1 SLV Jan 12/2026 57/61 Bull Put Spread

Recent Updates Page 5

BOIL Call Ladder

On the open

Sold 1 BOIL 01/16/2026 22.0 Covered Call at $0.10

Sold 1 BOIL 01/23/2026 22.0 Covered Call at $0.25

Sold 1 BOIL 01/30/2026 22.0 Covered Call at $0.41

SLV SOXL Spreads

Sold 1 SLV 01/14/2026 80/77.5 Bear Call Spread at $0.71 Credit (on the opening this morning)

Sold 1 SLV 01/16/2026 85.5/83 Bear Call Spread at $0.31 Credit (on the opening this morning)

Sold 1 SLV 01/16/2026 90/87 Bear Call Spread at $0.16 Credit (just now)

Sold 1 SOXL 01/16/2026 43.5/46 Bull Put Spread at $0.19 Credit (on the opening this morning)

Bought 1 SOXL 01/23/2026 64.0 Call / Sold 1 SOXL 01/16/2026 59.0 Call at $0.12 Diagonal Credit

SPY/XSP trades 1/12/26

#FuzzyLEAPs

Rolled $SPX Jan 12th 692 put to Jan 13th 692 put for .90

Opened my second $XSP LEAP spread (replacing SPY spread closed on Friday).

Dec 2028 690/690/730 spread for 37.60

Sold against it TODAY’s 694 put for .77

I could have sold tomorrow’s 694 for almost twice the price, so it may be futile to sell same day then roll later, but kind of testing that out.

Now I have 2 positions on each of SPY and XSP. I have one short put on each that are not rolled yet.

I will wait to close another SPY on a down day. I’m fine for now with two of each as assignment risk is lower than before.

SPX

Out the rest of the day so an early roll. Good premium with some big banks reporting before the open. Might add one more put sale if there’s a decent afternoon drop.

Rolled SPX Jan 12 2026 6940.0 Puts to Jan 13 2026 6940.0 Puts @ 8.00 credit. (12.50 total now)

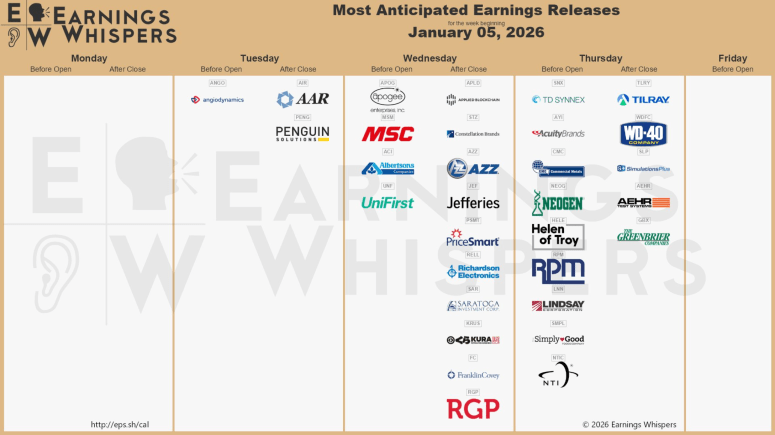

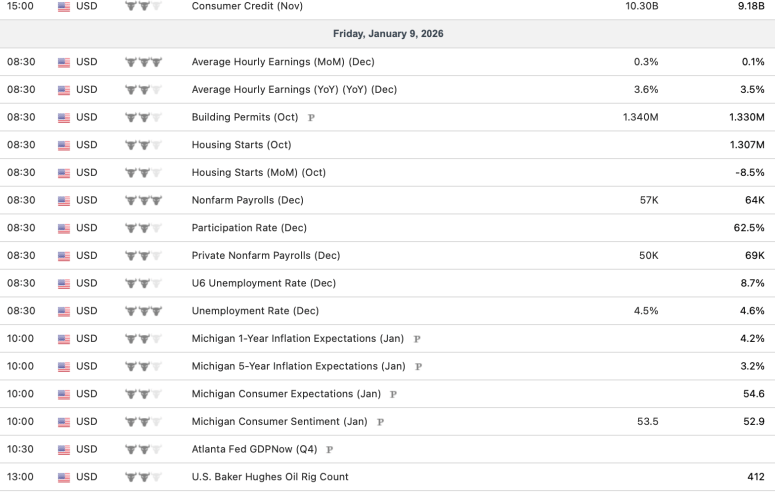

Earnings 1/12 – 1/16

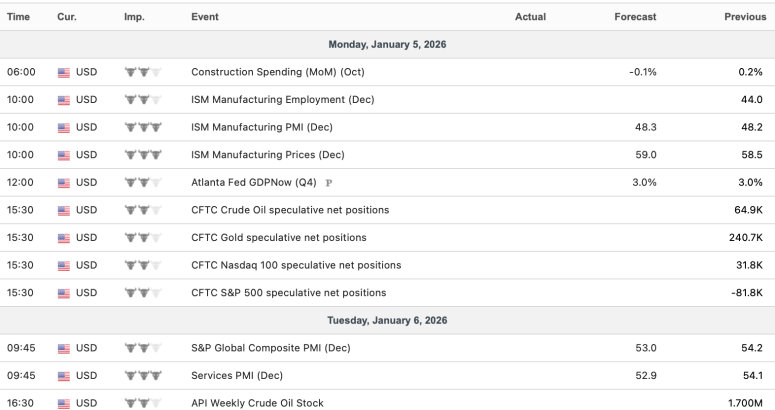

Econ Calendar 1/12 – 1/16

Question for @fuzzballl about SPX LEAPS

1. What is the advantage of doing LEAPS out to 2030 instead of staying with 2028 or 2029?

Theta decay would become an issue with 1 year or less before expiry.

The initial investment is larger if going out to 2030 vs. staying with 2028-2029.

The only benefit that I can think of going to 2030 is if SPX will start declining.

You would still have to roll up in case the SPX will keep moving up, so why not get the maximum return on your investment by staying in 2028-2029?

2. I understand the reason for keeping uncovered LEAPS. You can get much higher premium if you catch SPX in a down move. However, does the math works? If you are waiting for 3-5 trading days, then the premium lost would be $30-50 per LEAP. Do you think you can get that much in a down move in SPX to counter the lost revenue?

Of course, if you are holding uncovered LEAPS just as a hedge, then my question is irrelevant.

Would love to know what you think about this.

AMZN

AMAZON PHARMACY TO START SELLING NOVO NORDISK’S WEGOVY PILL

- $25/mo on insurance plans

- $149/mo cash-pay option

- free shipping to all 50 states, same-day delivery available to ~half of customers

$HIMS $NVO $LLY $AMZN

OptionsExpiration

GLD 430/425 Bear Call Spread

HLT 282.5/285 Bull Put Spread

HLT 282.5/287.5 Bull Put Spread

NVDA 172.5/175 Bull Put Spread

NVDA 212.5/207.5 Bear Call Spread

NVDA 202.5/197.5 Bear Call Spread

SLV 57/62 Bull Put Spread

SLV 60/65 Bull Put Spread

SLV 80/75 Bear Call Spread

SOXL 40/45 Bull Put Spread

SOXL 41/45.5 Bull Put Spread

APA 22.5 Put

CAG 16.0 Put

CPB 25.5 Put

LW 40.0 Put

BAX 23.0 Covered Calls

BOIL 25.0 Covered Call

MSTX 6.5 Covered Call

TZA 10.0 Covered Calls

Assignments:

1 BAX 20.5 Covered Call

1 IP 43.0 Covered Call

BOIL 18.5 Puts

BOIL 18.0 Put

BOIL 16.0 Puts

SPX

Bought to Close SPX Jan 9 2026 6925.0 Puts @ .15 (sold for 22.50)

Sold SPX Jan 12 2026 6940.0 Puts @ 4.50 (leaving one more uncovered)

TQQQ,

BTC January 30, $46 puts ay .45, Sold at 1.12 nd 21 days to expiration.

SOXL Spread

Sold 1 SOXL 01/16/2026 60/57.5 Bear Call Spread at $0.46 Credit

SPY/XSP for 1/9/26

#FuzzyLEAPs

Rolled $SPY Jan 9th 689 put to Jan 12th 689 put, .70 credit

Holding off on rolling 691 since it’s close to ATM. Seeing if premium increases toward day’s end.

Closed another SPY LEAP spread: Jan 2028 685/685/725 for 31.50. Originally purchased on Dec 4th for 36.11.

Allowing associated Jan 9th 687 put to expire.

Lost 4.61 on LEAPs, gained 17.59 from daily put sales.

Profit on trade is 12.98

Opened my first $XSP spread:

Bought the Dec 2028 695/695/735 spread for 39.39.

Sold Jan 12th 691 put for .70

XSP SPX

#creditspread

Closed to free capital

BTC VERTICAL XSP 12 JAN 2026 680/675 PUT @.05

BTC VERTICAL XSP 9 JAN 2026 686/682 PUT @.05

BTC VERTICAL SPX 9 JAN 2026 6825/6820 PUT @.05

BTC VERTICAL XSP 9 JAN 2026 683/678 PUT @.05

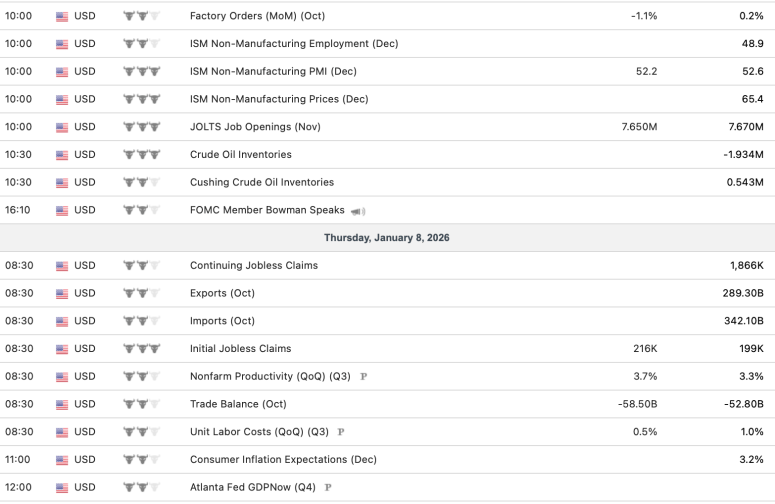

December Jobs Report

#Jobs — Lower than expected but UE drops.

Gain of +50,000 non-farm payroll jobs, vs. expected gain of 73K

Unemployment down by 0.2 at 4.4%

U6 unemployment 8.4%, down by 0.3

Labor force participation down 0.1 to 62.4%

Average hourly earnings up by 0.3%; +3.8% Y/Y

November jobs revised down by -8K to +56K

October jobs revised down by -68K to -173K

EMN DOW Stock

Sold out of my tiny position in EMN at $70.25

Bought on August 1 2025 at $57.00 and really never got the chance to average down.

Also got the latest quarterly dividend payment today in my account.

Also sold part of my position in DOW at $26.35 for a small overall gain

SPX

Great premium tomorrow with the early morning data dump and possible tariff decision.

Rolled SPX Jan 8 2026 6925.0 Puts to Jan 9 2026 6925.0 Puts @ 12.00 credit (22.50 total now)

SPY rolls 1/8/26

#FuzzyLEAPs $SPY

Rolled Jan 8th 687 put to Jan 9th 687 put for 1.11

Rolled Jan 8th 689 put to Jan 9th 689 put for 1.10

Rolled Jan 8th 691 put to Jan 9th 691 put for 1.00

Bought to close 690 put for 1.66 (sold for 1.03 yesterday)

Sold to close Jan 2028 LEAPs spread 690/690/730 for 34.45. Bought this for 33.20 on Tuesday.

I closed this spread and its daily short with intention to migrate to $XSP. I made 1.25 on the LEAPs and .18 on 2 put sales.

HLT Calls

Rolled HLT 01/09/2026 300/297.5 Bear Call Spreads to HLT 01/16/2026 305/300 Bear Call Spreads at $0.20 Credit

GIS Stock

Added a bit more at $42.91.

Ex-div tomorrow

SLV and GLD Expiration

SLV 56.5/61.5 Bull Put Spread

SLV 59/62 Bull Put Spread

SLV 60/65 Bull Put Spread

SLV 77/74.5 Bear Call Spread

SLV 74.5 Diagonal Call

SLV 75.0 Diagonal Calls

GLD 425/420 Bear Call Spread

XSP/SPX

#creditspread

#everylittlebithelps

SOLD VERTICAL XSP 12 JAN 2026 680/675 PUT @.17

SOLD VERTICAL XSP 9 JAN 2026 686/682 PUT @.26

SOLD VERTICAL XSP 9 JAN 2026 683/678 PUT @.15

==—

SOLD VERTICAL SPX 9 JAN 2026 6825/6820 PUT @.30

SLV Spreads

Sold 1 SLV 01/09/2026 60/65 Bull Put Spread at $0.18 Credit

Sold 1 SLV 01/09/2026 80/75 Bear Call Spread at $0.39 Credit

#EveryLittleBitHelps

TQQQ,

BTO March 20, $50 calls at 9.10

SPX

Rolled SPX Jan 7 2026 6925.0 Puts to Jan 8 2026 6925.0 Puts @ 4.60 credit (10.50 total now)

CPB CAG Puts

Sold 1 CPB 01/09/2026 25.5 Put at $0.10

Sold 1 CAG 01/09/2026 16.0 Put at $0.05

#TinyPuts #EveryLittleBitHelps

HLT Spreads

Adding one more at a better credit:

Sold 1 HLT 01/09/2026 300/297.5 Bear Call Spread at $0.65 Credit

Also:

Sold 1 HLT 01/09/2026 282.5/287.5 Bull Put Spread at $0.22 Credit

Sold 1 HLT 01/09/2026 282.5/285 Bull Put Spread at $0.12 Credit

BOIL Put

Rolled the long side of a spread down and out

Sold to close 1 BOIL 01/09/2026 19.0 Put at $0.53 (Bought at $0.29)

Bought to open 1 BOIL 01/16/2026 17.0 Put at $0.34 for a $0.19 Credit

FallingKnife stocks

Added to all these at or below prior 52-week lows:

CAG at $16.28 and $16.25

CPB at $26.50 (Ex-div tomorrow)

GIS at $43.50 and $43.27 (Ex-Div 01/09)

HPQ at $21.21

KHC at $23.00

KMB at $97.00

LW at $40.40

All have decent dividends

SPY rolls 1/7/26

#FuzzyLEAPs $SPY rolls:

Rolled Jan 7th 689 put to Jan 8th 689 put for .53

Rolled Jan 7th 690 put to Jan 8th 690 put for .60

Rolled Jan 7th 686 put FIVE strikes higher to Jan 8th 691 put for 1.23

Still leaving one LEAP spread without a daily short, which I’ll probably add on a decent pull back. Also considering migrating this whole mess to $XSP to avoid assignment risk.

KHC Stock

Added a tiny bit of KHC at $23.48

#SP500 #FallngKnife

HLT Spread

Sold 1 HLT 01/09/2026 300/297.5 Bear Call Spread at $0.35 Credit

GE,

STO February 20, 310/320 put spread at 3.40

SPY rolls 1/6/26

#FuzzyLEAPs Rolling on the intraday swings

At the low of day, rolled $SPY Jan 6th 686 put to Jan 7th 686 put for .61 (10.25 so far)

As we spiked higher, rolled Jan 6th 689 put to Jan 7th 689 put for .69 (7.42 so far)

My 687 roll didn’t fill yet, so looking for another dip to get good premium. (15.87 so far)

BOIL SOXL GLD Spreads

Bought 1 BOIL 01/16/2026 15.0 Put / Sold 1 BOIL 01/09/2026 17.5 Put at $0.13 Diagonal Credit

Bought 1 SOXL 01/16/2026 58.0 Call / Sold 1 SOXL 01/09/2026 52.5 Call at $0.12 Diagonal Credit

Sold 1 GLD 01/07/2026 425/420 Bear Call Spread at $0.15 Credit

Sold 1 GLD 01/09/2026 430/425 Bear Call Spread at $0.22 Credit

BW

#rolling

Sto-BW /from-16 JAN 2026 7.5 PUT to-15 MAY 2026/@1.17

SLV Expiration

1 SLV 74/71.5 Bear Call Spread

1 SLV 58.50/61 Bull Put Spread

1 SLV 60/63 Bull Put Spread

META GOOGL SOXL AMZN Covered CAlls

#coveredcalls #syntheticcoveredcalls

$META STO 1/9 685 calls at 1.10

$GOOGL STO 1/9 327.5 calls at .80

$SOXL STO 1/9 56 calls at .45

$AMZN STO 1/9 240 calls at .45

KMB Puts

Sold 1 KMB 01/09/2026 95/96 Bull Put Spread at $0.15 Credit

SLB HAL Stock

Sold a tiny bit of SLB at $45.01.

Bought at $40 in September of 2024

Sold a tiny bit of HAL at $33.03.

Bought at $30 in September of 2024

SPY rolls 1/5/26

#FuzzyLEAPs Tried to wait for a dip to roll but never got it. As a result, I’m getting less than I could have had I rolled early. However, now I feel we are enough above 686 that I’m going to let today’s expire.

Sold $SPY Jan 6th 686 put for .66. Today’s 686 will expire, barring some last minute crash, in which case I will close it.

My other two expire tomorrow so I will let them ride since they are close enough to the money, 687 and 689.

SPY

I’ll look to reload on any decent dips.

Bought to Close SPY Feb 20 2026 700.0 Puts @ 16.60 (sold for 18.70)

NVDA

Sold 1 NVDA 01/09/2026 197.5 Call at $1.26 against a long NVDA 202.5 Call left over from last week’s diagonal Spread

#DoubleDip

Sold 1 NVDA 01/09/2026 172.5/175 Bull Put Spread at $0.13 Credit

PG SLV Put Spreads

Sold 1 PG 01/09/2026 135/137 Bull Put Spread at $0.18 Credit

Sold 1 SLV 01/09/2026 57/62 Bull Put Spread at $0.18 Credit

Sold 1 SLV 01/12/2026 57/61 Bull Put Spread at $0.16 Credit

Sold 1 SLV 01/14/2026 55/60 Bull Put Spread at $0.22 Credit

Sold 1 SLV 01/16/2026 55/60 Bull Put Spread at $0.30 Credit

Sold 1 SLV 01/07/2026 60/65 Bull Put Spread at $0.27 Credit

SPX

With 9 more trading days left on this one I think I can do better selling daily aggressively and being much less directional. Been rolling this one up and staying ITM since the gubment shutdown started. Booking it and reselling tomorrow.

Bought to Close SPX Jan 16 2026 7000.0 Put @ 96.70 (sold for 213.35)

Sold Jan 6 2026 6925.0 Put @ 18.70

CPB KMB Stock

Added tiny bits of CPB at $27.60 and KMB at $99.00 and $98.00

#SP500 #FallingKnife

SPX

Straight roll.

Rolled SPX Jan 5 2026 6900.0 Puts to Jan 6 2026 6900.0 Puts @ 6.90 credit (53.10 total now)

Some light maintenance on the rental houses.

Rolled Dec 2029 6800 long puts up to Dec 2029 6900 long puts

Rolled Dec 2029 6800/7200 BeCS to Dec 2029 6900/7300 BeCS

Net debit for the whole thing: 32.20 per house

Earnings 1/5 – 1/9

Econ Calendar 1/5 – 1/9

SPX decisions (it’s good!)

With SPX basically unchanged from late October, I’ve had continuous premium coming in with little to no change in the LEAPS values. Love it!! With two more rolls next week all cash outlay for all positions will be recovered. And with the long LEAP puts sitting at 6800 things are setting up nicely.

But how can we make things even better and safer? After a long “Red Team” call with my brother @bikeeagle we came up with some ideas on what to do with excess cash that will hopefully be coming in (but you never know! 🙂 🙂 )

Some ideas:

1. Keep doing everything as is and just add to the LEAPS.

2. Roll up the LEAPS further and even into the money a little on the put side for margin reduction and more downside protection.

3. Buy back the bear call spread LEAPS. That would be nice margin reduction getting rid of those.

4. When adding going forward only buy the LEAP put. A little more expensive but no margin hit on the call side.

5. Go ahead and roll the current LEAPS positions out to 2030 now.

What I’m leaning towards as premium received allows:

2 and 3 together then 5 then 4.

It’ll take awhile but would make the setup absolutely perfect….

OptionsExpiration

SOXL 49/48 Bear Call Spreads

SOXL 50.5/48 Bear Call Spread

SOXL 50/48 Bear Call Spread

SOXL 35.5/40 Bull Put Spread

NVDA 195/192.5 Bear Call Spread

NVDA 192.5 Diagonal Call

SLV 59/61.5 Bull Put Spread

SLV 61/64 Bull Put Spread

SLV 71/68.5 Bear Call Spread

SPY 690/689 Bear Call Spread

SPY 688/687 Bear Call Spread

BOIL 21.0 Puts

SPCE 4.5 Covered Calls

Assignments:

1 BOIL 22.0 Put

Decent start to the new year

TQQQ,

STO Feb. 20, $45 puts at 1.70

STO Feb. 13, 46 puts at 1.70

BW

#rolling

CALENDAR BW 16 JAN 2026 7.5 PUT to/15 MAY 2026/7.5-put@1.26

BOIL Put

Sold BOIL 01/09/2026 18.5 Puts at $0.16 and $0.20

#TinyPuts

SPX

Straight roll.

Rolled SPX Jan 2 2026 6900.0 Puts to Jan 5 2026 6900.0 Puts @ 6.00 credit (46.20 total now)

SPY action 1/2/26

#FuzzyLEAPs I was assigned 200 shares of $SPY from my Jan 2nd 687 puts. Oddly, I was NOT assigned from my deeper ITM 689 put. That may have been due to margin considerations.

Today I sold the stock for 686.75. Cost basis was 685.78, given the price of my roll trade on Wednesday.

Then:

Sold (1) Jan 5th 687 put for 2.40

Sold (1) Jan 5th 686 put for 1.74

Also:

Rolled Jan 2nd 689 put to Jan 6th 689 put, .90 credit (skipping a day to avoid assignment)

Pretty easy management of the assignment. Wish I had waited a bit to sell the puts because now they are over a dollar higher each.

SLV NVDA Calls

Sold 1 SLV 01/05/2026 74/71.5 Bear Call Spread ar $0.14 Credit

Sold 1 SLV 01/07/2026 77/74.5 Bear Call Spread ar $0.14 Credit

Sold 1 NVDA 01/09/2026 212.5/207.5 Bear Call Spread at $0.17 Credit

Zero day Spreads

Sold 1 SPY 01/02/2026 688/687 Bear Call Spread at $0.32 Credit

Sold 1 SPY 01/02/2026 690/689 Bear Call Spread at $0.07 Credit

Sold 1 SOXL 01/02/2026 49/48 Bear Call Spread at $0.28 Credit

Hope everyone had a wonderful…

Hope everyone had a wonderful and prosperous trading 2025!

I closed all my positions Friday through today except 2 to make taxes easier.

Great year trading, 28.4 total portfolio return (401k, IRAs, Roth etc. and I can’t trade most of these) and 71.2% returns for the 2 trading accounts. It was 69% last Friday but I just closed out some SPX rhinos today pushing it over 70%. 2024 was a bad trading year and ironically that was a 28.4% trading return and a little less, 24% for the entire portfolio.

All from trading about 6-7 strategies repeatedly. In order of profitable to least profitable:

1. BWB/Rhino trades on SPX, RUT, and ETFs

2. Double calendars/diagonals but converted to nested iron condor once profits develop. This creates an iron condor with no risk to both sides or if I have a directional bias I can skew it.

3. Asymmetric iron condors (debit spread imbedded in iron condor in specific ratios then hedged to upside or downside)

4. Combos (all of the above combined usually as recovery tactics)

5. Strangles on futures

6. Jade lizards/naked puts/skewed butterflies/skewed iron condors

7. Hedging other positions using futures such as /ES for an SPX position that needs adjusting

No 0 DTE trading unless I saw a really good opportunity. Maybe 8 times all year. And no stocks other than what is in the 401k.

Having almost everything hedged prevents the big losses I had in 2015 (Chinese Yuan devaluation), 2018 (SVXY implosion), and 2020 (Covid). In fact when the market drops quickly and dramatically I cash in winning lottery tickets. Often large enough gains to offset any losses on the IRAs/401K for total portfolio hedging.

With that said I am throwing this out there and no hard feelings if no one interested. I no longer trade professionally for Traders Reserve (these are tactics I could not share there as they were too complex for our subscribers) but would be willing to pass along some of these tactics as long as no one tries to benefit commercially from the information. I run my own money like a mini-hedge fund. Interested in a group webinar/discussion where we can all share ideas and tactics?

I also would consider a pooled asset account if anyone is interested in that? Would need help from someone who is an expert in taxes and how to structure that. I know Interactive Brokers has a family and friends account which allows up to 15 accounts controlled as one.

Anyone know how to set up a corporation that could then pool assets to help control taxes?

Open for discussion, I have Fridays off so those would be good days for collaboration.

May 2026 be AWESOME for everyone and everything, not just trading!!

SLV Expiration

SLV 12/31/2025 61/63.5 Bull Put Spread

SLV 12/31/2025 74/71.5 Bear Call Spread

SLV 12/31/2025 75/73.5 Bear Call Spread

SLV 12/31/2025 62.0 Puts

SLV 12/31/2025 61.5 Put

Happy Healthy Prosperous 2026

BOIL Puts

Sold BOIL 01/02/2026 21.0 Puts at $0.13

#TinyPuts

SLV Puts Rolled

Rolled 1 SLV 12/31/2025 62/65 Bull Put Spread to 1 SLV 01/07/2026 56.5/61.5 Bull Put Spread at $0.05 Credit

TQQQ,

STO February 20, $45 puts at 1.51

SLV Puts

Sold 1 01/05/2026 58.5/61 Bull Put Spread at $0.17 Credit

SPX

Straight roll. 2026!!

Rolled SPX Dec 31 2025 6900.0 Puts to Jan 2 2026 6900.0 Puts @ 6.25 credit (40.20 total now)

EDIT: Doing similar rolls in XSP position.

More SLV

Sold SLV 12/31/2025 62.0 Puts at $0.06 and $0.08

#TinyPuts #EveryLittleBitHelps

VIX @fuzzballl Are you planing…

VIX

@fuzzballl

Are you planing to keep your VIX position until expiry or roll it out to Feb?

SLV Puts

Sold 1 SLV 12/31/2025 62/65 Bull Put Spread at $0.19 Credit

Sold 1 SLV 01/02/2026 61/64 Bull Put Spread at $0.14 Credit

Sold 1 SLV 01/05/2026 60/63 Bull Put Spread at $0.20 Credit

Sold 1 SLV 01/07/2026 59/62 Bull Put Spread at $0.26 Credit

SPX

Straight roll.

Rolled SPX Dec 30 2025 6900.0 Puts to Dec 31 2025 6900.0 Puts @ 9.00 credit (33.95 total now)

SPY rolls 12/30/25

#FuzzyLEAPs Rolled $SPY Dec 30th 687 puts to Jan 2nd 687 puts for 1.22. (Two puts with total rolls of 13.57 and 7.44 respectively).

I am traveling rest of today and tomorrow, so rolled to Friday expiry. Doing the same with my 689 put.

SLV

Closed 1 SLV 12/29/2025 74/72.5 Bear Call Spread at $0.00 debit

Rolled to 1 SLV 12/31/2025 73.5/70.5 Bear Call Spread at $0.18 Credit

SLV Expiration:

SLV 12/29/2025 63.5 Put – Sold today at $0.20

SLV 12/29/2025 62.5 Put – Sold today at $0.10

SLV 12/29/2025 61.5/63.5 Bull Put Spread – Sold today at $0.14

SPX

Straight roll.

Rolled SPX Dec 29 2025 6900.0 Puts to Dec 30 2025 6900.0 Puts @ 9.25 credit (24.95 total now)

Fading silver

Sold to open $SLV Jan 16 70/75 bear call spread @ .89. IV rank is 89.