CCL STO 4/24/20 13.0 CALL@.30 To complete a #covered call strangle, 12.0 Put, 12.37 Stock.

AAL STO 5/1/20 10.0 PUTS @.63

AAL STO 5/1/20 10.5 PUTS @.78 Sorry I did these AAL trades, earnings this Friday. We will see.

Monthly Archives: April 2020

NFLX Jeff can you please…

NFLX

Jeff can you please post the earnings evaluation? Thanks

HPE

Bought 100 HPE / Sold 1 HPE 04/24/2020 9.50 Covered Call @ 8.97 Net debit..

Earnings and the next dividend(5%) are not for a while. I’ll add more on further weakness.

RAD DDOG Calls

#coveredcalls

$RAD STO 4/24 14 calls at .40

$DDOG STO 5/15 42 calls at 1.90

TQQQ longs closed

STC $TQQQ Jan 2021 90 calls for 6.50. Bought for 2.50 on March 16th

STC $TQQQ Jan 2021 85 calls for 7.80. Bought for 1.90 on March 27th

I will enter these again when market drops further.

#shortputs #coveredcalls USO HAL VIAC…

#shortputs #coveredcalls USO HAL VIAC BOOT

USO bought 100 shares and sold April 24, 3 call for 2.78 Thanks Fuzzball

USO sold May 15, 2 put for .54 #tastytradefollow

HAL sold 2 April 24, 7.5 covered calls for .47 each

VIAC sold April 24, 15 covered call for .57

BOOT sold May 15, 12.50 put for .97

ADS

Sold 1 ADS 05/08/2020 40.00 Covered Call @ 1.80

USO

#CoveredCalls – Off it’s lows but it was halted for a little while this morning so still a lot of uncertainty. I’m rolling down the calls into next week for max downside protection while maintaining a profit if called away. There might be a possibility of rolling these but it would be tough at these prices especially if the stock rallies much.

Rolled USO APR 24 2020 3.5 Calls to MAY 1 2020 2.5 Calls @ .90 credit

Now:

Make .13 if called away or own stock at 2.37

SLB

Sold SLB APR 24 2020 $17 Covered Calls @ 0.17 replacing similar options that expired Friday

SPXpire

#SPX1dte The bullish slant didn’t come through but got to keep the credit.

$SPX April 20th long call spread and short put spread expired, put on Friday for .55 credit.

XLE Jade Lizard

And another idea borrowed from TastyTrade.

Sold $XLE 6/19 jade lizard (sold 28 puts + 36.21/37.21 bear call spread) for 2.10 credit. No upside risk (1.10 capped profit above 37.21) and downside breakeven of 25.90.

USO

#CoveredCalls – Low risk lottery ticket. Iceman style…buying covered stock with call ITM. Either make a little in a week or own stock considerably lower.

Bought USO stock and sold APR 24 2020 3.5 Calls @ 3.27 debit.

Make .23 or own stock @ 3.27

SPY

#CoveredCalls – Adding one…

Sold SPY APR 24 2020 292.5 Call @ 1.51

JPM strangle

Borrowing an idea from TastyTrade.

Sold $JPM 5/15 75/110 strangle @ 1.75. Put and call deltas at 10 and 13.

TRADES:

RCL STO 4/24/20 40.0 PUT @4.40 An experiment, -1 Put.

CCL BTO STOCK @12.26

CCL STO 4/24/20 12.0 PUTS @.58

PTON CC Apr 24 $32 Net $30.75 #coveredcall

SPY

#ShortPuts – Using a Mon Wed Fri ladder now for a little more safety…

Bought to Close SPY APR 20 2020 277.0 Puts @ .03 (sold for 1.25)

Sold SPY APR 27 2020 273.0 Puts @ 2.10

NVTA TWTR Calls / BX DDOG Puts

#coveredcalls

$NVTA STO 5/15 17.5 calls at .60

$TWTR STO 4/24 28 calls at .40

#shortputs

$BX STO 5/1 46 puts at 1.90

$DDOG STO 5/15 38 puts at 1.90

SLV

Sold 1 SLV Apr 24 2020 14.5 Covered Call at $0.16 replacing a similar option that expired Friday

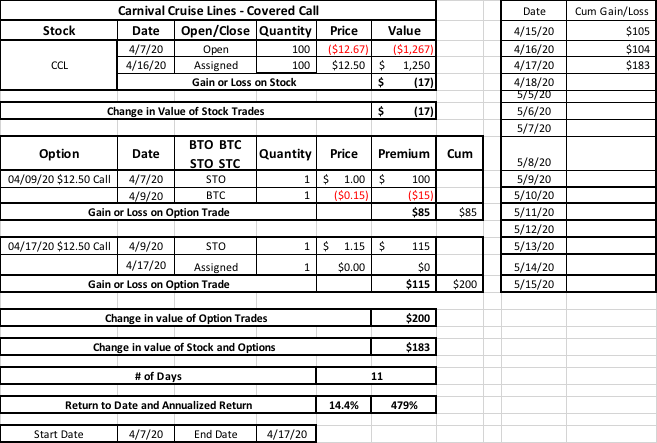

Assigned on CCL Apr 17 $12.50 14.4% Return 11 Days

Thank you to Option Iceman for the trade. #coveredcalls #returnoninvestment

Stock was hovering right around $12.50 strike price as market was closing. Couldn’t get a fair price to roll out so didn’t do anything and it got assigned. Happy with the trade.

Expiration

AA 6 coveredcall

AAL 10 covered call called away

AAL 11 covered call called away

APA 10 covered call

BOOT 10 short put

BOOT 15 covered call

BOOT 15 put assigned

CAR 8 short put

CCL 7.5 short put

CCL 10 covered call called away

CCL 11.50 covered call called away

CPRI 12 covered call called away

FEYE 11.50 covered call

GPRO 2.50 short put

GPS 5.50 short put

GPS 8 short put

GUSH 1 put ns

HAL 8 covered call

HBI 8 covered call called away

HTZ 4 short put

LB short 13 put

LUV short 25 put

MRO 3.5 covered call called away

MRO 4 short put

NBL 7.5 covered call called away

NKTR 17 short put

NKTR 25 covered call

NTGR 21 short put

NUGT 11.50 covered call

OXY 16 covered call

SPY 230/250 long put spread full loss!

T 29.50 covered call called away

UBER 29 covered call

USO 7 covered call

VFC 60 covered call

Expiration

$SPXL $32 Covered Call – ITM Shares called away.

$TLRY $7 Covered Call – OTM

Expiration

#bups

$AAPL 210/220

$AMZN 1900/1920

#shortcalls

$TWTR 37

$NVTA 20

$T 28

#shortputs

$PZZA 57.5 Thank you @jsd50101

$TWTR 35 Assigned

$DDOG 42 Assigned

$UBER 21

$MSFT 155

$PLAN 35

$XOP 35.50 Thanks @ramie77

$ENB 27.5

$UVXY 20 Thank you @jeffcp66

$PFE 35

$CODX 10 Thank you @honkhonk81

#LongPuts

$PTON BTO at 3.79. Ill be pedaling for a while to make this back.

OptionsExpiration

- Getting closer to $CASH after a long rally.

Expired:

ADS 04/17/2020 45.00 Covered Calls

AGNC 04/17/2020 13.50 Covered Calls

AAL 04/17/2020 15.00 Covered Call

IVZ 04/17/2020 12.00 Covered Call

GLW 04/17/2020 22.00 Covered Call

MRO 04/17/2020 4.50 Covered Calls

OXY 04/17/2020 19.00 Covered Call

SLB 04/17/2020 17.50 Covered Call

SLB 04/17/2020 18.00 Covered Calls

SLB 04/17/2020 19.00 Covered Calls

SLB 04/17/2020 20.00 Covered Calls

SLV 04/17/2020 14.50 Covered Call

WFC 04/17/2020 31.00 Covered Call #Earnings

FANG 04/17/2020 22.50 Put

Assignments:

BA 04/17/2020 85.00 Covered Calls (This is my largest gain of the year)

GPS 04/17/2020 7.50 Covered Call

HBAN 04/17/2020 8.00 Covered Call

HBI 04/17/2020 8.00 Covered Call

HFC 04/17/2020 26.00 Covered Call

JPM 04/17/2020 91.00 Covered Call #Earnings

NUGT 04/17/2020 9.00 Covered Call

SPX 1-dte Risk Reversal

#SPX1dte. Given the clearly bullish fervor that has gripped Wall Street, however irrational, I’m selling a more aggressive put spread and buying a call spread, all for a net credit.

Sold $SPX Apr 20th 2775/2755 put spreads

Bought $SPX Apr 20th 2790/2900 call spreads

Total credit: 0.55

IV 24%, SPX 2872, deltas: -.10, +.05

Expiring today: Apr 20th 2655/2675-2895/2915 condors, sold yesterday for 1.20

HFC Rollout

Bought to close HFC 04/17/2020 27.0 Covered Call / Sold 1 HFC 04/24/2020 27.0 Covered Call @ 0.95 Credit

TQQQ

#ShortPuts – Keep trying to get more stock but no luck once again. 🙂 🙂

Bought to Close TQQQ APR 17 2020 65.0 Put @ .05 (sold for 2.40)

Sold TQQQ APR 24 2020 66.5 Put @ 4.00

HAL Rollout

Bought to close 1 HAL 04/17/2020 8.50 Covered Call / Sold 1 HAL 04/24/2020 8.50 Covered Call @ 0.16 Credit with the stock at 7.42

XOM Rollup

Bought to close XOM 04/17/2020 41.0 Covered Call / Sold XOM 04/24/2020 42.0 Covered Call @ 0.39 Credit + 1.00 better strike.

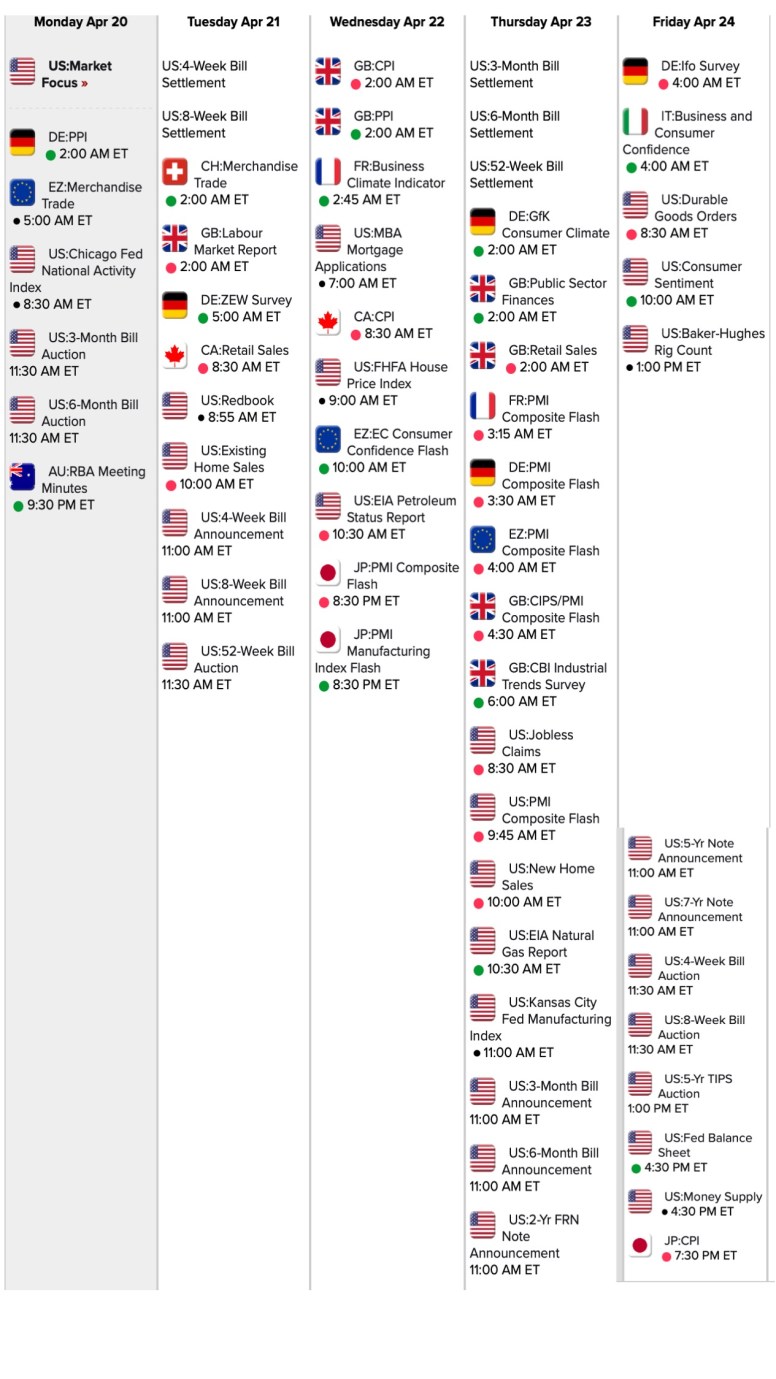

Econ calendar for week of 4/20/20

SLB Put Roll

Bought to close 1 SLB 04/17/2020 17.50 Put / Sold 1 SLB 05/15/2020 17.50 Put @ 0.52 Credit.

SLB cut the quarterly dividend by 75% to $0.125 per share as part of the move to conserve cash and protect its balance sheet. The payout is set for July 9 to shareholders of record on June 3, according to Schlumberger.

AA

Bought to close AA 04/17/2020 8.0 Covered Calls / Sold AA 05/15/2020 8.0 Covered Calls @ 0.25 Credit

AAL Rollout

Bought to close AAL 04/17/2020 15.00 Calls @ 0.01. Sold these on 04/09 @ 0.29.

Sold AAL 04/24/2020 15.0 Covered Calls @ 0.18 with the stock at 11.70.

#shortputs EWZ Added June 19,…

#shortputs EWZ

Added June 19, 20 put for 1.00.

VIAC Rollout

Bought to close VIAC 04/17/2020 18.00 Calls @ 0.01. Sold these on 04/07 @ 0.18.

Sold VIAC 04/24/2020 17.0 Covered Calls @ 0.32 with the stock at 15.50.

BEN – I wasn’t going…

BEN – I wasn’t going to keep this but…

Between the great entry yesterday, the 7% dividend yield, and the good additional premium I rolled the call.

Bought to close BEN 04/17/2020 15.0 Covered Call / Sold BEN 05/15/2020 15.0 Covered Call @ 0.70 Credit.

The additional premium drops my net cost to 14.09 which is below the YTD low

SOXL

STO June 50 put at 2.25 with the stock trading at 125, This is a small position and I will scale in some more at better strike prices.

SPY

#ShortPuts – This completes the ladder for next week…

Sold SPY APR 24 2020 270.0 Puts @ 2.25

TNA Rollup

Bought to close 1 TNA 04/17/2020 16.00 Call / Sold 1 TNA 04/24/2020 17.00 Call @ 0.18 Credit + 1.00 better strike

UDOW

#ShortPuts – Playing it safe…

Bought to Close UDOW APR 17 2020 50.0 Put @ .19 (sold for 2.85)

RCL Covered Call – holding on for another week

Bought to close RCL 04/17/2020 33.0 Call / Sold RCL 04/24/2020 34.0 Call @ 1.18 Credit + 1.00 better strike.

This stock is so volatile, it could be 20 or 50 by next Friday

SPY

#ShortPuts – Starters for next week. C’mon down here Mr. Market…

Sold SPY APR 20 2020 277.0 Puts @ 1.25

Sold SPY APR 22 2020 272.0 Puts @ 1.45

SPY

#ShortPuts – Closing these a little early and look to re-load if we sell off a little this afternoon…

Bought to Close SPY APR 17 2020 273.0 Puts @.05 (sold for 1.75)

Bought to Close SPY APR 20 2020 260.0 Puts @ .10 (sold for 1.95)

CCL

Sold CCL 04/24/2020 15.50 Call @ 0.15 with the stock @ 12.36

#coveredcalls #DXCM

~ JEFFLSMITH ~ EDIT “DEXCOM COVERED CALLS – STOCK RISES $100+ IN A MONTH”

In the past month Dexcom (DXCM) has risen from $190 to over $300. Great news for the stock…..not so good for the APR 17 $260 call. It is discouraging when a stock goes on a huge run and you sold an “at the money” stock option before the rise. The example below is real. $50,505 gain from buying 500 stock on Mar 3 at $206.99. I sold Apr 17 $200 Calls when I bought the stock. The calls have been “rolled up” twice from $200 to $230 and then to $260. Rolling up required an additional $20,728 investment. Instead of a $50,505 gain on the stock the net gain is now $19,180, 40% of what it could have been.

But here is the good news. In 29 days the CC strategy is returning 19.1%. Annualized 241%. Rather than be remorse about the money I missed…..very happy with the potential return so far.

Today is decision day as the Apr 17 $260 calls expire.

Alternatives are:

- Do nothing. Let the options expire and take profit of $19,810.

2. Roll the options out (buy back Apr 17 $260 Call and sell May 15 $260 Call). Rolling the call out generates a credit of $8 per share or $4,000 (Buy back Apr 17 $260 Call for $49 ($24,500) and sell May 15 $260 for $57 ($28,500).

3. Roll the options out and up (buy back Apr 17 $260 Call for $49/share and sell May 15 $305 Call for $29/share. Rolling the call out and up requires an investment of $9,500 (500 shares x $49 = ($24,500) – 500 shares X $29 ($14,500). Rolling up and out increases the strike price from $260 to $300 ($40 a share upside).

On the surface alternative #3 looks like the best idea. The “wild card” is an earnings announcement in early May. Historically Dexcom has shown high volatility around earnings. Stock can go up or down by 10%. Many medical device companies are announcing Q1 earnings and pulling their financial projections for the rest of 2020 until they understand how Covid-19 will impact them.

The downside of adding more Dexcom investment is further portfolio concentration. Dexcom now represents $156K of $236K (66%) of the portfolio. Not a good situation if things were to go wrong.

Likely action…..allow at least 1 Apr $260 Call to be “assigned” and sell 100 shares of stock. Roll the remaining 4 Apr $260 Calls up and out….but not all the way to $305. Probably sell $280 or $290 to offer some protection over the earnings call. This takes some of the profit off the table and helps with the portfolio %. Income tax implications are important….but this is long enough.

SPY jumps 2% after hours

S&P 500 ETF jumps 2% after hours on report Gilead drug showing effectiveness treating coronavirus

https://www.cnbc.com/2020/04/16/sp-500-etf-jumps-2percent-after-hours-on-report-gilead-drug-showing-effectiveness-treating-coronavirus.html?__source=twitter%7Cmain

SPX 1-dte

#SPX1dte Sold to Open $SPX April 17th 2655/2675-2895/2915 condors for 1.20. IV: 33%, SPX 2795, deltas -.04, +.06

Earnings calendar update:

$PG announces tomorrow morning

BEN

Bought BEN / Sold 04/17/2020 15.00 Covered Call @ 14.79 Net Debit with the stock @ 15.17.

A new 5-year low was set today @ 14.91 and the Div yield is about 7%

Assignment will pay for this weekend’s beer run

OXY Ladder Rollouts

Bought to close OXY 04/17/2020 17.50 Covered Call @ 0.01. Sold on Monday @ 0.60.

Sold OXY 04/24/2020 17.00 Covered Call @ 0.15.

Bought to close OXY 04/17/2020 18.00 Covered Call @ 0.01. Sold on Monday @ 0.47.

Sold OXY 04/24/2020 18.00 Covered Call @ 0.14

Plus on 4/15 I got the $79 dividend on my 1st buy of OXY. Future quarterly dividend rates are down to 0.11.

VIAC Rollup

Bought to close VIAC 04/17/2020 16.00 Covered Calls / Sold VIAC 04/24/2020 17.00 Covered Calls @ 0.12 Credit + 1.00 better strike

UVXY call spread

Sold $UVXY 5/15 60/70 bear call spread @ 1.55

ISRG earnings analysis

#Earnings $ISRG reports tonight. Below are details on earnings one-day moves over the last 12 quarters.

Jan. 23, 2020 AC -4.19%

Oct. 17, 2019 AC +6.96%

July 18, 2019 AC -1.45%

April 18, 2019 AC -7.00% Biggest DOWN

Jan. 24, 2019 AC -3.93%

Oct. 18, 2018 AC -3.45%

July 19, 2018 AC -0.86%

April 17, 2018 AC +8.17% Biggest UP

Jan. 25, 2018 AC -2.12%

Oct. 19, 2017 AC +3.39%

July 20, 2017 AC -4.55%

April 18, 2017 AC +6.36%

Avg (+ or -) 4.37%

Bias -0.22%, small negative bias on earnings.

With stock at 510.00 the data suggests these ranges:

Based on current IV (expected move into Friday per TOS): 484.03 to 535.97 (+/- 5.1%)

Based on AVERAGE one-day move over last 12 quarters: 487.28 to 532.28

Based on MAXIMUM one-day move over last 12 Q’s (8.2%): 468.33 to 551.67

Based on DOWN max only (-7.0%): 474.30

Open to requests for other symbols.

ROKU PLAN Roll

#coveredcalls

$ROKU BTC 5/1 110 calls and STO 5/15 120 calls at $2 debit. Stock at 126.52

$PLAN BTC 4/17 30 calls and STO 6/19 40 calls at $3.70 debit. Stock at 35.60

PNC Rollup

Bought to close PNC 04/17/2020 96.00 Covered Call / Sold PNC 05/15/2020 97.00 Covered Call @ 0.87 Credit + 1.00 better strike.

I also will get the 1.15 quarterly dividend at the end of the month.

FITB Rollout Call

Bought to close FITB 04/17/2020 14.00 Covered Call / Sold FITB 05/15/2020 14.00 Covered Call @ 0.78 Credit

TQQQ / LULU

Option Assigned over night – $TQQQ Apr 17 2020 41 #coveredcall Was BTO Mar 19 @ 32.

From Yesterday:

BTC $LULU 177.5/187.5 Apr 2020 #BuPS @0.12. Was STO 2020-04-09 @1.15.

MRVL TQQQ Roll / SLB Closed / T TQQQ Puts

#coveredcalls

$MRVL BTC 4/24 24 call and STO 5/8 26 call at .67 debit

$TQQQ BTC 5/1 57 call and STO 5/15 60 call at .30 debit

#shortputs

$SLB BTC 4/17 13 put at .20. STO 3/27 at 1.30

$T STO 5/15 28 put at .75

$TQQQ STO 6/19 35 put at 2.35 Thank you @jsd501

IHI CC Roll Up and Out

Apr 17 $230 to May 15 $240 Debit $2.30. IHI at $248.16 when written.

SPY

#ShortPuts – Decent one day scalp. Selling Friday a couple strikes lower…

Bought to Close SPY APR 15 2020 275.0 Puts @ .03 (sold for 1.00)

Sold SPY APR 17 2020 273.0 Puts @ 1.75

DXCM Rollout

Rolled Apr 17 $260 Call to May 15 $260 Call for $12.10 Credit. Stock is up $11+ at $292. Don’t want to roll up. Earnings 4/28. Tend to be very volatile and I have been burned at earnings. Large long term capital gain on the stock and don’t want it called away.

GS Earnings

#Earnings #JadeLizards – A big enough pullback is not looking likely saw hitting the eject button with beer money. Hey that’s 2 cases of Silver Bullets if I catch it on sale!

Bought to Close GS APR 17 2020 165.0/175.0/177.5 Jade Lizards @ 2.40 (sold for 2.55)

OXY

Occidental to Pay Warren Buffett’s Berkshire a Stock Premium to Conserve Cash

In an effort to conserve cash at a time of ultralow oil prices, Occidental Petroleum is paying the dividend on Berkshire Hathaway’s $10 billion preferred stock stake in common shares and not in cash, according to a filing early Wednesday.

Occidental (ticker: OXY) will issue 17,274,130 shares to Warren Buffett’s Berkshire (BRK.A), a move that will be nearly 2% dilutive. Occidental is effectively paying Berkshire a premium to save $200 million in cash.

(Note: Berkshire immediately sold that stock dividend and turned it into $CASH – I guess it’s too early to bottom fish)

SPCE

#CoveredCalls – Another small roll up into the week before earnings.

Rolled SPCE APR 24 2020 15.0 Calls to MAY 1 2020 15.5 Calls @ .05 debit (stock basis 14.45)

Banks

https://www.bizjournals.com/cincinnati/news/2020/04/15/fifth-third-u-s-bank-other-banks-sites-go-down-due.html

TSLA – still a rocketship but …

On March 23, Gov. Gavin Newsom made a dramatic announcement: Tesla founder Elon Musk was donating over 1,000 ventilators to California.

It seemed like miraculous news at a moment when the state was desperately searching for ventilators to help save critical coronavirus patients. But was it true?

Newsom’s office now says Musk was supposed to deliver the ventilators directly to hospitals. So far, however, the governor’s office says no California hospital has received them.

https://www.sacbee.com/opinion/editorials/article241982586.html

#shortputs XOM Sold May 1,…

#shortputs XOM

Sold May 1, 35 put for .67 XOM around 40

EWZ XOP

#ShortPuts – Booking XOP and re-deploying into a starter position in EWZ. Thanks @Ramie and @thomberg1201 !

Bought to Close XOP APR 17 2020 35.5 Puts @ .32 (sold for .88)

Sold EWZ MAY 15 2020 23.0 Put @ 1.08

Sold EWZ MAY 15 2020 24.0 Put @ 1.40

Sold EWZ MAY 15 2020 25.0 Put @ 1.78

EDIT:

Adding same strikes in June. Hoping to add to all of these eventually.

Sold EWZ JUN 19 2020 23.0 Put @ 1.73

Sold EWZ JUN 19 2020 24.0 Put @ 2.09

Sold EWZ JUN 19 2020 25.0 Put @ 2.53

Closing XOP short calls

Bought to close $XOP 5/15 53 calls @ .24. Sold for 1.12 on 4/9. They were paired as a short strangle with 5/15 35 puts which I am still short.

#shortputs EWZ Sold May 1,…

#shortputs EWZ

Sold May 1, 22 put @.57, EWZ around 24.80

TQQQ

STO June 35 puts at 2.26

STO June 30 puts at 1.47

XBI

#ShortPuts – Adding one to yesterday’s starter…

Sold XBI MAY 15 2020 75.0 Puts @ 1.50

SPY

#ShortPuts – Sold SPY APR 15 2020 275.0 Puts @ 1.00

Covered Call Strategy on EW

Good return on the strategy so far…..but it would have been better to just buy the shares. Shares dropped after establishing the CC and I rolled down for credit. When stock came back with strong momentum I have been too conservative selling at the money calls. Should have sold out of the money calls but volatility made me conservative. Can’t complain about the rate of return….EW is a stock I would like to keep.

SPX 1-dte

$SPX1dte Sold to Open $SPX April 15th 2705/2725-2940/2960 condors for 1.15, IV: 31.8%, SPX 2841, deltas -.05, +.04.