I am long $TQQQ 66.67 LEAP calls for Jan 2020. I wanted to look at the effect of compounding on the TQQQ, which moves 3x the $QQQ on a daily basis. Levered ETF’s like this are naturally drawn toward zero, a topic I’ve covered before as #ContangoETFs. This is why some of us sell calls on $DUST and $NUGT and a few others like $BOIL. Even though they can go high pretty fast, they will always be drawn back toward zero.

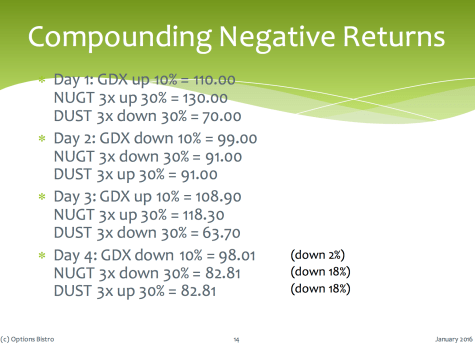

Here’s a chart from my long-ago webinar demonstrating the effect, using hypothetical 10% moves, up and down, on $GDX, and its levered ETFs NUGT and DUST:

As you can see, over just 4 days of moving up and down, GDX is only down 2% and both ETF’s are down 18%. Note that even though NUGT is bullish and DUST is bearish, they moved down the exact same amount.

So I was thinking of TQQQ over the last several months, since the market has gone up and down significantly. Unlike the gold miners, the indices like QQQ have been steadily rising for years, so can we can expect better behavior? I found that the close on June 6, 2018, was only 17 cents off from yesterday’s close on QQQ, so basically the same, and the perfect point from which to measure.

First, I looked at the intraday high of the year, on Aug 30th.

$QQQ up 6.6% from June 6 (175.86 to 187.52)

$TQQQ up 19.1% from June 6 (61.61 to 73.36) *better

This is not surprising, as the move was straight up, and TQQQ performs x3 the QQQ.

Then I looked at yesterday’s close:

QQQ flat at 175.69 from June 6th

TQQQ down 11.7% from June 6th *worse

So, from June 6 until now, TQQQ has suffered from the 3x compounding, while QQQ ended flat.

Looking at a longer time-frame, from the summer highs of 2015:

QQQ up 49.6%

TQQQ up 129.0% *better

What do we conclude? If an underlying has a persistent bullish trend, as QQQ and all the major indices have had since 2009, the triple levered ETF’s will perform better. However, if we enter a period of consolidation, or a bear trend, they will perform more weakly than the underlying.