#optionsexpiration

$SPX 2760/2780-2950/2970 1 DTE Thank you @Jeff

$PFE 39 call

$TWTR 31.5 call

$TQQQ 50 put Thank you @jsd501

$SPY 270 put Thank you @fuzzballl

Have a nice Mother’s Day.

#optionsexpiration

$SPX 2760/2780-2950/2970 1 DTE Thank you @Jeff

$PFE 39 call

$TWTR 31.5 call

$TQQQ 50 put Thank you @jsd501

$SPY 270 put Thank you @fuzzballl

Have a nice Mother’s Day.

#VIXIndicator The VIX closed below the 78.6% retracement, so that cancels the DW. Crazy stuff on a day with jobs numbers like that. If we can close well Monday and Tuesday it will set up nicely for a further rally higher.

#Earnings – I normally don’t do this but they never really took any heat so let ’em run the distance…

Expired:

OLED 135.0/155.0/157.5 Jade Lizard (sold for 2.55)

ROKU 123.0 Put (sold for 2.20)

BYND Rollout $125 to May 15 $130 $1.65 Credit

ISRG Diagonal Up May 8 $500 to May 15 $530 $26.55 Debit

SDC Diagonal UP May 8 $7.00 to May 15 $8 $.29 Debit

SDC Diagonal Up May 8 $7.50 to May 15 $8 $.12 Credit

New CC 1 Amazon May 15 $2380 Net $2344 Net

ET Diagonal DOWN May 8 $9 to May 15 $7.50 $.40 Credit

WFC Diagonal DOWN May 8 $27.50 to May 15 $27 $.18 Credit (Hopeful thinking?)

CAH Diagonal UP May 8 $47 to May 15 $49.50 $.80 Debit

BTC May 15, 40 puts at .02

#SPX1dte Sold to Open $SPX May 11th 2825/2845-2990/3010 condors for .95, IV 14.75%, SPX 2929, deltas -.06, +.05

Expiring: May 8th 2760/2780-2950/2970 condors, sold yesterday for 1.15.

#ShortPuts – Risk off…booking them a week early.

Bought to Close TQQQ MAY 15 2020 55.0 Put @ .15 (sold for 2.21)

Bought to Close TQQQ MAY 15 2020 60.0 Put @ .31 (sold for 2.47)

#SPX7dteLong Bought to Open $SPX May 15th 2900/2920-2930/2950 condors for 17.05, with SPX at 2922.

Expiring: May 8th 2840/2860 call spreads for maximum credit, 20.00. Condors bought last Friday for 18.40.

AAL STO 5/15/20 10.0 PUTS @.61

DAL BTO STOCK @22.55

CARR BTO STOCK @18.08

AAL STO 5/15/20 11.0 CALLS #STRANGLE See Put above.

#ShortPuts – Come and get it…

Sold TQQQ JUN 5 2020 60.0 Put @ 2.20

#shortputs

$MRNA STO 5/15 55 put at 1.45

BTC $TSLA May 15 2020 670/680 #BuPS @.32. Was Sto 4/29 @2.20

BTC $SQ Jun 19 2020 50/60 #BuPS @0.75. STO 5/6 @1.52

Assuming things don’t go crazy this afternoon:

OX $TLRY May 8 2020 $6.50 #ShortPut – STO 5/1 @.36

OA $TLRY May 8 2020 $7.00 #CoveredCalls – STO 5/1 @0.55. Overall Basis on the stock is $3.88. Position opened 3/31.

OX $OXY May 8 2020 $16 Call #CoveredCall

STO $OXY May 22 2020 $16 Call @0.44

OA $VIAC May 8 2020 $17 #CoveredCall – Position opened 4/23, @15.05, Basis @14.80 after roll last week.

STO MAy 22, 55 puts at .51

STO May 29, 55 puts at .51

STO June 19, 55 puts at 2.42

The higher the strike price, the smaller I trade.

STC May 22 118/120 Call Spread $1.45 BTO 5-7 $0.98

1 Day took profit

#shortputs

$SPY BTC 5/8 270 put at .06. STO at 1.70 on 4/28. Thank you @fuzzballl

$SQ BTC 5/15 60 put at .10. STO at .85 on 5/6. Thank you @fuzzballl for earnings on this earnings trade.

$NLOK STO 5/15 21 put at .65

#ShortPuts – Added on the early weakness. The additional put sales are being used to finance ITM covered call rolls…

Sold ROKU MAY 15 2020 115.0 Put @ 1.30

Thanks for the idea guys, I’ve placed the following diagonal:

Bought Aug 9 calls for 6.76

Sold May 15 calls for 1.40

TGIF!

Sue

#SPX7dteLong

In the pre-market, filled on GTC order, Sold $SPX May 11th 2840/2860 call spreads for 18.00. Condors bought for 18.20 on Monday. Will sell the put side today. Right now I’m asking 1.80, which I can get with a minor pullback.

Good Morning

#Jobs — biggest losses since WW2

Loss of 20,500,000 non-farm payroll jobs, vs. expected 21.5M loss

Unemployment at 14.7%, up by 10.3%, vs. expected 16%

U6 unemployment at 22.8%, up by 14.1%

Avg Hourly Earnings up 4.3%

Labor force participation 60.2%, down by 2.5, lowest in over a decade

March revised down from -701K to -870K

February revised up from +214K to +230K

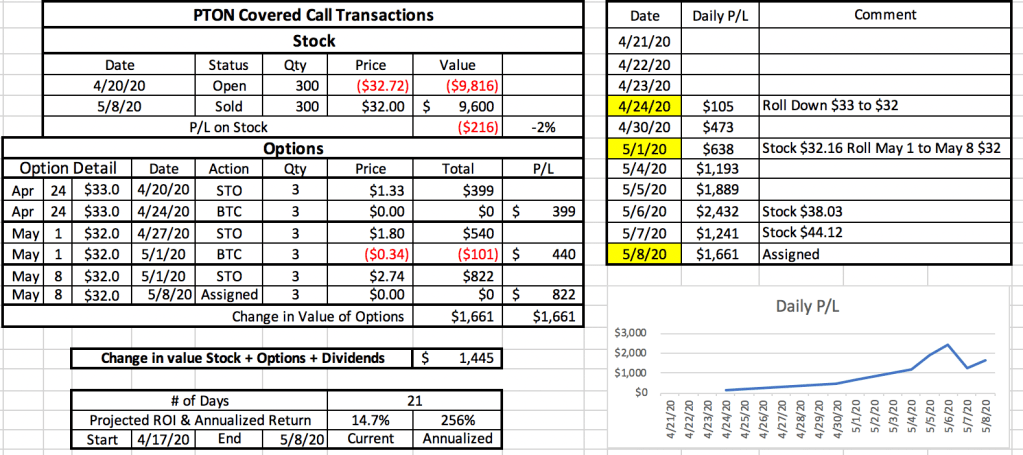

CC strategy left a lot of money on the table with the big run up. Maximized the profit on the position ….but tough to leave the $ on the table.

14.7% Return in 21 days….would take that any time.

Should have rolled up prior to earnings announcement and again yesterday after strong opening. I would like to have a position in PTON and continue writing. I rolled PTON up in other account…caught sleeping on this one.