BTO July 17, 50 calls and STO July 2, 60 calls for a debit of 3.15

Monthly Archives: June 2020

TQQQ

In my IRA, BTC June 19, 45 puts at .01, sold at .85

SPX trades

#SPX7dteLong Bought to Open $SPX June 24th 3090/3110-3120/3140 condors for 18.55. I tried legging in but it didn’t help the pretty high premium on this, due volatility the last hour. Only partially filled on the call side so I will try to add the last contracts tomorrow.

#SPX1dte Expired: June 17th 2975/2995-3225/3245 condors, sold yesterday for 1.45.

WFC early roll

Bought to close 1 WFC 06/19/2020 27.50 Covered Call / Sold 1 06/26/2020 28.50 Covered Call @ 0.22 Credit plus a 1.00 point better strike.

This increases my potential profit by $120 for holding the stock for one more week and pushes the strike price above my stock cost.

#CoveredCalls

Closing LULU

Bought to close $LULU 7/17 250/340 strangle @ 3.90. Sold for 8.20 on 6/12. Taking the >50% available profit off the table as IV on this stock has come in quite a bit (rank was 60 on Friday, today it’s 23).

MDLZ DiagBFly

$MDLZ @ $52.74

BTO 1 MDLZ Jan 22: 40 Put / 65 call long strangle @ $4.65

STO 1 MDLZ July 02: 52.50 short straddle @ $2.38

Going aggressive on the first sale, bringing in over 50% cost of the long strangle emergency covers.

583 days left to sell more premium.

TQQQ

STO July 31, 50 puts at 1.20

NVDA ROKU BUPS DDOG Closed / CRM BUCS Closed / ROKU Puts

#bups

$NVDA BTC 6/19 340/350 BUPS at .70. STO 5/22 at 3.65

$ROKU BTC 6/19 110/115 BUPS at .80. STO 5/8 at 1.52

$DDOG BTC 6/19 70/75 BUPS at .10. STO 5/22 at 2.50

#bucs

$CRM STC 6/19 170/180 BUCS at 8.58. BTO 5/11 at 5.20

#shortputs

$ROKU STO 6/26 110 at 2.48 Thank you @fuzzball

$ROKU STO 7/2 108 at 3.15 Ditto Monsieur @fuzzball

SPY Ladder Rolls

Bought to close 1 SPY 06/17/2020 300.0 Call / Sold 1 SPY 06/24/2020 300.0 Call @ 0.68 Credit.

Stock at 313.70.

Bought to close 1 SPY 06/17/2020 305.0 Call / Sold 1 SPY 06/26/2020 307.0 Call @ 0.61 Credit + 2 points better on the short strike.

Stock at 313.52

#SPYLadder

SPY

#CoveredCalls #Dividends – I’m not sure how SPY reacts to dividends and how likely a call position DITM is of getting exercised early. Was going to let this get called away at a tiny profit but I’ll hang onto it for the weekend to make sure I get the divvy.

Rolled SPY JUN 19 2020 263.0 Calls to JUN 22 2020 265.0 Calls @ 2.02 debit

Paying .02 to insure what is hopefully about a 1.40 divvy.

#closing BABA June 9 sold…

#closing BABA

June 9 sold a July 17 #ironcondor for 3.44, bought it back today for 3.54, so BABA stopped going up, but I don’t have to worry about it.

ROKU

#ShortPuts – Still have covered calls ITM so trying to talk it down a little more. 108 strike looks safe this week so adding. Earnings not until early August but still decent premium and easy fills.

Sold ROKU JUN 26 2020 110.0 Put @ 2.35

Sold ROKU JUL 2 2020 108.0 Put @ 2.50

DDOG Put

#shortputs

$DDOG STO 6/19 80 put at 1.35

VXX

One example of a Short Calendar Iron Condor Spread :

For those wondering why/how I’m managing all the VXX trades here is an example of one:

+1 Aug 21 2020 85.00 C

-1 Jun 19 2020 45.00 C

-1 Jun 19 2020 33.00 P

+1 Jan 15 2021 13.00 P

They are charging the $4000 call spread requirement but $0 on the put spread.

Given the recent (last 4 days) of trading in VXX, both the shorts are likely to expire.

If not, if VXX advances I would roll the 45 out and up, if it declines, I will roll the put out and down. If it stays near the centerline, I would likely roll laterally for additional premium for next week. But no action is likely until after 2pm Friday to allow all the time value to leach away from this week’s short options.

SPX 1 dte

#SPX1dte Sold to open $SPX June 17th 2975/2995-3225/3245 condors for 1.45, IV 32.9%, SPX 3114, deltas -.06, +.05

VXX – Dumping worthless longs

Sold VXX 06/19/2020 70.0 Calls @ 0.13

Sold VXX 06/19/2020 75.0 Call @ 0.11.

I’m surprised that they were worth anything 🙂

I wrote against these 5 times since I bought them on 5/13 , including the first write that totally paid for them.

CINF

Just in case anyone else is holding CINF, it went Xdiv 0.60 today and is still up 2.25

VXX Diagonal Call

I missed posting this one after the opening spike in the VIX Monday morning.

Since the VIX went into a major retreat later in the day, this one is not available now.

Bought to open 1 VXX 07/31/2020 70.0 Call / Sold 1 VXX 06/19/2020 45.0 Call @ 0.02 Credit.

Looking to pick up a free long to replace Long 70 calls I hold for this Friday.

XOM short puts

Sold $XOM 7/17 45 puts @ 1.58. IVR rank 49.

SPX 7-dte

#SPX7dteLong Legged out of the $SPX June 17th 3180/3200-3210/3230 condor on the swings this morning.

BTO condors for 17.35 last Wednesday.

STC call spreads at 7:01 PDT for 2.60

STC put spreads at 7:57 PDT for 17.50

SDGR Put / ROKU Calls

#shortputs

$SDGR STO 6/19 65 put at 1.40

#coveredcalls

$ROKU STO 6/26 116 calls at 3.48

TQQQ

In my IRA, BTC June 19, 35 puts at .01, sold at 2.26

Also BTC the 40 puts at .01, sold at .54 cents

NVDA

#ShortPuts – In the red today so adding a short term position…

Sold NVDA JUL 02 2020 325.0 Put @ 3.06

NVDA

#ShortPuts – Bought to Close NVDA JUN 19 2020 315.0 Put @ .10 (sold for 4.40)

LULU Earnings

#Earnings #JadeLizards – Taking some heat on the upside so calling this one good enough…

Bought to Close LULU JUN 19 2020 285.0/310.0/315.0 Jade Lizard @ 2.80 (sold for 6.00)

SPX 7-dte

#SPX7dteLong Bought to open $SPX June 22nd 3030/3050-3060/3080- condors for 18.30, with SPX at 3054.

#coveredcalls CODX Bought 100 shares…

#coveredcalls CODX

Bought 100 shares @ 17.27, Sold a June 19, 18 call for .70, debit of 16.57, thanks JSD501 for the ticker idea.

Premium is rich for a $16 stock.

VXX Puts

Sold VXX 06/19/2020 34.0 Put @ 0.63

Sold VXX 06/19/2020 33.5 Put @ 0.55

Sold VXX 06/19/2020 33.0 Put @ 0.43

Sold VXX 06/19/2020 32.5 Puts @ 0.37

Sold VXX 06/19/2020 32.0 Puts @ 0.26

Sold VXX 06/19/2020 31.0 Puts @ 0.19

Re-establishing diagonals against 2021 and 2022 long puts

A TRADE

SDGR STO 7/17/20 85.0 CALL @2.20

#jadelizard EWW Sold July 17,…

LULU BECS Closed / DFEN CCL Put Rolled / SQ Puts / NVTA ROKU MRVL Call / NFLX BUPS Closed

#bups

$LULU BTC 6/19 320/330 BECS at .50 STO at 3.65. Thank you @ramie

$NFLX BTC 6/19 380/400 BUPS at $1.00. STO 4/30 at 6.93

#shortputs

$DFEN BTC 6/19 19 put and STO 7/17 18 put at even. Stock at 14.50

$CCL BTC 6/19 21 put and STO 6/26 21 put at .60 credit. Stock at 19.46

$SQ BTC 6/19 87 put at 1.15. STO for 4.65 on 6/12

$SQ STO 6/19 88 put at 1.66

$SQ STO 6/26 88 put at 3.05

#coveredcalls

$NVTA STO 6/19 17.50 call at .35

$MRVL STO 6/19 35 call at .40

$ROKU STO 6/19 112 call at 1.60

QCOM short puts

Sold $QCOM 7/17 80 puts @ 2.15. 28 delta, IV rank 41.

SPY Ladder Roll

Bought to close SPY 06/15/2020 300.0 Call / Sold SPY 06/22/2020 302.0 Call @ 1.05 Credit Plus a 2.00 higher strike to avoid assignment on today’s short call.

Stock was 306.77 (up from an opening low below 299)

#SPYLadder

TQQQ

STO July 24, 45 puts at .85

SPCE

#ShortPuts – Early fill…

Bought to Close SPCE JUN 19 2020 13.0 Puts @ .10 (sold for .95)

Puts sold today

TDOC July 17, 180 put at 14.52

CODX 17 puts at 3.83

NET 31 puts at 2.60

DOCU 155 puts at 5.60 for June 26

DXCM July 17, 390 put at 26.00

TQQQ

BTC June 19, 30 puts in my IRA at .01,sold at 1.47

TRADES:

NET BTO STOCK @30.99 Broke a triple top today, a buy signal at 31..

AAL STO 17.0 6/19/20 CALLS @.55 Will cover if necessary.

SWBI STO 6/19/20 20.0 CALLS @.70 Earnings Thursday, my mistake.

TDOC

STO July 17, 180 put at 14.52

SLB SPY TQQQ

#ShortPuts #CoveredCalls – Finally getting caught up…

SLB: Covered

Bought to Close SLB JUN 12 2020 23.0 Calls @ .01 (sold for .37)

Sold SLB JUN 19 2020 20.5 Calls @ .40

SPY:

Sold SPY JUL 17 2020 280.0 Put @ 3.35

TQQQ: Starter positions

Sold TQQQ JUN 26 2020 72.5 Put @ 2.55

Sold TQQQ JUL 02 2020 70.0 Put @ 2.95

EWZ DiagBFly

$EWZ @ $30.39 (exact same price as last Friday!)

BTC 1 EWZ June 12: 30 short straddle @ $0.37 (originally sold for $1.84)

STO 1 EWZ June 19: 31 straddle @ $2.14

The short straddle is covered by a long EWZ Sep 18: 24 put / 30 call strangle.

#coveredcalls M Bought to close…

#coveredcalls M

Bought to close July 12, 9.50 covered call for .01, sold July 2, 9 call for .31.

IWM

IWM is ex-div on Monday

SPX 7-dte

#SPX7dteLong Bought to Open $SPX June 19th 3000/3020-3030/3050 condors for 18.40, with SPX at 3017.

VXX Diagonal rollup

with the stock at 40.99

Bought to close VXX 06/12/2020 34.0 Calls / Sold 06/19/2020 35.0 Calls @ 0.16 Credit + 1.0 point bump in the strike price. (rolls are getting worse as the day goes on).

LULU strangle

Sold $LULU 7/17 250/340 strangle (1 standard deviation–put and call deltas at 17 and 16) for 8.20 credit. Considered an iron condor but I decided to go with a smaller position for a trade that is much more easily adjustable if the stock has a big move in either direction. IV still high after earnings (IV rank 60).

TRADES:

PLAY STO 6/19/20 19.0 19.0 CALLS @.55

PLAY STO 6/19/20 14.0 PUTS @.65

AAL STO 6/19/20 19.5 CALLS @.51

NCLH STO 6/19/20 21.0 CALLS @1.10

DAL STO 6/19/20 33.0 CALLS @.71

Have a great weekend everyone. ;>)

TQQQ

In my IRA, STO July 2, 40 puts at .51 cents. A small trade and the market is looking ugly right now.

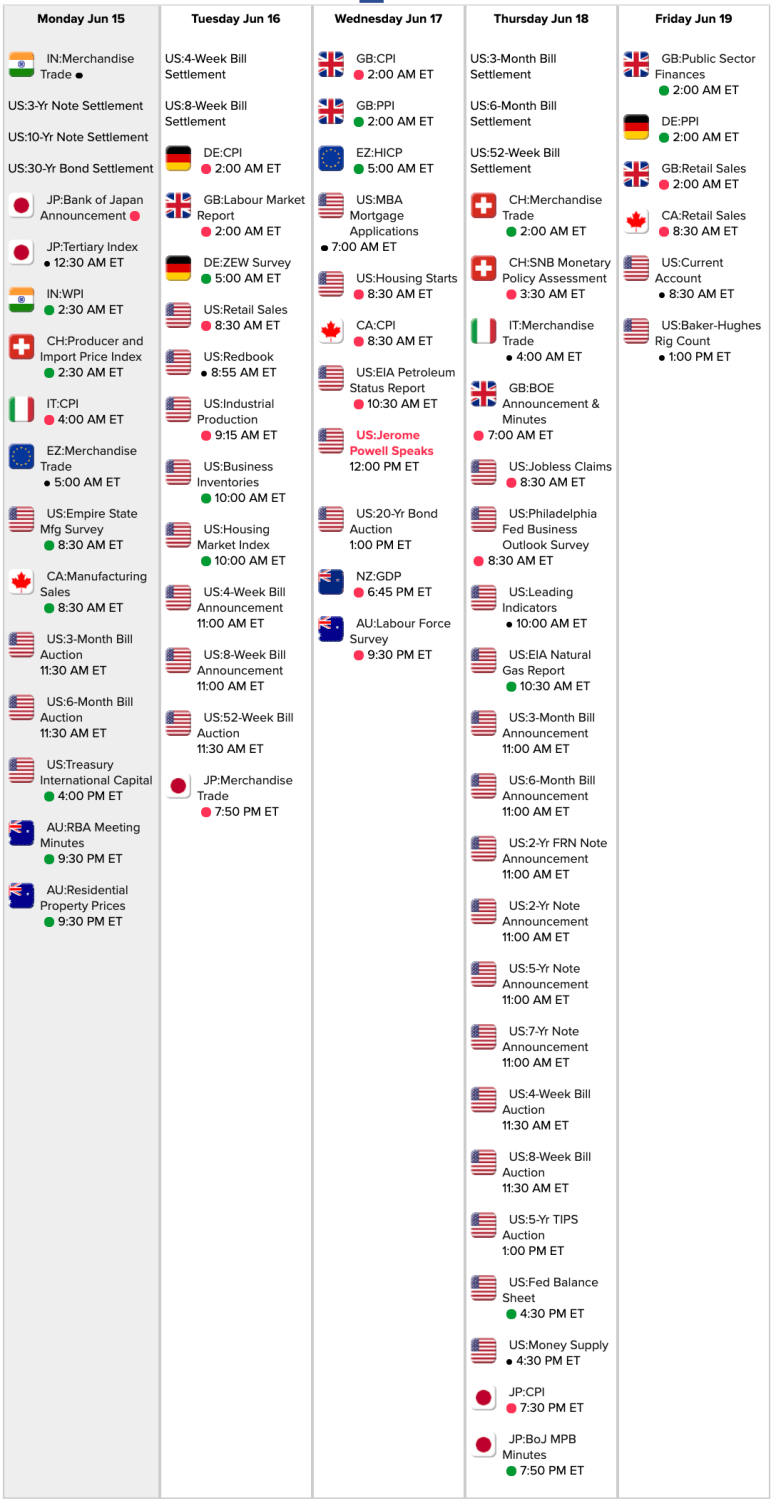

Econ Calendar for week of 6/15/20

#FOMC Jerome Powell opens his yapper again on Wednesday

Link to calendar: https://research.investors.com/economic-calendar/

WORK

Rolled $WORK Jun 12 34 #CoveredCalls // Jun-19-2020 32 @0.65 Credit. Basis now $27.22.

LULU

VXX Diagonal Call Rollups

Bought to close 1 VXX 06/12/2020 37.0 Call / Sold 1 06/19/2020 42.0 Call @ 0.09 Credit + a big 5.0 point bump in the strike price for next week with the stock at 38.48.

Edit: with the stock at 41.02 added this –

Bought to close VXX 06/12/2020 36.0 Calls / Sold 06/19/2020 39.0 Call @ 0.05 Credit + a 3.0 point bump in the strike price.

Edit2: with the stock at 41.76 added this –

Bought to close VXX 06/12/2020 35.0 Calls / Sold 06/19/2020 36.50 Call @ 0.05 Credit + 1.5 point bump in the strike price. (rolls are getting worse as the day goes on).

ADS Covered Call Rollup

Bought to close ADS 06/12/2020 49.0 Covered Calls / Sold ADS 06/19/2020 52.0 Covered Calls @ 0.05 Credit plus an additional 3.00 points on the strike price for one more week.

WBA OXY Covered Calls

Late fills

Bought to close WBA 06/12/2020 41.0 Covered Call / Sold WBA 06/19/2020 41.50 Covered Call @ 0.31 Credit plus an additional 0.50 on the strike price.

Bought to close OXY 06/12/2020 17.0 Covered Calls / Sold OXY 06/19/2020 17.50 Covered Call @ 0.52 Credit plus an additional 0.50 on the strike price for one more week.

SPX (no) trades

#SPX7dteLong Missed my chance for small profit yesterday and instead sold to close $SPX June 12th 3200/3220 call spreads this morning for 1.20. Bought for 9.30 last Friday. As I commented then, throwing in the towel on the relentless bull run probably would mark the top.

I am skipping the #SPX1dte for tomorrow. Premium is not high enough for the risk.

VXX Puts

Bought to close 50% of my VXX 06/12/2020 30.5 Puts @ 0.01.

Sold these last week at an average cost of 2.17.

Now it looks like I’ll have to roll all my short calls instead.

TQQQ

STO July 10, 45 puts at .60 cents, small trade though.

LULU earnings analysis

#Earnings $LULU reports tonight. Below are details on earnings one-day moves over the last 12 quarters.

March 26, 2020 AC -5.95%

Dec. 11, 2019 AC -3.73%

Sept. 5, 2019 AC +7.81%

June 12, 2019 AC +2.12%

March 27, 2019 AC +14.12%

Dec. 6, 2018 AC -13.36% Biggest DOWN

Aug. 30, 2018 AC +13.08%

May 31, 2018 AC +16.31% Biggest UP

March 27, 2018 AC +9.21%

Dec. 6, 2017 AC +6.42%

Aug. 31, 2017 AC +7.19%

June 1, 2017 AC +11.54%

Avg (+ or -) 9.24%

Bias 5.40%, strong positive bias on earnings.

With stock at 311.00 the data suggests these ranges:

Based on current IV (expected move into Friday per TOS): 288.00 to 334.00 (+/- 7.4%)

Based on AVERAGE one-day move over last 12 quarters: 282.27 to 339.73

Based on MAXIMUM one-day move over last 12 Q’s (16.3%): 260.28 to 361.72

Based on DOWN max only (-13.4%): 269.45

Open to requests for other symbols.

WHR long term

Sold $WHR 12/18 60 puts @ 1.75 with the stock at 127.12.

#FallingKnife

VXX new diagonal Call spread

Bought to open 1 VXX 09/18/2020 80.0 Call / Sold 1 VXX 06/12/2020 36.0 Call @ 0.14 Credit.

If this market flattens out after this 1300 point drop in the DJIA I should have a free September long position.

If the market continues to fall, I’ll roll the short up and out a week.

WFC rollups

Bought to close 1 WFC 06/12/2020 27.0 Covered Call / Sold 1 WFC 06/19/2020 27.50 Covered Call @ 0.34 Credit plus a 0.50 higher strike price.

Bought to close WFC 06/12/2020 27.5 Covered Calls / Sold WFC 06/19/2020 28.50 Covered Calls @ 0.20 Credit plus a 1.00 higher strike price.

ADS Rollup

Bought to close 1 ADS 06/12/2020 46.0 Covered Call / Sold 1 ADS 06/19/2020 47.0 Covered Call @ 0.90 Credit plus a one point higher strike price.

Hard to believe this stock was above 66 on Monday

TQQQ

In my IRA, STO September 40 puts at 1.70

UAL roll

From $UAL 6/19 40/60 short strangle, rolled the 60 calls down to 42 calls (21 delta) for .70 credit. Total premium now 3.23 so breakeven on the downside is 36.77. Stock currently trading around 35.

CINF early roll

Bought to close CINF 06/19/2020 60.0 Covered Calls / Sold 07/17/2020 60.0 Covered Calls @ 1.90 Credit.

LULU Earnings

#Earnings #JadeLizards – Going with the Lizard for next week. Playing it to the downside as usual. Breakeven at about twice the expected move with no upside risk.

Sold LULU JUN 19 2020 285.0/310.0/315.0 Jade Lizard @ 6.00

XLE XLF

2 Back Ratio’s STC today

XLE -47 Call/+2 49.21 STC .01 Bought 6-8 for 0.15 Cr Net 9.00

XLF -26 Put / + 2- 25 Puts STC 0.35 Cr Bought 6-9 0.06 Cr Net 37.00

SPY

#ShortPuts – Gradually easing back in…

Sold SPY JUL 17 2020 275.0 Put @ 2.85

Sold SPY JUL 17 2020 280.0 Put @ 3.35

UAL

STC 44/42 Jun 19 Put spread $1.79 Bought 6-5 for 1.05

TQQQ

BTC June 19, 35 puts at .01, sold at 2.04

SLB Rollup

Bought to close SLB 06/12/2020 19.00 Calls / Sold SLB 06/19/2020 19.50 Calls @ 0.20 Credit plus 0.50 higher strike.

SPY Ladder Roll – a day early

Bought to close SPY 06/12/2020 299.0 Call / Sold SPY 06/19/2020 300.0 Call @ 0.38 Credit to avoid assignment on tomorrow’s short call.

The initial spike down allowed me to bump the short strike a point too.

Edit: I was way too early. SPY dropped another 7 points after the opening gap down.

Oh well. I’ll make it up next week with 3 expiration dates.

ADBE earnings analysis

#Earnings $ADBE reports tonight. Below are details on earnings one-day moves over the last 12 quarters.

March 12, 2020 AC +17.71% Biggest UP

Dec. 12, 2019 AC +3.91%

Sept. 17, 2019 AC -1.74%

June 18, 2019 AC +5.21%

March 14, 2019 AC -3.95%

Dec. 13, 2018 AC -7.28% Buggest DOWN

Sept. 13, 2018 AC +2.29%

June 14, 2018 AC -2.43%

March 15, 2018 AC +3.05%

Dec. 14, 2017 AC +1.43%

Sept. 19, 2017 AC -4.24%

June 20, 2017 AC +2.36%

Avg (+ or -) 4.63%

Bias 1.36%, positive bias on earnings.

With stock at 400.00 the data suggests these ranges:

Based on current IV (expected move into Friday per TOS): 382.20 to 417.80 (+/- 4.5%)

Based on AVERAGE one-day move over last 12 quarters: 381.47 to 418.53

Based on MAXIMUM one-day move over last 12 Q’s (17.7%): 329.16 to 470.84

Based on DOWN max only (-7.3%): 370.88

Open to requests for other symbols.

TQQQ

STO July 24, 50 puts at .70 cents. Starting small but will add on higher premiums.

SPX trades

#SPX7dteLong Bought to Open $SPX June 17th 3180/3200-3210/3230 condors for 17.35, with SPX at 3207.

Expiring: June 10th 3100/3120-3130/3150 condors, max profit of 20.00 on call side. Bought for 17.10 last Wednesday.

#SPX1dte Expiring: June 10th 3100/3120-3285/3305 condors, sold yesterday for 1.10.