#Earnings Added a call butterfly at 1925/1950/1975 for 3.00. So I now have a bullish double hump, with max profits at 1950 or 2000. Now watch it go down….

Monthly Archives: May 2017

$UVXY #CoveredCall – Sold UVXY…

$UVXY #CoveredCalls – Sold UVXY May 12 2017 14.0 Calls @ 0.12.

At this point I just want out.

SVXY

STO June 9, 130 put @ 2.60

#earnings for you Tatsy Trade…

#earnings for you Tatsy Trade viewers, there are a boatload of earnings trades today, most which don’t seem to fit the prevailing style here. many are ironflys, too close for my comfort.

$UAA #CoveredCalls – Sold UAA…

$UAA #CoveredCalls – Sold UAA JAN 19 2018 27.5 Calls @ 0.64

#earnings #shortstrangle YELP May 19…

#earnings #shortstrangles YELP

May 19 28/40 for 1.15

SVXY

STO June 23, 125 put @3.20

SVXY

STO June 23, 120 put @ 2.65

$MNK #FallingKnife Well, this falling…

$MNK #FallingKnife

Well, this falling knife may have found some recent support but still…

Sold $MNK Jan 19 2018 30 puts @ 1.40. It’s never traded anywhere close to this level in the 4 years since its IPO.

SVXY

STO June 23, 135 put @4.85

$SVXY #ShortPuts #ShortCalls – lightening…

$SVXY #ShortPuts #ShortCalls – lightening up on old SVXY positions. Covering ITM calls at a loss. Only partially offset by covering short puts at a gain.

2 SVXY May 26 2017 85.0 Puts @ 0.05 – Sold at 1.53

1 SVXY Jun 2 2017 70.0 Put @ 0.05 – Sold at 1.21

5 SVXY JUN 16 2017 43.0 Puts @ 0.03 – Sold at 1.11

5 SVXY JUN 16 2017 50.0 Puts @ 0.11 – Sold at 0.60

2 SVXY JUN 16 2017 57.0 Puts @ 0.09 – Sold at 1.57

2 SVXY SEP 15 2017 35.0 Puts @ 0.18 – Sold at 0.72

10 SVXY SEP 15 2017 40.0 Puts @ 0.18 – Sold at 0.80

2 SVXY SEP 15 2017 45.0 Puts @ 0.31 – Sold at 1.45

2 SVXY JAN 19 2018 70.0 Puts @ 2.92 – Sold at 7.18

1 SVXY JUN 16 2017 120.0 Call @ 36.65 – Sold at 9.29

2 SVXY JAN 19 2018 140.0 Calls @ 37.00 – Sold at 6.40

2 SVXY JAN 19 2018 150.0 Calls @ 31.55 – Sold at 4.80

2 SVXY JAN 19 2018 155.0 Calls @ 29.25 – Sold at 4.70

SVXY

STO June 23, 130 put @4.00

SVXY

STO June 9, 140 put @ 3.90

SVXY strangle

Sold in June with a bit of a bearish bias:

$SVXY Jun 16 125/175 strangle @ 4.40 with the stock at 155.15

NVDA earnings

#Earnings Legging into the NVDA May 12th 95/115 strangle. Just sold the 115 calls for .75. Bid is in to sell the 95 puts for 1.30. Trade leans bullish as past earnings reports have a solid bullish bias. Biggest UP move: 29.8%, Biggest DOWN move: -7.4%, Average move: 9.6%. These strikes are +10.6% and -8.7% OTM.

#T btc ,jan 19, 37…

#T

btc ,jan 19, 37 call @ 3.05 had sold for 3.45

#DIA btc ,may 12 211…

#DIA

btc ,may 12 211 call @ .05/part of spread with 214 call /had sold for .31

214 call- left to expire.

PCLN earnings trade

#Earnings Bought to Open $PCLN May 12th 1975/2000/2025 call butterfly for 2.20. Max risk, 2.20, max gain, about 2200.

Small trade shooting for the high open interest at 2000.

IFF

STO November 120 puts @3.90

AMZN adjustment

#LongCallDiagonals – Still fighting the short call but that’s a good thing. Rolling it up and out and reducing basis on long call LEAP (again).

Rolled Oct 20th 850.0 short call to Dec 15th 865.0 call @ .21 credit

And:

Rolled Jan 2019 750.0 long call up to Jan 2019 850.0 call @ 67.00 credit (new basis now 30.50)

This thing has to level off at some point where the rolls can catch up. In the meantime 2019 long call/Bups working nicely.

SEE, falling knife

STO January 37 puts @1.10

GOOGL adjustment

#LongCallDiagonals – Still fighting the short call but that’s a good thing. Rolling it up and out and reducing basis on long call LEAP (again).

Rolled Sep 15th 880.0 short call to Dec 15th 900.0 call @ .50 credit

And:

Rolled Jan 2019 750.0 long call up to Jan 2019 850.0 call @ 73.55 credit (new basis now 31.00)

This thing has to level off at some point where the rolls can catch up. In the meantime 2019 long call/Bups working nicely.

TLT

#PerpetualRollingStrangles – A couple small adjustments to keep the theta up…

Bought to Close TLT MAY 19 2017 124.0 Calls @ .09 (sold for .96)

Sold TLT MAY 26 2017 121.5 Calls @ .60

SPX, puts closed, puts sold

#SPXcampaign Bought to close $SPX May 15th 2340/2315 put spreads for .30. Sold in a condor last week for 3.90.

Sold to Open SPX June 9th 2310/2285 put spreads for 1.35, with SPX at 2401.

NVDA earnings

#Earnings #ShortStrangles – Busy week so checking in for a couple minutes. Already have a long term position in NVDA but premiums look so good will probably be selling some more strangles today. Current position is long a few deltas so looking at a skewed strangle in the neighborhood of 95/110.

Good luck everyone!

$UVXY #CoveredCall – Sold 1…

$UVXY #CoveredCalls – Sold 1 UVXY May 12 2017 13.0 Call @ 0.23.

At this point I just want out.

$SVXY #ShortCalls #Rollup – Giving…

$SVXY #ShortCalls #Rollup – Giving this trade a bit more time to work.

Bought to close 1 SVXY May 19 2017 115 Call/Sold 1 SVXY Sep 15 2017 123 Call @ 0.05 Credit

$SLV #ShortPuts #IRA #FallingKnife –…

$SLV #ShortPuts #IRA #FallingKnife – Sold SLV Oct 20 2017 13.5 Puts @ 0.23 with the stock at 15.25.

#FallingKnife candidates – $TSN $CHRW

#FallingKnife candidates – $TSN $CHRW

SPX one closed, one rolled

#SPXcampaign

Bought to close $SPX May 10th 2375/2350 put spreads for .20. Sold for 4.15 on Apr 26th. This was sold on the day the Upside Warning fired.

STOPPED: Bought to close $SPX May 15th 2415/2440 call spreads for 2.25. Sold in an iron condor for 3.90 last Wednesday.

#ReverseRoll Sold SPX May 17th 2380/2355 put spreads for 2.35. Moved this 2 days further out, but still only 8 days from now… bullish action should continue but may not last too long, so I’m keeping aggressive put spreads close in expiration, for maximum theta burn.

$UVXY saw on TT an…

$UVXY saw on TT an interesting suggestion BuCS 10/20 with Jun16 expiration. Relatively low cost bto around 2.05. Small position but have already entered a STC for about 1$ higher

JAZZ earnings

#Earnings Sold to Open $JAZZ May 12th 155/157.5/160/162.5 iron condors for 1.80. Max risk .70.

Biggest UP move: 6.0%, Biggest DOWN move: -6.7%, Average move: 2.8%.

With stock at 158.50, short strikes are about 0.8% OTM. Breakevens are 1.9% OTM.

$SVXY #Short Puts Morning all….

$SVXY #Short Puts Morning all. Bought to close May 19th 80 Puts @ 0.05 off a GTC order. Missed getting this posted yesterday: Sold May 12th 140 put @ 0.51 with the $SVXY 153.97. Will roll if need be to avoid assignment.

SKEW at 128.2 this coincides…

SKEW at 128.2 this coincides with Jeff VIX level

Economic Data

6:00am EST NFIB Small Business Index – street sees 104.0

10:00am EST JOLTS Job Openings – street sees 5.67M

10:00am EST Final Wholesale Inventories m/m – street sees -0.1%

10:00am EST IBD/TIPP Economic Optimism – street sees 52.3

4:15pm EST FOMC Member Kaplan Speaks

Earnings before Open

ALLERGAN PLC (AGN) – consensus EPS $3.32

CHIMERIX INC (CMRX) – consensus EPS $-0.37

DISCOVERY COM (DISCA) – consensus EPS $0.49

DUKE ENERGY CP (DUK) – consensus EPS $1.05

ENDO INTL PLC (ENDP) – consensus EPS $1.12

OFFICE DEPOT (ODP) – consensus EPS $0.12

SILVER WHEATON (SLW) – consensus EPS $0.15

THESTREET.COM (TST) – consensus EPS $-0.03

VALEANT PHARMA (VRX) – consensus EPS $0.96

WAYFAIR INC – consensus EPS $-0.81

Earnings After Markets Close

ACACIA COMMUNIC (ACIA) – consensus EPS $0.52

ACADIA PHARMA (ACAD) – consensus EPS $-0.73

BLACK STONE MNL (BSM) – consensus EPS $0.17

CALIX INC (CALX) – consensus EPS $-0.59

DEPOMED INC (DEPO) – consensus EPS $-0.25

DISNEY WALT (DIS) – consensus EPS $1.45

ELECTR ARTS INC (EA) – consensus EPS $0.61

FOSSIL GRP INC (FOSL) – consensus EPS $-0.21

JAZZ PHARMACEUT (JAZZ) – consensus EPS $1.34

NVIDIA CORP (NVDA) – consensus EPS $0.66

PRICELINE.COM (PCLN) – consensus EPS $8.80

SAGE THERAPEUTC (SAGE) – consensus EPS $-1.56

TESARO INC (TSRO) – consensus EPS $-2.26

TRIPADVISOR INC (TRIP) – consensus EPS $0.17

VIVINT SOLAR (VSLR) – consensus EPS $-0.48

YELP INC (YELP) – consensus EPS $-0.08

These 2 are probably the…

These 2 are probably the bible on strangle/straddle selling. Occasionally watch tasytrade re-runs, wife and daughter at dance so catching a few of the more important re-runs.

https://www.youtube.com/watch?v=UBBjR3NcyUM managing straddles and strangles

https://www.youtube.com/watch?v=pDz10RKJdp0 how big account for 1 lot trades

SPX Chart and VIX Indicator have been updated

I made no new SPX trades today, but have finally caught up and the position chart is now up to date.

We hit a 10 year low on the VIX today, lowest since December 2006.

Taking some #VXXGame trades off…

Taking some #VXXGame trades off into the strength

Lightening the load in expirations that I had a heavier presence–bought to close:

$UVXY May 26 40 calls @ .04. Sold for 1.80 on 4/13

$UVXY May 26 42 calls @ .04. Sold for .80 on 4/21

$SVXY Jun 16 60 puts @ .20 Sold for 1.41 on 2/15.

$SVXY Jun 16 64 puts @ .12. Sold for 1.33 on 3/24.

$CELG #ShortPuts #FallingKnife – Sold…

$CELG #ShortPuts #FallingKnife – Sold a some more Puts in this name

Sold 1 CELG Oct 20 2017 95.0 Put @ 1.39

Sold 1 CELG Jan 19 2018 85.0 Put @ 1.39

$SVXY #ShortPuts – SVXY is…

$SVXY #ShortPuts – SVXY is too high and I’m going to have to cover more calls. I will also need to cover some worthless puts to get a full margin release.

Bought to close 6 May 12 2017 70.0 Puts @ 0.01. Sold on the last VIX spike at 0.64, 0.75 and 0.90

No earning trading today.

No earning trading today.

VIX

It is heading lower into the finish.

TSN

STO January 47 puts @1.05

BIIB

STO January 200 puts @4.00

OLN

BTC May 19, 26 puts. Sold @ .65

MPLX

STO Sept 15 33 puts @ 1.35 IRA account

CELG

STO October 95 puts @1.21

STO January 85 puts @1.25

Volatility question

So i have been watching how you guys trade the volatility products. What happens in an Aug 24, 2015 type event where VIX quickly spikes to 100? Can you hedge those products? Say go long or short stock or can you only cover with other options?

I lost more money that day than ever trading but was largely a function of size. My accounts I was able to hedge actually did ok but one very large account was wiped out because options xpress would not let me hedge, said there was “too much risk” to hedge and locked my account so I could not trade. Needless to say we do not have any money with them any more and I do not recommend them, their risk dept. did not seem to understand that by hedging the risk was controlled.

But seriously, how easy is it to hedge those products? Most of the move 8/24/15 occurred Sunday night into Monday morning so you could hedge with futures over night but by the time the market opened Monday morning it was already limit down and I know a lot of people could not place trades.

Just curious, I think a military conflict with N.Korea could obviously cause a spike like that.

VIX

It is below 10 again. This is a boring day.

$TRIP #Earnings – Sold $TRIP…

$TRIP #Earnings – Sold $TRIP May 19 2017 52.5 Calls @ 0.60 with the stock at 47.09.

Earnings after the bell on Tuesday.

Already short long term Puts from the drop after the last earnings report.

$SLV #ShortPuts #IRA – Sold…

$SLV #ShortPuts #IRA – Sold SLV Dec 29 2017 13.0 Puts @ 0.24 with the stock at 15.40.

$SLV just posted its longest losing streak ever. #FallingKnife

Carter Worth is looking for a bounce in this volatile commodity

#FallingKnife candidates – $BIIB

#FallingKnife candidates – $CELG $BIIB $AKAM

SVXY

STO May 19, 150 put @3.70 taking one for the team again.

Econ Calendar for week of 5/8/17

Earnings before Open

AES CORP (AES) – consensus EPS $0.20

CIMAREX ENERGY (XEC) – consensus EPS $0.85

HORIZON PHARMA (HZNP) – consensus EPS $0.25

JD.COM INC-ADR (JD) – consensus EPS $-0.05

KITE PHARMA INC (KITE) – consensus EPS $-1.68

NEWELL BRANDS (NWL) – consensus EPS $0.29

ON DECK CAPITAL (ONDK) – consensus EPS $-0.16

SYSCO CORP (SYY) – consensus EPS $0.51

TYSON FOODS A (TSN) – consensus EPS $1.06

Earnings After Markets Close

AMBER ROAD INC (AMBR) – consensus EPS $-0.18

AMC ENTERTAINMT (AMC) – consensus EPS $-0.08

DIPLOMAT PHARMA (DPLO) – consensus EPS $0.15

EOG RES INC (EOG) – consensus EPS $0.15

HERTZ GLBL HLDG (HTZ) – consensus EPS $-0.94

MARRIOTT INTL-A (MAR) – consensus EPS $0.90

OASIS PETROLEUM (OAS) – consensus EPS $-0.07

PANDORA MEDIA (P) – consensus EPS $-0.50

TESORO CORP (TSO) – consensus EPS $0.36

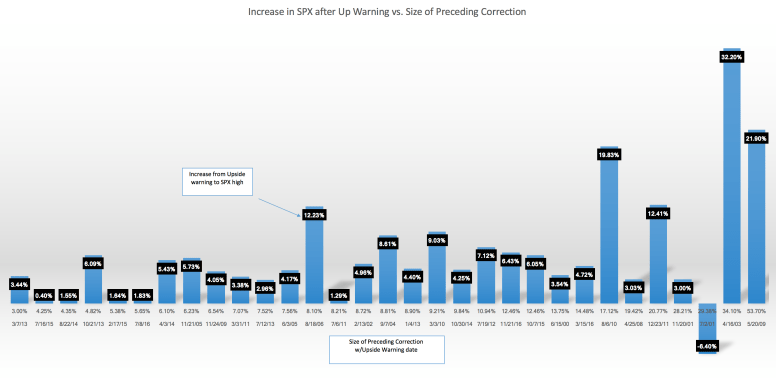

Upside Warning Update

#VIXIndicator Friday’s close was an all-time record, and just pennies short of the all-time intraday high. However it is only 0.5% above the close of the upside warning day (4/26). I’m including this chart again to show you the moves on all previous upside warnings. 0.5% would be one of the lowest ever, so more upside is likely.

Final trades and Options Expiration 5/5/17

Gangbuster week with consolidating indices and no losers in earnings trades (one breakeven and one assignment)

#SPXcampaign

Sold to Open $SPX June 2nd 2310/2285 put spreads for 1.50

#VXXGame

BTC $SVXY May 26th 85 put for .15. Sold for 1.45 on Apr 21st

#Earnings

Sold to close $GRPN May 5th long 4 puts for .62; filled near the open, breakeven on the 4 straddle.

Previously closed winners this week: CMI, TSLA, CHTR, MELI, STMP.

#OptionsExpiration

— Expiring w/max profit —

$FB 146, 147, and 148 puts

$REGN 355/375/430/450 iron condors

— Expiring worthless (breakeven) —

$SPX risk/reversal: Long 2415/2435 call spreads, short 2435/2415 put spreads

— Assignment —

$TAP 92/95/98 Iron Butterfly; taking the stock from 95 puts, cost basis 93.00. I was going to close this for breakeven but missed the fill.

End of Week..

Have a nice week all..i had a great week in my Futures abyss…looking fwd to sunday’s open with the french election happening..

Cheers..

#OptionsExpiration for 5/5 $NVDA 05/05/2017…

#OptionsExpiration for 5/5

$NVDA 05/05/2017 97 puts

$SVXY 05/05/2017 75 puts

$SVXY 05/05/2017 90 puts

$UVXY 05/05/2017 32 calls

$UVXY 05/05/2017 39 calls

$UVXY 05/05/2017 40 calls

No assignments.

Have a great weekend everyone.

EXPIRATIONS

Have a nice weekend and I hope every one had a nice profit this week.

We lucky few. We band of premium sellers.

SVXY

75 puts

80 puts

81 puts

82 puts

85 puts

90 puts

150puts

In my IRA

75 puts

90 puts

#OptionsExpiration – a decent week…

#OptionsExpiration – a decent week as more #Volatility trades roll off.

$TSLA #EarningCompression trade worked too. No assignments this week.

— Expirations —

NUGT (Weekly) May 5 2017 9 Calls (Covered)

NUGT (Weekly) May 5 2017 13.5 Calls (Covered)

NUGT (Weekly) May 5 2017 14 Calls (Covered)

SVXY (Weekly) May 5 2017 70 Puts

SVXY (Weekly) May 5 2017 80 Puts

SVXY (Weekly) May 5 2017 81 Puts

SVXY (Weekly) May 5 2017 82 Puts

SVXY (Weekly) May 5 2017 83 Puts

SVXY (Weekly) May 5 2017 84 Puts

SVXY (Weekly) May 5 2017 85 Puts

SVXY (Weekly) May 5 2017 90 Puts

SVXY (Weekly) May 5 2017 97 Puts

TSLA (Weekly) May 5 2017 280 Puts

UVXY (Weekly) May 5 2017 32 Calls (Covered)

UVXY (Weekly) May 5 2017 39 Calls

UVXY (Weekly) May 5 2017 40 Calls

UVXY (Weekly) May 5 2017 42 Calls

$TROW #ShortPuts – Bought to…

$TROW #ShortPuts – Bought to close TROW Jul 21 2017 55.0 Puts @ 0.05. They won’t trade any lower and still have 77 days left until expiration.

A former #FallingKnife Trade. Sold on 01/27/17 @ 0.80

CMI

#shortputs

STO $CMI Jun17 150 puts @ 2.20 in IRA this is a dividend play ok to get assigned.

#ShortPuts #Spxcampaign Afternoon all. I’ve…

#ShortPuts #Spxcampaign

Afternoon all. I’ve been away except for brief spells of insanity

Sold to open May 26th 2280/2300 BuPS for 0.80 when SPX was at 2391.57

Sold May 26th 125 Puts @ 1.77 when $SVXY was at 149.71.

I have nothing for this week’s OpEX.

Have a great weekend all.

Options Expiration

Have to head to meetings for the rest of the day so need to post these a few minutes early.

Very light week as I’ve been closing positions early. Not much left.

$SVXY $75 puts

$SVXY $80 puts

$SVXY $82 puts

I have no remaining $VXXGame positions for next week. Can’t remember the last time that happened.

Hey Jeff, I found out this morning that I’m being sent to Portland on Monday to go work an issue at a facility in Wilsonville. Will be nice to see your part of the country. I likely will not be able to watch the markets next week as I’ll be consumed by work so everyone trade safe.

Taking off TSLA trade from yesterday

If it’s making 50% of its potential profit in 1 day, it’s coming off.

Bought to close $TSLA Jun 16 250 puts @ .88. Sold for 2.00 on 5/4.

SVXY

30 minutes to go and Fuzzball and I will know if we get the medal of honor or just book another premium.

$SVXY

Earlier today BTC May 12 $70 puts @ $0.02

SVXY

STO May 19, 125 put @1.15 I could not help myself.I am short a lot of calls in January from 180 to 270.

$SVXY #ShortPuts – Sold 1…

$SVXY #ShortPuts – Sold 1 SVXY May 19 2017 125.0 Put @ 1.16.

Waiting for many short Puts to expire today against existing short Calls.

EVIX and EXIV

http://www.euroinvestor.com/news/2017/05/03/velocityshares-launches-first-european-volatility-etns/13589275

$IBM #ShortPuts #FallingKnife – Sold…

$IBM #ShortPuts #FallingKnife – Sold 1 IBM JAN 19 2018 115.0 Put @ 1.21.

The three year low on the stock is 116.90

Expirations

Pretty Sure These Will Expire Worthless

#spxcampaign

$SPX 2225/2250 BUPS Hail to the @jeffcp66eff

$SPX 2170/2270 BUPS Thank you @fibwizard

$SPX 2300/2350 BUPS Hail to the @jeffcp66eff

$WYNN 105/110 BUPS

$NFLX 145/150 BUPS

#vxxgame

$UVXY 40 calls Thanks @honkhonk81

$SVXY 81 puts

$SVXY 90 puts

$FB 146 puts Thanks @jeffcp66 Earnings Trades

$STMP 90 puts Thanks @jeffcp66 Earnings Trades

Have a great weekend everyone.

SVXY

STO May 19, 140 put @ 1.54 on 1 contract. I am not sure if I will be assigned on the 150 put that expire today.

$AKAM #FallingKnife Sold $AKAM Jan…

$AKAM #FallingKnife

Sold $AKAM Jan 19 2018 40 puts @ 1.10 with the stock at 51.87.

Thanks to Iceman for the heads up on this ticker earlier in the week.