Bought to close $IWM 150/155 bear call spread @ .25. Sold for 1.29 on 6/19.

Monthly Archives: July 2020

SPY Rolls

Bought to close 1 SPY 07/08/2020 306.0 Call / Sold 1 SPY 07/15/2020 308.0 Call @ 0.13 Credit plus 2 more points on the strike.

Bought to close 1 SPY 07/08/2020 307.0 Call / Sold 1 SPY 07/15/2020 310.0 Call @ 0.22 Credit plus 3 more points on the strike.

#SPYLadder

WBA Earnings

Diagonal Credit Spread

Sold to open WBA Jul 10 2020 40.00 Puts @ $0.43 / Bought WBA Jul 17 2020 30.00 Puts @ $0.02 for a 0.41 net credit.

#Earnings tomorrow.

WBA is 42.60 and has a nice divvy and is not all that far from the yearly low.

If the short put goes bad, I can roll it at least once because the throw-away long position is a week longer.

LABU

#ShortPuts – Still decent premium in this at much lower levels. Jumping back in on the little selloff. Selling outside the expected move and below the 50ma down near the 200ma.

Sold LABU JUL 31 2020 47.5 Puts @ 1.60

MDLZ DiagBFly

BTC MDLZ July 10: 51 short straddle @ $0.83 (originally sold for $1.32)

STO MDLZ July 17: 51 short straddle @ $1.50

Learnt not to wait until OpEx Friday to manage these weekly options. Getting lucky so something is about to happen.

Cover is the Jan 2022 long 40 put / 65 call strangle.

#closing TSLA TDA raised maintenance…

#closing TSLA

TDA raised maintenance requirements on TSLA significantly. I was forced to buy back my short, August 335 call, couldn’t buy anything long, ouch, pretty big loss.

SPX 7-dte

#SPX7dteLong Sold to close $SPX June 8th 3130/3150 call spreads for 16.85. Condors bought last Wednesday for 17.10. I’m taking a small loss now on the possibility of a roll over and going negative. If we do that in the next hour or two I should be able to get some decent premium for selling the 3120/3100 put side.

LABU STMP

#ShortPuts – Book ’em!

Bought to Close LABU JUL 10 2020 47.5 Puts @ .05 (sold for 1.90)

Bought to Close STMP JUL 17 2020 150.0 Put @ .30 (sold for 3.53)

WBA earnings analysis

#Earnings $WBA reports tomorrow morning. Below are details on earnings one-day moves over the last 12 quarters.

April 2, 2020 BO -6.29%

Jan. 8, 2020 BO -5.83%

Oct. 28, 2019 BO +0.68%

June 27, 2019 BO +4.08% Biggest UP

April 2, 2019 BO -12.80% Biggest DOWN

Dec. 20, 2018 BO -5.02%

Oct. 11, 2018 BO -1.94%

June 28, 2018 BO -9.90%

March 28, 2018 BO +2.47%

Jan. 4, 2018 BO -5.17%

Oct. 25, 2017 BO +3.07%

June 29, 2017 BO +1.66%

Avg (+ or -) 4.91%

Bias -2.92% significant negative bias on earnings.

With stock at 42.50 the data suggests these ranges:

Based on current IV (expected move into Friday per TOS): 39.70 to 45.30 (+/- 6.6%)

Based on AVERAGE one-day move over last 12 quarters: 40.41 to 44.59

Based on MAXIMUM one-day move over last 12 Q’s (12.8%): 37.06 to 47.94

Based on UP max only (+4.1%): 44.23

Open to requests for other symbols.

BBBY earnings analysis

#Earnings $BBBY reports tonight. Below are details on earnings one-day moves over the last 12 quarters.

April 15, 2020 AC +18.01% Biggest UP

Jan. 8, 2020 AC -19.21%

Oct. 2, 2019 AC +2.69%

July 10, 2019 AC -3.03%

April 10, 2019 AC -8.75%

Jan. 9, 2019 AC +16.55%

Sept. 26, 2018 AC -20.99% Biggest DOWN

June 27, 2018 AC -3.81%

April 11, 2018 AC -19.95%

Dec. 20, 2017 AC -12.49%

Sept. 19, 2017 AC -15.87%

June 22, 2017 AC -12.12%

Avg (+ or -) 12.79%

Bias -6.58%, strongly negative bias on earnings.

With stock at 10.00 the data suggests these ranges:

Based on current IV (expected move into Friday per TOS): 8.26 to 11.74 (+/- 17.4%)

Based on AVERAGE one-day move over last 12 quarters: 8.72 to 11.28

Based on MAXIMUM one-day move over last 12 Q’s (21.0%): 7.90 to 12.10

Based on UP max only (+18.0%): 11.80

Open to requests for other symbols.

VXX Diagonal Calls

Sold VXX 07/10/2020 40.0 Calls @ 0.21

Sold 1 VXX 07/10/2020 38.0 Call @ 0.38.

Looking to balance out my short put exposure.

VXX at 33.38

SPX 1-dte

#SPX1dte Sold to Open $SPX July 8th 3045/3065-3205/3225 condors for 1.10, IV 19%, SPX 3047, deltas -.04, +.06

ROKU

#ShortPuts – Still trying to talk this one down…

Sold ROKU JUL 24 2020 115.0 Put @ 2.07

RAD Roll

#coveredcalls

$RAD BTC 18.50 call and STO 7/24 19 call at added .05 credit.

AMZN call spread

Sold $AMZN 7/17 3110/3130 bear call spread @ 5.20 with the stock around 3021.

LABU Put / NEO Call Roll / PFE Strangle

#shortputs

$LABU STO 7/24 51.5 put at 1.60

#coveredcalls

$NEO BTC 7/17/35 call and STO 8/21 40 call at .40 debit. Stock at 35.49

#shortstrangles

$PFE STO 7/10 34/34.5 strangle at .61

NVDA

#ShortPuts – Bought to Close NVDA JUL 17 2020 330.0 Put @ .10 (sold for 3.55)

EWZ

#ShortPuts – Bolsonaro tested positive so got a tiny pullback. Adding here…

Sold EWZ JUL 31 2020 27.5 Puts @ .76

EWZ DiagBfly

Early management of the short sale, taking profits & rolling out to sell some additional premium

BTC EWZ July 10: 30 straddle @ $1.30 (originally sold for $1.90)

STO EWZ July 17: 30 straddle @ $2.04

The short straddle is covered by a long EWZ Sep 18: 24 put / 30 call strangle.

CHWY

STO August 21, 45 puts at 2.70

SPY

#ShortPuts – Bought to Close SPY JUL 17 2020 280.0 Put @ .25 (sold for 3.35)

TSLA call spread

Sold $TSLA 7/17 1450/1470 bear call spread @ 5.00 with the stock around 1368.

TSLA

Please sit down before you read this…At 9:07 AM, CST, TSLA is down 26 points!

The moon is in the 7th house

SPXpirations

#SPX7dteLong $SPX July 6th 3045/3065 call spread expired with full credit of 20.00. Condors bought last Monday for 18.05. I wasn’t able to place one for next Monday; will do it tomorrow.

#SPX1dte July 6th 3060/3040 put credit and 3215/3235 call debit #RiskReversal expired with no additional profit… keeping the .30 credit that I placed it for on Friday.

SPY Rollup

Bought to close 1 SPU 07/06/2020 306.0 Call / Sold 07/15/2020 308.0 Call @ 0.17 Credit plus 2 more points on the short strike.

#SPYLadder

KSS SLB Covered Calls

Sold KSS 07/10/2020 22.0 Covered Calls @ 0.46

Sold SLB 07/10/2020 20.0 Covered Calls @ 0.07

ADS AAL Covered Calls

Sold 1 ADS 07/10/2020 50.0 Covered Call @ 0.40

Sold 1 AAL 07/10/2020 13.50 Covered Call @ 0.34

A TRADE:

CIEN BTO a little stock @56.58

CIEN Just broke a double…

CIEN Just broke a double top on the Point & Figure chart, a buy signal.

TRADES:

OSTK STO 7/10/20 41.0 CALLS 1.70

OSTK STO 7/10/20 43.0 CALLS @1.20

SDGR BTO STOCK @94.0 An add to.

PLAY STO 7/10/20 14.0 CALLS @.22

PLAY STO 710/20 11.5 PUTS @.25

LABU

#ShortPuts – This week’s looks good so throwing a starter out there. Hopefully get a chance to add…

Sold LABU JUL 24 2020 47.5 Puts @ 1.50

HAL Put NUGT Call Rolled

#shortputs

$HAL BTC 7/17 15 put and STO 7/24 15 put at .13 added credit

#coveredcalls

$NUGT BTC 7/17 80 call and STO 7/31 82 call at 1.40 added credit

NVDA

#ShortPuts – Breaking out to all time highs. With next week’s 330 looking safe I’m going out to the week before earnings and selling at the rapidly rising 50ma and slightly outside the expected move. This isn’t my usual style so let’s also add this hashtag:

Sold NVDA AUG 07 2020 350.0 Put @ 4.49

LULU

VXX

Question for Jeff What is you thoughts on The Jan 21 20 Puts some of are holding. In this VIX environment should we be taking some profits when available or are the a good hold?

Weekend ideas

TNA

#ShortPuts – Once again couldn’t quite get this one over the finish line. Try again next week…

Rolled TNA JUL 02 2020 27.5 Puts to JUL 10 2020 27.5 Puts @ 1.15 credit (2.85 total now)

OPTION EXPIRATIONS: 7/2/20, all below…

OPTION EXPIRATIONS: 7/2/20, all below expired worthless except as noted.

APT 21.5 CALLS STO @.90

NCLH 16.0 PUTS STO @1.35 Rolled out last week.

PLAY 12.5 PUTS STO @.25

PLAY 17.5 CALLS STO @.45

SWBI 17.0 PUTS STO @.40

SWBI 20.0 CALLS STO @.38 Stock will be called

WFC 24.5 PUTS STO @.46

WFC 27.0 CALLS STO @.39

AAL 13.0 CALLS STO @.60

AAL 13.5 CALLS STO @.49

Happy Holiday to all.

Expirations etc

OX NFLX 420/430 #BuPS – Was STO @1.13 on 6/24

Rolled SLB Jul-02-2020 $20 #CoveredCalls // Jul-10-2020 $19 @0.32 Credit, but lower strike. Basis is $16.23.

OX SPX Jul-02-2020 3190/3200 #BeCS – STO @1.00 this morning, thanks @Jeff !!

OX Work Jul-02-2020 $34 #Covered Call – was STO @1.33 on 6/19. Replaced with Jul-10-2020 $31.5 @ 0.48

Happy 4th.

SPX trades

#SPX7dte Bought to Open $SPX July 10th 3125/3145-3155/3175 condors for 17.00, with SPX at 3148.

#SPX1dte #RiskReversal – going for a bullish trade given the low $VIX

Sold $SPX June 6th 3060/3040 put spreads for .80

Bought $SPX June 6th 3215/3235 call spreads for .50

Placed as one trade for .30 credit. IV 14%, SPX 3141, put short delta -.09, call long delta +.04

Expiring: June 2nd 3190/3210 call spreads, sold this morning for 1.20.

VXX last roll

With less than an hour until expiration I decided not to chance riding this out to the bitter end –

Bought to close 07/02/2020 32.0 Puts / Sold 07/10/2020 29.0 Puts @ 0.05 Credit plus 3.00 lower strike for next week.

All my puts are rolled now and my 42,44,46 short calls will expire.

Ready for the next pullback in the market now.

NKLA Iron Fly

Over on OMM they’re getting filled on this trade. Took it in a a couple of accounts. Seems impossible:

Filled on $NKLA 8/21 45/55/65 iron butterfly for 10.40 credit. You read that right. Credit exceeding the wing width. Can’t figure out how that happened, I’ve never seen it before.

VXX Rolldown Puts

Bought to close VXX 07/02/2020 32.50 Puts / Sold VXX 07/10/2020 30.50 Puts @ 0.04 Credit plus 2.00 better strike.

Stock is 31.65

WBA Rollup

Bought to close WBA 07/02/2020 42.0 Covered Calls/ Sold WBA 07/10/2020 42.50 Covered Call @ 0.89 Credit

#Earnings on 07/09

CINF early unwind

This was a very profitable buy/write in a small retirement account

Sold 100 CINF 64.91 today. Acquired this on a Put assignment at an adjusted basis or 52.80 on 05/12/2020.

Covered 1 July 60 Call @ 5.91. Sold it @ 7.90 on a nice rollout of the June 60.

Earned one nice $60 dividend payment due 7/15.

Over all I’m happy with the result and glad to be back in cash.

KSS Rolls

Bought to close KSS 07/02/2020 20.0 Covered Calls / Sold KSS 07/10/2020 20.50 Covered Calls @ 0.42 Credit plus 0.50 better strike.

Bought to close KSS 07/02/2020 20.50 Diagonal Calls/ Sold KSS 07/10/2020 21.0 Diagonal Calls @ 0.52 Credit plus 0.50 better strike.

My 07/02/2020 21.0 short calls should expire today.

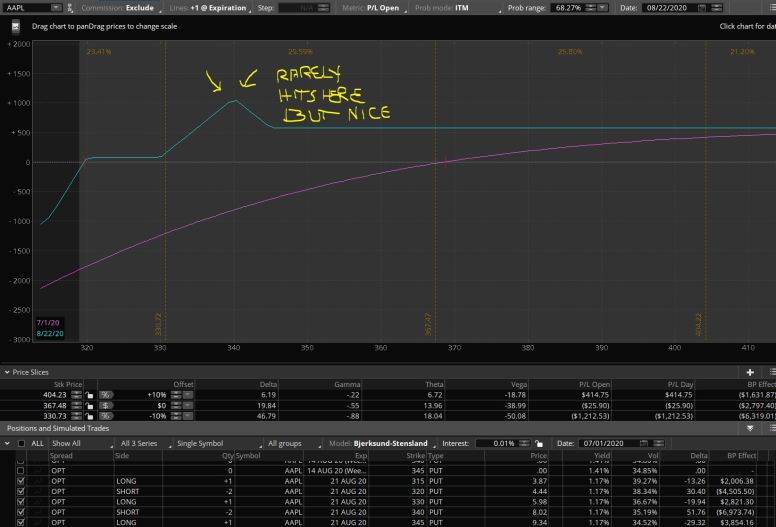

#FuzzyHotAir #PutRatioLadder I really like…

I really like Fuzzy’s work on this. I’ve been doing loads of collars all year, but there’s times on a run up that I don’t want to chase the calls up, so I’ll let the position go. Then I’ll use some type of premium selling as a way to re-establish a position at a discount. Or if I want to add to a position, I can’t stomach buying at highs, but this is a great way to add in.

My favorite put selling strategy is a put ratio. My go-to is 45 DTE, buy 1x 30 delta and sell 2x 25 delta. THEN (since I’m more and more risk averse every year) I’ll often set a broken wing debit fly right at the breakeven on the put ratio to get me a few more $$ of break even room.

The part I’ve been missing though is the ladder dynamic of doing this campaign style.

I have a small AAPL collar position right now that I’ve been wanting to add into. I’ve been doing weekly put ratios on it, but I’d like to flip to a laddering style like Fuzzy laid out in his post yesterday. Why AAPL? It’s the driving force behind both SPY and QQQ…as AAPL goes, so goes SPY/QQQ. But it has higher volatility than SPY, so more $$$ (mo’ money ties into probability).

I’ll do one of these every week, here’s today’s trade (I chose Aug 21 strike at 50 days for liquidity, had problems with fills on the Aug 14 expiry)

Bought to open qty 1 Aug 21 345 put @ 9.34

Sold to open qty 2 Aug 21 340 put @ 8.02

Ratio net credit 6.70, break even: $328.24 (roughly 18 delta)

Additional butterfly (hedge):

Aug 21 330/320/315 @ .97 debit

New breakeven: $319.69 about 13% down, 15 delta

I acknowledge the butterfly hedge eats into profits, but I’m happy w/ the trade off for the extra wide profit structure on these. Plus this is a much more complicated way of executing Fuzzy’s idea, but I really like the risk/reward on it.

MDLZ DiagBFly

BTC MDLZ July 02: 52.50 short straddle @ $0.82 (originally sold for $2.38)

STO MDLZ July 10: 51 short straddle @ $1.32

Selling weeklies for the moment, but may lengthen the time period to reduce screen staring time.

Cover is the Jan 2022 long 40 put / 65 call strangle.

SPY Roll

Bought to close 1 SPY 07/02/2020 309.0 Call / Sold 1 SPY 07/13/2020 312.0 Call @ 0.34 Credit plus 3 points improvement in the short strike.

Stock at 313.64.

EWZ DiagBfly

BTC EWZ July 02: 28 straddle @ $2.31 (originally sold for $1.89)

STO EWZ July 10: 30 straddle @ $1.90

Tried to get clever by adding the new straddle late yesterday and hoping to close out the Jul 02 ITM short call at a smart price today – Wrong!

The short straddle is covered by a long EWZ Sep 18: 24 put / 30 call strangle.

Rolling PFE Call

#coveredcalls

$PFE BTC 7/2 32.50 call and STO 7/17 35 call at added .75 credit and 2.50 in price if called away. Vaccine.

NTAP

#CoveredCalls – An old earnings trade that’s been a pain for a long time. Getting closer to being out…

Bought to Close NTAP JUL 2 2020 45.0 Calls @ .05 (sold for 1.10)

Sold NTAP JUL 17 2020 45.0 Calls @ .80

EWZ

#ShortPuts – Nice little pullback. Re-loading out an extra week.

Sold EWZ JUL 24 2020 27.5 Puts @ .72

VIAC

Bought to close VIAC 07/02/2020 23.0 Calls / Sold VIAC 07/10/2020 24.0 Calls @ 0.04 Credit plus 1 one point better strike

VXX Roll Puts

Bought to close VXX 07/02/2020 33.0 Puts / Sold 07/10/2020 31.50 Puts @ 0.26 Credit plus a 1.50 drop in the short strike.

Written against 2021 and 2022 long puts.

The 33’s were the farthest in the money of all my short Puts and since VXX rallied from 31.03 to 32.03 in the last hour I don’t want to deal with how low it may go if the market has a late run higher and pushes VXX back down.

I still have to cover or roll 32.0 and 32.50 puts but those should be easier.

SPY Roll

Bought to close 1 SPY 07/02/2020 303.0 Call / Sold 1 SPY 07/10/2020 304.0 Call @ 0.10 Credit plus a 1 point improvement in the short strike.

This got too far ITM for a better roll today.

VXX Calls

Bought to close VXX 07/02/2020 41.0 Calls @ 0.01. Sold these last Friday @ 1.52

EWZ ROKU UVXY

#ShortPuts – Booking, adding, and rolling.

EWZ: This thing has gone from up nicely to back to even 3 times since opening the positions. Taking profits this time and hoping for a pullback to reset.

Bought to Close EWZ JUL 17 2020 28.0 Put @ .50 (sold for 1.55)

Bought to Close EWZ JUL 17 2020 29.0 Put @ .78 (sold for 1.98)

Bought to Close EWZ JUL 17 2020 30.0 Put @ 1.12 (sold for 2.56)

Bought to Close EWZ JUL 17 2020 31.0 Put @ 1.60 (sold for 3.15)

Bought to Close EWZ JUL 17 2020 32.0 Put @ 2.25 (sold for 3.95)

ROKU: Replacing the one closed yesterday.

Sold ROKU JUL 17 2020 115.0 Put @ 2.33

UVXY: Rolling.

Rolled UVXY JUL 2 2020 31.0 Puts to JUL 10 2020 29.0 Puts @ .01 credit

SPX 0-dte

#SPX1dte Sold to Open $SPX July 2nd 3190/3210 call spreads for 1.20, with SPX at 3160. Same day trade meant to expire worthless in a few hours.

June Jobs Report

#Jobs — an increase beats expectations again.

Gain of +4,800,000 non-farm payroll jobs, vs. expected 2.9M gain

Unemployment at 11.1%, down by 2.2%, vs. expected 12.4%

U6 unemployment at 18.0%, down by 3.2%

Labor force participation 61.5%, up by 0.7%

Average hourly earnings down 1.2% from May, up 5% from last June.

May jobs revised upward by +190K

TSLA

Up 100 points pre-market on June deliveries number

Over 1200 now

Tesla Says It Delivered 90,650 Vehicles In Q2, Beating Estimates

…production was down 20% Q/Q, however…

#CrazyTown

SPY and learning put selling (weekend reading)

First off, I apologize for the length of this but it might be entertaining if we get a long, wet, locked down 3 day weekend. I’ve got a friend who’s still about 4 years from retirement but has a sizable nest egg (1.2 million). He was interested in maybe learning a little bit about the option market in hopes that there was something he could do in retirement to live off of safely but not have to watch the market every single day. I came up with a plan (3 parts) that serves 2 purposes. It lets him learn option basics as well as experiment to see if it brings in enough to live on and be within his risk tolerance. I’ve been paper trading this for a month now (TDA will turn on live quotes in your paper account if you ask them). It’s been a choppy market which is nice and the plan is going about how I imagined. The true test will be the next big panic selloff but based on what this last selloff was like I think it will do fine.

Any thoughts, ideas, or comments are welcome. I’ll post a current screenshot at the bottom of where we stand so far and break it up into 3 or 4 responses down below. I’m hoping to continue this for the foreseeable future to really get a longer term feel for it. Here we go!

SPY New diagonal

Bought to open 1 SPY 09/30/2020 335.0 Call / Sold 1 SPY 07/10/2020 312.0 Call @ 0.12 Credit

I’m thinking that the market is again overbought with the SPY at 311.75.

The long has 91 DTE and the short has 9 DTE and is out of the money

SPX 7-dte

#SPX7dteLong Bought to Open $SPX July 8th 3100/3120-3130/3150 condors for 17.10, with SPX at 3124.

Expiring: July 1st 3070/3090 call spreads for 20.00. Sold put side this morning for .80.

July 2nd call side sold this morning for 18.50. Not filled on attempts to sell put side; will see if high IV around the jobs report in the morning can get me some premium.

OSTK

Rolled OSTK Jul-17-2020 $27.5 #CoveredCalls // Aug-21-2020 $30’s for $1 Credit and 2.50 better strike. Basis $17.93.

TQQQ Put Closed

#shortputs

$TQQQ BTC 7/17 45 put at .10. Thank you @jsd501

Rolling COST

With $COST breaking above the 50 day moving average I’m extending my stock acquisition position (short 7/17 295 puts) by rolling it to 8/21 295 puts for 3.80 credit. Total premium now 7.95 so breakeven if assigned has dropped to around 287. Option delta 33. Earnings not expected until after Aug opex.

ROKU UVXY

#ShortPuts – Just a couple today. Most of my positions are sitting out in the July monthly expiation. Decaying nicely…

Bought to Close ROKU JUL 2 2020 108.0 Put @ .05 (sold for 2.50)

Sold UVXY JUL 10 2020 29.0 Puts @ 1.40

TSLA

Toyota just announced a 27% drop in June sales vs last year.

Tesla Surpasses Toyota, Becomes World’s Most Valuable Automaker

Up 50 to 1130

#CrazyTown again

AAL UAL DAL etc.

IATA – May Passenger Demand Shows Slight Improvement IATA announced that passenger demand in May (measured in revenue passenger kilometers or RPKs), dropped 91.3% compared to May 2019.

SPY Rolls

Bought to close 07/01/2020 304.0 Call / Sold 07/08/2020 306.0 Call @ 0.32 Credit plus a 2 point bump in the short strike.

Bought to close 07/01/2020 303.0 Call / Sold 07/08/2020 305.0 Call @ 0.30 Credit plus a 2 point bump in the short strike.

#SPYLadder

LULU

SPX 7-dte

#SPX7dte Sold to close $SPX July 1st 3060/3040 put spreads for .80. Looking for 3070/3090 call side to expire at 20.00. Condors bought for 18.00 last Wednesday.

Sold to close $SPX July 2nd 3015/3035 call spreads for 18.50. Looking to get a dollar or more for put side. Condors bought for 18.30 last Friday.