#coveredcalls OMC

Sold Jan. 15, 65 call for .90. Bought 100 shares on Dec. 15 for 63.71 for the .65 dividend.

#coveredcalls OMC

Sold Jan. 15, 65 call for .90. Bought 100 shares on Dec. 15 for 63.71 for the .65 dividend.

Not sure it was the right time to let the shares go…..but had to manage margin creep up do to “roll ups” on Friday.

https://coveredcallswithjeff.wordpress.com/2020/12/28/assigned-on-ew-covered-call-profit-of-3498-in-63-days-roi-of-8-8-or-51-annualized/

#bucs

$NNDM BTO 1/15/2021 7.5/10 BUCS at .90

#coveredcalls

$NVTA STO 1/15/2021 55 call at 1.85

$BIDU BTC 12/24 200 call and STO 1/8/2021 210 call at added credit of 1.20. Stock at 193.08.

$PENN BTC 12/31 80 call and STO 1/8/2021 91 call at debit of 5.10. Would gain $11 if called away. Stock at 92.72

#shortputs

$SNOW BTC 12/24 275 put at .20. STO at 2.50 Thank you @fuzzballl for rolling these downhill

$VXX BTC 12/24 21 put and STO 12/31 20.50 at even but lowered strike .50

$FSLR STO 12/24 92.50 put at 2.32

$TSLA BTC 12/31 450 put and STO 1/15/2021 450 put at added credit of 3.21 Thank you @fuzzballl

Expires:

ADBE Dec-18-2020 480/490 #BuPS

TLSA Dec-18-2020 615/625 #BuPS STO earlier today @1.0

Assignments:

SONO Dec-18-2020 22.5 #CoveredCalls

SPXL Dec-18-2020 69.00 #coveredcalls

Roll:

NFLX 530/540 Dec-18-2020 #BeCS // Dec-31-2020 @1.00 credit.

#coveredcalls

$BIDU BTC 12/18 195 call and STO 12/24 200 call at 1.10 added credit

#ShortPuts #CoveredCalls – Replacing stock getting called away…

Sold OSTK DEC 31 2020 57.5 Puts @ 1.30

#shortputs

$CHWY BTC 12/18 70 put at .10. STO at 1.22. Earnings trade with @fuzzballl

$NVAX BTC 12/11 120 and STO 12/18 120 put at added credit of $5. Total credit taken in at $9.

$MRVL BTC 12/11 44 and STO 12/18 43 put at added credit of .05 (yes a nickel). Total credit taken in at $1.83 while reducing strike by a $1.00.

#coveredcalls

$NVDA BTC 12/18 545 and STO 12/24 540 at added $4.10.

#CoveredCalls #OptionsExpiration – Slow day today. Out most of the morning. Sold some, rolled some, and ignored some. 🙂 🙂

BIIB: Covered. Rolled to keep the theta cranking…

Rolled BIIB DEC 18 2020 265.0 Call to BIIB DEC 31 2020 260.0 Call @ 4.25 credit (9.95 total now)

OSTK: Covered. New sale replacing this week’s…

Sold OSTK DEC 18 2020 56.0 Calls @ 2.00

Expiring: 59.5 Calls (sold for 1.65)

SNOW:

Expiring: 330 Put (sold for 3.05)

Have a great weekend!

#coveredcalls

CCL STO 24 Dec 26 call for .42

.20 Delta

Closing AAL Dec-20-2020 14 #CoveredCalls+underlying stock @13.95.

A bit of clearing the decks going into the end of the year.

$TSLA BTC 12/18 595 call and STO 12/18 620 call at added debit of $13.67, but would gain $25 if called away.

Stock at $646. Basis is 480.04. Wish I owned a hawk to watch this.

$NUGT BTC 12/7 74 call and STO 12/18 80 call at even

$TQQQ BTC 12/18 90 put at .15. STO at 2.00. Thank you @jsd501

https://coveredcallswithjeff.wordpress.com/2020/12/07/good-week-for-bcrx-position-after-122-days-unrealized-profit-of-29300-roi-of-76-3-or-125-annualized/

$TLRY STO 12/4 10 call at .20

#coveredcalls AAL #shortstrangles CCL

AAL bought 100 shares, sold Dec. 18, 17 call for 15.55, AAL is around 16.30

CCL sold Jan. 15, 17.50/30 strangle for 1.46

#tastytradefollow

#rolling SNAP #coveredcalls GPRO

SNAP Rolled Dec. 4 covered 46 call to Dec. 11 for .63 SNAP is at 48.

GPRO sold Dec. 18 9 calls for .27, GPRO is a little over 8.

#coveredcalls MRO

Sold Dec. 18, 7 call for .15. MRO is at 6.20.

#shortputs #coveredcalls FCEL

Sold Jan. 15, 5.5 put for .72. FCEL down 18% today to 7.39.

#tastytradefollow

Bought 100 shares and sold a Dec. 18, 7 call for 6.00

#coveredcalls $STE

https://coveredcallswithjeff.wordpress.com/2020/12/01/covered-call-strategy-on-ste-after-180-days-unrealized-profit-of-10045-32-6-roi-or-66-annualized/

#coveredcalls SNAP

Bought 100 shares and sold a Dec. 4, 46 call for 44.14. SNAP is at 44.89 or so, down a dollar and change.

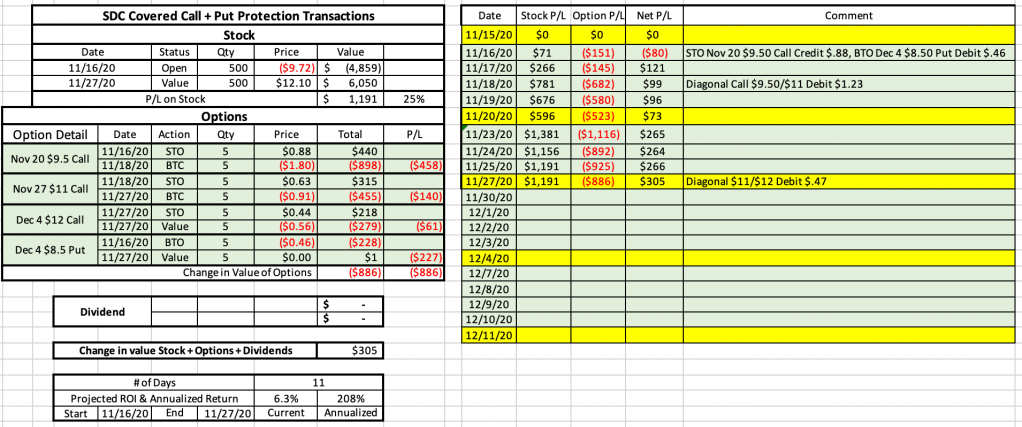

I established a CC + Put Protection (*.98) strategy for SDC. SDC has moved up from $9.72 to $12.10. I rolled the short calls from $9.50 to $11 to $12. The Put was at $8.50 and it is now worth $0. Would you usually roll the Put up when the stock runs up as the appreciation is no longer protected or just let the stock get called (assuming it stays above $12) away and do a reset.

#CoveredCalls – Just a couple rolls today. Not much else to do but sit and watch the time value come out of everything…

Rolled FSLR NOV 27 2020 81.0 Calls to DEC 31 2020 82.0 Calls @ .12 credit

Rolled OSTK NOV 27 2020 58.5 Calls to DEC 11 2020 59.5 Calls @ .29 credit

$TSLA BTC 12/18 392/400 BUPS at .20. STO at 2.78

$TSLA BTC 12/4 550 call and STO 12/11 570 call at debit of .58 but would gain $20 more if called away. Stock at $574. Since covering on 11/23, rolled twice and have netted 9.37 credit and added 45 if stock called away. Wish I had a net.

$NVAX BTC 11/27 100 call and STO 12/4 105 call at added 1.48 credit and plus $5 if called away

$PEP BTC 11/27 146 call at .10. STO at 1.57. Covered by LEAP. Will sell again

$TSLA BTC 11/27 525 call and STO 12/4 550 call at debit of 2.48 but would gain $25 if called away. Stock at $563.

$NVDA STO 12/4 535 call at 8.50

#shortstrangles

$NIO STO 11/27 51/55 covered strangle at 2.90

#syntheticcoveredcalls

$TSLA BTC 12/4 525 call and STO 12/11 540 call at added $2 credit. Sold against 12/18 long 450 call.

#coveredcalls

$TSLA STO 11/27 525 call at 12.79

#shortputs CVS #coveredcalls GPS

CVS Sold Dec. 18, 65 put for 1.02

GPS sold Nov. 27, 28 call for .52 GPS has earnings Tuesday.

#CoveredCalls – Replacing this week’s a little early..

Sold BIIB DEC 18 2020 265.0 Call @ 5.70

EDIT: On second thought I don’t trust this thing to the upside with the rumors that must be floating around. No extra call sales on this one.

Bought to Close BIIB NOV 27 2020 260.0 Call @ .24 (sold for 2.35)

$PFE 11/20 39 call

Stock closed at adjusted price of 38.88. Call holder

exercised at 39. Stock called away. Previously reported as expired. Ooops!

BOOT #coveredcalls 35 call, #assignment, finally profitable on a long suffering position

GPS #coveredcalls 25 call

NKTR #shortputs 16 put

FEYE #shortputs 13 put

MRNA #shortputspread 65/70

M #shortputs 8 put 5 put

NKLA #shortputs 15 put

OXY #shortputs 8 put

DKNG #shortputs 40 put

WBA #shortputs 35 put

CCL #shortputs 12 put

UAL #shortputs 35 put

UNG #shortputs 8 put

CCL #coveredcalls #assignment 16 call

CNQ #coveredcalls #assignment 20 call

M #coveredcalls #assignment 8 call

Options Expiration / Assignment.

OA $USO Nov-20-2020 29 #CoveredCalls. Stock closed at 29.29 so this will be assigned.

#coveredcalls SNAP

Bought 100 shares and sold Nov. 27, 44 call for 42.72.

Rolled $AAL Nov-20-2020 13 #CoveredCalls // Dec-18-2020 14 @0.40 Credit.

Didn’t mean to go out to December, dammit.

#CoveredCalls – Rolling but keeping a little downside protection…

Rolled OSTK NOV 20 2020 56.0 Calls to DEC 04 2020 57.0 Calls @ 1.20 credit

Rolled $SONO Nov-20-2020 15 #CoveredCalls // Dec-18-2020 22.5 @5.25 Debit for a 7.50 better strike.

Sold Dec. 18, 40 call for 1.80. LB up after earnings.

Rolled $PTON Nov-20-2020 $125 #CoveredCalls // Nov-27-2020 110 @1.50 Credit.

Was earlier today and I could have probably gotten a bit more if I’d have waited.

#coveredcalls AAL

Bought 100 shares, sold Nov. 27, 13 call for 12.08.

$NVDA STO 11/20 550 call at 17.82. Covering shares assigned Friday at $535

STO $AAL Nov-20-2020 13 #CoveredCalls @0.30.

#CoveredCalls – Sold OSTK NOV 20 2020 56.0 Calls @ 1.60

Roll $SPCE Nov-20-2020 $30 #shortputs // Dec $30 #ShortPuts @.45.

Roll $SLB Nov-13-2020 $18 #CoveredCalls // Nov-20-2020 $.32

Expiring $AAL Nov-13-2020 14.5 #CoveredCalls Was STO @0.25

https://coveredcallswithjeff.wordpress.com/2020/11/12/ib-account-down-from-high-up-from-dip-over-past-30-days/

#ShortPuts #CoveredCalls – Got lucky with a 290 put expiration on Friday since the stock never opened. In a different account I’ll be assigned at about 271 so covering that now on this little bounce. Will continue mixing in put sales as well. The actual announcement on the drug isn’t until March so might have decent premium until then.

Sold BIIB NOV 27 2020 260.0 Call @ 2.35

Also taking the morning scalp…

Bought to Close BIIB NOV 13 2020 225.0 Put @ 1.40 (sold this morning @ 5.60)

BTC $OSTK Nov-20-2020 $85 #CoveredCalls – Was STO @10.40 on 10/16 when the stock was at $82.09.

Still holding the stock.

#coveredcalls BOOT

Wanting to unload my assigned shares, sold Nov. 20, 35 call for 2.20, shares at 35.80

$MGM BTC 11/6 22 put and STO 11/13 21.50 put at even

$T STO 11/20/26.5 put at .45

$NIO STO 11/6 36 calls at .75. Against stock that was assigned Friday at $31

#assignment #coveredcalls TWTR #earnings

assigned TWTR from an Oct. 30, 44/63 earnings trade.

Sold 40.50 covered call for 1.46.

#ShortPuts #CoveredCalls #Earnings – Out all morning but finally caught up. Some winners booked and some rolls done along with a couple new sales.

AAPL: Selling slightly ITM playing for the iPhone 12/5G/Black Friday/Holiday Bounce.

Sold AAPL NOV 20 2020 110.0 Put @ 5.45

FSLR: Covered Calls.

Sold FSLR NOV 6 2020 86.0 Calls @ 3.45

NFLX: New sale…can’t resist. Going out a little to sell even lower. At the expected move and well below the 200ma.

Sold NFLX NOV 20 2020 425.0 Put @ 6.61

NVDA: Rolled and sold against.

Rolled NVDA OCT 30 2020 525.0 Put to NVDA NOV 13 2020 512.5 Put @ .37 credit (12.75 total now)

Rolled NVDA OCT 30 2020 517.5 Put to NVDA NOV 13 2020 500.0 Put @ .30 credit (3.65 total now)

Sold NVDA NOV 6 2020 535.0 Call @ 3.40

OLED: Earnings trade worked nicely 🙂 🙂

Bought to Close OLED OCT 30 2020 172.5/230.0 Strangles @ .10 (sold for 2.87)

OSTK: Rolled and sold against. Basis if assigned is down in the 59.70 area

Rolled OSTK OCT 30 2020 67.5 Put to NOV 13 2020 65.0 Put @ .20 debit

Rolled OSTK OCT 30 2020 65.0 Put to NOV 13 2020 62.0 Put @ even

Rolled OSTK OCT 30 2020 62.5 Put to NOV 13 2020 60.0 Put @ 1.40 credit

Sold OSTK NOV 6 2020 70.0 Call @ 1.05

SPY: Adding one outside the expected move.

Sold SPY DEC 11 2020 275.0 Put @ 3.20

TQQQ: Booking but not adding anywhere.

Bought to Close TQQQ OCT 30 2020 110.0 Put @ .12 (sold for 1.55)

Bought to Close TQQQ OCT 30 2020 115.0 Put @ 1.10 (sold for 2.00)

TSLA: New sale:

Sold TSLA NOV 06 2020 350.0 Put @ 5.94

https://coveredcallswithjeff.wordpress.com/2020/10/29/dxcm-hard-to-understand-a-90-drop-and-how-we-responded/

#ShortPuts #CoveredCalls – Up huge through the 90 calls on my short strangle. Bought stock pre-market and will manage as a covered call now. Should be bigly premium next few weeks.

Bought stock @ 93.50 (basis 92.0 and covered @ 90.0)

STO ABT Oct 30 $111 Call Credit $1.31 to reestablish covered call yesterday

https://coveredcallswithjeff.wordpress.com/2020/10/23/follow-up-to-abt-post-on-10-21-about-buying-back-oct-23-107-calls/

#coveredcalls CCL WBA CNQ GPRO

CCL sold Nov. 20, 16 call for .75

WBA sold Oct. 30, 39 call for .36

CNQ sold Nov. 20, 20 call for .32

GPRO sold Oct. 23, 7 calls for .18

OX LULU Oct-16-2020 310/330 #BuPS

OX SLB Oct-16-2020 20 #CoveredCalls

OX USO Oct-16-2020 30 #CoveredCalls

STO USO Oct-30-2020 30 #coveredcalls @0.32 credit

Roll OSTK Oct-16-2020 85 #CoveredCalls // Nov-16-2020 @10.40 Credit.

Roll SONO OCT-16-2020 15 #CoveredCalls // Nov-20-2020 @1.22 credit.

Was really hoping most of the Covered Calls would be assigned. The LULU was a #BUPS that got rolled into another, so was wider than my typical. Probably should bail out of the SLB with a small loss – not much premium even going to Dec expirations.

Sharing current covered call positions in IB account along with graphs showing the progression of the return on each position. Left money on the table as stock prices have run past our strike prices on almost every position.

https://coveredcallswithjeff.wordpress.com/2020/10/14/ib-account-holdings-and-update-23742-or-7-5-in-last-30-days/

#shortstrangles

$MRVL STO 10/16 43.5/45 strangle at .75

#coveredcalls

$NUGT BTC 10/16 93 call and STO 1023 95 call at 1.20 added credit.

#shortputs

$PENN BTC 10/16 72 put and STO 10/23 72 put at added credit of 1.05

#coveredcalls

$NVAX STO 10/16 128 call at 1.80

#bucs

$PYPL BTO 10/23 200/210 BUCS at 4.08. Earnings 10/28

#coveredcalls

$PENN BTC 10/16 78 calls at .10. STO at 3.62

Rolled AAL Oct-09-2020 13 #CoveredCalls // Oct-23-2020 14 @0.35. (thought about letting it get assigned)

OX $NVAX Oct-09-2020 84/94 #BuPS – STO @1.22 Thanks @geewhiz112

STO $NVAX Oct-23-2020 92/102 #BuPS @1.46 (actually put limit in at 1.32 and got a little extra)

#CoveredCalls – With earnings coming I think the buying power can be put to use in better ways. Taking the small loss on the covered stock. Sold stock pre-market at 17.75 (basis 18.90) and looking to close the short 18 calls for a penny or two.

https://coveredcallswithjeff.wordpress.com/2020/10/09/is-smile-direct-club-sdc-a-good-candidate-for-covered-calls/

https://coveredcallswithjeff.wordpress.com/2020/10/08/crazy-market-somehow-generating-great-roi/

#rolling #diagonal SPY #coveredcalls CC

SPY Rolled Oct. 7, 335 calls to Oct. 12, 336 for .43

CC sold Oct. 16, 24 covered call for .33

#closing NFLX #rolling AAL M CCL NKLA #coveredcalls X CCL UAL

NFLX closed a Nov. 20 #ironcondor for a loss of $24, being uncooperative

AAL rolled Oct. 16, 20 put to Nov. 20 for .27

CCL rolled Oct. 16, 20 put to Nov. 20 for .50

M rolled Oct. 16, 8 put to Nov. 20 for .18

X sold Oct. 16, 8.5 #coveredcall for .16

CCL sold Oct. 16, 16 #coveredcall for .45

UAL rolled Oct. 30, 27 #coveredcall to Dec. 18 for 1.40

NKLA Sept. 9 sold an Oct. 16, 20/30 put spread for 1.47. financial shenanigans brought the stock down, Today sold the long put for 1.40, was bought for .35, rolled the short put to Nov. for 2.90

https://coveredcallswithjeff.wordpress.com/2020/10/05/goldman-sachs-gs-covered-call-assigned-profit-of-455-in-44-days-roi-5-or-4-annualized/

#shortputs

$TDOC BTC 10/9 180 put at .15. STO at 2.70.

$OSTK STO 10/9 70 put at 1.80

$NVDA STO 10/9 480 put at 3.60. Thank you @fuzzballl for the hat trick.

#coveredcalls

$PENN BTC 10/2 65 call and STO 10/16 70 call at 1.40 debit but would gain $5 if called away. Stock at 73.80.

$DKNG BTC 10/16 60 call and STO 10/30 63 call at .40 additional credit and would gain $3 if called away. Stock at 62.98.

$NUGT BTC 10/2 90 call and STO 10/9 90 call at 1.70 credit. Stock at 83.95.

#ShortPuts #CoveredCalls – Assigned stock at 85 and have reduced basis to 65.80 so letting it get called away at 70 if the market holds today. Replacing with these…

Sold OSTK OCT 9 2020 70.0 Puts @ 1.60

#coveredcalls

$NVTA BTC 10/16 and STO 11/20 40 calls at added 2.60 credit

#shortputs

$T STO 10/9/2020 28.50 put at .70

$PENN STO 10/9/2020 72 put at 2.60

$MRVL BTC 10/2/2020 40 put at .35. STO at 1.95

#bups

$NFLX BTC 10/16 455/465 BUPS at 1.29. STO at 3.45. Thank you @ramie77. No, I don’t know why I closed it.

Rolled $PTON Oct-09-2020 100 #CoveredCalls // Oct-16-2020 103 @0.10 debit

(edited to fix the weeks)

#ShortPuts #CoveredCalls – Catching up on Friday. Keeping stock a little longer and adding a put sale.

Rolled OSTK SEP 25 2020 70.0 Call to OCT 02 2020 70.0 Call @ 3.05 credit

Sold OSTK OCT 02 2020 67.5 Put @ 2.20

Expirations / Roll

OX $AAL 14 Sep-25-2020 Calls

STO $AAL 12.5 Oct-02-2020 #CoveredCalls

OX $AMD Sep-25-2020 82.5/85 #BeCS (end of a long chain of trades)

#ShortPuts #CoveredCalls – Staying really short term…

SPLK: Covered.

Sold SPLK OCT 02 2020 182.5 Call @ 2.15

TDOC: Going back in.

Sold TDOC SEP 25 2020 187.5 Put @ 2.30

TSLA: Rolling up slightly for a little more battery day risk. Premium similar to earnings here. 50ma and expected move now.

Rolled TSLA SEP 25 2020 350.0 Put to SEP 25 2020 375.0 Put @ 3.90 credit (9.80 total now)

VXX: Beer money on the volatility bounce.

Bought to Close VXX SEP 25 2020 25.0 Puts @ .71 (sold for .80)

#ShortPuts #CoveredCalls – A few more.

OSTK: Covered Calls and adding a short put.

Rolled OSTK SEP 18 2020 70.0 Call to SEP 25 2020 70.0 Call @ 3.30 credit (12.95 total now)

Sold OSTK SEP 25 2020 67.5 Put @ 2.70

SPCE: Covered Calls.

Rolled SPCE SEP 18 2020 15.0 Calls to OCT 16 2020 15.0 Calls @ .51 credit

STX: Covered rolling hoping I don’t get taken out of the divvy.

Rolled STX SEP 18 2020 46.0 Calls to OCT 9 2020 46.0 Calls @ .20 credit

UVXY: Replacing this week’s expiation. Hedging my hedge selling slightly ITM.

Sold UVXY SEP 25 2020 17.0 Calls @ 2.25

VXX: Rolling another week.

Rolled VXX SEP 18 2020 26.0 Puts to VXX SEP 25 2020 25.0 Puts @ .01 credit

#coveredcalls CC #longcallspread BA #shortstrangles JD

CC Bought 100 shares, sold Oct. 2, 21.50 call for 20.55.

BA bought Oct. 23, 165/170 call spread for 2.23

JD sold Nov. 20, 62.50/90 for 3.32

#tastytradefollow