Bought to close 1 CINF 06/19/2020 65.0 Put / Sold 1 CINF 09/18/2020 60.0 Put @ 0.65 Credit.

I expect to lose $500 less than I previously thought but I’ll have to wait until fall to reap the benefit

Monthly Archives: May 2020

SPY STC may 26 297/299 $1.85

Bal of trade should expire for 0

Bought 5-21 as a debit IC $1.27.

Thx to Jeff

SPX call side stopped

#SPX1dte Bought to close $SPX May 26th 3025/3045 cll spreads for 3.75. Condors sold Friday for 1.10.

#SPX7dteLong May 26th 2970/2990 call spreads set to expire for 20.00. Condors bought last Monday for 17.15. Have to keep a watch for too deep a pullback, however.

Options Expiration

HTZ 4 covered call

WFC 26.5 covered call

CCL 12.5 put

CCL 14 put

M 5 put

Episode 6 – These Six Yutes

Millennial/Gen Z Takeover — we pass the mics to six youth from the world over to give us their Picks for music, TV, and more. // Find more details, links, and playlists at https://thepickcast.com

OLLI Put / DDOG BUPS / DKNG Put Rolled

#shortputs

$OLLI STO 6/19 80 put at 3.70

$DKNG BTC 5/22 29 put and STO 5/29 28 put at .65 added credit

#bups

$DDOG STO 6/19 70/75 BUPS at 2.50

NVDA SPY TNA

#CoveredCalls #BullPutSpreads #Earnings

NVDA: Earnings down to the wire but went out worthless

MAY 22 2020 360.0/355.0 Bull Put Spread @ 2.65 (expired)

SPY: Down to the wire but had to roll (covered)

Rolled SPY MAY 22 2020 295.0 Call to MAY 27 2020 295.0 Call @ 2.20 credit (4.65 total now)

TNA: Rolled out a week and up a little (covered)

Rolled TNA MAY 22 2020 20.0 Calls to MAY 29 2020 20.5 Calls @ .12 credit

Expirations

OX $OSTK May-22-2020 21 #CoveredCalls – STO 5/11 @.45.

OX $OXY May-22-2020 16 #CoveredCalls – STO 5/8 @0.44.

OX $PTON May-22-2020 43 #ShortPuts – STO 5/18 @0.70.

OX $LULU May 22-2020 215/225 #BuPS – STO as part of a roll last week, total 1.86 premium.

Expiration

#optionsexpiration

$SDC 8.5 call

$ROKU 121 call

$NVAX 32 put

EXPIRATION FRIDAY:

AAL 9.0 & 9.5 PUTS STO @.53 & .44

AAL 10.5 CALLS STO @.60

AAL 10.0 PUTS STO @.1.16 ROLLING OUT TO 5/29, SAME STRIKE for .58 BTC the 5/22s for .25

DKNG 26.0 & 29.0 PUTS

DKNG 35.0 CALL STO @.69

ACB 13.0 CALL STO @1.00 did this Wednesday as a covered call atm

OSTK 18.0 &19.0 & 20.0 CALLS STO @1.75, 1.60, .65

Remember

#Memorial Day

Thanks to all who serve and have served.

Three day weekend. Spend some of it relaxing.

SPX 1-dte

#SPX1dte Sold to Open $SPX May 26th 2840/2860-3025/3045 condors for 1.10. IV: 14.5%, SPX 2953, deltas: -.06, +.04

Expiring: May 22nd 2855/2875-3010/3030 condors, sold for 1.35 yesterday.

Econ calendar for week of 5/25/20

SPX 7-dte

#SPX7dteLong Bought to open $SPX May 29th 2920/2940-2950/2970 condors for 17.35, with SPX at 2945.

Trades

TLRY sold May 29, 9.50 put for .61 #shortputs

TSLA Sold May 29, 760/765 put spread for .68 #shortputspread

LUV rolled June 19 40 put to August for .50 #rolling #shortputs

HTZ sold my 200 shares, risk off, for traditional Chicago Bears first play from scrimmage-no gain

FB Sold June 19, 242.50/245 #shortcallspreads for .83

TWTR sold July 17, 27/38 #shortstrangles strangle for 1.24

BABA Sold July 17, 170/175/230/235 #ironcondor for 1.39

EWY strangle

Sold to open $EWY 7/17 45/56 strangle @ 1.27 with the ETF at 51.23. Just about delta neutral (puts 18 and calls 19).

TRADES:

OSTK 5/29/20 STO 19.0 CALLS @.75

TLRY BTO STOCK @10.0

ACB STO 5/29/2018.0 CALLS @1.18

LULU

BTO Jun 19 275/272.5 Put spread $1.15

A TRADE:

DKNG STO 5/29/20 28.0 PUT @1.10

#ironcondor BABA Sold June 19,…

#ironcondor BABA

Sold June 19, 170/175/230/235 for 1.39. BABA is down 10 today to around 201 after earnings

LULU

AZO earnings analysis

#Earnings $AZO reports Tuesday morning before the bell. Options trades need to be placed today to capture any earnings move. Below are details on earnings one-day moves over the last 12 quarters.

March 3, 2020 BO -2.11%

Dec. 10, 2019 BO +6.92% Biggest UP

Sept. 24, 2019 BO -4.41%

May 21, 2019 BO +5.56%

Feb. 26, 2019 BO +5.10%

Dec. 4, 2018 BO +6.74%

Sept. 18, 2018 BO -1.97%

May 22, 2018 BO -9.48%

Feb. 27, 2018 BO -11.06%

Dec. 5, 2017 BO +0.42%

Sept. 19, 2017 BO -5.00%

May 23, 2017 BO -11.84% Biggest DOWN

Avg (+ or -) 5.88%

Bias -1.76%, negative bias on earnings.

With stock at 1100.00 the data suggests these ranges:

Based on current IV (expected move into Friday per TOS): 1025.76 to 1174.24 (+/- 6.7%)

Based on AVERAGE one-day move over last 12 quarters: 1035.27 to 1164.73

Based on MAXIMUM one-day move over last 12 Q’s (11.8%): 969.76 to 1230.24

Based on UP max only (+6.9%): 1176.12

NOTE: 5-day historical maximums are +5.7 and -9.9%. So LESS than the one day moves on both sides, meaning the big one day moves were somewhat retraced 5 days after earnings.

Open to requests for other symbols.

EXPE closed

#Earnings Bought to close $EXPE May 22nd 79 calls for .10. 79/81 call spreads sold Wednesday for .90.

PTON

STO $PTON May-29-2020 43 #ShortPuts @0.70.

Holding May-22-2020 43 #ShortPuts, planning to let them go to expire.

BOUGHT 3 CC’s May 29 $205 TWLO net $198.49, Stock at $204.50

NVDA BUPS and BUCS

NVDA

BOUGHT 5 May 29 CC’s on WORK @ $30.392, Stock at $31.50

#shortputs CAR Sold June 19,…

#shortputs CAR

Sold June 19, 13 put for 1.11, CAR is just under 16

WORK CC Rollout

Rolled $WORK May-22-2020 31.50 #CoveredCalls // May 29 2020 33.00 @0.20 Credit +better strike.

Second roll on this one, originally purchased 5/13 when the stock was $30.25. My basis is now $29.02.

Takin’ what they’re giving, $WORK’n for a livin’ (Not Slack’n)

Hey good morning everyone. Hope…

Hey good morning everyone. Hope you all have been safe and trading well.

Kelly

SPY

BTO May 26 IC 297/299 293/291 $1.27

My version of Jeff’s SPX BTO trades

#shortputs BOOT Sold July 17,…

#shortputs BOOT

Sold July 17, 20 put for 1.70

SPX 1dte

#SPX1dte Sold to Open $SPX May 22nd 2855/2875-3010/3030 condors for 1.35. IV: 21.0%, SPX 2951, deltas -.06, +.07

TSLA iron condor

Sold $TSLA 6/19 630/650/950/970 iron condor @ 4.70 with the stock around 819. Leaning short with the short calls at 24 delta, short puts at 11 delta. Will look to roll the put spread side up it starts to run again.

BBY short puts

Post-earnings, sold to open $BBY 7/17 65 puts @ 1.82. Delta 18. IV rank 42.

GILD put spread

Sold to open $GILD 6/19 70/65 bull put spread @ 1.31 with the stock at 73.63.

NVDA Earnings

STO $NVDA May-29-2020 320/325 #BuPS @1.05

NVDA Earnings

#BullPutSpreads – Wouldn’t mind owning this but would like to see it implode a little. Selling ITM bull put spread for upside gain but a decent ownership basis if it does tank.

Sold NVDA MAY 22 2020 360.0/355.0 Bull Put Spread @ 2.65

Not much else going on…just letting things work.

NVDA earnings analysis

#Earnings $NVDA reports tonight. Below are details on earnings one-day moves over the last 12 quarters.

Feb. 13, 2020 AC +7.02%

Nov. 14, 2019 AC -2.66%

Aug. 15, 2019 AC +7.25%

May 16, 2019 AC -2.28%

Feb. 14, 2019 AC +1.81%

Nov. 15, 2018 AC -18.75% Biggest DOWN

Aug. 16, 2018 AC -4.90%

May 10, 2018 AC -2.15%

Feb. 8, 2018 AC +6.69%

Nov. 9, 2017 AC +5.26%

Aug. 10, 2017 AC -5.32%

May 9, 2017 AC +17.82% Biggest UP

Avg (+ or -) 6.83%

Bias 0.82%, positive bias on earnings.

With stock at 356.00 the data suggests these ranges:

Based on current IV (expected move into Friday per TOS): 330.23 to 381.77 (+/- 7.2%)

Based on AVERAGE one-day move over last 12 quarters: 331.70 to 380.30

Based on MAXIMUM one-day move over last 12 Q’s (18.8%): 289.25 to 422.75

Based on UP max only (+17.8%): 419.44

Open to requests for other symbols.

NFLX – Rollout

Rolled $NFLX 320/330 May-22-2020 #BuPS // May-29-2020 @1.47 credit.

NFLX trading around 434, down ~$13.50 or so today.

TQQQ

In my IRA:

BTC May 22, 50 puts at .01, sold at 1.25 and I want a pull back before I sell any more puts.

NVDA BUPS Closed

#closing #earnings LOW May 19…

May 19 sold #jadelizard for 2.59, bought today for 2.07

June 19, 105/119/121

TQQQ

BTC May 22, 50 puts at .01

BTC May 22, 55 puts at .01

I have covered about half of the position and will cover the rest probably tomorrow at .01. With no brokerage, I don’t mind taking the risk off for a penny.

EXPE bear call spread

Sold to Open $EXPE May 22nd 79/81 call spreads for .90. Risking 1.10.

SPX 7-dte

#SPX7dteLong Bought to Open $SPX May 27th 2950/2970-2980/3000 condors for 17.00, with SPX at 2972.

TSLA

BTC $TSLA 5-22-2020 720/730 #BuPS @0.09 debit. Was STO 5/8 @1.82.

Trade was earlier today when underlying was at about 812.

Rolling AMZN put spread up

From my iron condor, rolled $AMZN 6/19 2150/2130 bull put spread up to 2300/2280 for 2.10 credit. New short puts at 16 delta. Paired with 6/19 2600/2620 bear call spread. Total premium taken in now 8.10 against 20 point wide wings.

TQQQ Put Rolled

#shortputs

$TQQQ BTC 5/22 50 put and STO 6/19 60 put at 1.77 added credit. The BTC was for.01. Thank you @jsd501 for the original impetus. I enjoy being impetized.

#closing #shortstrangles BA Bought June…

#closing #shortstrangles BA Reset #shortstrangles

Bought June 19, 95/145 strangle for 5.57, sold May 15 for 6.20 when BA was around 120, now around 132.

Sold June 19, 105/160 strangle for 3.59

TDOC CC May 22 $167.50 net $164.99 w stock at $171.07

REGN synthetic strangle

Putting on a short synthetic strangle in $REGN (short options with 50 point wide wings to reduce buying power requirement). Sold $REGN 6/19 470/520/650/700 iron condor @ 8.05 with the stock around 479. Short puts and calls at 18 and 15 delta. IV rank 43.

CORRECTION: Stock is at 579 not 479.

Closing TQQQ

Bought to close:

$TQQQ 6/12 55 put @ .78 (sold for 2.20 on 5/13)

$TQQQ 6/19 55 put @ 1.12 (sold for 2.85 on 5/13)

Thanks @jsd501 for the trade idea

GLD iron condor

Sold $GLD 6/19 153/158/170/175 iron condor @ 1.49, leaning a bit short with short puts at 22 delta, short calls at 29 delta. IV rank 44.

#coveredcalls #assignment WBA #earnings #closing…

#coveredcalls #assignment WBA #earnings #closing TGT

WBA May 15, bought 100 shares at 37.96 and sold a May 29 38 call for 1.01. I was assigned yesterday, thought I was safe but no harm.

TGT Yesterday sold June 15 110/140 strangle for 2.16, bought today for 1.61

SE Covered Call May 22 $70 for net $68.70

#coveredcall $SE

SPX 1-dte

#SPX1dte Sold to Open $SPX May 20th 2820/2840-2995/3015 condors for 1.00. IV: 22.1%, SPX 2930, deltas -.04, +.06.

#earnings RCL One last trade…

#earnings RCL

One last trade as we cruise into the close of the market

Sold a June 19, 31.50/43/45 #jadelizard for 2.16

SPX 7-dte

#SPX7dteLong About 15 minutes ago, on the way up, Sold to Close $SPX May 22nd 2860/2880 call spreads for 18.00. Then, on the huge spike down, sold 2850/2830 put spread for 1.75. Could have gotten more but how was I to know there’d be a party goin’ on? Condors bought for 18.10 on Friday, sold for 19.75 today.

#earnings LOW Sold June 19…

#earnings LOW #shortputs VFC

VFC sold May 29, 52.50 put for .70

LOW Sold June 19 105/119/121 #jadelizard for 2.59

#earnings #shortstrangles TGT Sold June…

Sold June 19, 110/140 for 2.16

#earnings #closing WMT KSS WMT…

WMT bought #jadelizard for 1.68, sold yesterday for 2.09

KSS bought #shortstraddle for 3.72, sold yesterday for 4.22

AMD

BTC AMD May-22-2020 $52 #ShortPut @0.17 – was STO as part of a roll on 5/7 @0.91 credit.

Probably could have waited until the end of the week, but opted to take the win early.

EWW

#ShortPuts – Thanks @Ramie joining in…

Sold EWW JUN 19 2020 28.0 Puts @ .90

Sold EWW JUN 19 2020 29.0 Put @ 1.21

Sold EWW JUN 19 2020 30.0 Put @ 1.70

TRADES:

SDGR BTO STOCK @63.25 – 64.70

SDGR STO 6/19/20 80.0 CALL @1.60

CODX STO 6/19/20 25.0 CALLS @1.10

EWW June short puts

Sold $EWW 6/19 28 puts @ .81. Delta 30. IV rank 47.

STO SDC May 22 $7.50 @$.30 to re-establish covered call. Stock at $7.32.

JPM

#ShortPuts – A couple weeks prior to earnings and down near recent lows…

Sold JPM JUN 19 2020 80.0 Puts @ 1.57

TQQQ

BTC May 22, 45 put at .01

SPCE

#ShortPuts – Launching into this one again…

Sold SPCE JUN 19 2020 13.0 Puts @ .95

KSS closed breakeven

#Earnings Sold to close $KSS May 22nd 19 puts for 1.45. Bought yesterday for 1.40. Didn’t get the big drop I was betting on so happy to pretend it never happened.

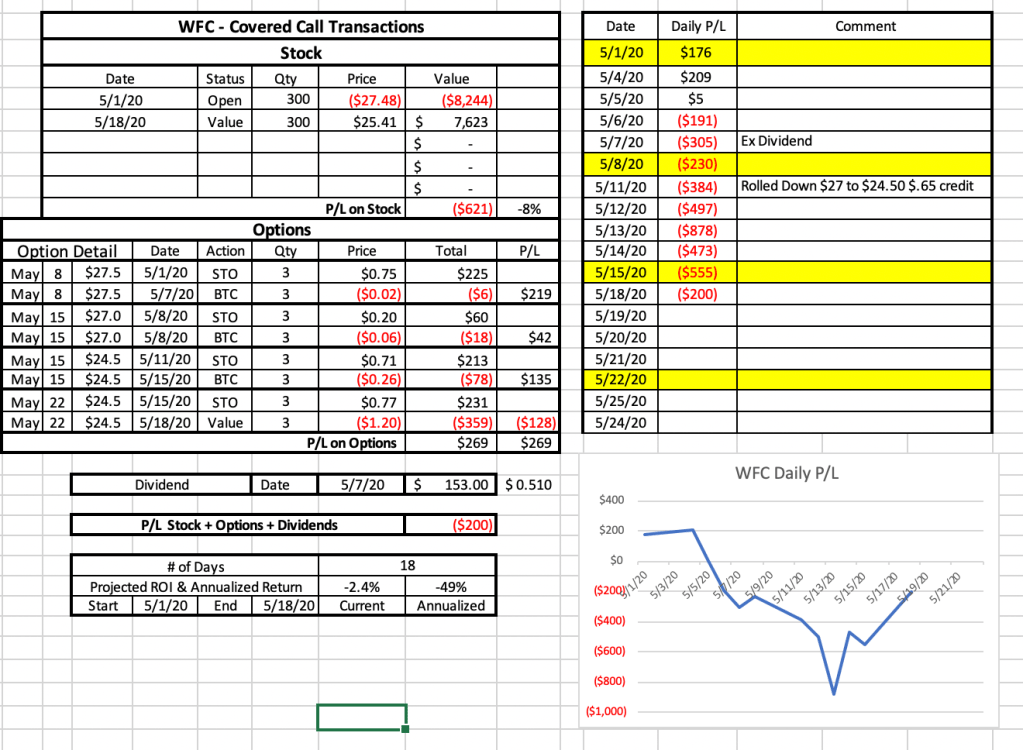

WFC CC – Might be some life after all!

Good day yesterday for WFC. Likely have to roll up from May 22 $24.50 to get it back positive but nice to see the change in direction.

#Coveredcalls $WFC

QQQ Iron Condor

Sold $QQQ 6/19 205/210/240/245 iron condor @ 1.60 with QQQ at 227.43. Almost 1/3 of the width of the strikes. Just about delta neutral with put and call short strikes at 21 and 20. IV rank 31.