STO ITM PYPL Mar 50/40 Bull Put @6.97

Author Archives: MikeL

SPX

Has anyone tried to model the risk/reward of selling 1 DTE vs. 4 or 7 DTE puts on SPX for #FuzzyLEAPs?

What is better?

Question for @fuzzballl about SPX LEAPs

What if we roll up the LEAP puts separately from the LEAP call spread in the #FuzzyLEAPs trade?

Roll up the put when the market is up and roll up the call spread when the market is down.

This would delay the extra investment in the rolling of the call spread, increasing the return.

Also, partially ITM call spread would work better as a hedge in SPX down move.

One thing I am not sure is how easy it would be to roll up a call spread that is 1/2 or more ITM.

Using XSP Long Put and Call LEAP

About a month ago @jeffcp66 mentioned an idea to use long call and put LEAP’s instead of the long put and a short call spread.

I have been testing this strategy live from early December 2025 and despite the Call premium being 2x the put premium, the strategy is viable.

Original position was Long Dec17’27 685 Put and Call. It was changed to Long 690 Put and 685 Call.

Pros:

Any loss on the put side is covered by the gain on the call side.

While #FuzzyLEAPs are naturally losing money in the up move, this trade does not.

Cons:

Definitely requires larger initial investment.

Difficulty to roll up the calls, as they get easily ITM.

Not sure how this position will behave in a strong down move, because the call premium was 2x the put premium.

VIX 20/35 Bull Call spread

Rolled VIX Jan 20 20/35 Bull Call spread to Feb 17 20/35 for $0.67

Question for @fuzzballl about SPX LEAPS

1. What is the advantage of doing LEAPS out to 2030 instead of staying with 2028 or 2029?

Theta decay would become an issue with 1 year or less before expiry.

The initial investment is larger if going out to 2030 vs. staying with 2028-2029.

The only benefit that I can think of going to 2030 is if SPX will start declining.

You would still have to roll up in case the SPX will keep moving up, so why not get the maximum return on your investment by staying in 2028-2029?

2. I understand the reason for keeping uncovered LEAPS. You can get much higher premium if you catch SPX in a down move. However, does the math works? If you are waiting for 3-5 trading days, then the premium lost would be $30-50 per LEAP. Do you think you can get that much in a down move in SPX to counter the lost revenue?

Of course, if you are holding uncovered LEAPS just as a hedge, then my question is irrelevant.

Would love to know what you think about this.

VIX @fuzzballl Are you planing…

VIX

@fuzzballl

Are you planing to keep your VIX position until expiry or roll it out to Feb?

Covered call position during a takeover?

Does anyone know what happens to a covered call position during a takeover?

Example:

Stock price – $28

Short call – @32

Takeover price – $30

I understand that shares will be sold at $30 and removed from the account.

But what happens to the calls?

TQQQ SPLIT 2-FOR-1

TQQQ split today after close. Will start trading after split on Thursday.

Things are getting ugly.

Things are getting ugly. 😦

NVDA

Risk Reversal using LEAPS

STO NVDA Jan15’27 125 PUT @35.12

BTO NVDA Jan15’27 90 CALL @38.12

Net debit $3.00

TSM

STO TSM Apr11 155/150 Bull Put @0.53

SMH

STO SMH Apr04 205/200 Bull Put @0.46

NVDA

STO NVDA Apr11 105/100 Bull Put @0.57

TSLA

STO TSLA Apr11 220/200 Bull Put @1.00

TSLA

BTC TSLA Apr04 200/180 Bear Put @0.35 (Sold for $1.00)

STO TSLA Apr04 200/180 Bull…

STO TSLA Apr04 200/180 Bull Put @ 1.00

NVDY, TSLY, MSTY, CONY

Does anyone know if there is a downside to holding NVDY, TSLY, MSTY, CONY long-term?

Do they have a tendency to go down over time?

NVDA

STO NVDA Mar21’25 90 PUT @1.92

@fuzzballl Any trades on XBI?…

@fuzzballl

Any trades on XBI?

It is below $87

Alternative to TOS paper account?

It looks like TOS is canceling paper accounts. It started about a month ago and now even my oldest paper account was closed today. New paper accounts are not available.

Is there a decent alternative to TOS paper account with similar functionality?

LABU Split: 1 : 20

LABU announced a reverse split, effective 2023-12-04.

The terms of the split are 1 : 20.

@fuzzballl Are you loading up…

Are you loading up on XBI or waiting for a better price?

🙂

SPY

STO SPY Oct27’23 410 PUT @2.00

SPY

STO SPY Oct27’23 420 PUT @2.15

DIS

STO DIS Jan19’24 80 PUT @2.45

How do you manage the emotional side of trading SPX?

This question is for Jeff and everyone else trading SPX.

When your position is tested, like today with SPX at 3961 and short calls at 3970, how do you manage the emotional side of trading?

I usually close the trade early for a small loss, but most of the time miss out on a winning trade.

I think, it is a purely emotional response, but should be avoided in trading.

- Do you stick to your plan and close early, or hope for the best and see what happens?

- Is your approach different for Calls vs. Puts?

KRE

STO KRE Apr21’23 25 PUT @0.45

STO KRE Apr21’23 30 PUT @0.95

FAS

STO FAS Apr21’23 40 PUT @1.98

STO FAS Apr21’23 35 PUT @1.24

XBI

STO XBI Apr21’23 70 PUT @ 1.50

KRE

STO KRE Jun16’23 40 PUT @1.20

FYI SPY Dividend

FYI SPY Dividend – Mar 17, 2023

KRE

STO KRE Jun16’23 50 PUT @1.15

IWM

STO IWM Mar17’23 180 PUT @1.00

XBI

STO XBI May19’23 75 PUT @1.80

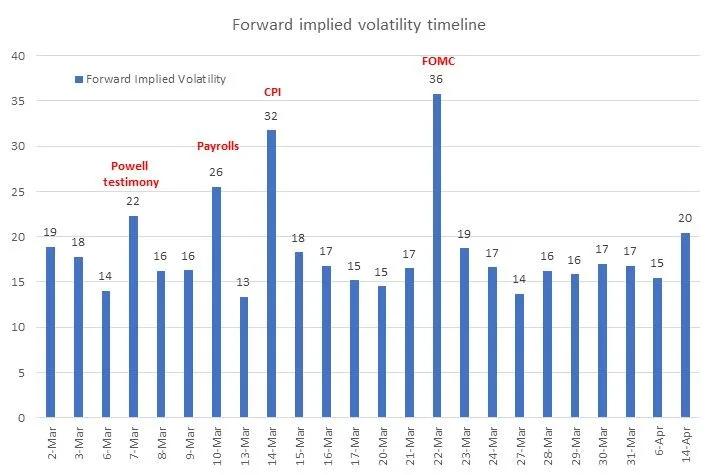

Forward implied volatility

XBI

STO XBI Apr21’23 75 PUT @1.50

SPY

STO SPY Mar10’23 380 PUT @1.65

Commission on SPX

I am curious what are you paying per contract for SPX options with your broker?

Interactive Brokers is charging $1.55 and $1.64 per contract, depending on the premium amount.

SPY

STO SPY Mar03’23 390 PUT @1.50

STO SPY Mar03’23 395 PUT @2.00

TSLA

Not sure if this was a smart move, but ..

STO TSLA Jul21’23 80 PUT @8.75

Question about keeping track of trades

Over the years, I have noticed that keeping track of trades is taking 2 to 3 times longer that the actual trading activities.

I use Excel spreadsheet and entering open/close trades is not a big deal. However, when I roll positions, sometimes for years, it is a tedious task.

Has anyone found a better way of recording trades (than Excel), including multiple rolls?

TSLA

STO TSLA Dec16’22 130 PUT @1.75

META

STO META Dec16’22 95 PUT @5.76

Let’s see what happens 🙂

TSLA

STO TSLA Oct21’22 200 PUT @4.00

Ability to create new posts.

Hi Jeff,

Somehow I lost ability to create new posts or reply directly in the optionsbistro.com.

Was working fine 2 days ago.

Checked login, cleared cache, etc…, but nothing helps.

This post is done from the WordPress account.

Can you please check if there are any issues with my username?

Thank you,

Mike

@fuzzballl Looks like EWZ is…

@fuzzballl

Looks like EWZ is coming back down into the range.

XBI

STO ITM XBI Jan20’23 70 PUT @11.45

INTC

STO INTC Sep16’22 35 PUT @1.16

STO INTC Jan20’23 35 PUT @1.98

BA

STO BA Mar18’22 180 PUT @6.40

STO BA Jan20’23 180 PUT @26.20

FXI

STO FXI Apr14’22 31 PUT @0.50

RSX

STO RSX Jan’23 20/10 Bull Put @8.05

B/E at $11.95

TSLA

STO TSLA Mar18’22 500 PUT @6.00

On a GTC order at the open.

RSX

STO RSX Mar18’22 10 PUT @0.70

Russia ETF

FB

Possibly too early, but…

STO FB Mar18’22 190 PUT @ 2.05

STO FB May20’22 175 PUT @ 3.75

How is everyone planing to…

How is everyone planing to celebrate the New Year?

@fuzzballl Have you looked at…

Have you looked at ARKG and ARKF ?

FAS

STO FAS Dec17’21 90 PUT @1.80

SOXL

STO SOXL Dec17’21 45 PUT @1.20

TQQQ

STO TQQQ Dec17’21 105 PUT @1.73

ARKK

STO ARKK Jan21’22 70.96 PUT @1.62

EWZ

STO EWZ Jan21’22 26 PUT @1.10

SPLK

SPLK is down 18% today on CEO resignation.

LABU

STO LABU Nov26’21 50 PUT @1.60

TSLA

STO TSLA Nov19’21 700 PUT @4.25

PYPL

PYPL is down 12%

VIX

Any idea why we had a 10% spike in VIX?

PTON

PTON is down 35%

DKNG

DKNG is down 3.3%

MRNA

MRNA is down 20%

Jan 150 Puts are $3

PENN

PENN is down today 20%

Z

If Cathie Woods is buying Zillow, that is good for me … 🙂 🙂

STO Z Jan21’22 50 PUT @1.50

EWZ

Just as a long hold with about 15% annual return.

STO EWZ Jan20’23 30 PUT @6.30

B/E = $23.70

BITO Time for a test…

BITO

Time for a test 🙂

STO BITO Dec17’21 30 PUT @ $1.05

STO BITO Dec31’21 30 PUT @ $1.45

Short NEGG AUG 20 2021…

Short NEGG AUG 20 2021 CALL got assigned on Friday. So I exercised the long call.

There is probably a charge for being short shares, just not sure how much.