$LABU BTC 8/13 65 put and STO 8/20 64.50 put at even

$TQQQ BTC 8/20 99 put at .10. STO at 1.06.

$TQQQ BTC 8/20 100 put at .10. STO at 1.82.

$TQQQ BTC 8/20 105 put at .10. STO at 2.40.

$COIN BTC 8/13 250 put at .20. STO at 3.00. Inspired by @fuzzballl

$TQQQ STO 10/1 105 put at 2.35 Thank you @jsd501

Monthly Archives: August 2021

VXX Put Rolls

Rolled 1 VXX 08/13/2021 29.0 Put to next week at $0.25 Credit

Rolled VXX 08/13/2021 28.0 Puts to next week at $0.33 Credit

Rolled VXX 08/13/2021 27.50 Puts to next week’s 27.0 Puts at $0.01 Credit and a $0.50 lower strike

Rolled VXX 08/13/2021 27.0 Puts to next week’s 26.50 Puts at $0.03 Credit and a $0.50 lower strike

Rolled VXX 08/13/2021 26.50 Puts to next week’s 26.0 Puts at $0.14 Credit and a $0.50 lower strike

COIN Call

Anticipating the expiration on my short 267.50 Diagonal call this afternoon –

Sold 1 COIN Aug 20 2021 275.0 Diagonal Call at $4.25

AMC Call

Sold to Open AMC Aug 20 2021 38.0 Diagonal Call at $1.12.

Paired with the strike 24 Puts I sold yesterday for a total 24/38 Strangle premium of $1.39

NVDA Sep

Sold to open $NVDA Sep 17 180 puts @ 2.55, delta 17. Earnings next week. Strike is near the July lows, a level at which I wouldn’t mind taking assignment.

SPX trades

#SPX7dteLong Sold to close $SPX Aug 13th 4460/4440 call spreads for 19.00. Put side sold for 2.45, yesterday, for 21.45 total, on purchase price of 14.10, means 7.35 profit.

#tqqq sto TQQQ 1 OCT…

TQQQ,

STO October 1, 105 put at 2.41

LAZR earnings

#CoveredCalls – Sending this one packing. Sold all covered stock at a loss of 1.75 per share. Didn’t hear much in the earnings one way or another so not worth the risk anymore.

Goodbye ol’ buddy. One of my top 5 performers since it went public.

🙂 🙂

LABU

#CoveredCalls – Looks like it’s wanting to recover but I’m selling next week at breakeven for max downside protection.

Bought to Close LABU AUG 13 2021 60.0 Calls @ .10 (sold for 2.54)

Sold LABU AUG 20 2021 55.0 Calls @ 4.10

VXX1 – Old(pre-split) long Puts

Sold another VXX1 09/17/2021 7.0 Put @ $1.04. Bought on 03/05/2021 @ $0.15

#VXXContango

COIN Call Close / RIOT Call Roll / LABU Put Roll

#shortcalls

$COIN BTC 8/13 310 call at .20. STO at 4.00 on Monday. Thank you @optioniceman for idea.

$RIOT BTC 8/20 36 call and STO 8/27 38 call at even (covered)

$PANW BTC 8/13 377.50 call at .60. STO at 2.40 (Covered)

#shortputs

$LABU BTC 8/13 63 put and STO 8/20 62 put at added credit of .35. Taken in 6.41 and reduced strike from 54 to 62 since 7/28.

Upside Warning imminent

#VIXindicator It should take effect at the close Friday, unless the day is volatile.

#spx btc VERTICAL SPX, 20…

#spx

btc VERTICAL SPX, 20 AUG 4270/4265 PUT @.10/sold for.50

right @ closing

AMC Puts for next week

Sold AMC Aug 20 2021 24.0 Diagonal Puts at $0.27.

Similar puts for this week look to expire.

COIN Call Roll

Not at all confident that these will expire tomorrow so rolling them up another 10 points

Bought to close COIN Aug 13 2021 255.0 Diagonal Call at $6.00. Sold last week at $13.44 on a rollup.

In place of it sold to Open 1 COIN Aug 20 2021 265.0 Call at $6.10.

Looking for this week’s 267.50, 300 and 305 calls to expire tomorrow.

SOXL

#ShortPuts – Added.

Sold SOXL SEP 17 2021 39.0 Put @ 2.50

VXX1 – Old(pre-split) long Puts

Sold 1 of my VXX1 09/17/2021 7.0 Puts @ 0.97. Acquired the entire position on these on 03/05/2021 @ $0.15 as the long side of a long expired diagonal spread.

Sold to close some VXX1 Sep 17 2021 6.0 Puts at $0.31. Acquired the entire position on these on 01/15/2021 @ $0.09 as the long side of another long expired diagonal spread.

Sold to close VXX1 Jan 21 2022 4.0 Puts at $0.29. Bought this lot on 03/30/2021 @ $0.08.

I’ll try to scale out of more at higher prices.

#VXXContango

SPX trades

#SPX7dteLong Sold to close $SPX Aug 13th 4430/4410 put spreads for 2.45. Leaving call spreads for now. Condors bought for 14.10 on Monday.

#soxl sto SOXL 17 SEP…

#soxl

sto SOXL 17 SEP 38 PUT @2.05

first go with SOXL

thanks fuzzball

TQQQ Roll

Rolled TQQQ 08/13/2021 120.0 Diagonal Calls out another week at $0.40 Credit.

TQQQ is still too high to roll it up

LAZR earnings

#CoveredCalls – Would really like for these to get called away. Rolling down and out prior to earnings. This will be sitting pretty close to breakeven.

Rolled LAZR AUG 13 2021 19.0 Calls to AUG 27 2021 18.0 Calls @ .74 credit (basis now 18.16)

COIN

One day scalp

Sold COIN Aug 13 2021 227.5 Diagonal Puts at $0.15.

Paired with short 300 and 305 calls that also expire tomorrow.

So no additional spread margin

NIO earnings

#IronFlies #Earnings – Didn’t really get the volatility collapse I was hoping for. These work a lot better on Thursday going into Friday. No interest in messing with it so taking beer money.

Bought to Close NIO AUG 13 2021 42.0/44.0/46.0 Iron Flies @ 1.40 (sold for 1.60)

NIO earnings

#IronFlies #Earnings – Just for fun. Rolling the dice on some of my COIN and OSTK gains.

Sold NIO AUG 13 2021 42.0/44.0/46.0 Iron Flies @ 1.60

SOXL

#ShortPuts – Adding.

Sold SOXL SEP 17 2021 38.0 Put @ 2.00

SPX trades

#SPX7dteLong Sold to close $SPX Aug 11th 4425/4445 call spreads for 15.10. Could not risk any further down move. Put side sold for 2.25 yesterday so 17.35 total. Bought for 15.05 last week, so 2.30 profit.

#SPX1dte Expected to expire worthless: Aug 11th 4365/4385-4465/4485 condors, sold yesterday for 1.00.

AMC LABU VXX

Sold AMC Aug 13 2021 26.0 Diagonal Puts at $0.26 & 0.33. Paired with some in-the-money calls I would like to cover and roll up on Friday

Sold LABU Aug 13 2021 53.0 Diagonal Put at $0.65. Paired with a short 65.0 Call for this week.

Sold VXX Aug 13 2021 31.0 Covered Calls at $0.13

ALB Put

#shortputs

$ALB STO 8/20/220 put at 1.30

ROKU

#ShortPuts – Adding in a different account. It took out the 50 day let’s see if it can do the same with the 100 and 200. Selling slightly outside the expected move.

Sold ROKU SEP 3 2021 325.0 Put @ 4.00

COIN earnings

#ShortPuts #Earnings #OneNightStand – Thanks! See ya next time!

Bought to Close COIN AUG 13 2021 255.0 Put @ .50 (sold for 4.70)

O Put Roll / COIN Put

#shortputs

$O BTC 8/20 67.50 put and STO 9/17 67.50 put at added credit of .55

$COIN STO 8/13 250 put at 3.00. @fuzzballl inspired

BX Call / SOXL MRVL Put Open and SOXL Put Close

#coveredcalls

$BX STO 8/13 116 call at .30

#shortputs

$SOXL STO 9/17 39 put at 2.05

$SOXL BTC 8/20 38 put at .20. STO at 2.35 Thank you @fuzzballl

$MRVL STO 8/13 58.50 put at .26

TQQQ

#ShortPuts – Taking profit on a straggler.

Bought to Close TQQQ SEP 3 2021 100.0 Put @ .80 (sold for 2.40)

SQQQ Covered Calls

Sold 1 SQQQ 08/13/2021 8.50 Covered Call @ 0.05

Sold 1 SQQQ 08/20/2021 9.00 Covered Call @ 0.08

TQQQ

#ShortPuts – Adding.

Sold TQQQ SEP 17 2021 105.0 Put @ 2.00

OSTK

#ShortPuts – New positions.

Sold OSTK SEP 17 2021 55.0 Puts @ .88

Sold OSTK SEP 17 2021 60.0 Puts @ 1.70

SPX trades

#SPX7dteLong Sold to close $SPX Aug 11th 4415/4395 put spreads for 2.25. Condors bought for 15.05 last Thursday. Saving call spreads to sell later today or tomorrow.

SOXL

#ShortPuts – Adding to the bottom and top of the ladder.

Sold SOXL SEP 17 2021 39.0 Put @ 2.00

Sold SOXL SEP 17 2021 42.0 Put @ 3.00

OLED

#ShortPuts – Filled post earnings. Had a small gain on it so threw a stop on at breakeven for safety. Hit today.

Bought to Close OLED SEP 17 2021 185.0 Put @ 3.00 (sold for 3.00)

OSTK

#ShortPuts -Taking decent profits from a lot of post earnings positions.

Bought to Close OSTK AUG 20 2021 60.0 Puts @ .28 (sold for 1.04 and 1.07)

Bought to Close OSTK AUG 20 2021 65.0 Puts @ .93 and .95 (sold for 2.00 and 2.07)

Bought to Close OSTK AUG 20 2021 66.0 Put @ 1.17 (sold for 1.90)

COIN

Sold 1 COIN Aug 13 2021 230.0 Diagonal Put at $1.27, adding to my position.

#Earnings after the close today

COIN earnings

#ShortPuts #Earnings – For lack of anything better to do. This was at the expected move when I sold it. Stock has dropped a little more since then.

Sold COIN AUG 13 2021 255.0 Put @ 4.70

INCY

Another #SP500 stock hits a 52-week low.

Bought a small bit at $75

VXX Puts

Bought VXX Oct 15 2021 19.0 Puts/ Sold VXX Aug 13 2021 27.0 Puts at $ 0.02 Credit

Bought VXX Oct 15 2021 18.0 Puts/ Sold VXX Aug 13 2021 26.5 Puts at $ 0.05 Credit

Short DTE = 3

Long DTE = 66

#VXXContango

TLRY Calls

Sold TLRY Aug 13 2021 15.5 Diagonal Calls at $0.30 to go along with my existing short 15.50 Puts for a straddle with a total credit of $1.48

TLRY at 15 for now.

AMC Calls

Sold AMC Aug 13 2021 36.0 Diagonal Calls at $2.29.

Stock at 33.50. #Earnings tonight

GTLS Put Close

#shortputs

$GTLS BTC 8/20 155 put at 1.00. STO at 8.00 on 7/21

TQQQ Put Close / TQQQ Put / PINS BNTX LABU NVAX TSLA Call

#shortputs

$TQQQ BTC 8/27 put at .40. STO at 1.72. Thank you @jsd501

$TQQQ STO 8/13 126 put at .30. Thank you @optioniceman

#coveredcalls

$PINS STO 8/13 60 call at .65

$BNTX STO 8/13 450call at 14.70

$LABU STO 8/13 62.50 call at 1.50

$NVAX STO 8/13 220 call at 3.80

$TSLA STO 8/13 735 call at 5.50

SPX trades

#SPX7dteLong Bought to Open $SPX Aug 13th 4410/4430-4440/4460 condors for 14.10, with SPX at 4434.

SLV long puts closed

Sold to close SLV Aug 20 2021 21 Puts at $0.20.

Bought these back on 5/23 at $0.17.

I’ve written against it at least 6 times, collecting at least twice the original cost.

#WinWin

TLRY

Sold TLRY Aug 13 2021 16.0 Covered Calls at $0.11 replacing similar calls that expired Friday

TQQQ,

STO September 24, 100 put at 1.94, I am selling only a half position because September can be a very bad month for the market.

COIN

Sold 1 COIN Aug 13 2021 305.0 Call at $5.79 and 1 COIN Aug 13 2021 230.0 Put at $1.00 for a total strangle premium of $6.79

VXX

Sold 1 VXX Sep 03 2021 30.0 Covered Call at $2.01

and

Sold VXX Aug 13 2021 27.0 Diagonal Puts at $0.13

TQQQ Puts

Sold TQQQ Aug 13 2021 126.0 Puts at $0.38.

Little risk because of my in the money short calls

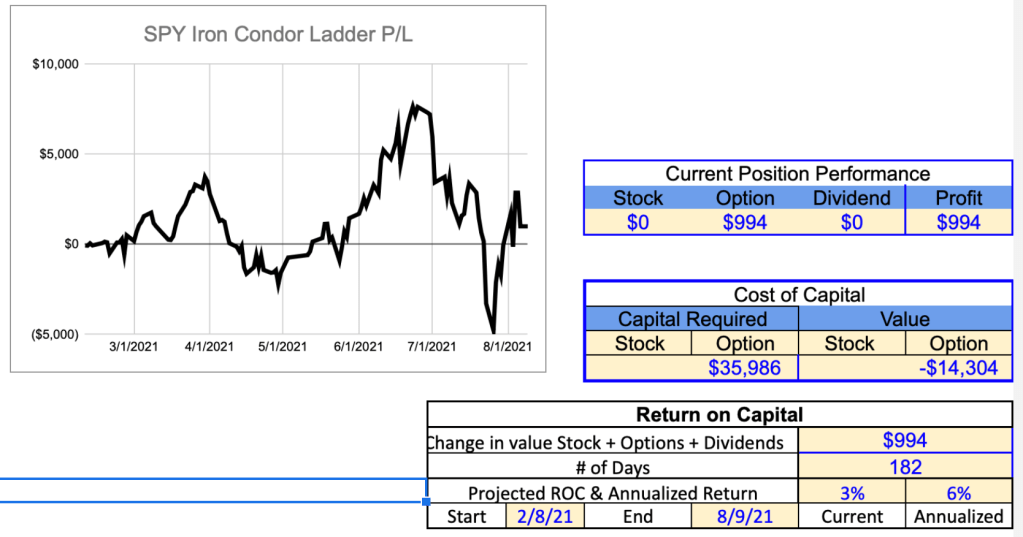

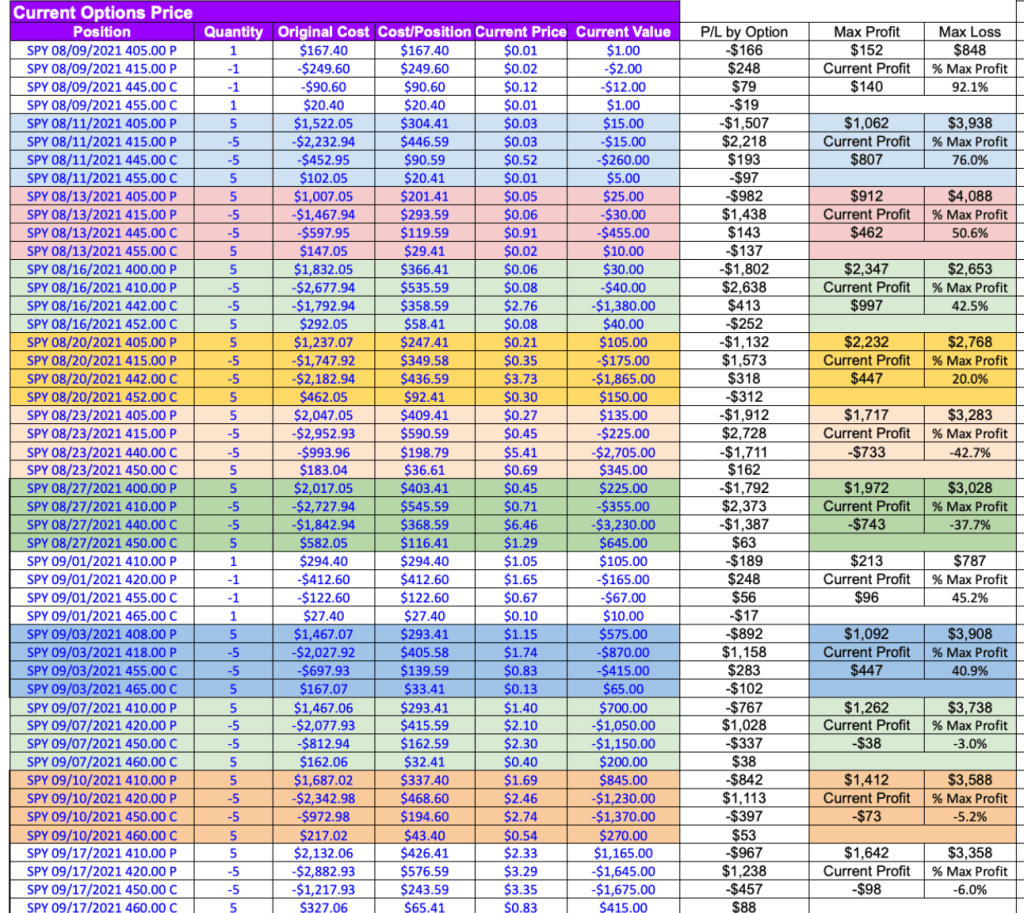

SPY Iron Condor Ladder Update….not much return….yet

The SPY IC Ladder started in Feb has shown significant swings in profit (high of $8,000 to low of $(5,000)…. I would not call it a winning strategy just yet. Annualized return as of Friday was 6%…..not worth the capital at risk. To date I was primarily selling the 45 DTE IC’s (or when they became available) and closing them around 21 DTE. Typically selling body width of 30 and wing width of 10. I stopped selling if the IV dropped below 14 (more recent development). I was rarely achieving the 1/3 value of the wing spread that TT recommend. Currently letting the DTE run lower to see if it helps. I haven’t been doing a lot of “adjustments”…..at the cottage for the summer and the internet connection is a little painful for rolling SPY spreads.

If anyone is interested in the complete list of trades to analyze let me know and I would be happy to share.

Open positions in the bottom table. Would like to see a pull back as current price has pushed a couple of the short calls ITM.

#t sto T 6 AUG…

#t

sto T 6 AUG 21 27.5 PUT @.05 BATS /expired

sto 6 AUG 21 28 PUT @.15 BATS /assigned

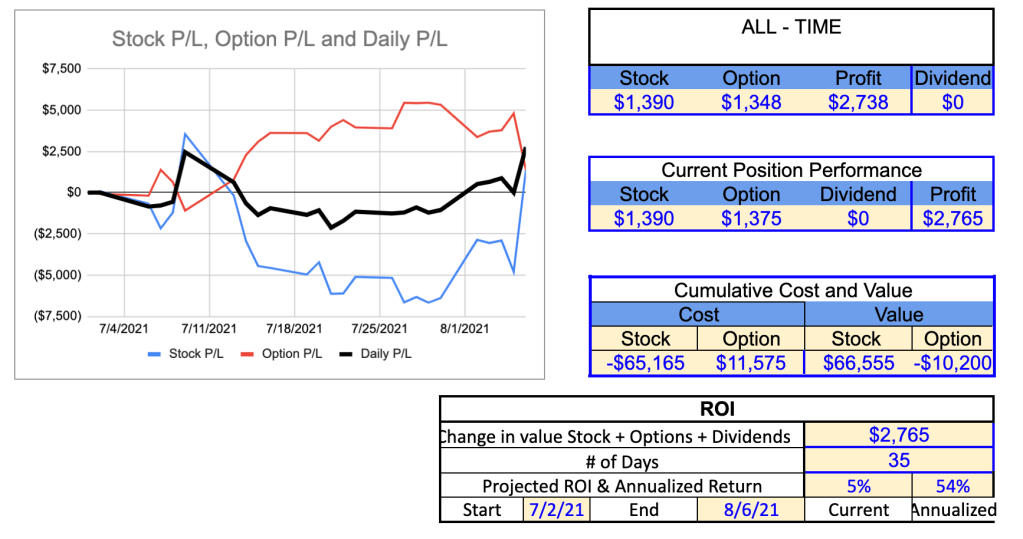

Update on CFLT Position

Couple of weeks ago I posted about opening a new CC shortly after CFLT IPO. Stock price did go up after establishing the position only to start a sustained decline……until last week when the stock recovered.

Last week was an interesting time for the banks/analysts to come out with strong upgrades and new target prices pushing the price up …..considering the IPO lock up expires on Monday……

Little nervous heading into next week so we wrote ITM calls at $40 (Sep).

Position looks good today with a 54% annualized return…..might feel different next Saturday….hopefully not but can’t say I have a lot of trust in the bankers…….

Black line in the graph is the net of the stock and option profitability. They were mostly offsetting until the last week.

OptionsExpiration

Pretty good week:

Expired:

AMC 08/06/2021 28.0 Diagonal Puts

AMC 08/06/2021 26.0 Diagonal Puts

AMC 08/06/2021 25.0/10.0 Bull Put Spreads

COIN 08/06/2021 210.0 Diagonal Put

LABU 08/06/2021 65.0 Diagonal Call

LABU 08/06/2021 50.0 Diagonal Puts

TLRY 08/06/2021 23.0 Diagonal Calls

TLRY 08/06/2021 16.5 Covered Calls

TLRY 08/06/2021 16.0 Covered Calls

TNA 08/06/2021 94.0 Diagonal Call

TNA 08/06/2021 92.0 Diagonal Call

TNA 08/06/2021 77.0 Diagonal Put

TQQQ 08/06/2021 138.0 Diagonal Call

TQQQ 08/06/2021 141.0 Diagonal Call

TQQQ 08/06/2021 122.5/85.0 Bull Put Spread

TQQQ 08/06/2021 122.5/65.0 Bull Put Spread

VXX 08/06/2021 42.0 Diagonal Calls

VXX 08/06/2021 41.0 Diagonal Calls

VXX 08/06/2021 40.0 Diagonal Calls

VXX 08/06/2021 37.0 Diagonal Calls

VXX 08/06/2021 36.5 Diagonal Call

VXX 08/06/2021 35.0 Covered Calls

VXX 08/06/2021 34.5 Covered Calls

VXX 08/06/2021 28.0 Diagonal Puts #VXXContango

VXX 08/06/2021 27.5 Diagonal Puts #VXXContango

VXX 08/06/2021 27.0 Diagonal Puts #VXXContango

SLV Puts

Rolled SLV Aug 06 2021 23.0 Diagonal Puts to next week for a$0.10 Credit

Added new short SLV Aug 06 2021 22.5 Diagonal Puts at $0.30

AMC Puts and Calls

Sold AMC Aug 13 2021 24.0 Diagonal Puts at $0.40.

Bought to close AMC Aug 06 2021 31.0 Diagonal Calls at $2.67 (Sold on a roll last week at $7.91)

Sold Sold AMC Aug 13 2021 34.0 Diagonal Calls at $2.94, so a $0.27 Credit on a 3 point bump in the short strike

TLRY Put Rolls

Bought to close TLRY 08/06/2021 15.5 Puts at $0.97 (Sold last week on a roll at $1.27)

Sold TLRY 08/13/2021 15.5 Puts @ $1.19, so a $0.22 Credit.

Then near the close:

Bought to close TLRY 08/06/2021 14.5 Puts at $0.05 (Sold last week on a roll at $0.61)

Sold TLRY 08/13/2021 13.5 Puts @ $0.16, so a $0.11 Credit plus a point drop to an out of the money strike

VXX Put Rolls

At various times during a weak day in VXX:

Bought to close 1 VXX 08/06/2021 29.5 Put at $0.86 (Sold last week on a roll at $0.99)

Sold 1 VXX 08/13/2021 29.0 Put @ $1.06 so a 0.20 Credit and a half point lower strike

Bought to close VXX 08/06/2021 29.0 Puts at $0.36 (Sold last week on a roll at $0.68 and $0.72)

Sold VXX 08/13/2021 28.0 Puts @ $0.38, so a 0.02 Credit and a 1 point lower strike

Bought to close VXX 08/06/2021 28.5 Puts at $0.12 (Sold last week on a roll at $0.35)

Sold VXX 08/13/2021 27.5 Puts @ $0.29, so a 0.17 Credit and a 1 point lower strike

#VXXContango

SOXL Put Close / Expiration

#shortputs

$SOXL BTC 8/20 35 put at .20. STO at 2.10

#optionsexpiration

$T 28.5 call

$NVAX 192.5 call

$NVAX 250 call

$ARKK 124 call

$TSLA 720 call

$MRVL 60 put

Z post-earnings

Sold to open Sep 17 85 puts @ 1.20

#TastyTradeFollow

LABU

#CoveredCalls – Going another week.

Bought to Close LABU AUG 6 2021 60.0 Calls @ .14 (sold for 1.22)

Sold LABU AUG 13 2021 60.0 Calls @ 2.54

SPX trades

#SPX1dte Sold to open $SPX 4360/4380-4465/4486 condor for 1.05, SPX at 4434, IV 6.5%, deltas -.07 +.08

Expiring: 4350/4370-4465/4485 condors, sold yesterday for 1.05

Closing BYND calendar

Stock not cooperating. Sold Aug 6/Aug 13 122 put calendar @ 1.76 for a 21% loss.

ROKU

#ShortPuts – Back in…new position. Outside the expected move and near multi month lows.

Sold ROKU SEP 17 2021 325.0 Put @ 4.40

BYND post earnings

#ShortPuts – Took the quick scalp.

Bought to Close BYND SEP 17 2021 95.0 Puts @ .80 (sold for 1.20)

HOOD Sep

Sold Sep 17 40/30 bull put spread @ 3.05 with the stock at 53.63

OLED post earnings

#ShortPuts – Had this one sitting out there. Didn’t think it would fill. Selling the expected move with the stock already down 25 points.

Sold OLED SEP 17 2021 185.0 Put @ 3.00

LAZR

#CoveredCalls – Earnings next week. Covering early.

Bought to Close LAZR AUG 6 2021 19.0 Calls @ .01 (sold for .47)

Sold LAZR AUG 13 2021 19.0 Calls @ .50

BYND calendar

Trying a @Hawk trade.

Bought Aug 6/Aug 13 122 put calendar @ 2.23. Will be closed before end of day today.