Stocks Scream To “Most Expensive Ever” In Greatest Month Since ’87

Daily Archives: Thursday, April 30, 2020

#bullputspreads TSLA Playing a bounce…

#bullcallspreads TSLA

Playing a bounce back bought a May 15, 775/780 call spread for 2.45 as I hope it continues down

#earnings #ironcondor AAPL Sold May…

#earnings #ironcondor AAPL

Sold May 15, 260/265/315/320 for 1.19

#earnings #closing TSLA Closed May…

AAPL Earnings

#ShortPuts #Earnings – Going out to the monthlies just above the 200ma.

Sold AAPL MAY 15 2020 265.0 Put @ 2.25

VXX – Covered put rolldown

Bought to close VXX 05/01/2020 35.50 Puts @ 0.09.

Sold them on 04/27 @ 0.12 and 0.31

Replaced them with short VXX 05/08/2020 34.00 Puts @ 0.45.

My long VXX Puts are out in Jan 2021 and are 25% fully paid for after about 10 days.

SPX 1-dte

#SPX1dte Sold to Open $SPX May 1st 2800/2820-2990/3010 condors for 1.30. IV 25.6%, SPX 2906, deltas -.07, +.04

Expiring: Apr 30th 2830/2850-3015/3035 condors, sold yesterday for 1.00.

AMZN put spread

#Earnings

Sold to Open $AMZN May 1st 2325/2320 put spreads for 1.50. With stock at 2430, that’s 4.3% OTM.

New CC on BCRX May 15 $4.00 net $3.26, stock @$3.84

TQQQ

#ShortPuts – Sold TQQQ MAY 15 2020 60.0 Put @ 2.47

WFC

#earnings UAL Sold May 15,…

#earnings UAL

Sold May 15, 23.50/37 strangle for 1.00

#earnings #closing TSLA Sold May…

Sold May 15, 750/800 #bullcallspreads for 29.94, bought Tuesday for 23. Woulda coulda shoulda, decided to take the profit, 2 trades left.

ZM

BTO May 15 136/139 Calls $1.45

ZOOM #In-Out

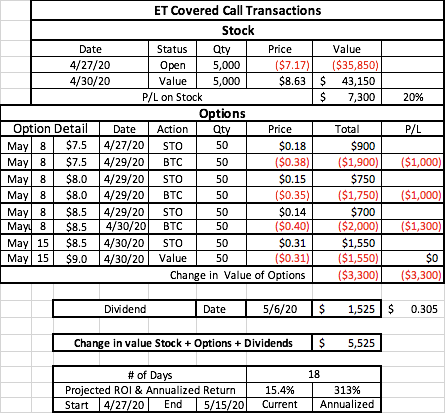

CC on ET, Roll from $7.5 to $8 to $8.5 to $9 in 4 days! $.305 Div payable 05/05

CINF

Sold 1 May 15 2020 65.00 Put @ 1.70 with the stock at 67.10.

52-week low: 65.69

52-week high: 118.19

PNC Rollup

Bought to close 1 PNC 05/01/2020 98.0 Covered Call / Sold 1 PNC 05/08/2020 99.0 Covered Call @ 0.05 Credit.

With the stock at 106 I’ll risk holding on one more week for an extra $100.

Fitch Affirms PNC Financial at ‘A+/F1’; Outlook Stable Despite Coronavirus Impact

#shortputs FEYE Sold May 15,…

#shortputs FEYE VFC

FEYE Sold May 15, 11 put for .39

VFC Sold May 15, 50 put for .80. Earnings May 15

#closing #bullcallspreads TSLA Sold May…

#closing #bullcallspreads TSLA

Sold May 1, 720/730 call spread for 9.92, bought April 14 for 4.47

ZM

Rolled $ZM 130/140 May-1-2020 #BuPS // May-08-2020 @0.70 Credit.

I probably should have closed it out yesterday with a small loss.

TQQQ

#CoveredCalls – Another roll…

Rolled TQQQ MAY 08 2020 52.0 Call to JUN 19 2020 56.0 Call @ .10 debit (1.40 premium received now)

TSLA

#CoveredCalls – Using call premium received to finance the roll. I can do it about 7 more times assuming no pullback in the stock. Picking up 7.00 of upside…

Rolled TSLA MAY 01 2020 500.0 Call to JUN 19 2020 510.0 Call @ 3.00 debit (total premium now 22.00)

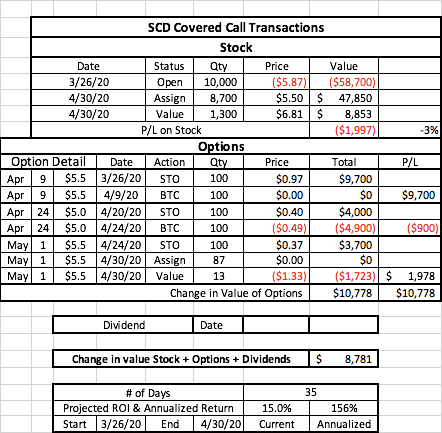

New 100 CC SDC May 8 $7 for net $6.50, Stock was at $7.04

TQQQ

STO May 22, 50 puts at 1.25, This is a small position and will add at lower strike prices if we get another down move. The volatility and premiums are high.

CINF Covered Call

Bought 100 Shares of CINF / Sold 1 CINF 05/15/2020 65.0 Covered Call @ Net Debit of $63.80

Filled at $67.68 on the stock.

ADS

Got a strange assignment overnight. Sold 100 of my 300 ADS shares when my 05/01/2020 45.0 Covered call was assigned. Interestingly I was not assigned on the strike 41.0 call expiring tomorrow.

AAPL earnings analysis

#Earnings $AAPL reports tonight. Below are details on earnings one-day moves over the last 12 quarters.

Jan. 28, 2020 AC +2.09%

Oct. 30, 2019 AC +2.26%

July 30, 2019 AC +2.04%

April 30, 2019 AC +4.90%

Jan. 29, 2019 AC +6.83% Biggest UP

Nov. 1, 2018 AC -6.63% Biggest DOWN

July 31, 2018 AC +5.89%

May 1, 2018 AC +4.41%

Feb. 1, 2018 AC -4.33%

Nov. 2, 2017 AC +2.61%

Aug. 1, 2017 AC +4.72%

May 2, 2017 AC -0.30%

Avg (+ or -) 3.92%

Bias 2.04%, strongly positive bias on earnings.

With stock at 292.50 the data suggests these ranges:

Based on current IV (expected move into Friday per TOS): 279.77 to 305.23 (+/- 4.4%)

Based on AVERAGE one-day move over last 12 quarters: 281.04 to 303.96

Based on MAXIMUM one-day move over last 12 Q’s (6.8%): 272.52 to 312.48

Based on DOWN max only (-6.6%): 273.11

Open to requests for other symbols.

AMZN earnings analysis

#Earnings $AMZN reports tonight. Below are details on earnings one-day moves over the last 12 quarters.

Jan. 30, 2020 AC +7.37%

Oct. 24, 2019 AC -1.09%

July 25, 2019 AC -1.55%

April 25, 2019 AC +2.54%

Jan. 31, 2019 AC -5.38%

Oct. 25, 2018 AC -7.81% Biggest DOWN

July 26, 2018 AC +0.51%

April 26, 2018 AC +3.60%

Feb. 1, 2018 AC +2.87%

Oct. 26, 2017 AC +13.21% Biggest UP

July 27, 2017 AC -2.48%

April 27, 2017 AC +0.71%

Avg (+ or -) 4.09%

Bias 1.04%, positive bias on earnings.

With stock at 2430.00 the data suggests these ranges:

Based on current IV (expected move into Friday per TOS): 2276.91 to 2583.09 (+/- 6.3%)

Based on AVERAGE one-day move over last 12 quarters: 2330.53 to 2529.47

Based on MAXIMUM one-day move over last 12 Q’s (13.2%): 2109.00 to 2751.00

Based on DOWN max only (-7.8%): 2240.22

Open to requests for other symbols.

GUSH

On 3/10 I bought 200 GUSH just under 1.00 and sold 2 March GUSH Covered Calls for $60 in total premium for a 30% reduction in breakeven.

After the reverse split I’ve now dumped my (5) GUSH shares @ $42.20 and added a bit more to the profit.

Glad to be out 🙂

TSLA Earnings

#ShortPuts #Earnings – Bought to Close TSLA MAY 15 2020 525.0 Put @ .90 (sold for 3.40)

FB Earnings

#Earnings #JadeLizards – Beer money…

Bought to Close FB MAY 1 2020 185.0/200.0/202.5 Jade Lizard @ 2.02 (sold for 3.05)

SPX 7-dte closed

#SPX7dteLong Yesterday an hour before market close,

Sold to close $SPX May 1st 2840/2860 call spreads for 18.40.

This morning, half hour before the open,

Sold to close May 1st 2830/2810 put spreads for 1.20.

Condors bought last Friday for 18.05, sold this week for 19.60.

Assigned on 87 of 100 SDC $5.50 Calls. 15% in 35 days.

Would have preferred to roll out and up later in the week…but happy with the profitability of the trade. Probably replace the shares today and sell May 8 $6.50.

The #coveredcalls #SDC