#ContangoETFs STO $GUSH March 55 call for 4.20. Looks like I was filled at today’s top.

Monthly Archives: September 2018

#spxcampaign Paired my Oct 08th…

#spxcampaign Paired my Oct 08th BECS with Oct 08th 2840 / 2820 BuPS for 1.20 when SPX was at 2916.34. Profit stop is .30 with a Stop Loss of 4.60. I am still trying to find the best stop loss value on these. Sheridan teaches essentially 3X the profit target. I am considering a modification using Jeff’s method of a tag of the short call while maintaining the stop loss on the Put side. Why? The Oct 03rd and Sept 28th Call spreads were stopped out on the gap up for a loss but didn’t tag the short call. Critiques are welcomed.

CLF covered calls

Sold $CLF Nov 16 14 calls @ .54. Another long term hold I wouldn’t mind being taken out of.

RIG covered calls

Sold $RIG Jan 18 2019 16.00 calls @ .62. Been long for a couple of years. Wouldn’t mind getting taken out at 16.

GOOGL pre-earnings lophir

CML recommended a different way of playing GOOGL pre-earnings.

http://www.cmlviz.com/research.php?number=12335&cml_article_id=20180924_the-trading-pattern-in-alphabet-right-before-earnings

Bot Oct26 1/-2/-1/2 1162.5/1145/1115/1100 PUT/PUT/PUT/PUT x1 @-6.51. BE 1121. Max risk $3594. Will let it run to expiration or take 70% quick profit @ 1.95 if it plays out quickly.

TSLA and RH

#Earnings Building back after earnings trades gone bad

BTC $TSLA Sep 28th 275/322.5 strangle for 2.40. Sold for 8.20 on Sept 17th. (still holding another lot)

Sold $TSLA Oct 5th 275/322.5 strangle for 11.15 (legged in)

Sold $RH Oct 5th 130 put for 2.80.

Covered Calls and such

#coveredcallcampaign

BTC $FB Oct 5th 175 calls for .15. Sold for 1.50 on Sept 11

BTC $AAPL Oct 5th 230 calls for .35. Sold for 3.60 on Sept 13th

STO $AAPL Oct 19th 227.5 call for 2.10

STO $AAPL Oct 12th 215 put for 2.05

BTC $SQ Sep 28th 80 put for .13. Sold for 1.30.

STO $SQ Oct 19th 97 calls for 1.60

Sold to close $BABA stock for 163.15. Raising some cash by selling half of my stock. This one can’t get off its ass. Was assigned via 200 puts on Feb 2nd. With covered call and put sales, cost basis 183.00. Holding the rest for an eventual return to 200.

BTC $BABA Oct 5th 175 call for .45. Sold for 1.60 on Friday.

#ironcondor TSLA Sold Oct. 19…

#ironcondor TSLA

Sold Oct. 19 255/260/340/345 for 1.57, TSLA is at 300.

#ironcondor #closing AMZN September 18,…

#ironcondor #closing AMZN

September 18, sold October 19, 1795/1800/2050/2055 for 2.04, bought today for 1.66.

LMT

STC October 5, 320/330 bull call spread @ 9.25, bought at 8.20

Direxion Distribution Schedule.

www.direxioninvestments.com/press-release/distributions?

Expiration / TNDM Puts / NFLX Calls Rolled / MZOR Puts Closed

#spxcampaign

$SPX 2760/2780/2960/2640 Iron Condor Thank you @jdietz1954 and @jeffcp66

#shortputs

$TNDM STO 9/28 41 put at 1.10 Thank you @honkhonk81

Closed Early

$MZOR BTC 11/16 70 puts at 12.80 STO at 17.20 Since company has been acquired at 58.50 not sure how I closed these.

#shortcalls

$NFLX BTC 10/5 375 calls and STO 10/19 400 calls at added 2.10 credit (covered)

TRADES:

BTO TNDM STOCK @44.03 BTO Originally as a day trade, but may keep the stock to cover my short calls if the stock keeps moving up.

STO TNDM 9/28/18 41.0 PUTS @1.15

STO TNDM 9/28/18 45.5 CALLS @1.50

STO TNDM 9/28/18 47.0 CALLS @1.25

#putratiospread #fallingknife JD Tastytrade idea…

#putratiospread #fallingknife JD

Tastytrade idea sold Oct. 19 back ratio, sold 2, 24 puts, bought 1, 25 put for .40 credit.

Getting back in BOIL

Haven’t traded this in nearly 2 years but it looks like it’s time to dip a toe in again. Starting small.

Sold $BOIL Jan 18 2019 45 calls @ 1.00 with the stock at 30.94. Highest strike in Jan. Will look to add if there’s a continued move up in nat gas.

Pre-Earnings days are here again…

Update: This list is based on my research and backtesting. Although I use CML tools, this list did not come from CML nor has it been vetted by them. Buy at your own risk which you already do.

Each quarter, I compile a list of pre-ER candidates based on CML backtests. Attached is the Q4 2018 list. Over the next few weeks, I will continue to modify the spreadsheet to add new ideas, custom setups and confirmed earnings dates. The suggested entry date is the date on which the backtest is based. The yellow highlight means it’s currently in entry week. You can start watching earlier for a good entry or add to a position after this date. This is a starting point for taking a long position in a stock before earnings. Green highlights indicate that the candidate has 100% win rates in more than one setup.

I include only setups and backtests with 100% win rate over at least four quarters, an average return per trade of 40% or more, stocks with weekly options, and medium to high options liquidity. There are many other pre-ER candidates in CML but my preference is to stick with the 100% winners as long as they provide a diverse selection.

Some interesting observations include:

- WYNN and SWK are the only stocks with a 100% win rate over more than 4 quarters

- CML has introduced a new pre-ER straddle that I like. It’s in the spreadsheet under the Custom column

- Many of our favorites have fallen off the 100% win rate list (BA, INTC, MA, PYPL and others)

- SWK emerges as the best candidate this quarter with 100% win rate across five setups

https://docs.google.com/spreadsheets/d/1RKD02IWjO9ZpAsJ7DqRojBkAnVTE1ZncFxUNHnUOZsE/edit?usp=sharing

#rolling EOG rolled 115 put…

EOG rolled 115 put 18 DTE out to 39 DTE for 0.83 credit. Cost basis now 9.13 and still have 68 weeks to manage. I may unhinge this one and just be short the puts if it keeps moving up.

MU trade from Friday did not have time to post. Rolled 50 call from 8 DTE out to 39 for 0.60 credit. Cost basis now 9.1 and same as above 68 weeks left to sell options.

A couple of falling knives today

$KORS-Versace deal ultimately good for the company IMO. Sold Jan 18 55 puts @ 1.10. Strike below 2018 lows in Jun and Feb. Delta 14.

$NWL-Sold Jan 18 18 puts @ .73. If the strike is reached it would be a 6 year low for the stock. I would take assignment there for what would be an almost 5% dividend yield. Delta 25.

AAPL supercharger

Bot AAPL Oct26 205/215 @ 7.91. GTC order to close @ 9.40.

AAPL earnings tentatively 10/30. Historically, earnings have been end of Oct to early Nov so should be able to avoid earnings.

NFLX

STC 9/28 342.5/357.5 BuCS @4.70. BTO 9/12 @3.80 #supercharger

#spxcampaign Morning all. Sold to…

#spxcampaign Morning all. Sold to open Oct 8th 2980/3000 BeCS when SPX was at 2920.87. A Dan Sheridan method. Stops .30 and 2.10. I will pair it later. It will be a light week for me. Friday my daughter is presenting her research at a department seminar so we are hopping down to Tallahassee, FSU, to give it a listen.

AMZN Supercharger

#SuperCharger $AMZN keeps testing new lows so I’m out with a tiny profit on this round, small loss overall counting the first one I rolled.

Sold to close $AMZN Oct 19th 1865/1875 bull call spreads for 6.75. Bought for 6.55 last week.

$GOOGL also looking weak, but didn’t breach my 1150 short strike so I’ll hang with it.

Also opened one in $NVDA Friday, which is holding up.

Econ Calendar for week of 9/24/18

HOS

I got a late fill on Friday afternoon. STO March 15, 6 covered calls @ .40 cents.

$MamaCash………Lophirs Trying to get my…

$MamaCash………Lophirs

Trying to get my head around these and would appreciate if you could explain a couple of points!

Are these similar to long condor spreads but opened with a credit?

Assume max profit is the credit received, if not how is the target profit calculated?

I followed your UNH trade for 2.25 (only one as test)

ERX

9/21….Still chipping away…Rolled ERX 9/21 34 Call out to 10/26 35 Call for 0.17 credit…..CB now $35.92 after being assigned at $42.50 0n 5/29 #pietrade

PYPL FB AMZN LABU BIDU Close Early Plus Expirations Assignments

#longcalls

Closed Early

$PYPL BTC 9/21 90/95 BUCS for .85 STO at 1.97

$AMZN BTC 9/21 1800 call at 116.80 BTO 8/6 at 65.62 Not around all day and got clobbered at EOD. Fortunately I have earned an MOB (Masters of Option Bistro) degree and sold 22.84 of calls against the long calls (rolling often) Thanks to all the Jolly rollers who taught me that aspect.

$BIDU STC 9/21 220/230 BUCS at 9.50 BTO at 4.08

$LABU STC 9/21 95.50 calls at .35 BTO at 3.90

#shortputs

$FB BTC 9/21 155/165 BUPS for .40 STO at 2.50

Closed Early

$AMZN BTC 9/21 1880/1900 BUPS at .05. STO 8/29 for 2.70

#optionsexpiration

$TNDM 40 call Covered

$KR 31 call Covered

$NVDA 285 call

$MTN 300 call

$DBX 26.5 call Covered

$ESPR 40 put

$TNDM 35 put

$MO 61 put

$SRPT 137/142 BUCS

$NFLX 320/335 BUPS

Total Loss

$TSLA 330/340 BUPS

#Assigned

$TNDM 45 and 44 puts Basis 41.4

Thanks to all that make the bistro special. Have a great weekend

Missed it by that much

#VIXIndicator The close bumped us up to 11.68, so still no start of the countdown to an Upside Warning.

Options Expiration for 9/21

I didn’t have many left to expire. Took a bunch off early this month.

Expirations for full profit:

$QQQ Sep 21 182/172 BuPS

$WDC Sep 21 57.50 puts

$WHR Sep 21 115 puts

$NFLX Sep 21 330/320 BuPS

$SQ Sep 21 75/70 BuPS (see below)

Expirations for full loss:

$SQ Sep 21 75/80 BeCS–stock went through the money quickly. I sold a put spread against it and then rolled that up (the one that expired today) but the position will still be a loss. 5.00 spread offset by 3.60 in total premium = 1.40 loss on this position). I didn’t have time to post earlier but I reinitiated a bearish position on this in October with a 90/95 bear call spread for 1.08 credit.

$SODA Sep 21 130/135 BeCS–not much I could do here. On 8/20 the takeover was announced and the stock immediately started trading between 142 and 143 and has been that way since. There was no premium in any put options to sell to offset. Just one of those things that’s an occupational hazard of this business. I’m glad I was hedged with a spread. Took in 1.50 against the 5.00 spread so a 3.50 loss. Sayonara SodaStream. Good luck at Pepsi.

Took off before the close today:

$EWZ bought to close Sep 21 34/37 inverted strangle @ 3.27. Position was originally a 37/39 strangle and I rolled the 39 calls down to go inverted with 34 calls and 37 puts. Total premium taken in was 3.54 (2.57 for the original strangle plus .97 for the roll down) so I’m out of this for a .27 profit.

Need to decompress. Have a great weekend everyone.

Expirations, have a nice weekend.

I am heading off to the gym in a few minutes so there are only 2 expirations today.

HOS, 35 calls covered. Will short again next week.

SIVB, 300 puts. Sold some more this morning that will expire in January.

Covered Calls

#CoveredCallCampaign

#Rolling $BABA hit 170 in the pre-market; I closed one of two calls I had at the 170 strike. Kept the other.

BTC BABA Sep 28th 170 call for 1.95. Sold for 1.55 on Sept 12th

#Rolling Sold BABA Oct 5th 175 call for 1.60

BTC $SQ Oct 5th 97 covered calls for .25. Sold for 2.45 on Sept 13th

Sold $MU Sept 28th 45 covered call for .90. I also am still long Oct 5th 45 calls.

BTC $OLED Sept 21st 122 covered call for .40. Sold for 1.50 last Friday.

Sold Sept 28th 124 call for 1.65.

EWZ

BTC 9/21 34 call @ 0.02..STO 9/5 @0.29..This is against my Jan 20 32/32/30 #fuzzy. Need 0.08 per week to cover. I am selling calls mainly at 14 dte every 7 days as an experiment

STO EWZ 10/5 35 Call @0.50

NVDA Supercharger

#SuperCharger I was looking at a #Lophir but wasn’t liking the margin requirement R/R. This trade is a better fit.

Bought to open $SPX Oct 26th 247.5/257.5 bull call spreads for 7.30. Profit target: 9.40.

SQ

Interesting chart

Top performer update

Strategy to buy lophirs on top performers in top sectors is working so far. 100% win rate for Sept, hit 70% target profit in three weeks or less. Tickers PG, JNJ, TGT, COST, XLY, and XLV. For those who followed on these trades, I apologize for the late update.

Now holding Oct26 lophirs in BA, PG, UNH, MMM, JNJ, and WMT based on top sectors (industrial, healthcare, and comsumer staples). Posted these trades ydy and today.

AMZN

BTO Sept 28 1897.50/1900.00 Call spread $1.90 #supercharger

Order to close 2.40 GTC

Also STO Sept 28 BuPS 1900.00/1897.50 .63 Order to close .10

#shortputs DOCU Sold Nov. 47.50…

#shortputs DOCU

Sold Nov. 47.50 put for 2.30, DOCU is at 52.40.

Top performers

Buying lophirs in top performing stocks in top performing sectors (Health, Industrial, Consumer Staples). Set GTC orders to close positions at 70% profit based on credit received. There is some earnings risk on MMM and JNJ but not on WMT. Hope to be out of these positions before earnings.

BOT MMM Oct26 1/-2/-1/2 212.5/210/205/197.5 puts @-1.90

BOT JNJ Oct26 1/-2/-1/2 140/139/136/133 puts x2 @-.82

BOT WMT Oct26 1/-2/-1/2 94.5/93.5/92/88.5 puts x2 @-.80

#coveredcalls Rolled my Sept 21st…

#coveredcalls Rolled my Sept 21st 13.50 calls out and up to Oct 05th 14.50 for .20 credit.

#spxcampaign BTC my Sept 28th…

#spxcampaign BTC my Sept 28th 2800/2820 BuPS and Sept 28th 2790/2810 BuPS at .20. Originally sold for a 1.20 and a 1.05. Mitigates the damage from yesterday a bit. Traveling next week so I’m not putting anything on. My daughter is presenting her research as part of her degree requirements so we are off to be wowed. I had always thought she would go into business. Never tried to influence her career choice. Instead she ended up in biology like her old man. Damn, genetics is a powerful thingy. Ha!.

XBI

BTC 9/21 97.5 Calls @0.02..STO 9/14 @0.39..These are against a Jan20 95/95/93 #fuzzy needing 0.20 per week to cover

#assignment #earnings SKX April 19,…

#assignment #earnings SKX

April 19, sold a May 37/47 strangle, SKX went down big, rolled the 37 to October, assigned last night, cost basis of 35, stock is at almost 27, grrr

TRADES:

TNDM BTO STOCK @45.0

TNDM STO 9/21/18 45.0 CALLS @.65 Expires in 5 hours. ;>) If not, I have some stock a little cheaper.

SIVB

STO January 2019, 300 puts @10.40

TQQQ

I rolled all of my October 19, 73 calls to November 16, 75 calls for a credit of .92 cents. These are against my January 2020, 66.67 calls.

#earnings #closing #shortstrangles MU Yesterday…

#earnings #closing #shortstrangles MU

Yesterday sold Oct. 18, 41/55 strangle for 1.38, bought today for .88.

OK, but can it hit both in the same week?

Futures Up Modestly

$SPY is down due to ex-div

VIX can’t shake off the fear

#VIXIndicator We spent the morning in Upside Warning territory, but despite a steadily rising SPX all day, the VIX also rose steadily then ended up closing higher on the day.

TQQQ

In one of the smaller accounts that I manage.

Rolled October 19, 73 calls to November 16, 75 calls for a credit of .90 cents. If these expire at zero, I still have 61 more weeks to sell premium. So far, I have collected 14% of the cost of the trade. These are against the 2020 65 calls that I bought at 16.00 on August 10.

Lophirs in top performers

Bought lophirs in top performing stocks in top performing sectors. As explained earlier, these trades do well when price moves up, flat, or down. They lose money on big pullbacks but losses are capped. There is potential earnings risk in October so will have to watch dates as earnings get confirmed. These are half-size positions. Will add opportunistically on pullbacks.

Bot BA Oct26 1/-2/-1/2 362.5/355/347.5/337.5 PUT/PUT/PUT/PUT @ 2.71 credit (BE 346)

Bot UNH Oct26 1/-2/-1/2 262.5/260/255/247.5 PUT/PUT/PUT/PUT @ 2.22 credit (BE 255)

Bot PG Oct26 +5 1/-2/-1/2 84/83/82/80.5 PUT/PUT/PUT/PUT @ .42 credit (BE 81.80)

#lophir

MU earnings

AMZN

STC Sept 21 1885.00/1885.5 #supercharger $2.45

BTO 9/6 1.90

Covered Calls

#CoveredCallCampaign

Sold $AAPL Oct 12th 227.5 covered call for 2.13

Sold $FB Oct 12th 172.5 covered call for 1.20

BTC $OLED Sep 21st 114 put for .15. Sold for 1.50 last Friday

A TRADE: Something different for me.

KFY BTO STOCK 49.77 Was or still is a falling knife. Just dipping a toe. ;>)

RHT financial report after closing…

RHT

RHT financial report after closing of market today? any idea?

A TRADE:

ROKU STO 9/28/18 76.0 CALLS @.94

#shortstrangles SMH TastyTrade idea, sold…

#shortstrangles SMH

TastyTrade idea, sold Nov. 16, 98/113 for 2.53, SMH is just under 108.

BA, CAT

STC January 2020, 360 calls and BTC October 19, 375 calls for a net profit of 3.90

Just thought I would start booking some profits since everyone is so bullish.

Also, STC, CAT, 2020, 150 calls and BTC September 28, 155 calls for a net profit of 2.93

A TRADE:

:

TNDM BTO STOCK 42.90 A day trade.

IQ STO 9/28/18 26.50 PUTS @.50

NKE BTO 9/28/18 80.0 PUTS @.56

NKE STO 9/28/18 85.0 PUTS @2.07 A BuPS

GOOGL

STC 28 SEP 1130/1140 BuCS @9.40….BTO 9/12 @7.70

#spxcampaign Stopped out of my…

#spxcampaign Stopped out of my Sept 28th BeCS @ 3.15 off a GTC stop order. I adjusted the stop loss order to 3x the 70% of the credit received for the entire IC rather than based on the credit for the leg. The ones from last week would have worked if I had used a stop based on the IC rather than the individual legs. So I believe this is the better set up but the gap up this morning was a killer. I was loading in an adjustment by rolling up the short call but was stop a millisecond before I fired off the order. Still learning.

Too busy at work to…

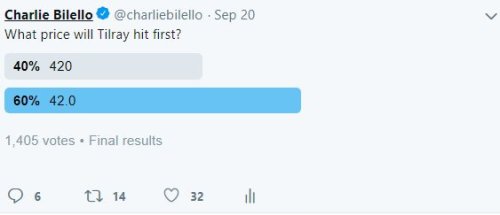

Too busy at work to check in this week, some interesting trades but TRLY I will watch with amusement from the sidelines:)

After rolling and recovering earnings trades for weeks equity curve finally moving up again. The theta decay finally caught up the the drops in AMAT, WDC, MU and the rebound does not hurt but now ITM on some of the shorts so will have to move them back the other way but have a few weeks.

Rolls/new trades/ #pietrades and position update.

#fuzzy coversions

MU 55/50 2020 LEAP recovering. Cb 9.70. and will roll short call for 15 DTE soon.

WDC 60/58 2020 LEAP now ITM. 36 DTE on the short so will roll up when the time value erodes. CB 15.41

EOG 115 2020 LEAP Cb 9.96. 22 DTE on short side, waiting for time value to drop.

XBI Lot 1 80/97 2020 LEAP cb 19.56 and short calls 22 DTE.

LNG 50/66.5 2020 LEAP cb 19.25 22 DTE on shorts

XBI lot 2 95/98 2019 LEAP next week rolled to 22 DTE for 0.67 credit. Cost basis 4.82. Also have 87/95 at 5.68 and 95/95 at 2.2. Trying to take these to zero cost basis then roll cash into new trades.

TQQQ lot 1 65 CC cb 63.20, will let assign next week and reset

TQQQ lot 2 65.5 cc cb 63.15 and will let assign next week

LNG lot 1 cc 66 rolled 1 week for 0.49 credit. Cb 64.23

LNG lot 2 66 cc rolled a week for 0.40 credit. Cb 64.32

1 new #pietrade and may become a ladder.

EXPE 43 DTE 126 put sold for 2.95. Cb 123.05 if assigned.

Hope everyone else is having a good week and anyone in NC hope things are drying out.

#earnings #shortstrangles MU Sold October…

#earnings #shortstrangles MU

Sold October 19, 41/55 for 1.38, Micron is at 46.

#shortputs #closing #fallingknife INTC July…

#shortputs #closing #fallingknife INTC

July 27, sold Jan. 42 put for 1.27, bought today for .84, thanks Iceman

PVTL owner

#Earnings #Assignment While waiting for $PVTL 22.5 puts to hopefully expire, I got assigned last night. At least it is cheap. No weeklies, and options premium is weak, so I will hopefully catch a bounce and sell it.

Ripping

We awake to a ripping rally and lowest VIX since early August.

GS

BTO September 28, 225/235 bull call spread @ 8.25, stock trading at 236

TLRY puts

#Scary Sold $TLRY Sept 21st 150 puts for 1.85. One put in each of two retirement accounts.

TLRY, I bailed on my 250/300 September 28, bear call spread

Took a 5 point loss. Too crazy for me.

NFLX

#lophir

BOT +1 +1/1/-2/2 NFLX 100 19 OCT 18 360/355/340/335 PUT @-.66

Order BTC .19 30% of credit. Think I got this correct.

SSO lophir

Bot SSO Oct18 +1/-2/-1/+2 126/124/122/119 PUT/PUT/PUT/PUT @ .55 credit. GTC order to close @ .16.

This is a rinse and repeat trade. When this one closes, I replace it immediately with a new trade… 28 to 35dte, deltas 40/30/22/15. GTC order to close @ 30% of credit received.

VXX short stock

#VXXGame Waited a long time for this… Bought to cover 10 shares of $VXX shares for 26.95. Was early assigned 100 short shares on Feb 12th via a 27 short call. I will scale out as it moves down.

ISRG lophir

Bot ISRG Oct26 +1/-2/-1/+2 547.5/535/520/505 put/put/put/put @ 3.60 credit. GTC order to close @ 1.80 or day before earnings whichever comes first. Earnings report not yet confirmed. This is not specifically an earnings trade. I just want to avoid earnings risk.

I’m doing rinse and repeat trades on AMZN, ISRG, and SSO. This means that when a 28-35dte lophir closes for profit, I immediately replace with a new trade using the same parameters.