#CoveredCalls – Sending this one packing. Sold all covered stock at a loss of 1.75 per share. Didn’t hear much in the earnings one way or another so not worth the risk anymore.

Goodbye ol’ buddy. One of my top 5 performers since it went public.

🙂 🙂

#CoveredCalls – Sending this one packing. Sold all covered stock at a loss of 1.75 per share. Didn’t hear much in the earnings one way or another so not worth the risk anymore.

Goodbye ol’ buddy. One of my top 5 performers since it went public.

🙂 🙂

#CoveredCalls – Looks like it’s wanting to recover but I’m selling next week at breakeven for max downside protection.

Bought to Close LABU AUG 13 2021 60.0 Calls @ .10 (sold for 2.54)

Sold LABU AUG 20 2021 55.0 Calls @ 4.10

#CoveredCalls – Would really like for these to get called away. Rolling down and out prior to earnings. This will be sitting pretty close to breakeven.

Rolled LAZR AUG 13 2021 19.0 Calls to AUG 27 2021 18.0 Calls @ .74 credit (basis now 18.16)

#coveredcalls

$BX STO 8/13 116 call at .30

#shortputs

$SOXL STO 9/17 39 put at 2.05

$SOXL BTC 8/20 38 put at .20. STO at 2.35 Thank you @fuzzballl

$MRVL STO 8/13 58.50 put at .26

#shortputs

$TQQQ BTC 8/27 put at .40. STO at 1.72. Thank you @jsd501

$TQQQ STO 8/13 126 put at .30. Thank you @optioniceman

#coveredcalls

$PINS STO 8/13 60 call at .65

$BNTX STO 8/13 450call at 14.70

$LABU STO 8/13 62.50 call at 1.50

$NVAX STO 8/13 220 call at 3.80

$TSLA STO 8/13 735 call at 5.50

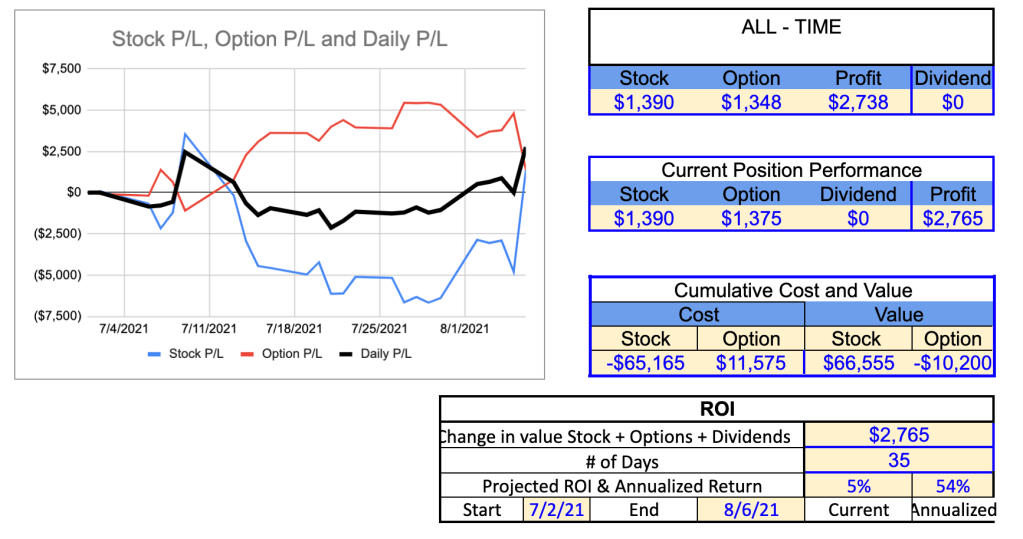

Couple of weeks ago I posted about opening a new CC shortly after CFLT IPO. Stock price did go up after establishing the position only to start a sustained decline……until last week when the stock recovered.

Last week was an interesting time for the banks/analysts to come out with strong upgrades and new target prices pushing the price up …..considering the IPO lock up expires on Monday……

Little nervous heading into next week so we wrote ITM calls at $40 (Sep).

Position looks good today with a 54% annualized return…..might feel different next Saturday….hopefully not but can’t say I have a lot of trust in the bankers…….

Black line in the graph is the net of the stock and option profitability. They were mostly offsetting until the last week.

#CoveredCalls – Going another week.

Bought to Close LABU AUG 6 2021 60.0 Calls @ .14 (sold for 1.22)

Sold LABU AUG 13 2021 60.0 Calls @ 2.54

#CoveredCalls – Earnings next week. Covering early.

Bought to Close LAZR AUG 6 2021 19.0 Calls @ .01 (sold for .47)

Sold LAZR AUG 13 2021 19.0 Calls @ .50

#CoveredCalls – Last little scrap of 100 shares with no interest in getting stuck if it tanks on earnings. Taking small loss.

Sold SPCE Covered Stock @ 30.22 (basis 31.56)

#shortputs

$SOXL BTC 8/20 34 put at .30. STO at 1.85.

$SOXL BTC 8/20 40 put at .80. STO at 3.90

$SOXL BTC 8/20 39 put at .70. STO at 2.70. Thank you @fuzzballl

$TQQQ STO 12/17 65 put at 2.70. Thank you @jsd501

$MRVL STO 8/6 60 put at .45 and .39.

$MRVL STO 8/13 59 put at .56

$O STO 8/20 67.50 put at .35

#coveredcalls

$BX STO 8/6 119 call at .57. Sold against LEAPS

$T STO 8/13 28.50 call at .25

#CoveredCalls #ShortPuts – Covering and adding.

Sold PINS AUG 20 2021 62.5 Calls @ .95

Sold PINS AUG 20 2021 55.0 Puts @ 1.05

#ShortPuts #CoveredCalls – A few more.

FB: Lottery ticket expiring for loss.

FB JUL 30 2021 365.0/375.0/375.0/385.0 @ 10.00 (sold for 8.50)

SPOT: Covered.

Bought to Close SPOT JUL 30 2021 237.5 Call @ .05 (sold for 11.50)

Sold SPOT AUG 20 2021 235.0 Call @ 4.56

TNA: Taking about half of max 3 weeks early.

Bought to Close TNA AUG 20 2021 65.0 Puts @ .63 (sold for 1.20)

Bought to Close TNA AUG 20 2021 70.0 Put @ 1.09 (sold for 1.90)

#ShortPuts #CoveredCalls – A few…

COIN: Book it and wait for earnings.

Bought to Close COIN AUG 6 2021 210.0 Put @ .80 (sold for 2.55)

LABU: Finally taking stock. Will be assigned at 62.25. Covering early slightly below basis. Come and get it.

Sold LABU AUG 6 2021 60.0 Calls @ 1.22

LAZR: Stock will be assigned at 19.85. Covering early. Earnings in two weeks. One of my top performers of the year so would let it go for tiny loss.

Sold LAZR AUG 6 2021 19.0 Calls @ .47 average.

SPCE: One contract I couldn’t get out of. Will be assigned at 32.80. Covering early. Earnings next week so might add.

Sold SPCE AUG 6 2021 32.0 Call @ 1.24

#shortputs

$NVAX BTC 7/30 175 put at .40. STO at 5.40.

$AAPL BTC 7/30 146 put at .75. STO at 2.63.

$SOXL BTC 8/20 25 put at .10. STO at 1.05.

$LABU BTC 7/30 63 put and STO 8/6 62 put at added credit of .30.

$LABU BTC 7/30 64 put and STO 8/6 63 put at added credit of .10.

#coveredcalls

$NVAX BTC 7/30 177.5 call and STO 8/6 192.5 call at added credit of 1.40.

#CoveredCalls – Sold the covered call slightly below my basis for max protection. Stock didn’t drop quite enough so letting it get called away tomorrow for a 2.80 loss. Jumping back into the stock with a directional play. This will get me back to overall profit on the whole thing or get back into the sock at a reasonable level.

Sold TDOC AUG 20 2021 155.0/145.0 Bull Put Spread @ 4.18

#ShortPuts #CoveredCalls #Earnings – Same as SPOT. Taking stock assignment at 152.45 in the pre earnings trade. Selling earnings week covered call now in case the stock remains weak. In an IRA so have to spread it. Selling for max downside protection just below basis.

Sold TDOC JUL 30 2021 135.0/245.0 Bear Call Spread @ 14.65

#ShortPuts #CoveredCalls #Earnings – Taking stock assignment at 249.40 in the pre earnings trade. Selling earnings week covered call now in case the stock remains weak. In an IRA so have to spread it. Selling for max downside protection near breakeven.

Sold SPOT JUL 30 2021 237.5/385.0 Bear Call Spread @ 11.50

First time in this. Recent IPO. Stock was at $43.38

08/20/2021 $40 Call at $7.23

08/20/2021 $45 Call at $4.99

08/20/2021 $50 Call at $3.31

#shortputs

$TQQQ BTC 7/9 70 put at .05. STO at .90. Thank you @jsd501

#coveredcalls

$ALB BTC 7/16 170 call and STO 8/20 175 call at added credit of 2.95 and added $5 if called away.

#shortputs

$SNOW BTC 7/2 230 put at .80. STO at 4.70. Thank you @jsd501

$SNOW STO 7/2 235 put at 1.25 Thank you @fuzzballl

$COUP BTC 7/16 195 put at .30. STO at 3.30. Thank you @fuzzballl

$UPST STO 6/25 123 put at 2.60

$VLO BTC 7/2 80 put at .60. STO at 3.86.

#coveredcalls

$RBLX BTC 7/2 92 calls at 1.40. STO at 6.45

#ShortPuts #CoveredCalls – A little early on a couple but nice to see some volatility coming back.

LABU: Adding.

Sold LABU JUL 16 2021 59.0 Put @ 2.80

Sold LABU JUL 16 2021 61.0 Put @ 2.20

Sold LABU JUL 16 2021 62.0 Put @ 2.50

ROKU: Rolling covered and a new position.

Rolled ROKU JUN 18 2021 320.0 Call to JUL 16 2021 320.0 Call @ 5.40 credit

Sold ROKU JUL 16 2021 310.0 Put @ 6.00

SPOT: Rolling covered.

Rolled SPOT JUN 18 2021 235.0 Call to JUL 2 2021 235.0 Call @ 2.35 credit

TWTR:

Bought to Close TWTR JUN 18 2021 55.5 Puts @ .05 (sold for 1.04)

#coveredcalls

$UPST STO 6/18 130 call at 2.30 Thanks for the idea @honkhonk81

#coveredcalls

$EL BTC 6/18 310 call at .20. STO at 1.60 on 6/8

$RBLX BTC 6/18 88 call and STO 7/2 92 call at even. Been at this a while. Still at a debit of $6 but have moved strike up from 79. Stock now at 92.42. Should call the whole thing off soon.

#ShortPuts #CoveredCalls – Closing and opening.

COUP: Post earnings quickie.

Bought to Close COUP JUL 16 2021 195.0 Put @ 1.75 (sold for 4.20)

PINS:Expiring. Already sold next batch.

62.0 Puts (sold for .90)

ROKU: Still holding a little stock covered. Booking the rest.

Bought to Close ROKU JUN 18 2021 315.0 Put @ .65 (sold for 5.10)

Bought to Close ROKU JUN 18 2021 320.0 Put @ 1.02 (sold for 6.50)

SNOW: Booking and reloading.

Bought to Close SNOW JUN 18 2021 220.0 Put @ .85 (sold for 3.30)

Bought to Close SNOW JUN 18 2021 225.0 Put @ 1.50 (sold for 4.90)

Sold SNOW JUL 16 2021 215.0 Put @ 4.40

Sold SNOW JUL 16 2021 220.0 Put @ 5.50

SPOT: Covered rolling another week. Old earnings trade with even as the goal.

Rolled SPOT JUN 11 2021 235.0 Call to JUN 18 2021 235.0 Call @ 1.50 credit

#coveredcalls

$EL STO 6/18 310 call at 1.60

$LEN STO 6/11 97 call at .70

$NVTA STO 6/18 32.50 call at .56

#shortputs

$LABU BTC 6/11 66 put at 1.08. Rolled twice for total credits of 8.20. Thank you @fuzzballl

$LABU BTC 6/18 65 put at 2.75. STO at 9.62.

$LABU BTC 6/18 64 put at 1.80. STO at 8.90.

$SNOW STO 7/2 230 put at 4.70. Thank you @jsd501

$COUP STO 7/16 195 put at 3.30. Thank you @fuzzballl

$SOXL BTC 6/18 37 put at 2.75. STO at 9.86. @fuzzballl strikes again. Merci!

$SOXL STO 6/18 34 put at 2.05.

$T BTC 6/18 31 put and STO 7/16 31 put at added credit of .53

#coveredcalls

$VLO STO 6/11 85 call at .75

#shortputs

$SNOW BTC 6/18 205 put at .40. STO at 3.10. Thank you @fuzzballl

#ShortPuts #CoveredCalls – A couple trades this morning.

LAZR: New starter positions.

Sold LAZR JUN 25 2021 21.0 Puts @ 1.00

Sold LAZR JUN 25 2021 21.5 Puts @ 1.20

SPOT: An old earnings trade. Breakeven is the goal.

Bought to Close SPOT JUN 4 2021 237.5 Call @ .22 (sold for 4.20)

Sold SPOT JUN 11 2021 235.0 Call @ 5.02

#shortputs

$ALB STO 6/18 165 put at 3

$RBLX STO 6/4 95 put at 1.27

$TQQQ STO 7/16 80 put at 2.10. Thank you @walter6871

#coveredcalls

$LEN STO 6/4 99 call at .50

#shortputs

$TQQQ BTC 6/18 45 put at .05. STO at 1.26. Thank you @jsd501

$ROKU BTC 6/4 23 put at .20. STO at 2.47.

#coveredcalls

$VUZI STO 6/18 20 call at .80.

#earnings

$NVDA BTC 575/650/660 Jade Lizard at 6.80. STO at 9.30. Thank you @fuzzballl

#CoveredCalls #ShortPuts – Rolling and adding.

Rolled TWTR MAY 28 2021 54.0 Calls to TWTR JUN 18 2021 54.5 Calls @ .28 credit

Sold TWTR JUN 18 2021 55.5 Puts @ 1.04

#shortputs

$ALB STO 6/18 160 put at $4.00

$SNOW STO 6/18 205 put at $3.10 Thank you @fuzzballl

$SNOW BTC 5/28 215 put at .50. STO at 3.80. Thank you @fuzzballl

$SOXL BTC 6/18 33 put at 1.00. STO at 4.00. Thank you @fuzzballl

#coveredcalls

$DAN STO 6/18 28 put at .50

#CoveredCalls #ShortPuts – One annoying position and one new position.

Assigned stock at 450.0 and basis since reduced to 345.50 Leting stock get called away at 317.50 so a manageable loss to recover now. Starting a put selling replacement program on it.

Sold ROKU JUN 18 2021 320.0 Put @ 6.50

And a new position in a different account:

Sold ROKU JUN 18 2021 315.0 Put @ 5.10

#CoveredCalls – Barely ITM so rolling another week for nice credit.

Rolled TWTR MAY 21 2021 54.0 Calls to MAY 28 2021 54.0 Calls @ .90 credit (1.95 total now)

#CoveredCalls – Replacing this week’s.

Sold SPOT JUN 4 2021 237.5 Call @ 4.20

#CoveredCalls – A few adjustments.

LAZR: Small profits and new positions. Replacing stock getting called away.

Bought to Close LAZR MAY 21 2021 22.5 Puts @ 1.15 (sold for 1.70)

Sold LAZR JUN 11 2021 20.0 Puts @ 1.20

Sold LAZR JUN 11 2021 20.5 Puts @ 1.35

Sold LAZR JUN 11 2021 21.0 Puts @ 1.66

PINS: Nice premium collection.

Rolled PINS MAY 21 2021 60.0 Calls to JUN 4 2021 60.0 Calls @ 1.50 credit (4.05 total now)

ROKU: Out and up a week.

Rolled ROKU MAY 21 2021 315.0 Call to MAY 28 2021 317.5 Call @ .34 credit (7.34 total now)

#shortputs

$SOXL BTC 5/21 35 put and STO 6/18 33 put at added credit of .45

$SOXL BTC 5/21 38 put and STO 6/18 37 put at added credit of .20

#coveredcalls

$RBLX STO 5/21 79 call at $1

#CoveredCalls – A couple this morning. Still out on the road…took delivery of my moving home last Saturday so been kinda busy with that getting some bugs worked out.

PLTR: A new batch…covered.

Bought to Close PLTR MAY 21 2021 24.0 Calls @ .04 (sold for 1.38)

Sold PLTR JUN 18 2021 20.0 Calls @ .95

ROKU: Booked, scalped, sold…covered

Bought to Close ROKU MAY 14 2021 330.0 Call @ .10 (sold for 4.30)

Sold ROKU MAY 21 2021 320.0 Call @ 9.00 (16 seconds after the open)

Bought to Close ROKU MAY 21 2021 320.0 Call @ 5.00 (17 minutes later 🙂 🙂 )

Sold ROKU MAY 21 2021 315.0 Call @ 7.00

#ShortPuts #CoveredCalls – A little bit of everything.

NVDA: Pre-earnings. Dodged a bullet with ROKU in this account so replacing with this. Week before earnings.

Sold NVDA MAY 21 2021 550.0 Put @ 4.30

PINS: Covered call roll down for additional credit.

Rolled PINS MAY 21 2021 65.0 Calls to MAY 21 2021 60.0 Calls @ 1.05 credit (2.57 total now)

SNOW: Rolling call side down to a short straddle. Week before earnings.

Rolled SNOW MAY 21 2021 240.0 Call to MAY 21 2021 217.5 Call @ 1.40 credit (217.5 straddle @ 7.40 now)

SPOT: Covered Calls should have done this Friday.

Sold SPOT MAY 21 2021 240.0 Call @ 5.00

TSLA: Rolling call side out a week setting up a short strangle.

Rolled TSLA MAY 14 2021 760.0 Call to MAY 21 2021 750.0 Call @ 2.08 credit (550/750 strangle @ 7.18 now)

TWTR: Covered Calls should have done this on Friday.

Sold TWTR MAY 21 2021 54.0 Calls @ 1.05

#CoveredCalls #BigLizards #OptionsExpiration – Tied up with a lot of non market stuff this week but did manage a couple trades as well as letting a few go the distance.

Bought to Close ROKU MAY 7 2021 320/320.0/327.5 Big Lizard @ 4.30 (sold for 8.35)

Expired:

PINS 67 Calls (sold for 1.90)

ROKU 325 Call (sold for 27.50)

SPOT 252/310 Bear Call Spread (sold for 8.35)

TWTR 55/70 Bear Call Spreads (sold for 2.21)

#CoveredCalls – Rolling down for additional premium. Still selling slightly under my basis with the market looking weak. Earnings after the close tomorrow.

Rolled ROKU MAY 7 2021 350.0 Call to MAY 7 2021 325.0 Call @ 6.25 credit (27.50 total now)

#CoveredCalls – Stop set on this week’s sales. Adding more a couple weeks out.

Sold PINS MAY 21 2021 65.0 Calls @ 1.52

#coveredcalls

$AG STO 5/7 16 call at .40

$MGM STO 5/7 42 call at .35

$TQQQ STO 5/7 110 call at 1.75

#CoveredCalls – These will be covered after today. In an IRA so have to spread the call sales for now. Going for max downside protection selling slightly below basis.

Sold SPOT MAY 7 2021 252.5/310.0 Bear Call Spread @ 8.35

Sold TWTR MAY 7 2021 55.0/70 Bear Call Spreads @ 2.21

#CoveredCalls – These will be covered after today. Selling right at breakeven.

Sold PINS MAY 7 2021 67.0 Calls @ 1.90

#coveredcalls

$NVDA STO 4/30 620 call at 1.50. Sold against long calls

$RIOT STO 5/7 45 call at 1.40.

#ShortPuts #CoveredCalls – Setting up early for earnings next week. One covered and one new position.

Sold ROKU MAY 7 2021 350.0 Call @ 21.25 (slightly below basis but prefer downside protection)

Sold ROKU MAY 7 2021 320.0 Put @ 5.70 (replacing one closed this morning)

#coveredcalls

$TQQQ STO 4/30 113 call at .70

#shortputs

t 5.27$LABU BTC 4/30 69 put at .20. STO a7 5.27.

#coveredcalls

$WYNN STO 4/30 130 call at .90

#shortputs

$TQQQ BTC 6/18 55 put at .50. STO at 4.20. Thank you @jsd501

$TQQQ BTC 6/18 50 put at .40. STO at 3.16.

$PENN BTC 4/30 108 put and STO 5/7 107 put at added cost of .30

#coveredcalls

$TQQQ STO 4/30 113 call at 1.50

$BLNK STO 4/30 39.50 call at .90

$MRVL STO 4/30 48 call at .40

Comparison after 300 days ….positions remain open

I should have mentioned in the original post that if the stock declines in value the BuPS adds to the loss…..

#CoveredCalls – Stock was assigned at 450 but all the premium sold has reduced basis to 392.60. Rolling next week’s call to below my basis but with earnings the following week should be a decent roll opportunity if needed.

Rolled ROKU APR 30 2021 400.0 Call to APR 30 2021 370.0 Call @ 4.10 credit

#CoveredCalls – Sold LAZR MAY 21 2021 20.0 Calls @ 1.35

#CoveredCalls – These will be covered after today.

Sold PLTR MAY 21 2021 24.0 Calls @ 1.38

Rolled $ENPH Apr-23-2021 $200 #CoveredCalls // Apr-30-2021 @1.50 Credit.

#shortputs

$LABU BTC 4/9 77 put at 1.60. STO at 7.47. Thank you @fuzzballl

$FSLR BTC 4/16 75 put at .20. STO at 2.10. Thank you @fuzzballl

#coveredcalls

$WIX BTC 4/16 300 call and STP 5/21 320 call at added credit of 5.40

Rolled $AMC Apr-09-2021 14 #ShortPuts // Apr-23-2021 @0.36 Credit

Rolled $AMC Apr-09-2021 14 #CoveredCalls // Apr-23-2021 @0.39 Credit

#ShortPuts #CoveredCalls – Letting stock get called away at a slight loss. Replacing with this to work it back to even.

Sold SNOW APR 16 2021 220.0 Put @ 4.00

EDIT: And…should be week before earnings at least.

Sold SNOW APR 30 2021 220.0 Put @ 6.40

Rolled $ENPH Apr-16-2021 195 #CoveredCalls // Apr-22-2021 200 #CoveredCalls @0.50 credit for $5 higher strike

First time I’ve seen weeklies for this symbol.

#ShortPuts #CoveredCalls – Cleaning up a few annoying positions this week.

BIIB: Stock being called away at 260.0 (basis 269.0) Pretty good recovery from the Nov 4th craziness. Replacing with a pre-earnings put sale.

Sold BIIB APR 16 2021 260.0 Put @ 4.30

SLV: Not worth holding on to. Taking the small loss.

Sold SLV Shares @ 23.23 (basis 23.90)

UVXY: Position sizes are small enough now I’m letting the hedge go. A loss but that is typical for my hedges.

Stock will be called away @ 5.50 (basis 6.77)

Rolled AMC Mar-26-2021 15 #CoveredCalls // Apr-09-2021 @0.50 credit.

Roll $PTON Mar-26-2021 120 #CoveredCalls // Apr-16-2021 @2.05 Credit.

#CoveredCalls – Rolling out and down slightly. Still managing to sell slightly above my basis.

Rolled OSTK MAR 26 2021 68.0 Calls to APR 1 2021 66.0 Calls @ 1.65 credit.

#ShortPuts #CoveredCalls – Some fairly aggressive roll downs so that could signal a bottom in some of these. 🙂 🙂 Still long deltas though.

ROKU: Basically a covered call selling against a DITM short put.

Rolled ROKU APR 1 2021 350.0 Call to APR 1 2021 325.0 Call @ 4.20 credit

SNOW: Covered.

Rolled SNOW MAR 26 2021 215.0 Call to APR 1 2021 200.0 Call @ 9.60 credit

Rolled SNOW MAR 26 2021 215.0 Call to APR 1 2021 205.0 Call @ 6.55 credit

#coveredcalls

$WIX BTC 4/16 320 call and STO 4/16 300 call at added credit of 3.80

#shortputs

$TQQQ BTC 4/1 75 put at .90. STO at 3.00

$TQQQ BTC 4/16 50 put at .40. STO at 1.55 Thank you @jsd501

$PENN STO 3/26 111 puts at 2.50

$PENN STO 3/26 115 puts at 4.20

#bups

$PENN STO 4/16 100/110 BUPS at 3.42

#coveredcalls

$WIX STO 4/16 320 call at 6.00

$DKNG STO 4/16 75 call at 3.80

https://coveredcallswithjeff.wordpress.com/2021/03/21/covered-call-strategy-with-sdc-smile-direct-club-after-422-days-144230-unrealized-profit-123-return-or-107-annualized-return/

Smile Direct Club has been a good candidate for writing covered calls against. The weekly option premiums are excellent. To date the combination is generating a return of 123% or 107% annualized. Stock price has dropped significantly from Jan ($14+) to Mar ($11). Option premiums have helped offset some of lost profit on the stock. Overall this remains one of our key positions.

https://coveredcallswithjeff.wordpress.com/2021/03/20/assigned-on-inmd-profit-of-6675-in-66-days-25-return-or-140-annualized/

#CoveredCalls – Same position in two accounts.

Rolled SNOW MAR 19 2021 215.0 Calls to MAR 26 2021 215.0 Calls @ 3.80 credit