Author Archives: Jeff

Econ Calendar 2/2 – 2/6

XSP rolling 1/30/26

#FuzzyLEAPs

Rolled $XSP Jan 30th 693 to Feb 2nd 693 puts, 1.50 credit.

After 4 days of misplaying the waiting game, getting it right today. This filled right when XSP was passing through 693.00. My order to roll 696 puts is for the same amount and should fill if we can get back to that level, which we already crossed three times today.

XSP rolling 1/29/26

#FuzzyLEAPs

Rolled $XSP Jan 29th 693 puts to Jan 30th 693 puts, .80 credit

Order is in to roll my 696 puts

XSP rolling and LEAPs 1/28/26

#FuzzyLEAPs

At the overnight highs in futures (which would have been all time market highs had the market been open), filled on a fourth $XSP LEAP spread: Dec 2028 695/695/735 for 38.40.

Will add another daily put today, going with all 4 XSP LEAPs with daily puts and my $SPY spread as a hedge.

XSP roll 1/27/26

#FuzzyLEAPs

Sold $XSP Jan 28th 693 put for .47. Letting today’s 692 put expire. Just like yesterday, selling on a last minute drop when rolling at the open would have been best move. But today I moved a strike higher.

XSP and SPY rolling 1/26/26

#FuzzyLEAPs

Rolled $XSP Jan 28th 696 puts to Jan 29th 696 puts for .95 credit

Since XSP is trading right at 696, I’m rolling this today, 2 days before expiration. I think the importance of being ATM overrides the distance to expiry as optimal time for rolling.

Working on rolling my XSP 692 put but since we’ve gone up all day the best time to do this was at the open. We are now enough above $SPY 692 that I will leave my Jan 28th put there to continue to drain. I want to leave my one SPY LEAPs spread “uncovered” as a hedge.

Earnings 1/26 – 1/30

Econ Calendar 1/26 – 1/30

XSP and SPY rolls 1/23/26

#FuzzyLEAPs

Rolled $XSP Jan 23rd 692 put to Jan 26th 692 put, .90 credit.

SPY roll 1/22/26

#FuzzyLEAPs Rolled $SPY Jan 26th 692 put to Jan 27th 692 put, .44 credit. Staying ahead of the expiry to avoid early assignment.

XSP and SPY rolls 1/20/26

#FuzzyLEAPs This will be a boring week waiting for a rebound. Trying to roll to Friday or Monday but only one filled so far. I was waiting for possibility of ending higher but we turned south instead.

Rolled $XSP Jan 20th 692 put to Jan 23rd 692 put, .75 credit

Earnings 1/19 – 1/23

Econ Calendar 1/19 – 1/23

XSP rolls for 1/16/26

#FuzzyLEAPs

Filled at the bell: Rolled $XSP Jan 16th 692 put to Jan 20th 692 put for .83

I had this order going in pre-market with no fill. Filled immediately after bell, after which premium quickly dropped to around .70. This seems to be a good fill for being 4 pts OTM…. grabbing high premium at the volatile moment of the open may be an approach to consider often.

I was NOT filled on 696 roll, limit order of 1.10. But I will wait since we are ATM like yesterday.

XSP rolls 1/15/26

#fuzzyleaps

Rolled $XSP Jan 15th 692 put to Jan 16th 692 put for .53

Order in for .88 to roll the 696 puts. Since this is close to the money roll premium should increase as day progresses.

XSP and SPY for 1/14/26

#FuzzyLEAPs

Rolled $XSP Jan 14th 692 put to Jan 15th 692 put, .83 credit

Missed the fill on rolling ITM 696 puts. Waiting to see if we can rally into afternoon.

Closed my third $SPY spread:

STC $SPY Jan 2028 685/685/725 LEAP spread for 31.20 right after the open (could have almost been breakeven had I waited)

Originally bought for 33.50 on Dec 11th.

Loss of -2.25 on LEAPs

Gain of 13.67 on daily put sales.

TOTAL profit +11.42

I now have one 690/690/730 $SPY LEAP spread I plan to keep open as a hedge.

I have ITM Jan 14th 692 put that I will keep rolling until it expires worthless, after which I will leave the LEAP spread “uncovered” with no daily puts.

I will also add a fourth and final $XSP LEAP spread when we return toward new highs.

XSP and SPY rolls 1/13/26

#FuzzyLEAPs

Rolled $XSP Jan 13th 696 puts to Jan 14th 696 puts, .85 credit

Rolled $SPY Jan 13th 692 put to Jan 14th 692 put, .70 credit

Will probably sell another XSP daily today.

I’m going to dump one of my two $SPY spreads on a decent pullback, and may keep the other as a longer-term hedge against XSP strategy going forward.

SPY/XSP trades 1/12/26

#FuzzyLEAPs

Rolled $SPX Jan 12th 692 put to Jan 13th 692 put for .90

Opened my second $XSP LEAP spread (replacing SPY spread closed on Friday).

Dec 2028 690/690/730 spread for 37.60

Sold against it TODAY’s 694 put for .77

I could have sold tomorrow’s 694 for almost twice the price, so it may be futile to sell same day then roll later, but kind of testing that out.

Now I have 2 positions on each of SPY and XSP. I have one short put on each that are not rolled yet.

I will wait to close another SPY on a down day. I’m fine for now with two of each as assignment risk is lower than before.

Earnings 1/12 – 1/16

Econ Calendar 1/12 – 1/16

SPY/XSP for 1/9/26

#FuzzyLEAPs

Rolled $SPY Jan 9th 689 put to Jan 12th 689 put, .70 credit

Holding off on rolling 691 since it’s close to ATM. Seeing if premium increases toward day’s end.

Closed another SPY LEAP spread: Jan 2028 685/685/725 for 31.50. Originally purchased on Dec 4th for 36.11.

Allowing associated Jan 9th 687 put to expire.

Lost 4.61 on LEAPs, gained 17.59 from daily put sales.

Profit on trade is 12.98

Opened my first $XSP spread:

Bought the Dec 2028 695/695/735 spread for 39.39.

Sold Jan 12th 691 put for .70

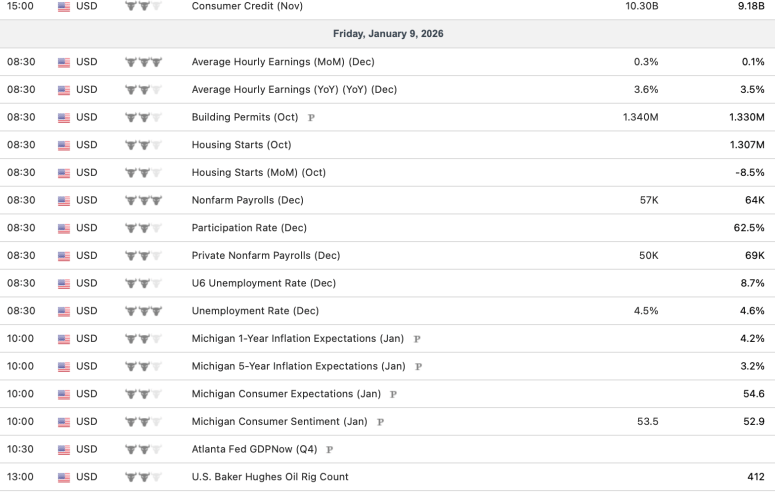

December Jobs Report

#Jobs — Lower than expected but UE drops.

Gain of +50,000 non-farm payroll jobs, vs. expected gain of 73K

Unemployment down by 0.2 at 4.4%

U6 unemployment 8.4%, down by 0.3

Labor force participation down 0.1 to 62.4%

Average hourly earnings up by 0.3%; +3.8% Y/Y

November jobs revised down by -8K to +56K

October jobs revised down by -68K to -173K

SPY rolls 1/8/26

#FuzzyLEAPs $SPY

Rolled Jan 8th 687 put to Jan 9th 687 put for 1.11

Rolled Jan 8th 689 put to Jan 9th 689 put for 1.10

Rolled Jan 8th 691 put to Jan 9th 691 put for 1.00

Bought to close 690 put for 1.66 (sold for 1.03 yesterday)

Sold to close Jan 2028 LEAPs spread 690/690/730 for 34.45. Bought this for 33.20 on Tuesday.

I closed this spread and its daily short with intention to migrate to $XSP. I made 1.25 on the LEAPs and .18 on 2 put sales.

SPY rolls 1/7/26

#FuzzyLEAPs $SPY rolls:

Rolled Jan 7th 689 put to Jan 8th 689 put for .53

Rolled Jan 7th 690 put to Jan 8th 690 put for .60

Rolled Jan 7th 686 put FIVE strikes higher to Jan 8th 691 put for 1.23

Still leaving one LEAP spread without a daily short, which I’ll probably add on a decent pull back. Also considering migrating this whole mess to $XSP to avoid assignment risk.

SPY rolls 1/6/26

#FuzzyLEAPs Rolling on the intraday swings

At the low of day, rolled $SPY Jan 6th 686 put to Jan 7th 686 put for .61 (10.25 so far)

As we spiked higher, rolled Jan 6th 689 put to Jan 7th 689 put for .69 (7.42 so far)

My 687 roll didn’t fill yet, so looking for another dip to get good premium. (15.87 so far)

SPY rolls 1/5/26

#FuzzyLEAPs Tried to wait for a dip to roll but never got it. As a result, I’m getting less than I could have had I rolled early. However, now I feel we are enough above 686 that I’m going to let today’s expire.

Sold $SPY Jan 6th 686 put for .66. Today’s 686 will expire, barring some last minute crash, in which case I will close it.

My other two expire tomorrow so I will let them ride since they are close enough to the money, 687 and 689.

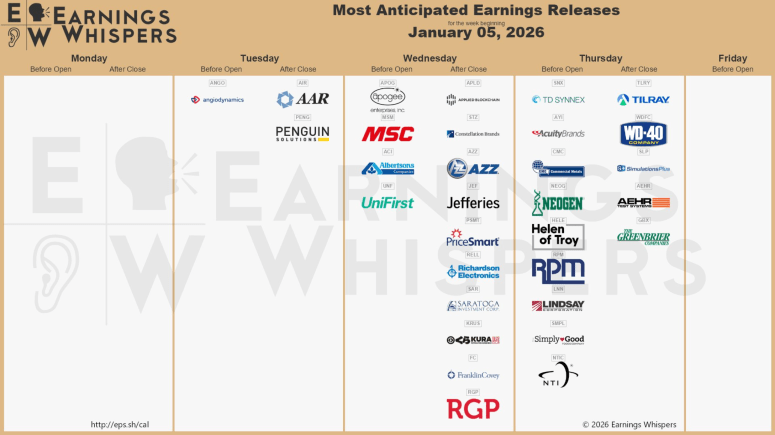

Earnings 1/5 – 1/9

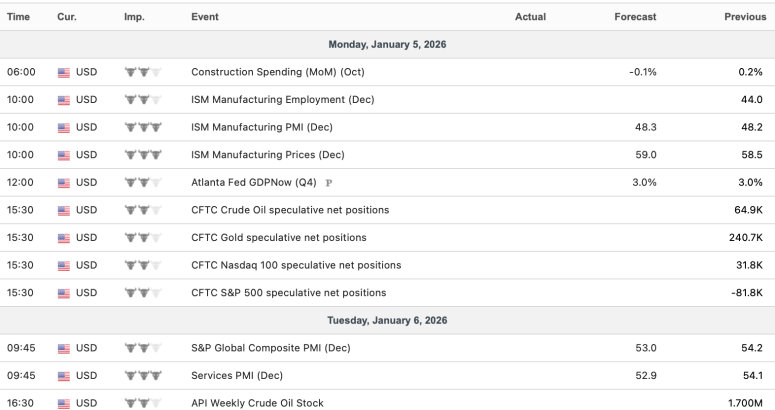

Econ Calendar 1/5 – 1/9

SPY action 1/2/26

#FuzzyLEAPs I was assigned 200 shares of $SPY from my Jan 2nd 687 puts. Oddly, I was NOT assigned from my deeper ITM 689 put. That may have been due to margin considerations.

Today I sold the stock for 686.75. Cost basis was 685.78, given the price of my roll trade on Wednesday.

Then:

Sold (1) Jan 5th 687 put for 2.40

Sold (1) Jan 5th 686 put for 1.74

Also:

Rolled Jan 2nd 689 put to Jan 6th 689 put, .90 credit (skipping a day to avoid assignment)

Pretty easy management of the assignment. Wish I had waited a bit to sell the puts because now they are over a dollar higher each.

SPY rolls 12/30/25

#FuzzyLEAPs Rolled $SPY Dec 30th 687 puts to Jan 2nd 687 puts for 1.22. (Two puts with total rolls of 13.57 and 7.44 respectively).

I am traveling rest of today and tomorrow, so rolled to Friday expiry. Doing the same with my 689 put.

SPY rolls 12/29/25

#FuzzyLEAPs Rolled $SPY Dec 29th 687 puts to Dec 30th 687 puts for .65.

Working on rolling the 689 put.

Econ Calendar 12/28 – 1/2

SPY rolls 12/26/25

#FuzzyLEAPs Rolled $SPY Dec 26th 688 put to Dec 29th 689 put for .70 (2.14 so far).

I have (2) 687 puts I will also be rolling.

SPY rolls 12/24/25

#FuzzyLEAPs Rolled $SPY Dec 24th 688 put to Dec 26th 688 put for .62 (1.44 so far)

No pullback so put prices just screaming toward zero. I have 683 and 684 puts today that I can’t get meaningful premium to roll. I will probably allow to expire and roll up several strikes. Or skip sales for Friday’s expiry and start fresh then.

VIX low

Today was the first time in all of 2025 that $VIX got below 14.00. It was the lowest reading since December 13, 2024.

Spy rolls 12/23/25

#FuzzyLEAPs Rolled $SPY Dec 23rd 683 put to Dec 24th 683 put, .36 credit (4.84 so far)

Rolled Dec 23rd 682 put UP two strikes to Dec 24th 684 put, .85 credit (11.08 so far)

Earnings 12/22 – 1/2

Econ Calendar 12/22 – 12/26

SPY roll 12/19/25

#FuzzyLEAPs Rolled $SPX Dec 22nd 683 put to Dec 23rd 683 put, .50 credit (4.48 so far). Now I have 682 and 683 ITM puts for the 23rd.

SPY roll 12/18/25

#FuzzyLEAPs Rolled $SPY Dec 19th 682 put to Dec 23rd 682 put, .97 credit (10.23 total). Leaving my Monday 683 put until tomorrow.

Frankly surprised that the option I rolled wasn’t assigned stock overnight. It has huge Open Interest, since it is a monthly, and we ended yesterday with it over 3 dollars ITM. I guess since there was still another day to expiry it survived, which is the reason I am rolling a day ahead while I am ITM.

SPY roll 12/17/25

#FuzzyLEAPs Rolled $SPY Dec 18th 684 put to Dec 22nd 683 put, 1.26 credit (3.98 total). This rolls tomorrow’s put until Monday, and one strike lower. For now I am leaving Friday’s 683 put to stand.

SPY rolls 12/16/25

#FuzzyLEAPs Rolled $SPY Dec 16th 683 put to Dec 19th 682 put, 2.10 credit (9.28 so far). Rolled this a strike down but went all the way to Friday, which has a significant jump in premium from Thursday.

For my 684 put, rolled Dec 16th 684 to Dec 18th 684, .80 credit. Keeping this ITM at same level, rolling to Thursday.

November Jobs Report

#Jobs — Abbreviated October data shows a loss, while November had a small gain. UE ticks higher.

Gain of +64,000 non-farm payroll jobs, vs. expected gain of 45K

An “abbreviated” October count indicates a loss of -105,000 jobs.

Unemployment up by 0.2 from Sept at 4.6%, highest since Sept 2021

U6 unemployment 8.7%, up by 0.7 from Sept

Labor force participation up 0.1 to 62.5%

Average hourly earnings up by 0.1%; +3.5% Y/Y, smallest gain since May 2021

September jobs revised down by -11K to +108K

August jobs revised down by -22K to -26K

SPY roll

#FuzzyLEAPs Rolled $SPY Dec 15th 683 put to Dec 16th 683 put, 1.10 credit (7.18 so far)

My other put is the 684 already rolled until tomorrow, so I will wait until then unless we drop ITM today.

Earnings 12/15 – 12/19

Econ Calendar 12/15 – 12/19

SPY rolls

Rolled $SPY Dec 12th 682 put to Dec 15th 683 put (up one strike), .50 credit, 6.08 total

Rolled Dec 12th 684 put to Dec 15th 684 put, .55 credit, 1.05 so far

SPY roll 12/11/25

Rolled $SPY Dec 11th 682 put to Dec 12th 682 put, .75 credit, 5.58 total.

SPY roll

Rolled $SPY Dec 10th 682 put to Dec 11th 682 put, 1.06 credit, 4.83 total so far for a week in the trade.

SPY roll

Rolled $SPY Dec 8th 682 put to Dec 9th 682 put for 1.45.

This is against the 685 LEAP spread, with total now of 3.77 in daily put sales. Still waiting to add another position after closing my 675 one yesterday.

SPY rolls

Rolled $SPX Dec 8th 682 put to Dec 9th 682 put, .62 credit

Trying to roll up my 675 LEAP spread today

Earnings 12/8 – 12/12

Econ Calendar 12/8 – 12/12

SPY rolls

Rolled $SPY Dec 5th 678 put to Dec 8th 679 put. Sold the 679 for .60, and allowing the 678 to deflate to .05 (far enough OTM to wait). I will be looking to roll this LEAP spread up soon.

Rolled $SPY Dec 5th 682 put to Dec 8th 682, credit .60

SPY roll

Moved up a strike, even though my LEAP spread is still down at 675. Was considering rolling up the LEAPs today but the weakness has me on pause.

Rolled Dec 4th 677 to Dec 5th 678, .55 credit,

Spy Roll 12/3/25

Rolled $SPY Dec 3rd 677 put to Dec 4th 677 put for .70, total rolls 4.26 since Nov 17th.

SPY roll

Right after the open, rolled $SPY Dec 2nd 677 put to Dec 3rd 677 put, .52 credit. After the 11am drop in SPY, the credit for this roll went as high as .90

SPY rolls

For my live trade, on Nov 21st I had rolled a week ahead to today’s expiry. Sold the Dec 1st 677 put for 22.62 in that roll, and today it’s expiring worthless. I made the choice to wait out the day to see if I could get a better price on the Dec 2nd 677, but the day kept going higher so I only got .50, even though I don’t need to pay to close today’s option. Had I rolled near the open could have gotten as high as .80.

So the .50 roll gives me a total of 10.04 so far against my Jan 2028 LEAP spread (at 675 strike) that I paid 37.76 for. That spread is down about 2 bucks so trade is $800 in profit, for a 1-lot over 2 weeks.

Earnings 12/1 – 12/5

Econ Calendar 12/1 – 12/5

Earnings 11/24 – 11/28

Econ Calendar 11/24 – 11/28

Week One result

I entered the trade on Monday when SPY was at 672, and the week ended at 659. With a one-lot my account is down 150.00, which is pretty satisfying for a week that was down 13 points. This included three rolls totaling 2.54, including two assignments. My ITM short 677 put is currently at -18.00.

If I had purchased 100 shares of SPY stock, I’d be down 1,300.

If I had just bought the LEAPs spread and not sold puts, I’d be up 594.

SPY LEAP/dailys

Got assigned on my Nov 24th 677 puts, two trading days before expiration.

Sold stock for 655.75 and sold the Dec 1st 677 puts for 22.72. That’s a roll of 1.47 credit. I was able to do that by legging in on the opening swings. A scary move I don’t try often, but sold the put on the 9:39am down bar and sold the stock on the 9:42am spike up (ET, 1-min chart).

So now this is 5-trading days out, over the holiday week. I will look to roll on Wednesday to avoid assignment.

September Jobs Report

#Jobs — Higher than expected, although August went negative and UE ticks up

Gain of +119,000 non-farm payroll jobs, vs. expected gain of 50K

Unemployment up by 0.1 at 4.4%

U6 unemployment 8.0%, down by 0.1

Labor force participation up 0.1 to 62.4%

Average hourly earnings up by 0.2%; +3.8% Y/Y

July jobs revised down by -7K to +72K

August jobs revised down by -26K to -4K

New trades

I’ve been paper trading @fuzzballl‘s LEAP strategy on paper, for both $SPX and $SPY, and I started one in $SPY live this week. Just one contract to get an idea how it affects margin and NLV over time. Since I’m not trading too much of my regular strategies right now I devoted one account to this trade.

Monday, with 1/21/28 expiration, bought the 675 put, sold the 675/715 call spread, total debit 37.76.

Monday, sold the Tuesday 677 put for 7.00

Monday night, I was assigned stock!

Tuesday, rolled the stock to Thursday’s 677 put, net credit .27

Today, rolled the Thursday 677 to Monday’s 677, net credit .80.

Not a great start, due to this week’s dropping market. But I will be rolling deep ITM puts a day or more before expiration to avoid assignments. Despite this, the account’s value has barely dropped due to the increase in value on the LEAP spread.

I am also testing on paper doing this in reverse, with LEAP long call and selling daily calls. However, the skew is large, so this will take more time to break even. It cost me (virtually) 79.33 to enter the reverse spread, which only cost me 37.66 on the put side. It may benefit from better rolls on the call side but I will wait and see whether it’s ever worth trying with live money.

Earnings 11/17 – 11/21

Econ Calendar 11/17 – 11/21

Earnings 11/10 – 11/14

Econ Calendar 11/10 – 11/14

Swings continue

2025 continues to be the bizarro year for intraday moves. Whereas the last seven years (at least) have shown that 6-delta EM breaches were the rarity, the have now become the norm. It was predictable that after yesterday’s call-side EM breach, that today we would see a put-side breach. Sadly, I predicted its likelihood but didn’t buy a put spread (let the record show I am adverse to long trades). I have been trying to find trades here and there. Last week I did okay with some ATM narrow condors, but this week so far has been a misfire. On the sidelines for now.