Sold 1 AAP 08/22/2025 50/54 Bull Put Spread at $0.36 Credit

Monthly Archives: August 2025

SPX 0-dte trades for 8/21/25

#SPX0dte BOUGHT to open $SPX Aug 21st 6305/6285 put spreads for .55, IV 20.74%, delta -.06

I’m sticking with long trades at least until we get a day or two of muted moves. I’m only bothering with put side today, given we have trickled lower overnight.

I have also been watching for tight condor options later in the trading day, but the swings have kept up in last two afternoons.

SOXL

Sold 1 SOXL 08/22/2025 28.0 Call at $0.13

PLTR

25% pullback over the last week and now a bounce back up above the 50DMA. Sold to open Sep 19 130/120 bull put spread @ 1.17.

SPX

Straight roll to tomorrow.

Rolled SPX Aug 20 2025 6435.0 Puts to Aug 21 2025 6435.0 Puts @ 1.75 credit (12.15 total now)

SOXL

Sold 1 SOXL 08/22/2025 27.5 Call at $0.13

SPY

Give Mr. Market more to think about. 🙂

Sold SPY Oct 17 2025 590.0 Put @ 4.51

And for margin reduction:

Bought to Open SPY Oct 17 2025 325.0 Puts @ .13

SPX

Selling against one of my uncovered LEAPS positions. Down at the 200 day and well outside the expected move.

Sold SPX Sep 19 2025 6000.00 Put @ 27.00

SPX

Closing the double vertical hedge.

Bought to Close Sep monthly 6550/6575 bear call spread

Sold to Close Sep monthly 6200/6100 bear put spread

Net credit 10.50 (bought for .25)

SOXL

#shortputs

SOLD SOXL 22 AUG 2025 21.5 PUT @.19

follow @optioniceman

STC SOXL 22 AUG 2025 20.5 PUT @.09

Was long side part of spread

SOXL TQQQ AAP CLF TZA

Sold 1 AAP 08/22/2025 50/54 Bull Put Spread at $0.26 Credit

Sold 1 SOXL 08/22/2025 21.5 Put at $0.16

Sold 1 TQQQ 08/22/2025 92.0 Call at $0.34

Sold 1 CLF 08/22/2025 10.5 Call at $0.15

Sold 1 TZA 08/22/2025 10.0 Put at $0.12

Sold 1 TZA 08/22/2025 9.0 Put at $0.02

#EveryLittleBitHelps

SPX 0-dte trades for 8/20/25

#SPX0dte Yesterday was a decent drop. $VIX closed higher but made a LOWER high and a lower low than the day before. The internals just not in sync. I’m buying long condor today.

Not fill yet…. I will increase buy price if not filled before the open.

BUYING $SPX Aug 20th 6325/6345-6450/6470 condors, bidding .90, IV 17.10%, deltas -.05 +.05

SPX

Straight roll to tomorrow.

Rolled SPX Aug 19 2025 6435.0 Puts to Aug 20 2025 6435.0 Puts @ 3.20 credit (10.40 total now)

SOXL

#creditspread

thanks @optioniceman

SOLD SOXL 22 AUG 2025 24.5/20.5 PUT @.24

#backwardsroll

SOLD SOXL from 22 AUG 2025 25.50 call/to 25 CALL 29 AUG / @.95 credit

out and down

Tuesday Trades

Sold 1 AAP 08/22/202 61.0 Call at $0.26

Sold SOXL 08/22/2025 20/24 Bull Put Spreads at $0.14 and $0.17 Credits

Sold SOXL 08/22/2025 20.5/24.5 Bull Put Spreads at $0.22 and $0.26 Credits

Sold 1 TQQQ 08/22/2025 80/84 Bull Put Spread at $0.18 Credit

Sold 1 TQQQ 08/22/2025 79.5/83 Bull Put Spread at $0.18 Credit

Sold 1 TZA 08/22/2025 9.5 Put at $0.12

SPX 0-dte trades for 8/19/25

#SPX0dte Sold to Open $SPX 6390/6410-6480/6500 condors for 1.15, IV 13.13%, deltas -.085 +.065

IV, EM, premium not expecting much today so this condor a bit aggressive.

SPX

Same strike 4 or 5 days in a row now. 🙂 🙂 🙂

Bought to Close SPX Aug 18 2025 6435.0 Puts @ .20 (sold for 24.90)

Sold SPX Aug 19 2025 6435.0 Puts @ 7.20

Monday trades

Sold 1 CNC 08/22/2025 33.0 Covered Call at $0.05

Sold WBA 08/22/2025 12.0 Covered Calls at $0.06 and $0.07

Sold 1 VFC 08/22/2025 14.0 Covered Call at $0.06

Sold 1 CZR 08/22/2025 26.5 Covered Call at $0.21

Sold 1 DOW 08/22/2025 24.0 Covered Call at $0.29

#EveryLittleBitHelps

Sold 1 UPS 08/22/2025 84.0 Put at $0.36

#TinyPuts

Sold 1 SOXL 08/22/2025 20/25 Bull Put Spread at $0.30 Credit

Sold 1 SOXL 08/22/2025 20/24.5 Bull Put Spread at $0.24 Credit

Sold 1 TQQQ 08/22/2025 80/85 Bull Put Spread at $0.19 Credit

Sold 1 TQQQ 08/22/2025 80/84.5 Bull Put Spread at $0.16 Credit

Sold 1 TQQQ 08/22/2025 80/84 Bull Put Spread at $0.13 Credit

#OnlySpreads

Sold my last tiny bit of MRK at $85.01. Bought on 05/12/25 at $74.00

#FormerFallingKnife

TQQQ,

STO September 26, $70 puts at 1.01

STO September 19, $70 puts at .75

SPX 0-dte trades for 8/18/25

#SPX0dte Sold to Open $SPX Aug 18th 6375/6395-6485/6505 condors for 1.05, IV 15.75%, deltas -.08 +.06

Earnings 8/18 – 8/22

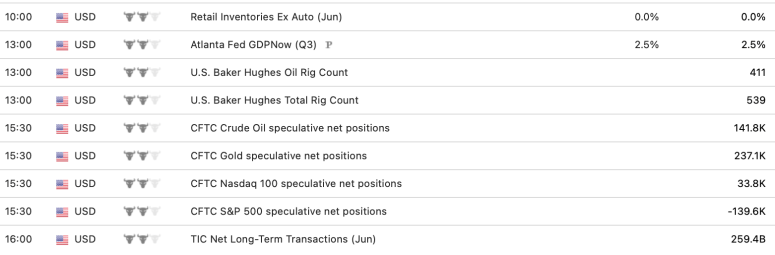

Econ Calendar 8/18 – 8/22

Friday Expirations

CRCL 127/126 put

META 755/752.5 put

NFLX 1172.5/1170 put

OKLO 68.5/67.5 put

OptionsExpiration

AAP 40/45 Bull Put Spread

AAP 42.5/47.5 Bull Put Spread

AAP 43/47.5 Bull Put Spread

AAP 48/52 Bull Put Spread

AAP 67.5 Diagonal Call

AAP 67.5/62 Bear Call Spread (different account)

CLF 7.5/9 Bull Put Spreads

CLF 8/9.5 Bull Put Spreads

LABU 52/54.5 Bull Put Spread

SOXL 29 Diagonal Call

SOXL 30 Diagonal Call

SOXL 21/23.5 Bull Put Spread

SOXL 21/24 Bull Put Spread

TQQQ 96 Diagonal Call

UPS 82/85 Bull Put Spread

#OnlySpreads

CAG 20 Covered Calls

CE 65 Covered Calls

CMCSA 30.5 Put

CZR 26.5 Covered Call

DOW 24 Covered Call

DOW 19.5 Put

HAL 24 Covered Call

PSKY 9.5 Put

SPCE 4 Covered Calls

VFC 14 Covered Call

TZA 9.5 Put

WBA 12 Covered Calls

#TinysPuts and #EveryLittleBitHelps Covered Calls

Expiration

#optionsexpiration

$TSLA 350 call

$TSLA 360 call

$NVDA 190 call

$GOOGL 222.5 call

$SOXL 28 call

$RGTI 18.5 call

$COIN 307.5 put

$RGTI 14.5 put

Have a terrific weekend

SPX

Rolled SPX Aug 15 2025 6435.0 Puts to Aug 18 2025 6435.0 Puts @ 9.00 credit (24.95 total now)

SPX 0-dte trades for 8/15/25

#SPX0dte Sold to Open $SPX Aug 15th 6400/6420-6520/6540 condors for 1.15, IV 17.87%, deltas -.08 +.06

TQQQ,

STC August 222, 95/100 bull ball spread at 1.75, the number today was not good and the summit on Friday makes me nervous.

SPX Hedge

Out to Sep monthly. Jackson Hole could be the trigger next week. Thinking JP will be hawkish.

Sold Sep monthly 6550/6575 bear call spread

Bought Sep monthly 6200/6100 bear put spread

Net debit .25

AMZN

Got the quick bounce so taking it.

Bought to Close AMZN Sep 19 2025 230/215 Bull Put Spread @ 4.70 (sold for 9.00)

SPX

Out the rest of the day so an early roll to same strike.

Rolled SPX Aug 14 2025 6435.0 Puts to Aug 15 2025 6435.0 Puts @ 8.00 credit (15.95 total now)

Thursday trades

Sold the last tiny bit of CVS at $67.01. Bought in December 2024 at $45.97

#FormerFallingKnife

Sold SPCE Aug 15 2025 4.0 Covered Calls at $0.02

#EveryLittleBitHelps

SPX 0-dte trades for 8/14/25

#SPX0dte Sold to Open 6355/6375-6485/6505 condors for 1.15, IV 19.70%, deltas -.06 +.06

Wednesday trades

Sold a tiny bit of PEP at 148.76

Sold a tiny bits of TROW at 109.01 and $110.01

Sold a tiny bit of CVS at $66.01

#FormerFallingKnife

Sold 1 VFC Aug 15 2025 14.0 Covered Call at $0.03

Sold 1 DOW Aug 15 2025 24.0 Covered Call at $0.03

#EveryLittleBitHelps

TLT

Bought to Close TLT Aug 15 2025 87.5 Calls @ .40 (sold for .58)

Bought to Close TLT Aug 15 2025 88.0 Calls @ .17 (sold for .46)

Sold TLT Sep 12 2025 89.0 Calls @ .64

SPX

Rolled SPX Aug 13 2025 6400.0 Puts to Aug 14 2025 6435.0 Puts @ 4.75 credit (7.95 total now)

CRCL META NFLX SOXL

#shortputs

#alittlebitisbetterthannada

SOLD CRCL 15 AUG 2025 127/126 PUT @.14

SOLD META 15 AUG 2025 755/752.5 PUT @.10

SOLD NFLX 15 AUG 2025 1172.5/1170 PUT @.10

#rolling

SOLD CALENDAR SOXL from 15 AUG 2025 25.5 CALL /to 22 AUG 2025/ @.30

SPX 0-dte trades for 8/13/25

#SPX0dte Sold to Open $SPX Aug 13th 6400/6420-6495/6515 condors for 1.05, IV 14.18%, deltas -.08 +.07

Sharp drop in IV and premium today, so this one is a bit aggressive. Overnight move was bullish but only represents about 20 SPX points which is modest compared to recent weeks.

SPX

Waited for some weakness but never got it. Take what I can get tomorrow.

Bought to Close SPX Aug 12 2025 6350.0 Puts @ .10 (sold for 8.00)

Sold SPX Aug 13 2025 6400.0 Puts @ 3.20

Tuesday Trades

Bought 1 AAP Aug 22 2025 68.0 Call / Sold 1 AAP Aug 15 2025 65.0 Call at $0.41 Diagonal Bear Call Credit

Added a tiny bit to my CE position at $39.50 on the open.

Sold the last of my KEY position at $17.79. Bought at $10.00 and at $8.75 in 2023

Sold 1 CAG Aug 15 2025 20.0 Covered Call at $0.05

Sold 1 CZR Aug 15 2025 26.5 Covered Call at $0.03

#EveryLittleBitHelps

TQQQ,

BTO August 22, 95/100 call spread at 1.56

The TQQQ made a new all time high and that usually means it goes higher.

TLT

Jumping back in the bond pit selling just before the next Fed meeting.

Sold TLT Sep 12 2025 86.5 Puts @ 1.15

Sold TLT Sep 12 2025 87.0 Puts @ 1.41

Sold TLT Sep 12 2025 87.5 Puts @ 1.70

Sold TLT Sep 12 2025 88.0 Put @ 2.01

EDIT: I do have long Sep 70 strike puts I’m selling against along with short calls.

SPX 0-dte trades for 8/12/25

#SPX0dte I’m skipping the wide condor given the large move after CPI report. Until this market returns to some semblance of normality I will be picking my spots more selectively.

CPI 2.7% in July, less than expected

The consumer price index increased a seasonally adjusted 0.2% for the month and 2.7% on a 12-month basis, the Bureau of Labor Statistics reported Tuesday. That compared to the respective Dow Jones estimates for 0.2% and 2.8%.

https://www.cnbc.com/2025/08/12/cpi-inflation-report-july-2025.html

SOXL TQQQ

Sold 1 SOXL Aug 15 2025 21.0/ 23.5 Bull Put Spread at $0.15 Credit

Bought 1 TQQQ Aug 22 2025 100.0 Call / Sold 1 TQQQ Aug 15 2025 95.0 Call at $0.17 Diagonal Bear Call Credit

SPY SPX TLT

Not a bad week of not watching the market. Survived Sturgis but still on the road. Checking in when I can.

SPY:

Bought to Close SPY Sep 19 2025 580.0 Put @ 1.71 (sold for 5.12)

Bought to Close SPY Sep 19 2025 590.0 Put @ 2.24 (sold for 6.42)

SPX:

Bought to Close SPX Aug 11 2025 6350.0 Puts @ .30 (sold for 48.15, 52.35, 61.90)

And selling same strike again. 🙂 🙂 🙂

Sold SPX Aug 12 2025 6350.0 Puts @ 8.00

And:

Bought to Close SPX Aug 15 2025 5800.0 Put @ .60 (sold for 10.40)

Bought to Close SPX Aug 15 2025 5900.0 Put @ .80 (sold for 20.00)

TLT:

Bought to Close TLT Aug 15 2025 86.0 Puts @ .07 (sold for 1.22)

Bought to Close TLT Aug 15 2025 86.5 Puts @ .14 (sold for 1.49)

Bought to Close TLT Aug 15 2025 87.0 Puts @ .25 (sold for 1.65)

More Monday trades

Sold 1 HAL Aug 15 2025 24.0 Covered Call at $0.03

#EveryLittleBitHelps

Sold 1 CMCSA Aug 15 2025 30.5 Put at $0.06

Sold 1 LYB Aug 15 2025 45.0 Put at $0.10

Sold 1 OKE Aug 15 2025 70.0 Put at $0.10

#TinyPuts

SPY diagonal put

Bought 1 SPY Aug 14 2025 628.0 Put / Sold 1 SPY Aug 13 2025 631.0 Put at $0.12 Diagonal Bull Put Credit

Monday trades

Sold WBA Aug 15 2025 12.0 Covered Calls at $0.07

Sold 1 DOW Aug 15 2025 19.5 Put at $0.07

Sold 1 PSKY Aug 15 2025 9.5 Put at $0.06

Sold 1 LABU Aug 15 2025 52/54.5 Bull put Spread at $0.23 Credit

QQQ

(last week)

Rolled Short calls from 8/15/25 550 to 9/30/25 555 @ 4.70 credit

BTO QQQ 12/31/25 530 Calls @ 49.23

SPX 0-dte trades for 8/11/25

#SPX0dte Sold to Open $SPX Aug 11th 6315/6335-6435/6455 condors for 1.00, IV 17.11%, deltas -.07 +.06

I’m taking the brief Downside Warning’s end on Friday as a sign the moves will quiet a bit. At least for today. We’ll see if CPI starts to get ugly tomorrow morning.

Earnings 8/11 – 8/15

Econ Calendar 8/11 – 8/15

OptionsExpiration

VFC 14.5 Covered Call

WBA 12.0 Covered Calls

SPCE 5.0 Covered Calls

CZR 26.5 Covered Call

HAL 24.0 Covered Call

DOW 23.5 Covered Call

PSKY (formerly PARA) 10.0 Put

APA 16.35 Put

BAX 21.0 Put

DOW 21.0 Put

DOW 20.5 Put

DOW 20.0 Put

DVN 29.0 Put

PFE 22.0 Put

SOXL 20.0 Put

TZA 10.5 Put

SOXL/OKLO/ETHA/BOIL

#optionsexpiration

SOXL/23.5/put

OKLO/SPREAD/80-72PUT

ETHA/24/PUT

BOIL/64/65CALL

AXP/280/282.5/PUT

TQQQ,

STO September 19, $75 puts at 1.64 earlier today. I am starting small because next week we get the PPI, CPI and import prices.

LKQ LYB Stock, HAL Call

Started a tiny new position in LKQ at $29.00

Added a tiny bit of LYB at $49.00

#SP500 #FallingKnife

Sold a HAL Aug 08 2025 24.0 Covered Call at $0.02

#EveryLittleBitHelps

SOXL

#rolling

out/and/up/and.50Cents/higher!

SOLD/ SOXL/from 8 AUG 2025/25 CALL/to15 AUG 2025 25.5-call/ @.42

SPX 0-dte trades for 8/8/25

#SPX0dte BOUGHT to open $SPX Aug 8th 6275/6295-6405/6425 condors for .95, IV 19.26%, deltas -.06 +.07

After 9 straight days of big moves, I feel forced to reverse strategy and try this long on both sides. Over these nine days the pattern has mostly been to start the move about a half hour or more into the day. So I found my strikes at my usual time, about 45 minutes before the open. This time they would gave SOLD for 1.05. I waited until after the open for a cheaper BUY price. So we’ll see if this becomes the 10th day, two full trading weeks, where the SPX moves past the expected move on 6-ish-delta condors. Since I’m now long, it’s probably the day it won’t happen!

SOXL Diagonal Call

Bought 1 SOXL Aug 22 2025 31.0 Call / Sold 1 SOXL Aug 15 2025 28.0 Call at $0.15 Credit

WBA

Sold WBA Aug 08 2025 12.0 Covered Calls at $0.02

#EveryLittleBitHelps

SPX 0-dte trades for 8/7/25

#SPX0dte After 8 days straight of Expected Move getting hit, I’m throwing in the towel and getting directional. Although it is downside that was most tested, I think we bottomed on Friday and now will recover to new highs. So I’m trying a bullish #RiskReversal. This condor would have gotten me about 1.10 had I sold both sides.

Sold to open $SPX Aug 7th 6315/6295 puts, delta -.07

Bought to open 6430/6450 calls, delta -.05

Total CREDIT +.20

IV 19.30%

SOXL

roll SOXL/8 AUG 2025 25 PUT /to 15 AUG 25-PUT @.56

roll SOXL 8 AUG 2025 24.5 PUT/to-15 AUG 2025-24.5-put/ @.64

roll SOXL/8 AUG 2025 24 PUT/to 15 AUG 2025-24put/ @.67

PARA DOW Put

Sold 1 PARA Aug 08 2025 10.0 Put at $0.06.

Sold 1 DOW Aug 08 2025 20.5 Put at $0.08.

Also have a 23.5 Covered Call on DOW

#EveryLittleBitHelps

SPX

#onlyspreads

BTC VERTICAL SPX 7 AUG 2025 6125/6120 PUT @.05

SOXL Put

Sold 1 SOXL Aug 08 2025 17/21 Bull Put Spread at $0.13 Credit

Sold 1 SOXL Aug 08 2025 20.0 Put at $0.07

#EveryLittleBitHelps

SPX 0-dte trades for 8/6/25

#SPX0dte Sold to Open $SPX Aug 6th 6225/6245-6360/6380 condors for 1.05, IV 19.60%, deltas -.06 +.05

Tuesday trades

Sold 1 DOW Aug 08 2025 21 Put at $0.08

Sold 1 TZA Aug 08 2025 10.5 Put at $0.08

#TinyPuts

SOXL/OKLO

#shortputs

tIP Sto SOXL 8 AUG 2025 23.5 PUT @.79

#onlyspreads

Sto OKLO 8 AUG 2025 72/70 PUT @.26

SPX 0-dte trades for 8/5/25

#SPX0dte Sold to Open $SPX Aug 5th 6250/6270-6385/6405 condors for 1.15, IV 19.53%, deltas -.07 +.06

forgot to click “post” but this was placed about 38 minutes before the open.

SMH,

STO August 29, 250 puts at 1.28

STO September 5, 245 puts at 1.25

LYB Stock

Added tiny bits of LYB ay $51.11 and $51.00

#SP500 #FallingKnife

Monday trades

Sold VFC Aug 08 2025 14.5 Covered Calls at $0.02

Sold 1 DOW Aug 08 2025 23.5 Covered Call $0.06

Sold 1 CZR Aug 08 2025 26.5 Covered Call at $0.32

#EveryLittleBitHelps

Sold 1 DOW Aug 08 2025 20.0 Put at $0.06

Sold 1 APA Aug 08 2025 16.5 Put at $0.07

Sold 1 DVN Aug 08 2025 29.0 Put at $0.09

Sold 1 PFE Aug 08 2025 22.0 Put at $0.09

#TinyPuts

TQQQ,

I closed my positions on the TQQQ because of the uncertainties. First loss is my least loss and I am still ahead for the year.

SPX 0-dte trades for 8/4/25

#SPX0dte Sold to Open $SPX Aug 4th 6170/6190-6325/6345 condors for 1.30, IV 23.20%, deltas -.06 +.06