#perpetualrollingstrangles #inversestrangle TSLA

Rolled June 19, 325/450 inverted ugly strangle to July 20, 330/445 slightly less ugly inverted strangle for 1.17

#perpetualrollingstrangles #inversestrangle TSLA

Rolled June 19, 325/450 inverted ugly strangle to July 20, 330/445 slightly less ugly inverted strangle for 1.17

In my IRA:

STO June 19, 40 put at .54

STO June 19, 45 put at .85

#ShortPuts – Bought to Close SPY MAY 15 2020 265.0 Put @ .03 (sold for 2.30)

#SPX7dteLong In premarket, GTC order filled: Sold to close $SPX May 13th 2870/2890 call spreads for 18.60. Condors sold last Wednesday for 17.90. Will sell put side today.

#shortputs

$T BTC 5/15 28 put and STO 6/19 28 put at .55 added credit.

Bought to close $XLE 6/19 jade lizard (28 puts + 36.21/37.21 bear call spread) for .87. Sold for 2.10 on 4/20.

Corrected: Originally posted .66 as the closing price but that was just the call spread. Total to close .87 so 59% of possible profit.

CARR Broke a double top today, a buy signal on the Point & Figure chart.

AAL STO 5/15/2020 10.0 PUTS @.54

OSTK BTO STOCK @17.50 A little.

AAL STO 5/22/20 9.0 PUTS @.53

AAL STO 5/22/20 9.0 PUTS @.53

AAL STO 5/22/20 10.5 CALLS @.60

CARR BTO STOCK @18.73

#SPX7dteLong Bought to Open $SPX May 18th 2920/2940-2950/2970 condors for 16.80, with SPX at 2942. These are getting cheaper, which also means probability of profit has dropped.

#SPX1dte Expiring: May 11th 2825/2845-2990/3010 condors, sold Friday for .95

#coveredcalls $ILMN

STO August 55 puts at 2.90 with index at $140

STC May 15 45/48 Call spread $2.30 BTO 5-5 $1.49

#nflx STO 12 jun 20 430/435 put @ 2.20

#shortputs #earnings

$NVAX STO 5/15 19.50 put at 1.10

#shortputs CCL

Bought May 15, 11.50 put for .09, sold May 6 for .45.

Sold May 22, 12.50 put for .48

BTO IC May 15 297/299 Calls 278/275 Puts $0.57

My take off on Jeff’s SPX trades

#coveredcalls

$NVTA BTC 5/15 17.50 calls and STO 6/19 17.50 calls at $1.00 credit. Stock at 17.55. If it continue up may roll again, or just take the extra dividend. Lowers my cost basis another 5%. Still a ways to go but going in the right direction.

#shortputs

$AXSM BTC 5/15/95 put and STO 6/19 92.50 put at 3.50 added credit

#ShortPuts – Just for fun I’m going to try the tastytrade theory of selling at 45 days and rolling at 21 and see how it goes. Selling the expected move 46 days out…

Sold SPY JUN 26 2020 265.0 Put @ 4.52

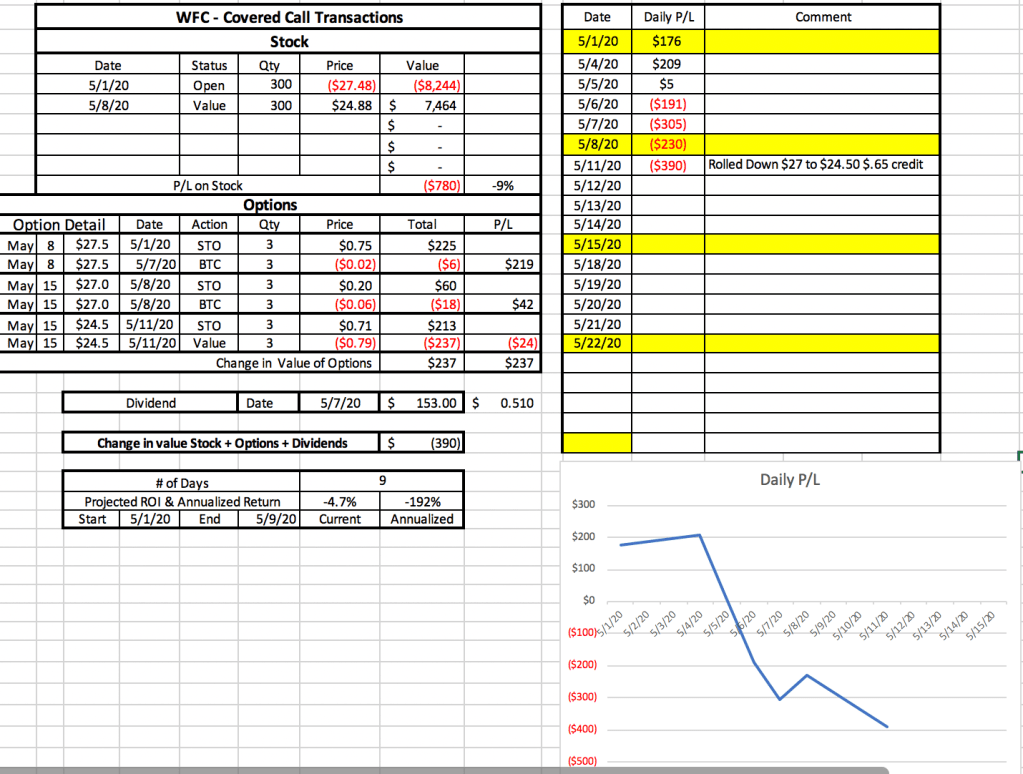

#coveredcalls WFC UNG

WFC Sold May 22, 26.50 call for .31

UNG Sold June 19, 15 call for .42

#OPTION EXPIRATION FRIDAY

RCL 5/8/20 47.0 CALLS STO @.80

AAL 5/8/20 8.5 PUTS STO @.45

AAL 5/8/20 9.5 PUTS STO @.45

#optionsexpiration

$SPX 2760/2780-2950/2970 1 DTE Thank you @Jeff

$PFE 39 call

$TWTR 31.5 call

$TQQQ 50 put Thank you @jsd501

$SPY 270 put Thank you @fuzzballl

Have a nice Mother’s Day.

#VIXIndicator The VIX closed below the 78.6% retracement, so that cancels the DW. Crazy stuff on a day with jobs numbers like that. If we can close well Monday and Tuesday it will set up nicely for a further rally higher.

#Earnings – I normally don’t do this but they never really took any heat so let ’em run the distance…

Expired:

OLED 135.0/155.0/157.5 Jade Lizard (sold for 2.55)

ROKU 123.0 Put (sold for 2.20)

BYND Rollout $125 to May 15 $130 $1.65 Credit

ISRG Diagonal Up May 8 $500 to May 15 $530 $26.55 Debit

SDC Diagonal UP May 8 $7.00 to May 15 $8 $.29 Debit

SDC Diagonal Up May 8 $7.50 to May 15 $8 $.12 Credit

New CC 1 Amazon May 15 $2380 Net $2344 Net

ET Diagonal DOWN May 8 $9 to May 15 $7.50 $.40 Credit

WFC Diagonal DOWN May 8 $27.50 to May 15 $27 $.18 Credit (Hopeful thinking?)

CAH Diagonal UP May 8 $47 to May 15 $49.50 $.80 Debit

BTC May 15, 40 puts at .02

#SPX1dte Sold to Open $SPX May 11th 2825/2845-2990/3010 condors for .95, IV 14.75%, SPX 2929, deltas -.06, +.05

Expiring: May 8th 2760/2780-2950/2970 condors, sold yesterday for 1.15.

#ShortPuts – Risk off…booking them a week early.

Bought to Close TQQQ MAY 15 2020 55.0 Put @ .15 (sold for 2.21)

Bought to Close TQQQ MAY 15 2020 60.0 Put @ .31 (sold for 2.47)

#SPX7dteLong Bought to Open $SPX May 15th 2900/2920-2930/2950 condors for 17.05, with SPX at 2922.

Expiring: May 8th 2840/2860 call spreads for maximum credit, 20.00. Condors bought last Friday for 18.40.

AAL STO 5/15/20 10.0 PUTS @.61

DAL BTO STOCK @22.55

CARR BTO STOCK @18.08

AAL STO 5/15/20 11.0 CALLS #STRANGLE See Put above.

#ShortPuts – Come and get it…

Sold TQQQ JUN 5 2020 60.0 Put @ 2.20

#shortputs

$MRNA STO 5/15 55 put at 1.45

BTC $TSLA May 15 2020 670/680 #BuPS @.32. Was Sto 4/29 @2.20

BTC $SQ Jun 19 2020 50/60 #BuPS @0.75. STO 5/6 @1.52

Assuming things don’t go crazy this afternoon:

OX $TLRY May 8 2020 $6.50 #ShortPut – STO 5/1 @.36

OA $TLRY May 8 2020 $7.00 #CoveredCalls – STO 5/1 @0.55. Overall Basis on the stock is $3.88. Position opened 3/31.

OX $OXY May 8 2020 $16 Call #CoveredCall

STO $OXY May 22 2020 $16 Call @0.44

OA $VIAC May 8 2020 $17 #CoveredCall – Position opened 4/23, @15.05, Basis @14.80 after roll last week.

STO MAy 22, 55 puts at .51

STO May 29, 55 puts at .51

STO June 19, 55 puts at 2.42

The higher the strike price, the smaller I trade.

STC May 22 118/120 Call Spread $1.45 BTO 5-7 $0.98

1 Day took profit

#shortputs

$SPY BTC 5/8 270 put at .06. STO at 1.70 on 4/28. Thank you @fuzzballl

$SQ BTC 5/15 60 put at .10. STO at .85 on 5/6. Thank you @fuzzballl for earnings on this earnings trade.

$NLOK STO 5/15 21 put at .65

#ShortPuts – Added on the early weakness. The additional put sales are being used to finance ITM covered call rolls…

Sold ROKU MAY 15 2020 115.0 Put @ 1.30

Thanks for the idea guys, I’ve placed the following diagonal:

Bought Aug 9 calls for 6.76

Sold May 15 calls for 1.40

TGIF!

Sue

#SPX7dteLong

In the pre-market, filled on GTC order, Sold $SPX May 11th 2840/2860 call spreads for 18.00. Condors bought for 18.20 on Monday. Will sell the put side today. Right now I’m asking 1.80, which I can get with a minor pullback.

Good Morning

#Jobs — biggest losses since WW2

Loss of 20,500,000 non-farm payroll jobs, vs. expected 21.5M loss

Unemployment at 14.7%, up by 10.3%, vs. expected 16%

U6 unemployment at 22.8%, up by 14.1%

Avg Hourly Earnings up 4.3%

Labor force participation 60.2%, down by 2.5, lowest in over a decade

March revised down from -701K to -870K

February revised up from +214K to +230K

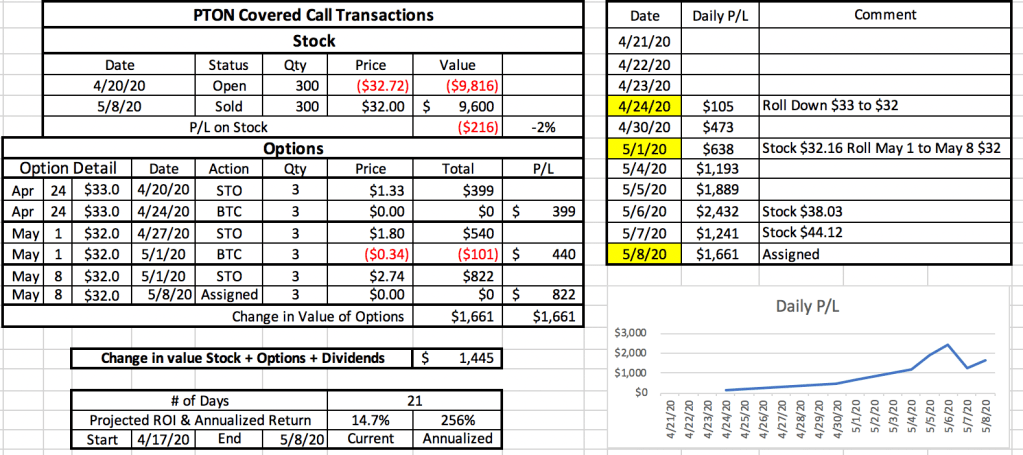

CC strategy left a lot of money on the table with the big run up. Maximized the profit on the position ….but tough to leave the $ on the table.

14.7% Return in 21 days….would take that any time.

Should have rolled up prior to earnings announcement and again yesterday after strong opening. I would like to have a position in PTON and continue writing. I rolled PTON up in other account…caught sleeping on this one.

#ShortPuts #Earnings – I’ve got some DITM covered calls in this so wouldn’t mind a pullback. Come and get it! LOL

Sold ROKU MAY 8 2020 123.0 Put @ 2.20

#JadeLizards #Earnings – Throwing one out there. Put side is outside the expected move and below the 50 day ma with no upside risk.

Sold OLED MAY 8 2020 135.0/155.0/157.5 Jade Lizard @ 2.55

#SPX1dte Sold to Open $SPX May 8th 2760/2780-2950/2970 condors for 1.15, IV: 25.5%, SPX 2877, deltas -.05, +.05.

#earnings UBER

Sold May 15, 28/30 #putratiospread for .32

BTO May 22 52/54 Calls $0.97

#in-out

BTO May 22 118/120 Calls $0.98

Call expired last Friday, was hoping for a rebound to sell into

Stock showing strength again so I’m giving a quick hook to this trade, keeping the loss to a minimum (.38). Bought to close $PTON 6/19 45/50 bear call spread @ 1.80. Sold earlier today for 1.42.

STO May 29, 50 put at .87

#shortputs

$CODX BTC 5/15 10 put at .20. STO 4/14 at 2.85

#coveredcalls

$NET STO 5/15 call at 2.20

Sold $PTON 6/19 45/50 bear call spread @ 1.42. Post-earnings, looking like it may have hit its high on the gap up. Short leash–if the stock moves back toward the morning high I’ll cut bait.

#ShortPuts – Wasn’t going to hold over the weekend so now is probably as good a time as any to book these.

Bought to Close SPY MAY 11 2020 270.0 Puts @ .15 (sold for 2.07)

Bought to close $AMZN 5/15 2130/2150/2480/2500 iron condor @ 1.96. Sold for 6.00 on 5/1.

Rolled $AMD May-08-2020 52 #Shortput // May-15-2020 @0.85 credit.

#BearCallSpreads #Earnings – Sold these ITM and got a nice move. I’ll take it here and not be greedy…even though it’s coming out of a nice squeeze.

Bought to Close SPCE MAY 8 2020 19.0/16.0 Bull Put Spreads @ .60 (sold for 1.80)

BTO May 22 305/302.5 BePS $1.15

STC May 15 136/139 Call Spread $2.37 BTO 4-30 $1.45

#ShortPuts #Earnings #OneNightStand – See ya next time…

Bought to Close SQ MAY 15 2020 60.0 Puts @ .20 (sold for .85)

#Earnings $OLED reports tonight. Below are details on earnings one-day moves over the last 12 quarters.

Feb. 20, 2020 AC -2.46%

Oct. 30, 2019 AC +15.27%

Aug. 1, 2019 AC -1.64%

May 2, 2019 AC +8.76%

Feb. 21, 2019 AC +23.03%

Nov. 1, 2018 AC -20.50% Biggest DOWN

Aug. 9, 2018 AC +13.54%

May 3, 2018 AC +12.43%

Feb. 22, 2018 AC -15.81%

Nov. 2, 2017 AC +9.52%

Aug. 3, 2017 AC -1.30%

May 4, 2017 AC +23.87% Biggest UP

Avg (+ or -) 12.34%

Bias 5.39%, strong positive bias on earnings.

With stock at 150.00 the data suggests these ranges:

Based on current IV (expected move into Friday per TOS): 135.19 to 164.81 (+/- 9.9%)

Based on AVERAGE one-day move over last 12 quarters: 131.48 to 168.52

Based on MAXIMUM one-day move over last 12 Q’s (23.9%): 114.20 to 185.81

Based on DOWN max only (-20.5%): 119.25

Open to requests for other symbols.

#SPX7dteLong Bought to open $SPX May 13th 2840/2860-2870/2890 condors for 17.90, with SPX at 2859.

#SPX1dte Expiring: May 6th 2770/2790-2940/2960 condors, sold yesterday for 1.20.

Bought to close $TLT 6/19 170/175 bear call spread @ .70. Sold for 1.50 on 4/27.

STO May 29, 40 puts at .40

STO May 29, 45 puts at .68

STO June 5, 40 puts at .68

BTCMay 8, 50 puts at .02 and still waiting on the 45 puts and the 40 puts to fill at .01 cent.I don’t mind taking the risk off for a penny or two.

#ShortPuts #Earnings – Closing AAPL and adding SQ. Out a week for a little more safety…

Bought to Close AAPL MAY 15 2020 265.0 Put @ .35 (sold for 2.25)

Sold SQ MAY 15 2020 60.0 Puts @ .85

Slowly. Sold $DIS 6/19 90 puts @ 2.08. Delta 21.