#SPX7dteLong Bought to Open $SPX Nov 18th 3515/3535-3545/3565 iron condors for 17.75, with SPX at 3540. I picked the wrong date, was supposed to be Nov 16th. So this one is 8-dte. I may add a Nov 16th later today or tomorrow.

Monthly Archives: November 2020

TSLA

#ShortPuts – Sold TSLA DEC 11 2020 325.0 Put @ 4.25

VXX Calls

I was too cautious and only did 1 each hoping to add if it ran a bit more above the 20.30 high for the day.

Offsetting a large short put position.

Sold VXX Nov 13 2020 23 Call Limit at $0.31

Sold VXX Nov 13 2020 23.5 Call Limit at $0.26

Sold VXX Nov 13 2020 24 Call Limit at $0.21

#shortputspread TTD Sold Nov. 27,…

#shortputspread TTD

Sold Nov. 27, 660/670 for 2.10

#shortputs NKTR Sold a Nov….

#shortputs NKTR

Sold a Nov. 20, 16 put for .55 on the beaten down NKTR

SLB Covered Calls

Sold SLB 12/04/2020 20.0 Covered Calls @ 0.43

WBA

Up 9% today.

Above my cost and at the highest price since early August.

Next dividend date is 11/18

TQQQ

#ShortPuts – Adding one at a lower strike…

Sold TQQQ DEC 18 2020 90.0 Put @ 2.25

BYND Earnings

#JadeLizards #Earnings – Looks like we’re not getting rid of cows quite yet… 🙂

Rolled call spread side of the Lizard down from 144/147 to 120/124 for 1.09 credit against a 125 put. Total credit now 4.14 so still no upside risk. Dead zone in this position is from 124.14 to 125.00 I’d be happy for it to get back to those levels.

TQQQ

STO December 18, 120 put in my IRA at 8.25, a starter position.

Market’s end of day fade

Not political, just observing that Mitch McConnell’s comments about Trump’s legal fight(s) may have gotten some notice: https://www.zerohedge.com/political/mcconnnell-backs-trump-push-recounts-says-shouldnt-accept-election-results-media

Things could get hairy for a while in the markets before they calm down if election uncertainty gets priced back into this again.

OLLI Puts

$OLLI STO 11/20 82.5 put at 1.20

BYND Earnings

#JadeLizards #Earnings – Taking a small shot needing a little down move. No upside risk…

Sold BYND NOV 13 2020 125.0/144.0/147.0 Jade Lizard @ 3.05

TQQQ

#ShortPuts – Starter…

Sold TQQQ DEC 18 2020 95.0 Put @ 2.05

TQQQ Put Closed

$TQQQ BTC 12/18 45 put at .40. STO at 2.75 on 7/21. Thank you @jsd501

SPX 7dte

#SPX7dteLong Bought to open $SPX Nov 13th 3580/3600-3610/3630 iron condors for 17.25, with SPX at 3603.

Expiring with max profit of 20.00: Nov 9th 3430/3450 call spreads. Condors bought last Wednesday for 18.20.

NVDA

#ShortPuts – Nice down day on this…let’s try to talk it down even more for earnings next week. Selling just outside the expected move and down nearer to the 50ma.

Sold NVDA NOV 13 2020 535.0 Put @ 2.30

BIIB

#ShortPuts #CoveredCalls – Got lucky with a 290 put expiration on Friday since the stock never opened. In a different account I’ll be assigned at about 271 so covering that now on this little bounce. Will continue mixing in put sales as well. The actual announcement on the drug isn’t until March so might have decent premium until then.

Sold BIIB NOV 27 2020 260.0 Call @ 2.35

Also taking the morning scalp…

Bought to Close BIIB NOV 13 2020 225.0 Put @ 1.40 (sold this morning @ 5.60)

#closing #shortputspread WYNN Nov. 6,…

#closing #shortputspread WYNN

Nov. 6, sold Nov. 20, 70/75 put spread for a 1.05 gamble, cashed in my chips today for .05.

Thanks @fuzzballl for the idea.

SLB

Sold to open SLB 11/13/2020 18.50 Covered Calls @ 0.19.

Sold to open SLB 11/13/2020 19.00 Covered Calls @ 0.13.

Sold to open SLB 11/13/2020 20.00 Covered Calls @ 0.12.

AAL

Sold to open AAL 11/13/2020 17.00 Covered Calls @ 0.17.

Sold to open AAL 11/20/2020 17.00 Covered Calls @ 0.30.

BIIB NFLX TDOC

#ShortPuts – A little early but had so few positions figured I’d take a shot…

Sold BIIB NOV 13 2020 225.0 Put @ 5.60

Sold NFLX NOV 20 2020 450.0 Put @ 5.00

Sold TDOC NOV 20 2020 170.0 Put @ 4.00

OSTK

BTC $OSTK Nov-20-2020 $85 #CoveredCalls – Was STO @10.40 on 10/16 when the stock was at $82.09.

Still holding the stock.

Markets

Nice day to have leftover “lottery ticket” long calls from old diagonal spreads.

Will try and exit as many as I can.

Downside Warning canceled

….at the open with SPX hitting new all-time highs. #VIXIndicator

SPX 1-dte

Wow. Perfect day for a #RiskReversal. Definitely should have known…. but Friday being flat made me think the upward move would be limited. Nothing to do but take the loss, with slim hope for some intraday reversal.

Have a great WE

Have a great WE

Election Volatility Part 2

Have a great WE

Have a great WE

BIIB

Expert panel votes down Biogen’s Alzheimer’s drug, and rebukes the FDA in the process

https://www.fool.com/investing/2020/11/06/fda-committee-votes-strongly-against-biogens-alzhe/

SPX expirations

Expiring today:

$SPX 11/6 3300/3325/3530/3555 iron condor

$SPX 11/6 3395/3420/3560/3585 iron condor

#optionsexpiration

Expiration

$PFE 38.5 call

$NIO 29 put

$MRVL 43 put

$NVAX 78 put

Have a great WE

Have a great WE

TQQQ OSTK Puts Closed

$TQQQ BTC 11/20 80 put at .20. STO at 2.35

$OSTK BTC 11/20 60 put at 1.80. STO at 5.90 Thank you @fuzzballl

VXX New Diagonals

Bought to open Jan 15 2021 14.0 Puts / Sold Nov 13 2020 19.50 Puts @ 0.05 Credit.

Bought to open Jan 15 2021 13.0 Puts / Sold Nov 13 2020 19.0 Puts @ 0.05 Credit.

VXX is at the low of the week @ 20.51

BTW – the strike prices are getting much closer together so the margin on the spreads is pretty small.

TSLA

#ShortPuts – Taking the one day scalp here…

Bought to Close TSLA NOV 13 2020 405.0 Put @ 3.25 (sold for 5.70)

MGM Put Closed / NFLX BUPS Part Close

$MGM BTC 11/13 21.5 put at .40. Originally STO the $23 put on 9/16 for 1.62. Rolled for a while and gained .05 of moss.

#bups

$NFLX BTC 11/20 445/455 BUPS at .40. STO at 2.60

SPX trades

#SPX1dte Sold to Open $SPX Nov 9th 3370/3390-3580/3600 iron condors for 1.40, SPX 3500, IV 17.4%, deltas -.06,+.06

Expiring: Nov 6th 3400/3420-3600/3620 condors, sold yesterday for 1.25

#SPX7dteLong Expiring with max credit of 20.00: Nov 6th 3375/3395 call spreads. Condors bought Tuesday for 18.35.

BIIB

@adamfeuerstein 2m

$BIIB – FDA panel votes against aducanumab efficacy for the “positive” EMERGE study.

1 Yes 8 No 2 Uncertain

This was the best data Biogen had.

More votes to come.

GILD

Decided to roll this instead of taking assignment. The EX Dividend date is not until December so no need to commit the cash just yet.

Bought to close GILD 11/06/2020 60.0 Put / Sold GILD 12/04/2020 58.0 Put @ 0.25 Credit and lowered the short strike 2 points.

Made money on the short 60 put too.

LABU

#ShortPuts – Peeling a few more of these off after another big run…

Bought to Close LABU NOV 20 2020 40.0 Put @ .20 (sold for 1.55)

Bought to Close LABU NOV 27 2020 35.0 Put @ .15 (sold for 1.29)

Bought to Close LABU DEC 04 2020 35.0 Put @ .29 (sold for 1.65)

VXX – one last roll

Bringing in $CASH. Buying more time.

Bought to close VXX 11/06/2020 21.0 Diagonal Puts / Sold VXX 11/13/2020 19.50 Diagonal Puts @ 0.01 Credit plus 1.50 points better on the short strike..

When VXX was 27.00 on Monday I never would have believed I would have to roll this position.

Done with VXX rolls for this week.

And I’m just waiting for my remaining VXX Diagonal Calls to expire in an hour.

ADS Roll

Bought to close ADS 11/06/2020 55.0 Calls / Sold ADS 11/13/220 55.0 Calls @ 0.35 Credit

Last ADBE adjustment

Rolled $ADBE 11/20 470/460 bull put spread up to 485/475 @ 1.40 credit. After multiple rolls on both sides of this original iron condor, the position has now been adjusted to ultimately become an iron butterfly with total premium collected of 7.30. With wing widths of 10 points, that leaves the max loss at 2.70 which I am okay to sit with through expiration. I will probably put a GTC order in probably for somewhere around 7.00 to get out of this wild garden hose of a trade for near breakeven.

PTON TQQQ LULU

BTC TQQQ Nov-20-2020 80.90 #BuPS@0.14. Was STO 10/28 @1.56.

Roll-up PTON Nov-20-2020 110 #CoveredCall // Nov-20-2020 125 #CoveredCall @10.25 debit ( 15$ better strike)

Expiring (unless the bottom drops out of athleisure wear the next hour & 1/2) LULU Nov-6-2020 285/295 #bups

Thats the last of my rolling LULU positions for the time being. Couple downs with the ups, but basically 2x’d my original capital in ~6mo.

KSS Covered Calls

Bought to close KSS 11/06/2020 23.0 Covered Calls @ 0.01. It won’t trade any lower. Sold last Friday @ 0.43.

Replaced them with KSS 11/13/2020 23.50 Covered Calls @ 0.26

#earnings TTD Up big after…

#earnings TTD

Up big after earnings!

#shortputspread WYNN Sold Nov. 20,…

#shortputspread WYNN

Sold Nov. 20, 70/75 for 1.05

Thanks @fuzzballl for the idea

WBA Covered Calls

Bought to close WBA 11/06/2020 37.50 Covered Calls / Sold WBA 11/13/2020 38.50 Covered Calls @ 0.08 Credit plus a point higher on the option strike price.

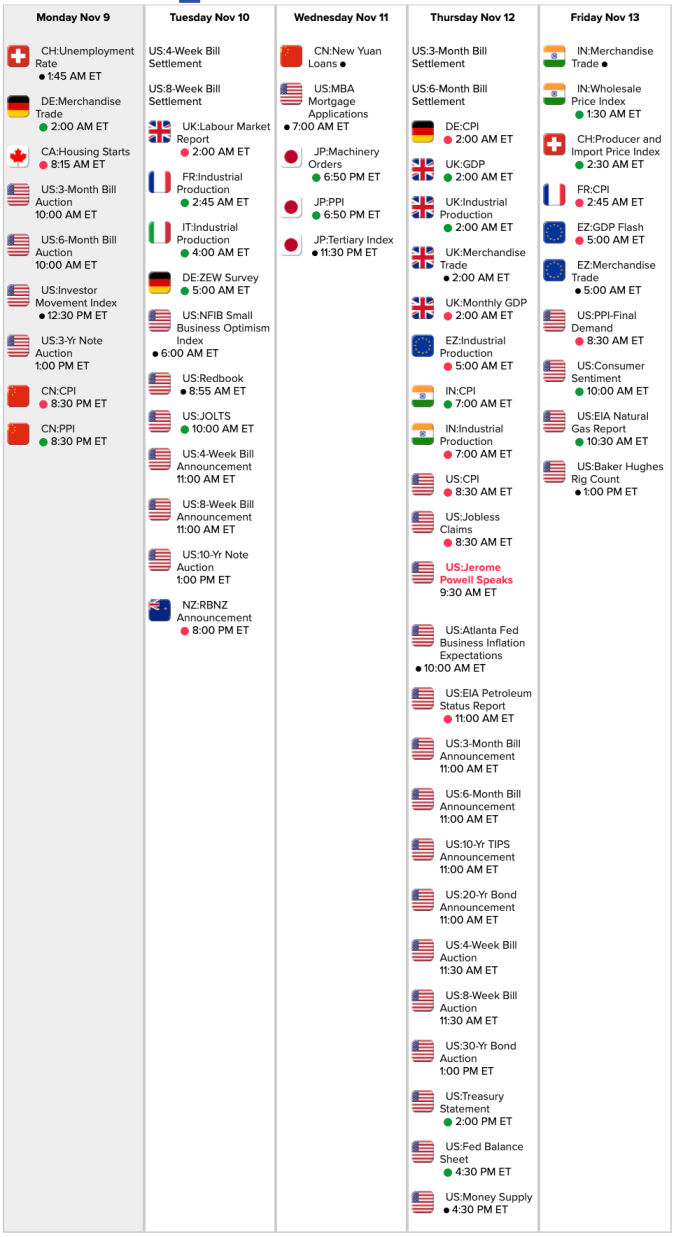

Econ Calendar for week of 11/9/20

#FOMC Jerome Powell speaks Thursday morning.

SPY Roll

Bought to close 1 SPY Nov 06 2020 345 Diagonal Call / Sold to Open 1 SPY Nov 11 2020 348 Call @ 0.02 Net Credit plus a 3 point bump in the short strike.

SPY @ 349.59

COST – Unbalanced Condor

COST @ $384

BTO 1 x COST Nov 20: $385 /$380 long PUT Vertical @ $ 2.45 debit

STO 2 x COST Nov 20: $375 / $370 short PUT Vertical @ $1.22 credit (x 2)

Total debit of $0.01 for the unbalanced Condor. Downside breakeven is around $372. No risk to the upside.

FTCH Puts

$FTCH STO 11/20 38 put at 2.00

VXX – more rolls

Bringing in $CASH. Buying more time

Bought to close VXX 11/06/2020 22.0 Diagonal Puts / Sold VXX 11/13/2020 21.0 Diagonal Puts @ 0.04 Credit.

Bought to close VXX 11/06/2020 21.5 Diagonal Puts / Sold VXX 11/13/2020 20.5 Diagonal Puts @ 0.12 Credit.

Dropped the strikes a full point.

I’m still holding out hope that my 21.0 puts can expire

TDOC

#ShortPuts – Bought to Close TDOC NOV 6 2020 197.5 Put @ .05 (sold for 2.20)

VXX

Bought to close VXX 11/06/2020 28.0 Diagonal Calls @ 0.01 to release some margin. They won’t trade any lower.

Sold last Friday on a rollup @ 1.48.

Bought to close VXX 11/06/2020 26.50 Diagonal Calls @ 0.01 to release some more margin. They won’t trade any lower.

Sold last Friday on a rollup @ 2.18

Rolled some Puts down for next week:

Bought to close VXX 11/06/2020 23.0 Diagonal Puts / Sold VXX 11/13/2020 22.50 Diagonal Puts @ 0.17 Credit.

Paired off with long Jan strike 15 and 16 puts.

Bought to close VXX 11/06/2020 22.50 Diagonal Puts / Sold VXX 11/13/2020 22.0 Diagonal Puts @ 0.22 Credit.

Paired off with long Jan strike 15, 16 and 17 puts.

TSLA

#ShortPuts – Throwing an aggressive one out to have something for next week…

Sold TSLA NOV 13 2020 405.0 Put @ 5.70

October Jobs Report

#Jobs — higher than expected

“October’s growth brings the total payroll gains since May to around 12 million, though that still leaves unfilled about 10 million positions lost in March and April.” -CNBC

Gain of +638,000 non-farm payroll jobs, vs. expected 530K gain

Unemployment at 6.9%, down by 1.0%, vs. expected 7.7%

U6 unemployment at 12.1%, down by 0.7%

Labor force participation 61.7%, up by 0.3

Sept jobs revised up by +11K to +672K

August jobs revised up by +4K to +1.493M

WYNN Earnings

#BullPutSpreads – Whiz has been starting to lean a little bullish on the casinos so selling aggressively here. Either make a little or get stock at a decent basis if it tanks.

Sold WYNN NOV 6 2020 85.0/80.0 Bull Put Spread @ 3.40

SPX 1-dte

#SPX1dte Sold to Open $SPX Nov 6th 3400/3420-3600/3620 iron condors for 1.25, SPX at 3518, IV 23.28%, deltas -.07,+.05.

Slightly bullish from a delta perspective, I’m throwing caution to the wind with employment announcement and ongoing election counts.

NVDA

#ShortPuts – Another one that seems to be up against resistance. Had to roll both of these last week so happy to take ’em off here. Looking out to earnings on the 18th with a clean slate.

Bought to Close NVDA NOV 13 2020 512.5 Put @ 1.38 (sold for 3.90)

Bought to Close NVDA NOV 13 2020 500.0 Put @ .77 (sold for 3.90)

SNOW

#ShortPuts – Selling near the all time low and outside the expected move…and two weeks before earnings.

Sold SNOW NOV 20 2020 230.0 Put @ 2.80

BABA

#ShortPuts – Selling down near the 200ma and outside the expected move. Stock down slightly on earnings…

Sold BABA DEC 11 2020 250.0 Put @ 3.35

NFLX

#ShortPuts – Sold Friday on the big down day. Taking it a couple weeks early…

Bought to Close NFLX NOV 20 2020 425.0 Put @ 1.30 (sold for 6.61)

LABU SPY

#ShortPuts – I’ll take ’em early here after the big run…

Bought to Close LABU NOV 13 2020 40.0 Put @ .10 (sold for 1.43)

Bought to Close SPY DEC 04 2020 280.0 Put @ .51 (sold for 3.17)

Bought to Close SPY DEC 11 2020 275.0 Put @ .63 (sold for 3.20)

Bought to Close SPY DEC 18 2020 270.0 Put @ .75 (sold for 3.45)

VIX futures

SPX 7dte

#SPX7dteLong Bought to Open $SPX Nov 11th 3490/3510-3520/3540 iron condors for 17.70, with SPX at 3515.

TSM BWB

Closing out a Nov 20 95 / 90 / 80 Put Broken Wing Butterfly for a credit of $1.05. BTO on Oct 08 for a credit of $1.09. (total credit for the trade $2.14).

TRADES: Sold, now flat following…

TRADES: Sold, now flat following stocks, options because of earnings, tonight, tomorrow A.M., & Monday A.M. All trades were profitable EXCEPT VIAC.

HWM STC STOCK @18.90

HWM BTC 18.0, 19.0,20.0 Short Puts

CZR STC STOCK @55.04

VIAC BTC 11/6/20 31.0 CALLS @.95

VIAC BTC 11/13/20 31.0 CALLS @1.22 Lost 232 dollars on VIAC TRADES

SPY

#ShortPuts – Could be running up to resistance so booking the higher risk election play…

Bought to Close SPY NOV 20 2020 322.5 Put @ 1.20 (sold for 6.12)

EWZ

#ShortPuts – Taking it on the quick run up…

Bought to Close EWZ NOV 20 2020 25.5 Puts @ .12 (sold for .60)

SPX New diagonal

Taking a leaf out of Iceman’s playbook:

Bought to open 5 SPX Mar 19 2021 3700 Call / Sold to open 5 SPX Nov 20 2020 3525 Call @ 27.25 Debit.

The short 3525 Nov calls roll to the Mar 19 3700 calls for a $30 credit.

SPY

BTC on GTC order SPY 11/20 332/327…1/2 #PutBackRatio @1.00…..STO 10/9 @3.98…

PTON?

Jeff – Do you have bandwidth to do an earnings analysis for PTON? Should be announcing after the bell tonight.

BIIB

#ShortPuts – Selling at the 50ma and well outside the expected move…

Sold BIIB NOV 13 2020 275.0 Put @ 3.80