#SPX7dteLong Bought to Open $SPX Nov 23rd 3595/3615-3625/3645 iron condors for 16.35, with SPX at 3620.

Monthly Archives: November 2020

COST

COST announced today that its Board of Directors has declared a special cash dividend on Costco common stock of $10 per share, payable December 11, 2020, to shareholders of record as of the close of business on December 2, 2020.

#shortputs PYPL Sold Dec. 18,…

#shortputs PYPL

Sold Dec. 18, 170 put for 1.61. PYPL hasn’t been below 170 since mid July.

OSTK

#ShortCalls – Catching a bid for some reason. I had double sold these against some short puts so taking them off for the gain…

Bought to Close OSTK NOV 20 2020 62.0 Calls @ .35 (sold for 1.00)

EXAS

STO December 18, 100 puts at 1.15 with stock down to 117 today.

ABBV – Oven Baked Election Proof – update

Original setup:

On 09/09/2020: BTO ABBV stock @ $92.19

STO ABBV Nov: 90 call @ $5.25

BTO ABBV Jun 2022: 120 put : @ $38.42

ABBV pays a $4.72 per share dividend (5.1% yield).

Update: 11/17/2020: Stock is @ $99.70. A couple of short call rolls to the March 100 calls @ $5.62. (for essentially a scratch).

The stock is up $7.40 and the protective puts are down $7.00.

Payday comes when the short calls expire worthless (one day).

The setup is doing what it should do.

#rolling CHGG Rolled Nov. 20,…

#rolling CHGG

Rolled Nov. 20, 70 put to Dec. 18 for 2.15, stock is at 68.

WBA

Walgreens is down a big chunck today, apparently after an Amazon announcement.

#coveredcalls AAL Bought 100 shares,…

#coveredcalls AAL

Bought 100 shares, sold Nov. 27, 13 call for 12.08.

TSLA

#ShortPuts – Sold TSLA DEC 04 2020 400.0 Put @ 5.80

Still holding Dec 11 325.0 strike…

AMZN WBA

Amazon to sell RX Drugs.

WBA down 10%

DKNG Anatomy of a Trade

Here’s a Tasty Trade segment done today on how they managed the swings in DKNG to a profit, I thought it was a really good example of “what can be done” with a crazy stock. I’ve got DKNG collared, and am not quite net-profitable on it after the big drop, but I have (and continue to) collected a lot on the short hedges.

Sue

https://tastytrade.com/tt/shows/market-mindset?_sp=f133318e-0cd5-4c2d-a1bb-31c2e60b16b0.1605556482468

#closing #shortputs CCL Closed a…

#closing #shortputs CCL

Closed a Nov. 20, 20 put, originally sold June 9 as a June 19, 21 put. It was rolled 5 times, finally made about $150. CCL was as low as 12.11 on Oct. 29, hanging around 17.40 today.

Ignoring Gift Horse NVDA Covered call

$NVDA STO 11/20 550 call at 17.82. Covering shares assigned Friday at $535

SPY Roll

Bought to close 1 SPY Nov 16 2020 349 Call / Sold to Open 1 SPY Nov 20 2020 349 Call @ 0.52 Credit

#closing TTD Nov. 10, sold…

#closing #shortputspread TTD #shortputs XOM

TTD Nov. 10, sold a Nov. 27, 660/670 put spread for 2.10, bought today for .98

XOM Aug. 4, sold an Aug. 14, sold a Sept. 18, 40 put for .76, rolled it out twice, closed today, made $32 on the recent increase in price.

SPX trades

#SPX7dteLong Bought to Open $SPX Nov 20th 3600/3620-3630/3650 iron condors for 16.35, with SPX at 3627.

Expected for expiry today: Nov 16th 3580/3600 call spreads for max credit of 20.00, plus 1.00 I got for put side this morning. Condors bought for 16.68 last Wednesday.

#SPX1dte: Expected to expire worthless: Nov 16th 3475/3495-3655/3675 condors, sold Friday for 1.15.

#shortputs DKNG Sold Nov. 20,…

#shortputs DKNG

Sold Nov. 20, 40 put for .57. DKNG down today, apparently on the wrong side of the Baltimore/New England game

INTC

Sold INTC Nov 20 2020 47.0 Covered Call at $0.37 to replace the 46.50 Covered Call that expired Friday

PFE

Now trading down where it was before the vaccine announcement.

SLB Covered Calls

Sold SLB 11/20/2020 19.50 Covered Calls @ 0.26

Sold SLB 11/20/2020 20.00 Covered Calls @ 0.11 & 0.17

VXX new Long term Diagonal Puts

Can you say contango?

Bought to open VXX Jan 21 2022 6 Puts/ Sold to Open VXX Nov 20 2020 18 Puts at $0.07 Credit.

Bought to open VXX Jan 21 2022 5 Puts/ Sold to Open VXX Nov 20 2020 17.5 Puts at $0.05 Credit.

Long side = 432 DTE

Short side = 5 DTE

AAL

STO $AAL Nov-20-2020 13 #CoveredCalls @0.30.

OSTK

#CoveredCalls – Sold OSTK NOV 20 2020 56.0 Calls @ 1.60

SPX 7-dte

#SPX7dteLong Sold to close $SPX Nov 16th 3570/3550 put spreads for 1.00. Leaving the 3580/3600 call spread to expire for full 20.00 credit. This takes away my protection from am intraday drop, but market looking stable and Moderna news should keep us positive today. Condors bought for 16.68 last Wednesday.

ABT Covered Call Strategy Progressing Well

REGN BuCS – 9 Rolls and still a challenge

We have been tracking our REGN BuCS since it was established on Oct 12. It remains a challenge…..

https://coveredcallswithjeff.wordpress.com/2020/11/16/regn-bull-call-spread-a-challenge-so-far/

BX – Calls instead of Stock with Protection – test case

Started on July 10th 2020. BX stock price @ $53.60. Ended on November 13th 2020. BX stock price @ $56.16

Stock price range during the period was $50.65 low, $59.10 high. Trading within that channel saw a couple of strong up and downtrends (more rolling than I expected).

Opening transaction: Buy 1x Dec 18, 2019; 40 Call (cost $15.75) / 55 Put (cost $6.45) Long Strangle Stock Replacement + Put protection, debit cost $22.20.

Close out transaction was a credit of $17.40 ($15.64 calls, $1.76 puts) – so the Puts suffered more from time decay and a lower VIX (my assumption).

Over the period 49 Buy/Sell (split 50% Buy / 50% Put) transactions made with a net final total profit of $0.76 per contract (10 contracts = $760).

Strategy was selling 1x weekly calls and 0.5x weekly puts – rolling as required.

In this case, Buy and Hold w/o protection would have been a more profitable strategy.

A couple of takeaways, and it is relevant for a #sleepatnight strategy.

- DITM Collar trades pay off more to the downside (the combined short deltas of short calls + long puts) so great for an averaging down strategy.

- Overcoming time decay on the long puts is a challenge and a balancing act, particularly in a period of rapid stock price appreciation as one has to deal with both short calls and long puts being challenged.

- Depending on risk tolerance careful analysis is needed on the strike prices of the short calls and long puts in a collar trade.

TQQQ Closed Early / MRVL Put / Expirations

$TQQQ BTC 11/20 85 put at .10. STO at 4.70. Thank you @ramie77

$MRVL STO 11/20 42.50 put at .80

$NVDA Assigned at 535

SPY

Sold to open 1 SPY 11/18/2020 355.0 Call @ 5.02.

Sold against a 360 Call already long for 11/27.

This works best if SPY drops next week.

SPX 1-dte

#SPX1dte Sold to Open $SPX Nov 16th 3475/3495-3655/3675 iron condors for 1.15, SPX close at 3585, IV 13.7%, deltas -.06,+.06. Sold right AFTER the closing bell.

SPCE SLB AAL

Roll $SPCE Nov-20-2020 $30 #shortputs // Dec $30 #ShortPuts @.45.

Roll $SLB Nov-13-2020 $18 #CoveredCalls // Nov-20-2020 $.32

Expiring $AAL Nov-13-2020 14.5 #CoveredCalls Was STO @0.25

ADS Roll

Bought to close ADS 11/13/2020 65.0 Calls / Sold ADS 11/20/2020 67.50 Calls @ 0.70 Credit plus another 2.5 points on the short strike for only 1 week.

No earning or dividend to account for the very generous premium/strike bump.

Last VXX Put Roll

Bought to close VXX 11/13/2020 19.00 Puts / Sold VXX 11/20/2020 18.00 Puts @ 0.15 Credit but I dropped the strike price a full point.

I’m done with VXX for this week.

*Except for the short VXX calls that expire in an hour

KSS Roll into earning

Bought to close 1 KSS 11/13/2020 23.50 Covered Call / Sold 1 KSS 11/20/2020 24.0 Covered Call @ 1.02 Credit plus another $0.50 up on the strike price. (a nice fat time premium)

I’m letting my other 11/13 23.50 covered Call get assigned, partly based on my history with this stock.

I bought my first 100 shares on 3/13 at 23.19 just as the Covid decline accelerated . I’m letting those shares go.

I bought a 2nd 100 shares on 04/02 at 11.65. I didn’t get the dead low but did pretty well on that buy.

I’ve been sell covered calls all the way up on both lots and have been tempted to get out many times since my shares got above my average cost of 17.42.

I figure whatever happens next week I’ll be happy. It the stock is up, at least I still have some, if it is down, at least I sold some.

TDOC

#ShortPuts – Similar to NFLX. It’s been weak but nicely profitable so resetting…

Bought to Close TDOC NOV 20 2020 170.0 Put @ 1.75 (sold for 4.00)

Sold TDOC DEC 04 2020 162.5 Put @ 2.95

WBA

Rolled some covered Calls out to attempt to capture next week’s 0.4675 per share dividend on 11/18.

Bought to close WBA 11/13/2020 38.50 Covered Calls / Sold WBA 11/27/2020 38.50 Call @ even money

Bought to close WBA 11/13/2020 41.0 Covered Call / Sold WBA 11/20/2020 41.0 Call @ 0.12 Credit.

WBA is at 42.42

NVDA

#ShortPuts – This one got caught in the early week tech selloff and never could quite recover. Rolling into earnings week…

Rolled NVDA NOV 13 2020 535.0 Put to NVDA NOV 20 2020 505.0 Put @ 1.05 credit (3.35 total now)

NFLX

#ShortPuts – Looking a little weak so booking and resetting…

Bought to Close NFLX NOV 20 2020 450.0 Put @ 1.98 (sold for 5.00)

Sold NFLX DEC 04 2020 425.0 Put @ 2.60

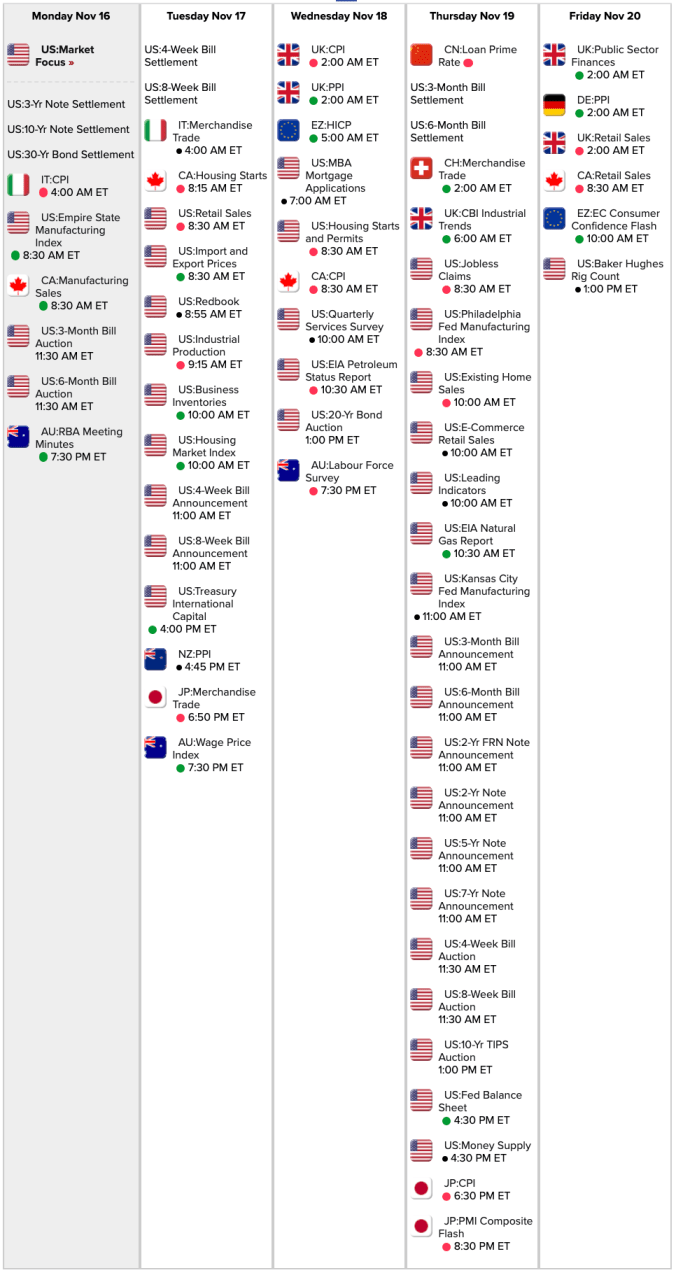

Econ Calendar for week of 11/16/20

VXX Put Roll

Bought to close VXX 11/13/2020 19.50 Puts / Sold VXX 11/20/2020 18.50 Puts @ 0.08 Credit but I dropped the strike price a full point.

My short strikes are rapidly approaching the long strikes in January.

Still waiting to see if I will have to cover the 19.0 Puts later this afternoon

SPY – selling out a long call

Sold 1 SPY 11/20/2020 355.0 Call @ 4.57.

Bought this on 10/05 as part of a diagonal spread @ 4.23.

I wrote against this several more times after the original short was gone.

Now with only a week to go until it expires, I’m cashing in my chips on this one.

I’m probably early …. but oh well

BYND Earnings

#JadeLizards – Looking weak so bailing now…

Bought to Close BYND NOV 13 2020 125.0/120.0/124.0 Jade Lizard @ 4.40 (sold for 4.14)

#shortputs PINS Sold Dec. 18,…

#shortputs PINS

Sold Dec. 18, 55 put for 1.99.

#closing PFE Nov. 11 I…

#closing PFE

Nov. 11 I bought a Jan. 15, 40 call, a successful vaccine bet, sold it today. Yesterday PFE announced a spin off that would make my call a non standard call. I am taking an $8 loss and will likely buy back in next week.

“Pfizer Inc. (PFE) has announced a spinoff distribution of its subsidiary Upjohn Inc. (“Newco”). Immediately following the spinoff, Newco will merge into Mylan N.V. (MYL), and the combined company will be renamed Viatris Inc. (VTRS). The distribution ratio is approximately 0.1247 of a VTRS share for each PFE share held. The NYSE has set November 17, 2020, as the ex-distribution date.”

DKNG Earnings

#ShortPuts #Earnings #OneNightStand – Quick and easy…

Bought to Close DKNG NOV 20 2020 37.0 Puts @ .20 (sold for .90)

SLB Covered Calls

Sold SLB NOV 20 2020 $19.0 Covered Calls @ 0.17 for next week.

VXX New Diagonal

Bought to Open VXX Jan 21 2022 5.0 Puts Net Credit / Sold to Open VXX Nov 20 2020 17.5 Puts @ 0.02 Credit.

Long side – 434 DTE

Short side – 7 DTE

DKNG Earnings

#ShortPuts #Earnings – Looks like I dodged the BYND bullet so taking another shot at earnings. Going out an extra week…

Sold DKNG NOV 20 2020 37.0 Puts @ .90

#closing DKNG Sept. 25, sold…

#closing DKNG

Sept. 25, sold a Nov. 20, 35 put for 1.05. Closed today for .44

Oct. 28, sold a Nov. 20, 52.50 call for .80. Closed today for .29.

Earnings tomorrow, decided to cash in my chips.

SPY early Roll

Bought to close 1 SPY 11/13/2002 340.0 Call / Sold 1 SPY 11/18/341.0 Call @ 0.07 Credit with SPY at 352.29

Bumped the strike up 1 point closer to my long Dec 355 call.

Even if SPY falls more tomorrow, I doubt the spread between the options changes much because they are too far in the money.

VXX

Since I’ve rolled most of my short put exposure to next Friday, I’m selling some counter-balancing calls to create some short strangles.

Sold 11/20/2020 26.0 Calls @ 0.39 with VXX at 20.30.

Also sold some more calls for this week – Sold VXX 11/09/2020 23.50 Calls @ 0.11.

Trying to encourage a few short puts in VXX to expire tomorrow.

Edit: Added some VXX 11/13/2020 23.0 short Diagonal Calls @ 0.11 and 0.15

SPX 7-dte

#SPX7dteLong Sold to Close $SPX Nov 13th 3600/3580 put spreads for 18.30. Condors bought Monday for 17.25.

This leaves the call side available and eliminates upside risk. I will look for a reversal to take profits, but if I dont get one the trade is already profitable.

TDOC BWB

TDOC currently trading @ $185

BTO TDOC Dec 04, 192.5 / 185.0 / 172.5 Broken Wing Put Butterfly @ $0.78 credit.

No risk to the upside (keep the credit) – downside breakeven $177.

VXX Puts

One more early roll that brings my short strike closer to the strikes of my 2021 long puts

Bringing in $Cash and buying more time

Bought to close to Close VXX Nov 13 2020 22.0 Puts / Sold to Open VXX Nov 20 2020 21.5 Puts @ 0.02 Credit but lowered the strike 0.50.

I now only have strike 19.0 and 19.50 puts to worry about for tomorrow.

A covering trade @ 0.01 or an expiration on both would be welcome.

RH BWB – add layer (not)

Yesterday: ‘A tingle of greed urges me to capitalize where $400 could be an obvious resistance level. 52 week high was $410. Earnings are on 12/03. So:

STO RH Nov 20, 420 / 430 Bear Call Spread for $2.20.

Started with 1 contract, ready to scale up if RH momentum continues’.

Today: RH moves rapidly to $420. I mean there’s momentum and there’s momentum. Moving out of the way of the freight train, so closed out the 1 contract for a debit of $5.30. Call it stop loss trigger.

#jadelizard WYNN WYNN has been…

#jadelizard WYNN

WYNN has been dropping after a pretty big runup. Sold Dec. 18, 77.50/90/92.50 for 3.50. No upside risk, downside break even is 74, stock at 88.

TAN

#ShortPuts #GreenNewDeal – A buddy of mine pointed this one out. Throwing these out there just to get it on the radar since it’s my first time in it. Selling the expected move and 50ma…

Sold TAN DEC 18 2020 65.0 Puts @ 1.35

DDOG

#ShortPuts – Taking the one day quickie…

Bought to Close DDOG DEC 18 2020 65.0 Puts @ .50 (sold for 1.20)

FTCH Puts

$FTCH STO 11/20 41 puts at 2.05

TQQQ, BTC November 20, 100…

TQQQ, BTC November 20, 100 puts at .01, sold at 2.11

IIPR , BTC November 20, 110 puts at .05, sold at 2.25

Labu, BTC November 20, 40 put at .05, sold at 1.60

Wild ride over past 30 days…..definitely need to learn more about handling volatility around earnings

https://coveredcallswithjeff.wordpress.com/2020/11/12/ib-account-down-from-high-up-from-dip-over-past-30-days/

SPY Roll

Bought to close 1 SPY 11/11/2002 348.0 Call / Sold 1 SPY 11/16/349.0 Call @ 0.26 Credit.

Bumped the strike a point. Sold against a long SPY Dec 355 call

#longcalls PFE Bought Jan. 15,…

VXX Puts

Some early rolls that I should have done yesterday with the stock higher.

Bringing in $Cash and buying more time

Bought to close to Close VXX Nov 13 2020 22.5 Puts / Sold to Open VXX Nov 20 2020 22.5 Puts @ 0.30 Credit.

Bought to close to Close VXX Nov 13 2020 21.0 Puts / Sold to Open VXX Nov 20 2020 20.5 Puts @ 0.02 Credit but lowered the strike 0.50.

Bought to close to Close VXX Nov 13 2020 20.5 Puts / Sold to Open VXX Nov 20 2020 20.0 Puts @ 0.04 Credit but lowered the strike 0.50.

#shortputspread AMZN Sold Dec. 18,…

#shortputspread AMZN

Sold Dec. 18, 2840/2850 for 2.03

SPX trades

#SPX7dteLong When $SPX was at 3573, bought to open Nov 16th 3550/3570-3580/3600 iron condors for 16.679 (avg price). This is only 5-dte, because yesterday I mistakenly sold the Nov 18th trade early.

Expected to expire today:

$SPX Nov 11th 3520/3540 call spreads at max credit of 20.00. Condors bought last Thursday for 17.70.

#SPX1dte Expected to expired worthless: 3425/3445-3620/3640 condors, sold yesterday for 1.50.

RH BWB – add layer

RH was trading @ $359 when I opened the Nov 20, 370 / 360 / 340 Broken Wing Put Butterfly @ $3.15 credit. RH has now moved up to around $400 (that’s good for the BWB). A tingle of greed urges me to capitalize where $400 could be an obvious resistance level. 52 week high was $410. Earnings are on 12/03. So:

STO RH Nov 20, 420 / 430 Bear Call Spread for $2.20.

Started with 1 contract, ready to scale up if RH momentum continues.

Z BUPS Closed / TQQQ Put Closed

$Z BTC 11/20 85/95 BUPS at .50. STO at 3.19

$TQQQ BTC 12/18 40 put at .20. STO at 2.10 Thank you @jsd501

#shortputs TWTR Sold Dec. 18….

#shortputs TWTR

Sold Dec. 18. 39 put for 1.00

Closing DOCU

Bought to close $DOCU 11/20 180/190/250/260 @ 1.59 for around 47% of the profit. Sold for 3.00 on 10/22. With the recovery since mid yesterday and the stock now above 204, I took the opportunity to get out for a profit. IV has increased since I sold this which is of course the opposite of what I wanted but enough time decay has happened so theta beats vega this time.

DDOG post earnings

#ShortPuts – Considered a short strangle but decided puts only and going out a little in time. Stock down today and still selling outside the expected move and below the 200ma.

Sold DDOG DEC 18 2020 65.0 Puts @ 1.20

SPX 1-dte

#SPX1dte Sold to Open $SPX Nov 11th 3425/3445-3620/3640 iron condors for 1.50, SPX at 3544, IV 22.3%, deltas: -.06,+.07

#fallingknife #shortputs TLRY Sold Dec….

#fallingknife #shortputs TLRY

Sold Dec. 18, 6 put for .42, stock down on earnings

Hello everyone,

Have not posted in a long time, busy at work with a new office, Covid, but more importantly for option traders have been working on several new projects and tactics with some of the professionals I have worked with over the years.

The 2 most exciting of these is Byran Klindworth, who developed the market tide and rate of change indicators, and I have been working on an indicator specifically for option selling and also a trading robot. We are currently in the process of beta testing both. They both work very well. I am not selling anything here, those that have the market tide already have some of the code, we are just making some adjustments.

However we have taken it a step further and are actually about to roll out an AI, quantitative analysis trading program that can actually be traded as a robot. His/her name is HERMES. It goes live on Tradestation tomorrow. Preliminary results about 2 months ago resulted in doubling a small account in 4-5 weeks. We are now scaling that up to a $5000 account to see how much slippage and commissions affect profits in real time with real money.

At first, we are putting a human filter on the trades before doing them, but later it will be able to trade automatically.

Also I have been working on tactics for Trader’s Reserve and have had excellent results substituting synthetics for regular trades. Live trading we have 260% annualized returns in some accounts including the Feb.-March meltdown.

Anyway, there is a new website developing for the robot/Hermes.

Stay tuned, we will give updates as it trades and progresses and everything will be transparent for those that are interested including the performance.

Again, not selling anything but there will be some tools on the website that might be interesting for all of you. First retail available quant trade program for the masses. We built a computer that can handle 1 trillion calculations a second and it still took 7 days to back test everything and optimize the robot. Bryan handled the coding, the math is way above my level, but it has the collective knowledge of some of the best trading strategies ever developed programmed into it.

As I said, stay tuned!

On a more personal note, hope everyone is doing well and have some time finally to start posting trades again. Wear your mask to avoid the Covid, they work.

Cheers, Chris