BTC September 25, 90 puts at 1.10, sold at 4.05

I may not have another trade until after the election.

Monthly Archives: September 2020

VXX New Diagonal Put

Bought to open Jun 18 2021 10.0 Puts / Sold Sep 25 2020 23.50 Puts @ 0.07 Credit.

Looking to add to my stable of “free” 2021 long puts

CC Bull engulfing and high…

CC Bull engulfing and high for the year today. Broke thru top Bollinger Band too.

TRADES: Fools rush in where…

TRADES: Fools rush in where angels fear to tread. ;>)

AAPL BTO STOCK @109.68

VMW BTO STOCK @142.24

VMW BTO STOCK @141.25

VMW BTO STOCK @141.80

VMW BTO STOCK @142.35

VXX – preparing for November

Bought to open 12/18/2020 80.0 Call @ 0.70

Bought to open 12/18/2020 70.0 Call @ 0.90

So I guess the 09/18/2020 calls I sold this morning covers part of the cost of these.

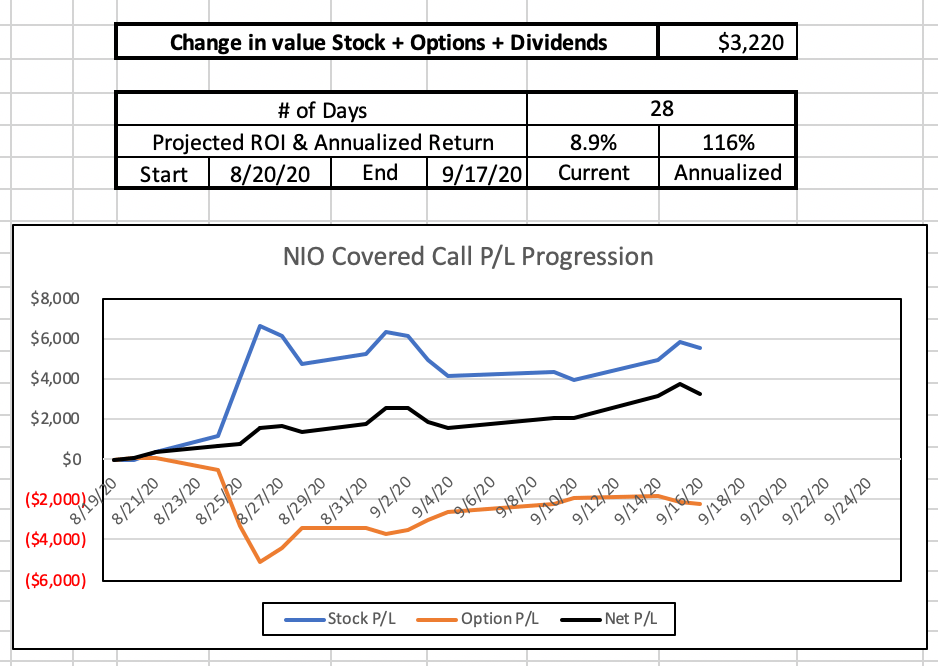

NIO Covered Call

NIO is looking like a good stock for CC strategy. Lots of volatility on the stock, good premiums on the options. 8.9% return in 29 days…..so far. Had 1,000 shares called away at $17.50 and replaced them and doubled down with 2,000 shares and covered with Sep 18 $18.

SPXL

Rolled Sep-18-2020 58 #Covered Calls // Oct-16-2020 @1.65 Credit.

#shortputs OXY Sold Oct. 16,…

#shortputs OXY

Sold Oct. 16, 10 put for .26. On Oct. 15 I will receive a dividend payment of .01 for my underwater shares!

AMAZ CC Sep 18 $3200 Roll down to $3000 for $43.10 credit

Defensive roll down to protect what has been a profitable trade over the past 123 days. $3200 was down to $2 offering minimal downside protection. Over the past two weeks I have rolled down from $3400 to $3300, $3200 and now $3000. Roll downs have helped ….much more fun rolling up!

VXX on the open

Sold VXX Sep 18 2020 28.5 Calls @ 0.23

Sold VXX Sep 18 2020 29.0 Calls @ 0.17

VXX open 25.73

ADS

Sold ADS 09/18/2020 51.0 Covered Calls @ 0.10. It’s all the market would give me.

WBA

In an effort to coax my WBA puts to stay out of the money I sold a new Bear Call Diagonal

Bought to open WBA Oct 30 2020 41 Calls / Sold WBA Sep 18 2020 36.50 Calls @ 0.05 Credit.

If the puts expire, I’ll be happy to roll the short Calls.

TQQQ

#ShortPuts – Starter…

Sold TQQQ SEP 25 2020 110.0 Put @ 2.36

SPY Last roll

Bought to close SPY Sep 16 2020 345 Call @ 0.02. There were 11,000 contracts bid at 0.01 ahead of me.

(This one worked although most have not in this endless bull market)

Replaced it with a Sep 23 2020 345.0 Diagonal Call @ 1.18

SPY is at 340.08

XBI

BTC September 18, 95 put at .01, sold at 1.05

NVAX Puts

#shortputs

$NVAZ STO 9/18 110 put at .85

SPY Roll

Rolled my 09/16/2020 340.0 Diagonal Call out 2 days to the 09/18/2020 341.0 Call @ 0.39 Credit plus another point higher on the short strike

SLB

Sold SLB 09/18/2020 19.50 Covered Calls @ 0.16 against a small part of my long stock.

SLB is 19.20

SPY Roll

Rolled my 09/16/2020 334.0 Diagonal Call out 2 days to the 09/18/2020 334.0 Call @ 0.39 Credit.

Just waiting for a bigger pullback

AAL

Sold 1 AAL 09/18/2020 Covered Call @ 0.12

Sold 2 AAL 09/18/2020 Diagonal Calls @ 0.15 against half my long calls

AAL is 13.79

TRADES:

MGM BTO STOCK @22.87

CZR BTO STOCK @57.85

NVDA

#ShortPuts – Jumping back in short term on today’s weakness. Outside the expected move and at the 50ma.

Sold NVDA SEP 25 2020 465.0 Put @ 3.05

DDOG

I did one of my combo trades for October 16, .65 debit.

BTO 1,90 call

STO 2, 100 call

BTO 1 105 call

STO 1, 80 put

TSM

BTO 1, 85 call

STO 2, 95 call

BTO 1, 100 call

STO 1, 75 put, for a total debit of 1.50

OSTK

#ShortPuts – Taking another one off for safety…

Bought to Close OSTK SEP 18 2020 75.0 Put @ 3.00 (sold for 4.00)

TSLA

#ShortPuts – Outside the expected move and down at the 50ma. Battery day on the 22nd will determine how this goes. IV is almost like an earnings trade.

Sold TSLA SEP 25 2020 350.0 Put @ 5.90

SQ NVAX PENN Calls Rolled

#coveredcalls

$SQ BTC 9/18 144 calls and STO 9/25 149 calls at 1.51 debit. Stock at 153.16

$NVAX BTC 9/18 110 calls and STO 9/25 115 calls at 1. credit. Stock at 110.17

$PENN BTC 9/18 62 calls and STO 10/2 70 calls at 2.50 debit. Stock at 70.80

ADBE ADSK FSLY NFLX NVDA OSTK TDOC

#ShortPuts #ShortStrangles – A lot of these nice bounces seem to be running out of steam (unless JP comes through again! 🙂 🙂 ) . In any case taking a lot of risk off today with some good profits.

ADBE: Earnings and post earnings.

Bought to Close ADBE SEP 18 2020 460.0 Put @ 1.65 (sold for 3.50)

Sold ADBE SEP 25 2020 440.0 Put @ 2.44

ADSK: Nice bounce and happy to be out with decent profit.

Bought to Close ADSK SEP 18 2020 225.0 Put @ .67 (sold for 2.62)

FSLY: Completely out of this one now.

Bought to Close FSLY SEP 18 2020 75.0 Put @ .40 (sold for 2.20)

NFLX: Nice profits but horrible management on a greedy 505.0 strike bonus call I sold in a strangle. Rolled it into a new strangle for next week.

Bought to Close NFLX SEP 18 2020 450.0 Put @ .50 (sold for 2.85)

Bought to Close NFLX SEP 18 2020 475.0/550.0 Strangle @ 2.55 (sold for 10.25)

Rolled NFLX SEP 18 2020 505.0 Call to SEP 25 2020 455.0/545.0 (2×1) Strangle @ even

NVDA: Very happy!

Bought to Close NVDA SEP 18 2020 490.0 Put @ 1.65 (sold for 11.75)

OSTK: Nice bounce and happy to be out with decent profit.

Bought to Close OSTK SEP 18 2020 75.0 Put @ 2.31 (sold for 4.10)

TDOC: Completely out of this one now.

Bought to Close TDOC SEP 18 2020 180.0 Put @ .55 (sold for 2.60)

VXX UVXY

Just noticed the Jan 2023 Options are now trading for VXX and UVXY.

The next time the VIX doubles, the lowest strike puts will make for interesting buys.

TRADES:

OSTK STO 9/18/20 78.0 CALL @2.40

OSTK STO 9/18/20 80.0 CALL @2.20

SPX 7-dte

#SPX7dteLong A little stuck on today’s expiration, so going to try a leg out…

Sold to close $SPX Sep 16th 3425/3445 call spreads for 5.20.

Will look to sell puts on a swing down. I usually suck at legging out, so no high hopes.

Condors bought for 17.75 last Thursday.

AAPL

Quote of the day:

Apple stumbled following the new iWatch and iPad launches y’day. Maybe it’s time they actually invented something new rather than just fleecing Apple Addicts with product upgrades every couple of years…

SPX 1-dte

#SPX1dte Sold to Open $SPX Sept 16th 3295/3315-3455/3475 condors for 1.25, IV 18.9%, SPX 3398, deltas: -.05,+.07.

WBA

Sold the stock I was put on Friday at 35.50 (net cost after put premium of 34.97) just now @ 35.56.

Putting the cash back into my account.

I’m still short diagonal puts for this week so I won’t be upset if the stock keeps running.

SPX 7-dte

#SPX7dteLong Earlier, BTO $SPX Sept 21st 3390/3410-3420/3440 condors for 17.35, with SPX at 3413.

VIAC

Sold 1 VIAC 09/18/2020 31.0 Diagonal Call @ 0.36.

The long hedge is an October 30th 36.0 Call I was already long.

PYPL UNH BWB

$PYPL BTO Oct 02, 190 / 185 / 175 Broken Wing Put Butterfly for 0.69 credit.

Breakeven on the downside at exp $179. No upside risk (keep credit).

$UNH BTO Oct 02, 315 / 310 / 300 Broken Wing Put Butterfly for 1.01 credit.

Breakeven on the downside at exp $304. No upside risk (keep credit).

DKNG, I unwound the October…

DKNG, I unwound the October 16, combo for a credit of 2.30 which I put on for a debit of .65, I still have a combo on PENN that I put on for a debit of 1.60

I also unwound the PENN combo at 4.70 credit , put on for a debit of 1.60, out of all my gambling options.

ADBE Earnings

#ShortPuts #Earnings – Going aggressive at the 50ma and the expected move. Was going to go out an extra week and sell down near the 100ma but those quotes were messed up on Fidelity.

Sold ADBE SEP 18 2020 460.0 Put @ 3.50

TQQQ

#ShortPuts – For safety…

Bought to Close TQQQ SEP 18 2020 115.0 Put @ .75 (sold for 2.75)

Bought to Close TQQQ SEP 18 2020 120.0 Put @ 1.25 (sold for 2.06)

FB

#ShortPuts – Taking beer money on the small bounce…

Bought to Close FB SEP 18 2020 270.0 Put @ 3.85 (sold for 4.05)

FSLY LABU

#ShortPuts – Booking a few more…

FSLY:

Bought to Close FSLY SEP 18 2020 70.0 Put @ .15 (sold for 1.20)

LABU:

Bought to Close LABU SEP 18 2020 40.0 Put @ .05 (sold for 1.50)

Bought to Close LABU SEP 18 2020 45.0 Put @ .15 (sold for 2.30)

Bought to Close LABU SEP 25 2020 40.0 Put @ .23 (sold for 1.65)

Bought to Close LABU SEP 25 2020 40.0 Puts @ .21 (sold for 1.45)

Bought to Close LABU OCT 2 2020 35.0 Put @ .20 (sold for 1.15)

#earnings #rolling CHWY Sept. 10,…

Sept. 10, sold a #jadelizard with long put protection, actually an iron condor, 55/59.50/62.50/64 for 2.13. Today sold the long put and rolled the short to Oct. 16.

NFLX

#ShortStrangles – Added another call for additional premium…

Sold NFLX SEP 18 2020 505.0 Call @ 1.85

Strangle is now 475 put and 600, 550, and 505 calls (10.25 total)

TSLA

#ShortPuts – Out most of the day but did manage one more trade. Taking this off after after selling it Friday.

Bought to Close TSLA SEP 18 2020 330.0 Put @ 1.00 (sold for 5.40)

NVAX Calls / MRVL Straddle

#coveredcalls

$NVAX STO 9/18 110 calls at 2.60

#shortstraddle

$MRVL STO 9/25 40 straddle at 2.30

VXX Calls

Sold VXX Sep 18 2020 30 Calls at $0.31

Sold VXX Sep 18 2020 30.50 Calls at $0.27

Sold VXX Sep 18 2020 31 Calls at $0.24.

Paired with a boatload of short puts for this week and hedged with Oct/Nov long calls

VXX is at 25.07

SPX Iron Condor

Sold $SPX Sep 21: 3260 / 3280 – 3500 / 3520 Iron Condor @ $5.15

Call it Fat Finger Freud – I meant to sell the October 02 strikes! I was thinking of the SPX calendars I was in the process of selling using the Sep 21 strikes. But hey, “The best laid schemes o’ mice an’ men / Gang aft a-gley.”

SPX stopped

#SPX1dte BTC $SPX Sept 14th 3415/3435 call spreads for .80. Was away with the order put in, would have ridden it lower if I could have managed it. Sold for 1.20 on Friday.

VXX

Bought to close all my VXX Sep 18 2020 80.00 Calls at $0.01.

During the last VXX run I liquidated a long in this contract and turned around and shorted it as a low risk sale against October/November longs.

I’m now free of this short and ready for another VIX spike.

SPY Call Rolled

Bought to close 1 SPY 09/14/2020 333.0 Diagonal Call / Sold 1 09/16/2020 334.0 Diagonal Call @ 0.04 Credit Plus one more point higher on the short strike.

The long side hedge is an October 16 2020 345.0 Call

Closing LABU

Bought to close 10/16 30 puts @ .40. Sold for 2.00 on 9/4. I’m completely out of this underlying now but they’ve all been profitable since I started dabbling (thanks @fuzzballl !) Will wait for a pullback to put any new positions on.

HAL Put Rolled

#shortputs

$HAL BTC 9/18 16 put and STO 9/25 16 put at added .o5 credit.

Closing BABA

$BABA Bought to close 9/18 270/280/290 iron butterfly @ 7.04. This was an adjusted position that began as a 225/235/280/290 iron condor that I had to start playing defense on, a few days after I entered on 8/20. The bull put spread was rolled up 3 times until the position became an iron fly with 7.16 in premium taken in. Closing today for 7.04 allows me to take the whole thing off for near breakeven.

SPX calendar

Sell Sep 21 / Oct 05 $3400 SPX call calendar @ $26.45 debit.

TDOC Put Closed / SQ Calls / KR Put Rolled

#shortputs

$TDOC BTC 9/18 180 put at 1.40. STO at 3.10. Thank you @fuzzballl

$KR BTC 9/18 35 put and STO 9/25 put at .11 added credit

#coveredcalls

$SQ STO 9/18 144 call at 2.40

CINF

Goes EX-Dividend for 0.60 tonight.

I’ve got CINF Sep 65.0 Covered Calls I suspect will be assigned early. Almost impossible to roll out a month for any premium so I guess I’ll take the cash influx and the profit on the stock.

I also have a Sep 70/75 Bull Call spread.

I did exercise the long side to prevent the short side getting assigned and costing me the dividend.

Edit:

The best outcome is if they don’t exercise the short 75.0 Call and I get the dividend on the long stock and they still take me out of the stock position at 75.0 on Friday.

LABU

#ShortPuts – Bought to Close LABU SEP 18 2020 40.0 Put @ .10 (sold for 1.30)

SPX 7-dte

#SPX7dteLong Sold to close $SPX Sept 14 3360/3340 put spreads for 1.05. Banking on the 3370/3390 call side for close. Condors bought for 18.25 last Tuesday.

Bought to Open $SPX Sept 18th 3370/3390-3400/3420 condors for 17.60, with SPX at 3395.

#SPX1dte – watching call side for today’s short condor closely as stop level has been breached.

#rolling #longcalldiagonals SPY Rolled Sept….

#rolling #longcalldiagonals SPY

Rolled Sept. 16, 345 call to Sept. 18 for .48, long is Oct. 23, 360

VIAC – They really wanted that dividend

Not only were my VIAC 09/11 23.00 Covered Calls assigned, but also my VIAC 09/18 23.00 Covered Calls, and even my 09/25 24.00 Diagonal calls (had to cover the resulting short this morning).

All that for 0.24

TSLA

#ShortPuts – Late fills…

Bought to Close TSLA SEP 11 2020 350.0 Put @ .10 (sold for 3.50)

Sold TSLA SEP 18 2020 330.0 Put @ 5.40

Expiration

#optionsexpiration

$AAPL 122.5 call

$SQ 145 call

$MRVL 38 put

VXX last put rolls

Bought to close VXX 09/11/2020 26.50 Puts / Sold VXX 09/18/2020 25.50 Puts @ 0.25 Credit

Bought to close VXX 09/11/2020 26.00 Puts / Sold VXX 09/18/2020 25.00 Puts @ 0.54 Credit

Bought to close VXX 09/11/2020 25.50 Puts / Sold VXX 09/18/2020 24.50 Puts @ 0.60 Credit

At least all my short calls will expire shortly 🙂

LULU

Roll $LULU Sep-18-2020 310/320 #BuPS // Sep-25 @0.23 debit

SPX trades

#SPX1dte Sold to Open $SPX Sept 14th 3205/3225-3415/3435 condors for 1.20, IV 17.07%, SPX 3341, deltas: -.06,+.06

#SPX7dteLong Sept 11th 3435/3415 put spreads expiring ITM for max credit of 20.00. Condors sold last Friday for 17.90.

(not so) Bonus trade: Sept 11th 3200/3220 call spreads expire ITM for max debit of 20.00. Sold for 17.25 last week, so loss of 2.75.

CHWY roll

$NVTA Put Closed

#shortputs

$NVTA BTC 9/18 25 put at .10. STO 8/11 at 1.05

SPY Call

One of these finally worked.

Bought to close 1 SPY 09/11/2020 339.0 Call @ 0.02. Sold this on Wednesday @ 4.35 on a rollup.

Replaced it with a short 09/16/2020 340.0 Call @ 1.17.

The long call it is paired against is a 10/16/2020 346.0 Call.

AMZN iron condor

Sold $AMZN 10/16 2650/2700/3500/3550 iron condor @ 14.39. Almost 30% the width of the strikes (short puts/calls at 15 and 18 delta). IV rank 52.

Econ Calendar for week of 9/14/20

#FOMC Wednesday afternoon

Link to calendar: https://research.investors.com/economic-calendar/

STX

#CoveredCalls – A new batch replacing this week’s. Should have this position long enough to capture the dividend the following week.

Sold STX SEP 18 2020 46.0 Calls @ .91

UVXY VXX

#ShortPuts – Rolling hedges…

Rolled UVXY SEP 11 2020 24.5 Puts to SEP 18 2020 23.5 Puts @ .15 credit (1.25 total now)

Rolled UVXY SEP 11 2020 24.0 Puts to SEP 18 2020 23.0 Puts @ .22 credit (1.05 total now)

Rolled VXX SEP 11 2020 27.0 Puts to SEP 18 2020 26.0 Puts @ .21 credit (.82 total now)

VIAC Roll

Bought to close VIAC 09/11/2020 29.0 Calls / Sold VIAC 09/18/2020 30.0 Calls @ 0.02 Credit but another point higher on the short strike for just one more week

The new short is above the recovery high on the stock and the stock goes Ex-Div next week too which should help it down by next Friday.

VXX

Bought to close VXX 09/11/2020 27.0 Puts / Sold VXX 09/18/2020 25.50 Puts @ 0.08 Credit plus an additional 1.5 points lower on the short strike.

Filled when VXX hit 26.25

WBA

New Diagonal Put spread

Sold WBA 09/18/2020 35.0 Puts / Bought WBA 10/30/2020 32.0 Puts @ 0.18 Credit