#SPX1dte Bought to close $SPX July 15th 3255/3275 call spreads for 3.00. Condors sold for 1.00 yesterday, but stop was hit this morning.

Monthly Archives: July 2020

SPX 1-dte

#SPX1dte Sold to Open $SPX July 15th 3080/3100-3255/3275 condors for 1.00, IV 21.25%, SPX 3198 (close), deltas -.05, +.06. Filled three minutes after the closing bell.

VXX

VXX is down almost 3 points from the peak of 36.01

Selling calls in the morning, and Puts in the afternoon

Sold VXX 07/17/2020 31.50 Puts @ 0.39 adding to my position.

The puts don’t scare me as much as the calls.

I still have Long Puts with nothing written against them for this week, but fully paid for with previous writes.

Long Put +3 Jun 18 2021 9.00

Long Put +2 Jan 21 2022 8.00

Long Put +2 Jan 21 2022 7.00

Long Put +2 Jan 21 2022 6.00

Long Put +2 Jan 21 2022 5.00

Long Put +2 Jun 17 2022 8.00

GS earnings analysis

#Earnings $GS reports tomorrow morning. Below are details on earnings one-day moves over the last 12 quarters.

April 15, 2020 BO +0.16%

Jan. 15, 2020 BO -0.18%

Oct. 15, 2019 BO +0.31%

July 16, 2019 BO +1.86%

April 15, 2019 BO -3.81% Biggest DOWN

Jan. 16, 2019 BO +9.54% Biggest UP

Oct. 16, 2018 BO +3.01%

July 17, 2018 BO -0.18%

April 17, 2018 BO -1.64%

Jan. 17, 2018 BO -1.86%

Oct. 17, 2017 BO -2.60%

July 18, 2017 BO -2.59%

Avg (+ or -) 2.31%

Bias 0.17%, no significant bias on earnings.

With stock at 211.50 the data suggests these ranges:

Based on current IV (expected move into Friday per TOS): 201.02 to 221.98 (+/- 5.0%)

Based on AVERAGE one-day move over last 12 quarters: 206.61 to 216.39

Based on MAXIMUM one-day move over last 12 Q’s (9.5%): 191.32 to 231.68

Based on DOWN max only (-3.8%): 203.44

Open to requests for other symbols.

#shortputs CHNG Sold Aug. 21,…

#shortputs CHNG

Sold Aug. 21, 11 put for 1.14. Stock is just under 11, earnings Aug. 17.

TQQQ

Just testing the market.

STO August 21, 45 puts at .57 cents.

VXX

Sold to Open VXX Jul 17 2020 41.0 Call @ $0.66 adding to my position.

Sold against long August and September Calls left over from older diagonals.

#DoubleDip

Episode 11 – Second to Nun

So much to stream, including badass nuns, bad crass singers, and terrorists in first class. And, Kevin turns the tables on Jeff with the guessing game. More details and links at https://thepickcast.com

VXX late report

Sometime after the close I got off a risky diagonal on an open order (pressing my luck on this one).

Bought 1 VXX Sep 18 2020 65.0 Call / Sold 1 VXX 07/17/2020 35.0 Call @ 0.25 Credit.

I have no idea how this turns out but the market goes up 4 days out of 5 recently so the short should expire Friday.

If not, it’s an easy rollup.

This also counterbalances my SPY bearish positions

NVAX Call

#coveredcalls

$NVAX STO 7/17 112 call at 2.80

VXX Diagonal Call

Sold 1 VXX 07/17/2020 38.0 Call / Bought 1 VXX 09/18/2020 80.0 Call @ 0.12 Credit.

If the market doesn’t implode this week I should have another free September long call.

TQQQ

#ShortPuts – Starter…

Sold TQQQ SEP 18 2020 45 Puts @ 1.35

SPX 7-dte

#SPX7dteLong Bought to Open $SPX July 20th 3160/3180-3190/3210 condors for 17.40, with SPX at 3183.

My expiration for today looked like an easy winner and then we had the collapse. Now at mercy of the close.

ROKU

#ShortPuts – Cleaned up some scraps earlier…

Bought to Close ROKU JUL 17 2020 115.0 Put @ .03 (sold for 2.33)

CRWD Puts

#shortputs

$CRWD STO 7/17 104 put at 1.35

VIX

It’s up over 8%

How much would it be UP if the market was actually down instead of notching all time highs on the QQQ and big rallies in the other indexes (DJIA up 300+).

SPY

#ShortPuts – Taking a little risk off about 5 weeks early.

Bought to Close SPY AUG 21 2020 250.0 Put @ .82 (sold for 3.13)

SPY Rolls

Bought to close SPY 07/13/2020 312.0 Call / Sold SPY 07/17/2020 313.0 Call @ 0.02 Credit plus a point on the strike

Bought to close SPY 07/13/2020 313.0 Call / Sold SPY 07/20/2020 315.0 Call @ 0.04 Credit plus 2 points on the strike

#SPYLadder

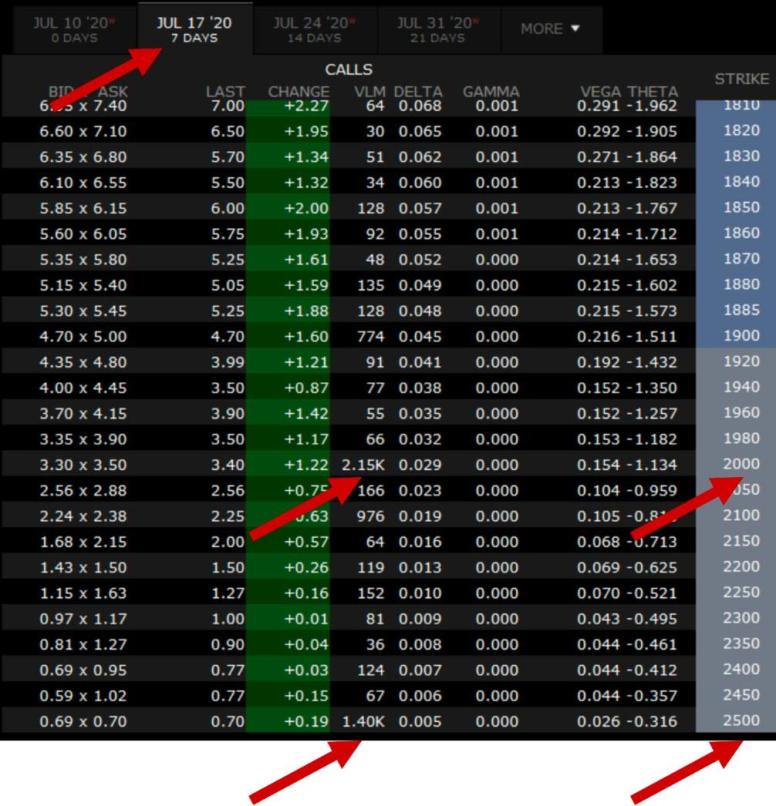

TSLA

TSLA is up over 13% this morning… up almost 80% since the start of July!

Almost made it to 1800 today.

$2000 here we come

VIX

Will Meade @realwillmeade Jul 11

Yesterday at 10:15AM

A trader-hedge fund purchased 13,600 $VIX 8/19 $90 calls for 35 cents

The VIX is currently 27

wow

VIAC Diagonal

Sold VIAC 07/17/2020 25.0 Calls @ 0.20 with the stock at 23.30

SLB Covered

Sold SLB 07/17/2020 19.50 Covered Calls @ 0.09 with the stock at 17.70

FAS FAZ

Second-quarter earnings season starts this week with the quarterly kick-off ritual of reports from the major investment and money center banks.

With the arrival of each bank earnings season comes opportunity with either the Direxion Daily Financial Bull 3X Shares (NYSE:FAS) and/or the Direxion Daily Financial Bear 3X Shares (NYSE:FAZ).

The bullish FAS tries to deliver triple the daily returns of the Russell 1000® Financial Services Index while the bearish FAZ, which is higher by 9.16% over the past month, attempts to deliver triple the daily inverse performance of that benchmark.

Banks faced an array of headwinds in the first half of 2020, including declining interest rates, rising loan loss reserves and the mandate from the Federal Reserve that buybacks be scuttled and dividend hikes be put on hold.

“Goldman analyst Richard Ramsden is more bearish, projecting earnings off 69% compared with last year. On the plus side, with the exception of Wells Fargo (NYSE:WFC), which he believes will report a quarterly loss, banks are apt to avoid dividend cuts,” reports Barron’s. “Still, banks will be hurt by higher reserves, which he expects to hit $32 billion, 27% over last quarter.”

Reading through the tea leaves of that assessment, it would appear that the bearish FAZ has a chance to shine this earnings season. Potentially bolstering the case for FAZ is that bank stocks, though still inexpensive relative to the broader market, aren’t quite the value plays they were 12 months ago. “Even with the recent increase in stock prices, the median North American financial sector stock still trades at an 11% discount to its fair value estimate but below a 30% discount a quarter ago,” according to Morningstar. “With our assessment that many financial sector stocks are less undervalued than they were a quarter ago, investors should be much more discerning of which stocks they choose and cognizant of the risks they’re taking.”

Something else to consider when it comes to the FAS/FAZ decision is that the Russell 1000 Financial Services Index isn’t a bank-specific benchmark. It includes insurance providers and asset managers, among others and some of those companies aren’t all that inexpensive, either.

“Outside of banks, we see fewer bargains in the financial sector. The investment-management firms we considered undervalued at the end of the first quarter are mostly fairly valued after the run in the stock market,” notes Morningstar. “The median North American insurer we cover also trades at around an only 8% discount to its fair value estimate, which is a relatively small margin of safety, given the insurance industry’s exposure to interest rates, asset prices, and tail risk of large insurance claims from the pandemic.”

VXX Diagonals

Partially restoring my diagonal puts that expired on Friday on the open

Sold 1 VXX 07/17/2020 30.50 Put @ 0.49

Sold VXX 07/17/2020 30.0 Puts @ 0.32

VXX opened at 31.81

#fuzzyhotair #putratioladder Hi Guys! I…

Hi Guys! I had ankle repair surgery last week….boy it’s been tough! Lots of pain and living on one leg! But was finally better enough this morning to add to my AAPL put ratio ladder. Adding on an up day like this….maybe not the best, but a 46 DTE expiration opened up this morning. (quick recap on my process: 1. delta 30/25 1×2 credit ratio 2. At the BE of that ratio I place a BWB (otherwise known as a venus fly or sumo fly) to extend the BE down a few more delta).

Week 1: Aug 21 345/340 1×2 credit ratio for 6.70 with a butterfly hedge

Current price: $3.375

Break even: About 319.60

Week 2 (placed today): Aug 28 372/365 1×2 credit ratio for 7.12

Butterfly hedge: 350/340/335 for .90

Break even: About $340, about 14 delta

The week one trade has realized 50% profit as of today….I’ll leave it sit a little while longer.

WFC Earnings

Sold WFC 07/17/2020 29.0 Diagonal Calls @ 0.24.

I also have a covered call position at the same strike.

Also

Sold WFC 07/17/2020 24.0 Puts / Bought 08/21/2020 20.0 Puts @ 0.20 Net Credit

Stock at 25.32 w/ Ann. Div. Yield $2.0400 / 8.01% and the 52-week low at 22.00

AAPL

#ShortPuts – Pure insanity….let’s add this:

Selling prior to earnings. If AAPL gets back to this there should be lots of other nice opportunities showing up also.

Sold AAPL JUL 24 2020 370.0 Put @ 2.30

ADS Covered and diagonal

Sold ADS 07/17/2020 47.0 Covered Calls @ 0.40

Also

Sold 1 ADS 07/17/2020 45.0 Call / Bought 1 ADS 09/21/2020 70.0 Call @ 0.25 Net Credit.

Stock at 41.39

OLED

#ShortPuts – Selling week before earnings at the expected move and well below the 50ma.

Sold OLED JUL 31 2020 145.0 Put @ 2.90

EWZ

#ShortPuts – Starter position…

Sold EWZ AUG 14 2020 28.0 Puts @ .71

AAL

STO $AAL Aug-21-2020 14 #CoveredCalls @0.92. Basis now 11.96. Stock @11.62.

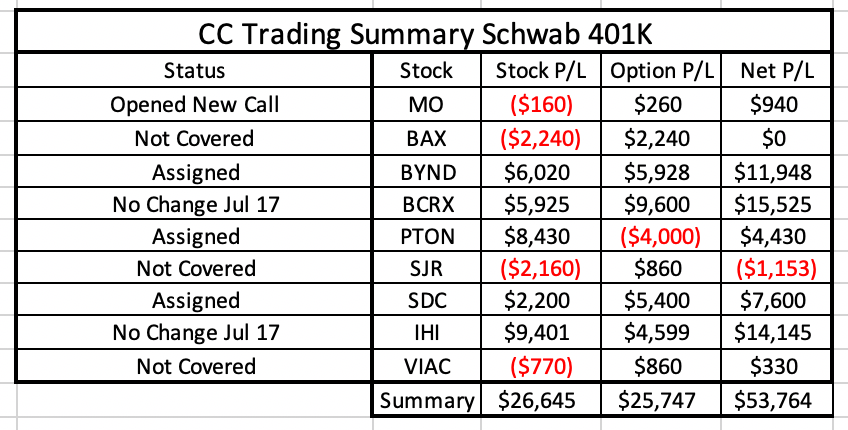

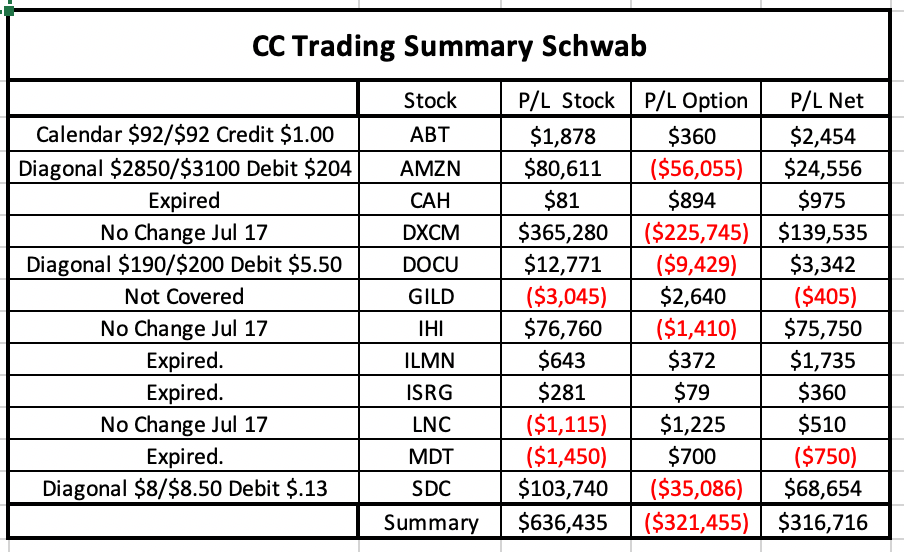

CC Strategy/Activity Jul 10

Options added to profitability in 24 of 28 positions. Overall large gains in stock price in DXCM, AMAZ and SDC create a loss on the options. Covered calls most successful in most conservative account (Schwab 401(K)) where they generate almost 50% of the profit.

P/L from stock and option does not always equal net P/L due to contribution from dividends.

Goldman Expects A 60% Drop…

Goldman Expects A 60% Drop In Q2 EPS, Much Worse Than Consensus

“Consensus forecasts S&P 500 EPS will decline by 44% year/year in 2Q, but we believe earnings will fall by 60% in the quarter… Management commentary will prove more valuable than backward-looking results.”

Episode 10 – Inrocktrination

We try to convince a country-music-loving college student that rock’n’roll is here to stay. Plus new music from Anderson.Paak, Nicole Atkins, Amber Mark, Bob Dylan, and more. And, we revisit KISW’s Top 1000 Rock songs of all time, as compiled in 1987. Playlists and more details at https://thepickcast.com

Dividends

Company Period Amount Yield Ex-Dividend Date Record Date Payable Date

PKI PerkinElmer quarterly $0.07 0.31% 7/16/2020 7/17/2020 8/7/2020

ZTS Zoetis quarterly $0.20 0.61% 7/16/2020 7/17/2020 9/1/2020

IEX IDEX quarterly $0.50 1.29% 7/15/2020 7/16/2020 7/31/2020

ACN Accenture quarterly $0.80 1.59% 7/15/2020 7/16/2020 8/14/2020

ABT Abbott Laboratories quarterly $0.36 1.61% 7/14/2020 7/15/2020 8/17/2020

ORCL Oracle quarterly $0.24 1.90% 7/14/2020 7/15/2020 7/28/2020

CL Colgate-Palmolive quarterly $0.44 2.41% 7/17/2020 7/20/2020 8/14/2020

CPB Campbell Soup quarterly $0.35 2.87% 7/14/2020 7/15/2020 8/3/2020

CAT Caterpillar quarterly $1.03 3.08% 7/17/2020 7/20/2020 8/20/2020

EOG EOG Resources quarterly $0.38 3.10% 7/16/2020 7/17/2020 7/31/2020

COP ConocoPhillips quarterly $0.42 4.11% 7/17/2020 7/20/2020 9/1/2020

PNC PNC Financial Services Group quarterly $1.15 4.37% 7/16/2020 7/17/2020 8/5/2020

ABBV AbbVie quarterly $1.18 4.90% 7/14/2020 7/15/2020 8/14/2020

BEN Franklin Resources quarterly $0.27 5.15% 7/14/2020 7/15/2020 7/27/2020

SJR.B Shaw Communications monthly $0.10 5.26% 7/14/2020 7/30/2020 7/30/2020

Earnings

This Week’s Earnings Announcements

Monday, July 13:

PepsiCo, Inc. (PEP),

Tuesday, July 14:

Citigroup Inc (C), Delta Air Lines, Inc. (DAL), Fastenal (FAST), First Republic Bank (FRC), JPMorgan Chase & Co. (JPM), Wells Fargo & Co (WFC),

Wednesday, July 15:

ASML Holding NV (ASML), Bank of New York Mellon Corp (BK), Goldman Sachs Group Inc (GS), IBM (IBM), Infosys Ltd (INFY), Omnicom Group Inc. (OMC), PNC Financial Services Group Inc (PNC), Progressive Corp (PGR), U.S. Bancorp (USB), UnitedHealth Group Inc (UNH), Wipro Limited (WIT),

Thursday, July 16:

Abbott Laboratories (ABT), Bank of America Corp (BAC), Danaher Co. (DHR), Domino’s Pizza, Inc. (DPZ), Dover Corp (DOV), Honeywell International Inc. (HON), J B Hunt Transport Services Inc (JBHT), Johnson & Johnson (JNJ), Morgan Stanley (MS), Netflix, Inc. (NFLX), PPG Industries, Inc. (PPG), SunTrust Banks, Inc. (STI), Taiwan Semiconductor Mfg. Co. Ltd. (TSM), Truist Financial Corporation (TFC),

Friday, July 17:

BlackRock, Inc. (BLK), Citizens Financial Group Inc (CFG), HDFC Bank Limited (HDB), Kansas City Southern (KSU), NVR, Inc. (NVR), State Street Corp (STT), Telefonaktiebolaget LM Ericsson (ERIC),

SPX 1-dte

#SPX1dte I didn’t place a trade for Monday. I was actually trying to place another bullish #Risk Reversal but couldn’t get filled before time ran out.

Expiring: $SPX June 10th 3055/3075-3215/3235 condors, sold yesterday for 1.40.

#SPX7dteLong Expiring at full 20.00 credit: June 10th 3155/3175 calls spread. Condors bought for 17.00 on June 2nd. Closed today for 20.50, total credit.

Expiration

#optionsexpiration

$LABU 47.5 put Thank you @fuzzballl

$SQ 124 put

$SQ 113 put Thank you @fuzzballl

$MRVL 34.5 put

$PFE 34.5 calls

Expirations

OX $SLB 19 #CoveredCallS. Replaced yesterday with $18.5 @0.25 for next week.

OX $SPX 3065/3075/3215/3225 #IronCondor. Sold yesterday @0.75. (thanks Jeff)

KSS Roll

Bought to close KSS 07/10/2020 21.0 Diagonal Calls / Sold KSS 07/17/2020 22.50 Diagonal Calls @ 0.32 Credit plus an extra 1.50 on the strike price.

KSS is @ 21.12 five minutes before the close

LABU

#ShortPuts – Sold LABU AUG 7 2020 40.0 Puts @ 1.05

MU

I unwound the spread I put on yesterday for a .15 cent profit because I was just not comfortable with the trade. BTC the August 65 call and sold the 2022 60 calls.

VXX and SPY Roll

Filled on orders to sell VXX 07/17/2020 31.5 Puts @ 0.88 and VXX 07/17/2020 31.0 Puts @ 0.66.

That was my signal to give up waiting and roll my last SPY Call for today.

Bought to close 1 SPY 07/10/2020 304.0 Call / Sold 1 SPY 07/20/2020 305.0 Call @ 0.14 Credit plus another point higher on the strike.

SPY @ 317.34 when I rolled.

KSS Covered Roll

Bought to close KSS 07/10/2020 20.50 Covered Calls / Sold KSS 07/17/2020 21.0 Covered Calls / 0.53 Credit plus an extra 0.50 on the strike price.

KSS is @ 20.88

SPX 7-dte

#SPX7dteLong Bought to Open $SPX July 17th 3150/3170-3180/3200 condors for 17.25, with SPX at 3177.

UVXY

#ShortPuts – Was going to let this one run the distance but playing it safe since I’ve already sold next week…

Bought to Close UVXY JUL 10 2020 30.0 Puts @ .08 (sold for 2.28)

SPY

#ShortPuts – Taking well over half with 6 weeks to go…

Bought to Close SPY AUG 21 2020 260.0 Put @ 1.15 (sold for 3.43)

TSLA

#CrazyTown again

TSLA Rockets Higher Again As ‘Someone’ Panic-Buys Massively OTM Call Options

The question is – who is buying these lottery tickets in size and who in the world benefits most from the TSLA share price being at these incredibly elevated levels?

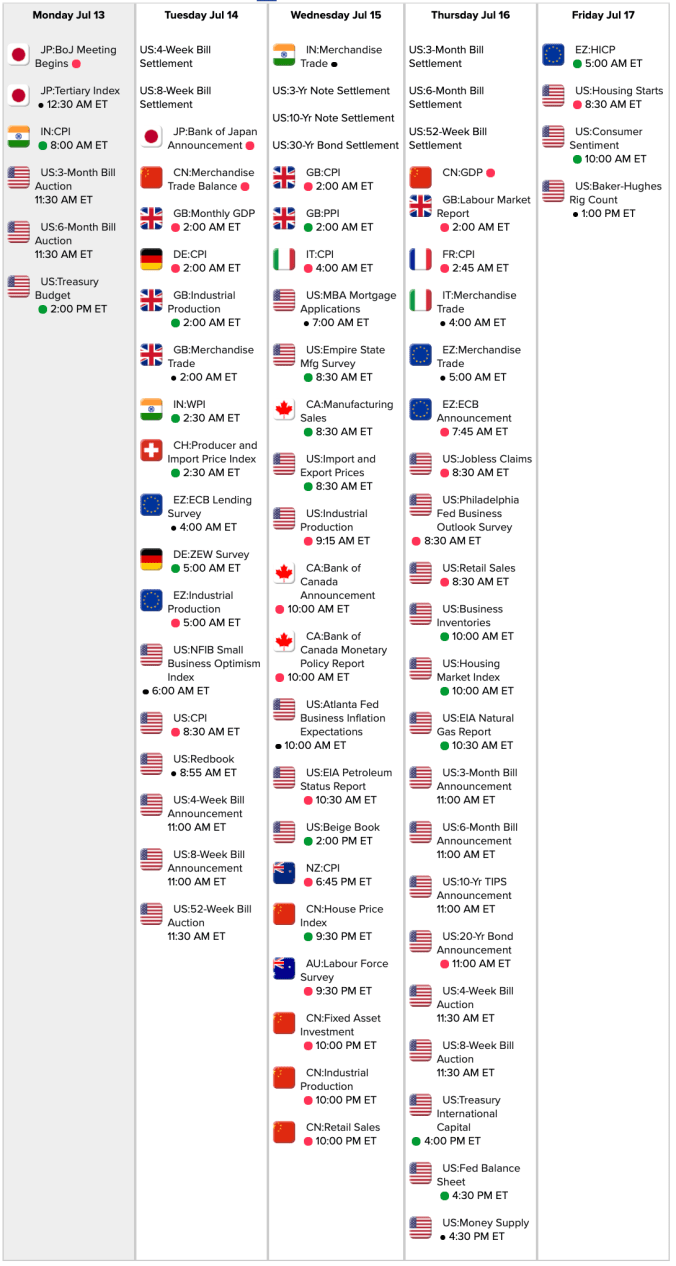

Econ Calendar for week of 7/13/20

VXX Puts

Sold VXX 07/17/2020 31.50 Puts @ 0.76

Sold VXX 07/17/2020 31.0 Puts @ 0.55

Sold VXX 07/17/2020 30.50 Puts @ 0.41

Partially replacing the 31.50 Puts for this week that I covered for a penny this morning.

#DoubleDip

SPX 7-dte

#SPX7dteLong Sold to Close $SPX June 10th 3145/3125 put spreads for .50. I have no choice now but to rely on the call side for profit, so dumping the put side. Need a close above 3175 for max profit.

SPY Roll

Bought to close 1 SPY 07/10/2020 312.0 Call / Sold 1 SPY 07/13/2020 313.0 Call @ 0.15 Credit plus an extra point higher on the strike for just one more trading day.

SPY at 315.36.

#SPYLadder

Markets

http://charleshughsmith.blogspot.com/2020/07/you-are-now-leaving-fantasyland-losses.html

“As the inverted pyramid collapses, the effects will be non-linear: a 10% decline may trigger dominoes that end up generating an 90% decline in “value” and “wealth” because the collapse of collateral to a non-fantasy valuation will implode all the phantom valuations piled on steadily more fragile and fantastic layers of phantom “capital.”

The fantasy of the Neofeudal Aristocracy is that the losses can be painlessly transferred to the debt-serfs and taxpaying peasantry. Mommy and Daddy (Treasury and Fed) will load future generations of debt-serfs and taxpaying peasantry with the losses and the political-financial Nobility will have their fortunes preserved. Gee, thanks, Mommy and Daddy! You’re swell!

The Neofeudal Aristocracy overlooks one terribly inconvenient fact: the debt-serfs and peasantry own next to nothing. The non-linear collapse of phantom capital will have asymmetric consequences: all the “assets” most likely to go to zero are owned not by the peasantry but by the Neofeudal Aristocracy.”

TNA UVXY VXX

#ShortPuts – Rolling and adding…

TNA: Still rolling and adding credit

Rolled TNA JUL 10 2020 27.5 Puts to JUL 24 2020 26.0 Puts @ .30 credit (3.15 total now)

UVXY: Adding

Sold UVXY JUL 17 2020 29.0 Puts @ .90

Sold UVXY JUL 17 2020 28.5 Puts @ .70

VXX: Adding

Sold VXX JUL 17 2020 31.5 Puts @ .60

VXX Puts

Bought to close 07/10/2020 31.50 Puts @ 0.01.

Rolled the 07/02/2020 33.0 Puts down to these at a 0.26 Credit last Friday.

They were written against VXX 2021 and 2022 long puts.

I also have 29, 30, and 30.50 short Puts and 38 and 40 short Calls expiring today.

WBA Diagonal Credit Spread unwind

On Wednesday, before #Earnings, I sold to open WBA Jul 10 2020 40.00 Puts @ $0.43 / Bought WBA Jul 17 2020 30.00 Puts @ $0.02 for a 0.41 net credit.

Today I Closed Out the Spread for a 0.40 Debit for a virtual break even.

Given that the stock dropped to 38.05 on Thursday and started below 38.60 this morning, I count this as a victory.

At least I got to add stock yesterday below 39.

VIAC Covered Roll

Bought to close VIAC 07/10/2020 20.0 Covered Calls / Sold VIAC 07/17/2020 20.0 Covered Calls @ 0.11 Credit.

The options are too far ITM to roll up with the stock at 22.49.

A pullback to about 21 by next Friday would help with that.

#Earnings not until 08/06

PFE Put Rolled

#shortputs

$PFE BTC 7/10 34 put and STO 7/17 34 put at .36 added credit

KSS Roll

Bought to close KSS 07/10/2020 22.0 Diagonal Calls / Sold KSS 07/17/2020 23.0 Diagonal Calls @ 0.27 Credit plus an extra point on the short strike.

The stock is at 20.60 with no #Earnings next week.

AAL Covered Roll

Bought to close 1 AAL 07/10/2020 13.50 Covered Call / Sold 1 AAL 07/17/2020 Covered Call @ 0.17 Credit with the stock at 11.35

WBA Covered Roll

Bought to close WBA 07/10/2020 42.50 Covered Call / Sold WBA 07/17/2020 41.0 Covered Call @ 0.32 Credit

With the stock around 39.0 after the earnings drop I’m expecting this one won’t be threatened next week.

However, my average stock cost is below 40, so whatever 🙂

PEP earnings analysis

#Earnings $PEP reports Monday morning. Below are details on earnings FIVE-day moves over the last 12 quarters, to indicate how PEP may move into next Friday’s expiration.

Tue 04/28/2020 BO -3.21%

Thu 02/13/2020 BO +0.62%

Thu 10/03/2019 BO +3.29%

Tue 07/09/2019 BO +0.54%

Wed 04/17/2019 BO +3.82%

Fri 02/15/2019 BO +2.97%

Tue 10/02/2018 BO -3.81% Biggest DOWN

Tue 07/10/2018 BO +4.57% Biggest UP

Thu 04/26/2018 BO -0.21%

Tue 02/13/2018 BO -0.78%

Wed 10/04/2017 BO +1.16%

Tue 07/11/2017 BO +0.57%

Avg (+ or -) 2.13%

Bias 0.79%, positive bias on earnings.

With stock at 32.00 the data suggests these ranges:

Based on current IV (expected move into Friday 7/17 per TOS): 126.73 to 137.27 (+/- 4.0%)

Based on AVERAGE five-day move over last 12 quarters: 129.19 to 134.81

Based on MAXIMUM five-day move over last 12 Q’s (4.6%): 125.97 to 138.03

Based on DOWN max only (-3.8%): 126.97

Open to requests for other symbols.

WFC Covered Calls

Sold 1 WFC 07/17/2020 28.50 Covered Call @ 0.17

Sold 2 WFC 07/17/2020 29.00 Covered Calls @ 0.15.

Sold 2 WFC 07/17/2020 29.50 Diagonal Calls @ 0.11.

With the stock at 24.50, the only reason the premiums are this high is that #Earnings are BMO on 07/14/2020

SPY

#ShortPuts – Filled on the bounce…

Bought to Close SPY JUL 17 2020 285.0 Put @ .25 (sold for 2.80)

SPX 1-dte

#SPX1dte Sold to Open $SPX July 10th 3055/3075-3215/3235 condors for 1.35, IV 20%, SPX 3152, ∆ -.07, +.06

UVXY

#ShortPuts – Taking profits while we have a little volatility. Also adding next week…

Bought to Close UVXY JUL 10 2020 29.0 Puts @ .10 (sold for 1.40 and 1.45)

Sold UVXY JUL 17 2020 28.5 Puts @ .95

Sold UVXY JUL 17 2020 29.0 Puts @ 1.17

Still short 30’s for tomorrow…

MU

BTO the 2022, 60 call at 7.29 and sold an August 21, 65 call at .14 cents. I plan to sell the short dated calls to pay for the LEAP.

XRX Covered Call

Bought 100 XRX / Sold 1 XRX 07/17/2020 15.0 Covered Call @ 14.21 Net Debit.

I’ve been waiting on this one to retrace to the old low.

#Earnings on 7/28. P/E at 7.00. Yield at 6.50%

VXX Diagonal

Sold 1 VXX Jul 17 2020 41.00 Call @ 0.57.

Waiting for this week’s calls @ 38 and 40 to expire before writing more.

COST ROKU SPY ULTA

#ShortPuts – A few today…

COST: Taking profits a week early

Bought to Close COST JUL 17 2020 290.0 Put @ .18 (sold for 3.20)

ROKU: Thinning the herd

Bought to Close ROKU JUL 10 2020 115.0 Put @ .05 (sold for 2.20)

SPY: Taking profits a week early

Bought to Close SPY JUL 17 2020 275.0 Put @ .11 (sold for 2.85)

ULTA: Heading back in small and hopefully safe…prior to earnings

Sold ULTA AUG 21 2020 155.0 Put @ 2.90

WBA Covered Call

Bought 100 WBA / Sold 1 WBA 07/17/2020 40.50 Covered Call @ 38.47 Net Debit

Earning were disappointing but revenues were up Y/Y and they raised the dividend by a penny per quarter

TRADES:

SDGR STO 8/21/20 95.0 CALL @9.70

SDGR STO 8/21/20 100 CALL @8.00

SPX trades

#SPX7dteLong Bought to Open $SPX July 15th 3140/3160-3170/3190 condors for 17.20, with SPX at 3167.

Wasn’t filled on trying to sell my put side on the lows…. I called the pullback but thought it would go a bit deeper.

#SPX1dte Expiring: July 8th 3045/3065-3205/3225 condors, sold yesterday for 1.10.

SQ NVTA Puts

#shortputs

$SQ STO 7/10/124 put at .63

$SQ STO 7/17/125 put at 2.80

$NVTA STO 8/21 30 put at 2.10

VXX

#ShortPuts – Can’t use UVXY in this account so going with VXX. Planning on being more active on the put side of these at least out through the election. Half size to start…

Sold VXX JUL 17 2020 31.5 Puts @ .85