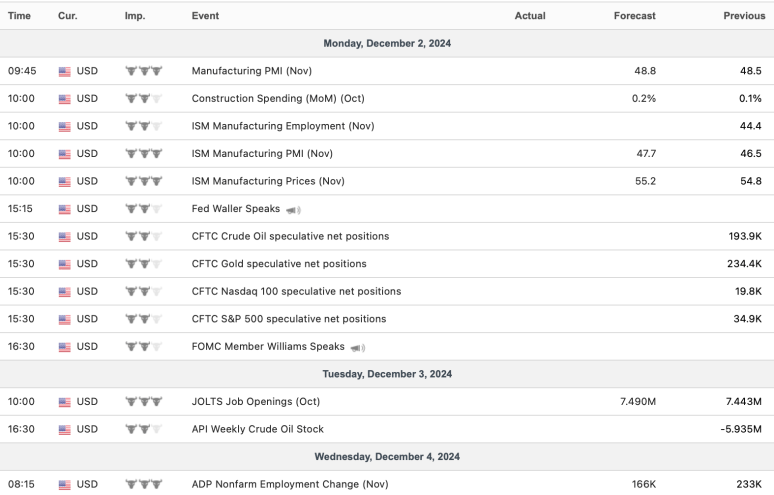

#SPX0dte With some volatility before the open and a spike in $VIX I avoided being aggressive on a wide condor and then missed some fills after the open. I’ll wait until after JOLT at 10am to look for a trade.

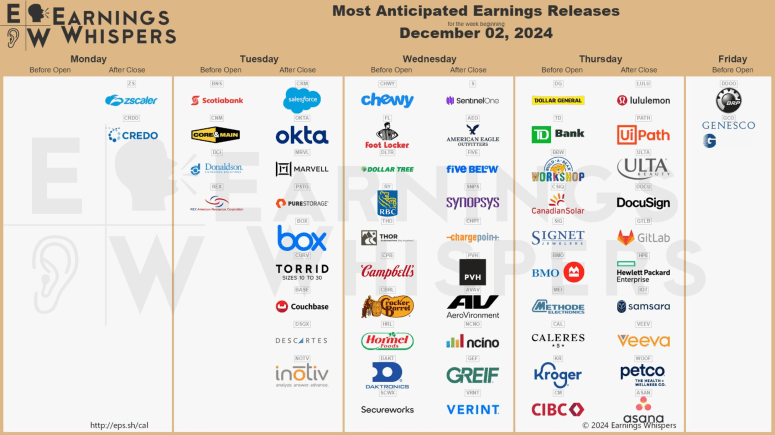

DG DLTR NUGT SOXL Tiny Trades

Sold 1 DG Dec 06 2024 55.0 Put at $0.10

Sold 1 DLTR Dec 06 2024 49.0 Put at $0.11

Sold NUGT Dec 06 47.0 Covered Calls at $0.10 and $0.15

Sold 1 SOXL Dec 06 37.0 Covered Call at $0.06

#EveryLittleBitHelps

SOXL FBY YQQQ NVDY

#shortputs

#everylittlebithelps

SOLD SOXL 6 DEC 2024 25 PUT @.07 and .09

#dividends

BOT FBY @19.39

BOT NVDY @25.31

#freeingup cash

SOLD YQQQ @17.75

QQQ

Rolled 12/3/24 short calls out to 12/6/24 and up to 524 for $.31 Credit

This Bully market called for some position management

TQQQ,

STO December 6, $81 puts at 1.05

TQQQ,

Earliar, STO December 13, $75 puts at .62

SPX

Bought to Close SPX Dec 02 2024 6015.0 Puts @ .35 (sold for 22.95)

Bought to Close SPX Dec 02 2024 6020.0 Put @ .40 (sold for 26.35)

Sold SPX Dec 03 2024 6025.0 Puts @ 5.00

Sold SPX Dec 03 2024 6030.0 Put @ 5.50

QQQ

#coveredcalls #1dte STO 12/3/24 QQQ 519 calls @.21

Selling against the LEAPS position

SPX 0-dte trades for 12/2/24

#SPX0dte Sold to Open $SPX Dec 2nd 5975/5995-6075/6095 condors for 1.00, IV 14.67%, deltas -.06 +.07

Before market the deltas on this were -.08 +.04. Lots of bulls buying arond the open.