BTO Sept 21 1885.0/1887.50 Call Spread #supercharger 1.90

Monthly Archives: September 2018

#coveredcalls #rolling WYNN Rolled Sept….

#coveredcalls #rolling WYNN

Rolled Sept. 21, 150 call to Sept. 21, 135 call for 1.39, cost basis down to 146, but WYNN is down to 128, not the way it is supposed to go.

FB Jan

Selling puts in January to potentially acquire the stock at what would be around a 2 year low, or keep the premium. Sold $FB Jan 18 2019 135 puts @ 3.05.

TRADES:

ROKU BTO STOCK @62.32 & 62.42

VXX Whiz trade

Another small Whiz experiment. Opened for a credit and closed for a credit…

Sold VXX SEP 14 2018 28/28.5/29/29.5 Put/Call double vertical @ .11 credit (opened for .14 credit)

.25 credit on the entire trade. I did 4 contracts and he did 150…LOL

TWTR Oct

Sold $TWTR Oct 19 27 puts @ .61. Premium is better now.

#fallingknife WYNN WYNN is down…

#fallingknife WYNN

WYNN is down $10 today, nothing new on yet but the Sept. 21, 150 call (covered) is gold.

TQQQ

#ShortPuts – In my little Tastyworks account I’ve been playing with. Selling below the 200ma again…

Sold TQQQ JAN 18 2019 50.0 Put @ 3.26

Sold TQQQ JAN 18 2019 45.0 Put @ 2.34

XBI

#LongCalls #LEAPS – Caught the top a week ago today (miracle!) to exit my 2019’s for pretty good profit. Getting back in now with the 2020’s. Getting better at these by scaling into the LEAPS gradually and then the ratio strategy when needed. This is a 30 percent (3/10) starter position beginning with a non ratio figuring more possible weakness.

Bought to Open XBI JAN 17 2020 97.0 Calls @ 11.25 (great fill with mid @ 11.90)

Sold XBI SEP 14 2018 97.5 Calls @ 1.02

In the early part of the trade with a non ratio I’ll roll the weekly calls aggressively if negative deltas are reached on a bounce…

A TRADE: Falling knife

ALRM BTO STOCK 54.85 A starter. I was a little early it seems.

TRADES:

ROKU STC all my stock this morning when it started to go down. I took it down yesterday, I didn’t want to do it again today, STC @61.83.

ROKU STO 9/7/18 60.5 PUTS @.55 Will accept assignment if it works out that way.

MZOR STO 9/21/18 50.0 CALLS @.80

AMZN

I rolled my September 7, 1950/1960 bull put spread to September 14, 1900/1920 bull put spread for a credit of 1.10, trying to stay ahead of the correction in tech stocks.

More stops

#Rolling #Earnings #CoveredCallCampaign

Had to stop two rolls I made yesterday. I have not re-rolled them, as I’m going to wait for things to settle down and choose my positions carefully.

BTC $FB Oct 5th 165 puts for 6.17.

BTC $RH Sep 28th 129 puts for 7.25.

My IB software has been funky on trade history so I don’t have sale prices handy.

#pietrades and making adjustments. I…

#pietrades and making adjustments.

I have some garbage in my accounts right now and just as I start to break even, it moves again. MU, WDC started as #pietrades, converted to #fuzzies. MU was showing a profit yesterday but 5 points down today on MU and 2 on WDC now have created more work. So anyway, here is what I have and will gradually be moving to ETFs. Only problem is some of my accounts are not big enough to handle the good ETFs unless I #fuzzy them which is probably what I should be doing anyway. On a positive note I have made back 25-30% of the SVXY losses in 6 months. Probably another year to make it all back. That was a harder lesson than the /ES in Aug. of 2015 but at least I had a bigger capital base so did not totally destroy the accounts. Will be interesting to see what happens with the premiums when SVXY reverse splits. I will not trade it unhedged!!

Adjustments

MU 55/50 LEAP call rolled out to 8 DTE for 0.42 credit. CB now 10.52

WDC rolled the 15 DTE 60/65 LEAP down to same date but 60 short call for 1.01 credit. Cb now 16.77

EOG 115 LEAP call 15 DTE, no adjustment. Cb 11.20

New trades

LABU STO the 15 DTE 90 put for 1.2. You could do better now.

TQQQ batch 1 cc 65 at 8 DTE for 64.00

TQQQ batch 2 65.5 cc 8 DTE at 64.45

LNG batch 1 66.5 cc 8 DTE at 65.40

LNG batch 2 66.5 cc 8 DTE at 65.65

Added to XBI #fuzzy and now have all Jan 2019 LEAPS and 22 DTE short calls

95/98 leaps at 5.49 this is the new one

87/95 leaps at 6.43

95/95 leaps at 2.95

At least my theta decay is huge.

Need to be better about direction and timing, wil be using my tools more now instead of just placing weekly #pietrades no matter the ticker is doing.

Even with the garbage still made $582 last week but generally stagnant after the last earnings round.

It seems that a lot of my #pietrades have been converted to #fuzzy lately. Maybe I can get to 10 names, 10 contracts each making $1 or more a week, that would be a lot of cash coming in which would offset some of these dogs 🙂

WYNN rollout

Rolled $WYNN Sep 21 140 puts out to Oct 19 140 puts for 1.45 credit

AMZN #BuPS Stopped out of…

AMZN #BuPS Stopped out of my Sept 21st 1920/1910 BuPS at 2.55 on the swoon this morning.

Trades today

Had to make a few rolls today:

Rolled $FB Sep 14th 170 puts to Oct 5th 165 puts, .10 credit.

Closed $FB Sep 14th 182.5 calls for .20

#Earnings #Rolling Rolled $RH Sep 7th 135 puts to Sep 28th 129 puts, .40 credit.

#CoveredCallCampaign Sold $BABA Sep 21st 177.5 covered call for 1.54 (what’s happening to BABA?)

#PieTrades Sold $AMAT Sep 14th 42.5 covered call for .72

#ContangoETFs Sold $DUST Nov 60 call for 1.95

Over or the start?

The VIX was docile once again but NASDAQ stocks not looking pretty today. Is this the start of something bigger, or is it already over?

#spxcampaign Sold to open Sept…

#spxcampaign Sold to open Sept 14th 2800/2780 BuPS @ .70 when SPX was at 2888.

WYNN

STC WYNN Sep 14 149/147 BePS 1.70 BTO 9/4 1.01 1 day #In-Out Trade

#supercharger Puts

$TSLA

BTC Sep 07 $305 Call for 0.95, STO Sep 07 $290 call for $3.02, presently $1.50×1.60

TRADES:

ROKU BTO STOCK @61.47

ROKU STO 9/14/18 65.0 CALLS @.95

ESPR BTC 9/21/18 45.0 PUTS @.75 STO @3.20

ESPR BTC 9/21/18 55.0 CALLS @.60 STO @2.25

ROKU Oct short puts

Sold $ROKU Oct 19 55 puts @ 1.77. Pure play in the OTT television space. May take assignment if the stock tanks before October.

Taking some profits

Bought to close:

$CAH Sep 21 50 puts @ .40. Sold for 1.35 on 3/23.

$DISH Sep 21 32.50 puts @ .30. Sold for 1.40 on 2/6.

Rolling FXB

Getting more time, waiting for a comeback in the British Pound.

Rolled $FXB Sep 21 129 puts out to Oct 19 129 puts for .15 credit.

DUST in 2020

Throwing another one out there.

Sold $DUST Jan 17 2020 64 call @ 6.50. Highest strike.

WTW

#CoveredCalls – Goal is to get out of this at even. Missed my chance on the bounce and now appears to be breaking below the 200ma. Replacing this week’s with another aggressive sale at the money.

Sold WTW SEP 21 2018 70.0 Calls @ 2.45

Basis is now lowered to 72.50 so some more work to do….

WYNN

#ShortPuts – Nice morning in the desert. Admiring my new property. Could be owning a small piece of this at Jan expiration. LOL!

#closedstock TRTN Sold my shares…

#closedstock TRTN

Sold my shares at 37.65, bought March 20 for 31.68, have an Oct. 19, 35 put. All thanks to @tabortrader for this ticker.

FB put spread

Selling some premium with the short strike at 20 delta. Sold $FB Oct 19 155/145 BuPS @ 1.25 with the stock at 168.12.

2 down days in a…

2 down days in a row. Isn’t that some kind of record?

I will still like more of a flush, have a ton of cash and still want better prices. Trying to be better about timing and direction 🙂

TQQQ

#ShortPuts – In a small account replacing the ones I closed 5 days ago. Glad I didn’t wait for the last nickel or these sales would not have been possible…. 🙂

Sold TQQQ JAN 18 2019 55.0 Put @ 4.10

Sold TQQQ JAN 18 2019 50.0 Put @ 3.00

Sold TQQQ JAN 18 2019 45.0 Put @ 2.15

Adding to Nov DUST

At a higher premium.

Sold $DUST Nov 16 64 calls @ 1.35.

Rolling ALRM and NFLX / SPX Redux

#shortcalls

$ALRM BTC 9/21 55 call and STO 10/19 57.50 call at .30 debit.

$NFLX BTC 9/21 365 call and STO 9/28 370 call at .50 debit.

Both are covered

#spxcampaign

$SPX STO 9/14 2810/2835 BUPS at 1.80

Afternoon Opened an AMZN Sept…

Afternoon Opened an AMZN Sept 21st 1910/1920 BuPS spread for 1.05 when AMZN popped through 2034 during the lunch hour. It hit the Trillion Cap and promptly sold off. I suspect on profit taking.

PYPL synthetic covered

#Earnings My long languishing Jan 2019 100 calls are looking better. Selling calls against them has been a bitch. Truing again:

Sold $PYPL Sept 21st 95 #SyntheticCoveredCalls for 1.10

#shortputs STO EWZ Jan18’19 28…

#shortputs

STO EWZ Jan18’19 28 PUT 2.10

RH earnings

#Earnings $RH down as much as 6% today before earnings after the bell. This is a huge mover and I have spent much of the last couple years being involved in repair trades after earnings. Including now… I already have a Sep 7th 135/180 strangle. So I’m not adding anything new. If the stock moves LESS than its average quarterly move on earnings, I could STILL have one of my sides breached. Be careful out there!

Over last 12 quarters: Biggest UP move: 38.5%, Biggest DOWN move: -28.8%, Average move: 18.6%. Bias is +5.66%.

AMZN

STO September 14, 1900/1920 bull put spread at 1.90

TWLO

#Earnings – Short calls got run over on the last announcement so rolled them into ITM put spreads. Getting out now with slight profit after the big run. So long TWLO!

Bought to Close TWLO SEP 21 2018 85.0/75.0 Bull Put Spreads @ 2.59 (sold for 2.75)

TQQQ

Rolled my September 14, 69 calls to September 28 70 calls for a credit of .40 cents. Just taking the opportunity to roll them to a better strike price and some premium. One day we will get a correction and I will let the short dated calls just expire or am I just smoking hopium.

TRADES:

ROKU STO 9/7/18 64.0 CALLS @.75 When it was up this morning.

CORT STO 9/21/18 16.0 CALLS @.55

TUR STO 9/21/18 21.0 CALLS @.65 May be a “Pie” trade. Forgot the criteria for the “pie” trade. One of my best “premium” stocks.

ROKU STO 9/7/18 63.0 PUT @1.58

ROKU STO 9/7/18 62.5 CALL @1.00 COVERED

STX Falling Knife

Sold $STX Jan 18 2019 40 puts @ 1.15

RTN

BTO 2020 195 calls @ 23.00 and STO October 205 calls @ 1.35, adding to my position.

Au revoir but not goodbye

I’m heading to Switzerland for a couple weeks to hike the Alps and enjoy some family time. I’ll check in occasionally but my goal is to get my mind off the markets. As you all know, that isn’t easy for a trader.

Notable Earnings AM Mon:

Holiday

Notable Earnings PM Mon:

Holiday

Notable Earnings AM Tues:

None

Notable Earnings PM Tues:

COUP, RH, WDAY

Notable Earnings AM Wed:

HDS

Notable Earnings PM Wed:

CLDR, CTRP, CWK, DOCU, GWRE, MDB, OLLI, ZS

Notable Earnings AM Thurs:

BKS, GIII, NAV

Notable Earnings PM Thurs:

ABM, AVGO, FIVE, FNSR, GME, MRVL, OKTA, PANW

Notable Earnings AM Fri:

None

Notable Earnings PM Fri:

None

Good Morning

Good Morning

DUST SMH

#LongCalls #LongPuts #LEAPS – September is going to be crazy at work so might not be in here as much. Did get a few trades in on Friday and just now getting around to the bookkeeping.

DUST:

Bought to Close DUST Aug 31 2018 38.5 Puts @ .05 (sold for 1.60)

Sold DUST Sep 14 2018 36.0 Puts @ .87

SMH:

Rolled SMH Aug 31 2018 104.5 Calls to Sep 14 2018 105.0 Calls @ .02 credit

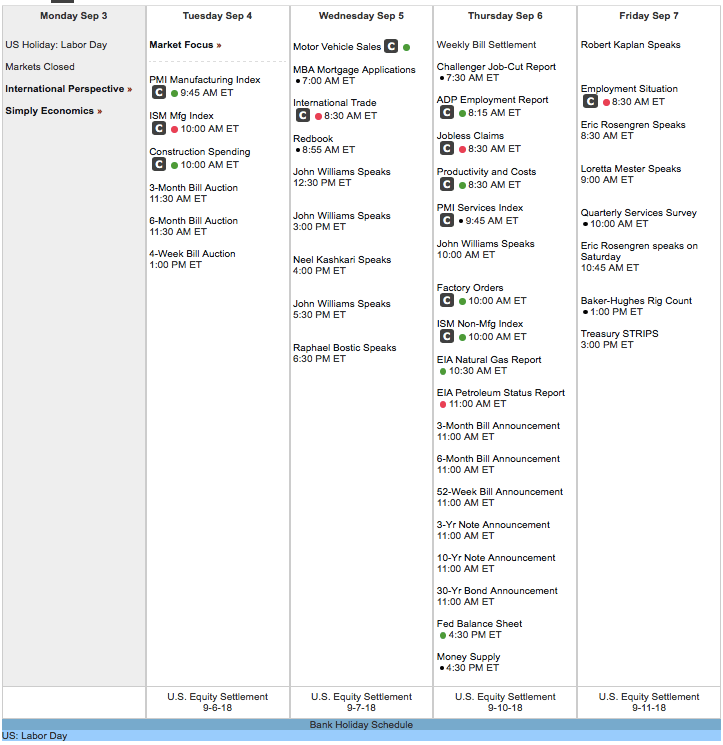

Econ Calendar for week of 9/3/18

#Jobs report is Friday at 8:30am ET