#SPX1dte Sold $SPX 2170/2190-2635/2655 condors for 1.85. IV: 84.2%, SPX 2406, deltas: -.07, +.06. OTM: -9.0% and +9.5%.

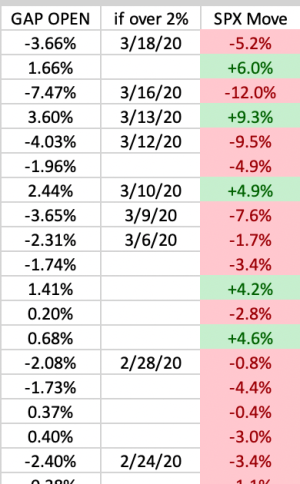

Couldn’t have picked a better outcome for my monthly condor put on this morning… placed the trade when we were flat on the day ended as close to flat as we can expect in this market. So I’m leaving the trade to settle in the morning as I do not fear +9% gaps.