Added a tiny bit more PAYX at $104.80. Probably my last buy for now.

EX-Div tomorrow

#DividendCapture #FallingKnife

Tag Archives: DividendCapture

CPB KMB Stock

Added tiny bits of CPB at $27.60 and KMB at $99.00 and $98.00

#SP500 #FallingKnife

AMCR Stock

Started buying AMCR at $8.35 (new low)

Ex-Div on 09/08 at 6.05%

#DividendCapture

AES Stock

Started a tiny position in AES at $11.00

Ex-div on Friday

#dividendcapture

NVDY CONY CRSH TSLY AMDY FIAT

tIP BOT NVDY @24.45

tIP BOT CONY @14.21

tIP BOT CRSH @13.33

tIP BOT TSLY @11.37

tIP BOT AMDY @14.21

tIP BOT FIAT @17.75

EBF CRSH YMAG TSLY GDXY YMAX

#smallbuy

#dividends

#exdivtomorrow

#ACROSS3ACCOUNTS

BOT EBF @24.31 …../special 2.50 /divvy coming up/ #dividendcapture

BOT CRSH @13.09

BOT YMAG @19.14

BOT TSLY @13.64

BOT GDXY @18.45

BOT YMAX @17.58

BIZD XYLD XRMI GOF XRMI LABU SOXL

#raisingcash

#waiting for next leg down

SOLD BIZD @15.16

SOLD XYLD @41.25

SOLD XRMI @20.77

SOLD XRMI @20.54

—

#dividendcapture

Monday is ex div day

BOT GOF @15.8299

—

#shortputs

STO LABU 16 JUN 2023 6.5 PUT @.13

STO SOXL 16 JUN 2023 20 PUT @.25

#optionsexpiration soxl btc SOXL 17…

#optionsexpiration

soxl

btc SOXL 17 SEP 2021 43 PUT @.05/sold for avg .87

right at close needed to release buying power to buy qyld /cause goes exdividend Monday

#dividendcapture

QYLD

Tracking Dividend Stocks for Covered Calls

Appreciate all the posts and helpful culture of the site. Hoping this might help some out.

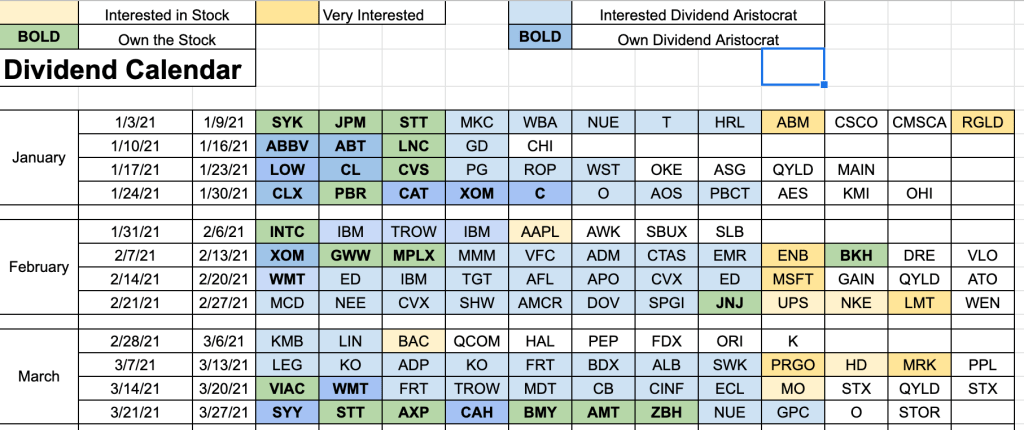

Over the past couple of weeks I increased my focus on writing CC’s against stocks with attractive dividends. I created the attached Google sheet to help out.

Worksheet has a fair amount of automation. User is responsible to add a ticker in the proper week from Jan to Mar. Ticker gets added in the appropriate spot for Q2,Q3 and Q4. Income sheet looks up the ticker on Yahoo and returns exdiv date and yield (yield is shown as a negative for some reason as exdate and yield are in the same Yahoo cell with yield in brackets). User adds the number of shares for the ticker on the income sheet. Worksheet calculates the monthly, quarterly and annual dividend income for the tickers you own.

i find it to be a good visual tool so you can see what is coming and not get shares called away because you miss the exdiv date. It also allows me to quickly identify potential candidates on my list.

Yahoo link seems to work well….but it can be slow. If I like using I might purchase a more reliable data source.c

A picture of what the first page looks like is below. Feel free to make suggestions.

https://docs.google.com/spreadsheets/d/1IpL-ogLz3YJQKfdKE7OtuIEaleRoBcCYHDCaK_dEbVY/edit?usp=sharing

ABT CC….ABT misses on revenue….might be opportunity to add

Assigned on NUE…..evaluating dividend capture strategy on series of stocks to see if it is scalable…

Short term CC dividend capture strategy….trying something different….not sure if it will be sustainable over time

https://coveredcallswithjeff.wordpress.com/2021/03/11/wmb-covered-call-dividend-capture-assigned-day-before-ex-div-return-on-capital-2-6-in-2-days-or-476-annualized-but-no-dividend/

New CC in RTX – looking to capture dividend next Friday

https://coveredcallswithjeff.wordpress.com/2021/02/19/new-cc-in-rtx-raytheon/

Closed CC on CFG, Picked up Dividend

WBA

Ex-div tomorrow for 0.4675 for those wanting a dividend capture trade.

Stock is close to the low for the last week.

Dividend Yield 4.46%