Bought to close TQQQ Jan 08 2021 200 Calls at $0.01.

Sold these as Diagonal Calls at $0.55 on 12/31.

#TripleDip on my long 220.0 Calls

Monthly Archives: January 2021

OSTK

#CoveredCalls – Small position. Rolling but maintaining some downside hedge.

Rolled OSTK JAN 8 2021 52.0 Calls to JAN 15 2021 52.0 Calls @ 1.10 credit

VXX Calls

Bought to close VXX Jan 08 2021 20.5 Calls @ 0.01. Sold Monday at $0.26.

Bought to close VXX Jan 08 2021 21.0 Calls @ 0.01. Sold Monday at $0.23.

Bought to close VXX Jan 08 2021 21.5 Calls @ 0.01. Sold Monday at $0.21.

ADSK

Sold 2/19 280 put @ 3.10. Earnings not expected until after Feb expiration. Delta 14.

SPY Rolls

Bought to close 1 SPY Jan 08 2021 375.0 Call / Sold to Open 1 SPY Jan 15 2021 377.0 Call @ $0.26 Credit while pushing the strike price up 2 points.

Bought to close 1 SPY Jan 08 2021 374.0 Call / Sold to Open 1 SPY Jan 13 2021 375.0 Call @ $0.14 Credit while pushing the strike price up 1 point.

TSLA’s rocket ship move (up over 20% this week alone) continues to power the SPY ever higher 😦

REGN

#ShortPuts – This is in an account I’m working back to all cash to begin a roll to TDA next week. Age 59.5 is finally here and will happily have everything in one spot now. Nice bounce. Will be looking to get back in prior to earnings…

Bought to Close REGN JAN 15 2021 450.0 Put @ .70 (sold for 4.20)

VLDR

#ShortPuts – Sold Feb at the open so taking Jan profits on the bounce now.

Bought to Close VLDR JAN 15 2021 20.0 Puts @ .15 (sold for 1.00)

PLTR

#ShortPuts – This one has been borderline the entire time so taking it here.

Bought to Close PLTR JAN 8 2021 25.5 Puts @ .30 (sold for 1.00)

VLDR

ShortPuts – Partial fill at the open. Better than nothing I guess.

Sold VLDR FEB 19 2021 17.5 Puts @ 1.00

SPY

In case I’m wrong and the market keeps going up like a SpaceX rocket:

#riskreduction

#ironbutterfly

Closed SPY Jan 15th Butterfly. Net loss 4.10.

Still holding SPX BECS hedged with SPY long call.

SNOW

Not trusting this rally, so:

#shortputs

#riskreduction

BTC SNOW Jan 15th 290 Put for 4.60, STO for 7.00.

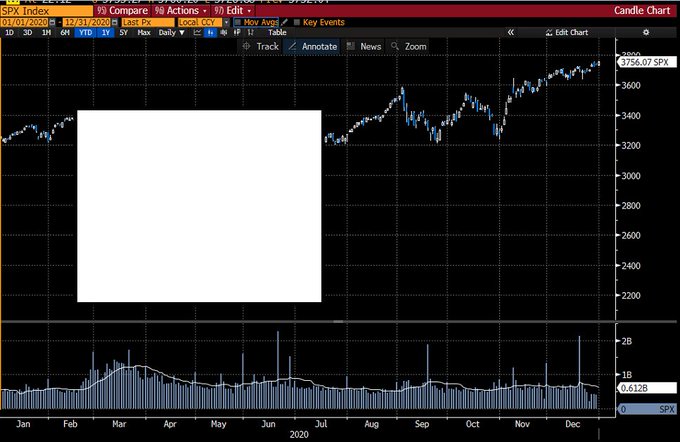

December Jobs Report

#Jobs — LOSS of jobs, first time in 8 months.

Loss of -140,000 non-farm payroll jobs, vs. expected gain of 50K

Unemployment at 6.7%, unchanged

U6 unemployment at 11.7%, down by 0.3%

Labor force participation 61.5%, unchanged

Avg hourly earnings +0.8%

Nov jobs revised up by +91K to +245K

Oct jobs revised up by +44K to +654K

Happy New Year everyone!

A few quick updates. Trying to catch up with the group now that the majority of the work for Traders Reserve and Quantculture is done.

Big 2 weeks for my personal accounts. Finally made back all the losses from the Feb 6, 2018 SVXY implosion that took out 3 of my accounts. They are all either at break even or all time highs. I appreciate the group introducing me to SVXY but since then I make sure I know the underlying and what it can or cannot do. Never be short unhedged volatility again!!!

Sometimes expensive lessons are the most painful but also the best teachers. Since then I stick to my mechanics and had an across the board 60.8% return for 2020 including the market puke in March.

With that said I am trading 6 active accounts each with up to 7-10 positions so posting them would take me hours.

Going forward will just point out really juicy trades that I see.

The Russian virus took out quantculture.com already. We have a back up working on Linux but will probably be a few weeks before it is functional again. Stay tuned, there will be some really useful tools coming in the future. The robot is back up and trading but to be honest has not been that successful. It keeps buying too expensive options. We are tweaking it to trade spreads or at least find the cheapest option or go out farther in time to reduce the theta decay/drag. That should work and also improve its winning %. Will update once it is optimized.

Stay healthy! Hope 2021 is good to everyone. Get your Covid vaccines when you can but expect some side effects. It creates a fairly massive immune response. I just had muscle aches on round 1. I hear round 2 is worse but it could save your life or someone you know. Staff had headaches, muscle aches, fatigue, low grade fevers, and nausea. All resolved in 24 hours.

Cheers!

FSLY Feb

May be a bit early but stock is up over 6% today (at 86.67) and looking like it’s bouncing off the lows. Sold $FSLY 2/19 80/70 bull put spread @ 3.62. Short puts 34 delta.

NVDA

#ShortPuts – Taking this a month early for a one day trade…

Bought to Close NVDA FEB 05 2021 450.0 Put @ 1.84 (sold for 4.40)

TQQQ, Getting filled early. BTC…

TQQQ, Getting filled early. BTC January 15, 65 puts at .02, sold at 4.70

TDOC

#ShortPuts – Taking it a couple weeks early on the big up move…

Bought to Close TDOC JAN 22 2021 180.0 Put @ .40 (sold for 3.70)

SPX trades

#SPX7dteLong Sold to close $SPX Jan 8th 3700/3720 call spreads for 19.70. Condors bought on Monday for 17.60. Put spreads remain as a hedge for tomorrow.

Skipping #SPX1dte for tomorrow as premium is low and #Jobs report is in the morning.

SNOW

#ShortStrangles – I may regret this but going way more directional than normal. Rolling put side into the money giving the short call some more protection.

Rolled SNOW JAN 15 2021 290.0 Put to JAN 15 2021 330.0 Put @ 25.75 credit.

Position is now 330/345 @ 35.90

Worse case stock is assigned at 294.10. If the stock rolls over from here I’ll probably roll the call down to set up a short straddle and reduce assignment basis by a little more.

SPX 7-dte

#SPX7dteLong Bought to Open $SPX 3775/3795-3805/3825 iron condors for 16.10, with SPX at 3802.

LAZR

#ShortPuts – Adding some more…

Sold LAZR JAN 22 2021 27.0 Puts @ 1.30

TDOC BuPS

Strong move today. Sold $TDOC 2/19 200/190 bull put spread @ 2.53. With the short puts at 25 delta, right at support.

TSLA

Crosses above 800 !!

#coveredcalls AAL Sold Jan. 15,…

#coveredcalls AAL

Sold Jan. 15, 17 call for .15, stock at 15.73, basis is 15.11

VXX Calls

Bought to close VXX Jan 08 2021 24.0 Calls at $0.01. Sold these on 12/29 at an average of 0.24.

Bought to close VXX Jan 08 2021 23.0 Calls at $0.01. Sold these on 12/29 at an average of 0.27.

LAZR

#ShortPuts – Stock is up but IV rank still pretty high. Starter position hoping to add at some point. Doing this while tastytrade does a segment on the disadvantages of short term options. LOL!

Sold LAZR JAN 15 2021 28.0 Puts @ .80

LAZR

#ShortPuts – Bought to Close LAZR JAN 8 2021 28.5 Puts @ .05 (sold for 1.80)

TQQQ, BTC January 8, 130…

TQQQ, BTC January 8, 130 puts at .02, sold at 2.01

That is all I have for this week.

VXX Calls

Bought to close VXX Jan 08 2021 25 Calls at $0.01. Sold these on 12/29 at an average of 0.22.

TQQQ, BTC January 8, 115…

TQQQ, BTC January 8, 115 puts at .02, sold at 2.65

TQQQ, STO January 2022, 50…

TQQQ, STO January 2022, 50 puts at 5.55

NVDA pre earnings

#ShortPuts – Big down day 30 days prior to the week before earnings and a defined support level. Favorite pre earnings setup. Selling outside the expected move and down near the 200ma and the week before earnings.

Sold NVDA FEB 05 2021 450.0 Put @ 4.40

SPX trades

#SPX7dteLong Sold to close $SPX Jan 6th 3735/3755 call spreads for 19.00. Condors bought for 17.05 on 12/29.

SPY long Calls

Taking a gain on the long side of the diagonals I have been writing for the last month and rolling it up and out a month.

Sold to Close SPY Jan 15 2021 370.00 Calls at $8.61. Bought these on 12/08/2020 at $7.12

Bought to open SPY Feb 19 2021 385.00 Calls at $4.86.

Put the $375 difference in my pocket for now.

OSTK

#ShortPuts – This position had gotten a little bigger than normal after adding a couple times. Happily taking it considering where it was a couple days ago.

Bought to Close OSTK JAN 08 2021 52.5 Puts @ .37 (sold for 1.55 avg.)

NIO SPWR Puts Closed

#shortputs

$NIO BTC 1/15 40 puts at .20. STO at 4.20

$SPWR BTC 1/15 20 puts at .20. STO at 1.58

COUP

#ShortPuts – Replacing the RH stop out with this.

Sold COUP JAN 29 2021 290.0 Put @ 4.60

FSLR RH

#ShortStrangles – Call sides taking heat so I’m getting out of the way. I’ll learn someday to quit touching the hot stove! 🙂 🙂

FSLR: I’ll apply the small loss to put premium received leaving .75 in the short puts.

Bought to Close FSLR JAN 22 2021 110.0 Calls @ 1.45 (sold for 1.05)

RH: Stopped out with small gain.

Bought to Close RH JAN 15 2021 410.0/480.0 Strangle @ 8.80 (sold for 9.05)

MU Put Closed / ALB Call Closed

#shortputs

$MU BTC 1/8 70 put at .30. STO 1/4 at 1.07. Earnings tomorrow.

#longcalls

$ALB STC 1/15 150 call at 20.20. BTO 12/24 at 5.50.

Unplugged

#Speculation Sold to close $PLUG Jan 15th 20 Calls for 16.00. Calls were bought for .80 on August 12th. I may reload if we get a deep enough pullback.

VXX Put Rolls

Despite the disappointing move in the VIX this morning, I was still able to bring in cash on my rolls to next week.

Rolled VXX 22.50 Puts to next week @ 0.15 Credit

Rolled VXX 21.50 Puts to next week @ 0.20 Credit

Rolled VXX 20.00 Puts to next week @ 0.25 Credit

Rolled VXX 19.50 Puts to next week @ 0.30 Credit

#earnings MU reports tomorrow, any…

#earnings

MU reports tomorrow, any thoughts?

SPX 3 DTE

Sold $SPX 1/8 3640/3665/3805/3830 iron condor @ 4.05. Short puts 14 delta, short calls 13 delta.

/NQ Futures

#BullPutSpreads – Selling a wide put spread down near the 200ma and about 1.5 times the expected move…

Sold /NQ FEB 21 11000/10500 Bull Put Spread @ 42.00

These trade at 20 dollars per point so max gain of $840

SPX 1-dte

#SPX1dte Sold to Open $SPX Jan 6th 3590/3600-3790/3810 iron condors for 1.65, SPX at 3725, IV 23.3%, deltas -.06, +.08.

MARA T Puts

#shortputs

$MARA STO 1/15 13 put at 1.60

$T STO 1/15 30 put at 1.28

$T STO 2/19 29 put at 1.15

SPX 7-dte

#SPX7dteLong Bought to Open $SPX Jan 11th 3690/3710-3720/3740 iron condors for 17.55, with SPX at 3718.

RH BWB – adjustment

Original trade from Dec 21st:

BTO RH Jan 08, 465 / 455 / 435 Broken Wing Put Butterfly @ $3.04 credit

RH exhibiting uncharacteristic weakness so using some of the credit to finance buying some more time for the Short Put spread (455/435) to work:

Buy Jan 08 455/435 put spread / Sell Feb 12 455/435 put spread for $0.39 debit.

If weakness continues expecting to pocket $10 from the long 465 / 455 put spread this Friday.

FSLR

#ShortStrangles – Caught a downgrade today so turning short puts into short strangles.

Sold FSLR JAN 22 2021 110.0 Calls @ 1.05 (87.5/110 @ 2.20 now)

INTC covered calls

Stock bought @ $45.41 – wanting to sell covered calls when INTC crosses $50 (or thereabouts).

Sold half cover Jan 08 $50 calls @ $0.68.

TQQQ

#ShortPuts – Another fill earlier…

Sold TQQQ FEB 19 2021 95.0 Put @ 2.20

SPX trades

Wow, what a wild day to start the year.

#SPX7dte Sold to close $SPX Jan 4th 3730/3710 put spreads for 19.30. Condors bought for 14.25 on Wednesday.

#SPX1dte – Got stopped out of call side the same day I placed the condor (Thursday), and now getting stopped out of 3665/3645 put side. Holding on now for a bounce to make the exit cheap.

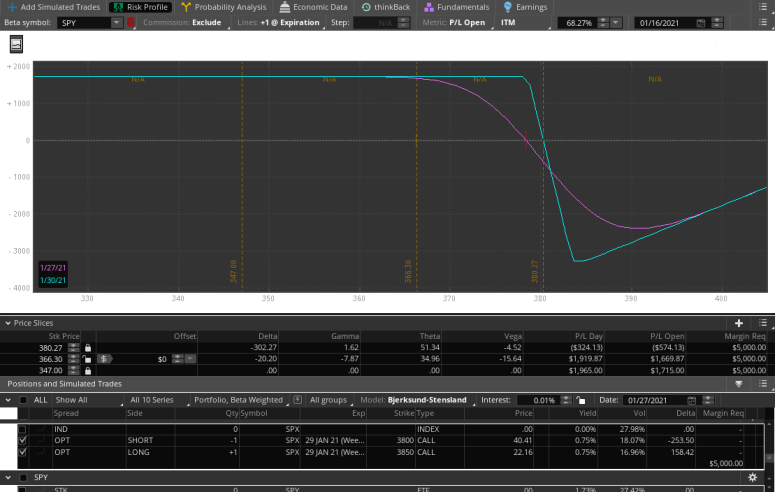

SPX BECS Hedge Using SPY Long Call

Took advantage of the pullback to buy some cheap insurance for my SPX BECS.

BTO 1 Contract SPY Jan 29th 385 Call for 1.10. Paying $110 now reduced my planned exit max risk from $1000 to $575, almost cutting it in half. Max profit now is $1715.

Come to think of it, since the new SPY call expires after my SPY butterfly, it is sort of an extra hedge for that position too.

New SPX P&L Diagram:

TQQQ, STO February 5 105…

TQQQ, STO February 5 105 put at 1.75

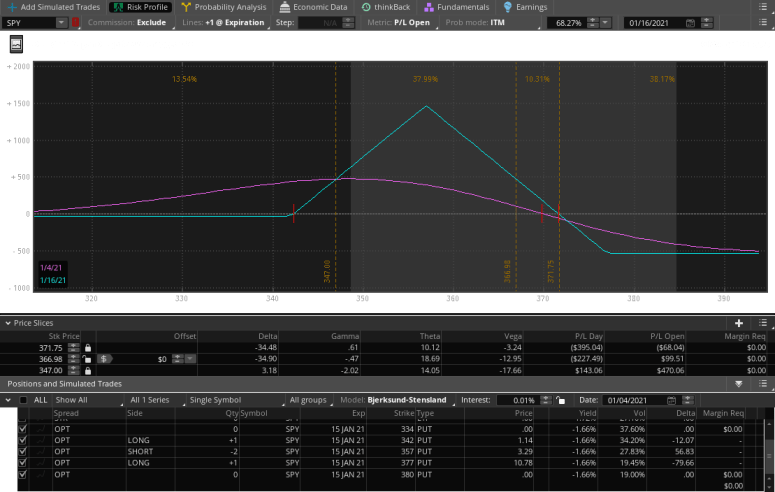

SPY Butterfly Risk Reduction

Took advantage of the early rally to rollup the lowest put and eliminate downside risk. Then, took advantage of the pullback to squeeze the upside of the butterfly to reduce upside risk.

Original Butterfly Strikes:

334 / 357 / 380

New Butterfly Strikes:

344 / 357 / 377

Still targeting between $500 and $1000 profit, new max risk is $534 (only to the upside).

Fans of Butterfly trading and of Gavin Mcmaster may recognize this as a “Reverse Harvey” adjustment. Here’s a reference for anyone interested:

New P&L Diagram:

TQQQ, In my IRA, STO…

TQQQ, In my IRA, STO February 19, 100 puts at 2.60

TQQQ

#ShortPuts – Adding at a lower strike…

Sold TQQQ FEB 19 2021 100.0 Put @ 2.20

TQQQ

@ShortPuts – Thanks @jsd501 for the idea. Going out to Feb for a starter. At the time mid price was 2.25 and I was filled immediately at 2.40 so give it some room.

Sold TQQQ FEB 19 2021 105.0 Put @ 2.40

TQQQ,

STO February 5, 110 puts at 1.85

TQQQ,

STO January 29, 120 puts at 1.65

NFLX RH

#ShortStrangles – A roll and an adjustment…

NFLX: Rolling a week for additional premium.

Rolled NFLX JAN 8 2021 485.0/585.0 Strangle to JAN 15 2021 485.0/585.0 Strangle @ 3.10 credit (8.35 total now)

RH: Rolling call side down slightly…

Rolled RH JAN 15 2021 510.0 Call to JAN 15 2021 480.0 Call @ 2.10 credit (410/480 @ 9.05 now)

TQQQ, STO January 22, 125…

TQQQ, STO January 22, 125 puts at 1.05, dipping my toe into the water.

NIO Strangle / PLTR Call / BIDU Call Roll / OSTK Put Roll

#shortstrangles

$NIO STO 1/8 54/55 straddle at 5.38

#coveredcalls

$PLTR STO 1/8 25 call at .40

$BIDU BTC 1/22 225 call and STO 2/5 232.50 at added credit of .30. Stock at 224.60

#shortputs

$OSTK BTC 1/8 55.5 put and STO 1/15 55 put at .50 added credit

VXX Calls

Sold VXX Jan 08 2021 20.5 Calls at $0.26.

Sold VXX Jan 08 2021 21.0 Calls at $0.23.

Sold VXX Jan 08 2021 21.5 Calls at $0.21.

VXX = 17.29 + 0.50

Replaces some calls that expired on 12/31

NFLX pre earnings

#ShortPuts – First one of the new year! Selling below the 50ma and outside the expected move and a week before earnings…

Sold NFLX JAN 15 2021 490.0 Put @ 2.50

SPY Rollups

I was faked out by the pre-market strength so I probably didn’t get the best fills.

At least I pushed the short strikes up a bit but based on what I’m seeing now(10:15), the shorts for today might have both expired

Oh well …..

Bought to close 1 SPY Jan 04 2021 372.0 Call / Sold to Open 1 SPY Jan 11 2021 375.0 Call @ 0.44 Credit.

Bought to close 1 SPY Jan 04 2021 373.0 Call / Sold to Open 1 SPY Jan 13 2021 377.0 Call @ 0.65 Credit.