#ShortPuts – Gotta book ’em on a move like this…

Bought to Close OSTK OCT 9 2020 65.0 Put @ .16 (sold for 1.60)

Bought to Close OSTK OCT 9 2020 64.0 Put @ .15 (sold for 1.35)

#ShortPuts – Gotta book ’em on a move like this…

Bought to Close OSTK OCT 9 2020 65.0 Put @ .16 (sold for 1.60)

Bought to Close OSTK OCT 9 2020 64.0 Put @ .15 (sold for 1.35)

Bought to close 1 SPY Oct 05 2020 338 Call / Sold to Open 1 SPY Oct 07 2020 340 Call @ 0.50 Net Credit.

SPY rallied 5 points today so getting almost a point for a call 3 points out of the money this morning just wasn’t enough premium I guess.

Sept. 29, sold Oct. 16, 75/80 for.95, bought today for .12

Selling a small diagonal with the short side next week instead of this week..

Bought to open VXX Jan 15 2021 16 Puts / Sold to Open VXX Oct 16 2020 23.5 Puts @ 0.07 Net Credit.

I expect the short to expire leaving me with a few more “no cost” longs for next January.

I’m thinking the VIX pulls back dramatically by Thanksgiving based on the skew in the VIX futures.

#SPX7dteLong Bought to Open $SPX Oct 9th 3370/3390-3400/3420 iron condors for 17.00, with SPX at 3395.

Expected to expire: Oct 5th 3345/3365 call spreads for max credit of 20.00. Condors bought last Tuesday for 17.50.

#SPX1dte expiring: Oct 5th 3240/3260-3440/3460 condors, sold Friday for 1.45.

Sold ADS Oct 09 2020 51.0 Covered Call @ 0.25

Sold KSS Oct 09 2020 22.0 Covered Calls at $0.22

Sold WBA Oct 09 2020 37.5 Covered Call at $0.15

Sold WDC Oct 09 2020 40.0 Covered Calls at $0.07

Enough for this week’s grocery store run 🙂

Sold to open VXX Oct 09 2020 24.5 Puts @ $0.42, adding to my position.

Sold to open VXX Oct 09 2020 24.0 Puts @ $0.22, adding to my position.

This replaces similar VXX Puts that expired Friday.

#DoubleDip

The low for VXX so far today is 24.90 but the VIX is still up 3.5% today

#closing NFLX #rolling AAL M CCL NKLA #coveredcalls X CCL UAL

NFLX closed a Nov. 20 #ironcondor for a loss of $24, being uncooperative

AAL rolled Oct. 16, 20 put to Nov. 20 for .27

CCL rolled Oct. 16, 20 put to Nov. 20 for .50

M rolled Oct. 16, 8 put to Nov. 20 for .18

X sold Oct. 16, 8.5 #coveredcall for .16

CCL sold Oct. 16, 16 #coveredcall for .45

UAL rolled Oct. 30, 27 #coveredcall to Dec. 18 for 1.40

NKLA Sept. 9 sold an Oct. 16, 20/30 put spread for 1.47. financial shenanigans brought the stock down, Today sold the long put for 1.40, was bought for .35, rolled the short put to Nov. for 2.90

#ShortPuts – Another one filled. Completely out of LABU now…

Bought to Close LABU OCT 09 2020 42.5 Put @ .10 (sold for 1.35)

It’s happening again

VIX up 4%

S&P up 1.3%

Arrrggg 🙂

#ShortStrangles – Adding a call next week to balance out this week’s 2P x 1C short strangle. Selling 2 times the expected move and above all time highs and a week prior to earnings.

Sold NFLX OCT 16 2020 580.0 Call @ 1.83

#ShortPuts – A couple small profits. NTES is post split now so booking here and looking for a smaller size entry…

Bought to Close LABU OCT 09 2020 40.0 Put @ .10 (sold for 1.20)

Bought to Close NTES OCT 09 2020 87.0 Puts @ .60 (sold for .80) split adjusted

Roll Oct-16-2020 SPCE 30 #Shortputs // Nov-20-2020 @1.05 Credit.

Still digging out on this one – multiple rolls since starting with 31 puts sold in Feb.

(ETA: The Spice must flow)

Sold to Open SPY Oct 09 2020 340 Diagonal Calls at $2.22 & 2.66

Sold to open SPY Oct 07 2020 339 Diagonal Calls at $1.83 & 2.27

Sold to open 1 SPY Oct 05 2020 338 Diagonal Call at $0.90

Sold these to replace the 10/02/2020 335 calls that expired and the 10/02/2020 336 Calls I covered for a penny on Friday.

Bought to Open 1 SPY Nov 20 2020 360 Call /Sold to Open 1 SPY Oct 07 2020 335 Call @ 0.58 Net Credit

Bought to Open 1 SPY Nov 20 2020 355 Call /Sold to Open 1 SPY Oct 09 2020 335 Call @ 0.14 Net Credit

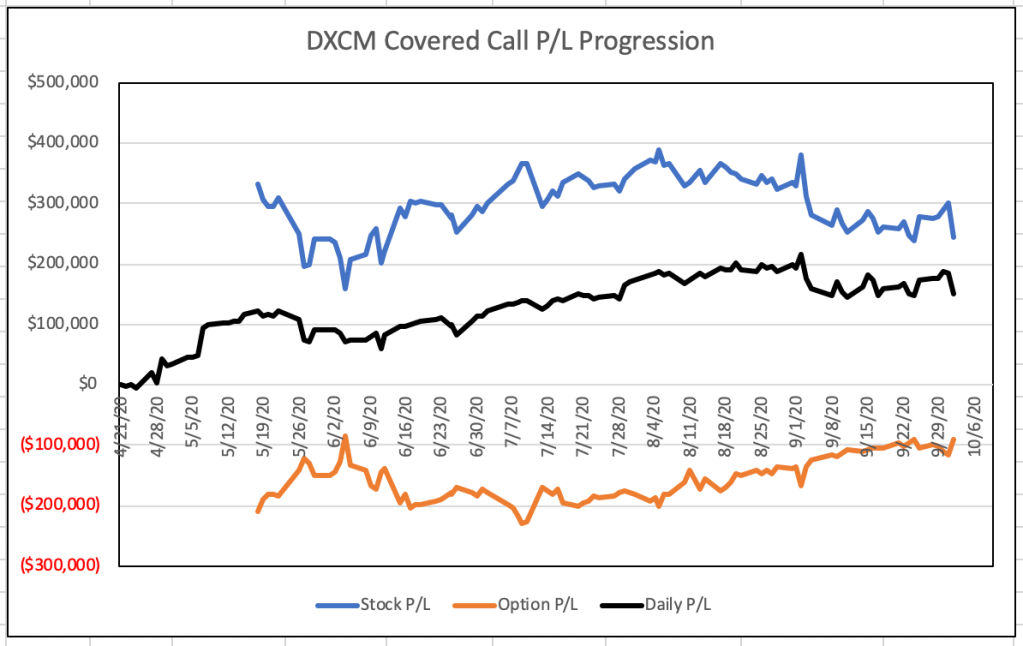

Short options have helped but hard to offset $50 drop in stock price.

https://coveredcallswithjeff.wordpress.com/2020/10/05/peleton-pton-covered-call-strategy-2771-in-33-days-roi-of-17-9-or-198-annualized/

https://coveredcallswithjeff.wordpress.com/2020/10/05/goldman-sachs-gs-covered-call-assigned-profit-of-455-in-44-days-roi-5-or-4-annualized/