https://www.zerohedge.com/markets/volatility-more-number-its-everything

Textbook Volatility Defined

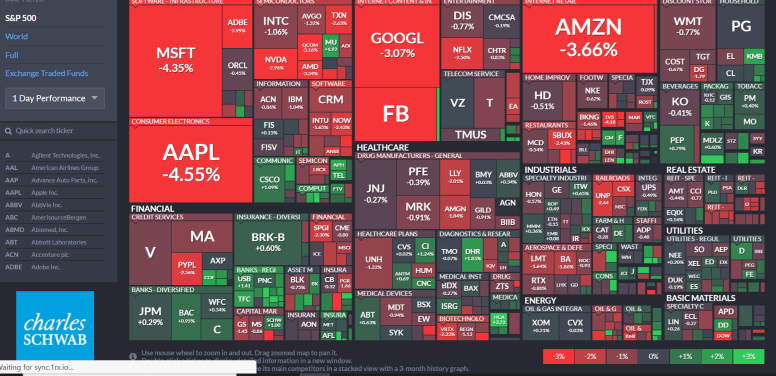

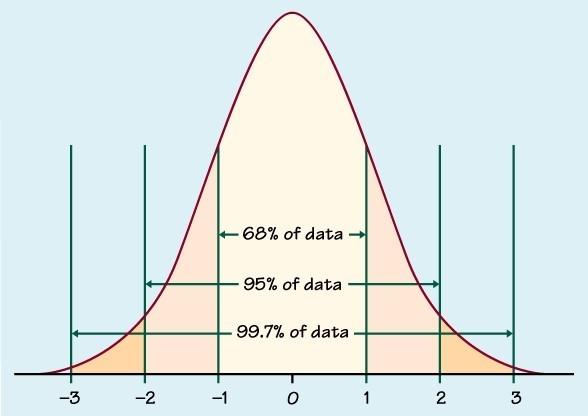

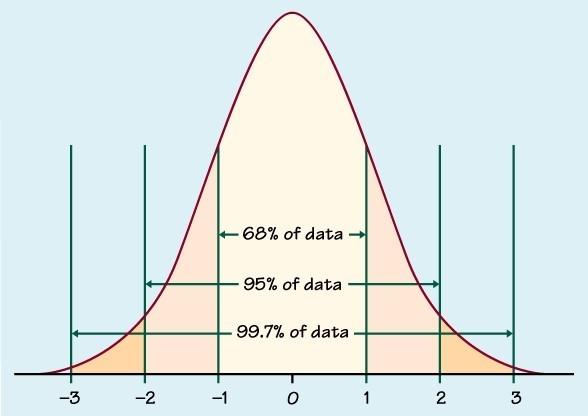

Volatility is a measure of the historical dispersion of returns around a mean. The greater the dispersion, the higher the volatility, and ultimately the range of potential outcomes.

Volatility is typically quoted as +/- 1 standard deviation. For instance, 14% annualized volatility means, with 68% certainty, we should expect annualized returns to be +/- 14%. The volatility formula describes a normal bell-shaped curve in which price changes should be contained.

Normal implies there are equal odds the market falls 1% or rises 1% versus the average change. The graph below depicts a bell-shaped curve. The diagram also highlights standard deviations and the percentage of data that falls within each deviation.

Normal Is Not Reality

The assumption of a normally distributed bell curve is at the heart of finance. Embedded in that assumption is the idea that market participants are rational and markets efficient. It drives risk management, option pricing, and many economic and market theories. The problem with such analysis is that the assumption is flat out wrong.

In a normal shaped curve, the S&P 500 should never move by more than five standard deviations up or down. By “never,” we mean once every 3.5 million trading days (approximately 14,000 years). Since 1970 there have been 34 such days. In March of 2020 alone, there were 7!

Summary

When investor confidence is high, liquidity is high, and volatility is typically low. Plenty of buyers and sellers willing to trade help assure orderly markets. However, when potential buyers become concerned about the risk of loss, liquidity fades. Buyers step away, sellers will take almost any price to protect against even steeper declines, and prices become more volatile. The suddenness of increased volatility and the false assumption of normally distributed prices leads to statistically impossible drawdowns.

Currently, volatility is two times pre-COVID levels. While sharply lower from March and April, liquidity remains problematic.

Volatility reminds us that the market structure is not stable. As a result, markets are more susceptible to sharp price changes. While most markets have been rising in recent months, the liquidity situation argues that bad news or a change in sentiment could result in substantial and nearly instantaneous losses.

Liquidity is poor, complacency is high, trade with caution.