Author Archives: Jeff

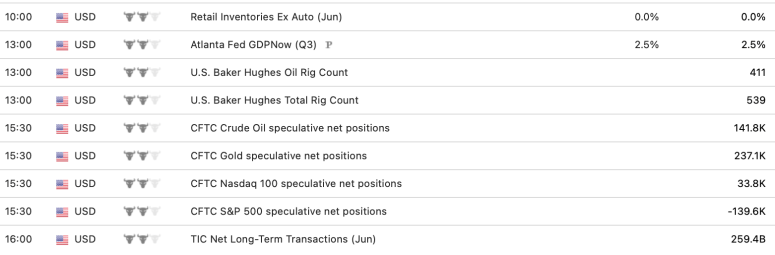

Econ Calendar 10/27 – 10/31

Saving grace

#SPX0dte Sold 6770/6800-6805/6830 condors for 9.95, BTC for 6.50. That took my small loss for the week and made it a small gain. Short trade wins after all. Downside Warning was canceled yesterday which hopefully means a period of calm. I think these last five weeks where I have struggled and abstained started right after a calm period ended and a wild one began. The wild swings began 14 trading days before the China tweet that dumped the $SPX. It’s like the market knew it was coming. And nine days after that VIX is back down and I get a calm Friday afternoon to save the week.

That said, I’m not going back to business as usual. Still going to be cautious.

SPX 0-dte trades for 10/22/25

#SPX0dte Sold to open $SPX Oct 22nd 6650/6670-6790/6810 condors for 1.05, IV 19.36%, deltas -.06 +.05

Earnings 10/20 – 10/24

Econ Calendar 10/20 – 10/24

New VIX high…

Exceeded Tuesday’s high by more than 3.00… is this crashout Thursday?

Day 12 out of 14

#SPX0dte Another day, another EM breach. Got some profit on a long put spread, bought for .35 at the open, legged out for 1.875.

Swings continue

Today is the 11th day out of 13 with an EM breach of the 6-delta condor. I am trying cheap long spreads, puts and calls. Yesterday had a small win on the call side which broke me even. Will happen again today if we go higher. Certainly need to continue my moratorium on short spreads.

Earnings 10/13 – 10/17

Econ Calendar 10/13 – 10/17

SPX 0-dte trades for 10/10/25

#SPX0dte Sold to Open $SPX Oct 10th 6660/6680-6780/6800 condors for 1.05, IV 16.78%, deltas -.07 +.06

SPX 0-dte

#SPX0dte Sold to Open $SPX Oct 9th 6700/6730-6735/6760 condors for 10.60, IV 14.04%. Gotta try something.

Swingy

Day 6 out of the last 7 with an EM breach for 6-delta condor… this time, like yesterday, not much more than a touch before retracing. No trades yet today.

SPX 0-dte trades for 10/8/25

#SPX0dte Sold to Open $SPX Oct 8th 6645/6665-6765/6785 condors for 1.10, IV 16.50%, deltas -.07 +.06

The overnight was mellow so the long trade from yesterday isn’t working, so I’ll either keep it for some protection on upside or close for breakeven or small loss.

SPX 1-dte

#SPX0dte Bought to Open $SPX Oct 8th 6775/6795 call spreads for .35. This same spread for Oct 7th was running about .45 before market and peaked at about 1.60 at the open. Since the market is so swingy any up move overnight should work.

SPX no go

#SPX0dte I’m back from 6-day hiatus and looking at futures shooting to all-time highs (25-point move in last 4 hours); there just is not a safe 0-dte selling opportunity. I’ll watch to see if anything develops.

Earnings 10/6 – 10/10

Econ Calendar 10/6 – 10/10

2025 Volatility persists

This is probably the first full week I’ve taken off from trading in 10 years. After a quiet Monday and Tuesday, the EM on 6-delta condors was hit Wed-Fri. This seems to be the 2025 norm, whereas the 2023-2024 norm was maybe twice in 2 weeks.

I tested the 6-delta all week and had I stopped out quickly when EM hit I would have been breakeven. However, since upside EM hits are common during Upside Warning, it also seems pullbacks are common on its way up. I think by waiting for pullbacks it would eke out a profit on a week like this.

Downside, however, is different. Premium is much higher on downside EM hit, and the drop can continue in earnest. Frustrating part is, that it almost always will bounce and end the day safely. But the one day it doesn’t can be a very large loss. So I have to consider how to manage downside EM breaks. That happened on Thursday this week and it was a 2.10 payout to close when it hit, but then went much deeper…. but eventually bounced and actually ended the day with new all-time closing high.

I also tested a cheap 60-cent LONG condor… 30-cent spreads on each side, then close the winning side at or above 1.20. Obvious losses on Monday and Tuesday but wins the other three days. Total profit for the week: 95 cents. Possible solution until the market returns to less swingy status. I think days like Monday and Tuesday, after a couple hours of consolidation, can be good for some tight condors.

Earnings 9/29 – 10/3

Econ Calendar 9/29 – 10/3

SPX 0-dte trades for 9/26/25

#SPX0dte Sold to Open $SPX 6540/6560-6675/6695 condors for 1.00, IV 19.45%, deltas -.07 +.05

.10 close orders on each leg. Manual stop level is Expected Move in each direction.

SPX 0-dte trades for 9/25/25

#SPX0dte BOUGHT to Open 6505/6525-6655/6675 condors for .90, IV 20.77%, deltas -.05 +.05

No choice but to take a long position and assume the sharp moves continue. $VIX has not gone up very much after two down days, so a bounce could be in the cards. When I entered this trade about 40 minutes before open it was going for 1.20 and deltas of -.07, +.06. A half hour reduced all of that significantly.

SPX 0-dte trades for 9/24/25

#SPX0dte Sold to Open $SPX Sep 24th 6620/6640-6690/6710 condors for 3.40, filled at open, deltas -.17 +.17. Going for $1

SPX 0-dte trades for 9/23/25

#SPX0dte Sold to Open $SPX Sep 23rd 6630/6650-6730/6750 condors for .95, IV 13.60%, deltas -.08 +.05

SPX 0-dte trades for 9/22/25

#SPX0dte Sold to Open $SPX Sep 22nd 6575/6595-6680/6700 condors for .95, IV 14.85%, deltas -.07 +.06

Earnings 9/22 – 9/26

Econ Calendar 9/22 – 9/26

SPX 0-dte trades for 9/19/25

#SPX0dte Sold to Open $SPX Sep 19th 6550/6570-6695/6715 condors for 1.05, IV 20.11%, deltas -.07 +.06

SPX 0-dte trades for 9/18/25

#SPX0dte Sold to Open $SPX Sep 18th 6550/6570-6695/6715 condors for 1.05, IV 20.33%, deltas -.07 +.06

No trades yesterday as the big drop then bounce during presser kept me away.

SPX 0-dte (possible) trades for 9/17/25

#SPX0dte No trades yet, and I may have none. Depends on whether market is calm as presser winds down. I’m monitoring both a wide and narrow condor since pre-market and both have gone UP in premium, meaning there is no decay happening before the announcement.

SPX 0-dte trades for 9/16/25

#SPX0dte Sold to Open $SPX Sep 16th 6565/6585-6655/6675 condors for 1.00, IV 13.13%, deltas -.09 +.07

SPX 0-dte trades for 9/15/25

#SPX0dte Sold to Open $SPX Sep 15th 6580/6610-6615/6645 condors for 10.00, IV 15%

Pre-market trades not really tenable lately so I skipped them and waited for market to calm down.

Earnings 9/15 – 9/19

Econ Calendar 9/15 – 9/19

SPX 0-dte trades for 9/11/25

#SPX0dte Sold to Open $SPX Sep 11th 6500/6520-6575/6595 condors for 3.80, deltas -.18 +.16. Looking for $1 profit

CPI up 2.9% y/y in August

The consumer price index posted a seasonally adjusted 0.4% increase for the month, double the prior month, putting the annual inflation rate at 2.9%, up 0.2 percentage point from the prior month and the highest reading since January. Economists surveyed by Dow Jones had been looking for respective readings of 0.3% and 2.9%.

https://www.cnbc.com/2025/09/11/consumer-prices-rose-at-annual-rate-of-2point9percent-in-august-as-weekly-jobless-claims-jump.html

SPX 0-dte trades for 9/9/25

#SPX0dte Sold to open $SPX Sep 9th 6435/6455-6540/6560 condors for 1.05, IV 15.08%, deltas -.07 +.06

SPX 0-dte trades for 9/8/25

#SPX0dte Sold to Open $SPX Sep 8th 6465/6495-6500/6530 condors for 13.15, IV 15.18%

Earnings 9/8 – 9/12

Econ Calendar 9/8 – 9/12

August Jobs Report

#Jobs — Lower than expected

Gain of +22,000 non-farm payroll jobs, vs. expected gain of 75K

Unemployment up by 0.1 at 4.3%

U6 unemployment 8.1%, up by 0.2

Labor force participation up 0.1 to 62.3%

Average hourly earnings up by 0.3%; +3.7% Y/Y

July jobs revised up by +6K to +79K

June jobs revised down by -27K to -13K

SPX 0-dte trades for 9/4/25

#SPX0dte Sold to Open $SPX Sep 4th 6375/6395-6490/6510 condors for 1.05, IV 16.15%, deltas -.07 +.06

SPX 0-dte trades for 9/3/25

#SPX0dte Sold to Open $SPX Sep 3rd 6405/6435-6440/6470 condors for 14.25, IV 16.20%

SPX 0-dte trades for 9/2/25

#SPX0dte Bought to Open $SPX Sept 2 6300/6280 put spreads for .50, IV 25.31%, delta -.05

At midnight PDT the futures started their drop for the beginning of the historically worst month for the stock market. I’m staying away from the selling, taking a cheap shot for a further downside move after the open.

Earnings 9/1 – 9/5

Econ Calendar 9/1 – 9/5

SPX 0-dte trades for 8/29/25

#SPX0dte Sold to Open $SPX Aug 29th 6425/6455-6460/6490 condors for 14.90, IV 19.64%

SPX 0-dte trades for 8/28/25

#SPX0dte Sold to Open $SPX Aug 28th 6415/6435-6525/6545 condors for 1.10, IV 15.70%, deltas -.07 +.07

It has been a well-contained week and this trade would havew worked all three days. So I’m lifting my moratorium.

SPX 0-dte trades for 8/27/25

#SPX0dte Sold to Open $SPX Aug 27th 6435/6465=6470/6500 condors for 12.35, IV 13.43%

SPX 0-dte trades for 8/26/25

#SPX0dte Sold to Open $SPX Aug 26th 6405/6435-6440/6470 condors for 12.70, IV 14.07%

SPX 0-dte trades for 8/25/25

#SPX0dte Taking a pause on the pre-market entries for the 6-delta condors. Although this has been my strongest strategy for about 7 years, it hasn’t been consistent for many months now. I will reinstate the normalcy when I feel the market has restored some normalcy. Meantime I will look for tighter condor opportunities after the mornings calm down, and occasional shots with long spreads.

Earnings 8/25 – 8/29

Econ Calendar 8/25 – 8/29

SPX 0-dte trades for 8/22/25

#SPX0dte Sold to Open $SPX Aug 22nd 6255/6275-6470/6490 condors for 1.50, IV 34.76%, deltas -.06 +.05

Was considering sitting on hands but this is pretty good width and premium anticipating Powell’s 10am speech.

SPX 0-dte trades for 8/21/25

#SPX0dte BOUGHT to open $SPX Aug 21st 6305/6285 put spreads for .55, IV 20.74%, delta -.06

I’m sticking with long trades at least until we get a day or two of muted moves. I’m only bothering with put side today, given we have trickled lower overnight.

I have also been watching for tight condor options later in the trading day, but the swings have kept up in last two afternoons.

SPX 0-dte trades for 8/20/25

#SPX0dte Yesterday was a decent drop. $VIX closed higher but made a LOWER high and a lower low than the day before. The internals just not in sync. I’m buying long condor today.

Not fill yet…. I will increase buy price if not filled before the open.

BUYING $SPX Aug 20th 6325/6345-6450/6470 condors, bidding .90, IV 17.10%, deltas -.05 +.05

SPX 0-dte trades for 8/19/25

#SPX0dte Sold to Open $SPX 6390/6410-6480/6500 condors for 1.15, IV 13.13%, deltas -.085 +.065

IV, EM, premium not expecting much today so this condor a bit aggressive.

SPX 0-dte trades for 8/18/25

#SPX0dte Sold to Open $SPX Aug 18th 6375/6395-6485/6505 condors for 1.05, IV 15.75%, deltas -.08 +.06

Earnings 8/18 – 8/22

Econ Calendar 8/18 – 8/22

SPX 0-dte trades for 8/15/25

#SPX0dte Sold to Open $SPX Aug 15th 6400/6420-6520/6540 condors for 1.15, IV 17.87%, deltas -.08 +.06

SPX 0-dte trades for 8/14/25

#SPX0dte Sold to Open 6355/6375-6485/6505 condors for 1.15, IV 19.70%, deltas -.06 +.06

SPX 0-dte trades for 8/13/25

#SPX0dte Sold to Open $SPX Aug 13th 6400/6420-6495/6515 condors for 1.05, IV 14.18%, deltas -.08 +.07

Sharp drop in IV and premium today, so this one is a bit aggressive. Overnight move was bullish but only represents about 20 SPX points which is modest compared to recent weeks.

SPX 0-dte trades for 8/12/25

#SPX0dte I’m skipping the wide condor given the large move after CPI report. Until this market returns to some semblance of normality I will be picking my spots more selectively.

CPI 2.7% in July, less than expected

The consumer price index increased a seasonally adjusted 0.2% for the month and 2.7% on a 12-month basis, the Bureau of Labor Statistics reported Tuesday. That compared to the respective Dow Jones estimates for 0.2% and 2.8%.

https://www.cnbc.com/2025/08/12/cpi-inflation-report-july-2025.html

SPX 0-dte trades for 8/11/25

#SPX0dte Sold to Open $SPX Aug 11th 6315/6335-6435/6455 condors for 1.00, IV 17.11%, deltas -.07 +.06

I’m taking the brief Downside Warning’s end on Friday as a sign the moves will quiet a bit. At least for today. We’ll see if CPI starts to get ugly tomorrow morning.

Earnings 8/11 – 8/15

Econ Calendar 8/11 – 8/15

SPX 0-dte trades for 8/8/25

#SPX0dte BOUGHT to open $SPX Aug 8th 6275/6295-6405/6425 condors for .95, IV 19.26%, deltas -.06 +.07

After 9 straight days of big moves, I feel forced to reverse strategy and try this long on both sides. Over these nine days the pattern has mostly been to start the move about a half hour or more into the day. So I found my strikes at my usual time, about 45 minutes before the open. This time they would gave SOLD for 1.05. I waited until after the open for a cheaper BUY price. So we’ll see if this becomes the 10th day, two full trading weeks, where the SPX moves past the expected move on 6-ish-delta condors. Since I’m now long, it’s probably the day it won’t happen!

SPX 0-dte trades for 8/7/25

#SPX0dte After 8 days straight of Expected Move getting hit, I’m throwing in the towel and getting directional. Although it is downside that was most tested, I think we bottomed on Friday and now will recover to new highs. So I’m trying a bullish #RiskReversal. This condor would have gotten me about 1.10 had I sold both sides.

Sold to open $SPX Aug 7th 6315/6295 puts, delta -.07

Bought to open 6430/6450 calls, delta -.05

Total CREDIT +.20

IV 19.30%

SPX 0-dte trades for 8/6/25

#SPX0dte Sold to Open $SPX Aug 6th 6225/6245-6360/6380 condors for 1.05, IV 19.60%, deltas -.06 +.05

SPX 0-dte trades for 8/5/25

#SPX0dte Sold to Open $SPX Aug 5th 6250/6270-6385/6405 condors for 1.15, IV 19.53%, deltas -.07 +.06

forgot to click “post” but this was placed about 38 minutes before the open.

SPX 0-dte trades for 8/4/25

#SPX0dte Sold to Open $SPX Aug 4th 6170/6190-6325/6345 condors for 1.30, IV 23.20%, deltas -.06 +.06