Sold SLB 07/24/2020 21.0 Diagonal Calls @ 0.16 with the stock at 19.60.

#Earnings this week.

I also have a large covered call position @ 20.50 strike

Monthly Archives: July 2020

TQQQ

STO December 18, 45 puts at 2.78

LABU

#ShortPuts – Selling below the 50ma and outside the expected move…

Sold LABU AUG 14 2020 50.0 Puts @ 1.50

TQQQ

#ShortPuts – This was a #TakeOneForTheTeam but it didn’t help much…

Bought to Close TQQQ JUL 24 2020 95.0 Put @ .10 (sold for 2.40)

Markets

SPX trades

#SPX7dteLong Bought to Open $SPX June 27th 3225/3245-3255/3275 condors for 16.75, with SPX close at 3251.

Expired with max 20.00 credit: June 20th 3190/3210 call spreads. Condors bought for 17.40 last Monday.

#SPX1dte #RiskReversal expired worthless, keeping .35 credit from Friday.

EWZ

ShortPuts – Bought to Close EWZ JUL 31 2020 27.5 Puts @ .06 (sold for .76)

Markets

If you are not in Tech this market sucks

Change in market cap year-to-date

Amazon +$561 billion

Apple +$365 billion

Microsoft +$335 billion

Tesla +$203 billion

Google +$112 billion

JPMorgan -$138 billion

Wells Fargo -$125 billion

Bank of America -$115 billion

Exxon Mobil -$111 billion

Berkshire Hathaway -$90 billion

This has sent Bloomberg’s Fear-Greed indicator to its highest ever – above March 2000’s previous peak – and as @C_Barraud notes that these highs contrasted with a plunge in March that produced record weekly lows, surpassing those in December 2018 and May 2000.

CINF

BTC August 21, 50 puts at $0.30, sold at $2.00

Hat tip @optioniceman

TNA

#ShortPuts – A little bit of boredom and a little bit of hopefully #TakeOneForTheTeam …

Sold TNA AUG 21 2020 20.0 Puts @ .61

SPY Rolls

Bought to close SPY 07/20/2020 305.0 Call / Sold SPY 07/27/2020 305.0 Call @ 0.25 Credit.

Bought to close SPY 07/20/2020 315.0 Call / Sold SPY 07/27/2020 316.0 Call @ 0.12 Credit plus an extra point on the strike/

SPY is just pennies away from it’s highest close since February, so we are overdue for a correction.

#SPYLadder

XLK DiagBFly

BTO $XLK Jan 22: $90 call / $125 put long strangle @ $50

STO $XLK Aug 21: $110 short straddle @ $6.70

Minimum cash out value of the LEAP strangle is $35. Whatever happens I get to keep the $6.70 for the first (aggressive) sale of a straddle, so that leaves ($50 – $35 – $6.70) = $8.30 to finance over the next 550 days or $0.015 per day.

Given the volatility of the underlying it will be a roller coaster ride, but doable.

On this kind of trade I want to get the max premium out of the first sale (hence the straddle sale) – recognizing that an aggressive roll will be needed on one of the sides. For sure with XLK, future short term sales will be strangles not straddles.

T

#ShortPuts #Earnings – Earnings this week but not much premium. Going out to the monthlies and selling below the recent range. 8.3% divvy yield down there…

Sold T AUG 21 2020 28.5 Puts @ .52

#shortputs UNG Sold Aug. 21,…

#shortputs UNG

Sold Aug. 21, 9.50 put for .63

XBI

STO September 95 puts at 1.05

SOXL

BTC August 21, 55 puts at .05, sold at 2.90

LABU

#ShortPuts – Bought to Close LABU JUL 24 2020 47.5 Puts @ .08 (sold for 1.50)

VXX

Sold VXX 07/24/2020 28.50 Puts @ 0.36 with the stock at 30.15.

Sold against long 2021 and 2022 long Puts and replacing similar puts that expired Friday although at a lower strike.

#DoubleDip

SLB

Sold SLB 07/24/2020 20.50 Covered Calls @ 0.11 with the stock at 18.80.

#Earnings this week 07/24 BMO

Is it blasphemy to call THIS the best Rolling Stones tune?

Teaser clip for episode 10: InRocktrination.

MRNA NVAX Call Roll / TQQQ Close Put

#coveredcalls

$MRNA BTC 7/17 90 call and STO 7/24 95 call at extra 2.50 credit. Stock at 94.85 at days end. Will try to roll again.

$NVAX BTC 7/24 120 call and STO 7/31 130 call at debit of .25. Stock jumped to 140.49 during the day. Rolling again on Monday perhaps.

#shortputs

$TQQQ BTC 7/31 50 put at .10. Thank you @jsd501 AKA the King of QQQ’s. 😉

Dexcom Covered Call Diagonal $400/$420 Roll

Bizarre market. Friday….Diagonal roll up $20 for a $7.49 credit with the stock at $422. $36.84 of premium……where is this market heading????

MDLZ DiagBFly

BTC MDLZ July 17: 51 short straddle @ $3.18 (originally sold for $1.50)

STO MDLZ July 24: 53.5 short straddle @ $1.38

MDLZ showing some strength, may have to move to selling short term strangles rather than straddles.

Cover is the Jan 2022 long 40 put / 65 call strangle.

EWZ DiagBfly

#DiagonalButterfly

BTC EWZ July 17: 30 straddle @ $1.26 (originally sold for $2.04)

STO EWZ July 24: 31 straddle @ $1.40

So far so accommodating with EWZ remaining in a nice channel. Premiums are coming down (obviously with a lower VIX), so I will look to roll the Sep 18 long strangle to Jan 22 to extend the selling opportunities.

The short straddle is covered by a long EWZ Sep 18: 24 put / 30 call strangle.

Expiration

#optionsexpiration

$EWZ 29 put Thank you @fuzzballl

$WORK 30 put

$T 30 put

$NEO 30 put

$SNAP 21 put

$PTON 55 put

$SPCE 18 put

$MRNA 75 put

$PFE 34 put

$CODX 20 call

$FB 255 call

$PTON 63 call

$SPX 1 DTE Thank you @jeffcp66

$BYND 144/155 BUPS Expired Total loss.

$TSLA 1470/1490 BECS Expired Full full loss

$AMZN 2570/2590 BUPS Expired Full profit

$ZM 190/210 BUPS Expired Full profit

#assignment

$DFEN 18 put assigned. Basis 16.85. Stock at 11.90. Go aerospace, please.

$PFE 36 call called away

Upside to come

The #VIXIndicator fired a bullish signal at the close. This indicates the likelihood of a further move higher in the coming days or weeks.

SPX 1-dte & NFLX

#SPX1dte #RiskReversal for Monday. Placed as one trade with SPX at 3229, IV 13.7%, total credit: .35. Aggressive positioning based on Upside Warning:

Sold $SPX July 20th 3185/3165 put spreads for 2.07, ∆ -.17

Bought $SPX July 20th 3270/3285 call spreads for 1.72, ∆ +.14

Expiring: July 17th 3115/3135-3270/3285 condors, sold yesterday for 1.15.

#Earnings Also expiring, $NFLX July 17th 460/465-590/595 condors, sold yesterday for 1.446

VXX Put Rolls

Bought to Close VXX Jul 17 2020 31.5 Puts / Sold to Open VXX Jul 24 2020 30 Puts @ Net Credit of $0.08 plus a 1.50 drop on the short strike.

Bought to Close VXX Jul 17 2020 31.0 Puts / Sold to Open VXX Jul 24 2020 29 Puts @ Net Credit of $0.07 plus a 2.00 drop on the short strike.

My 30.50 and 30.0 Puts for today should expire shortly

TQQQ

#ShortPuts – No sense waiting 2 weeks for this. Commission free below .10 in this account.

Bought to Close TQQQ JUL 31 2020 50.0 Puts @ .08 (sold for 1.23)

VIAC Rolls

Bought to lose VIAC 07/17/2020 20.0 Covered Calls / Sold VIAC 08/07/2020 20.0 Covered Calls @ 0.25 Credit.

This will keep me in this low p/e highish dividend stock through earnings on the 6th of August.

Also Bought to close VIAC 07/17/2020 25.0 Diagonal calls / Sold VIAC 07/24/2020 26.0 Calls @ 0.24 Credit plus an extra point on the strike price.

SPX 7-dte

#SPX7dteLong Bought to Open $SPX July 24th 3205/3225-3235/3255 condors for 16.95, with SPX at 3230.

Expiring today: July 17th 3180/3200 call spreads for max of 20.00. Condors bought last Friday for 17.25.

VXX longs

#VXXGame Bought to open $VXX Aug 21st 65 calls for .50. Added to a large number of 85’s I have for same expiry. I have not yet sold against these, but will look to do on next down turn. I have a smaller number of long $UVXY 90 calls expiring today, average purchase price .47.

UVXY

#ShortPuts – Sold UVXY JUL 24 2020 25.5 Puts @ .58

VXX New Put Diagonal

Bought to Open VXX Jan 15 2021 15 Puts / Sold to Open VXX Jul 24 2020 30 Puts @ Net Credit of $0.12

UVXY (again)

#ShortPuts – Closing for safety. Looking for new sales now…

Bought to Close UVXY JUL 17 2020 28.5 Puts @ .50 (sold for .70 and .95)

UVXY

#ShortPuts – Taking small profits from the 29 strike. Still holding 28.5s for a probable roll.

Bought to Close UVXY JUL 17 2020 29.0 Puts @ .90 (sold for 1.17)

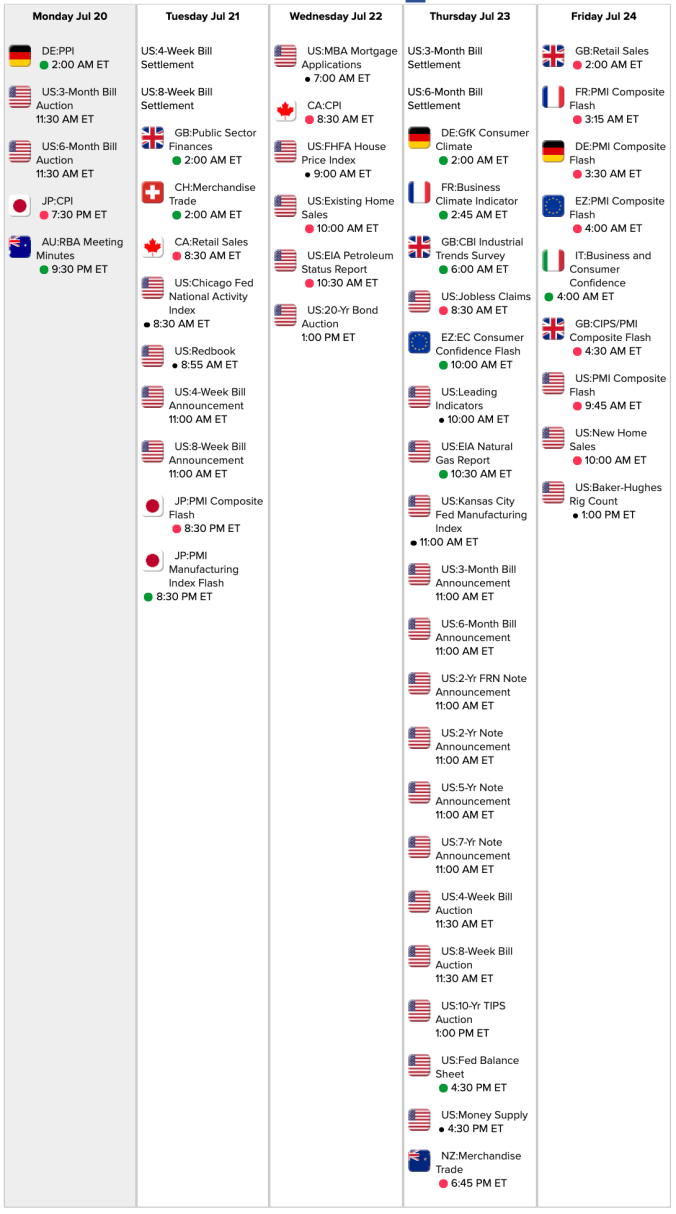

Econ Calendar for week of 7/20/20

EWZ NFLX NTAP OLED ROKU SLB VXX WYNN

EWZ: It keeps paying.

Bought to Close EWZ JUL 24 2020 27.5 Puts @ .05 (sold for .72)

NFLX: Still holding next week’s 450 short put.

Sold NFLX AUG 21 2020 400.0/600.0 Strangle @ 8.55

NTAP: Covered calls.

Bought to Close NTAP JUL 17 2020 45.0 Calls @ .02 (sold for .80)

Sold NTAP JUL 24 2020 45.0 Calls @ .71

OLED: Closed for tiny profit. Replaced with NFLX strangle.

Bought to Close OLED JUL 31 2020 145.0 Put @ 2.65 (sold for 2.90)

ROKU: Another one gone early.

Bought to Close ROKU JUL 24 2020 115.0 Put @ .06 (sold for 2.07)

SLB: Covered call roll with earnings next week.

Rolled SLB JUL 17 2020 18.5 Calls to JUL 24 2020 19.0 Calls @ .25 credit (1.65 total now)

VXX: Booked it earlier in the day.

Bought to Close VXX JUL 17 2020 31.5 Puts @ .37 (sold for .72)

WYNN: Stock will be assigned at about 88.05. Wanted to get it covered quickly. In an IRA so have to spread the call sale for now. Going DITM for max downside protection. Vegas could close again. Basis 74.90 after this sale with 2 weeks still to go to earnings.

Sold WYNN JUL 24 2020 70.0/100 Bear Call Spread @ 13.15

Upside coming?

#VIXIndicator – Looks like we will get an Upside Warning at the close.

I have posted for the last two years about #DoubleHeaders, where we get a Downside Warning canceled, followed by another DW without an Upside in between. They have become more common and I have been getting a bigger database to analyze. I missed an Upside Warning on May 27th. The SPX closed at 3036 that day, then ran up to its recent high of 3233 on June 8th. After that, I tweaked the Indicator again so we can catch the rallies in the #DoubleHeader environment.

So if $VIX closes below 28.02 today, we can expect another run up. However I would say it is a less reliable Upside Warning with VIX still in the high 20’s.

TRADES:

AAL STO 7/24/20 13.5 CALLS @.30

AAL STO 7/24/20 11.0 PUTS @.35 .65 STRANGLE

OSTK STO 7/24/20 49.0 CALLS @2.15 Stocks been on a tear. Have a 44.0 @2.25 & a 45.0 @1.75, covered calls expiring today.

VXX Calls

Bought to close VXX 07/17/2020 35.0 Calls @ 0.01.

Sold this on 7/13 @ 1.02 AND AGAIN @ 2.08 as part of two diagonal call spreads.

This leaves me with 2 more zero-cost long VXX Calls.

Letting my 36,37,38,41 and 42 Calls expire

VIAC Roll

With the stock at 24.89 I bought VIAC 07/17/2020 24.0 Calls / Sold VIAC 07/24/2020 24.0 Calls @ 0.45 Credit

VXX

Bought to close 1 VXX 07/17/2020 35.5 Call @ 0.01.

Sold this on 7/13 @ 1.05 as part of a diagonal spread.

I have another zero cost long for any Black swan events in the next month

TRADES:

SPCE STO 7/24/20 30.0 CALLS @.77

LUV STO 7/24/20 37.0 CALLS @.52

VXX Diagonal Puts

Bought to Open VXX Jan 15 2021 12.0 Puts / Sold to Open VXX Jul 24 2020 29.0 Puts @ Net Credit of $0.12

WBA Covered Rolls

Bought to Close WBA 07/17/2020 40.50 Call / Sold WBA 07/24/2020 41.00 Call @ 0.05 Credit plus 0.50 higher strike.

Bought to Close WBA 07/17/2020 41.00 Call / Sold WBA 07/24/2020 41.50 Call @ 0.27 Credit plus 0.50 higher strike.

My average stock cost is 39.73 with a nice dividend

NFLX Iron Condor

Sold $NFLX 8/21 430/440//580/590 iron condor @ 3.30 with the stock at 495.74.

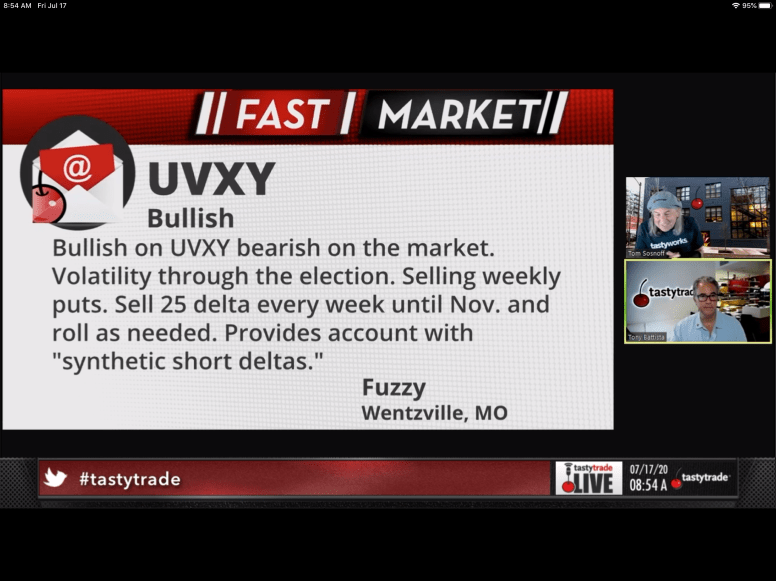

tastytrade “Fast Market”

#LMAO – Pretty funny. My trade idea made it on this morning. I knew I wouldn’t be able to get him to trade the weeklies. He went Aug monthly 22’s @ 1.40. 🙂 🙂 🙂

WORK

BTC $WORK Jul-24-2020 32.5 #CoveredCalls @1.15 Debit. Was STO 07-08-2020 @1.85

Underlying up slightly this morning.

CINF

I’m not ready to give up this dividend stock just yet.

Bought to close CINF 07/17/2020 60.0 Covered Calls / Sold 1 CINF 08/21/2020 60.0 Covered Calls @ 0.79 Credit.

A whole bunch of downside protection while I wait for another dividend.

Also rolled the short side of a CINF 70.0 Calendar spread.

Bought to close CINF 07/17/2020 70.0 Call / Sold CINF 08/21/2020 70.0 Call @ 2.21 Credit.

Since I only paid 2.17 for the long September 70 position, this spread is already zero cost.

I am also short an August 50.0 Put that is rapidly approaching minimum value.

SPY Rolls

SPY opened above yesterday’s entire trading range, so I decided to roll early instead of waiting for a typical late Friday move (probably higher)

Bought to close 1 SPY 07/17/2020 310.0 Call / Sold 07/24/2020 311.0 Call @ 0.11 Credit plus a point higher on the strike.

Bought to close 1 SPY 07/17/2020 313.0 Call / Sold 07/27/2020 315.0 Call @ 0.12 Credit plus two points higher on the strike.

SPY was at 321.56 and 321.59 for the two rolls

NFLX

STO August 21, 400/600 strangle for 10.50

SPX 1-dte

#SPX1dte Sold to Open $SPX July 17th (PM) 3110/3130-3275/3295 condors for 1.15, IV 20.2%, SPX 3211, ∆ -.06,+.05

NFLX Earnings

#ShortPuts #Earnings – Back in. A little more aggressively this time…

Sold NFLX JUL 24 2020 450.0 Put @ 5.25

NFLX Earnings

#ShortPuts #Earnings – Not something I normally do but scalping a little profit already and looking for a new one to sell before the close.

Bought to Close NFLX JUL 24 2020 425.0 Put @ 2.65 (sold for 4.00)

MS NVAX Calls Rolled

#coveredcalls

$MS BTC 7/17 52.50 call and STO 7/24 54 calls at additional .11 credit

$NVTA BTC 7/17 112 call and STO 7/24 120 calls at additional 3.68 credit

LULU

NFLX Earnings

#ShortPuts #Earnings – Somebody leak the earnings already? Stock is pretty weak so far today. I’m going out to next week and selling below the 50ma and near the 100ma.

Sold NFLX JUL 24 2020 425.0 Put @ 4.00

WFC Covered

Bought to close WFC Jul 17 2020 28.5 Call at $0.01. Then sold WFC Jul 24 2020 28.5 Call at $0.14.

Also sold :

WFC Jul 24 2020 27.5 Calls at $0.23 against long August Calls.

WFC Jul 24 2020 28.0 Calls at $0.18 against long August Calls.

The stock has made back all it lost after it’s earnings report.

WFC is 25.97

AMD

Rolled $AMD Jul-17-2020 $54 #ShortPut // Jul-31-2020 @ 2.25 Credit.

Might be a bit aggressive with an ATM strike and earnings on the 28th.

NFLX trade

#Earnings Sold to Open $NFLX July 17th 460/465-590/595 condors for 1.445. Filled quickly on an order for 1.40, so I clearly asked for too little. Short strikes at historical max moves.

NFLX earnings analysis

#Earnings $NFLX reports tonight. Below are details on earnings one-day moves over the last 12 quarters.

April 21, 2020 AC -2.86%

Jan. 21, 2020 AC -3.58%

Oct. 16, 2019 AC +2.46%

July 17, 2019 AC -10.27% Biggest DOWN

April 16, 2019 AC -1.31%

Jan. 17, 2019 AC -3.98%

Oct. 16, 2018 AC +5.28%

July 16, 2018 AC -5.24%

April 16, 2018 AC +9.18%

Jan. 22, 2018 AC +9.97%

Oct. 16, 2017 AC -1.57%

July 17, 2017 AC +13.54% Biggest UP

Avg (+ or -) 5.77%

Bias 0.97%, positive bias on earnings.

With stock at 520.00 the data suggests these ranges:

Based on current IV (expected move into Friday per TOS): 467.05 to 572.95 (+/- 10.2%)

Based on AVERAGE one-day move over last 12 quarters: 490.00 to 550.00

Based on MAXIMUM one-day move over last 12 Q’s (13.5%): 449.59 to 590.41

Based on DOWN max only (-10.3%): 466.60

Open to requests for other symbols.

AAL Covered Roll into earnings

Bought to close AAL 07/17/2020 13.50 Covered Calls / Sold AAL 07/24/2020 13.50 Covered Call @ 0.57 Credit.

Quite a nice premiums for just 1 week.

VXX New Diagonal Put

Sold VXX o7/17/2020 31.0 Put / Bought 01/15/2021 11.0 Put @ 0.14 Credit.

VXX hit a low of 31.03 for the month July on 7/02. I’m guessing the short expires.

SPY Rolls

Bought to close 1 SPY 07/15/2020 308.0 Call / Sold 07/24/2020 309.0 Call @ 0.38 Credit plus a point higher on the strike.

Bought to close 1 SPY 07/15/2020 309.0 Call / Sold 07/22/2020 310.0 Call @ 0.02 Credit plus a point higher on the strike.

Someday …. someday the market will actually drop for more than a day.

SPY was at 322.04 and 321.73 for the two rolls (pretty close to the highs for July so far.)

MRVL Call Roll

#coveredcalls

$MRVL BTC 7/17 40 call and STO 8/7 40 call at .58 extra credit

CRWD SQ Put Rolled / MS Call

#shortputs

$CRWD BTC 7/17 104 put and STO 7/24 102 put at added 3.42 credit

$SQ BTC 7/17 125 put and STO 7/24 124 put at added 1.80 credit

#coveredcalls

$MS STO 7/17 52.50 call at .64

SPX 7-dte

#SPX7dteLong Sold to Close $SPX July 15th 3170/3190 call spreads for 19.40. Bought condors for 17.40 last Wednesday. Not gonna get caught in another reversal today.

DOCU Iron Condor

Sold $DOCU 8/21 150/160//220/230 iron condor @ 3.69 with the stock at 192.60. Leaning short delta (short calls at 30, short puts at 16). IVR rank 45. Earnings not expected until Sep.

#shortputs #closing DKNG June 25…

#shortputs #closing DKNG #putratiospread LUV #coveredcalls CCL

DKNG June 25 sold a July 17, 30 put for 1.23, bought today for .35

LUV sold Aug. 17, 30/30/32.50 put ratio spread for .26

#tastytradefollow

CCL bought 100 shares @ 16.88, sold July 17, 16.50 call for .88

MRNA Call and Put / T Put Closed / NEO Put Rolled / PFE Call and Put

#coveredcalls

$MRNA STO 7/17 90 call at 2.08

$PFE STO 7/17 36 call at .24

$PFE STO 7/24 36.5 call at .36

#shortputs

$T BTC 7/17 29 put at .05. STO at .50

$NEO BTC 7/17 35 put and STO 8/21 35 put at added 1.85 credit. 7/17 was sold for 1.95. Total credit now 3.80

$MRNA STO 7/17 75 put at 1.05

$PFE STO 7/24 34.5 put at .25

TRADES:

OSTK BTO STOCK @43.85 To cover short calls

AAL STO 7/17/20 12.0 PUTS @.24 To own the stock a little cheaper or keep the premium.

PLAY STO 7/17/20 14.5 CALLS @ .55

CINF Covered Call

I’m not ready to give up this dividend stock just yet

Bought to close 1 CINF 07/17/2020 55.0 Covered Call / Sold 1 CINF 08/21/2020 55.0 Covered Call @ 0.65 Credit.

A whole bunch of downside protection while I wait for another dividend.

TQQQ

STO July 24, 95 puts at 2.04 earlier today. I should have waited.

STO August 7 65 puts at 1.05

STO July 31, 75 puts at 1.12 earlier today. I cannot fight the FED but I am staying small.

TQQQ

#ShortPuts #TakeOneForTheTeam – I feel like this is a TOFTT but in this market who knows…

Sold TQQQ JUL 24 2020 95.0 Put @ 2.40