#closing #butterfly NFLX

November 9, sold Dec. 21, 250/260/265 put butterfly, closed today for a gain of .25 (edited)

Daily Archives: Wednesday, November 28, 2018

DLTR Earnings

#Earnings #IronFlies – As usual…low risk and low probability but good reward if it works. Risk .41 to make 2.59 playing 3 wide on a 5.90 expected move.

Sold DLTR NOV 30 2018 80.5/83.5/86.5 Iron Flies @ 2.59

ANF trade

#Earnings Bought to open $ANF Nov 30th 17 #LongStraddle for 2.58.

TQQQ

#LongCalls #LEAPS – Lots of time left on this one so taking the small loss since it’s getting a little DITM and sold below the LEAPS.

Bought to Close TQQQ NOV 30 2018 47.0 Calls @ 2.90 (sold for 2.50)

TNA

#LongCalls #LEAPS – Just in case this rally has any follow through tomorrow I’m getting out of the way with a decent weekly profit. Looking to re-load higher at some point.

Bought to Close TNA NOV 30 2018 63.0 Calls @ 1.01 (sold for 2.45)

TQQQ

Rolled the 55 puts in January 2019 out to January 2021, 45 puts for a credit of 5.55

TQQQ

In my IRA, rolled December 21, 49 calls out to January 4, 49.5 calls for a credit of .35 cents. I am long the 60 calls in 2021 but now only need 9.33 cents to break even each week from January 4

UVXY

#LongPuts #LEAPS #ShortCalls – Even though UVXY is down today, it’s still historically high so booking and re-selling. Hoping to add another on any decent pop.

Bought to Close UVXY NOV 30 2018 60.0 Call @ .24 (sold for 4.40)

Bought to Close UVXY DEC 7 2018 70.0 Call @ .42 (sold for 4.10)

Sold UVXY DEC 14 2018 60.0 Call @ 2.25

#ironcondor CRM TastyTrade idea, sold…

#ironcondor CRM

TastyTrade idea, sold Jan. 18, 105/115/155/165 for 1.57.

#earnings #shortstrangles DLTR Sold Dec….

#earnings #shortstrangles DLTR

Sold Dec. 21, 70/95 strangle for .97, right at the max 1 day ranges.

BOIL

#BearCallSpreads – Adding one. Sold the first one into the panic for 4.27. Gonna be hard to match that…

Sold BOIL MAR 15 2019 50.0/60.0 Bear Call Spread @ 3.00

DG

#ShortCalls #BullPutSpreads – Just for safety booking a small gain on the weekly sale. I’ll reload for earnings next week…

Bought to Close DG NOV 30 2018 110.0 Calls @ 1.70 (sold for 2.00)

DLTR earnings analysis

#Earnings $DLTR reports tomorrow morning. Below are details on earnings 1-day moves over the last 12 quarters.

Aug. 30, 2018 BO -15.54% Biggest DOWN

May 31, 2018 BO -14.28%

March 7, 2018 BO -14.47%

Nov. 21, 2017 BO 2.41%

Aug. 24, 2017 BO 5.62%

May 25, 2017 BO 0.92%

March 1, 2017 BO 0.20%

Nov. 22, 2016 BO 8.15%

Aug. 25, 2016 BO -9.93%

May 26, 2016 BO 12.77% Biggest UP

March 1, 2016 BO 2.21%

Nov. 24, 2015 BO 6.62%

Avg (+ or -) 7.76%

Bias -1.28%, negative bias on earnings.

With stock at 83.30 the data suggests these ranges.

Based on current IV (expected move per TOS): 77.28 to 89.32

Based on AVERAGE move over last 12 quarters: 75.64 to 88.36

Based on MAXIMUM move over last 12 Q’s (15.5%): 69.26 to 94.74

Open for requests on other symbols.

TQQQ calls

#LongLEAPs #SyntheticCoveredCalls Sold $TQQQ Dec 7th 51.5 calls for 1.25.

LABU

I rolled the rest of my 61 calls in December 14, to January 18, 65 calls for a credit of .70 cents.

ANF earnings analysis

#Earnings I’m including this one because of my interest in a long straddle. The cost of an ATM straddle is about 2.60, which would be about a 15% move in the stock, which is its AVERAGE move over recent quarters. I’ll consider whether to sell in the last hour.

$ANF reports tomorrow morning. Below are details on earnings 1-day moves over the last 12 quarters.

Aug. 30, 2018 BO -17.15%

June 1, 2018 BO -8.72%

March 7, 2018 BO 11.90%

Nov. 17, 2017 BO 23.90%

Aug. 24, 2017 BO 17.06%

May 25, 2017 BO 8.99%

March 2, 2017 BO 13.94%

Nov. 18, 2016 BO -13.76%

Aug. 30, 2016 BO -20.30% Biggest DOWN

May 26, 2016 BO -15.66%

March 2, 2016 BO 3.64%

Nov. 20, 2015 BO 25.03% Biggest UP

Avg (+ or -) 15.00%

Bias 2.41%, positive bias on earnings.

With stock at 17.25 the data suggests these ranges.

Based on current IV (expected move per TOS): 14.60 to 19.90

Based on AVERAGE move over last 12 quarters: 14.66 to 19.84

Based on MAXIMUM move over last 12 Q’s (25.0%): 12.93 to 21.57

Open for requests on other symbols.

SPX 1-dte

#SPXcampaign Still working on this new approach… thought I’d share my big error on today’s spread.

I sold the $SPX Nov 28th 2590/2610-2710/2730 for 1.15 yesterday at 1:38p ET, when SPX was at 2672.

After selling, the SPX creeped higher into the close. Even so, my call spread side did NOT increase much. With the threat of a gap up opening, and a slow rise into the close, I could have closed the calls for about .70, and let puts expire today, for an overall profit on the trade, same day. But it didn’t rise enough to hit my stop, so I opted to stay in.

That turned out to be only a minor error: Consider taking profits same day if volatility drops enough in the last hour to exit with decent profit, and erase overnight risk. But, in this case, the gap up this morning wasn’t bad, and I could have closed at the open for a small loss.

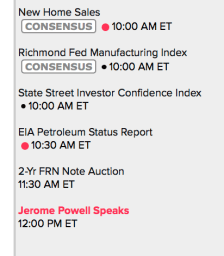

Further more, my call side DID hit its stop this morning, when the expected move touched my 2710 short calls. This means I should have exited, and COULD have exited for a profit on the fade back down to 2685 area. But I didn’t. And as it bounced, I was not focused…. I should have realized the volatility risk with Powell’s comments, but I didn’t and was focused on record keeping and other non-trade issues.

Now I’m 10 points ITM. Faced with possibility of a chunky loss if there’s no fade. Don’t know how I’ll roll yet.

1. Take partial profits if they present themselves early.

2. Follow rules even if you believe that waiting for better exits will work.

3. Focus on market events you KNOW are coming. Don’t get distracted or complacent.

Not sure if there is…

Not sure if there is anything wrong with the site or is it just no posts? Last one was 2 hours ago.

CRM closed

#Earnings Closed $CRM 138/143 call spreads for .51. Closed short 118 puts for .04. Leaving long 113 puts as lottery ticket.

Condors sold yesterday for 1.09.

#earnings #closing #shortstrangles WB CRM Yesterday…

#earnings #closing #shortstrangles WB

WB Yesterday sold Dec. 21, 45/75 strangle for 1.45, bought today for .70.

CRM Yesterday sold Dec. 21, 105/145 strangle for 1.73, bought today for 1.20.

I’ve been using max move strikes from Jeff’s info, going out in time to get over 1.00 in premium, just a couple have bombed.

Fed’s Powell, and other market movers

Closed Z door

#Earnings #Assignment Closed remaining $Z stock, selling at 34.90. Cost basis 32.55. Waited for a couple weeks for stock to return to profit zone, and exited all this week.