Bought to close $NVDA 9/25 465 put @ .28. Sold for 3.20 on 9/16. Thanks @fuzzballl !

Monthly Archives: September 2020

SPY

Covered up my last long call for a diagonal spread when SPY sprinted to 325.50.

Sold 1 SPY Sep 28 2020 332 Call at $0.52.

I have two short calls expiring (I hope) tomorrow at 333 and 334.

LABU STO LABU Oct16’20 35…

LABU

STO LABU Oct16’20 35 PUT @1.10

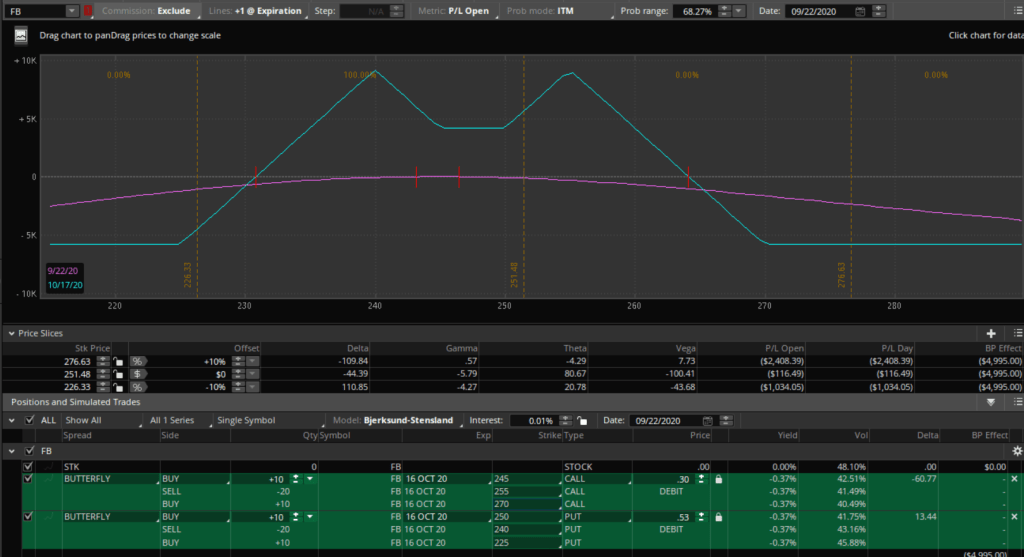

FB Batman BWB

$FB BTO Oct 16, 245 / 255 / 270 Broken Wing Call Butterfly for 0.53 debit.

$FB BTO Oct 16, 250 / 240 / 225 Broken Wing Put Butterfly for 0.30 debit.

Upside / Downside Breakeven at $264 / $231.

DOCU TDOC

#ShortPuts – Very similar stocks. Both down today and pretty high on my IV Rank list so going in again. Selling at the expected moves and near recent lows.

Sold DOCU OCT 09 2020 180.0 Put @ 2.90

Sold TDOC OCT 09 2020 180.0 Put @ 2.75

SPY

Looking at a 6 month chart.

Support seems to be in a band from 320 to 322.

We are testing that now.

If SPY breaks 320, not much support until 300 or so.

And the VIX could easily spike 10 -20%

NVDA TQQQ

#ShortPuts – Won’t be able to watch the market tomorrow so taking these off today on the early bounce. Re-loading TQQQ for another one next week.

Bought to Close NVDA SEP 25 2020 465.0 Put @ .80 (sold for 3.09)

Bought to Close TQQQ SEP 25 2020 110.0 Put @ 1.60 (sold for 2.36)

Sold TQQQ OCT 02 2020 100.0 Put @ 2.30

TSLA

#ShortPuts – Glad I turned on the computer in time to catch the quick rally. Took a big shot at battery day. Moved completely against me but still out on the bounce with tiny winners and re-loading next week.

Bought to Close TSLA SEP 25 2020 375.0 Put @ 9.00 (sold for 9.80)

Bought to Close TSLA SEP 25 2020 360.0 Put @ 4.00 (sold for 4.00)

Sold TSLA OCT 2 2020 325.0 Put @ 5.50

Sold TSLA OCT 2 2020 310.0 Put @ 3.80

WDC

Western Digital has given back almost all of yesterday’s big up move.

Two pieces of news yesterday:

Craig-Hallum analyst Christian Schwab upgrades Western Digital (NASDAQ:WDC) from Hold to Buy and raises the price target from $44 to $62.

Western Digital shares have sprung to life amid speculation that a corporate reorganization announced on Tuesday could be a prelude to a split into two companies, one focused on disk drives and the other on flash memory products.

Western Digital (ticker: WDC) said late Tuesday that it had created two separate business units, one focused on drives and the other on flash. The company also announced that it had hired a former Symantec and Cisco executive, Robert Soderbery , as general manager of the flash unit — and that it was looking for a leader for the hard drive business.

The company gave no indication that it planned to divest or spin either of the two businesses, but some analysts think CEO David Goeckeler may be laying the groundwork for major structural change at the company.

LABU

The puts get interesting around the $40 area.

A double bottom there in June and in August.

Trying for a 40/30 diagonal Bull Put Spread.

SPY Diagonals

Sold SPY Sep 28 2020 331 Calls at $0.56 and $0.66

Sold 1 SPY Sep 30 2020 332 Call at $1.04

Sold 1 SPY Oct 02 2020 335 Call at $1.05

Replacing some of the short calls that expired yesterday.

#DoubleDip

SPY ran from 320 to 324 after a lower open.

ADBE TDOC

#ShortPuts – A couple late fills…

Bought to Close ADBE SEP 25 2020 440.0 Put @ .75 (sold for 2.44)

Bought to Close TDOC SEP 25 2020 187.5 Put @ .43 (sold for 2.30)

TSLA

ShortStrangles – Booking for a small profit. Covers my probable .55 loss in the iron fly.

Bought to Close TSLA SEP 25 2020 350.0/570.0 Strangle 3.35 (sold for 4.10)

SPX trades

#SPX1dte STOPPED $SPX Sept 23rd 3240/3220 put spreads for 1.55. Condors sold yesterday for 1.20

#SPX7dteLong Expiring: $SPX Sept 23rd 3335/3315 put spreads for max credit of 20.00. Condors bought last Thursday for 17.55

VXX

Sold VXX Sep 25 2020 30.50 Calls at $0.13.

Balancing out short puts.

Hedged with Nov long calls.

LABU

#ShortPuts – Adding shorter term but slightly higher strike. At the expected move near recent lows and below the 200ma.

Sold LABU OCT 02 2020 45.0 Put @ 1.32

TRADES:

AAPL BTO STOCK @109.47, 109.65, 109.67, In increments of 25 shares each.

Closing DOCU

Bought to close $DOCU 10/16 180/170 bull put spread @ .90. Sold for 2.28 on 9/11.

Vacay

In our first attempt to “getaway” since this whole mess started, I will be away with the wife for two nights in a forest cabin. No internet or cell signal. We leave today after the market and will return Friday, so I will be logging in before Friday’s close to place a Monday trade. Please watch over Bistro while I’m gone!

ULTA, Last week I called…

ULTA, Last week I called ULTA a pig. I am sorry that I insulted pigs. I hope to get out of this stock around 2025 if I am lucky.

NFLX

#ShortPuts – Still staying very short term. Selling at the expected move and below recent lows. Also a couple weeks prior to earnings…

Sold NFLX OCT 02 2020 450.0 Put @ 3.60

DOCU

#ShortPuts – Bought to Close DOCU SEP 25 2020 177.5 Put @ .10 (sold for 2.50)

SPY

Sold 1 SPY Sep 25 2020 334.00 Diagonal Call @ 1.16.

I have SPY 332, 333, & 334 short diagonal calls hopefully expiring today

WDC

Big move in WDC this morning. Up almost 10%

Wrote my covered Calls way too early.

Sold WDC Sep 25 2020 41 Calls at $0.22

TSLA

#ShortStrangles – Hopefully this won’t get interesting…

Sold TSLA SEP 25 2020 350.0/570.0 Strangle @ 4.10

SPX 1-dte

#SPX1dte Sold to Open $SPX Sept 23rd 3220/3240-3375/3395 iron condors for 1.20, IV 18.5%, SPX 3315, deltas -.07,+.05

TSLA

#IronFlies – Just for fun playing this as a big dud with little movement. Risk 55 to make 945.

Sold TSLA SEP 25 2020 415.0/425.0/425.0/435.0 Iron Fly @ 9.45

Battery Day

WFC

Another tiny diagonal – puts this time – a bit longer life

Bought WFC Dec 18 2020 17.50 Puts / Sold Oct 16 2020 22.00 Puts @ 0.12 Credit.

The short strike is right at the March/April lows for the stock.

#FallingKnife

NVDA

#ShortPuts – At the expected move and below the 50ma…

Sold NVDA OCT 02 2020 450.0 Put @ 4.33

KSS SLB tiny diagonals

Bought to open KSS Nov 20 2020 32.50 Calls/ Sold KSS Sep 25 2020 22.50 Calls @ 0.06 Credit

Bought to open SLB Jan 15 2021 27.50 Calls/ Sold SLB Sep 25 2020 18.00 Calls @ 0.04 Credit.

I have long stock in both these names but I have not written covered calls on them for this week yet.

Let’s see how the spreads work out in the next few days.

#closing PTON Sept.10, sold an…

#closing PTON

Sept.10, sold an Oct.16, 65/70 put spread for 1.18, bought today for .45

SPX 7-dte

#SPX7dteLong Bought to Open $SPX Sept 28th 3275/3295-3305/3325 condors for 17.70, with SPX at 3298.

#closing ROKU Sept. 4 sold…

#closing ROKU

Sept. 4 sold 140/145 put spread for 1.75, bought today on the big jump for .35

TSLA

#ShortPuts – Adding one…

Sold TSLA SEP 25 2020 360.0 Put @ 4.00

NFLX put spread

Sold to open $NFLX 10/16 465/455 bull put spread @ 3.45. Short strike 36 delta. IV rank 32.

SPY diagonal

Sold SPY Sep 23 2020 332.00 Calls at $0.43 against already long calls in October.

SPX-7 dte

#SPX7dteLong Expiring today: $SPX Sept 21st 3410/3390 put spreads for max credit of 20.00. Condors bought last Tuesday for 17.35.

NOTE: I’m not buying one for this Friday’s expiration as I will be on a getaway Wednesday afternoon until Friday noon without internet.

LABU

#ShortPuts – Adding at lower strikes…

Sold LABU OCT 09 2020 40.0 Put @ 1.20

PYPL short puts

Sold to open $PYPL 10/16 170 puts @ 3.80. Stock is up nicely on a really weak day in the market. Delta 27, IV rank 41.

There was a good article this weekend in Barron’s on how Covid killed cash (it was on its way out before all this but the pandemic is just speeding things up). Some interesting takes on how to play it with $PYPL getting the most positive mentions. They also like $SQ $V and $MA among others. $PYPL and $SQ are both up today, not being dragged down by the ties to pandemic-reduced transaction volume that $V $MA have.

An alternative trade: 10/16 170/160 bull put spread for around 2.00.

Insurance Stocks

Taking it on the chin today

UNM -6.9%

LNC -7.4%

PRU -5.5%

AIG -4.5%

All pay nice dividends

Markets

#watchlist

OMC – Forward P/E 9.63 DivYield 5.04% 52WeekLow 46.37

T – Forward P/E 8.97 DivYield 7.19% 52WeekLow 26.08

PBCT – Forward P/E 11.03 DivYield 6.77% 52WeekLow 9.37

XOM – Forward P/E 24.84 DivYield 9.36% 52WeekLow 30.11 (Dividend cut candidate??)

STX – Forward P/E 9.28 DivYield 6.55% 52WeekLow 39.02

ULTA, STO January 300 call…

ULTA, STO January 300 call at 3.30, I still own this pig from an earnings trade last year so, I keep selling covered calls. My cost basis is $311 and it is only on 100 shares so I guess I am lucky it is not more shares.

#shortputs DKNG Sold Oct. 9,…

#shortputs DKNG

Sold Oct. 9, 41 put for .80, stock at 51, down 4 something today

SPY

#ShortPuts – Another starter…

Sold SPY OCT 16 2020 295.0 Put @ 2.30

LABU

#ShortPuts – Back in with a starter…

Sold LABU OCT 09 2020 42.5 Put @ 1.35

WBA

Reversed the bad assignment from Friday on the 36.50 Call by rebuying the stock @ 36.44 on the open.

Sold 1 WBA 09/25/2020 37.0 Covered Call @ 0.42 & Sold 1 WBA 09/25/2020 37.50 Diagonal Call @ 0.34.

WDC Puts

Sold WDC 09/25/2020 33.50 Puts @ 0.17. The strike is about equal to the post-earnings low.

Hedged with October 30 puts already long.

Closing AMAT

Bought to close $AMAT 10/16 50 puts @ .72. Sold for 1.60 on 9/8.

SPLK TDOC TSLA VXX

#ShortPuts #CoveredCalls – Staying really short term…

SPLK: Covered.

Sold SPLK OCT 02 2020 182.5 Call @ 2.15

TDOC: Going back in.

Sold TDOC SEP 25 2020 187.5 Put @ 2.30

TSLA: Rolling up slightly for a little more battery day risk. Premium similar to earnings here. 50ma and expected move now.

Rolled TSLA SEP 25 2020 350.0 Put to SEP 25 2020 375.0 Put @ 3.90 credit (9.80 total now)

VXX: Beer money on the volatility bounce.

Bought to Close VXX SEP 25 2020 25.0 Puts @ .71 (sold for .80)

#shortcalls SPY Sold Sept. 23,…

#shortcalls SPY

Sold Sept. 23, 335 call for .24 as part of diagonal.

SPX stopped

#SPX1dte Bought to close $SPX Sept 21st 3225/3205 put spreads for 2.40. Condors sold for 1.05 on Friday.

Expected-move stop point was 3260, so I got out on the bounce after this morning’s low.

Final trade/expirations

#SPX1dte Sold to Open $SPX Sept 21st 3205/3225-3390/3410 condors for 1.05

Expiring:

#SPX1dte Condor expired worthless, sold Thursday for .95

#SPX7dteLong Put side expired at full credit of 20.00, calls side sold this morning for .85, so 20.85 credit against 17.60 purchase; 3.15 profit

#Earnings $CHWY 57.5/56.5 put spreads, expire ITM for .30 loss. This was a roll but it can’t get off its ass. Walking away. Total loss on two trades: .70

OptionsExpiration

BOOT 20 put

GPS 16 put

SPY 345 short call part of diagonal

NTAP jade lizard

AMD jade lizard

DKNG 30 put

M 8 call covered

WBA 39 call covered

CNQ 21 call covered

MRO 6 call covered

CCL 18 call covered

Options Expiration

#OptionsExpiration – A few…

SLB 19 Calls (sold for .85)

TDOC 180 Put (sold for 2.60)

UVXY 21 Calls (sold for 3.05)

VXX

Forty minutes on hold to get to a trader at Fidelity. 😦

Bought to close 2 VXX 09/18/2020 24.50 Puts @ 0.15 two minutes after the close.

Originally sold @ 0.91

OSTK SPCE STX UVXY VXX

#ShortPuts #CoveredCalls – A few more.

OSTK: Covered Calls and adding a short put.

Rolled OSTK SEP 18 2020 70.0 Call to SEP 25 2020 70.0 Call @ 3.30 credit (12.95 total now)

Sold OSTK SEP 25 2020 67.5 Put @ 2.70

SPCE: Covered Calls.

Rolled SPCE SEP 18 2020 15.0 Calls to OCT 16 2020 15.0 Calls @ .51 credit

STX: Covered rolling hoping I don’t get taken out of the divvy.

Rolled STX SEP 18 2020 46.0 Calls to OCT 9 2020 46.0 Calls @ .20 credit

UVXY: Replacing this week’s expiation. Hedging my hedge selling slightly ITM.

Sold UVXY SEP 25 2020 17.0 Calls @ 2.25

VXX: Rolling another week.

Rolled VXX SEP 18 2020 26.0 Puts to VXX SEP 25 2020 25.0 Puts @ .01 credit

OSTK

ShortPuts – Booking the ones sold this morning. Taking the nice one day gain…

Bought to Close OSTK SEP 25 2020 65.0 Puts @ 1.60 (sold for 2.50)

TQQQ, I closed out all…

TQQQ, I closed out all of my short positions for December..35,40,45,and 50 puts at a nice profit. My thought is that the market expects a Biden win and his tax proposals are not good for the market. I am now on the sidelines until we get more clarity after the election.

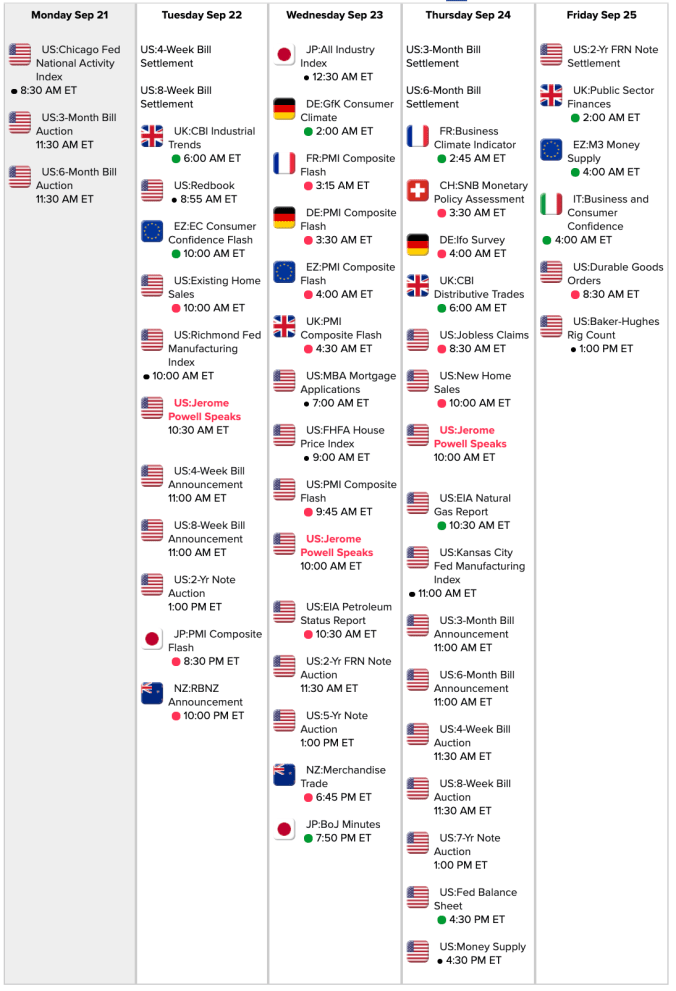

Econ Calendar for week of 9/21/20

#FOMC Jerome Powell scheduled to speak both Wednesday and Thursday at 10am ET

Link to calendar: https://research.investors.com/economic-calendar/

VXX – More calls

A quick rally in VXX up to 24.98, so I added a couple more calls for next week.

Sold 1 VXX 09/25/2020 28.50 Diagonal Call @ 0.58

Sold 1 VXX 09/25/2020 30.50 Diagonal Call @ 0.38

I’ve used up all my extra long calls, so I will have to cover something for this week if I want to sell any more.

VXX Puts

Another roll

Bought to close 09/18/2020 25.5 Puts / Sold 09/25/2020 24.5 Puts @ 0.03 Credit plus a one point lower strike for next week.

VXX at 24.34

Now left with just the 24.0 and 24.50 puts for today

VIAC Calls

Bought to close VIAC 09/18/2020 30.0 Diagonal Calls / Sold VIAC 09/25/2020 31.0 Diagonal Calls @ 0.18 Credit plus a big point higher on the short strike.

I have short VIAC 31.0 Diagonal Calls expiring today as well

VXX Calls

Sold VXX Sep 25 2020 29.0 Calls @ 0.37 for next week.

VXX @ 24.30

Letting similar calls for today expire.

Paired with Oct/Nov/ Dec long calls

#coveredcalls CC Bought 100 shares,…

#coveredcalls CC #longcallspread BA #shortstrangles JD

CC Bought 100 shares, sold Oct. 2, 21.50 call for 20.55.

BA bought Oct. 23, 165/170 call spread for 2.23

JD sold Nov. 20, 62.50/90 for 3.32

#tastytradefollow

VXX puts Rolls

First of my Put rolls today

Bought to close 09/18/2020 26.50 Puts / Sold 09/25/2020 26.00 Puts @ 0.08 Credit plus a half point lower strike for next week.

VXX at 24.12

Edit:

Another roll

Bought to close 09/18/2020 25.0 Puts / Sold 09/25/2020 24.0 Puts @ 0.04 Credit plus a one point lower strike for next week.

VXX at 24.18

WBA Roll

Bought to close 1 WBA 09/18/2020 36.0 Covered Call / Sold 1 WBA 09/25/2020 36.50 Covered Call @ 0.07 Credit plus a half point better short strike

SLB AAL USO Rolls

STO AAL Sep-25-2020 $14 #CoveredCalls @0.29

Holding AAL Sep-18-2020 $14 call sold last week, should expire today.

STO SLB Oct-16-2020 $20 #CoveredCall @0.67

Holding SLB Sep-18-2020 $20 Call Sold @1.48, should expire today.

STO USO OCT-16-2020 $30 #CoveredCalls @0.70

Holding USO Sep-18-2020 $30.5 Call Sold @0.38 on 9/3, Should expire.

All small positions (and I was kinda hoping they’d all be ITM, so I could move on… )

SPX 7-dte

#SPX7dteLong Sold to close $SPX Sept 18th 3400/3420 call spreads for .85. Relying on the 3390/3370 put side for the big profit today. Condors bought Monday for 17.60.

TQQQ, BTC THe September 18,…

TQQQ, BTC THe September 18, 70 puts at .01, sold at 2.51

It is odd that I am not getting filled on my 65 puts or 80 puts yet.

Finally got filled on my 65 puts at .01

OSTK

#ShortPuts – Just for something to do. Nice premium in this one…

Sold OSTK SEP 25 2020 65.0 Puts @ 2.50

SPY and triple witching

An unwelcome surprise this morning.

Assigned on 09/18/2020, 09/21/2020 and even 09/25/2020 short diagonal calls on SPY because of an Ex-Div on the ETF.

Now I have to cover the short stock.

Always a messy business.

Plus I have to figure out how to make back the dividend I now owe the guys that exercised me.

AND today is triple witching day in the options market.

SIGH 😦

SPX 1-dte

#SPX1dte Sold to Open $SPX Sept 18th 3225/3245-3435/3455 condors for .95, IV 25.8%, SPX 3353, deltas -.06,+.06

EWZ extension

I love the issuance of new LEAPs. The process of price discovery is in its infancy, and nobody quite understands fair value (I certainly don’t!). An EWZ ATM 7 DTE straddle (my selling vehicle du jour) can generally be sold for roughly $1.25.

If I look at my current asset to sell straddles against – the Jan 2022 $27 call / $37 put strangle which cost $16.70, I just closed that out for $16.10 and then BTO the Jan 2023 same strike strangle @ $18.75.

So I get 52 weeks additional selling opportunities at around $1.00 (being conservative) for an extra $2.65. That seems to imply that 3 winning weeks of straddle sales pays for the strangle extension.

Maybe XMAS does come early?

SPX 7-dte

#SPX7dteLong Bought to Open $SPX Sept 23rd 3315/3335-3345/3365 condors for 17.55, with SPX at 3338.