Post earnings trades, closed Nov. 18 put spreads, 720/730 for 45 credit, 734/745 63 credit, Dec. 700/710 for a 30 credit.

Daily Archives: Monday, October 31, 2016

$AMGN under Brexit low, eyeballing…

$AMGN #FallingKnife – under Brexit low, eyeballing Feb low.

DUST call closed

#ContangoETFs BTC DUST Nov 18th 70 call for .30. Sold for 3.50 on Oct 11th.

$SVXY #ShortPuts – Sold SVXY…

$SVXY #ShortPuts – Sold SVXY Jan 20 2017 40.0 Puts @ 1.25 with the stock at 71.40

$NUGT #CoveredCalls – Sold NUGT…

$NUGT #CoveredCalls – Sold NUGT Nov 11 2016 16.0 Calls @ 0.60 replacing a similar call that expired Friday

$SVXY

Sold a single Nov 11th 55 Put @ 0.55 when SVXY was at 72.55. Preparing for Yieldhog earnings week with a bunch reporting. Should keep me busy and off the streets. Have a great Halloween and if you must be out driving watch out for all those hard to see ghouls, goblins, politicians.

$UVXY #ShortCalls – Sold these…

$UVXY #ShortCalls – Sold these with the stock at 16.50

Sold UVXY NOV 11 2016 31.0 Calls @ 0.33

Sold UVXY NOV 18 2016 41.0 Calls @ 0.26

$TLT rollout

With previous rolls and adjustments I ended up with a Nov 136 straddle. I am rolling that full position out to December and bringing in additional premium (1.08 credit).

Bought to close $TLT Nov 18 136 straddle @ 5.86

Sold to open $TLT Dec 18 136 straddle @ 6.94

$TAP #ShortPuts #Earnings – Sold…

$TAP #ShortPuts #Earnings – Sold TAP NOV 4 2016 94.5 Puts @ 0.21. These expire Friday

TAP earnings

#Earnings Classic earnings trade: STO $TAP Nov 5th 100 puts for .80.

Over last 3 years, Biggest 5-day UP move: 6.8%, Biggest 5-day DOWN move: -4.6%, Average move: 2.8%. This trade is -4.5% OTM.

To find a bigger than 5% move at any point within 5 days after earnings, you have to go back to May 2011. THIS IS A NAKED TRADE. Use a spread if you’re not comfortable with the risk.

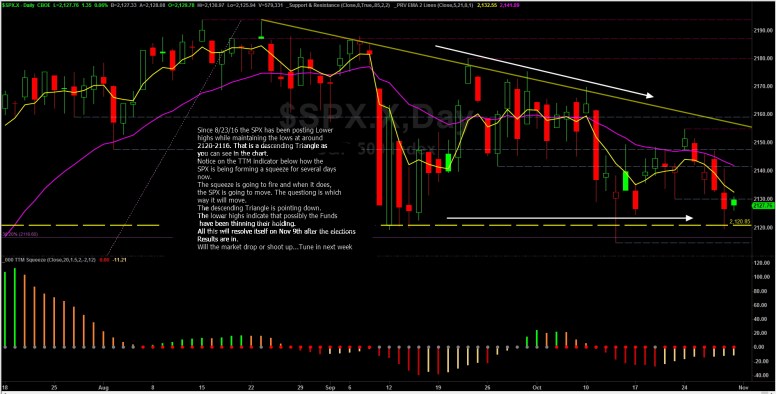

Is the SPX heading down?

$TIF #ShortPuts – Bought to…

$TIF #ShortPuts – Bought to close 1 TIF Nov 18 2016 52.5 Put @ 0.01. Nothing more to make here.

Sold on 8/3 @ 1.25

$RIG #ShortPuts – Bought to…

$RIG #ShortPuts – Bought to close RIG NOV 18 2016 7.0 Puts @ 0.01. Nothing more to make here.

Sold 8/1 @ 0.29

$NFLX #ShortPuts – Sold NFLX…

$NFLX #ShortPuts – Sold NFLX NOV 4 2016 119.0 Puts @ 0.22.

Paired with short stock AND short Nov 4 2016 133.0 calls

NFLX puts

#Earnings Selling to offset short calls:

STO NFLX Nov 11th 122 put for 1.50

STO NFLX Dec 16th 115 put for 2.10

$SVXY

Got a partial fill. STO $SVXY Nov 25 $50 puts @ $0.61

$NKE $TSCO $MAC – new…

$NKE $TSCO $MAC – new lows for SP500 stocks today. Possible #FallingKnife trades

$SVXY #ShortPuts #ClassicVXXGame – Sold…

$SVXY #ShortPuts #ClassicVXXGame – Sold 1 SVXY JAN 19 2018 24.0 Put @ 2.40. Paired with 145 Calls for the same date.

$SVXY #ShortPuts – Sold SVXY…

$SVXY #ShortPuts – Sold SVXY JAN 20 2017 40.0 Puts @ 1.15. I will add at higher prices if I can

FB Is anybody taking a…

FB Is anybody taking a position prior to earnings tomorrow? I am holding Jan 120 calls and Nov 130 but considering hedging withahigher strike. Any suggestions?

$SPX iron condor

STO Dec 9 2230/2220/1950/1940 @ 1.70

SPX calls closed, calls sold

#SPXcampaign Bought to close $SPX Nov 11th 2220/2245 call spreads for .20. Sold for 2.00 on Oct 14th.

Sold to Open $SPX Dec 2nd 2220/2245 call spreads for 1.40, with SPX at 2130.