#shortputs

$SDGR STO 6/19 65 put at 1.40

#coveredcalls

$ROKU STO 6/26 116 calls at 3.48

#shortputs

$SDGR STO 6/19 65 put at 1.40

#coveredcalls

$ROKU STO 6/26 116 calls at 3.48

#coveredcalls CODX

Bought 100 shares @ 17.27, Sold a June 19, 18 call for .70, debit of 16.57, thanks JSD501 for the ticker idea.

Premium is rich for a $16 stock.

#bups

$LULU BTC 6/19 320/330 BECS at .50 STO at 3.65. Thank you @ramie

$NFLX BTC 6/19 380/400 BUPS at $1.00. STO 4/30 at 6.93

#shortputs

$DFEN BTC 6/19 19 put and STO 7/17 18 put at even. Stock at 14.50

$CCL BTC 6/19 21 put and STO 6/26 21 put at .60 credit. Stock at 19.46

$SQ BTC 6/19 87 put at 1.15. STO for 4.65 on 6/12

$SQ STO 6/19 88 put at 1.66

$SQ STO 6/26 88 put at 3.05

#coveredcalls

$NVTA STO 6/19 17.50 call at .35

$MRVL STO 6/19 35 call at .40

$ROKU STO 6/19 112 call at 1.60

#ShortPuts #CoveredCalls – Finally getting caught up…

SLB: Covered

Bought to Close SLB JUN 12 2020 23.0 Calls @ .01 (sold for .37)

Sold SLB JUN 19 2020 20.5 Calls @ .40

SPY:

Sold SPY JUL 17 2020 280.0 Put @ 3.35

TQQQ: Starter positions

Sold TQQQ JUN 26 2020 72.5 Put @ 2.55

Sold TQQQ JUL 02 2020 70.0 Put @ 2.95

#coveredcalls M

Bought to close July 12, 9.50 covered call for .01, sold July 2, 9 call for .31.

Rolled $WORK Jun 12 34 #CoveredCalls // Jun-19-2020 32 @0.65 Credit. Basis now $27.22.

Rolled $OSTK Jun-12-2020 23.5 #coveredcalls // Jun-26-2020 @0.05 Credit for a better strike.

Sold 100 shares @ 9.01, sold June 12, 9.50 call for a debit of 8.70

#coveredcalls

$NUGT STO 6/12 65 calls at 1.70

$ROKU STO 6/12 114 calls at 2.20 and 6/12 112 calls at 1.30. Latter was opened pre golf pre market.

$UVXY STO 6/12 30 calls at 1.00 Shares were assigned to me this morning.

$VXX STO 6/12 32.5 calls at .27. Thank you @iceman

#shortputs

$HAL BTC 6/19 10 put at .02

$HAL STO 7/17 15 put at .88

$WORK STO 7/17 30 put at 2.05

#bups

$MSFT STO 7/10 167.5/177.5 BUPS at 1.36

$MSFT STO 6/19 165/175 BUPS at 1.10. Meant to close the position that was opened 5/6. Will close both tomorrow. Don’t trade after a morning of golf in the sun.

https://coveredcallswithjeff.wordpress.com/2020/06/08/assigned-on-14-pton-covered-calls-49-days-profit-8492-15-or-119-annualized/

#CoveredCalls – Finally able to sell a few of these closer to my basis…

Sold SLB JUN 12 2020 23.0 Calls @ .37

April 30 bought a May 15, 8.50 covered call for 7.14, shares at 7.79, call for .65, expired, sold June 5 call for .41.

Rolled Jun-05-2020 22.5 #CoveredCalls // Jun-12-2020 23.5 @.25 Credit + $1 better strike

Rolled SLB Jun-05-2020 18 #CoveredCalls // Jun-12-2020 18.5 @0.25 debit, for 50c higher Strike.

STO $OSTK Jun-05-2020 22.5 #CoveredCalls @0.45 credit. Basis now 19.40.

#shortputs

$OLLI BTC 6/19 80 puts at .60. STO 5/22 for 3.70

$TQQQ BTC 6/19 35 puts at .05. STO 4/15 for 2.35 Thank you @jsd501

$WORK BTC 6/19 80 puts at .50. STO 5/11 for 2.78

$AXSM BTC 6/19 92.50 puts at 19.11. STO 5/11 for 8.00. Ouch!

$TQQQ STO 9/18 35 put at 1.50 Thank you @jsd501

#coveredcalls

$RAD STO 6/5 14 calls at .28

#shortputs

$MRVL BTC 6/19 25 put for .05. STO at 1.30 on 5/8

#coveredcalls

$ROKU STO 6/5 113 calla at 2.40

#coveredcalls VSTO

Bought 100 shares @ 10.75, sold June 19, 10 call for 1.65, 9.10 debit

Rolled $WORK Jun-05-2020 33.50 #CoveredCalls // Jun-12-2020 #CoveredCalls @0.05 Debit. Still ITM, but $0.50 better strike.

#coveredcalls WFC

Sold June 5, 27 call for .59

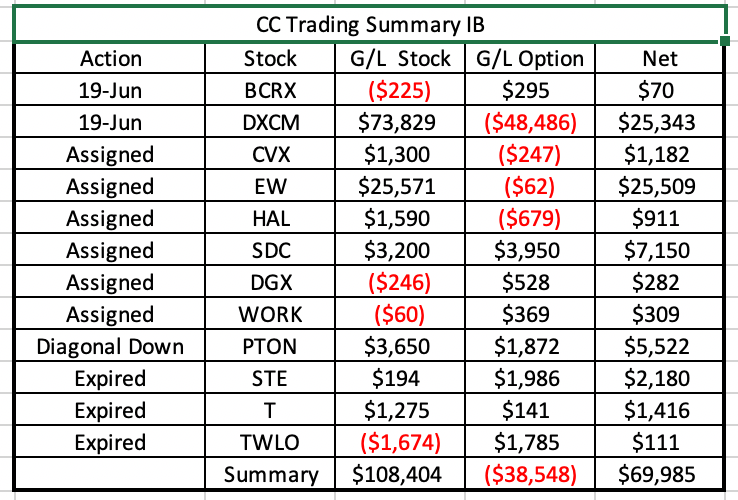

Overall net profits would be higher with just owning the stock (driven by DXCM and EW). Removing DXCM and EW from the calculation we have $19,000 in profit ($9,004 from stocks, $10,000 from short options).

6 positions assigned. 3 positions expired. 1 Diagonal down.

Moved to the cottage in Canada on Thursday. Issues with internet and couldn’t get trades done to roll positions and avoid assignment/expiration. Managed to get Schwab trades done but ran out of time with IB :(. Love the cottage…..hate the service.

#ShortPuts #CoveredCalls – Slow week but nice theta throughout the accounts.

NTAP: Old earnings trade still trying to work out of.

Bought to Close NTAP MAY 29 2020 45.0 Calls @ .01 (sold for 1.60)

Sold NTAP JUN 5 2020 44.0 Calls @ 1.09

SPY: Staying involved. Not nearly as heavy as I’ve been last 8 weeks.

Sold SPY JUN 19 2020 280.0 Put @ 2.50

UVXY: Feels like we’ll have some volatility though the election so trying to grab some put premium here.

UVXY MAY 29 2020 33.0 Puts expiring (sold for .86)

Sold UVXY JUN 5 2020 32.5 Puts @ 1.15

#coveredcalls WFC

Sold May 29, 28 call for 22, cost basis is 27.

#CoveredCalls – Not much today. Just sitting and enjoying the rally (EWZ especially!). For risk reduction letting some stock go…

SPY stock called away @ 295.0 (basis 291.90)

Assigned these on a 300 put that I sold at the beginning of the implosion. Happy to be out of it…

#coveredcalls

$ROKU BTC 5/29 121 call and STO 5/29 114 call at 2.68 added credit

$CODX BTC 6/17 19 call and STO 7/17 22 call at .20 added credit

$NVTA BTC 6/17 17.5 call and STO 7/17 20 call at .30 debit.

$AMD STO 5/29 57 call at .65

$ROKU STO 5/29 112 call at 2.23

#shortputs

$DDOG STO 6/19 65 put at 1.70

#shortcalls

$SDGR BTC 6/19 70 call and STO 7/17 80 call at added cost of .80

#CoveredCalls #BullPutSpreads #Earnings

NVDA: Earnings down to the wire but went out worthless

MAY 22 2020 360.0/355.0 Bull Put Spread @ 2.65 (expired)

SPY: Down to the wire but had to roll (covered)

Rolled SPY MAY 22 2020 295.0 Call to MAY 27 2020 295.0 Call @ 2.20 credit (4.65 total now)

TNA: Rolled out a week and up a little (covered)

Rolled TNA MAY 22 2020 20.0 Calls to MAY 29 2020 20.5 Calls @ .12 credit

OX $OSTK May-22-2020 21 #CoveredCalls – STO 5/11 @.45.

OX $OXY May-22-2020 16 #CoveredCalls – STO 5/8 @0.44.

OX $PTON May-22-2020 43 #ShortPuts – STO 5/18 @0.70.

OX $LULU May 22-2020 215/225 #BuPS – STO as part of a roll last week, total 1.86 premium.

Rolled $WORK May-22-2020 31.50 #CoveredCalls // May 29 2020 33.00 @0.20 Credit +better strike.

Second roll on this one, originally purchased 5/13 when the stock was $30.25. My basis is now $29.02.

Takin’ what they’re giving, $WORK’n for a livin’ (Not Slack’n)

#coveredcalls #assignment WBA #earnings #closing TGT

WBA May 15, bought 100 shares at 37.96 and sold a May 29 38 call for 1.01. I was assigned yesterday, thought I was safe but no harm.

TGT Yesterday sold June 15 110/140 strangle for 2.16, bought today for 1.61

#shortputs #coveredcalls #rolling HTZ CCL M SDC SBUX GPS

CCL Sold May 22, 14 put for .45

HTZ sold May 22, covered call for .10

M sold May 22, 5 put for .16

M sold June 19 covered call for .21

SDC sold June 5 covered call for .41

SBUX rolled long suffering May 22 73.50/85 put spread to June 19, 76/87.50 for a lousy .12

GPS Bought 100 shares and sold May 22, 8 call for 7.45

#coveredcalls

$SDGR BTC 5/15 50 call and STO 6/19 55 call at .35 added credit. Stock at 56.39. But is a gyrating stock.

$NET BTC 5/15 30 call and STO 6/19 34 call at .85 added credit. Stock at 30.37

#CoveredCalls – Chipping away at this one…

Bought to Close TNA MAY 15 2020 23.0 Calls @ .01 (sold for .50)

Sold TNA MAY 22 2020 20.0 Calls @ .66

#ShortPuts #CoveredCalls #CoveredStrangles – Adding another put and selling a covered call against yesterday’s put sale…

Sold SPY JUN 12 2020 250.0 Put @ 3.50

Sold SPY JUN 05 2020 290.0 Call @ 3.15

#CoveredCalls – Sold this one pretty aggressively last week…

Bought to Close SPY MAY 15 2020 290.0 Call @ .10 (sold for 3.50)

#shortputs

$NVAX BTC 5/15 19.50 put and STO 5/22 32 put at 1.17 added credit. Stock at 42.20

#coveredcalls

$CODX BTC 5/15 17.50 call and STC 6/19 19 call at 1.25 added credit. Stock at 18.25

#coveredcalls

$CODX BTC 5/15 15 call and STO 5/15 17.50 call at 1.20 debit. Stock at 17.348. We’ll see what happens.

#coveredcalls

$NVTA BTC 5/15 17.50 calls and STO 6/19 17.50 calls at $1.00 credit. Stock at 17.55. If it continue up may roll again, or just take the extra dividend. Lowers my cost basis another 5%. Still a ways to go but going in the right direction.

#coveredcalls WFC UNG

WFC Sold May 22, 26.50 call for .31

UNG Sold June 19, 15 call for .42

BTC $TSLA May 15 2020 670/680 #BuPS @.32. Was Sto 4/29 @2.20

BTC $SQ Jun 19 2020 50/60 #BuPS @0.75. STO 5/6 @1.52

Assuming things don’t go crazy this afternoon:

OX $TLRY May 8 2020 $6.50 #ShortPut – STO 5/1 @.36

OA $TLRY May 8 2020 $7.00 #CoveredCalls – STO 5/1 @0.55. Overall Basis on the stock is $3.88. Position opened 3/31.

OX $OXY May 8 2020 $16 Call #CoveredCall

STO $OXY May 22 2020 $16 Call @0.44

OA $VIAC May 8 2020 $17 #CoveredCall – Position opened 4/23, @15.05, Basis @14.80 after roll last week.

#coveredcalls

$NET STO 5/15 call at 2.20

#shortputs #coveredcalls OXY NTGR CPRI

OXY Sold June 19, 12 put for 1.00

NTGR Sold June 19, 25 covered call for .75

CPRI Sold May 15, 15 covered call for .40

CCL Sold May 15, 11.50 put for .45

Significant investment to maintain CC positions. Don’t want stock called away due to tax implications. Share of account value getting too high.

BTC May 15 $310 sold at $35.03 and closed at $62.95

BTC May 15 $320 sold at $27 and closed at $53.32

STO May 15 $350 at $28.24

STO May 15 $360 at $21.32

Leaves CC’s with strikes at $330, $350, $360.

#CoveredCalls – Come and get it Mr. Market…

Bought to Close SPY MAY 06 2020 292.0 Call @ .16 (sold for 1.70)

Sold SPY MAY 15 2020 290.0 Call @ 3.50

#coveredcalls

$NCLH BTC 5/15 20 call and STO 5/15 16 call at .65 credit.

Lost stock to assignment on the weekend

#CoveredCalls – Another roll…

Rolled TQQQ MAY 08 2020 52.0 Call to JUN 19 2020 56.0 Call @ .10 debit (1.40 premium received now)

#CoveredCalls – Using call premium received to finance the roll. I can do it about 7 more times assuming no pullback in the stock. Picking up 7.00 of upside…

Rolled TSLA MAY 01 2020 500.0 Call to JUN 19 2020 510.0 Call @ 3.00 debit (total premium now 22.00)

#coveredcalls GPS

Bought 100 shares at 7.80, sold May 15, 7.50 call for .82.

#ShortPuts #CoveredCalls – A couple fills today…

Bought to Close SPY APR 29 2020 267.0 Put @ .05 (sold for 2.04)

Sold SPY MAY 06 2020 275.0 Puts @ 2.00

Rolled SPY APR 29 2020 259.0 Calls to MAY 15 2020 261.0 Calls @ .19 debit (5.40 total now)

#coveredcalls

$MRVL 25.5 called away. Basis 20.16

#optionsexpiration

$PFE 34.5 put

$AMD 55 put

Rolled TLRY Apr 24 7 #CoveredCalls // May 1 7.5 @0.12. Credit + $0.5 higher strike.

#coveredcalls

$RAD BTC 4/24 14 call and STO 5/1 15.50 call at even. Stock at 14.28

#shortputs

$TQQQ BTC 4/24 66.50 put and STO 5/1 64.50 put at 1.10 credit

#ShortPuts #CoveredCalls – This is about it for the day…

SPY: Continuing 7 day ladders.

Bought to Close SPY APR 24 2020 270.0 Puts @ .04 (sold for 2.25)

Sold SPY MAY 01 2020 267.5 Puts @ 2.11

TQQQ: Rolling puts and covered calls.

Rolled TQQQ APR 24 2020 66.5 Put to MAY 01 2020 65.5 Put @ 1.20 credit (5.20 total now)

Rolled TQQQ APR 24 2020 50.0 Call to MAY 08 2020 52.0 Call @ .15 credit

#CoveredCalls – Another round…

Bought to Close SPY APR 24 2020 292.5 Call @ .05 (sold for 1.51)

Sold SPY MAY 01 2020 290.0 Call @ 1.60

#shortputs

$BX BTC 4/24 45 puts at .15 STO 4/8 at 2.02

$AMD STO 4/24 55 puts at .50

#coveredcalls

$TWTR BTC 4/24 28 calls and STO 5/1 31.50 calls at credit of .23 Stock at 28.54

#coveredcalls

$NVTA STO 5/15 20 call at .45

#coveredcalls

$RAD STO 4/24 14 calls at .40

$DDOG STO 5/15 42 calls at 1.90

#shortputs #coveredcalls USO HAL VIAC BOOT

USO bought 100 shares and sold April 24, 3 call for 2.78 Thanks Fuzzball

USO sold May 15, 2 put for .54 #tastytradefollow

HAL sold 2 April 24, 7.5 covered calls for .47 each

VIAC sold April 24, 15 covered call for .57

BOOT sold May 15, 12.50 put for .97

#CoveredCalls – Off it’s lows but it was halted for a little while this morning so still a lot of uncertainty. I’m rolling down the calls into next week for max downside protection while maintaining a profit if called away. There might be a possibility of rolling these but it would be tough at these prices especially if the stock rallies much.

Rolled USO APR 24 2020 3.5 Calls to MAY 1 2020 2.5 Calls @ .90 credit

Now:

Make .13 if called away or own stock at 2.37

#CoveredCalls – Low risk lottery ticket. Iceman style…buying covered stock with call ITM. Either make a little in a week or own stock considerably lower.

Bought USO stock and sold APR 24 2020 3.5 Calls @ 3.27 debit.

Make .23 or own stock @ 3.27

#CoveredCalls – Adding one…

Sold SPY APR 24 2020 292.5 Call @ 1.51

#coveredcalls

$NVTA STO 5/15 17.5 calls at .60

$TWTR STO 4/24 28 calls at .40

#shortputs

$BX STO 5/1 46 puts at 1.90

$DDOG STO 5/15 38 puts at 1.90

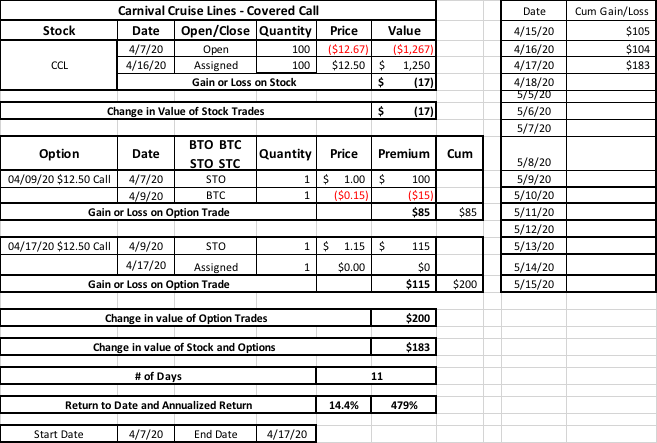

Thank you to Option Iceman for the trade. #coveredcalls #returnoninvestment

Stock was hovering right around $12.50 strike price as market was closing. Couldn’t get a fair price to roll out so didn’t do anything and it got assigned. Happy with the trade.

#coveredcalls

$ROKU BTC 5/1 110 calls and STO 5/15 120 calls at $2 debit. Stock at 126.52

$PLAN BTC 4/17 30 calls and STO 6/19 40 calls at $3.70 debit. Stock at 35.60

#coveredcalls

$MRVL BTC 4/24 24 call and STO 5/8 26 call at .67 debit

$TQQQ BTC 5/1 57 call and STO 5/15 60 call at .30 debit

#shortputs

$SLB BTC 4/17 13 put at .20. STO 3/27 at 1.30

$T STO 5/15 28 put at .75

$TQQQ STO 6/19 35 put at 2.35 Thank you @jsd501

#CoveredCalls – Another small roll up into the week before earnings.

Rolled SPCE APR 24 2020 15.0 Calls to MAY 1 2020 15.5 Calls @ .05 debit (stock basis 14.45)

#coveredcalls

$AMD BTC 4/17 52 call and STO 5/1 55 call at .30 added credit

$ROKU BTC 4/17 97 call and STO 5/1 110 call at 4.60 debit

#coveredcalls

BTC 4/24 11.50 and STO 5/15 15 call at .89 debit. Stock at 11.57

#coveredcalls #shortputs #shortcalls AAL APA GPS HFC NUGT

NUGT bought 100 shares sold 1 April 17, 11.50 call for 10.76, NUGT is around 11.50

HFC sold April 17, 25 covered call for 1.10, cost basis is 22.28, HFC is around 25

GPS Sold April 17, 8 put for .40, GPS is around 8.30

APA bought 100 shares sold 1 April 17 10 call for 8.13, APA is around 8.30

AAL bought 100 shares sold 1 April 17, 11 call for 10.39

#coveredcalls CPRI NBL OXY HAL

CPRI bought 100 shares, sold 1 April 17, 12 call for 11.29

NBL bought 100 shares sold 1 April 17 7.50 call for 6.90

OXY bought 100 shares sold 1 April 17, 16 call for 14.69

HAL bought 100 shares sold 1 April 17, 8 call for 7.59

#CoveredCalls – Sold TNA APR 24 2020 23.0 Calls @ .81