$SPX $SVXY – so somebody explain this to me. During the first few hours of trading the Dow and SP500 indexes were hardly moving and SVXY rallied hard to another new high. Then as the market took off like a rocketship in the afternoon, SVXY flatlined, and then gave up all of its gains and closed down on the day.

What’s up with that?

Daily Archives: Wednesday, December 7, 2016

#shortputs #longcalls #shortstrangle Joined @ramie77…

#shortputs #longcalls #shortstrangles

Joined @ramie77 Burrito Brigade (What does our flag look like?)

$CMG 3/17/2017 275 put @ 4.40

$CMG 1/20/2017 330 put @ 5.20

#DB BTO 1/20/2017 18 calls @ 1.20

$MDLZ STO 1/20/2017 38/44 Strangle (Thanks Ramie via Tasty)

#bups #vxxgame Close early $AMZN…

/ES /VX pairs trade

Re-post from a couple weekends ago. Still going strong in the paper account. I’ll probably give it a shot for real when I assume a short /ES contract at the end of the year. Paper trading account is up over 25 percent since early September. This includes a nice boost it received shorting /VX futures on election night and never having more than about a third of it in the market at any time.

======================================================================================

#Futures I’ve been paper trading this for awhile and it seems to really work well. A low risk way to take advantage of contango all the time…not just during or after volatility spikes.

Looking at spot VIX as well as the futures…there is generally about a 2 point difference ($2000) between spot and front month and between front month and second month. As time passes with no volatility the front month future will gradually decrease to match spot while second month drops a similar amount (contango). If there is a volatility spike, spot will generally be the first to react with front month future lagging behind and second month future lagging even further behind since volatility is generally a short term phenomenon. Once spot exceeds front month we will be approaching a backwardation scenario.

So…with all that in mind, what’s the trade?

I’ve been shorting the front and second month futures against a similar number of short eminis. I keep a stop on the futures positions of 1.5 to 2 points higher and also sell a well out of the money put against the short emini. This allows 3 things to happen.

1. Drastically reduces risk on a volatility spike using the stops while continually cashing in on contango during long periods of low volatility.

2. If stopped out of the short volatility positions, the short /ES should make up for all the loss and probably more.

3. By selling the well out of the money /ES put I can still gradually raise my basis of the short /ES position but still give enough downside protection to make up for more than the volatility stop out loss.

Any thoughts or ideas are welcome. Still haven’t put the trade on in a real account. I probably will on the next decent volatility spike we get.

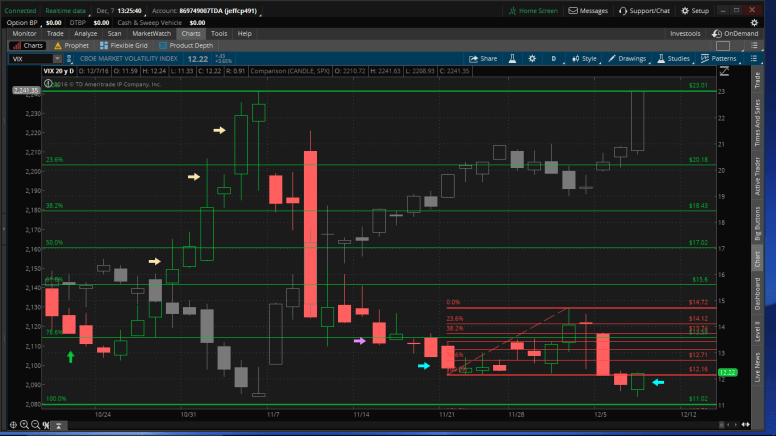

Upside warning re-validated

#VIXIndicator. On the chart below, the green/red candles are the VIX, and the gray candles are the SPX. The cyan arrows indicate the initial Upside Warning on 11/21, and then today. The smaller (red) Fib lines were not an official correction; just the weakness from last week. The 78.6% Fib line is at 12.71, and with today being the third consecutive day below that line, it is a “mini” Upside Warning, thus validating the one we were already under. I’ve seen in the past that these “mini” warnings almost always mean a follow-through of the original rally.

$ILMN #ShortPuts #FallingKnife #OptionLadder -…

$ILMN #ShortPuts #FallingKnife #OptionLadder – sold these early today

Sold ILMN Dec 9 2016 118.0 Puts @ 0.60 – these expire in two days

Sold ILMN Dec 16 2016 115.0 Puts @ 0.75

Sold ILMN Dec 23 2016 110.0 Puts @ 0.70

Sold ILMN Dec 30 2016 105.0 Puts @ 0.65

$AGN #ShortPuts #FallingKnife – Sold…

$AGN #ShortPuts #FallingKnife – Sold AGN Dec 16 2016 175.0 Puts @ 0.75.

$SVXY #CoveredCalls – another new…

$SVXY #CoveredCalls – another new high on SVXY and another rollup

Bought to close SVXY DEC 16 2016 70.0 Calls / Sold SVXY Jan 19 2018 100.0 Calls @ 0.50 Credit

I’ve got covered calls at 85 and 90 for this week so it’s likely I will be selling some of my stock.

$UVXY #ShortPuts #OptionLadder – yes…

$UVXY #ShortPuts #OptionLadder – yes you read that right 🙂

Sold UVXY DEC 23 2016 8.0 Puts @ 0.28

Sold UVXY DEC 30 2016 7.5 Puts @ 0.26

Sold UVXY JAN 6 2017 7.0 Puts @ 0.22

If they don’t expire or get covered for a penny I suspect they will be easy to roll.

SPX Bam!

#SPXcampaign #VIXIndicator As I study and analyze the past performance of the VIX Indicator, I am struck at how resilient the Upside Warning is. It is a better indicator than the Downside Warning. Today we again saw its potency. After weakness last week failed to cancel the warning, we saw three consecutive days of a much lower VIX. This provides further validation of the original Upside Warning. (I will post a chart).

My account experienced a substantial drawdown today as I wasn’t able to keep up with this sharp move. I am comfortable in the fact that I know I can roll as necessary and I will make it back on the next significant pullback in the market. That could be a month or more away, but it will happen.

I stopped out on three call spreads. I have only rolled one thus far.

Bought to close $SPX Dec 9th 2230/2255 call spreads for 11.20. Sold for 1.30 on Nov 8th.

Rolled: Sold to Open $SPX Dec 23rd 2245/2270 call spreads for 9.10, and Dec 23rd 2175/2150 put spreads for 1.55. I stayed at same position size for the calls and 1.5x size for the puts, so the roll resulted in a .13 credit. The call spread is pretty close to the money, but since it is 2 weeks DTE it is more manageable than the Dec 9th spread that it replaces.

Bought to close $SPX Dec 15th 2255/2280 call spreads for 3.85. Sold for 1.30 on Nov 17th.

Bought to close $SPX Dec 23rd 2260/2285 call spreads for 5.35. Sold for 1.70 on Nov 21st.

Both of these hit my stop of 20-points OTM. I will look to roll this week.

I am still left with four call spreads that have past my stop levels. Will decide how to manage depending on how the week plays out.

SPX call Roll

Rolled My Dec 16 Long Call

Nov-18 BTO 2 Dec 16 2260 Long calls @ 2.50

Dec-7 STC 2 Dec 16 2260 Long calls @ 5.00

Dec 7 BTO 2 Dec 16 2280 Long calls @ 1.85

#earnings no LULU takers today?…

#earnings no LULU takers today? I’m not because I’m still fighting off last quarters assignment

How is it that UVXY…

How is it that UVXY is flat on the day? VIX up?

$SPX wild one

Took a chance on last hour pull back. STO Dec 7 $SPX 2235/2230/2230/2225 IC for 3.70, with $SPX at about 2234.

SPX Trade

Closed out Jan 06 week, freeing up some Margin and taking a profit as ES topped at the R3, a 3 PP move for the day

5-December STO 2 1980/2080 BUPS @ 4.61

7-december BTC 2 1980/2180 BUPS @ 1.50

Gain @ ~ 60%

SPX run up

Ok, so I left the computer about 10 minutes after my last post and came back to see that you “guys” ran the index up 10+ points to a new high! As my granddaughter used to say about the unexpected, ” whaa hop’ng?”

Good thing I unloaded my Dec 16 2245/2270 call spread @ 1.1o, sold at 1.30 Dec 2 earlier today. I’m thinking that not even 35 points is a good enough cushion anymore on the call side.

Now, if you wouldn’t mind dialing it back somewhat… ;-}

What happened anyway? The Renzi resignation???

SPX Roll

30-Nov STO 2 Dec 30 2110 Short Puts @ 6.90

07-Dec BTC 2 Dec 30 2110 Short Puts @ 2.60 gain ~ 65%

07-Dec STO 2 Dec 30 2150 short puts @ 4.70

UA is now UAA

Got this off of SMM. Some strange symbol change. The regular UA is now UAA.

http://www.marketwatch.com/story/under-armour-stock-tickers-change-prices-rally-2016-12-07

GS roll up

Rolled Dec 23rd 210 puts up to 225 @ 1.50 credit. Total credit received on gradual roll ups is now 4.05

SPX Trades

Closed Dec 23rd Week

BTC 2ea Dec 23 2040/2140 BUPS

25-nov BTO Long 2040 @ 2.50

25-Nov STO Short 2140 @ 8.60

7-dec BTC Short 2140 @ 2.20

7-dec STC Long 2040 @ 0.60

gain @ 75%

$SVXY

Afternoon all. Hope everyone is doing well and gearing up for the madness of the season. Late yesterday I bought back my Dec 09th 80 Calls for 9.80 when $SVXY was at 89.61. I had originally sold for 3.60 back on Nov 15th. It was trading close to 100 Delta so I figured with the strong up trend in the market I had a good chance to improve the position with a higher strike. I’m looking at Dec 30th 95’s to cover if $SVXY climbs closer to 93 or 94. I don’t have much long stock left in my IRA to sell calls against thus the trade change. However I expect to be completely out or nearly so by year end and will return to put selling as most of my cash is currently committed to #YieldHog orders.

SPX close calls and sell calls

#SPXcampaign Bought to close $SPX Dec 9th 2245/2270 call spreads for .10. Sold for 1.25 on Nov 10th.

Sold to Open $SPX Jan 6th 2290/2315 call spreads for 1.40, with SPX at 2224. Those are the highest strikes I have ever sold on SPX.

Closing trades for margin

#ShortPuts #ShortCalls #LongStock #ShortStock #ShortStrangles

Closing a few trades earlier than planned due to upside pressure on my margin. Fortunately, all but the REGN stock is profitable, but that one’s a biggie (sucks to lose due to downside pressure on a stock while the indices are breaking new highs). I have lost fights with REGN before, I should know better. But I will look to start selling some options once things calm down.

STC REGN long stock for 351.25. Assigned at 415.00 earlier this week.

BTC AZO Dec 16th 720/830 strangles for 1.95. Sold for 3.90 on Monday.

BTC DUST short stock for 48.00. Assigned at 50.00 on Nov 18th.

STC NFLX long stock for 125.05. Assigned at 122.00 on Nov 11th.

FSLR rolling up and out covered call

BTC $FSLR Dec 9 31.50 call @ 1.61. Sold on Nov 21 @ .40

STO $FSLR Mar 17 35.00 call @ 2.22 with stock @ 33.05

Shares assigned on Nov 18 after .75 put credit.

Bullish VIX Indicator

#VIXIndicator #markets

On one hand, the VIX is very low and some bounce should be expected. But on other hand, today could be considered a “mini” Upside Warning, with three consecutive days under the 78.6% Fib line from the 11/21 low to the 12/1 high. I believe we are in for continued move up, although I would be surprised if the velocity is very strong.

$SPX trade

@fibwizard have you started looking at rolling up the Dec 23 $2110 puts up to the next delta 15 (currently about $2160)? Those puts are about 70% profitable now.

$SPX iron condor

STO $SPX Jan 20 2310/2300/2100/2090 for 1.60.

SPX calls sold

#SPXcampaign Sold to Open $SPXPM Dec 16th 2240/2265 call spreads for 2.00, when SPX was at 2213.

New all-time highs this morning.

SVXY

#ShortPuts – Gradually freeing up cash in an #IRA

Bought to Close SVXY JAN 20 2017 40.0 Put @ .25 (sold for 2.75)

GLD

#ShortCalls – These were double sold against ITM short puts. Don’t wanna get caught on a rebound so easing back to regular size…

Bought to Close GLD DEC 9 2016 112.5 Calls @ .55 (sold for 1.22)

OK-I’ll say it, as of…

OK-I’ll say it, as of now the market is actually down at 8:53 CST on Wednesday, Dec. 7, 2016.