Monthly Archives: April 2020

GOOGL is tomorrow, here is FFIV earnings analysis

#Earnings $FFIV reports tonight. Below are details on earnings one-day moves over the last 12 quarters.

Jan. 27, 2020 AC -5.04%

Oct. 23, 2019 AC +5.50%

July 24, 2019 AC -0.65%

April 24, 2019 AC -1.08%

Jan. 23, 2019 AC -2.22%

Oct. 24, 2018 AC +6.10% Biggest UP

July 25, 2018 AC +1.07%

April 25, 2018 AC +0.89%

Jan. 24, 2018 AC -5.05%

Oct. 25, 2017 AC +3.97%

July 26, 2017 AC -7.16%

April 26, 2017 AC -7.50% Biggest DOWN

Avg (+ or -) 3.85%

Bias -0.93%, negative bias on earnings.

With stock at 130.00 the data suggests these ranges:

Based on current IV (expected move into Friday per TOS): 121.47 to 138.53 (+/- 6.6%)

Based on AVERAGE one-day move over last 12 quarters: 124.99 to 135.01

Based on MAXIMUM one-day move over last 12 Q’s (7.5%): 120.25 to 139.75

Based on UP max only (+6.1%): 137.93

NOTE: 5-day max moves are -7.97% and +4.33%, so slightly more bearish than the one-day.

Open to requests for other symbols.

#closing #shortputs FEYE Bouth May…

#closing #shortputs FEYE

Bought May 15, 11 put for .61, originally a 10.50 sold March 31 and rolled twice.

GM

GM Suspends Dividend, Stock Buyback Program To Preserve Cash, following Ford’s move last month.

XLU iron condor

Sold $XLU 48/53/58/63 iron condor @ 1.48. IV rank 56.

VXX

Added some short puts for this week

Sold 1 VXX 05/01/2020 35.50 Put @ 0.31

Sold 1 VXX 05/01/2020 34.50 Put @ 0.16.

These are covered by Long VXX puts for Jan 2021

SPY

STO May 13, 260 put at 1.45

TLRY

Roll-Up $TLRY 7.5 May 1 CC // 8.5 May 1 CC @ 0.60 debit. Cost basis now $4.97.

TQQQ

STO May 8, 45 puts at .30 cents

STO May 8, 50 puts at .60 cents

#rolling #shortputs LUV 3rd roll…

#rolling #shortputs LUV

3rd roll of 40 put sold March 3 (how’s that for timing). Out to June from May 15, earnings today. Cost bais is 417, LUV is around 29.

STO 3 PTON May 1 $32 @ $1.80 to re-establish CC

Tiny trades

Sold AA 05/01/2020 8.00 Covered Call @ 0.10 on a partial fill of a larger order

Sold VXX 05/01/2020 35.0 Covered Put @ 0.12 against one of my long 2021 long puts

Sold GLW 05/01/2020 23.0 Covered Call @ 0.17. #Earnings this week.

Case Study – IHI CC Strategy, 53 days in, 12 Option Rolls

IHI is a medical device ETF. Consider it to be a reasonable “safe” haven as it has 50 of the biggest medical device names in the portfolio. If the market goes south it usually comes back….as long as boomers need medical procedures. Covid-19 definitely playing a role in the number of “procedures” in the short term so the current calls are deep in the money entering earnings season. Thought the group might find it interesting to follow what has happened so far. IHI dropped from $246 entry to under $190). As it fell I rolled down, and rolled down. With each roll I pulled out some premium trying to hold onto as much value as possible. I felt like I was getting about $4.00 of premium each time I gave up $10 of strike price. On the way back up it felt like I paid $7.00 of premium to roll up $10 of strike price.

After 53 days the return is 2.1% and continuing to run. Not much time premium on the current May 1 in the money calls. Happy with the return considering the volatility in the period.

Wk Ending 4/24 – CC Positions and Gain/Loss Status

MRVL Called Away / Expiration

#coveredcalls

$MRVL 25.5 called away. Basis 20.16

#optionsexpiration

$PFE 34.5 put

$AMD 55 put

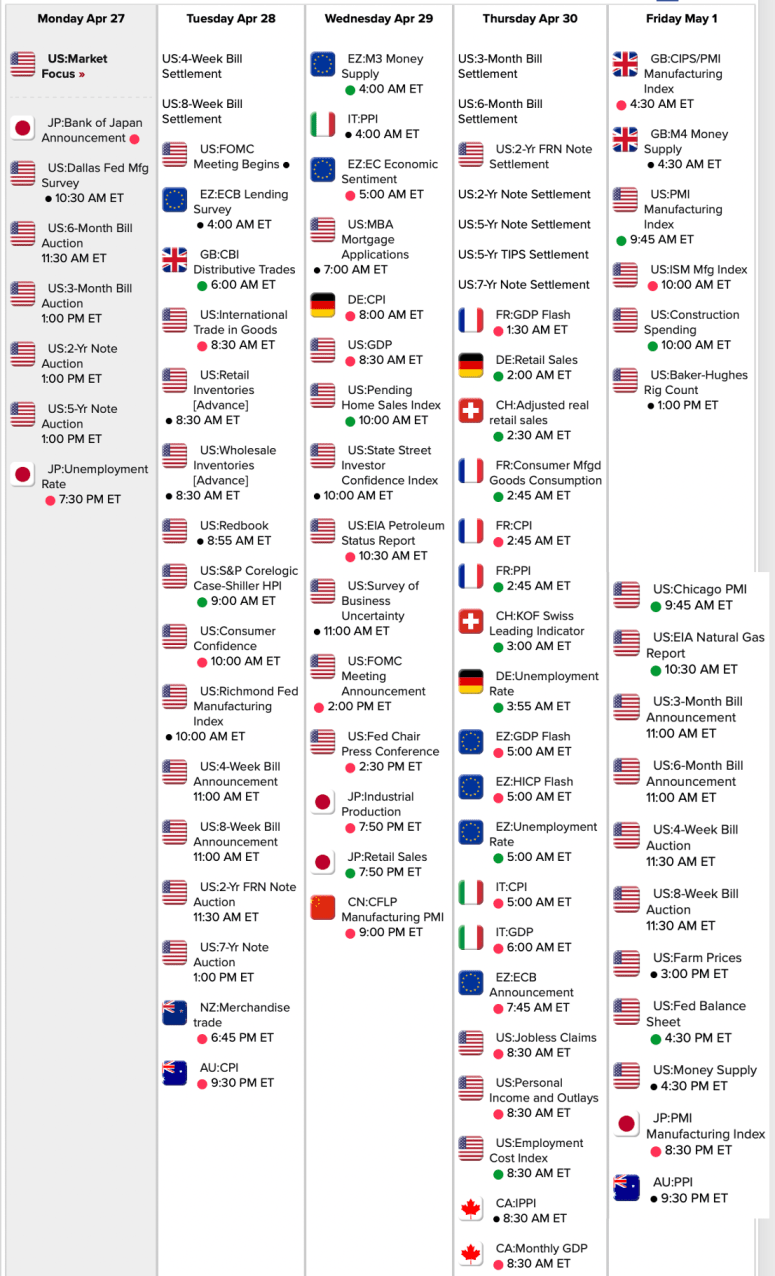

Econ Calendar for week of 4/27/20

#FOMC Meeting Announcement on Wednesday

Link to calendar: https://research.investors.com/economic-calendar/

#optionsexpiration CCL Short 11.50 puy…

CCL Short 11.50 put

HAL 7.50 covered call called away

USO 3 covered call

VIAC 15 covered call called away

X 6 short put

OptionsExpiration

Expiring:

AA 04/24/2020 8.00 Covered Calls

AAL 04/24/2020 15.00 Covered Calls

CCL 04/24/2020 15.50 Covered Call

OXY 04/24/2020 17.00 Covered Call

OXY 04/24/2020 18.00 Covered Call

SLB 04/24/2020 17.00 Covered Calls

SLV 04/24/2020 14.50 Covered Call

VIAC 04/24/2020 17.00 Covered Calls

MRO 04/24/2020 3.50 Puts

Assignments:

HAL 04/24/2020 8.50 Covered Call – Stock cost 5.10 (not adjusted for covered call premiums)

HFC 04/24/2020 27.00 Covered Call- Stock cost 19.05 (not adjusted for covered call premiums)

RCL 04/24/2020 34.00 Covered Call– Stock cost 32.14 (not adjusted for covered call premiums)

TNA 04/24/2020 17.00 Covered Call- Stock cost 10.10 (not adjusted for covered call premiums)

XOM 04/24/2020 42.00 Covered Call- Stock cost 37.14 (not adjusted for covered call premiums)

Getting closer to $CASH and preparing for the next big downswing or earnings implosion

SPY

#ShortPuts – Taking the weekend risk off…

Bought to Close SPY APR 27 2020 273.0 Puts @ .12 (sold for 2.15)

HPE rollout

Almost forgot this one

Bought to close 1 HPE 04/24/2020 9.50 Covered Call / Sold 1 HPE 05/01/2020 9.50 Covered Call @ 0.18 Credit

SMH iron condor

Sold $SMH 6/19 100/110/150/160 iron condor @ 2.49. Short put/call strikes at 16 and 19 delta.

SPX 1-dte

#SPX1dte Sold $SPX Apr 27th 2710/2730-2935/2955 condors for 1.05, IV 20.4%, SPX 2840, deltas -.04,+.04

Expiring: 2675/2695-2880/2900 condors, sold yesterday for 1.00.

ADS Rollup

Bought to close ADS 04/24/2020 40.0 Call / Sold 05/01/2020 41.0 Calls @ 0.79 Credit + 1.00 better strike.

Done for today.

Letting all the rest of my ITM covered calls get assigned as the rolls are not that generous on the strikes I’m short now.

SPX 7-dte long

#SPX7dteLong. Bought to open $SPX May 1st 2810/2830-2840/2860 condors for 18.05.

Earlier, sold to close Apr 24th 2840/2820 put spreads for 15.20, and 2850/2870 calls spreads for .30. Bought last week for 18.30. Second loss on this strategy… still learning a bit as I go, but could have waited a bit later in the morning and gotten 17.00+ for put side.

The SPX has been consolidating around 2800 for over a week, making this strategy less palatable.

MRO roll

Bought to close MRO 04/24/2020 4.5 Calls / Sold 05/01/2020 4.5 Calls @ 0.08 Credit

ZM

#ShortPuts – Just to get my feet wet in this one. Earnings out in June so hopefully nothing too crazy until then. Adding to the Nasdaq 100 on April 30th.

Sold ZM MAY 01 2020 120.0 Put @ 1.30

XBI

#ShortPuts – Taking these off a few weeks early. Looking to take a shot at GILD earnings next week with my biotech allotment.

Bought to Close XBI MAY 15 2020 75.0 Puts @ .22 (sold for 1.30 avg.)

ZM Close BUPS

#bups

$ZM BTC 5/15 90/100 BUPS at .44. STO 1.79 on 4/6

Closing JPM

Bought to close $JPM 5/15 75/110 strangle @ .77. Sold for 1.75 on 4/20.

ZM Calls

#shortcalls

$ZM STO 5/15 180 calls at 8.90

#shortputspread GILD Motivated by mortlightman,…

#shortputspread GILD

Motivated by mortlightman, sold June 19, 75/80 for 1.55.

GILD

STO BuPS 78/77 Puts May 1 $0.49 Credit

A TRADE: An add to.

INO STO 5/1/20 19.5 CALLS @.85

TRADES:

INO BTO STOCK @13.44, @13.69, 13.89

INO STO 5/1/20 15.5 CALLS @.70 Covered

INO STO 5/1/20 17.0 CALLS @1.15 Covered

TLRY

Rolled TLRY Apr 24 7 #CoveredCalls // May 1 7.5 @0.12. Credit + $0.5 higher strike.

RAD Call Rolled / TQQQ Put Rolled

#coveredcalls

$RAD BTC 4/24 14 call and STO 5/1 15.50 call at even. Stock at 14.28

#shortputs

$TQQQ BTC 4/24 66.50 put and STO 5/1 64.50 put at 1.10 credit

RCL Call Closed / SPY Put / CCL Put Closed

#shortcalls

$RCL BTC 5/1 40 call at .65. STO 4/9 at 8.42

#shortputs

$SPY STO 4/29 267 put at 1.99

$CCL BTC 4/24 11.50 put at .05 STO 4/22 at .40 Thank you @thomberg1201

AMD

Rolled $AMD 54 Apr 24 #Shortput // May 1 52 @1.35.

#closing #shortputs CSCO CCL CCL…

#closing #shortputs CSCO CCL

CCL Bought May 15, 7.5 put for .15, sold March 31 for 1.08

CSCO Bought May 15, 34 put for .20, sold April 2 for 1.11

Closing XOP

Bought to close $XOP 5/15 35 puts @ .70. Sold for 2.30 on 4/8.

A TRADE:

INO STO 5/1/20 15.5 CALLS @.70

3

#shortputs HTZ Sold May 15,…

#shortputs HTZ

Sold May 15, 2.50 put for .30

IVZ Covered Call & short Put

Bought 100 IVZ / Sold 1 IVZ 05/15/2020 10.0 Covered Call @ 7.48 Net Debit.

Sold 1 IVZ 05/15/2020 7.0 Put @ 0.50.

Earning already reported with the stock off 20% yesterday. They cut the dividend in half from 31 cents to 15.5 cents but the yield is still about 8.5%. Next Ex-Dividend date is on 05/08/2020.

Baby steps 🙂

EWZ

#ShortPuts – Adding…

Sold EWZ MAY 15 2020 22.0 Put @ 1.50

Sold EWZ JUN 19 2020 22.0 Put @ 2.20

And just for fun to make me feel better if this keeps dropping…

Bought EWZ JUN 19 2020 11.0 Puts @ .10

#shortstrangles MU Sold June 19,…

Sold June 19, 35/52.50 for 2.08

SPY TQQQ

#ShortPuts #CoveredCalls – This is about it for the day…

SPY: Continuing 7 day ladders.

Bought to Close SPY APR 24 2020 270.0 Puts @ .04 (sold for 2.25)

Sold SPY MAY 01 2020 267.5 Puts @ 2.11

TQQQ: Rolling puts and covered calls.

Rolled TQQQ APR 24 2020 66.5 Put to MAY 01 2020 65.5 Put @ 1.20 credit (5.20 total now)

Rolled TQQQ APR 24 2020 50.0 Call to MAY 08 2020 52.0 Call @ .15 credit

PNC Rollup

Bought to close 1 PNC 04/24/2020 97.0 Call / Sold 1 PNC 05/01/2020 98.0 Call @ 1.38 Credit + 1.00 better strike

AAL

Sold 1 AAL 05/01/2020 9.00 Put @ 0.27.

Stock Day’s Range: $10.24 – $10.67

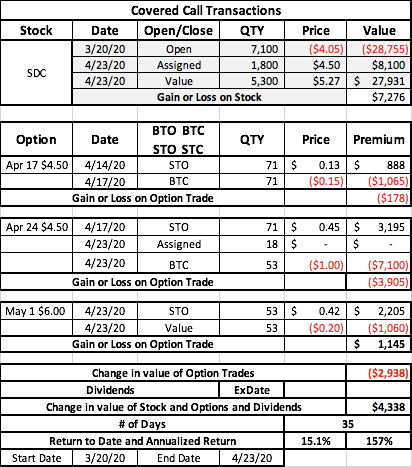

SDC Partial Assignment + Roll Up and Out

Assigned on 18 of 71 calls last night. Rolled Apr $4.50 up and out to May 1 $6.00. Stock was at $6.00 when I did the roll….then reversed and gave up any gains. Probably should have waited until tomorrow but I didn’t want more called away.

OXY

Sold 1 OXY May 01 2020 17.50 Covered Call @ 0.17

SPX 1-dte

SPX1dte Sold to Open, 4 minutes after the market closed:

$SPX Apr 24th 2675/2695-2880/2900 condors for 1.00, IV 27.75%, SPX 2797, deltas: -.04,+.04

#rolling TSLA Rolled May 15,…

#rolling TSLA

Rolled May 15, 320/450 inverted strangle to June 19 325/450 for 8.19. I picked up 5 more points on the call side.

I have taken in $14,526 in premium.

SPY

#CoveredCalls – Another round…

Bought to Close SPY APR 24 2020 292.5 Call @ .05 (sold for 1.51)

Sold SPY MAY 01 2020 290.0 Call @ 1.60

GILD

Day Trade BTO Apr24 79/77 Puts $0.99 STC $1.50 in a 15 min period

VXX

Bought 1 VXX Jan 15 2021 21.00 Put @ 1.99.

Bought 1 VXX Jan 15 2021 16.00 Put @ 0.75

The strike is a point closer to the stock than my first buy for the same money.

I re-invested the proceeds of my ADS covered calls into these.

ADS covered call ladder

Sold 1 ADS 05/01/2020 45.00 Covered Call @ 0.75.

Sold 1 ADS 05/15/2020 50.00 Covered Call @ 0.75.

Sold 1 ADS 05/22/2020 48.00 Covered Call @ 1.05.

The stock is at 40 after it’s earnings report.

“Alliance Data Systems (ADS) said Thursday that it booked Q1 core earnings of $0.75 per share, which is significantly down from $3.79 in the same period last year. Analysts surveyed by Capital IQ were looking for EPS of $3.84.

Revenue increased to $1.38 billion from $1.33 billion in the prior-year quarter. The CapIQ-compiled consensus view was for revenue of $1.31 billion.

The data-driven marketing and customer loyalty solutions provider said that it increased its provision for loan losses by $404 million, attributing over $300 million of the increase to the economic impact of the COVID-19 crisis.

Alliance said that it expects cost reduction measures to result in $150 million in savings, which will be recognized in FY2020. The company also suspended share buybacks and reduced the quarterly dividend to $0.21 per share, down from the prior distribution of $0.63, payable on June 1 to stockholders of record on May 14.”

GUSH

I was able to dump the GUSH that was put to me on the exercise of the March 1.00 short puts at a gain.

Sold GUSH @ 29.20 yesterday.

BX Puts Closed / TWTR Calls Rolled / AMD Puts

#shortputs

$BX BTC 4/24 45 puts at .15 STO 4/8 at 2.02

$AMD STO 4/24 55 puts at .50

#coveredcalls

$TWTR BTC 4/24 28 calls and STO 5/1 31.50 calls at credit of .23 Stock at 28.54

AAL Neutralized my entire stock/option…

AAL Neutralized my entire stock/option positions, just in case earnings are tomorrow.

AAL Earning tomorrow morning. Since…

AAL Earning tomorrow morning. Since we already know that earnings will be down, because of CV, I feel that, it already has been baked into the price, but still conflicted over weather to hold over earnings, something I never do. Anybody????

SKX earnings analysis

#Earnings $SKX reports tonight. Below are details on earnings one-day moves over the last 12 quarters.

Feb. 6, 2020 AC +4.05%

Oct. 22, 2019 AC -3.36%

July 18, 2019 AC +11.96%

April 18, 2019 BO -10.43%

Feb. 7, 2019 AC +15.19%

Oct. 18, 2018 AC +13.78%

July 19, 2018 AC -20.99%

April 19, 2018 AC -27.04% Biggest DOWN

Feb. 8, 2018 AC +7.54%

Oct. 19, 2017 AC +41.44% Biggest UP

July 20, 2017 AC +0.67%

April 20, 2017 AC -2.56%

Avg (+ or -) 13.25%

Bias 2.52%, positive bias on earnings.

With stock at 25.00 the data suggests these ranges:

Based on current IV (expected move into Friday per TOS): 21.80 to 28.20 (+/- 12.8%)

Based on AVERAGE one-day move over last 12 quarters: 21.69 to 28.31

Based on MAXIMUM one-day move over last 12 Q’s (41.4%): 14.64 to 35.36

Based on DOWN max only (-27.0%): 18.24

Open to requests for other symbols.

#coveredcallsDUST Was long 10,700 shares…

#coveredcallsDUST

Was long 10,700 shares DUST.

This morning DUST did a 1 for 25 reverse split.

What happens to my 8 May 20 2.00 call which I sold a few days ago? T.O.S. has is as a 2.oo call not a 50.00 call (2 x 25)

I’ve never held options when an underlying split.

Do I need to be concerned?

Thanks

SPXpire and new trade strategy

#SPX1dte Expired: $SPX Apr 22nd 2595/2615-2840/2860 condors, sold yesterday for 1.25.

Something I’ve been trying for a couple weeks but haven’t yet shared because it was in “test phase”… since volatility is here to stay for awhile, I have been buying one-week-out ATM condors with only 10-points between the shorts. The idea is that the market moves, and we most likely will be higher or lower a week from now.

So far it worked five times in a row… then the 6th one today was the first loss! But I’m going to stick with it as long as it continues to work and volatility is with us.

Today’s closing trade:

Last Wednesday, bought to Open $SPX Apr 22nd 2760/2780-2790/2810 condors for 18.35. (opening price has consistently been 18.25-18.40)

Today, sold to close the put side for 3.50 at 9:49am PT. Call side expired at 8.02. Total credit 11.52, so 6.80 loss.

All of the other ones I have done have either expired for 20.00, or closed a day or more early for 19.00+.

It is difficult to have much control over these trades unless you wish to go for pure speculation and leg out on ups and downs during the week. Otherwise you are at the mercy of the market on expiration day. Today was a bit nerve-wracking because SPX hovered in my dead zone for most of the morning. When it started trending upward, I took the profit on put side (first time I have legged out). Call side looked to be a 100% winner until the last 5 minutes, when it quickly turned from a 5.15 winner to a 6.80 loser. If I had exited before the drop i probably could have gotten 17.00 or so maximum, since the short 2810 call kept a lot of value until the last couple minutes of the day.

Bought to Open $SPX Apr 29th 2780/2800-2810/2830 condors for 18.40.

Also currently holding

Apr 24th 2820/2840-2850/2870

Apr 27th 2810/2830-2840/2860

#shortputs HTZ Bottom feeding sold…

#shortputs HTZ

Bottom feeding sold May 1, 4 put for .42

NVTA Call

#coveredcalls

$NVTA STO 5/15 20 call at .45

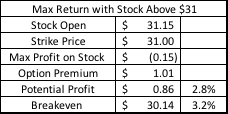

PTON CC Apr 24 $31 Net $30.14

#shortputs #closing EWZ XOM EWZ…

#shortputs #closing EWZ XOM

EWZ bought May 1, 22 put for .24, sold for .57 on April 15, still have June 19, 20 put.

XOM bought May 1, 35 put for .34, sold for .67 on April 15.

SPY

#ShortPuts – Keeping the rolling 7 day ladder going…

Bought to Close SPY APR 22 2020 272.0 Puts @ .03 (sold for 1.45)

Sold SPY APR 29 2020 267.0 Puts @ 2.04

VIX -bought yesterday for the…

VIX -bought yesterday for the eventual re-opening of the economy

Bought 1 SVXY Jan 15 2021 35.0 Call @ 3.00

Bought 1 VXX Jan 15 2021 15.0 Put @ 0.75

Bought 1 VXX Jan 15 2021 20.0 Put @ 1.99

#shortputs CCL Sold April 24,…

#shortputs CCL

Sold April 24, 11.50 put for .40

#closing USO Bought May 15,…

#closing USO

Bought May 15, 2 put for .35, sold yesterday for .54

LRCX earnings analysis

#Earnings $LRCX reports tonight. Below are details on earnings one-day moves over the last 12 quarters.

Jan. 29, 2020 AC +4.26%

Oct. 23, 2019 AC +13.90%

July 31, 2019 AC -1.36%

April 24, 2019 AC +4.93%

Jan. 23, 2019 AC +15.69% Biggest UP

Oct. 16, 2018 AC +1.31%

July 26, 2018 AC +7.19%

April 17, 2018 AC -4.03%

Jan. 24, 2018 AC -4.99% Biggest DOWN

Oct. 17, 2017 AC +3.05%

July 26, 2017 AC -2.12%

April 18, 2017 AC +6.85%

Avg (+ or -) 5.81%

Bias 3.72%, strongly positive bias on earnings.

With stock at 260.00 the data suggests these ranges:

Based on current IV (expected move into Friday per TOS): 234.20 to 285.80 (+/- 9.9%)

Based on AVERAGE one-day move over last 12 quarters: 244.90 to 275.10

Based on MAXIMUM one-day move over last 12 Q’s (15.7%): 219.21 to 300.79

Based on DOWN max only (-5.0%): 247.03

Open to requests for other symbols.

CC’s into back of Week

CVX 24APR2020 85 C

EW 24APR2020 220 C

HAL 24APR2020 7.5 C

ILMN 24APR2020 315 C

SDC 24APR2020 4.5 C

T 24APR2020 31 C

Had DXCM CC’s pulled away on Tuesday.

NFLX earnings analysis

#Earnings $NFLX reports tonight. Below are details on earnings one-day moves over the last 12 quarters.

Jan. 21, 2020 AC -3.58%

Oct. 16, 2019 AC +2.46%

July 17, 2019 AC -10.27% Biggest DOWN

April 16, 2019 AC -1.31%

Jan. 17, 2019 AC -3.98%

Oct. 16, 2018 AC +5.28%

July 16, 2018 AC -5.24%

April 16, 2018 AC +9.18%

Jan. 22, 2018 AC +9.97%

Oct. 16, 2017 AC -1.57%

July 17, 2017 AC +13.54% Biggest UP

April 17, 2017 AC -2.64%

Avg (+ or -) 5.75%

Bias 0.99%, positive bias on earnings.

With stock at 435.00 the data suggests these ranges:

Based on current IV (expected move into Friday per TOS): 385.03 to 484.97 (+/- 11.5%)

Based on AVERAGE one-day move over last 12 quarters: 409.98 to 460.02

Based on MAXIMUM one-day move over last 12 Q’s (13.5%): 376.10 to 493.90

Based on DOWN max only (-10.3%): 390.33

Open to requests for other symbols.

SPX 1-dte

#SPX1dte Sold to Open $SPX Apr 22nd 2596/2615-2840/2860 condors for 1.25, IV 36%, SPX 2736, delats -.05, +.05