#shortputs

At the bell!

Sto SOXL 1 NOV 24, 28.5 PUT @.37

Monthly Archives: October 2024

SPY Expiration

1 SPY 555/565 Bull Put Spread

1 SPY 553/563 Bull Put Spread

1 SPY 590 Diagonal Call

AMZN earnings

Lottery ticket:

Bought Nov 01 2024 175/180/185 put butterfly @ .60

SPY

Add to Dec ladder.

Sold SPY Dec 20 2024 510.0 Put @ 3.00

VXX

Adding to synthetic short one more time.

VXX Jan 16 2026 55/55/85 @ 13.50 debit.

And:

Sold VXX Nov 08 2024 54.0 Puts @ 2.05

SOXL GLD 1dte

Sold 1 SOXL 11/01/2024 23.5/27.5 Bull Put Spread at $0.17 Credit

Sold 1 SOXL 11/01/2024 23.0/27.0 Bull Put Spread at $0.14 Credit

Sold 1 GLD 11/01/2024 247.5/251 Bull Put Spread at $0.25 Credit

Sold 1 GLD 11/01/2024 246/250 Bull Put Spread at $0.28 Credit

#EveryLittleBitHelps

SPY post election

Sold 1 SPY 11/11/2024 525/565 Bull Put Spread at $4.47 Credit

Sold 1 SPY 11/12/2024 540/561 Bull Put Spread at $2.95 Credit

#OnlySpreads

TQQQ,

BTC November 8, $82 calls at .42, sold at .91 last week. Now I am going to sit untill the election.

NVDA Put

#shortputs

$NVDA STO 11/8 135 put at 4.93

SPY VXX BIIB EL SOXL DJT

Sold 1 SPY 11/01/2024 555/565 Bull Put Spread at $0.29 Credit

Sold 1 SPY 11/04/2024 550/560 Bull Put Spread at $0.27 Credit

Bought to open 1 VXX Mar 21 2025 24.0 Put at $0.13

Bought to close 1 BIIB 11/01/2024 160.0 Put at $0.05 to free up margin to sell the options below:

Sold 1 EL 11/01/2024 60.0 Put at $0.55

Sold 1 SOXL 11/01/2024 27.0 Put at $0.09

Sold 1 DJT 11/01/2024 25.0 Put at $0.18

Sold 1 INTC 11/01/2024 18.0 Put at $0.11

SPX 0-dte trades for 10/31/24

#SPX0dte Sold to Open $SPX Oct 31st 5705/5725-5845/5865 condors for 1.25, IV 22.59%, deltas -.06 +.06

SPY and GLD Expiration

1 SPY 540/567 Bull Put Spread

1 SPY 558/568 Bull Put Spread

1 SPY 594/587 Bear Call Spread

1 GLD 246/250 Bull Put Spread

VXX

Sold to close 1 VXX Nov 15 2024 75.0 Call at 1.04. BTO last Friday at $0.84

Bought to open 1 VXX Mar 21 2025 23.0 Put at $0.13.

142 Days to expiration

#VXXContango

MCD

Took a shot at a post Ecoli bounce. Not getting it so selling the same strikes on the call side to reduce max loss. Just one contract.

Sold MCD Nov 15 2024 300/305 Bear Call Spread @ 1.05 (total for both sides now 3.65)

I’ll have to decide on expiration day if I want the stock or not. Planning on just taking the loss unless Mickey Deez really tanks. Would maybe consider keeping it around 280.

SPX

RDDT

BTC 11/1/24 $90 Calls; STO 1/15/27 $95 Puts for $3.15 Credit

Now holding a Synthetic long position in RDDT. Strong Earnings report forced adjustment.

DJT SMCI Puts

Sold 1 DJT Nov 01 2024 29.0 Put at $0.15

Sold 1 SMCI Nov 01 2024 25.0 Put at $0.20

Sold 1 SMCI Nov 01 2024 22.0 Put at $0.10

SPX 0-dte trades for 10/30/24

#SPX0dte Sold to Open $SPX Oct 30th 5760/5780-5875/5895 condors for 1.30, IV 18.47%, deltas -.07 +.07

SPY Calls

Sold 1 SPY 10/30/2024 594/586 Bear Call Spread at $0.36 Credit

SPY Expiration

1 SPY 557/571 Bull Put Spread

1 SPY 562/572 Bull Put Spread

1 SPY 585 Diagonal Call (Sold today at $0.15)

DJT

Rolled my DJT 65.0 Long calls UP

Sold 1 DJT 11/01/2024 65.0 Call and bought 1 DJT 11/01/2024 70.0 Call at $0.64 Credit

Sold 1 DJT 11/01/2024 65.0 Call and bought 1 DJT 11/01/2024 75.0 Call at $1.28 Credit

DJT

Rolled 11/1/24 58/65 calls up to 80/95 for $.24 debit

SPY Puts

Sold 1 SPY 10/31/2024 553/563 Bull Put Spreads at $0.16 Credit

Sold 1 SPY 10/31/2024 555/565 Bull Put Spread at $0.19 Credit

Sold 1 SPY 10/30/2024 558/568 Bull Put Spread at $0.16 Credit

#OnlySpreads

Tiny Puts

Sold 1 JBLU 11/01/2024 6.0 Put at $0.06

Sold 1 DJT 11/01/2024 30.0 Put at $0.15

Sold 1 DJT 11/01/2024 29.5 Put at $0.15

Sold 1 MSTX 11/15/2024 18.0 Put at $0.20

#EveryLittleBitHelps

VXX Puts

Bought 1 VXX Jan 17 2025 33.0 Put at $0.15

Bought 1 VXX Jan 17 2025 34.0 Put at $0.17

Sold VXX Nov 01 2024 50.0 Puts at $0.21 and $0.23 to pay for them

Sold 1 VXX 11/01/2024 44/49.5 Bull Put Spread at $0.14 Credit

Sold 1 VXX 11/01/2024 45/49.5 Bull Put Spread at $0.15 Credit

AMZN INTC GOOGL Call

$AMZN STO 11/1 200 call at 2.07 Earnings Thursday

$INTC STO 11/1 23.50 call at .30 Earnings Thursday

$GOOGL STO 11/1 180 call at 1.57 Earnings tonight

SPX o-dte trades for 10/29/24

#SPX0dte Sold to Open $SPX Oct 29th 5740/5760-5860/5880 condors for 1.15, IV 18.58%, deltas -.06 +.07

SPY Expiration

1 SPY 554/564 Bull Put Spread

1 SPY 560/566 Bull Put Spread

1 SPY 561/568 Bull Put Spread

1 SPY 563/570 Bull Put Spread

1 SPY 585 Diagonal Call (sold today at $0.25)

More Monday Spreads

Sold 1 CVS 11/01/2024 71/59 Bear Call Spread at $0.16 Credit

Sold 1 VFC 11/01/2024 22/19.5 Bear Call Spread at $0.26 Credit

Sold 1 NUE 11/01/2024 160/155 Bear Call Spread at $0.24 Credit

Sold 1 GLD 10/30/2024 246/250 Bull Put Spread at $0.16 Credit

Sold 1 DJT 11/01/2024 65/58 Bear Call Spread at $0.73 Credit

Sold 1 TSLA 11/01/2024 205/227.5 Bull Put Spread at $0.16 Credit

Tiny Puts

Sold 1 APA 11/01/2024 22.5 Put at $0.07

Sold 1 INTC 11/01/2024 18.5 Put at $0.07

Sold 1 BIIB 11/01/2024 160.0 Put at $0.15

#EveryLittleBitHelps

Expirations / PLTR Put

#optionsexpiration

$PLTR 41.50 put

$VKTX 59 put

$ELF 120 call

$BA 170 call

$AMZN 195 call

#shortputs

$PLTR STO 11/1 43 put at .31

DJT

Sold 11/1/24 58/65 Bear Call Spread @ $.62

Thanks Iceman

QQQ

STO 11/1/24 508 Calls @ $1.36

Sold against the LEAPS position

Monday Spreads

Sold 1 SPY 10/29/2024 562/572 Bull Put Spread at $0.14 Credit

Sold 1 DJT 11/01/2024 65/56 Bear Call Spread at $0.39 Credit

Sold 1 TQQQ 11/01/2024 86/81 Bear Call Spread at $0.41 Credit

Sold 1 AVGO 11/01/2024 152.5/162.5 Bull Put Spread at $0.65 Credit

Sold 1 VXX 11/01/2024 43/49.5 Bull Put Spread at $0.15 Credit

Sold 1 VFC 11/01/2024 21.5/19 Bear Call Spread at $0.24 Credit

Sold 1 AVGO 11/22/2024 130/150 Bull Put Spread at $1.09 Credit

SPX 0-dte trades for 10/28/24

#SPX0dte Sold to Open $SPX Oct 28th 5750/5770-5880/5900 condors for 1.10, IV 19.10%, deltas -.07 +.05

Deltas seem a bit off again… despite the delta put being 2 pts higher than the call, the premium I’m getting from the call side is twice as much as the put side.

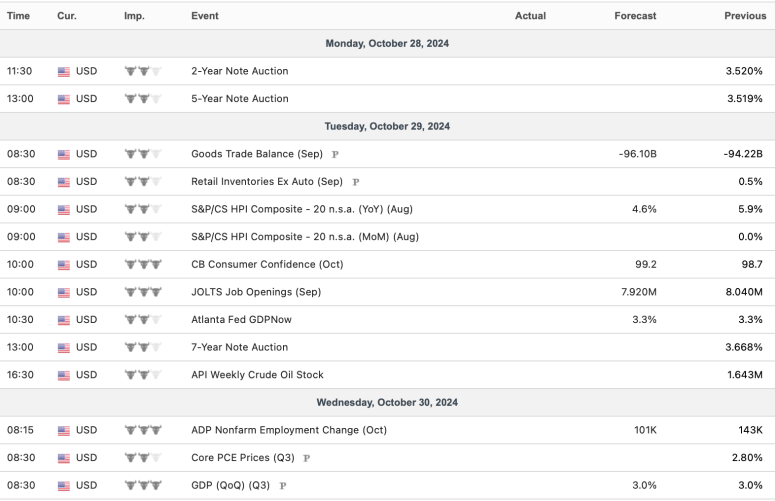

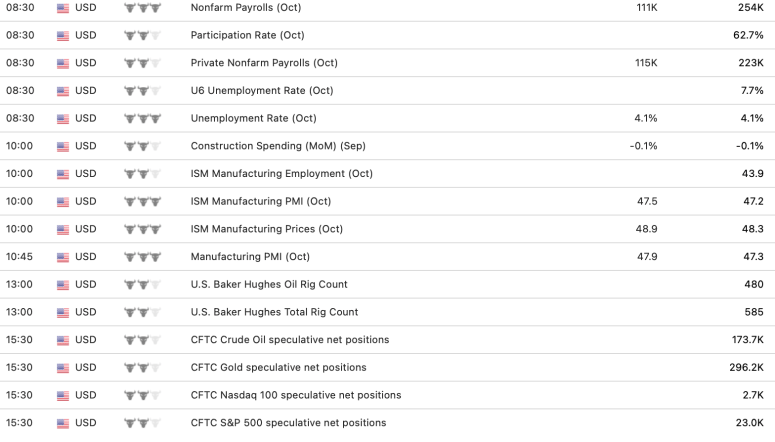

Earnings 10/28 – 11/1

Econ Calendar 10/28 – 11/1

SOXL

#optionsexpiration

soxl 32/put

OptionsExpiration

Rolled some TSLA, SOXL, SPY, and VXX Calls, Plus some NUE and NUGT puts.

Here is what was left:

EXPIRED:

AMZN 157.5/177.5 Bull Put Spread

AMZN 202.5/192.5 Bear Call Spread

AVGO 157.5/167.5 Bull Put Spread

AVGO 160/170 Bull Put Spread

AVGO 200/190 Bear Call Spread

BIIB 175/180 Bull Put Spread

BOIL 10 Covered Calls

CVS 71/58 Bear Call Spread

DJT 50/44 Bear Call Spread

DJT 46/41 Bear Call Spread

DJT 45/40.5 Bear Call Spread

DJT 45/40 Bear Call Spread

GLD 242/246 Bull Put Spread

NUE 136/140 Bull Put Spread

NUGT 61/55.5 Bear Call Spread

SPY 561/571 Bull Put Spreads

SPY 586 Diagonal Call

TQQQ 61.5/68 Bull Put Spread

TQQQ 83/79 Bear Call Spread

TQQQ 85/79 Bear Call Spread

TQQQ 86/80 Bear Call Spread

VFC 23/20 Bear Call Spread

VFC 23/19 Bear Call Spread

VXX 49.0 Diagonal Puts

VXX 49.5 Diagonal Put

VXX 62/57 Bear Call Spread

VXX 60/56 Bear Call Spread

VXX 60 Diagonal Call

WBA 11 Covered Call

AAP 35.0 Put

AAP 36.5 Put

APA 23.5 Put

APA 24.0 Put

BOIL 8.0 Put

CNC 51.0 Put

CNC 53.0 Put

DOW 48.5 Put

HAL 27.5 Put

INTC 21.0 Put

LABU 90.0 Put

WBA 9.0 Put

ASSIGNMENTS:

1 VFC 18.5 Put

1 VFC 17.0 Put

VFC #Earnings next Monday

1 WBA 9.5 Put

SOXL VFC MSTX

Sold 1 VFC 11/01/2024 18.5 Covered Call at $0.32

Sold 1 SOXL 11/01/2024 44.0 Covered Call at $0.07

Sold 1 MSTX 11/15/2024 15.0 Put at $0.15

@geewhiz112 Thanks for the idea

QQQ

I took profits and closed long position at $499.19 bought the calls back @ $.64 (sold at $.80) Flat now in QQQ except for LEAPS

SNOW

Selling against synthetic stock.

Bought to Close SNOW Oct 25 2024 117.0 Calls @ .10 (sold for 3.85)

Sold SNOW Nov 01 2024 117.0 Calls @ 2.65

VXX

Selling against synthetic shorts. Staying aggressive. Plenty of nice IV to roll into during election week if needed.

Bought to Close VXX Oct 25 2024 52.5 Puts @ .14 (sold for .88, 1.30, 1.40, 4.50)

Sold VXX Nov 01 2024 53.0 Puts @ 1.59

BA

Reloading.

Sold BA Nov 15 2024 145.0 Puts @ 2.03

BA earnings

Bought to Close BA Oct 25 2024 152.5 Puts @ .05 (sold for 1.57)

SPY Puts

Sold 1 SPY 10/29/2024 557/571 Bull Put Spread at $0.16 Credit

Sold 1 SPY 10/30/2024 540/567 Bull Put Spread at $0.18 Credit

#EveryLittleBitHelps

QQQ

#CoverdCalls STO 10/25/24 QQQ 500 Calls @ $.80

Feels like I’m waving goodbye to the $496 position Put to me 10 days ago.

SPX 0-dte trades for 10/25/24

#SPX0dte Sold to Open $SPX Oct 25th 5745/5765-5865/5885 condors for 1.30, IV 18.10, deltas -.06 +.07, sold 17 minutes before the open.

COIN Call

#coveredcalls

$COIN STO 11/1 227.50 at 4.95

SPY Expiration

1 SPY 565/575 Bull Put Spread

1 SPY 564/574 Bull Put Spread

1 SPY 583 Diagonal Call

QQQ

BTO 12/18/26 430 QQQ Calls @ $119.20

TLT

Still have a synthetic stock position I’m selling against.

Bought to Close TLT Nov 01 2024 97.5 Calls @ .03 (sold for .38)

Sold TLT Nov 08 2024 95.5 Calls @ .61

HOOD Put

$HOOD STO 11/1 26.50 put at 1.15

MSTX Put

Bitcoin Bet

$MSTX STO 11/15 40 put at 5.86

TSLA earnings

I’ll take it. LOL

Bought to Close TSLA Dec 20 2024 160.0 Puts @ .58 (sold for 1.95)

TQQQ.

I rolled my November 1, $82 calls to November 8, 82 calls for a credit of .70 cents.

AVGO TQQQ TSLA NUGT SOXL

Sold 1 TSLA 10/25/2024 272.5/262.5 Bear Call Spread at $0.45 Credit

Sold 1 NUGT 10/25/2024 52/54 Bull Put Spread at $0.28 Credit

Sold 1 SOXL 10/25/2024 38/36 Bear Call Spread at $0.17 Credit

Sold 1 TQQQ 11/01/2024 58/66 Bull Put Spread at $0.54 Credit

Sold 1 AVGO 11/15/2024 130/150 Bull Put Spread at $1.04 Credit

Sold 1 AVGO 11/15/2024 132/145 Bull Put Spread at $0.87 Credit

SPX 0-dte trades for 10/24/24

#SPX0dte Sold to Open $SPX Oct 24th 5730/5750-5855/5875 condors for 1.00, IV 20.50%, deltas -.06 +.06

I waited until after open on this one since recently selling before open hasn’t given much edge.

Jobs Looked Good

U.S. Department of Labor

@USDOL

Unemployment Insurance Weekly Claims

Initial claims were 227,000 for the week ending 10/19 (-15,000).

Insured unemployment was 1,897,000 for the week ending 10/12 (+28,000).

SPY and GLD Expiration

1 SPY 597/584 Bear Call Spread

1 SPY 582 Diagonal Call

1 SPY 564/574 Bull Put Spread

1 SPY 565/573 Bull Put Spread

1 GLD 244/249 Bull Put Spread

SPX

Rolling out to next Friday. Down a little but going for extra premium.

Rolled SPX Oct 23 2024 5845.0 Puts to Nov 01 2024 5835.0 Puts @ 10.00 credit (24.60 total now)

VXX

Adding to synthetic short again. Turning into a decent sized position. A bunch of short puts sitting at 52.50 for Friday. Be nice not to have to roll again.

VXX Jan 16 2026 55/55/85 @ 15.00 debit.

And:

Sold VXX Oct 23 2024 52.5 Puts @ .88

SPY

Adding below the 200 day.

Sold SPY Dec 20 2024 520.0 Put @ 3.15

SOXL MARA

SOLD SOXL 25 OCT 24 32 PUT @.31

MARA

#rolling

SOLD – MARA 25 OCT/ NOV 1, 2024 ,18 PUT @.46

SPY Chart

SPY just broke the 10/15 low point. A close below 578.50 would be short term bearish.

Next support at 574.50

However:

Sold 1 SPY 10/28/2024 561/566 Bull Put Spread at $0.25

Sold 1 SPY 10.24/2024 565/570 Bull Put Spread at $0.28 Credit

Edit for some headlines:

AAPL Slides After Analyst Warns iPhone 16 Orders Cut By 10 Million Units

US Existing Home Sales Slump To Lowest Since 2010

CDC Unveils E.coli Outbreak In Quarter-Pounders

MCD

Just for fun. Earnings on the 29th.

Sold MCD Nov 15 2024 305/300 Bull Put Spread @ 2.60

BA

Early on this but might get a pop if the contract offer passes.

Rolled BA Oct 25 2024 152.5 Calls to Dec 20 2024 165.0 Calls @ .30 debit (3.00 total now)

SPY

Out to Dec and down at the 200 day. Looking to add lower.

Sold SPY Dec 20 2024 530.0 Put @ 3.47

QQQ

#CoveredCalls STO QQQ 10/24/24 496 Calls @ $1 credit

SPY Puts

Sold 1 SPY 10/28/2024 560/570 Bull Put Spread at $0.29 Credit

#EveryLittleBitHelps

SPX 0-dte trades for 10/23/24

#SPX0dte Sold to Open $SPX Oct 23rd 5770/5790-5880/5900 condors for 0.969, IV 15.96%, deltas -.06 +.06

SPY Expiration

1 SPY 556/568 Bull Put Spread

1 SPY 565/575 Bull Put Spread

DJT

SyntheticLong DJT 1/17/25 C/P 34 @ 0.67 Credit

NUE Puts

Bought 1 NUE Nov 01 2024 130.0 Put / Sold 1 NUE Oct 25 2024 140.0 Put at $0.42 Diagonal Credit

AVGO Calls

Sold 1 AVGO 10/25/2024 200/190 Bear Call Spread at $0.20 Credit