$GOOGL BTO 1/16/2026 185 calls at 27.84. Will sell calls during the year. Hope I remember.

Author Archives: geewhiz112

AMD PLTR Call

#coveredcalls

$AMD STO 2/7 128 at 2.20

$PLTR STO 2/7 108 at 1.40

Where have the MAG7 Gone

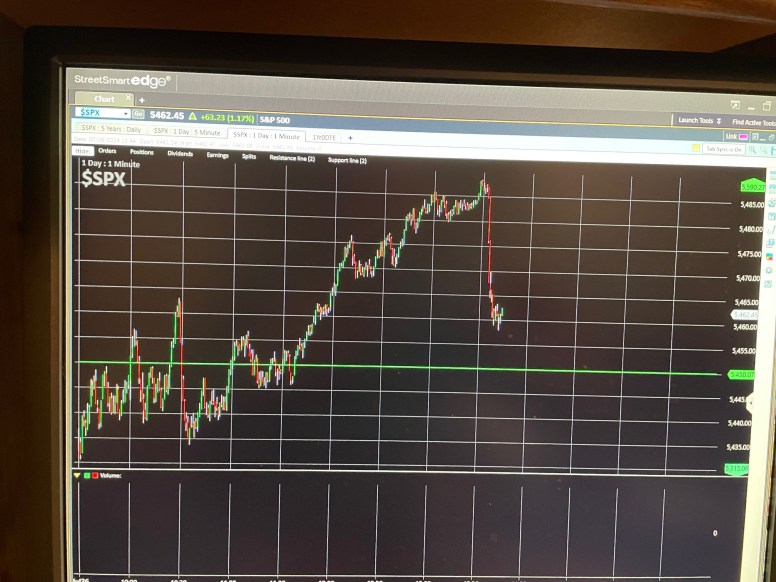

Since January 10, the cap-weighted $SPY has been up 2.6%, but the equal-weight $RSP has been up 5.5%. Similarly, the cap-weighted $QQQ is up +3.1%, but equal weight $QQQE is up 5%. These cap-weighted indexes are, therefore, masking strength in the other stocks, so it isn’t all about the Magnificent Seven this year. What this means is that stock picking may be back.

NVDA Call

#syntheticcoveredcalls

$NVDA STO 1/31/135 call at .40

BA Put Close

#shortputs

$BA BTC 1/24 170 put at .20. Thanks for the idea @fuzzballl Rolled this once and took in 5.40.

Close BA Put

#shortputs

$BA BTC 1/17 167.50 put at .05. STO at 3.25. Thank you @fuzzballl for the idea

Jobs and Sales

US INITIAL JOBLESS CLAIMS ACTUAL 217K (FORECAST 210K, PREVIOUS 201K)

US RETAIL SALES MOM ACTUAL 0.4% (FORECAST 0.6%, PREVIOUS 0.7%)

TQQQ Put Close

$TQQQ BTC 1/17/2025 70 put at .o5 Thanks @jsd501 for the idea

GOOGL META NVDA Calls

$GOOGL STO 1/17 197.5 call at .40

$META STO 1/17 627.5 call at 3.42

$NVDA STO 1/17 137 call at .90

$NVDA STO 1/17 138 call at .90

PLTR Put

$PLTR STO 1/10 75 put at .80

SPX Return By Year

AMZN META Calls

$AMZN STO 1/10 235 call at .51

$META STO 1/10 625 call at 3.50

Expirations

#optionsexpiration

$AMZN 227.5 call

$META 612.5 call

$TSLA 450 call

NVDA PLTR Put Roll

#shortputs

$NVDA BTC 1/3 138 put and STO 1/10 136 put at added credit of 1.20 and $2 less if called away.

$PLTR BTC 1/3 77 put and STO 1/10 76 put at added credit of .54 and $1 less if called away.

META Call

#syntheticcoveredcalls

$META STO 1/3 612.50 call at 1.41

Happy Healthy Prosperous 2025

NVDA Put

$NVDA SYO 3/21 2025 120 put at 6.10

AMZN TSLA Call

#coveredcalls #syntheticcoveredcalls

$AMZN STO 1/3 227.50 call at .50

$TSLA STO 1/3 450 call at 4.20

Expired / Assigned

#optionsexpiration

$AMD 128 call

$META 610 call

$NNE 29.5 call

$NVDA 143 call

$RUM 20 call

$SOUN 25.5 call

#assignment

$RUM 24 put Basis 22.90

SOUN Call and Put

#coveredcalls #shortputs

$SOUN STO 12/27 25.50 call at .65

$SOUN STO 12/27 24 put at 1.10

RUM Call and Put

#shortputs #coveredcalls

$RUM STO 12/27 16 put at .70

$RUM STO 12/27 20 call at .45

PLTR Put

#shortputs

$PLTR STO 1/3/2025 77 put at .96

NVDA Put

#shortputs

$NVDA STO 1/3/2025 138 out at 2.50

Merry Christmas / Happy Hanukkah

Thanks to everyone for sharing great ideas during the year.

Health Happiness and Prosperity to @jeffcp66 and all the Bistroites

META NNE NVDA Call

#coveredcalls #syntheticcoveredcalls

$META STO 12/27 610 call at 3.20

$NNE STO 12/27 29.5 call at .70

$NVDA STO 12/27 143 call at .65

AMD Call

#coveredcalls

$AMD STO 12/27 128 call at .95

Expired

#coveredcalls

$AMD 121 calls

$AMZN 242.50 calls

$GOOGL 207.5 calls

$META 645 calls

The Cat Bounced

#SPY calls

During Wednesday’s yikes moment with ten minutes until close

$SPY BTO 12/20 590 calls at 3.28

Today

$SPY STC 12/20 590 calls at 5.16

AMZN Call

#syntheticcoveredcalls

$AMZN STO 12/20 242.50 call at .45

META GOOGL Call

#coveredcalls

$META STO 12/20 645 call at 1.75

$GOOGL STO 12/20 207.50 call at .50

Happy Thanksgiving

Appreciate you all. A thoughtful, analytical and sharing community.

Thank you @jeffcp66 for making this all possible.

AMZN AMD Calls / DELL Strangle

$AMZN STO 11/29 207.5 call at .45

$AMD STO 11/29 143 call at 1.10

#shortstrangles #earnings

$DELL STO 11/29 150/143 strangle at 8.55

COIN Call

#coveredcalls

$COIN STO 11/22 317.50 call at .55

Options Expiration

#optionsexpiration

$MSFT 427.5 call

$META 567.5 call

$META 587.5 call

$AMSC 28 call Called away

$PLTR 55 call Called away$NVDA 114 put

$PLTR 42 put

META NVDA Calls Rolled

#rolling

$META BTC 11/8 582.5 and STO 11/15 587.5 at added credit of 1.62 and extra $5 if called away

$NVDA BTC 11/8 145 and STO 11/15 147 at added credit of .4 plus $2 more if called away

$MSFT BTC 11/8 422.50 and STO 11/15 427.50 at even but would gain $5 if called away

MSTR Call Roll

$MSTR BTC 11/8 252.5 call and STO 11/15 265 call at added credit of 1.38 and added 12.50 if called away

PLTR NVO NVDA MSTR COIN Calls

#coveredcalls

$PLTR STO 11/8 54 call at .40

$NVO STO 11/8 112 call at 1.12

$NVDA STO 11/8 145 call at .72

$MSTR STO 11/8 252.50 call at 10.00

$COIN STO 11/8 215 call at 4.00

NVDA Put

#shortputs

$NVDA STO 11/8 135 put at 4.93

AMZN INTC GOOGL Call

$AMZN STO 11/1 200 call at 2.07 Earnings Thursday

$INTC STO 11/1 23.50 call at .30 Earnings Thursday

$GOOGL STO 11/1 180 call at 1.57 Earnings tonight

Expirations / PLTR Put

#optionsexpiration

$PLTR 41.50 put

$VKTX 59 put

$ELF 120 call

$BA 170 call

$AMZN 195 call

#shortputs

$PLTR STO 11/1 43 put at .31

COIN Call

#coveredcalls

$COIN STO 11/1 227.50 at 4.95

HOOD Put

$HOOD STO 11/1 26.50 put at 1.15

MSTX Put

Bitcoin Bet

$MSTX STO 11/15 40 put at 5.86

Jobs Looked Good

U.S. Department of Labor

@USDOL

Unemployment Insurance Weekly Claims

Initial claims were 227,000 for the week ending 10/19 (-15,000).

Insured unemployment was 1,897,000 for the week ending 10/12 (+28,000).

Roll VKTX Put

#shortputs

$VKTX BTC 10/11 61 put and STO 10/18 61 put at added credit of 1.01 ($2 taken in so far)

PPI

PPI 0.0% M/M, Exp 0.1%

PPI Core 0.2% MoM, Exp. 0.2%

PPI 1.8% YoY, Exp. 1.6%

PPI Core 2.8% YoY, Exp. 2.6%

Bank earnings looked good this morning

VKTX PLTR Puts

$VKTX STO 10/11 61 put at .90

$PLTR STO 10/11 38 put at .33

Expiration

#assignment

$VKTX 66 put

#optionsexpiration

$TQQQ 70 put

$ENPH 115 call

NVDA Put

$NVDA STO 11/15 114 put at 6.50

TQQQ Put

#shortputs

$TQQQ STO 10/4 70 put at 1.07

VKTX Put

Adding

$VKTX STO 9/27 66 put at 1.80

Expiration TQQQ / VKTX Puts

#optionsexpiration

$TQQQ 65 put

$VKTX 64 put

#shortputs

$TQQQ STO 9/27 68 put at .96

$VKTX STO 9/27 68 put at .1.90

.50% cut

Ooops

CRWD BUPS Close

NVDL Put Close

#shortputs

$NVDL BTC 8/30 60 put at 1.35. STO at 3.93

Options Expiration

#optionsexpiration

$ARM 140 call

$META 555 call

$NVDL 70 call

NVDA Call Roll / NVDL Put Roll

#coveredcalls

$NVDA BTC 8/23 134 call and STO 8/30 144 call at added credit of 2.12. Earnings next week. I think this is within expected move.

#shortputs

$NVDL BTC 8/23 67 put and STO 8/30 60 put at added credit of 3.38 and 7 less if assigned.

PLTR Put

$PLTRSTO 8/23 32 put at .77

VKTX Put Roll

$VKTX BTC 8/16 55 put and STO 8/23 55 put at added credit of 1.08. Total credit so far 3.33

NVDA Puts

$NVDA BTC 8/16 110 put at .10. STO at 3.40. Thank you @fuzzballl

CRWD BUPS Close

$CRWD BTC 8/16 210/225 BUPS at .15. STO at 1.35. Thank you @ramie77 for the trade

Bungee Jump Time???

Schwab Not Working

Thanks to Crowdstrike (?) I cant close out my positions on any Schwab platform other than the new TOS. Unfortunately my accounts not moved over yet.. Not a good place to be on Friday opex!

LLY BUCS

$LLY BTO 8/9 840/880 Bull call spread at 17.03

Earnings 8/8 before market. Plan is to capture earnings run. If it doesn’t work I will at least lose weight since I’ll have less disposable income to eat at McDonalds.

COIN Call

$COIN STO 7/19 250 call at $3.00

Happy Fourth of July

COIN META MSFT TTD Calls

$COIN STO 6/28 235 calls at 1.57

$META STO 6/28 520 calls at 1.82

$MSFT STO 6/28 457.5 calls at .68

$TTD STO 6/28 101 calls at .23

Roll NOVO COIN ARM TTD Call / OLLI Call

#coveredcalls #rolling

$NVO BTC 6/7 139 call and STO 6/14 141 call at even.

$COIN BTC 6/7 245 call and STO 6/14 255 call at .85 added credit plus the $2 if balled away.

$ARM BTC 6/7 129 call and STO 6/14 134 call at cost of .40 but gain $5 if called away.

$TTD BTC 6/7 96 call and STO 6/14 98 call at even.

#coveredcalls

$OLLI STO 6/21 95 call at $1. Earnings were very good.

VKTX NVO Calls / VKTX Put

#coveredcalls

$VKTX STO 6/7 65 call at .63

$NVO STO 6/7 139 call at 1.52

#shortputs

$VKTX STO 6/7 60 put at .58

ARM TTD Call

#coveredcalls

$ARM STO 6/7 129 call at 2.29

$TTD STO 6/7 96 call at .45

COIN Call

#coveredcalls

$COIN STO 6/7 245 call at 3.20

Expiration

#optionsexpiration

$VKTX 69 call

$AMD 180 call

$VKTX 63 put

VKTX Strangle

#shortstrangles

$VKTX STO 5/24 63/69 strangle at 1.60

Expiration

#optionsexpiration

$NVO 136 call

$NVO 134 call

$MARA 18.50 put

$VKTX 78 call

$VKTX 72 put assigned

$AI 27.50 call

$MOS 30 put

$UPST 32.50 call

GME Puts

#longputs

STC 6/21 20 puts at 4.25. BTO 5/14 for 2.10. Taking partial. Thank you @fuzzballl