I didn’t expect to have an opportunity to close this so soon but I’ll take it. Bought to close $CINF 6/19 40 puts @ .51. Sold for 1.45 on 5/13. Captured 65% of the potential profit in 5 days.

Monthly Archives: May 2020

#earnings #shortstrangles KSS Sold June…

Sold June 19, 19 straddle for 4.22.

Thanks for the data Jeff

SPX 7-dte

#SPX7dteLong Bought to Open $SPX May 26th 2940/2960-2970/2990 condors for 17.15, with SPX at 2964

KSS earnings analysis

#Earnings $KSS reports tomorrow morning. Below are details on earnings one-day moves over the last 12 quarters.

March 3, 2020 BO -2.62%

Nov. 19, 2019 BO -19.48% Biggest DOWN

Aug. 20, 2019 BO -6.88%

May 21, 2019 BO -12.33%

March 5, 2019 BO +7.31% Biggest UP

Nov. 20, 2018 BO -9.22%

Aug. 21, 2018 BO +1.71%

May 22, 2018 BO -7.42%

March 1, 2018 BO -5.05%

Nov. 9, 2017 BO +0.93%

Aug. 10, 2017 BO -5.79%

May 11, 2017 BO -7.83%

Avg (+ or -) 7.21%

Bias -5.56%, strongly negative bias on earnings.

With stock at 19.00 the data suggests these ranges:

Based on current IV (expected move into Friday per TOS): 16.45 to 21.55 (+/- 13.4%)

Based on AVERAGE one-day move over last 12 quarters: 17.63 to 20.37

Based on MAXIMUM one-day move over last 12 Q’s (19.5%): 15.30 to 22.70

Based on UP max only (+7.3%): 20.39

NOTE: 5-day historical maximums are +2.5 and -19.5%. So positive move is LESS and negative move is the same.

Open to requests for other symbols.

#closing #shortputs SPY Bought June…

#closing #shortputs SPY

Bought June 26 260 put for 3.03 , sold May 11 for 4.24. Thanks fuzzball

WHR short puts

Sold to open:

$WHR 6/19 101 puts @ 1.99 (17 delta)

$WHR 6/19 100 puts @ 1.89 (16 delta)

IV rank 42

TQQQ

STO July 17, 40 put at 1.13

STO July 17, 45 put at 1.64

TQQQ

BTC May 22, 40 puts at .01

SPX 7-dte

#SPX7dteLong Sold to Close $SPX May 18th 2920/2940-2950/2970 condors for 10.50. Bought for 16.80. This was the cheapest one I have purchased, and it’s simply hilarious that when I posted the trade last Monday I said that “probability of profit has dropped.” Sho’nuff!

TRADES:

DNKG STO 5/22/20 29.0 NTM PUTS @1.34

DNKG STO 5/22/20 35.0 CALLS @69

SDGR STO 6/19/20 70.0 CALLS @2.25 semi-covered

OPTION EXPIRATIONS, All 5/15/20

AAL 5/15/20 9.0 puts STO @.51

AAL 11.0 CALLS STO @.21

CCL 14.0 CALLS STO @1.15

CODX 11.0 PUTS STO @.55

CODX 14.0 PUTS STO @1.00

NET 31.0 CALLS STO @.55

NET 32.0 CALLS STO @.30

OSTK 14.0 PUTS STO @.40

OSTK 18.0 CALLS STO @.68

PM 5/15/20 70.0 & 74.0 Long puts STC TODAY.

2@

Earnings Update KSS

KSS is confirmed for tomorrow morning earnings report.

HD earnings analysis

#Earnings $HD reports tomorrow morning. Below are details on earnings one-day moves over the last 12 quarters.

Feb. 25, 2020 BO -0.96%

Nov. 19, 2019 BO -5.43% Biggest DOWN

Aug. 20, 2019 BO +4.39% Biggest UP

May 21, 2019 BO +0.26%

Feb. 26, 2019 BO -0.88%

Nov. 13, 2018 BO -0.23%

Aug. 14, 2018 BO -0.53%

May 15, 2018 BO -1.62%

Feb. 20, 2018 BO -0.13%

Nov. 14, 2017 BO +1.63%

Aug. 15, 2017 BO -2.65%

May 16, 2017 BO +0.59%

Avg (+ or -) 1.61%

Bias -0.46%, negative bias on earnings.

With stock at 247.00 the data suggests these ranges:

Based on current IV (expected move into Friday per TOS): 232.83 to 261.17 (+/- 5.7%)

Based on AVERAGE one-day move over last 12 quarters: 243.03 to 250.97

Based on MAXIMUM one-day move over last 12 Q’s (5.4%): 233.59 to 260.41

Based on UP max only (+4.4%): 257.84

NOTE: 5-day historical maximums are +4.6 and -9.2%. So positive move is the same but it has moved to the downside further in 5 days versus one day.

Open to requests for other symbols.

#earnings #jadelizard WMT Sold June…

#earnings #jadelizard WMT

Sold June 19, 116/128/130 jade lizard for 2.09

Bullish UAL

Stock is trading like the bottom may be in. Sold to open $UAL 6/19 20 puts @ 1.59. Delta 26. IV rank 64.

SPX 1-dte stopped

#SPX1dte Bought to close $SPX May 18th 2930/2950 call spreads for 14.75. Condors sold for 1.25 on Friday.

Pretty sure this spread will end the day at 20.00, so I’m cutting losose now to avoid full loss. Looking to do the same with the 7dteLong because that one may end the day at 0.00.

AMZN CC called on weekend. New CC this morning. May 22 $2395 for net $2364

#coveredcalls $AMZN

Rolling MMM

Just put this initial trade on Friday and with the big move up I’m rolling $MMM 9/18 100 puts up to 115 puts for 1.42 credit. New strike at 14 delta. Total premium now 3.62.

#shortputs #coveredcalls #rolling HTZ CCL…

#shortputs #coveredcalls #rolling HTZ CCL M SDC SBUX GPS

CCL Sold May 22, 14 put for .45

HTZ sold May 22, covered call for .10

M sold May 22, 5 put for .16

M sold June 19 covered call for .21

SDC sold June 5 covered call for .41

SBUX rolled long suffering May 22 73.50/85 put spread to June 19, 76/87.50 for a lousy .12

GPS Bought 100 shares and sold May 22, 8 call for 7.45

#closing #shortputs XOP WBA XOP…

#closing #shortputs XOP WBA

XOP Bought June 19, 40 put for .61, sold May 15 for 1.14

WBA Bought May 29, 36 put for .16, sold May 15 for .63

SPX 7-dte

#SPX7dteLong One hour before open, sold to close $SPX May 20th 2810/2830 call spreads for 18.50. Will try to close put side today on any small push down. Condors sold for 18.30 last Wednesday.

My expirations today, both 7dte and 1dte, are in trouble at the moment. My best hope will be a close below 2920. Otherwise I will be mitigating losses.

SPY

#ShortPuts – Assigned a few shares over the weekend so getting lucky with this move…

Sold SPY MAY 22 2020 295.0 Call @ 2.45

IB Account Friday

- CVX – Roll Out May 15 $95 to May 22 $95 for $.37 per share credit.

- DXCM – Diagonal Roll Up From May 15 $350 to Jun 19 $380. Increases our profit potential if called away by $30. Required an investment of $15.73 per share.

- EW – Roll Out May 15 $220 to May 22 $220 (hoping for stock appreciation). $1.10 per share credit.

- HAL – Option Expired – Look to write new call on Monday

- ILMN – Diagonal Roll Up from May 15 $330 to May 22 $335 increasing our profit potential by $5 per share. Required an investment of $.90 share…..great trade.

- PTON – 2 Diagonal Roll Up from May 15 $33 to May 22 $45. Increases profit potential by $12 share. Required investment of $11.18 share. Not a great trade. Further PTON upside may be limited based on low premiums that were available.

- PTON – 3 May 15 $40 Call options called away as stock was at $48. Probably not replace the stock.

- SDC – May 15 $7.50 Call options expired (stock below $7.50).

- SDC – Sold May 22 $7.00 Call options to reestablish covered call. $.37 per share credit.

- STE – Rolled Out May 15 $155 Call to Jun 19 $155 for $5.28 per share credit.

- T – Rolled Out May 15 $29.50 Call to May 22 $29.50 Call for $.09 per share credit.

#nflx put spread ,12, jun…

#nflx put spread ,12, jun 435/430 btc 1.70/had sto 2.20 last week

#optionsexpiration GPS 7.50 covered call…

GPS 7.50 covered call assigned

SDC 8.5 covered call

BOOT 12.5 put

CPRI 15 covered call

HTZ 3 covered call

LK 30 put, big loss

VFC 50 put

Expiration

#optionsexpiration

$ROKU 127 calls

$CODX 15 and 17.5 calls

$NEO 35 calls

$MRVL 28 calls

$NVAX 23 calls

$NET 22.5 put

$HAL 8 put

$MRNA 55 put

$DDOG 65 and 55 put

#assignment

$NLOK at $21 Basis 20.40. Stock at 20.03. Ooops 😉

A TRADE:

DKNG STO 5/22/20 26.0 PUTS @1.16

OPTION EXPIRATIONS, All 5/15/20

AAL 5/15/20 9.0 puts STO @.51

AAL 11.0 CALLS STO @.21

CCL 14.0 CALLS STO @1.15

CODX 11.0 PUTS STO @.55

CODX 14.0 PUTS STO @1.00

NET 31.0 CALLS STO @.55

NET 32.0 CALLS STO @.30

OSTK 14.0 PUTS STO @.40

OSTK 18.0 CALLS STO @.68

PM 5/15/20 70.0 & 74.0 Long puts STC TODAY.

2@

SPX 1dte

#SPX1dte Sold to Open $SPX May 18th 2730/2750-2930/2950 condors for 1.25, IV 18.8%, SPX 2859, deltas -.04, +.06.

Expiring: May 15th 2730/2750-2930/2940 condors, sold yesterday for 1.00.

SPX 7-dte

#SPX7dteLong Bought to Open $SPX May 22nd 2830/2850-2860/2880 condors for 18.10, with SPX at 2854.

Expiring at max profit: May 15th 2920/2900 put spreads for 20.00. Condors bought last Friday for 17.05.

Nibbling at MMM

Ready to take a long term shot here. Sold $MMM 9/18 100 puts @ 2.20 with the stock at 136.46. Delta 11. Strike is well below the March low. Stock hasn’t been at 100 since early 2013.

#FallingKnife

SMH

#ShortPuts – Starter position…haven’t been in this one in a long time.

Sold SMH JUN 19 2020 115.0 Put @ 2.21

EWZ

#ShortPuts – A few positions in this one…

Bought to Close EWZ MAY 15 2020 22.0 Put @ .02 (sold for 1.50)

Sold EWZ JUN 19 2020 22.0 Put @ 1.45

Rolled the rest of the ladder adding to June monthly…

Rolled EWZ MAY 15 2020 23.0 Put to JUN 19 2020 23.0 Put @ 1.34 credit (2.42 total now)

Rolled EWZ MAY 15 2020 24.0 Put to JUN 19 2020 24.0 Put @ .97 credit (2.37 total now)

Rolled EWZ MAY 15 2020 25.0 Put to JUN 19 2020 25.0 Put @ .70 credit (2.48 total now)

SDGR NET Call Rolled

#coveredcalls

$SDGR BTC 5/15 50 call and STO 6/19 55 call at .35 added credit. Stock at 56.39. But is a gyrating stock.

$NET BTC 5/15 30 call and STO 6/19 34 call at .85 added credit. Stock at 30.37

Econ Calendar for week of 5/18/20

#FOMC Jerome Powell speaks Thursday

Link to calendar: https://research.investors.com/economic-calendar/

#shortstrangles BA Sold June 19,…

#shortstrangles BA #shortputs XOP

BA Sold June 19, 95/145 strangle for 6.20 BA is around 119

XOP Sold June 19, 40 put for 1.14, XOP is around 48.40

TQQQ

STO July 17, 35 put at 1.36

BYND iron condor

Idea from TastyTrade.

Sold $BYND 6/19 100/110/175/185 iron condor @ 2.91

Triple header

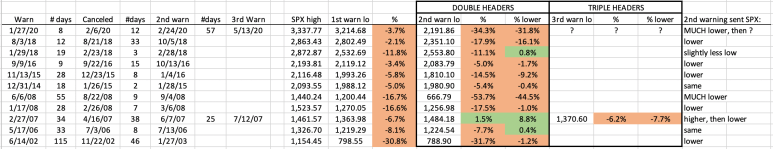

#VIXIndicator Since 1999, what happened this week has happened once previously: a Downside Warning going into effect after it had been canceled, with no Upside Warning in between… and then that happening AGAIN. It’s a “triple-header” of Downside Warnings (DW).

The Downside Warning was reinstated on Wednesday after being canceled Monday. The DW that preceded the big drop was on February 24th, and that was a double-header already, after the first DW on January 27.

Double-headers usually result in the SECOND drop being deeper than the first. That certainly happened this time, with the second drop being exceeded only by the 2008 financial crisis. The only triple header before now was in 2007, when the second warning didn’t go as low as the first, but the third went lowest of all.

So we don’t have enough data to build a historical model of what we are in now. But it’s interesting to see the history of these market double/triple dips.

Below is a chart of all occurrences of doubles/triples since 1999:

DDOG Puts Closed

#shortputs

$DDOG BTC 5/15 65 puts at .20 STO at 1.90

AAPL

#ShortPuts – Going out to the monthly and selling at the 200ma. Slightly outside the expected move also…

Sold AAPL JUN 19 2020 265.0 Put @ 3.40

SPX 1-dte

#SPX1dte Sold to Open $SPX 2730/2750-2920/2940 condors for 1.00, IV 25.6%, SPX 2846, deltas -.05, +.05

AMAT earnings analysis

#Earnings $AMAT reports tonight. Below are details on earnings one-day moves over the last 12 quarters.

Feb. 12, 2020 AC +3.05%

Nov. 14, 2019 AC +8.95% Biggest UP

Aug. 15, 2019 AC -1.12%

May 16, 2019 AC +2.49%

Feb. 14, 2019 AC -3.95%

Nov. 15, 2018 AC +1.08%

Aug. 16, 2018 AC -7.71%

May 17, 2018 AC -8.24% Biggest DOWN

Feb. 14, 2018 AC +3.89%

Nov. 16, 2017 AC -2.33%

Aug. 17, 2017 AC +2.73%

May 18, 2017 AC +0.38%

Avg (+ or -) 3.83%

Bias -0.07%, no significant bias on earnings.

With stock at 52.00 the data suggests these ranges:

Based on current IV (expected move into Friday per TOS): 49.22 to 54.78 (+/- 5.3%)

Based on AVERAGE one-day move over last 12 quarters: 50.01 to 53.99

Based on MAXIMUM one-day move over last 12 Q’s (9.0%): 47.35 to 56.65

Based on DOWN max only (-8.2%): 47.72

Open to requests for other symbols.

BCRX CC June 19 $5 Net @3.98 with stock at $5.07

Company conducting clinical on corona virus (similar to Gilead). Wouldn’t hurt to cover the back door with some of the premium.

#ironcondor IWM Sold June 19,…

#ironcondor IWM

Sold June 19, 102/107/135/140 for 1.70.

CODX Earnings Put Roll

#earnings #shortputs

$CODX BTC 5/15 14 put and STO 6/19 15 put for added credit of 2.65

TNA

#CoveredCalls – Chipping away at this one…

Bought to Close TNA MAY 15 2020 23.0 Calls @ .01 (sold for .50)

Sold TNA MAY 22 2020 20.0 Calls @ .66

SPY

#ShortPuts #CoveredCalls #CoveredStrangles – Adding another put and selling a covered call against yesterday’s put sale…

Sold SPY JUN 12 2020 250.0 Put @ 3.50

Sold SPY JUN 05 2020 290.0 Call @ 3.15

SPY

#CoveredCalls – Sold this one pretty aggressively last week…

Bought to Close SPY MAY 15 2020 290.0 Call @ .10 (sold for 3.50)

CVX@NYSE (Name: CHEVRON CORP) announced a cash dividend with ex-dividend date of 20200518 and payable date of 20200610. The declared cash rate is USD 1.29.

#dividend $CVX

So much for that.

#VIXIndicator The Downside Warning was reinstated at the close Wednesday, as VIX closed over 25% higher than Monday’s close.

CINF puts

Sold $CINF 6/19 40 puts @ 1.45. Delta 19. Stock at 48.53.

Thanks again for the heads up on this @optioniceman.

SPX 7-dte

#SPX7dteLong Bought to Open $SPX May 20th 2780/2800-2810/2830 condors for 18.30, with SPX at 2814.

CODX roll

I took profit on my CODX diagonal (may/aug) and reset the trade this morning into something you might find interesting. I bought a 1/2 size stock position and sold the June 18 straddle for $8.15. This creates a full size covered call profit structure with just 1/2 the stock size. As you probably know, selling a put equates to a covered call. So I have a full size covered call ceiling with only 1/2 the stock. Takes up less buying power. Got much more selling the put than the call, despite it being ATM at the time. Because of that, the smarter trade would have been just selling puts for a full size position (in hindsight).

I hear earnings are tomorrow….

Sue

AMZN iron condor

Sold $AMZN 6/19 2130/2150/2600/2620 iron condor @ 6.00. Short deltas 20 (puts) and 17 (calls).

TRADES:

PM BTO 70.0 PUTS @1.18 also have the 74.0 long puts 5/15/20 @3.65 from last week.

SDGR STO 5/15/20 60.0 CALLS @1.40 COVERED

SDGR STO 5/15/20 55.0 CALLS @2.50 COVERED Stock is volatile.

AAPL short calls

Sold $AAPL 6/19 335 calls @ 2.12. Wrote against long stock so the calls are covered.

#rolling APA Rolled May 15,…

#rolling APA #ironcondor QQQ

Rolled May 15, 11 put to June 12 for .85, APA down $1.00 below 11 today.

QQQ Sold June 19, 185/195/235/246 for 2.68.

AMD Roll Out

Rolled $AMD May 15 2020 52 #ShortPuts // May 22 2020 @0.90 Credit

SPY

#ShortPuts – Sold SPY JUN 05 2020 260.0 Put @ 3.40

LULU Roll Out

Rolled $LULU May 15 2020 115/125 #BuPS // May 22 2020 @1.00 Credit.

#shortputs CODX Bought May 15,…

#shortputs CODX

Bought May 15, 14 put for .15, sold May 7 for 1.25.

Thanks geewhiz112 for the ticker and Ramie for pointing out earnings.

Markets

And so it begins again. New lows so far today in the SP500:

GE – 5.48

IVZ – 6.71 (8.56% Div)

WFC – 22.10 (8.49% Div)

LUV – 23.52

CINF – 49.00 (4.66% Div)

BXP – 75.00 (4.98% Div) REIT

AAL – 8.83

WBA – 38.48 (4.52% Div)

L – 28.25

NVAX Put Roll / CODX Covered Call roll

#shortputs

$NVAX BTC 5/15 19.50 put and STO 5/22 32 put at 1.17 added credit. Stock at 42.20

#coveredcalls

$CODX BTC 5/15 17.50 call and STC 6/19 19 call at 1.25 added credit. Stock at 18.25

CODX–closing and reinitiating

Bought to close $CODX diagonal call spread (long 8/21 9 calls + short 5/15 15 calls) @ 5.83 for a quick .50 profit with the stock running. Thanks for the great idea @smasty.

But I just can’t quit you, CODX. Reinitiated another diagonal call: bought 8/21 10 calls + sold 6/19 20 calls @ 6.00 debit. Earnings tomorrow (5/14) after the bell.

TQQQ

#ShortPuts – Selling against a DITM covered call position so wouldn’t mind a pullback…

Sold TQQQ JUN 12 2020 55.0 Put @ 2.20

Sold TQQQ JUN 19 2020 55.0 Put @ 2.85

SVXY

#VXXGame Sold to close $SVXY Jan 2021 35 calls for 4.40. Bought for 4.114 (avg price) on March 26 & 27. What a bust… this thing hardly moved. TQQQ much better choice to get long at lows.

SPX skip

#SPX1dte Pretty sharp move at day’s end, but IV on tomorrow’s expiry is only 22%. I’m skipping this as tomorrow could be a sharp bounce or a sharp drop.

#VIXIndicator would have fired an upside warning today if the close was calm. This is why it takes 3 consecutive days of VIX closes before it fires… too many head-fakes with only 1 or 2 days.

#shortcallspreads SHOP Sold June 19,…

IWM

STO IC Jun 19 115/118 Puts 142/145 Calls $1.17 Cr

SPY Put Closed

#shortputs

$SPY BTC 5/13 270 put at .01. STO 4/9 @ 9.20.

MU

BTO May 22 46.5/48.5 Calls $0.95

#in-out

CODX Roll Call

#coveredcalls

$CODX BTC 5/15 15 call and STO 5/15 17.50 call at 1.20 debit. Stock at 17.348. We’ll see what happens.

#shortputs APA Sold May 15,…

#shortputs APA

Sold May 15, 11 put for .14

DDOG Put

#shortputs

$DDOG STO 5/15 65 put at 2.65